Welcome to the Bollinger Bands® Squeeze Package for ... · PDF filetrading the Squeeze can...

Transcript of Welcome to the Bollinger Bands® Squeeze Package for ... · PDF filetrading the Squeeze can...

Welcome to the Bollinger Bands® Squeeze Package for TradeStation.

Without a doubt the Squeeze is the most talked about of all the Bollinger Band strategies and this TradeStation Package is your key to the Bollinger Band Squeeze.

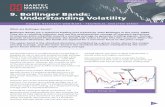

First, some background: a Squeeze is a periodic low in BandWidth and a Bulge is a periodic peak in BandWidth. A Squeeze is potentially an indication of the start of a trend and a Bulge is an indication that atrend may be ending. A Squeeze or a Bulge is not by itself a signal; there are times when they can persist for a long time. Price action and the action of indicators like %b and Intraday Intensity are the ultimate arbiters of what to do.

A Squeeze is a tightening of the Bollinger Bands. Squeezes are the birthplace of new trends and can help forecast periods of increased volatility. However, without the right combination of tools, locating and trading the Squeeze can be difficult. This Bollinger Band Squeeze indicator package is the key to getting the most out of this powerful trading set up.

The Charting tools in this Bollinger Band Squeeze package are:Bollinger Bands: which define high and low on a relative basis%B: which tells us where we are in relation to the bandsBandWidth: which tells us how wide the bands areSqueeze/Bulge: which is used to identify the beginnings and ends of trendsSqueeze Breakout: which is used to find opportunities in the wake of a SqueezeBackIn: which is used to identify Head Fakes and other potential reversalsIntraday Intensity %: which is used to gauge supply and demand

Finally there is a scan for on-demand searching of lists of tickers for trading opportunities, and a RadarScreen for monitoring watch lists in real time.

The RadarScreen tool in this Bollinger Band Squeeze package is:Bollinger Bands Squeeze: finds trading opportunities on a watch list of symbols

These tools can be applied in most markets; stocks, futures and forex are popular target markets. They canalso be applied in many time frames, from intraday to long term. The qualifier is that there be enough datain each bar to get a good picture of the price-formation mechanism at work. For big, liquid ETFs like SPY, or highly liquid futures like the e-mini, minute bars are no problem, but for an illiquid stock daily bars might be the downward limit.

A lot of time, work and experience have gone into developing this package. I think that you will find it to be very useful in your day to day trading operations. If you have questions about what these tools are, how to use them or the ideas behind them please see the documentation for the individual tools or feel free to drop us a line at [email protected]. If you need help with the TradeStation platform, their excellent customer support is available at: 800.822.0512

Good trading,

John Bollingerwww.BollingerBands.com

© Copyright 2017 Bollinger Capital, All Rights Reserved

Bollinger Band Squeeze Package Disclosure Statement

This product is not a recommendation to buy or sell, but rather a guideline to interpreting the specified analysis methods. The information provided should only be used by investors who are aware of the risks inherent in securities trading. TradeStation, John Bollinger or Bollinger Capital Management accept no liability whatsoever for any loss arising from any use of this product or its contents.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options futures or forex); therefore, you should not invest or risk money that you cannot afford to lose.

If you plan to use margin, please read about the risks of margin: http://www.finra.org/Investors/SmartInvesting/AdvancedInvesting/MarginInformation/P005927

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ Bollinger Bands® (Charting Indicator)

‘Bollinger Bands’ are volatility-driven trading bands that define whether price is high or low on a relative basis. There are three Bollinger Bands, upper, middle and lower, with the middle band serving as the base for the upper and lower bands. The middle band is colored to reflect the direction of the trend, green whenthe trend is up and red when it is down. The upper band is traditionally colored red and the lower green. By definition price is high at the upper band and low at the lower band. The information derived from the bands can be used in developing trading approaches, pattern recognition, identifying over bought and oversold levels, tracking trades, anticipating moves and more...

To identify a ‘Squeeze’ we look for period in which the Bollinger Bands are very close together, which is often a precursor of important moves in security prices.

By analyzing price action in relation to the Bollinger Bands and employing the other indicators in this package, you will be able to identify and manage opportunities as they arise. The indicator ‘SqueezeBulge’ will highlight the Squeeze and Bulge conditions.

The default parameters for Bollinger Bands are a calculation period of 20 bars and a width of plus/minus 2 standard deviations. These parameters work in most applications, but can be adjusted to suit your trading style.

Parameters:BB_Data: CloseBB_Length: 20BB_Width: 2.0BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ %b® (Charting Indicator)

‘%b’ tells us where we are in relation to the Bollinger Bands. While %b has many uses, for the Squeeze there are two important ones. Its primary use is to help identify the potential breakout direction and then to alert us to breakouts or breakdowns when they actually occur.

The %b formula is derived from the formula for Stochastics, with the values of the upper and lower Bollinger Bands being substituted for Stochastics' periodic highs and lows.

%b equals 1.0 when the close of the bar is at the upper Bollinger Band and 0.0 when it is at the lower band. Hence a breakout is indicated by a value for %b of greater than 1.0 or a breakdown with a value for %b of less than 0.0.

%b is usually combined with BandWidth to identify opportunities in the wake of a Squeeze.

Parameters:BB_Data: CloseBB_Length: 20BB_Width: 2.0BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ BandWidth® (Charting Indicator)

‘BandWidth’ tells us how wide the range of the Bollinger Bands are. BandWidth's most important use is to identify the beginning and end of trends. BandWidth is the distance from the upper band to the lower band divided by the middle band. For most securities BandWidth runs in the low single digits, but it can get as high as fifty, with occasional readings outside of that range.

BandWidth and %B were the first two Bollinger Band indicators. Like the bands, their formulation has not changed over the years.

Troughs in BandWidth are known as Squeezes and mark beginnings of trends; peaks in BandWidth are known as Bulges and mark the end of trends. The problem with BandWidth is that it can be hard to discern what is a peak and what is a trough. Is BandWidth high enough? Or low enough? Absolute levels won't do as they vary from security to security and time to time. That means that we must adopt a relative measure. Our solution is to define a Squeeze as a 125-period low in BandWidth and a Bulge as a 125-period peak. Armed with those relative definitions we can successfully diagnose market conditions that lead to the beginnings and ends of trends.

BandWidth is usually combined with %B to identify breakouts and breakdowns after Squeezes.

Parameters:BB_Data: CloseBB_Length: 20BB_Width: 2.0BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}LookBack: 125

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ SqueezeBulge® (Charting Indicator)

The “SqueezeBulge’ indicator automates the identification of Squeezes and Bulges. When plotted as an indicator SqueezeBulge is +1 for a Squeeze (Yellow Arrow) and -1 for a Bulge (Cyan Arrow). When plotted with price, arrows above and below the Bollinger Bands highlight Squeezes and Bulges. We have tested the SqueezeBulge look-back period and found it to be very robust, periods of 100 through 150 all seem to produce similar results over time. The default lookback is 125 bars.

SqueezeBulge can be combined with BackIn to identify Head Fakes. SqueezeBulge is often paired with Intraday Intensity to give a sense of potential directionality as the trade sets up.

Parameters:BB_Data: CloseBB_Length: 20BB_Width: 2.0BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}Squeeze_Lookback: 125RangePct: 95 {show Squeeze and Bulge when thet are close.}ShowSqueeze: TRUESqueeze_Color: DarkGreen {for Charting SQUEEZE}Squeeze_ArrowSize: 18 {for Charting SQUEEZE}Squeeze_String: "SQUEEZE" {for SQUEEZE - RadarScreen and Scanner}ShowBuldge: TRUEBulge_Color: DarkRed {for Charting BULGE }Bulge_ArrowSize: 18 {for Charting BULGE }Bulge_String: "BULGE" {for BULGE - RadarScreen and Scanner}ArrowShiftATRs: 0.5 {for chart display }

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ SqueezeBreakout® (Charting Indicator)

‘SqueezeBreakout’ looks first for a Squeeze and then searches for a breakout or a breakdown within the next five periods. SqueezeBreakout presents trading signals much in the same way that the old volatility breakout systems tried to do, but rather than a simplistic stand-alone approach, Squeeze Breakout is part of the BBTK Squeeze ecosystem and, as such, integrates with the other tools in the package to produce a comprehensive trading approach. A SqueezeBreakout signal is generated when price closes above the upper or below the lower Bollinger Band within five periods of a Squeeze.

SqueezeBreakout is often paired with Intraday Intensity to quantify accumulation / distribution as the trade sets up and then develops. Many traders like to look for a downturn in BandWidth after a squeeze expansion to signal the end of a trend. Often, that is coincident with a Bulge. Others like to use a trailing stop like our Chandelier stops.

Parameters:BB_Data: CloseBB_Length: 20BB_Width: 2.0BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}Squeeze_Lookback: 125RangePct(95),Signal_Window: 5Up_Color: Green {For BUY signal}Up_ArrowSize: 18 {For BUY signal, chart}Up_String: "BUY" {For BUY signal, RadarScreen and Scanner}Down_Color: Red {For SELLSHORT signal}Down_ArrowSize: 18 {For SELLSHORT signal, chart}

© Copyright 2017 Bollinger Capital, All Rights Reserved

Down_String: "SELLSHORT" {For SELLSHORT signal, RadarScreen and Scanner}PlotShiftATRs: 1.0 {for chart display}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ SqueezeBreakout® (RadarScreen Indicator)

Inputs Parameters: Same as the Charting Indicators

Note: Make sure the inputs for each indicator line up with the others so that the values match across all windows.

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ BackIn® (Indicator)

‘BackIn’ is one of the simplest of the tools in this package, but it is the key to one of the most powerful Squeeze trading setups, The Head Fake. BackIn indicates when a close outside the Bollinger Bands is followed by a close inside the Bollinger Bands, +1 for in from below, -1 for in from above. It is most significant immediately after a SqueezeBreakout. Smaller arrows are used to denote the Head Fake, with red arrows showing selling opportunities and green arrow showing buying opportunities.

For many years traders have noticed that when Squeeze Breakouts fail they often lead to spectacular moves in the opposite direction. This combination of a failed breakout and an emerging trend in the opposite direction is known as a Head Fake. The term comes from sports where an attacker will tilt their head in one direction to fake out the defender before making the real move in the opposite direction.

For Bollinger Band traders a Head Fake is signaled by a Squeeze Breakout and then an immediate BackIn. High volume and large ranges are strong confirmation indicators.

Parameters:BB_Data: CloseBB_Length:20BB_Width: 2.0BB_CalcType: 1 {1 Simple Avg. 2 Exponential Avg.}Up_Color: Green {for Back-In from below}Up_ArrowSize: 12 {for Back-In from below, Chart}Up_String: "UP" {for Back-In from below, RadarScreen and Scanner}Down_Color: Red {for Back-In from above}Down_ArrowSize: 12 {for Back-In from above, Chart}Down_String: "DOWN" {for Back-In from above, RadarScreen and Scanner}

© Copyright 2017 Bollinger Capital, All Rights Reserved

PlotShiftATRs: 0.5 {for chart display}

© Copyright 2017 Bollinger Capital, All Rights Reserved

BBSQ Intraday Intensity % (Indicator)

‘Intraday Intensity %’ is a volume indicator that was developed by David Bostian. It is the best technical gauge of accumulation distribution that I know of. Intraday Intensity is designed to track the action of large institutional investors, going negative as they sell and positive as they buy.

Intraday Intensity was originally designed for daily bars, but we have found it useful in shorter time frames as well. The key is that there must be enough activity in each bar to transmit a clear picture of the price formation mechanism in action.

The formula parses the location of the close in the period's range to partition volume into positive and negative components. We give you two versions of Intraday Intensity, an unbounded line and an oscillator. The choice is mostly a matter of taste and is entirely up to you. The information is the same, butthe presentation is different. The line is generally plotted in the same clip as price, while the oscillator is usually plotted in its own clip. I'd suggest plotting the line in the same clip with price as an initial choice for Squeeze trading. For buy/sell decisions using Bollinger Bands the oscillator is generally favored.

Parameters:Length: 21Up_Color: GreenDown_Color: Red

© Copyright 2017 Bollinger Capital, All Rights Reserved

![Package ‘ibmdbR’ - Revolution Analytics...Package ‘ibmdbR’ June 3, 2018 Version 1.50.0 Title IBM in-Database Analytics for R Author Toni Bollinger [aut, cre], Alexander Eckert](https://static.fdocuments.in/doc/165x107/5ed0ef6ca712bd65e41ef9f9/package-aibmdbra-revolution-analytics-package-aibmdbra-june-3-2018.jpg)

![Bollinger 9a1 mini_grammar[1]](https://static.fdocuments.in/doc/165x107/54c4829d4a7959d17c8b45ff/bollinger-9a1-minigrammar1.jpg)