Week 2 Quantitative Analysis of Financial Markets Hypothesis … · 2017-10-27 · Introduction...

Transcript of Week 2 Quantitative Analysis of Financial Markets Hypothesis … · 2017-10-27 · Introduction...

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Week 2Quantitative Analysis of Financial Markets

Hypothesis Testing and Confidence Intervals

Christopher Ting

Christopher Ting

http://www.mysmu.edu/faculty/christophert/

k: [email protected]: 6828 0364

ÿ: LKCSB 5036

October 27, 2017

Christopher Ting QF 603 October 27, 2017 1/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Table of Contents

1 Introduction

2 Confidence Intervals

3 Hypothesis Test

4 Chebyshev’s inequality

5 VaR

6 Problems with VaR

7 Takeaways

Christopher Ting QF 603 October 27, 2017 2/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Introduction

a Impracticality to analyze an entire population.

a Random sampling

a Estimation of sample statistics: Mean and Variance

a Hypothesis formation and procedures used to conduct testsconcerned with population means and population variances.

a Construction of confidence intervals for population parametersbased on sample statistics.

a t test, chi-square test

a Chebyshev’s Inequality

a Value at risk: Extremely useful in risk management

Christopher Ting QF 603 October 27, 2017 3/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Learning Outcomes of QA05

Chapter 7.Michael Miller, Mathematics and Statistics for Financial Risk Management, 2nd Edition(Hoboken, NJ: John Wiley & Sons, 2013).

a Calculate and interpret the sample mean and sample variance.

a Construct and interpret a confidence interval.

a Construct an appropriate null and alternative hypothesis. andcalculate an appropriate test statistic.

a Differentiate between a one-tailed and a two-tailed test andidentify when to use each test.

a Interpret the results of hypothesis tests with a specific level ofconfidence.

a Demonstrate the process of backtesting VaR by calculating thenumber of exceedances.

Christopher Ting QF 603 October 27, 2017 4/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Recall: Sample Mean

a Sample mean

µ̂ =1

n

n∑i=1

xi =

n∑i=1

xin.

Consider the random variable Xi/n. Sample mean is equivalentto the sum of n i.i.d. random variables, Xi/n, each with a mean ofµ/n and a standard deviation of σ/n.

a The central limit theorem suggests that the distribution of thesample mean converges to a normal distribution with mean µ andvariance σ2/n, i.e.,

µ̂ ∼ N(µ,σ2

n

).

a Sample mean is unbiased.

Christopher Ting QF 603 October 27, 2017 5/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Recall Sample Variance

a The sample variance σ̂2 =1

n− 1

n∑i=1

(xi − µ̂

)2 is unbiased.

a The variance of the sample variance is

E((σ̂2 − σ2

)2)= σ4

(2

n− 1+κ− 3

n

).

a If we have n sample points, then the sample variance σ̂2 follows achi-squared distribution with (n− 1) degrees of freedom:

(n− 1)σ̂2

σ2∼ χ2

n−1.

a This relationship between the ratio of variances and thechi-squared distribution is true only when the data generatingprocess (DGP) results in normally distributed data points.

Christopher Ting QF 603 October 27, 2017 6/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

t-Statistic

H If we first standardize our estimate of the sample mean using thesample standard deviation, the new random variable follows aStudent’s t distribution with (n− 1) degrees of freedom.

t =µ̂− µσ̂√n

.

H This standardized version of the population mean is so frequentlyused that it is referred to as a t-statistic, or simply a t-stat.

Christopher Ting QF 603 October 27, 2017 7/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Confidence Interval

H By looking up the appropriate values for the t distribution, we canestablish the probability that our t-statistic is contained within acertain range:

P

xL ≤ µ̂− µσ̂√n

≤ xU

= γ.

where γ is the probability that our t-statistic will be found within thelower and upper bounds.

H Typically γ is referred to as the confidence level, and 1− γ isknown as the significance level and is often denoted by α.

Christopher Ting QF 603 October 27, 2017 8/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Estimation of Confidence Interval

H In practice, the population mean, µ, is often unknown. Afterrearranging, we obtain an equation with a more interesting form:

P(µ̂− xLσ̂√

n≤ µ ≤ µ̂+

xU σ̂√n

)= γ.

H We are now giving the probability that the population mean will becontained within the defined range. We call this range theconfidence interval for the population mean.

H A problem with confidence intervals is that they require us to settleon an arbitrary confidence level.

Christopher Ting QF 603 October 27, 2017 9/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Hypothesis Testing

K What is the probability that the population mean is greater than y.

K In the form of a null hypothesis, we are interested in knowingwhether the expected return of a portfolio manager is greater than10%:

H0 : µr > 10%.

K Even though the true population mean is unknown, for thehypothesis test we assume that the population mean is 10%.

Christopher Ting QF 603 October 27, 2017 10/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Hypothesis Testing (cont’d)

K If the true population mean were 10%, what would be theprobability that we would see a given sample mean?

t =µ̂− 10%

σ̂/√n.

We can then look up the corresponding probability from the tdistribution.

K In addition to the null hypothesis, we can offer an alternativehypothesis. In the previous example, where our null hypothesis isthat the expected return is greater than 10%, the logical alternativewould be that the expected return is less than or equal to 10%:

H1 : µr ≤ 10%.

Christopher Ting QF 603 October 27, 2017 11/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Hypothesis Test in Practice

K Many practitioners construct the null hypothesis so that thedesired result is false. If we are an investor trying to find goodportfolio managers, then we would make the null hypothesisµr ≤ 10%.

K That we want the expected return to be greater than 10% but weare testing for the opposite makes us seem objective.

K In the case where there is a high probability that the manager’sexpected return is greater than 10% (a good result), we have tosay, “We reject the null hypothesis that the manager’s expectedreturn is less than or equal to 10% at the x% level.”

Christopher Ting QF 603 October 27, 2017 12/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 1

K At the start of the year, you believed that the annualized volatilityof XYZ Corporation’s equity was 45%. At the end of the year, youhave collected a year of daily returns, 256 business days’ worth.You calculate the standard deviation, annualize it, and come upwith a value of 48%. Can you reject the null hypothesis,H0 : σ = 45%, at the 95% confidence level?

K Answer:The appropriate test statistic is

(n− 1)σ̂2

σ2= (256− 1)

0.482

0.452= 290.13 ∼ χ2

255.

K For a chi-squared distribution with 255 degrees of freedom,290.13 corresponds to a probability of 6.44%. Hence, we fail toreject the null hypothesis at the 95% confidence level.

Christopher Ting QF 603 October 27, 2017 13/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

One Tail or Two?

K In risk management, more often than not we are more concernedwith the probability of extreme negative outcomes, and thisconcern naturally leads to one-tailed tests.

K A two-tailed null hypothesis could take the form

H0 : µ = 0, H1 : µ 6= 0.

In this case, H1 implies that extreme positive or negative valueswould cause us to reject the null hypothesis.

K A one-tailed null hypothesis could take the form

H0 : µ > c, H1 : µ ≤ c.

In this case, reject H0 only if the estimate of µ is significantly lessthan c.

Christopher Ting QF 603 October 27, 2017 14/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Some t Statistics at Different α

α t10 t10 t1000 t∞1.00% -2.76 -2.36 -2.33 -2.332.50% -2.23 -1.98 -1.96 -1.965.00% -1.81 -1.66 -1.65 -1.64

10.00% -1.37 -1.29 -1.28 -1.2890.00% 1.37 1.29 1.28 1.2895.00% 1.81 1.66 1.65 1.6497.50% 2.23 1.98 1.96 1.9699.00% 2.76 2.36 2.33 2.33

K For a normal distribution 95% of the mass is within ±1.96 standarddeviations.

K For a one-tailed test, 95% of the mass is within either +1.64 or-1.64 standard deviations. Using 1.96 instead of 1.64 is acommon mistake.

Christopher Ting QF 603 October 27, 2017 15/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Gold Standards of Confidence Level

K In practice, 95% and 99% confidence levels are gold standards.

K If we can reject a null hypothesis at the 96.3% confidence level,some practitioners will simply say that the hypothesis can berejected at the 95% confidence level. The implication is that, eventhough we may be more confident, 95% is enough. Thisconvention can be convenient when testing a hypothesisrepeatedly.

K In statistics, there is no such thing as a sure bet; there is no suchthing as absolute certainty.

Christopher Ting QF 603 October 27, 2017 16/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

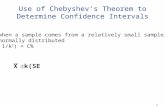

Chebyshev’s Inequality

T For the random variable X with mean µ and variance σ2, andgiven any positive constant k,

P(|X − µ| ≥ kσ

)= E

(1|X−µ|≥kσ

)= E

1(X−µkσ

)2

≥1

≤ E

((X − µkσ

)2)

=1

k2E((X − µ)2

)σ2

=1

k2.

HenceP(|X − µ| ≥ kσ

)≤ 1

k2

Christopher Ting QF 603 October 27, 2017 17/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Chebyshev’s Inequality (cont’d)

T Interpretation: The probability of the magnitude of dispersion fromthe mean being greater than kσ is no greater than 1/k2. Intuitively,Chebyshev’s inequality suggests that outliers are rare.

T Instead of µ and σ2, suppose we can only estimate with unbiasedsample mean µ̂ and sample variance σ̂2, respectively.

T It is easy to prove that

E((X − µ̂)2

)= E

((X − µ)2

).

It follows that Chebyshev’s inequality becomes

P(|X − µ̂| ≥ kσ̂

)≤ 1

k2σ2

σ̂2.

Christopher Ting QF 603 October 27, 2017 18/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Chebyshev’s Inequality (cont’d)

T Assume a large number of data points so that σ2/σ̂2 = 1. Then

P(|X − µ̂| ≥ kσ̂

)≤ 1

k2.

T Now,P(|X − µ̂| < kσ̂

)= 1− P

(|X − µ̂| ≥ kσ̂

).

It follows thatP(|X − µ̂| < kσ̂

)≥ 1− 1

k2.

Christopher Ting QF 603 October 27, 2017 19/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Chebyshev’s Inequality in QF

T Interpretation: |X − µ̂| < kσ̂ is equivalent to

µ̂− kσ̂ < X < µ̂+ kσ̂.

T The probability for X to realize a value in the interval is at least1− 1/k2. The larger k is or the wider the interval is, the minimumprobability will be larger.

Christopher Ting QF 603 October 27, 2017 20/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Application of Chebyshev’s Inequality

T For a given level of variance, Chebyshev’s inequality places anupper limit 1/k2 on the probability of a variable being more than acertain distance from its mean, for any statistical distribution (withwell defined variance and mean).

T For a given distribution, the actual probability may be considerablyless.

T Take, for example, a standard normal variable. Chebyshev’sinequality tells us that the probability of being greater than twostandard deviations from the mean is less than or equal to 25%.The exact probability for a standard normal variable is closer to5%, which is indeed less than 25%.

Christopher Ting QF 603 October 27, 2017 21/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Tutorial on Chebyshev’s Inequality

T What is the upper bound for the probability of a stock return to be3 standard deviations away from the mean?Answer:

T On October 19, 1987, the S&P 500 index dropped about 23% (logreturn). The daily standard deviation is 0.9722%. How manystandard deviations is the Black Monday away from the mean?Answer: .

T According to Chebyshev’s inequality, what is the upper bound ofthe probability of the Black Monday?Answer: .

Christopher Ting QF 603 October 27, 2017 22/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Tutorial on Chebyshev’s Inequality (cont’d)

T The number of daily returns used for estimating the samplestandard deviation is 16,525.

T What is the expected number of Black Nondays?

Answer: .

T What is the actual probability of a Black Monday?

Answer: .

Christopher Ting QF 603 October 27, 2017 23/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Value at Risk

o Value at risk (VaR) is one of the most widely used risk measures.

o VaR was popularized by J.P. Morgan in the 1990s. The executivesat J.P. Morgan wanted their risk managers to generate onestatistic at the end of each day, which summarized the risk of thefirm’s entire portfolio. What they came up with was VaR.

o If the 95% VaR of a portfolio is $400, then we expect the portfoliowill lose $400 or less in 95% of of the scenarios, and lose morethan $400 in 5% of the scenarios.

o We can define VaR for any confidence level, but 95% has becomean extremely popular choice.

o VaR is decidedly a one-tailed confidence interval.

Christopher Ting QF 603 October 27, 2017 24/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Value at Risk Time Horizon

o The time horizon also needs to be specified for VaR.o On trading desks, with liquid portfolios, it is common to measure

the one-day 95% VaR.o In other settings, in which less liquid assets may be involved, time

frames of up to one year are not uncommon.

Christopher Ting QF 603 October 27, 2017 25/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Formal Definition of VaR

o If an actual loss equals or exceeds the predicted VaR threshold,that event is known as an exceedance.

o Let the random variable L represent the loss to your portfolio. L issimply the negative of the return to your portfolio. If the return ofyour portfolio is -$600, then the loss, L, is +$600.

o For a given confidence level, γ , then, we can define value at riskas

P(L ≥ VaRγ

)= 1− γ.

o If a risk manager says that the one-day 95% VaR of a portfolio is$400, it means that there is a 5% probability that the portfolio willlose $400 or more on any given day (that L will be more than$400).

Christopher Ting QF 603 October 27, 2017 26/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 2

o The probability density function (PDF) for daily profits at TriangleAsset Management can be described by the following function:

p(x) =

1

10+

1

100x, −10 ≤ x ≤ 0;

1

10− 1

100x, 0 < x ≤ 10.

What is the one-day 95% VaR for Triangle Asset Management?

o Answer: To find the 95% VaR, we need to find a, such that∫ a

−10p(x) dx = 0.05.

o Hence,∫ a

−10

1

10+

1

100x dx =

1

10a+

1

200a2 + 0.50 = 0.05.

Christopher Ting QF 603 October 27, 2017 27/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 2 (cont’d)

o We obtain a quadratic equation a2 + 20a+ 90 = 0.

o Using the quadratic formula, we can solve for a

a = −10±√10.

o Because the distribution is not defined for x < −10, we can ignorethe negative, giving us the final answer

a = −10 +√10 = −6.84.

o The one-day 95% VaR for Triangle Asset Management is a loss of6.84.

Christopher Ting QF 603 October 27, 2017 28/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

95% vs. 99.9%

o At the 95% confidence level will, on average, an exceedanceevent occurs every 20 days. Is an event that happens once every20 days really something that we need to worry about?

o VaR at the 99.9% confidence level expects to see an exceedanceonly once every 1,000 days. It is tempting to believe that the riskmanager using the 99.9% confidence level is concerned withmore serious, riskier outcomes, and is therefore doing a better job.But this is a common mistake for newcomers—choosing aconfidence level that is too high.

o If we have 1,000 data points, then there are 50 data points to backup our 95% confidence level, but only one to back up our 99.9%.

Christopher Ting QF 603 October 27, 2017 29/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Backtesting

o Backtesting entails checking the predicted outcome of a modelagainst actual data. Any model parameter can be backtested.

o In the case of one-day 95% VaR, there is a 5% chance of anexceedance event each day, and a 95% chance that there is noexceedance.

P(K = k

)=

(n

k

)pk(1− p)n−k.

Here, n is the number of periods that we are using in our backtest,k is the number of exceedances, and (1− p) is our confidencelevel.

Christopher Ting QF 603 October 27, 2017 30/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 3

o As a risk manager, you are tasked with calculating a daily 95%VaR statistic for a large fixed income portfolio. Over the past 100days, there have been four exceedances. How manyexceedances should you have expected? What was theprobability of exactly four exceedances during this time? Theprobability of four or less? Four or more?

o Answer: Over 100 days we would expect to see five exceedances:(1− 95%)× 100 = 5. The probability of exactly four exceedancesis 17.81%:

P(K = 4

)=

(100

4

)0.054(1− 0.05)96 = 17.81%.

Christopher Ting QF 603 October 27, 2017 31/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 3 (cont’d)

o Like we compute for zero, one, two, and three exceedances, andthe probability of excedences less than or equal to four is

P(K ≤ 4

)=

4∑k=0

(100

k

)0.05k(1− 0.05)100−k

= 0.0059 + 0.0312 + 0.0812 + 0.1396 + 0.1781 = 43.60%

o The probability of four exceedances and above is

P(K ≥ 4

)= P

(K > 4

)+P(K = 4

)= (1−0.4360)+0.1781 = 74.21%

Christopher Ting QF 603 October 27, 2017 32/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Serial Correlation in Exceedences

/ To model serial correlation in exceedances, look at the periodsimmediately following any exceedance events. The number ofexceedances in these periods should also follow a binomialdistribution.

/ For example, suppose you are calculating the one-day 95% VaRfor a portfolio, and you observed 40 exceedances over the past800 days. You count the number of back-to-back exceedances bylooking at the 40 days immediately following the exceedanceevent. Because you use 95% confidence level, you would expectthat 2 of them, 5% × 40 = 2, would also be exceedances. Theactual number of these day-after exceedances should follow abinomial distribution with n = 40 and p = 5%.

Christopher Ting QF 603 October 27, 2017 33/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Serial Correlation in Exceedences (cont’d)

/ Another common problem with VaR models in practice is thatexceedances tend to be correlated with the level of risk.

/ Positive correlation between exceedances and risk levels canhappen when a model does not react quickly enough to changesin risk levels. Negative correlation can happen when modelwindows are too short.

/ To test for correlation between exceedances and the level of risk,you divide exceedances into two or more buckets, based on thelevel of risk.

Christopher Ting QF 603 October 27, 2017 34/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Example

/ As an example, consider again the one-day 95% VaR for aportfolio over the past 800 days.

/ You divide the sample period in two, placing the 400 days with thehighest forecasted VaR in one bucket and the 400 days with thelowest forecasted VaR in the other.

/ After sorting the days, you would expect each 400-day bucket tocontain 20 exceedances: 5% × 400 = 20. The actual number ofexceedances in each bucket should follow a binomial distributionwith n = 400, and p = 5%.

Christopher Ting QF 603 October 27, 2017 35/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Subadditivity

/ One criticism is that VaR is not a subadditive risk measure.Subadditivity is basically a fancy way of saying that diversificationis good, and a good risk measure should reflect that.

/ Assume that our risk measure is a function f that takes as its inputa random variable representing an asset or portfolio of assets.Higher values of the risk measure are associated with greater risk.

/ If we have two risky portfolios, X and Y , then f is said to besubadditive if

f(X + Y ) ≤ f(X) + f(Y ).

/ In other words, the risk of the combined portfolio, X + Y , shouldbe less than or equal to the sum of the risks of the separateportfolios.

Christopher Ting QF 603 October 27, 2017 36/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 4

/ A portfolio consists of two bonds, each with a 4% probability ofdefaulting. Assume that default events are uncorrelated and thatthe recovery rate of both bonds is 0%. If a bond defaults, it isworth $0; if it does not, it is worth $100. What is the 95% VaR ofeach bond separately? What is the 95% VaR of the bondportfolio?

/ Answer: For each bond separately, the 95% VaR is $0. For anindividual bond, in (over) 95% of scenarios, there is no loss. In thecombined portfolio, however, there are three possibilities, with thefollowing probabilities:

p(x) x

0.16% -$2007.68% -$100

92.16% $0Christopher Ting QF 603 October 27, 2017 37/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 4 (cont’d)

/ There are no defaults in only 92.16% of the scenarios,(1− 4%)2 = 92.16%. In the other 7.84% of scenarios, the loss isgreater than or equal to $100. The 95% VaR of the portfolio istherefore $100.

/ For this portfolio, VaR is not subadditive. Because the VaR of thecombined portfolio is greater than the sum of the VaRs of theseparate portfolios, VaR seems to suggest that there is nodiversification benefit, even though the bonds are uncorrelated.

/ It seems to suggest that holding $200 of either bond would be lessrisky than holding a portfolio with $100 of each. Clearly thissuggestion is not correct.

Christopher Ting QF 603 October 27, 2017 38/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 4 (cont’d)

/ This example makes clear that when assets have payout functionsthat are discontinuous near the VaR critical level, we are likely tohave problems with subadditivity.

/ By the same token, if the payout functions of the assets in aportfolio are continuous, then VaR will be subadditive. In manysettings this is not an onerous assumption. In between, we havelarge, diverse portfolios, which contain some assets withdiscontinuous payout functions. For these portfolios subadditivitywill likely be only a minor issue.

Christopher Ting QF 603 October 27, 2017 39/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Expected Shortfall

/ Another criticism of VaR is that it does not tell you anything aboutthe tail of the distribution.

/ Two portfolios could have the exact same 95% VaR but verydifferent distributions beyond the 95% confidence level.

/ More than VaR, then, what we really want to know is how big theloss will be when we have an exceedance event. Using theconcept of conditional probability, we define the expected value ofa loss, given an exceedance, as follows:

E(L∣∣L ≥ VaRγ

)= S.

/ We refer to this conditional expected loss, S, as the expectedshortfall.

Christopher Ting QF 603 October 27, 2017 40/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Expected Shortfall (cont’d)

/ If the profit function has a probability density function given byf(x) and VaR is at the γ confidence level, then we can find theexpected shortfall as:

S = − 1

1− γ

∫ −VaR−∞

x f(x) dx.

Christopher Ting QF 603 October 27, 2017 41/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 5

/ For the same confidence level and time horizon of SampleProblem 2 in Slide 27 , what is the expected shortfall?

/ Answer:

S = − 1

0.05

∫ −VaR−10

x p(x) dx = −20∫ −VaR−10

x

(1

10+

1

100x

)dx

= −(x2 +

1

15x3) ∣∣∣∣−VaR−10

.

/ With VaR = 10−√10, we find that S = 7.89.

/ Thus, the expected shortfall is a loss of 7.89.

Christopher Ting QF 603 October 27, 2017 42/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Sample Problem 5 (cont’d)

/ Intuitively, the expected shortfall must be greater than the VaR,6.84, but less than the maximum loss of 10.

/ Because extreme events are less likely (the height of the PDFdecreases away from the center), it also makes sense that theexpected shortfall is closer to the VaR than it is to the maximumloss.

Christopher Ting QF 603 October 27, 2017 43/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Summary

® The hypothesis testing process requires a statement of a null andan alternative hypothesis, the selection of the appropriate teststatistic, specification of the significance level, a decision rule, thecalculation of a sample statistic, a decision regarding thehypotheses based on the test, and a decision based on the testresults.

® Hypothesis testing compares a computed test statistic to a criticalvalue at a stated level of significance, which is the decision rule forthe test.

Christopher Ting QF 603 October 27, 2017 44/45

Introduction Confidence Intervals Hypothesis Test Chebyshev’s inequality VaR Problems with VaR Takeaways

Summary (cont’d)

® A hypothesis about a population parameter is rejected when thesample statistic lies outside a confidence interval around thehypothesized value for the chosen level of significance.

® Backtesting is the process of comparing losses predicted by thevalue at risk (VaR) model to those actually experienced over thesample testing period.

® If a model were completely accurate, we would expect VaR to beexceeded with the same frequency predicted by the confidencelevel used in the VaR model. In other words, the probability ofobserving a loss amount greater than VaR should be equal to thelevel of significance.

Christopher Ting QF 603 October 27, 2017 45/45