Welcome To Success | Change Edition, Summer 2012

-

Upload

sarah-pierce -

Category

Documents

-

view

220 -

download

5

description

Transcript of Welcome To Success | Change Edition, Summer 2012

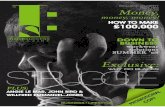

welcome tosuccessthe CHANGE issue - summer 2012

QR codes - could they change your

business? p4

is your accounting system holding you

back? p8

the changing face of Australia p12

presented by...

32

welcomeWelcome to Success! Our Summer edition newsletter is packed full of hints, tips and advice to help you get ahead in your finances, whether business or personal. But don’t take our word for it - have a look for yourself!

In case you missed our issue last quarter, here’s who we are: High Street Finance Centre houses four services under one roof, all aimed at being a complete financial solution for you or your business. If you haven’t heard what those services are, there’s a handy guide on page 3 (just over there!)

There’s a lot of talk about change in this edition - but don’t let that put you off! Change can be a very good thing for a business, especially when that business is moving in the right direction.

Read with an open mind, and enjoy!

Allan JohnsonDirectorHigh Street Finance Centre

contents

More than just your average accountant - we believe in

education, along with delivering the usual tax and compliance services.

Business Development specialists, helping out small

businesses and contractors with planning, PR and performance.

Mortgage brokers and financial planning specialists, able to design

a full wealth creation strategy for personal finance.

Insurance brokers that have your best interests in mind - we’ll do our

best to find a deal that’s right for your individual situation.

meet the teamWelcome 2

Meet the team 3

QR Codes - a change for business? 4

Social Media for your business 6

Is your accounting system holding you back? 8

Succession Planning - are you ready for it? 10

The changing face of Australia 12

Are you ready for change? 13

The secret life of... 14

Final notes 15

office hours 8:30am - 5:00pm Monday to Friday

(closed for lunch from 1pm - 2pm)

branches84 High Street, North Rockhampton

15 Hill Street, Yeppoon

contactoffice: (07) 4928 9320

fax: (07) 4926 1962email: [email protected]

(if you have any questions about anything in this magazine, email us!)

54

QR CodesHow could they changeyour business?If you haven’t heard of a QR (Quick Response)

code, chances are you’ve probably seen one and just wondered what on earth it was. You’ll see them

all through this magazine – and their purpose is something similar to a barcode.

A barcode is a one-dimensional code that can only hold 20 numerical digits – maximum – whereas a QR code can hold thousands of alphanumeric characters.

In essence, a QR code is a next-gen barcode.

So how do you use them? When you scan a QR code with your smartphone’s camera, it can link to content on the internet – videos, webpages and so on – or even activate the phone’s functions, such as email or SMS. Try out the QR codes in the pages of this magazine and see what happens! (Be warned, you will need a QR code reader app on your smartphone).

Realistically, the possibilities for uses of QR codes in small business are only limited by your creativity. Some uses could include:

• Business cards – link to website• Brochures and other marketing materials – link to

mailing list signup• Vehicle signage – link to website/phone number• Product tags and packaging – link to

re-order site• Signs in your business – link to online help,

bookings, place reviews, directions• Novel gift tags – the reader has to scan to see

who the gift is from!These QR code uses are great not only because they encourage your customers to interact with your business – but if you use them wisely, you can track and measure the response you’re getting.

It goes without saying that you first have to know your target audience. Research, research, research

is the key – if you’re trying to introduce the use of QR codes somewhere that people don’t use smartphone technology (a nursing home, perhaps?), there will be limited success!

Keep in mind that not only does the consumer need to know what a QR code is and what to do with it, but they also must have a smartphone and a QR code app installed. Businesses that cater to a younger, more tech-savvy customer base will see better responses – think universities, shopping centres, restaurants and the like.

As a small business owner, your customers are vital to your success. Interacting with and engaging them could be what makes your business brand stand out from your competitors. But could QR codes change your business? That depends entirely on how well you know your target market.

phot

o: F

lickr

use

r Whi

ch T

ech

photo: Flickr user Vincent

photo: Flickr user Jerome

Quick fact:“QR” stands for Quick Response....not Queensland Rail, or Quite Right...scan the QR code

to the left for more great business ideas...

Quick tip: to get yourself a QR reader, just type ‘QR’ into whatever app store your smartphone has - we recommend Scan for iPhone/iPad users and QR Droid for Android. Blackberry users can scan codes in BBM.

76

SocialMedia

...is it time to rethinkhow you do business?

Social media is another powerful tool for businesses.

When used correctly, social media can be a great source of low-cost, authentic connection with your customers and target market. It’s changed the way small businesses market to their customers – are you missing out?

If you haven’t jumped on the social media bandwagon, there are three major ‘cornerstones’ you need to conquer, according to Amber MacArthur, a social media expert and author. These three cornerstones are:

1. Planning

Probably the worst thing you could do would be to jump into social media for your business without a solid plan. I’m not talking a step-by-step guide to how exactly you’ll do everything – you need a plan for the voice of your business on the internet. Choosing a staff member to look after the identity, image and voice of your business online could be one of the most important marketing decisions you’ll make.

If you don’t have a staff member with the time or ability, consider hiring a professional…outsourcing social media functions isn’t as uncommon as you’d think! The right specialist will have your business’s best interests at heart – and of course, they’ll know what they’re talking about!

2. Listening

Many people (my mother included) mistakenly believe that social media is all about having something clever to say at all times. I would say to those people (and my mother) that they’ve missed the point entirely – social media is about creating a conversation, and there’s a reason we were given two ears and one mouth.

Listening is incredibly important, especially for businesses in the world of social media. Listening to and understanding your customers will benefit the business in exponential ways.

3. Creating

Once you’ve made a solid plan for customer engagement and spent some time listening to your customers, you’re ready to create content.

If you remember nothing else from this article, remember this – your content HAS to be authentic.

Nobody cares about following a boring corporate image that routinely spits out the same old PR message – they connect with a real, live person who posts information that is relevant to their daily lives. So don’t use a boring logo for your profile pictures – use your face!

One more caution: when you’re busy creating and sharing, don’t neglect to listen and make simple conversation with your followers. Nobody likes listening to someone who only talks about themselves…

At the end of the day, if your customers feel that they are connected to your business, they’ll keep coming back for more. This alone could change your business – repeat customers are worth their weight in gold.

But the added bonus with social media is its share-ability…if your customers are connected and happy, they tend to want to share how happy they are, and think where that could take your business!

One of the best uses of social media for connecting with customers I’ve seen has been the Queensland Police Service. They have a dedicated social media team that posts out relevant, timely information to the community…and they aren’t afraid to have a sense of humour. Recent heavy rain in South-East Queensland led to a flood of road closure updates (excuse the pun) via both Twitter and Facebook QPS accounts – providing vital information to the public.

Now, we know you’re not necessarily an organisation with the state-wide reach of the Queensland Police Service, but there’s no reason that your business can’t be a helpful, authentic contributor to the social-media-using public. Why not share articles that are relevant to your target market or post updates on developments in your business?

- Sarah-Joy Pierceexceler8 Business Development Coordinator

photo: Flickr user tartanpodcast

6

scan this QR code to read more about Twitter fiascos

PR disasters like the Twitter fiascos recently seen by Qantas (the #qantasluxury hashtag) and McDonalds (the #McDStories hashtag) could have been avoided if the business had only been listening to its customers. Of course, timing is everything – trying to get positive comments from unhappy customers isn’t an easy task!

scan this QR code to read more about QPS’s

use of social media

98

Is youraccountingsystem

you back?holding

phot

o: F

lickr

use

r ala

n.98

photo: Flickr user Perry McKenna

9

scan this QR code for more accounting tips...

For any business big or small, the quality of the accounting system is a major factor in sustaining success (you’d expect an accountant to say

that!). Unfortunately, we have seen many situations where poor accounting records have led to very poor financial decisions and significant pain with the ATO, among other things.

So what should you expect from your accounting system?

1. Up-to-date information.

This is by far the most important reason for having an efficient accounting system. Operating a small business is hard enough, but if you don’t understand exactly what is happening in your business it becomes almost impossible. Knowing nine months after the end of the year that you have made some poor financial decisions means that you are probably 12 months behind in the correction process!

These days, it is possible to maintain your accountingrecords daily with minimal effort thanks to technology. Electronic data collection has made the overall process far simpler and more reliable.

2. Reports that you care about.

The traditional financial statements (profit and loss statements and balance sheet) do convey some information, but they are not the most meaningful reports that can be produced from an accounting system – and you should expect more. Modern software will provide you with a multitude of customised reports, and it really is up to you to identify the reports that are going to assist you and your small business. These may be different to the reports used by other businesses.

3. Speedy operations.

If your software is old, the chances are it is not

operating as quickly as it should. Unfortunately, advances in hardware sometimes cause old programs to operate inefficiently. Have you spent hours lately waiting for just one report to generate?

If you have not upgraded in the last 12 months, do it!

4. The whole package.

If you find that you have to use other programs to provide you with the necessary information (e.g. Excel), there is a good chance that your accounting software is not right for you.

You should review your total requirements, document them (a simple list will do!) and then set about finding software that can provide you with everything you need. We know your time is precious – you will be amazed at the time you save with the right software.

Of course, there’s a flip side to this – if your software has all the bells and whistles in the world and you only use about 10% of them, chances are you’re paying too much and you could be much better off with a simpler solution. Again, review your requirements, make a list, and make sure your software matches up.

Over the last few years we have helped many small businesses simplify their approach to record keeping, so that they are able to get the necessary information to operate their business successfully.

If you need help with analysing your needs and matching your business to the right programs – all you have to do is ask!

1110

People say that change is the only constant – and when it comes to accounting, the need to account for major life changes is important for

your business.

We’re talking about succession planning. We know you probably don’t want to think of the day your business runs without you, but if you want to create an asset that can exist without your daily attention, you need to plan for it from the start (and now can be that start!).

Whether you want to sell your business or hand it over to a family member, you need to plan for this to happen smoothly. We have seen too many examples of situations where a business has gone through a major transition without making proper plans. More often than not, it all falls in a heap.

As well as a business development plan, you and your business need a succession (or exit) plan.

When you plan, there are a number of possible exit strategy options, including: • Outright sale• Partial sale• Management buy-out• Family succession• Appointing a manager• Walking away (not recommended!)

When developing your succession plan, you need to choose which of these strategies suits your business, and then focus on moving the business toward that result. A number of strategies have common methods (e.g. improving the business value will assist in a sale, buy-out or a succession), but obviously with a final result in mind, all your business decisions aim towards that result.

Also, it is important that your family are at least aware of your plans for your business (especially if we’re talking family succession!).

This gives them peace of mind and perhaps helps to explain some of the decisions you make along the way.

You may find along the way that your succession plan calls for a restructure. This needs to be done with the help of trusted advisors and experts to ensure that the aftermath is manageable, and you’re not left with more of a mess than you started with.

We would encourage anyone in small business to research this topic and know your options – and we’ve even provided a starting point for you. The QR code above will direct you to an eBook on succession planning (see the exceler8 article on QR codes!). If you don’t have the necessary technology to scan a QR code, email us at [email protected] for the link.

Planning forchange

scan this QR code for more info on

succession planning.

12 13121212

For example, a coal miner would have a higher risk of being injured whilst at work in comparison to an office worker who stays indoors most of the day.

Another factor affecting the premiums is the waiting period and benefit period selected on the policy. The waiting period refers to the length of time you are unable to work before benefits will be paid; for example, if you believe that you would survive without employment income for one month, you may require a policy with a waiting period of one month or more.

Most policies offer waiting periods from 14 days up to 2 years. Selection of a waiting period will vary depending on the individual, how much leave they have owing at work and the level of liquid funds they may have. The shorter the waiting period, the higher the premium. The benefit period is the length of time you will receive a benefit payment. It can range from 1 year to up to age 65 (both the waiting and benefit periods will depend on the provider). Again, the benefit period selected will vary depending on the individual.

You can mix and match different policies to ensure you are fully covered. For example, if you have an existing income protection policy within your employer superannuation fund that has a benefit period of 2 years, you could then obtain an additional income protection policy that has a waiting period of 2 years and a benefit period of up to age 65.

How would you cope financially if your life suddenly changed? What would happen to your expenses and lifestyle should you become

unable to work for an extended period of time due to an illness or injury?

After sick leave provisions and any accrued leave you may have within employment have been exhausted, you may find that you cannot cover your ongoing expenses. We tend to take for granted our ability to work and earn an income, and do not consider the prospect of being unable to do so. However, losing your income could have devastating effects on your future plans and financial security.

Income protection is an insurance policy that has the potential to provide you with a portion of your employment income for a specified period of time or until you are able to return to employment (subject to conditions).

The benefit is paid on an ongoing basis, and not as a lump sum, and is taxable as normal income. Income protection policies generally pay up to a maximum percentage of 75% of your employment income. It is only available for people who are in paid employment (including self-employed people), and the premiums are fully tax deductible.

Similar to life insurance, the premiums are based on factors such as your age, medical history, and smoking habits; however they are also substantially influenced by the type of employment you are involved in.

Are you covered against

change?

The “average” Aussie is changing and by 2020 we’ll barely recognise ourselves. The iconic Aussie lifestyle is under threat, according to a

new report.

Business information analysts Ibis World looked at population trends, migration, working hours, employment and leisure activities - taking a stab at where we could be in a decade or so.

Forecasts for lower unemployment and longer working hours are expected to cut into our free time by 2020.

We still love our sport, with the number attending events jumping to 8.0 million in 2010 -11. AFL still draws the biggest crowds, but soccer and netball – not cricket or rugby (league & union)- are the most popular sports we play.

However, people no longer spend so much free time outdoors, with the video game industry expected to double its annual revenue over the next decade..

Just about every Aussie is jumping online as computer literacy and internet speeds increase, with predictions that online shopping could account for 10% or more of our overall retail spending by 2020.

Rising incomes and household wealth, coupled with low unemployment, good job security, and government policy like the baby bonus and child care rebates, have greatly contributed to the boom in births in the last five years.

Property price hikes coupled with increasing population density in the major cities have brought the end of the suburban home among the gum trees, with its clotheslines out the back and verandah out the front.

Fewer Aussies own their home outright, and more people are ditching backyards for balconies, with apartment sales on the rise. More people will elect to rent as they are priced out of the market.

With this amount of change going on, you can find stability by planning for your future. Finance First are qualified experts who can help you achieve your long-term financial goals and dreams.

If you think your life is changing and your finances need to reflect that, why not talk to John at Finance First today?

It could be the best investment you make.

The changingface ofAustralia

1514

Here at HSFC we make it our mission to stay up-to-date with all the latest in social media. Chances are, if you like to Tweet, Facebook or LinkedIn (is that a verb yet?)...you’ll see us around!

To make sure you don’t miss out on any of the hints, tax tips or deals we pass on to our favourite followers, connect with us today!! You can find us on...

@JandTaccounting

@exceler8growth

facebook.com/JandTaccounting

facebook.com/exceler8growth

Allan Johnson (J&T)

Sarah-Joy Pierce (exceler8)

John MacMaster (Finance First)

Even if you’re not a fan of social media, check out exceler8’s website (www.exceler8.com.au) or Johnson & Tennent’s website (www.jandt.com.au) and try our Live Chat!

the secret life of...

final notes

Want a free

eBook?

visit www.jandt.com.au and enter your details - and you’ll receive our 7 Strategies for Growing Wealth Through Property!

scan this QR code to see our latest Webinar on Business in CQ

scan this QR code and enter your details to sign up to our monthly newsletter (we promise not to spam you!)

scan this QR code for a surprise :)

Angela

Angela is the newest team member at HSFC, having only started in January this year. Angela is an aspiring accountant studying at CQUniversity, but for now is helping our administration staff out while she learns the ropes.

What do you spend the most time on outside of work?Well, currently I’m studying so I try to study during the day when I’m not working, and then I like to get outside in the afternoon! You can’t stay inside all the time…

What is one thing that clients wouldn’t know about you?My parents run a charter boat business – the Marjorie J III – so when I was a week old I was out on the boat already! I’m a Yeppoon girl, and I grew up around the charter boat and the water. And yes, I’ve seen that RACQ ad about the ‘charter boat? What charter boat?’…we get that all the time!

What accomplishment are you the most proud of?Just working my way to where I am now…I worked hard in school and I’m trying to do the same at uni, and of course working here at High Street Finance Centre is great for that! It’s such a lovely workplace, the people are so nice.

Whose ‘biggest fan’ are you?Growing up I absolutely idolised Jennifer Hawkins and Miranda Kerr – I wanted to be a supermodel! I always used to dress up, and I did dancing…I guess I’ve sort of grown away from that though…there’s nobody who I’m really the ‘biggest fan’ of right now.

If you could possess one superpower, what would it be?Again, growing up, I watched Heroes (the TV show) all the time, and I always wanted to be like the cheerleader girl who could never die – that would be pretty awesome!