Welingkar's Amit Rajani wins Budget Ace organised by Ernst & Young and the Financial Express

1

UNION BUDGET 2011-12 – THE BALANCING ACT Amit Rajani Welingkar Institute of Management (Mumbai) he Finance Minister was expected to address three key macroeconomic concerns in this year’s budget viz., high inflation, high current account deficit and fiscal consolidation. It was also expected that the government would resume the process of reforms. The Finance Minister has made an attempt to focus on all these issues although through small steps. The Budget is in sync with RBI’s monetary policy which has raised key rates eight times since March 2010 to tame the persistently high rate of inflation. The government aims to bring down the fiscal deficit in 2011-12 to 4.6%, below the 13 th Finance Commission’s target of 4.8%. However, considering the fact that the growth in FY12 may be subdued, tax revenues lower and absence of one-time gains like 3G auction, the government may find it difficult to achieve its target. India’s Current Account Deficit {CAD} touched 4.1% in the second quarter of this fiscal, the highest since 1991. India needs long term foreign inflows to bridge the CAD. The move to raise the limit on foreign investment in the corporate bond market by $20 billion is a welcome step as it will improve the composition of foreign inflows besides attracting much needed funds into the infrastructure sector. The Budget also placed due emphasis on resolving the supply chain blockages in the agricultural sector which required serious attention besides considerably stepping up credit flow to the farmers from Rs. 3750 bn to Rs. 4750 bn. The IT industry was caught off-guard when the Finance Minister decided to levy MAT on IT companies which are operating in SEZs, from FY12. It is expected to significantly impact IT companies which had exemptions from MAT under the SEZ scheme. The introduction of service tax on hotels, air conditioned restaurants as well as increasing the same on air travel is bound to have an adverse impact on the hospitality sector. Despite four major state elections due, the government has refrained from a populist budget and kept its commitment on fiscal consolidation. While the emphasis of the budget on active consideration of a new fertiliser policy for urea, efforts to direct transfer of cash subsidy for better delivery of kerosene to BPL families and fertiliser to farmers, further liberalisation of the FDI policy, et al is definitely positive, how these proposals fare on the implementation front remains to be seen. T

-

Upload

udaysalunkhe -

Category

Economy & Finance

-

view

617 -

download

2

description

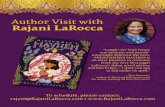

Amit Rajani, MMS (2010-12) has won the Budget Ace Competiton organised by Ernst & Young and the Financial Express.As a part of the competion he was required to write an article expressing his views on the Union Budget 2011-12.

Transcript of Welingkar's Amit Rajani wins Budget Ace organised by Ernst & Young and the Financial Express

- 1. T he Finance Minister was expected to address three key macroeconomic concerns in this years budget viz., high inflation, high current account deficit and fiscal consolidation. It was also expected that the government would resume the process of reforms. TheFinance Minister has made an attempt to focus on all these issues although through small steps. The Budget is in sync with RBIs monetary policy which has raised key rates eight times sinceMarch 2010 to tame the persistently high rate of inflation. The government aims to bring down thefiscal deficit in 2011-12 to 4.6%, below the 13th Finance Commissions target of 4.8%. However,considering the fact that the growth in FY12 may be subdued, tax revenues lower and absence ofone-time gains like 3G auction, the government may find it difficult to achieve its target. Indias Current Account Deficit {CAD} touched 4.1% in the second quarter of this fiscal, thehighest since 1991. India needs long term foreign inflows to bridge the CAD. The move to raisethe limit on foreign investment in the corporate bond market by $20 billion is a welcome step asit will improve the composition of foreign inflows besides attracting much needed funds into theinfrastructure sector. The Budget also placed due emphasis on resolving the supply chain blockages in theagricultural sector which required serious attention besides considerably stepping up creditflow to the farmers from Rs. 3750 bn to Rs. 4750 bn. The IT industry was caught off-guard when the Finance Minister decided to levy MAT on ITcompanies which are operating in SEZs, from FY12. It is expected to significantly impact ITcompanies which had exemptions from MAT under the SEZ scheme. The introduction of servicetax on hotels, air conditioned restaurants as well as increasing the same on air travel is bound tohave an adverse impact on the hospitality sector. Despite four major state elections due, the government has refrained from a populist budgetand kept its commitment on fiscal consolidation. While the emphasis of the budget on activeconsideration of a new fertiliser policy for urea, efforts to direct transfer of cash subsidy forbetter delivery of kerosene to BPL families and fertiliser to farmers, further liberalisation of theFDI policy, et al is definitely positive, how these proposals fare on the implementation frontremains to be seen.