VUKILE PROPERTY

Click here to load reader

-

Upload

tnt-multimedia-limited -

Category

Documents

-

view

221 -

download

1

description

Transcript of VUKILE PROPERTY

featur

e

V u k i l e P r o P e r t y

2 www.southafricamag.com

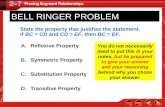

Property company Vukile is performing well in a difficult trading environment says CEO Laurence Rapp. It plans to grow by continuing to focus on its retail footprint and improving the quality of its office portfolio.

By Ian Armitage

Vukile’sa w a k e n i n g

V ukile has one of South Africa’s most successful property portfolios.

The fund is exposed to retail centres in lower-income areas including the Randburg Square, Dobsonville Shopping Centre in Soweto, Phoenix Plaza in Durban, Daveyton and the Hillfox Power Centre in Roodepoort.

Chief executive Laurence Rapp says the fund is “poised for growth”.

SA landlords are generally struggling to fill vacant office, industrial and retail space and push through higher rentals on lease renewals.

Vukile has nevertheless managed to achieve rental growth across all three segments as reported recently in their annual results.

“The portfolio has performed well in a difficult trading environment in which the industry faced higher vacancies, escalating costs and an uncertain economic outlook,” says Rapp.

Highlights for the past year include an increase in the annual distribution of 6.1percent, the acquisition of an R1.5 billion portfolio from Sanlam and the raising of a corporate bond programme.

“We brought 20 properties in a package worth R1.5 billion and added some 25 percent to the size of the portfolio. It will provide a springboard for future growth. Our market capitalisation has grown and we are now a strong mid cap property fund with a market capitalisation of about R6.6 billion. Our assets under management are at about R7.6 billion.”

Vukile focus ProPerty

3www.southafricamag.com

Vukile’sa w a k e n i n g

4 www.southafricamag.com

Vukile focus ProPerty

Rapp says the company plans to expand in rural and urban markets and it will expand some of its township malls.

“The malls aimed at the lower LSM market are achieving better trading densities and stronger growth in the number of monthly visitors than most urban malls.

“The performance of township malls has made it a red-hot sector to be active in.”

Vukile’s Daveyton Mall in the East Rand attracts 920,000 visitors a month.

Its mall in Dobsonville attracts 958,000 visitors a month.

“While we want the fund to be a balanced one in having exposure to retail, industrial and commercial, the focus will be on retail,” Rapp adds. “We have a strong pipeline of acquisitions in townships and rural areas – we want to increase our exposure in this market and there are a number of deals we are evaluating.

“An increase in disposable income and shifting spending patterns in lower-income segments of the market led us to take this view. We are in good shape. The market is not easy. But I think the fact we have over half of our assets in the retail sector has helped. Even in this difficult market we have been able to achieve positive rental reversions in all three sectors of the market — retail, offices and industrial. In the current soft market that is exceptional.”

Mr Rapp expects trading conditions to continue to remain challenging, especially on the office front. “To stress, we think our retail centres will continue to perform

C

M

Y

CM

MY

CY

CMY

K

Office Leasing | Industrial Leasing | Investment Broking | Valuation and

Advisory Services | Retail Leasing and Consulting | Corporate Real Estate

Services | Facilities Management | Property Management | Shopping Centre

Management | Broll-Online | ResearchMAXIMISING PROPERTY POTENTIAL

www.broll.co.za

PART OF THE CBRE AFFILIATE NETWORK

WE’RE PROud TO PROvIdE A WIdE RANGE Of PROPERTY-RELATEd SERvIcES TO vukILE PROPERTY fuNd

6 www.southafricamag.com

well. Overall the portfolio has performed admirably. I do see a modest uptick in the industrial sector and, based on our experience over the past few months, it appears that the office sector may have bottomed out. The sector has faced some vacancy and re-letting challenges. SA landlords have generally struggled to fill vacant office space and push through higher rentals on lease renewals. It is perhaps too early to predict a recovery but it is encouraging to note, looking at our results, vacancy levels across the portfolio are beginning to improve.”

Looking to the future, he stresses the Sanlam acquisition is the initial step of the company’s “new strategy” to be more “acquisitive and proactive”

and will also provide it with “further scope for growth”.

Vukile has accordingly decided to reduce its exposure to lower B grade CBD offices and replace them with higher quality offices in popular office nodes.

“We are confident of again delivering reasonable growth in distributions in the next year,” Rapp says. “We will certainly grow going forward.

“The word Vukile is a Zulu word which means ‘Awaken’ or ‘Arise’. It’s very much a proactive type of word and that’s the essence of the new energy in the company. We’ve changed our logo and we feel it symbolises the new energy and the new awakening. We have an aggressive growth strategy and we’re a lot more proactive in terms of looking for deal and opportunities. We’re going

We are confident of

again delivering reasonable growth in

distributions in the next

year. We will certainly grow going forward

7www.southafricamag.com

FACT BOXVukile deClAres heAlThy prOFiT: Vukile declared and paid an early distribution of 70.5 cents per unit for the second half of the year in April 2012. In total, the distribution for the full year was 124.81 cents per unit representing growth of 6.1 percent for the full year. The full year’s distribution equals 99.8 percent of the profit available for distribution. The early distribution was done to avoid any dilution that would have resulted through the issue of linked units required to partially fund the R1.5 billion acquisition of a portfolio of 20 properties from Sanlam, which was concluded during April 2012.

Vukile focus ProPerty

to remain a diversified fund in three sectors of the market and we are going to specifically try to deepen our niche in lower-income areas, looking at rural and urban opportunities, as it’s a strategy that has worked well for us historically. We are exploring acquisitions of retail centres as well as joint venture development opportunities in the retail environment that would complement our existing portfolio. The focus will remain firmly on retail in emerging markets and we are keen to grow Vukile’s exposure to this market segment. However, that won’t preclude us from acquiring property assets that cater for higher income groups should the right opportunities present themselves.”

Moves to improve the quality of their office assets would continue, Rapp says.

“The next part of the strategy is looking to continually to upgrade our office and industrial portfolio through both acquiring better properties, upgrading existing properties that we already have and, at the same time, selling out of riskier properties in areas that we

think are no longer showing growth potential.”

He is determined to grow Vukile’s portfolio.

“The strategy is to grow our portfolio far more aggressively than before. The Sanlam deal shows we are not afraid to put our money where our mouth is.”

To learn more visit www.vukile.co.za. eND

Vukile Property 1st Floor Meersig Building Constantia Boulevard Constantia Kloof, 1709

Tel: 011 288 1000

www.vukile.co.za

South Africa Magazine, Suite 9 and 10, the royal, Bank Plain, Norwich, Norfolk, uk. Nr2 4SF

tNt Multimedia limited, unit 209, 16 Brune Place, london e1 7NJ

eNquiriestelephone: +44 (0) 1603 343367Fax: +44 (0)1603 [email protected]

subscriptioNs Call: +44 (0)1603 [email protected]

www.southafricamag.com