Vision | Economics | Strategy | Finance | Implementation Public-Private Partnerships: Evolving...

-

Upload

tracy-skinner -

Category

Documents

-

view

215 -

download

1

Transcript of Vision | Economics | Strategy | Finance | Implementation Public-Private Partnerships: Evolving...

Vision | Economics | Strategy | Finance | Implementation

Public-Private Partnerships: Public-Private Partnerships: Evolving ResourcesEvolving Resources

March 30, 2009March 30, 2009Stephen B. Friedman, CRE, AICPStephen B. Friedman, CRE, AICP

Counselors of Real EstateCounselors of Real EstateMid-year MeetingMid-year Meeting

New York, NYNew York, NY

Vision | Economics | Strategy | Finance | Implementation

Overview

1. The Stimulus and Development 2. New Markets Tax Credits 3. Low Income Housing Tax Credits 4. The Local Tool Kit

Tax Incremental Financing Business Improvement Districts Other Tools

Sales Tax Sharing Special Assessments Infrastructure Bonding

2

Vision | Economics | Strategy | Finance | Implementation

1. The Stimulus and Development

Not your Grandfather’s Keynesian Economics Several Major Initiatives

Troubled Assets Relief Program (TARP) Housing and Economic Recovery Act of 2008 (HERA) Heartland Disaster Tax Relief Act of 2008 American Recovery and Reinvestment Act (ARRA) Special Katrina Provisions Holding Over

Pending: Transportation Reauthorization Bill Push for Integration of Land Use/Transportation

Decisions Confluence of Infrastructure/Land Use/Environment

2

Vision | Economics | Strategy | Finance | Implementation

Stimulus, Cont’d

Tax-exempt Bonds Recovery Zone/Empowerment Zone

Economic Development Bonds ($10 Billion) Taxable Federal Reimbursement to County/Muni of 45% of Interest Paid

Facility Bonds ($15 Billion) Tax Exempt Private Activity Bonds

Heartland Disaster Tax Relief Act of 2008 (Arkansas, Illinois, Iowa, Indiana, Missouri, Nebraska and Wisconsin Counties) $14.1 Billion Multi-family Rental Housing Public Utility Property Mortgage Financing Commercial Development Broadly

3

Vision | Economics | Strategy | Finance | Implementation

Stimulus, Cont’d

Highways and Bridges 29 Billion

Airport Improvements $1.3 Billion Mostly FAA, Safety Improvements

Brownfields and Environment $100 Million for Clean-Up Grants; $600 Million

Superfund Sites Part of Broader $10 Billion Environmental

Infrastructure Clean Water Superfund Watershed and Flood Prevention

5

Vision | Economics | Strategy | Finance | Implementation

Stimulus, Cont’d

Other Public Works including Army Corps and Public Buildings

Transit $8.4 Billion including New

Starts/TOD Opportunities Intercity Rail

$9.3 Billion, $8 Billion of Which Is for High-Speed Rail

School Funds Including Modernization

6

Vision | Economics | Strategy | Finance | Implementation

Stimulus, Cont’d

Additional New Markets Tax Credits (NMTC) Authorization $3 Billion, ½ Added to Each of ’08 and ’09 Two-year Total: $10 Billion

Housing Provisions Additional $.20 per Capita LIHTC Treasury Exchange Window for LIHTC at $.85 $2.25 B Home Funds for LIHTC Project Gaps $1 B Additional CDBG $2 B Additional Section 8 Funding for Rehab $2 B Additional Neighborhood Stabilization

7

Vision | Economics | Strategy | Finance | Implementation

The New-New Thing New Markets Tax

Credits Support Commercial and Industrial Development in Qualifying Areas

Increases Access to and/or Lowers Cost of Capital

Supplements TIF, EZ and Other Funds

NMTC: A Tax Credit for Equity Investments in CDEs

Community Development Entities (CDEs): Mission to Serve Low-income Communities

Low-Income Communities (LICs): 20% Poverty or Where Median Family Income Is Below 80% of AMI

8

2. New Markets Tax Credits

Vision | Economics | Strategy | Finance | Implementation

New Markets Tax Credits, Cont’d

Created in 2000 as part of Community Renewal Tax Relief Act

Companion program to Low Income Housing Tax Credit

Administered by CDFI Fund division of U.S. Treasury

Primarily support industrial, community facility, and commercial development in qualifying Census tracts

Can also support direct loans/equity investments to operating businesses

9

Vision | Economics | Strategy | Finance | Implementation

New Markets Tax Credits, Cont’d

7-year stream of federal income tax credit benefits triggered by the flow of debt or equity capital through a “CDE”

Increase access to and/or lower cost of capital (e.g., lower interest rates, partial loan forgiveness, etc.)

Awarded on a competitive national basis to CDEs

10

Vision | Economics | Strategy | Finance | Implementation

Federal Authorization

2001-02 $2.5 billion

2003-04 $3.5 billion

2005 $2 billion

2006 $3.5 billion

2007 $3.5 billion

2008 $3.5 billion *

2009 $3.5 billion *

11

*Additional Approved Allocation for 2008 and 2009 per Stimulus Bill: $3 billion for $5 billion total each year

Vision | Economics | Strategy | Finance | Implementation

CDFI Fund(U.S.

Treasury)

Private Investors

Qualifying Project/Busines

s(QALICB)

QEIQLICICommunity

Development Entity(CDE)

Allocation of NMTCs

7-yearStream ofNMTC Benefits

New Markets Tax Credits, Cont’d

12

Vision | Economics | Strategy | Finance | Implementation

What is a CDE?

Community Development Entity, certified by CDFI Fund (division of U.S. Treasury)

Domestic corporation or partnership For-profit or non-profit Controlled by private, non-profit, or government

organizations Intermediary vehicle for the provision of loans or

other investments in “Low-Income Communities” (LICs)

CDEs are required to demonstrate that they: Have a primary mission of serving LICs and/or

Low-Income Persons Are accountable to residents of the LICs that

they serve

13

Vision | Economics | Strategy | Finance | Implementation

14

Areas of Eligibility in City of Chicago

Vision | Economics | Strategy | Finance | Implementation

New Markets Tax Credits, Cont’d

CDEs Use Investments to Make “Qualified Low-Income Community Investments” (QLICIs)

QLICIs include: Capital or Equity Investment in, or Loan to, any “Qualified

Active Low-Income Community Business” (QALICB) Equity Investment in, or Loan to, any CDE Purchase of a Loan from Another CDE Financial Counseling and Other Services to Businesses

Located in LICs

15

Vision | Economics | Strategy | Finance | Implementation

What Is the Tax Credit Benefit?

For investment (QEI) of $1.00, investor would receive a seven-year federal income tax credit of:

TOTAL VALUE OVER 7 YEARS = $0.39

Up-Front Discounted Value: Generally $0.25 to $0.30

Above Example Consumes $1 of “Allocation”

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

$0.05 $0.05 $0.05 $0.06 $0.06 $0.06 $0.06

16

Vision | Economics | Strategy | Finance | Implementation

Allowable Uses of NMTC Financing

Must be provided to a Qualified Active Low-Income Community Business (QALICB)

Debt, equity, or “hybrid” financings Commercial, industrial, institutional, not-

for-profit projects For-sale housing (challenging timing

issues) Mixed-use project (provided rental housing

is <80% of income stream) Operating businesses

17

Vision | Economics | Strategy | Finance | Implementation

Qualified Low-Income Community Investments (QLICIs)

Capital provided by a CDE to a “Qualified Active Low-Income Community Business” (QALICB or “Qualifying Project”)

Generally have term of 7 years Debt or equity with better-than-market terms Potential for partial forgiveness by CDE at

end of Year 7

18

Vision | Economics | Strategy | Finance | Implementation

Who has NMTC Allocations?

Competitively allocated at federal level Strong competition for the credit – demand

exceeds supply by about 10 to 1 In 2008 round, 239 CDEs applied for credits

and 70 received an allocation Average allocation award per CDE is $50

million Banks are the dominant recipients of credit

to date City and state agencies Non-profits

19

Vision | Economics | Strategy | Finance | Implementation

NMTC Investors

Type of Investors: Banks/Financial Institutions (e.g., US

Bank, JPMorgan Chase, Capmark, Bank of America)

Corporations (e.g., Target) With proper structuring, Investor can also

play other roles in the transaction (lender, CDE, borrower)

Credit begins to flow when investor makes the Qualified Equity Investment (QEI)

20

Vision | Economics | Strategy | Finance | Implementation

Allocatees Nationally

115 Community Development Entities (CDEs) currently have NMTC allocations according to the Community Development Finance Institutions (CDFI) Fund

21

Vision | Economics | Strategy | Finance | Implementation

Allocatees Serving Illinois

Chicago Development Fund Citibank NMTC Corporation HEDC New Markets, Inc Hospitality Fund, II LLC Local Initiatives Support Corporation M&I New Markets Fund, LLC National City New Market Fund, Inc Urban Research Park CDE, LLC Chase New Markets Corporation Fifth Third New Markets Development Company LLC Gateway CDE LLC Related Community Development Group, LLC Urban Development Fund, LLC USBCDE, LLC

22

Vision | Economics | Strategy | Finance | Implementation

How Deals are Assembled Project Sponsor identifies a CDE (or Investor) and submits

project proposal CDEs have differing geographic service areas and targeted

project types CDE typically will assist in identifying the Investor or vice

versa Possible to have multiple CDEs for larger projects, but it will

drive up transaction costs Find out CDE and Investor fees up-front. Average fees for

2008 allocatees were 6.75% for for-profit allocatees and 7.25% for non-profit allocatees

Expect Investors to be looking for IRR at 7-9% on non-profit deals and 8.5-10% on for-profit deals

$4MM or larger transactions with high community impact are most attractive to CDEs and Investors

22

Vision | Economics | Strategy | Finance | Implementation

Imperial Zinc

Applicant : Manufacturer of zinc anodes and alloys

Project: 80,000-square-foot production facility to replace building destroyed by fire in March 2008. Project will allow for expansion into two new product lines.

Location: 103rd Street & Woodlawn Avenue, Pullman Community Area

24

Vision | Economics | Strategy | Finance | Implementation

Sample $10 Million Deal

25

QALICB(Project)

CDE

Tax Credit Benefits($3.9 MM over 7

Yrs)

7-Year Mini-Perm Loan

@ Low Blended Rate($9.5MM)

NMTCInvestor

Lender

Cash Up-Front($2.5-$3MM)

Interest-Only Debt Service w/Balloon In Year 7

7-Year Loan at Conventional Market Terms ($7-$7.5MM)

$500k in CDE fees and other

transaction costs(placeholder amt)

Sinking Fund for

Loan Repayment

Vision | Economics | Strategy | Finance | Implementation

Year 7

26

QALICB(Project)

CDE

Return on and of capital provided via

tax credits

NMTCInvestor

LenderPrincipal Repayment

($7-$7.5MM) Principal Repayment($7-$7.5MM)

Remaining $2-$2.5MMcan be forgiven or

restructured

Vision | Economics | Strategy | Finance | Implementation

CSTLC/Homan

26

Henry Ford Learning Institute Charter high school at

Homan Square in Lawndale $41 million project with $22

million of NMTC allocation LEED Gold Historic rehab 450-500 students NMTCs used to make low-

interest forgivable loans

Vision | Economics | Strategy | Finance | Implementation

Sample “Non-Economic” Deal

28

QALICB(Project)

Nominal InterestLoan

($9.5MM)

NMTCInvestor

QEI$10MM

$5MM Loan

$2MM Loan

$3MMEquity

Tax Credit Benefits($3.9 MM over 7 Yrs)

QLICI

•$500k in CDE fees and other transaction costs

(placeholder amt)

CDEInvestment Fund

CharitableDonations

GovernmentGrant

Vision | Economics | Strategy | Finance | Implementation

QALICB(Project)CDE

Loan Can be Forgiven

($9.5MM)

CharitableDonations

GovernmentGrant

Year 7 Unwind

29

Return on and of capital provided via tax credits

NMTCInvestor

NoRepayment

Needed- Loans Can be Forgiven

Vision | Economics | Strategy | Finance | Implementation

$9.5MMRevolver

$3MM Equity

Investment

7-Year Loan ($7MM)

NMTC Structure with For-Sale Housing

30

CDE

Tax Credit Benefits($3.9 MM over 7 Yrs)

NMTCInvestor

Lender

$10MMQEI

InvestmentFund

Principal Paymentsw/Sales Proceeds

Home Builder

(QALICB)

ConstructionLoan

Disbursements HomeIn

QCT

SalesProceeds

Construction

•Principal must stay at CDE level or below for 7-year NMTC compliance period•CDE must re-deploy repaid principal within 1 year

HomeIn

QCT

Vision | Economics | Strategy | Finance | Implementation

Use of Condo Structure to Combine LIHTC & NMTC With careful structuring, can create mixed-use

building with an NMTC-financed transaction: NMTC-financed commercial/community facility

transaction on lower floors LIHTC-financed affordable rental transaction on

upper floors Requires division of ownership between the

two deals within the same building

30

Vision | Economics | Strategy | Finance | Implementation

States May Create Piggy-Back Credits:Example -- New Illinois NMTC Limit allocations to amount that will result in max of $10M of

tax credits in any fiscal year Follows Federal program with a couple of exceptions:

Excludes businesses that derive 15% or more of annual revenue from rental or for-sale real estate (carve-out for sponsor lease so long as sponsor passes test)

7-year credit percentages are different split QEI can be debt or equity Max QLICI to any one entity and its affiliates is $10MM

Small and shallow state credit

31

TOTAL VALUE OVER 7 YEARS = $0.39 QEI for federal purposes can also be

considered QEI for state NMTC purposes

Vision | Economics | Strategy | Finance | Implementation

3. Low Income Housing Tax Credits

The Workhorse Created in 1986 Credits Allocated to States

Per Capita Allocated Using QAP to

Developers 9% (+/-) of Eligible Basis for

10 Years Sold to Investors $.70 to

$.90 4% Option With Bonds 30 Year Restriction to Low

Income

33

Vision | Economics | Strategy | Finance | Implementation

Lasagna Financing

Assuming a $20M deal: LIHTC Yield $13M Home Funds$2M First Mortgage

$1.5M Other Soft $ $2M TIF $1.5M

34

Tax Credits (assuming 9% credits) typically are between 60% and 70% of total development costs. The 60 - 70% swing ultimately depends on credit pricing and/or if the applicant gets the full amount of credits requested. First mortgages are typically 10% of TDC or less. The rest could be just about anything.

Vision | Economics | Strategy | Finance | Implementation

The Process

Application Issues

State Housing Agencies Qualified Allocation Plan Competitive Process Multiple Financing

Sources Local Support Site ControlSignificant upfront effort toprepare competitive

application

Developer Compensation is Upfront with Limited Ongoing Cash Flow

Bank and Corporate Buyers Out of Market

Stimulus Provides Treasury Window and Added Gap

The Program for NewAffordable Housing WillIncrease in Importance

35

Vision | Economics | Strategy | Finance | Implementation

4. The Local Tool Kit

Tax Incremental Financing Business Improvement Districts Other Tools

Sales Tax Sharing Special Assessments Infrastructure Bonding

36

Vision | Economics | Strategy | Finance | Implementation

Tax Incremental Financing

37

Vision | Economics | Strategy | Finance | Implementation

TIF in Virtually All States

TIF exists in 49 states and Washington D.C.

Only Arizona does not have TIF legislation

TIF, TAD, RAD, TIRZ…

38

Vision | Economics | Strategy | Finance | Implementation

But the Midwest is the Leader…

39

Vision | Economics | Strategy | Finance | Implementation

Tax Incremental Financing , Cont’d

Criteria Vary by State Usual Factors

1.5-Acre Minimum (IL) Blight and Conservation

Factors But For… Industrial and Special

Vacant Land Factors Maximum Length of District

50% over 35 years Deterioration Dilapidation Excessive Vacancy Lack of Growth of EAV Environmental Contamination Deleterious Land Use or

Layout Obsolescence Code Others

40

Vision | Economics | Strategy | Finance | Implementation

Uses of TIF Funds: Vary by State

Property Assembly/Site Preparation/Remediation or Capping of Contaminated Soils

Relocation Rehabilitation, Reconstruction,

Repair, or Remodeling of Existing Structures

Low-income Housing Construction

Public Works or Improvements (Including Parking Facilities)

Interest Subsidy Studies, Surveys, Planning,

Legal, Consulting, and Administration

Job Training/Welfare to Work Day Care

Financing Costs Taxing Districts’ Capital

Costs Payment in Lieu of Taxes School and Library Costs Park Improvements Hiking and Biking Trails Pedestrian Pathways and

Bridges Facilitating Intermodal Transportation

Pedestrian Platforms at Transit Stations

Public Golf Courses and Buildings

Hospitals Community Colleges Convention Centers

4141

Vision | Economics | Strategy | Finance | Implementation

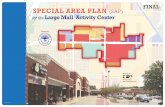

Range of TIF Projects

Manpower Bryn Mawr/Belle Shore

Block 37/Lowes Hotel

Uptown at Park Ridge

42

Vision | Economics | Strategy | Finance | Implementation

Deal Criteria and Process

Criteria Process

District creation varies Financing gap

Extraordinary costs Weak market High risk

Competitive locations Project increment vs.

District increment Leverage

Formal application Market Gap Analysis Increment Projections Ownership Review

Underwriting of pro forma

Public review Review of parties

43

Vision | Economics | Strategy | Finance | Implementation

Structure and Funding

Structure Funding Methods

Grants Junior Mortgage

Loans Clawbacks Cessation of

Payments

Front Funding from Balances

Alternate Revenue Bonds (G.O. Backed)

Special Revenue Bonds

Developer Notes Sold at Discount Held

Annual Payments44

Vision | Economics | Strategy | Finance | Implementation

45

Vision | Economics | Strategy | Finance | Implementation

Business Improvement Districts

Special Districts Providing Special Services or Infrastructure

Additional Tax Results in Complex Approvals

Both Urban and Greenfield A Rose by Any Other

Name…. Business Improvement

Districts Business Development

Districts Special Service Areas Community Improvement

District

46

Vision | Economics | Strategy | Finance | Implementation

BIDs and Their Cousins

Parameters Issues and Concerns

Designated Sub-area of Community

Additional Tax to Pay for Facilities or Services beyond Usual

Downtown District Improvements & Marketing

Greenfield Infrastructure Back-up for Owner’s

Associations 51% of Owners & Electors

Can Block

Tax Rates (Commercial Districts: .5% To 1.0% Typical)

Shifting Infrastructure Costs – Windfall Profits?

Subsequent Owner Disclosure

Equity Issues But Can Be Useful

47

Vision | Economics | Strategy | Finance | Implementation

Two Broad Uses

Business Districts Greenfield Infrastructure

Special Streetscape and Lighting

Marketing and Promotions Security/Concierge Additional Cleaning and

Snow Removal Special Events Festivals Small Tax Rate (1%)

Streets, Water, and Sewer Stormwater facilities Parks and Open Space

Improvements Other Typical Subdivision

Improvements Dedicated or Granted to Public

Substantial Tax Rate (May be ½ up to Equal Other Property Tax)

48

Vision | Economics | Strategy | Finance | Implementation

Back-up for Property Owner Associations

Obligations Reasons for Failure

Maintain public infrastructure

Maintain open space Maintain stormwater

facilities Other responsibilities

in which there is a public right or responsibility assumed by POA

Disagreement Economic distress of

members Refusal of some to pay

Allows Public Sector toStep In and Levy Tax toPay for Missed

Obligation

49

Vision | Economics | Strategy | Finance | Implementation

Other Examples

New York City: 60 BIDs; $80 Million Alliance for Downtown New York

Serves the Wall Street financial district; provides supplemental security and sanitation; economic development; streetscape, design and transportation services

Center City District in Philadelphia Encompasses 120 blocks and more than 4,500 individual properties; provides

sidewalk cleaning, graffiti removal, landscape maintenance, crime prevention, and advertising and promotion

Downtown D.C. Approximately 140 blocks and 825 properties; provides services for hospitality,

safety, maintenance, public space programming, streetscape, homeless services, and so on

Hollywood Entertainment District Spans an18-block stretch of Hollywood Boulevard and is funded by 225 property

owners; provides security, cleaning, and marketing services Historic Third Ward Association in Milwaukee

Includes over 350 business and 400 residences; focused on converting various manufacturing and warehousing structures into commercial and residential uses

Downtown BID in Grand Rapids Located in the Heart of Downtown Grand Rapids; focuses on maintenance and

beautification, business development, event programming, and marketing

50

Vision | Economics | Strategy | Finance | Implementation

Other Variants

Business Development District

Differing Revenue Sources

Missouri and Illinois Blighted Areas Additional Taxes in

Area Only

An Interest in Land (MI) Ad Valorem Tax (IL and

Others) Hotel Tax Sales Tax

If it is a property tax, it is likely

to be deductible from Federal

Income Tax

51

Vision | Economics | Strategy | Finance | Implementation

Other Tools: Sales Tax Sharing

Parameters Form of Rebate

Available in Some States Where a Portion of Sales Tax Returned to Point of Origin

Compete for STGs Auto Dealers Shopping Centers Large

Appliance/Electronic Stores

Big-box Stores

Share of Increase Sometimes Net Impact

on Other Stores Time Limits Dollar Limits Sometimes Linked to

Extraordinary Costs Often Linked to Major

Investment

52

Vision | Economics | Strategy | Finance | Implementation

Sales Tax Sharing, Cont’d

Sales Tax Sharing

Big-box-anchored 380,000 S.F. Shopping CenterDeveloper Requested Approximately $5.8 Million in Municipal AssistanceRecovery Period for Sharing % Scenarios

100% 8 Years75% 11 Years50% 21 Years

53

AssumptionsInflation 3.0%Sales Tax Rate 1.0%NPV Discount Rate 10.0%Occupancy Factor for Non-Anchors 90.0%

Sales GenerationSales psf Sales Area

Anchor 1 [1] 422.00$ 203,091 Anchor 2 [1] 268.00$ 88,248 Non-Anchor [2] 195.00$ 71,022 Pads [2] 195.00$ 20,000 [1] Based on annual reports.[2] Based on Dollars and Cents of Shopping Centers .

Anchor 1 Anchor 2 Non-Anchor Pads Total 100% 75% 50%Sales [1] Sales [1] Sales [2] Sales [2] Sales Sales Tax Sharing Sharing

1 2005 - - - - - - - - 2 2006 57,136,268 15,766,976 6,232,181 1,755,000 80,890,425 808,904 606,678 404,452 3 2007 85,704,402 23,650,464 9,348,271 2,632,500 121,335,637 1,213,356 910,017 606,678 4 2008 88,275,534 24,359,978 12,464,361 3,510,000 128,609,873 1,286,099 964,574 643,049 5 2009 90,923,800 25,090,777 12,838,292 3,615,300 132,468,169 1,324,682 993,511 662,341 6 2010 93,651,514 25,843,501 13,223,441 3,723,759 136,442,214 1,364,422 1,023,317 682,211 7 2011 96,461,060 26,618,806 13,620,144 3,835,472 140,535,481 1,405,355 1,054,016 702,677 8 2012 99,354,891 27,417,370 14,028,748 3,950,536 144,751,545 1,447,515 1,085,637 723,758 9 2013 102,335,538 28,239,891 14,449,611 4,069,052 149,094,091 1,490,941 1,118,206 745,470 10 2014 105,405,604 29,087,088 14,883,099 4,191,124 153,566,914 1,535,669 1,151,752 767,835 11 2015 108,567,772 29,959,700 15,329,592 4,316,857 158,173,922 1,581,739 1,186,304 790,870 12 2016 111,824,805 30,858,491 15,789,480 4,446,363 162,919,139 1,629,191 1,221,894 814,596 13 2017 115,179,550 31,784,246 16,263,164 4,579,754 167,806,713 1,678,067 1,258,550 839,034 14 2018 118,634,936 32,737,773 16,751,059 4,717,146 172,840,915 1,728,409 1,296,307 864,205 15 2019 122,193,984 33,719,907 17,253,591 4,858,661 178,026,142 1,780,261 1,335,196 890,131 16 2020 125,859,804 34,731,504 17,771,198 5,004,421 183,366,927 1,833,669 1,375,252 916,835 17 2021 129,635,598 35,773,449 18,304,334 5,154,553 188,867,934 1,888,679 1,416,510 944,340 18 2022 133,524,666 36,846,652 18,853,464 5,309,190 194,533,972 1,945,340 1,459,005 972,670 19 2023 137,530,406 37,952,052 19,419,068 5,468,466 200,369,992 2,003,700 1,502,775 1,001,850 20 2024 141,656,318 39,090,613 20,001,640 5,632,520 206,381,091 2,063,811 1,547,858 1,031,905 21 2025 145,906,007 40,263,332 20,601,690 5,801,495 212,572,524 2,125,725 1,594,294 1,062,863 22 2026 150,283,188 41,471,232 21,219,740 5,975,540 218,949,700 2,189,497 1,642,123 1,094,748 23 2027 154,791,683 42,715,369 21,856,332 6,154,806 225,518,191 2,255,182 1,691,386 1,127,591 24 2028 159,435,434 43,996,830 22,512,022 6,339,450 232,283,736 2,322,837 1,742,128 1,161,419 25 2029 164,218,497 45,316,735 23,187,383 6,529,634 239,252,249 2,392,522 1,794,392 1,196,261

TOTAL 2005-2029 41,295,575 30,971,681 20,647,787 NPV 2005-2029 12,134,702 9,101,027 6,067,351 PV @ 10% 2005- 6,080,005 5,809,180 5,713,100

Note: Shaded portions of columns represent recovery period.[1] Anchors phased in at 67% in first year of operations, 100% in second year of operations.[2] Non-Anchors phased in at 50% in first year of operations, 75% in second year of operation, 100% in third year of operations.

Year

Vision | Economics | Strategy | Finance | Implementation

Other Infrastructure Tools

Special Assessments Infrastructure Bonding

Traditional Tool Assessment Based on

Benefit Court Process in IL Key Role for Appraisers Methods Vary –

Historically Lineal Lien on Property Not Tax Deductible

Omnibus Approach Special Sales Tax in

IL; Likely Variants Elsewhere

Can be Combined Developer Payments Impact Fees SSA Type Vehicles Recapture Agreements

54

Vision | Economics | Strategy | Finance | Implementation

In Closing…

Stimulus Should Provide Opportunities and Turnaround

Public Project Opportunities Accelerated A Complex Tool Kit To Close Gaps Through Public-Private Partnerships

55

Vision | Economics | Strategy | Finance | Implementation

Real Estate Economics Public-Private Partnerships Developer Solicitation Development

Management Public Financing Area Plans &

Implementation Fiscal & Economic Impact

56

221 North LaSalle StreetSuite 820Chicago, IL 60601(312) 424-4250www.friedmanco.com