Value Investing Opportunities in Korea (Presentation by Petra) (1)

-

Upload

mike-chang -

Category

Documents

-

view

55 -

download

0

Transcript of Value Investing Opportunities in Korea (Presentation by Petra) (1)

8th annual Springvalue investing congress

•May 6, 2013 • Las Vegas, NV

Taking Advantage of MispricingOpportunities in Korea

Chan H. Lee & Albert H. Yong,Petra Capital Management

Join us for the 9th Annual New York Value Investing Congress! To register and benefit from a special discount go to www.ValueInvestingCongress.com/SAVE

www.ValueInvestingCongress.com

Strictly Confidential | May 2013

Taking Advantage of Mispricing Opportunities in Korea Value Investing Congress 2013

Strictly Confidential

Petra Capital Management – Overview

1

Investment advisory and portfolio management firm based in Seoul, Korea registered with the

Financial Services Commission of Korea

Co-founded by Managing Partners, Albert H. Yong (MBA) and Chan H. Lee (JD); both

received their graduate degrees from UCLA in 1997

Value investors, focusing on undervalued Korean public companies with potential catalyst(s)

whose market prices are trading at a significant discount to intrinsic value; a bottom-up stock

selection approach and detailed fundamental/research-based analysis

Petra: 40.0% vs. KOSPI index: 9.4% (year 2012)

Petra: 138.1% vs. KOSPI index: 21.3% (cumulative return since inception in Sept 2009)

Korea offers compelling value investing opportunities

− Many Korean companies with earnings power + strong balance sheet + growth potential

− Many small/mid-cap Korean companies not followed by sell-side analysts

− Various mispricing opportunities in Korea (market price vs. intrinsic value)

Strictly Confidential

Petra Capital Management – Overview (Cont’d)

2

From April 30, 2012 to April 25, 2013

-50%

0%

50%

100%

150%

200%

250%

4/30/12 5/31/12 6/30/12 7/31/12 8/31/12 9/30/12 10/31/12 11/30/12 12/31/12 1/31/13 2/28/13 3/31/13

KG INICIS CJ O Shopping KOSPI

KG INICIS

+231.9%

CJ O Shopping

+76.3%

KOSPI

-1.5%

Strictly Confidential

Table of Contents

3

I. Korea Overview

II. Types of Mispricing Opportunities in Korea

III. Value Investing Opportunity 1: Sebang

IV. Value Investing Opportunity 2: Daechang Forging

V. Conclusion

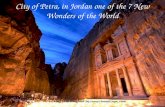

I. Korea Overview

Strictly Confidential

Source: International Monetary Fund, The World Bank, Statistics Korea

Country Overview

Country Name: Republic of Korea (South)

Area: 100,140 km2

Population: 50 million (2012)

GDP: US$1,164 billion (2011)

15th in the world

GDP per Capita (PPP): US$31,753 (2011)

25th in the world

Average GDP Growth: 5.0% (Since 1999)

Foreign Exchange Reserves: US$327 billion

(as of December 31, 2012) 8th in the world

Inflation (CPI): 4.3% (2012)

Unemployment Rate: 2.8% (2012)

Trade Surplus: US$30 billion (2012)

Total Equity Market Cap: US$1,189 billion

(as of December 31, 2012) 13th in the world

5

Strictly Confidential

Strong Fiscal Position

6

Source: Fitch, S&P, Moody’s

Korea’s Sovereign Credit Rating Sovereign Debt and Budget Balance

All three major credit rating agencies, Fitch, S&P and Moody’s,

have recently upgraded Korea to its highest ratings since the

country was first rated in 1986

Korea’s level of sovereign debt (33.4% of GDP) is one of the

lowest amongst developed economies

Source: International Monetary Fund (2011)

AA-

A+

A

A-

AA

AA+

220.0

142.8

119.0

94.4

84.0

33.4

0 50 100 150 200 250

Japan

Greece

Italy

US

Germany

Korea

Sovereign Debt to GDP Ratio

-9.1

-7.6

-7.6

-2.9

0.1

0.6

-10 -8 -6 -4 -2 0 2

Japan

Greece

US

Italy

Germany

Korea

Budget Balance (% of GDP)

The Korean government had a budget surplus in 10 of the past

11 years

Strictly Confidential

Balanced Industry Structure

7

The Korean industry structure is well diversified while most emerging economies are

disproportionately concentrated in few dominant industries

Source: Bloomberg, Institutional Brokers' Estimate System

10.6

8.5

10.4

9.5

10.1

8.7

21.3

11.6

5.0

4.4

2.5

14.9

15.1

13.3

4.9

0.5

16.3

28.0

2.8

1.7

- 5 10 15 20 25 30

Energy

Materials

Industrials

Con. Dis.

Con. Stp.

Healthcare

Financials

IT

Telco

Utilities

Korea

AC World

16.4

5.3

7.7

5.4

6.2

0.9

37.9

5.0

13.2

2.0

- 10 20 30 40

Energy

Materials

Industrials

Con. Dis.

Con. Stp.

Healthcare

Financials

IT

Telco

Utilities

0.7

12.5

3.5

3.0

1.8

0.0

15.5

58.5

4.5

0.0

- 20 40 60 80

Energy

Materials

Industrials

Con. Dis.

Con. Stp.

Healthcare

Financials

IT

Telco

Utilities

20.7

26.1

3.3

5.3

8.8

0.0

25.8

2.0

2.5

5.6

- 10 20 30

Energy

Materials

Industrials

Con. Dis.

Con. Stp.

Healthcare

Financials

IT

Telco

Utilities

Korea vs. World China Taiwan Brazil

Industry Structure by Country

Strictly Confidential

Growing Exposure to Emerging Markets

8

Exports Exposure

Korea is strategically positioned geographically and industrially to benefit considerably from

the robust growth in emerging markets

Source: Statistics Korea

1% 11%

25%

35%

43%

50%

64%

47%

26%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1990 2000 2012

Developed Countriees Other Emerging Countries China

Strictly Confidential

Korean Economic Achievements

9

Korea has become an epicenter of

Asian culture/entertainment; for

example, Psy, a Korean rapper has

successfully entered into global

markets with an immensely popular

hit song “Gangnam Style,”

reaching over 1.5 billion YouTube

views

Korea's “Big Three” shipbuilders –

Daewoo Shipbuilding and Marine

Engineering, Hyundai Heavy

Industries and Samsung Heavy

Industries – dominate the global

shipbuilding industry with over 50

percent of the global market share

Korea is the largest mobile phone

manufacturer in the world with

Samsung Electronics being the

largest mobile phone manufacturing

company

Hyundai Motor along with Kia

Motors is the world’s fastest growing

and 4th largest automaker and has

more than 10 percent of the global

market share

The South Korean city of

Pyeongchang has been awarded

the 2018 Winter Olympics, the first

city in Asia outside of Japan to

host the Winter Olympics; hosting

the Winter Olympics will directly

add US$20 billion to the Korean

economy

Amore Pacific is becoming one of

the leading cosmetics companies in

the world thanks to its increasing

market shares throughout Asia,

benefiting from rise in popularity of

Korean culture, including Korean

movies, dramas and K-pop songs

Strictly Confidential

Positive Regulatory Changes

10

Improving corporate governance

− The Korea government is introducing a new bill on corporate governance of financial companies; the

Ministry of Justice is working on another amendment to the Korean corporate law to better define the

role of “outside” director

− The recent Korean corporate law amendments require super-majority board approval for transactions

between the company and its director(s) and impose personal liability on director(s) for such decisions

Economic democratization

− The newly elected Park administration has pledged to promote free-competition economy that protects

the market and smaller companies as well as consumers from unfair business practices

− The Korean government is set to enact regulations restricting the cross-holding ownership structure of

chaebols and prohibiting inequitable business transactions with affiliated companies

Strictly Confidential

1,427

392

105

0 500 1,000 1,500

Small Cap

Mid Cap

Large Cap

Introduction to Korean Stock Market

11

Sector Breakdown Number of Listed Companies by Market Cap

The Korean stock market has approximately 2,000 companies with total market capitalization

of US$1,189 billion, the 13th largest in the world (as of December 31, 2012)

Source: Korea Stock Exchange Source: Korea Stock Exchange

(<200 billion Won)

(2 trillion ~

200 billion Won)

(>2 trillion Won)

Technology 27%

Auto & Auto Parts

13%

Financials 13%

Services 11%

Chemical 9%

Retail 5%

Metals 5%

Others 16%

Strictly Confidential

Korean Index Performance

12

Trends of Stock Markets in Korea and the U.S.

The Korean stock market drastically outpaced the U.S. stock market over the last decade

(1/04/2000 = 100)

+35%

1172.5

747.7

1951.6

1585.2

Source: Bloomberg

+161%

0

50

100

150

200

250

300

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

KOSPI S&P 500

Strictly Confidential

Attractive Valuation

13

Attractive Valuations

“There has been a huge advance in the Korean market; nevertheless, many Korean stocks

still sell at more attractive prices than stocks in other major countries” – Warren Buffett

Source: Bloomberg (as of March 31, 2013)

Country Index P/E P/B

China Shanghai Comp 10.0 1.7

Korea KOSPI 10.6 1.2

Hong Kong Hang Seng 10.8 1.5

Brazil Bovespa 11.1 1.1

France CAC 40 11.3 1.2

Germany DAX 30 11.8 1.5

U.S. S&P 500 14.0 2.2

India Sensex 14.4 2.6

Taiwan TWSE 14.7 1.7

Mexico Mexican Bolsa 16.3 3.0

Japan Nikkei 225 24.1 1.5

Strictly Confidential

-5% 0% 5% 10% 15% 20% 25% 30% 35%

KOSPI

Shanghai Composite

Hang Seng

DAX 30

CAC 40

FTSE 100

S&P 500

Nikkei 225

Korean Stock Market in 2013

14

KOSPI index is underperforming most other indices in year 2013, a sharp contrast to other

major equity markets

Source: Bloomberg

Strictly Confidential

Weakening of Japanese Yen (I)

15

The Japanese Yen has significantly weakened in the past few months; however, it is still

relatively overvalued compared to its level against the Korean Won before the global financial

crisis in 2008

Source: Bank of Korea

(Won)

700

800

900

1,000

1,100

1,200

1,300

1,400

1,500

1,600

1,700

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Korean Won/100 Japanese Yen

Strictly Confidential

-5

-4

-3

-2

-1

-

1

2

3

4

5

6

7

8

10

15

20

25

30

35

40

45

50

55

Jan/12 Feb/12 Mar/12 Apr/12 May/12 Jun/12 Jul/12 Aug/12 Sep/12 Oct/12 Nov/12 Dec/12 Jan/13 Feb/13 Mar/13

Exports (LHS)

Imports (LHS)

Trade Balance (RHS)

Weakening of Japanese Yen (II)

16

The Korean stock market may have overreacted to the weakening of the Japanese Yen; so

far, its effect on the Korean exports and imports has been minimal

Source: Bank of Korea

(billion US$) (billion US$)

JPY

II. Types of Mispricing Opportunities in Korea

Strictly Confidential

Mispricing Type 1: Net-Net

There are still many publicly listed Korean companies which can be categorized as “Net-Net”

as defined by Benjamin Graham, the Father of Value Investing

18

(Unit: million Won)

Company Net-Net Value Market Cap

KCC Engineering & Construction 209,110 142,970

Dongwon Development 230,121 142,569

Dongil Industries 157,788 137,752

Shinyoung Wacoal 95,262 94,500

Hanshin Construction 176,217 88,409

HNK Machine Tool 107,779 81,435

Keyang Electric Machinery 86,859 80,312

Choil Aluminium 83,122 78,300

Kyeryong Construction 101,839 76,806

Samyang Tongsang 117,116 75,300

Man Ho Rope & Wire 85,795 62,458

Taegu Broadcasting Corporation 64,724 61,500

Sam Sung Climate Control 133,565 60,541

Hwa Sung Industries 103,061 59,639

Nam Kwang Engineering & Construction 87,769 57,110

Moatech 76,178 54,172

Pang Rim 87,401 50,142

Young Poong Paper 53,122 48,840

Seung Il 51,775 47,217

Keum Kang Steel 67,192 46,894

.

.

.

.

.

. . . .

Source: Petra analysis

Strictly Confidential

37.7% 39.9%

24.8%

59.2%

66.9%

40.5% 43.0%

38.2% 39.7%

46.5%

35.3%

57.4%

40.1%

34.1% 34.7%

27.4%

31.5%

21.6%

32.9%

25.0%

0%

10%

20%

30%

40%

50%

60%

70%

80%

Preferred Stock Price in % of Common Stock Price

Mispricing Type 2: Preferred Stocks

Many Korean preferred stocks trade at about 40% of the value of the equivalent common

stocks; the gaps have been widening over the past decade

19

Source: Bloomberg

Average: 38.8%

Median: 37.9%

Strictly Confidential

Mispricing Type 3: Holding Company Discounts

Increasing number of Korean public companies are transforming into a holding company

structure by spinning off the business operation; however, many holding companies are

unreasonably, significantly discounted by the market compared to the value of their

subsidiaries

20

Company P/B

Hanjin Heavy Industries & Construction Holdings 0.1x

S&T Holdings 0.1x

Iljin Holdings 0.2x

Dongwha Holdings 0.2x

SK Holdings 0.2x

KISCO Holdings 0.2x

SeAH Holdings 0.2x

KPX Holdings 0.2x

Pyung Hwa Holdings 0.2x

KEC Holdings 0.2x

Hite Jinro Holdings 0.2x

CS Holdings 0.2x

Chinyang Holdings 0.3x

Poongsan Holdings 0.3x

Daesung Holdings 0.3x

Noroo Holdings 0.3x

Kolon 0.4x

CJ 0.5x

Humax Holdings 0.5x

Hanjin Shipping Holdings 0.5x

Nongshim Holdings 0.6x

JW Holdings Corporation 0.6x . . .

.

.

.

Source: Petra analysis

Subsidiary

Company A

Strictly Confidential

Mispricing Type 4: Shareholder Activism Targets

Current valuations of many stocks in Korea are reminiscent of the valuations of companies in

the U.S. that attracted activists and LBO buyers in the late-1970s and early-1980s; the

corporate governance and rule of law have improved significantly in Korea, creating a more

favorable environment for shareholder activism

21

III. Value Investing Opportunity 1: Sebang

Strictly Confidential

Sebang (004360) – Snapshot

23

Stock Price (4/19/2013) 17,600 Won Industry Industrial

EPS 2,356 Won Market Cap 296 billion Won

P/E 7.5x Sales (2012) 718 billion Won

BPS 36,415 Won EBIT (2012) 34 billion Won

P/B 0.5x Dividend Yield 0.9%

US$1 = 1,100 Won

10,000

12,000

14,000

16,000

18,000

20,000

12/31/09 6/30/10 12/31/10 6/30/11 12/31/11 6/30/12 12/31/12

(Won)

* US$269 million

*

Strictly Confidential

Investment Thesis

24

Subsidiary:

Sebang Global

Battery

The Company’s subsidiary, Sebang Global Battery, is Korea’s leading manufacturer of

automobile batteries with a domestic market share of 43%

The value of the Company’s equity stake (37.9%) in Sebang Global Battery (also listed

on the Korea Stock Exchange) is not properly reflected in the stock price of the Company

Sebang

The Company is one of Korea’s leading regional port operating companies that provides

integrated logistics services, including harbor stevedoring, transportation and storage

The port stevedoring business has a high entry barrier in Korea because only a few

companies are granted with a port operating license by the government

Attractive

Valuation

The Company is a good example of holding company discounts in Korea as the

Company is trading at an unreasonable, excessive discount compared to the sum of the

value of its business operation and publicly-traded subsidiary

The Company’s liquidation value far exceeds its market cap

Strictly Confidential

Sebang (004360) – Overview (I)

The Company was established in 1965 and is currently owned 38.3% by the founding family

and 16.2% by institutional investors

The Company is one of Korea four major regional integrated logistics companies with a port-

operating license

The Company is a controlling shareholder (37.9%) of Sebang Global Battery, Korea’s leading

provider of automobile batteries, which it had acquired in 1978

25

Category Sales (2012) %

Integrated Logistics Services 688,833 95.9

Construction 5,523 0.8

Battery 23,643 3.3

Total 717,999 100

Sebang

Global

Battery

(004490)

Sebang

(004360)

37.9%

Source: Sebang

(Unit: million Won)

Strictly Confidential

Sebang (004360) – Overview (II)

The Company provides fully integrated logistics services, including harbor stevedoring,

transportation and storage

The Company operates in several major ports in Korea, including Busan, Gwangyang, Masan

and Pohang, and offers transportation services of containers and bulk cargo from harbors to

logistic centers

The Company has a strong bargaining power as only a few selected operators are permitted

to conduct stevedoring services in each port

26

Source: Sebang

Integrated Logistic Services Breakdown by Services

Harbor Stevedoring Transportation Storage

41.3%

53.5%

5.2%

Transportation

Harbor Stevedoring

Storage

Strictly Confidential

Sebang (004360) – Overview (III)

The Company is poised to benefit from increasing port traffic in and out of Korea

27

Source: Sebang

Port Traffic Growth Market Share*

Company 2010 2011 2012

Hanjin 21.9% 23.5% 21.1%

CJ Korea Express 14.9% 18.1% 15.9%

Dongbang 8.5% 9.4% 8.0%

Sebang 7.8% 8.2% 7.1%

Dongbu 1.5% 1.5% 1.3%

KCTC 0.8% 0.9% 0.7%

Others 44.7% 38.4% 45.9% 800

900

1,000

1,100

1,200

1,300

1,400

2007 2008 2009 2010 2011 2012

(million Ton)

CAGR 4.0%

* Market share in terms of port traffic in Korea’s 23 major ports

Strictly Confidential

Sebang (004360) – Financials

28

(Unit: million Won)

2008 2009 2010 2011 2012

Sales 1,192,435 1,173,681 1,394,503 764,646 717,999

% Growth - -1.57% 18.81% -45.17% -6.10%

Cost of Sales 959,359 944,211 1,152,414 691,627 649,510

% COGS/Sales 80.45% 80.45% 82.64% 90.45% 90.46%

Gross Profit 233,076 229,470 242,088 73,019 68,489

% Margin 19.55% 19.55% 17.36% 9.55% 9.54%

SG&A 86,682 85,457 91,218 32,130 34,050

% SG&A/Sales 7.27% 7.28% 6.54% 4.20% 4.74%

Operating Income 146,394 144,012 150,870 40,890 34,439

% Margin 15.60% 17.10% 19.80% 20.10% 22.60%

EBITDA 149,331 146,197 153,070 42,461 36,252

% Margin 12.52% 12.46% 10.98% 5.55% 5.05%

Net Income 94,165 95,425 105,697 54,818 54,088

% Margin 7.90% 8.13% 7.58% 7.17% 7.53%

Income Statements

Valuation

* From year 2011, financials are prepared in accordance with K-IFRS

US$1 = 1,100 Won

Source: Sebang, Petra analysis

(Unit: million Won; thousand US$)

Won US$

Normalized Earnings 27,310 24,827

Multiple 10x 10x

Equity Value 273,100 248,273

Strictly Confidential

Subsidiary: Sebang Global Battery (004490)

Established in 1952, Sebang Global Battery (the “Subsidiary”) manufactures a wide range of

automobile and industrial batteries

GS Yuasa of Japan, one of the world’s leading manufacturers of automobile and motorcycle

batteries, owns 16.0% of the Subsidiary

The Subsidiary boasts a strong balance sheet with little debt and is also significantly

undervalued, trading at 7.3 times its earnings

29

Category Sales (2012) %

Automobile Batteries 645,461 76.3

Industrial Batteries 198,530 23.5

Motorcycle Batteries 2,339 0.2

Total 846,330 100

(Unit: million Won)

Financial Summary

Share price (4/19/2013) 50,800 Won

Market cap 711 billion Won

EPS 6,991 Won

P/E 7.3x

BPS 41,823 Won

P/B 1.2x

Source: Sebang, Korea Stock Exchange

Strictly Confidential

Subsidiary: Sebang Global Battery (004490) (Cont’d)

The Subsidiary is the largest manufacturer of automobile batteries in Korea with a market

share of 43.4% and the world’s 5th largest manufacturer

The Subsidiary benefits from declining lead price which will reduce its raw material costs,

improving gross profit margin

The sale of automobile batteries in the aftermarket is a big plus as the Subsidiary is less likely

to be affected by the economic downturn

30

Global Market Share

Source: Petra analysis

0%

5%

10%

15%

20%

25%

30%

0

500

1,000

1,500

2,000

2,500

3,000

2006 2007 2008 2009 2010 2011 2012

Gross Profit Margin (RHS)

Lead Price (LHS)

Profitability

(US$/ton) Company 2012

Johnson Controls 34%

Exide 10%

GS Yuasa 8%

East Penn 7%

Sebang Global Battery 4%

AtlasBX 2%

Others 35%

Strictly Confidential

Subsidiary: Sebang Global Battery (004490) – Financials

31

(Unit: million Won)

2008 2009 2010 2011 2012

Sales 624,589 627,174 790,200 953,872 846,330

% Growth - 0.41% 25.99% 20.71% -11.27%

Cost of Sales 460,321 479,404 622,217 752,482 655,118

% COGS/Sales 73.70% 76.44% 78.74% 78.89% 77.41%

Gross Profit 164,268 147,771 167,983 201,389 191,213

% Margin 26.30% 23.56% 21.26% 21.11% 22.59%

SG&A 54,361 53,774 61,733 68,772 68,067

% SG&A/Sales 8.70% 8.57% 7.81% 7.21% 8.04%

Operating Income 109,907 93,996 106,251 132,617 123,146

% Margin 15.60% 17.10% 19.80% 20.10% 22.60%

EBITDA 110,517 94,628 106,842 133,264 124,252

% Margin 17.69% 15.09% 13.52% 13.97% 14.68%

Net Income 75,369 70,290 79,210 105,375 97,869

% Margin 12.07% 11.21% 10.02% 11.05% 11.56%

(Unit: million Won; thousand US$)

Won US$

Normalized Earnings 91,440 83,127

Multiple 10x 10x

Operation Value 914,400 831,273

Cash & Investments 199,508 181,371

Equity Value 1,113,908 1,012,643

Share of Sebang (37.9%) 422,728 384,298

Intrinsic Value (20% Discount) 338,182 307,439

Income Statements

* From year 2011, financials are prepared in accordance with K-IFRS

US$1 = 1,100 Won

Source: Sebang Global Battery, Petra analysis

Valuation

*

Strictly Confidential

Valuation

32

Sebang Global

Battery

Other

Subsidiaries

Market

Cap

44 billion Won

Operation

338 billion Won

273 billion Won

296 billion Won

(US$269 million)

655 billion Won

(US$595 million)

US$1 = 1,100 Won

Source: Petra analysis

Market Cap Intrinsic Value

Strictly Confidential

(Unit: million Won)

Book Value Appraisal Value Market Cap

Liquid Assets

Cash & Equivalents 96,180 96,180

Account Receivable 135,447 67,723

Other Receivables 8,353 4,177

Investments

Sebang Global Battery 226,116 277,305

Other Subsidiaries 50,930 35,651

Other Investments 4,528 3,170

PP&E

Land 116,366 174,549

Building 65,471 65,471

Other PP&E 34,774 17,387

Investment Property

Land 64,075 96,112

Building 67,654 67,654

Other Assets 33,297 16,648

Total Assets 903,191 922,028

Total Liabilities plus

Non-Controlling Interest 293,228 293,228

Liquidation Value 609,964 628,800 296,000

Liquidation Value

The Company trades at 50% of its book value; we think that the book value fairly reflects the

Company’s liquidation value

33

Source: Sebang, Petra analysis

IV. Value Investing Opportunity 2: Daechang Forging

Strictly Confidential

Daechang Forging (015230) – Snapshot

35

Stock Price (4/19/2013) 44,800 Won Industry Industrial

EPS 11,345 Won Market Cap 90 billion Won

P/E 3.9x Sales (2012) 279 billion Won

BPS 44,222 Won EBIT (2012) 30 billion Won

P/B 1.0x Dividend Yield 2.2%

US$1 = 1,100 Won

(Won)

10,000

20,000

30,000

40,000

50,000

60,000

12/31/09 6/30/10 12/31/10 6/30/11 12/31/11 6/30/12 12/31/12

* US$82 million

*

Strictly Confidential

Investment Thesis

36

Catalyst:

Improving

Complex

Ownership

Structure

There exists a catalyst where the Company can improve shareholder value by

reorganizing the complex ownership structure of its subsidiaries and affiliated companies

Shareholder activism can expedite the value unlocking process if the controlling

shareholder (i.e., the founding family) is slow on making necessary changes

Daechang

Forging

The Company is one of Korea’s leading manufacturers of excavator/tractor parts

The Company maintains strong business relationships with its global customers,

including Volvo, Caterpillar and Doosan Infracore and is poised to benefit from the

seeming recovery of investment activities in Asia

Attractive

Valuation

The Company is exceptionally cheap, trading at 3.9 times its 2012 earnings, implying

minimal downside risk (even without activism)

The Company’s current market valuation is significantly discounted compared to its peers

in the industry

Strictly Confidential

Daechang Forging (015230) – Overview (I)

Founded in 1955, the Company is one of Korea’s leading manufacturers of excavator/tractor

parts

The Company has a long track record in the industry as the Company is one of the first

companies to manufacture excavator/tractor parts in Korea

The Company is 44.0% owned by the founding family (including its specially-related parties)

and is now run by the 3rd generation son

37

(Unit: million Won)

Category Sales %

Excavator/Tractor Parts 249,800 89.5

Automobile Parts 19,043 6.8

Others 10,282 3.7

Total 279,125 100

44.0%

10.8%

45.2%

The Park Family

Institutional Investors

Retail Investors

Source: Daechang Forging

Ownership Breakdown

Strictly Confidential

Daechang Forging (015230) – Overview (II)

The Company manufactures excavator/tractor parts which include links, roller assemblies,

track shoes, track chains, seals, pins, bushings, bolts and nuts

Known for its strong relationships with global customers, including Volvo, Caterpillar and

Doosan Infracore, the Company’s exports to Asian countries account for 60% of its sales

The Company’s presence in the aftermarket has a stabilizing effect during the economic

downturn

38

27%

19%

7% 7%

40%

Volvo

Hyundai HeavyIndustries

Doosan Infracore

Caterpillar

Others

Source: Daechang Forging

<Roller Assemblies>

<Track Chains>

<Track Shoes>

Main Products Customer Breakdown

<Links>

Strictly Confidential

Daechang Forging (015230) – Financials

39

(Unit: million Won)

2008 2009 2010 2011 2012

Sales 204,808 164,216 263,234 338,129 279,125

% Growth - -19.82% 60.30% 28.45% -17.45%

Cost of Sales 182,285 152,804 243,334 304,979 243,823

% COGS/Sales 89.00% 93.05% 92.44% 90.20% 87.35%

Gross Profit 22,523 11,412 19,900 33,150 35,302

% Margin 11.00% 6.95% 7.56% 9.80% 12.65%

SG&A 4,759 4,263 4,915 5,595 5,115

% SG&A/Sales 2.32% 2.60% 1.87% 1.65% 1.83%

Operating Income 17,764 7,148 14,985 27,556 30,188

% Margin 15.60% 17.10% 19.80% 20.10% 22.60%

EBITDA 17,841 7,228 15,092 27,663 30,289

% Margin 8.71% 4.40% 5.73% 8.18% 10.85%

Net Income 3,989 3,485 12,754 19,535 22,689

% Margin 1.95% 2.12% 4.85% 5.78% 8.13%

Income Statements

* From year 2011, financials are prepared in accordance with K-IFRS

US$1 = 1,100 Won

Source: Daechang Forging, Petra analysis

(Unit: million Won; thousand US$)

Won US$

Normalized Earnings 19,000 17,273

Multiple 10x 10x

Equity Value 190,000 172,730

Valuation

*

Strictly Confidential

Daechang Forging (015230) – Peer Comparison

The Company trades much cheaper than its peers in the heavy equipment parts industry

whose valuation has been already depressed due to the recent global economic slowdown

40

Source: Korea Stock Exchange

Industry Peers Multiple (Unit: billion Won)

Company Market Cap EV Sales EBIT EBITDA Net Income P/E EV/EBITDA

FreeMS 18.1 18.9 38.6 3.2 3.4 3.1 5.9 5.6

Dongil Metal 99.5 98.3 109.0 18.7 18.7 16.1 6.2 5.3

Heungkuk 23.2 50.8 90.3 5.5 9.4 3.5 6.6 5.4

Everdigm 97.7 153.7 229.3 18.7 22.6 12.9 7.6 6.8

Jinsung T.E.C. 131.7 141.6 178.4 10.2 11.1 4.3 30.4 12.7

Mean 11.3 7.2

Median 6.6 5.6

(Unit: billion Won)

Company Market Cap EV Sales EBIT EBITDA Net Income P/E EV/EBITDA

Daechang Forging 90.8 90.3 312.3 30.7 34.3 23.5 3.9 2.6

Daechang Forging Multiple

Strictly Confidential

Ownership Structure – Current

41

The Company’s intricate, complex ownership structure is the reason for market discount;

DCF Trek, a private company controlled by the founding family, co-owns all of the Company’s

subsidiaries without providing any plausible explanation to shareholders

Source: Daechang Forging, Petra analysis

Sunway

DCF

Dongchang

Forging

Najun

Metal

Bonglim

Metal

Pusan

Metal

Mold

Daechang

Heavy

Equipments

Trek

36%

80%

8%

The Park

Family

The Company

The Company: 70%

DCF Trek: 30%

The Company: 20%

DCF Trek: 32%

The Company: 40%

DCF Trek: 47%

The Company: 40%

DCF Trek: 46%

The Company: 40%

DCF Trek: 46%

DCF Trek: 40% DCF Trek: 30%

DCF Trek

Strictly Confidential

Ownership Structure – New

42

Source: Daechang Forging, Petra analysis

The Company can improve its ownership structure by acquiring all of DCF Trek’s equity

stakes in its subsidiaries by merging with DCF Trek, which will eventually increase the

transparency and shareholder value of the Company

Sunway

DCF

Dongchang

Forging

Najun

Metal

Bonglim

Metal

Pusan

Metal

Mold

Daechang

Heavy

Equipments

Trek

DCF Trek

The Company

36%

80%

8%

The Park

Family

Merger

Strictly Confidential

Valuation

43

US$1 = 1,100 Won

Source: Petra analysis

Market

Cap

Shareholder

Activism

Change of

Industry

Multiple

90 billion Won

(US$82 million)

190 billion Won

(US$173 million)

Market Cap Intrinsic Value

Strictly Confidential

Rights of Minority Shareholders in Korea

44

Classification and Requirements 5% Disclosure Requirements

► Any shareholder who holds more than 5% of voting shares

(including voting shares held by any specially-related person)

► A disclosure report must be submitted to the Financial

Services Commission of Korea and the Korea Stock

Exchange within 5 business days after the execution date

► Any change of more than 1% with respect to the number of

voting shares must be reported within 5 business

To hold more than 3% of voting shares and

to provide a 6-weeks notice prior to the

shareholders meeting

Extraordinary

shareholders

meeting

To hold more than 1.5% of voting shares for

at least 6 months without interruption

Shareholder

proposal

To hold more than 1% (0.5%)* of voting

shares for at least 6 month without

interruption

Request for

dismissal of director/

statutory auditor

To hold more than 0.5% (0.25%)* of voting

shares for at least 6 month without

interruption

Request for

inspection of

accounting books

To hold more than 0.1% (0.05%)* of voting

shares for at least 6 month without

interruption

Representative suit To hold more than 0.01% of voting shares

for at least 6 month without interruption

Request for

cumulative voting

Minority Shareholder Protection in Korea

► The “poison pill”, a common defensive strategy used against

corporate takeovers, is not allowed under Korean law

► In electing statutory auditor, voting rights of the controlling

shareholder (including its specially-related parties) are

restricted to 3% in aggregate

► Korean companies generally do not offer dual-class shares

with different voting rights

* ( ) is applicable to any public company whose shareholders’ equity is more than 100 billion Won at the end of the most recent fiscal year

V. Conclusion

Strictly Confidential

Conclusion

46

Many Korean stocks are still cheap

Korea is strategically positioned (geographically and industrially) to benefit

from the growth of emerging markets

Korean corporations have solid economic fundamentals

Korea has been going through positive regulatory changes for minority

shareholders

The Korean stock market continues to offer various mispricing

opportunities for value investors

Strictly Confidential

Contact Us

47

Important Notice

This material has been prepared by Petra Capital Management. This material is for distribution only under such circumstances as may be permitted by

applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any recipient. It is published solely for

informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No

representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained

herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the materials. It should not be

regarded by recipients as a substitute for the exercise of their own judgment.

Any opinions expressed in this material are subject to change without notice and may differ or be contrary to opinions expressed by other business areas

or groups of Petra Capital Management as a result of using different assumptions and criteria. Petra Capital Management is under no obligation to update

or keep the current information contained herein. Petra Capital Management may, from time to time, as principal or agent, have positions in, underwrite,

buy or sell, make a market in or enter into derivatives transactions in relation to any financial instrument or other assets referred to in this material. Petra

Capital Management operates rules, policies and procedures, including the deployment of permanent and ad hoc arrangements/information barriers within

or between business groups or within or between single business areas within business groups, directed to ensuring that individual directors and

employees are not influenced by any conflicting interest or duty and that confidential and/or price sensitive information held by Petra Capital Management

is not improperly disclosed or otherwise inappropriately made available to any other client(s). Neither Petra Capital Management nor any of its affiliates,

directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material.

© 2013 Petra Capital Management. All rights reserved. Petra Capital Management specifically prohibits the redistribution of this material and accepts no

liability whatsoever for the actions of third parties in this respect.

Petra Capital Management 9F, Anwon Bldg.

14-15 Yeouido-dong, Yeongdeungpo-gu

Seoul, Korea 150-871

Telephone: +82-2-3774-0978

Fax: +82-2-783-0079

Email: [email protected]

www.petracm.com