Value Chain Analysis Soybean - … · COMPETITIVENESS PROJECT ... Land Preparation 21 ... for...

Transcript of Value Chain Analysis Soybean - … · COMPETITIVENESS PROJECT ... Land Preparation 21 ... for...

RAJASTHAN AGRICULTURAL COMPETITIVENESS PROJECT

Value Chain Analysis

Soybean

Prepared by:

AGRI BUSINESS PROMOTION FACILITY

Value Chain Analysis – Soybean i

Contents

Page

List of Table iii

List of Figure iv

Executive Summary: Soybean 1

1.1. Global Scenario 7

1.2. Indian Scenario 12

1.3. State Scenario: Rajasthan 15

1.4. District & Cluster Scenario 16

1.5. Approach to Value Chain Analysis 17

1.6. Resourcing mapping of value chain 17

1.7. Marketable surplus of Soybean in Cluster 18

Chapter 2- Pre Harvest Management 20

2.1. Major Commercial Varieties Grown in Rajasthan 20

2.2. New Initiatives & Practice 20

2.3. Seasonality Pattern of Soybean in Rajasthan visa-vis other parts of the world 21

2.4. Land Preparation 21

2.5. Sowing/Planting/Cultivation 21

2.6. Climatic & Soil Requirement 22

2.7. Nutrient Management 22

2.8. Water Management 23

2.9. Weed Management 23

2.10. Disease & pest Management 23

2.11. Recommended Good Agricultural Practices 26

2.12. Harvesting 26

2.13. Pre-Harvesting Constraints 27

Chapter-3: Post-Harvest Management 28

3.1. Post-Harvest Losses, Harvesting Care and Post–Harvest Equipment 28

3.2. Grade Specification & Grading at Producer Level 30

3.3. Major Storage Disease and Pest and their Control Measure 34

Chapter4. Cost of production & Net accruals to producer 36

Chapter 5- Supply Chain of commodity 37

Value Chain Analysis – Soybean ii

5.1. Seasonal Availability & Price Pattern 37

5.2. Existing Marketing Channels 39

5.3. Alternative System of Marketing 40

Chapter 6- Processing Infrastructure availability and utilization 43

6.1. Processing 43

6.2. Stakeholder’s Share in Consumer Rupee 48

6.3. Price build up & Marketing Efficiency Analysis 49

6.4. Consumer Preference Analysis 49

Chapter 7- Existing Institutional support and Infrastructure facility 51

7.1. Support at Cultivation stage 51

7.2. Support at post-harvest, Primary and Secondary Processing stage 56

Chapter 8- Gap & Constraint Analysis 59

8.1. As Perceived by Producers and Other Stakeholder 59

8.2. SWOT Analysis of the Pre-intervention Value Chain 61

8.3. Key constraints in Soybean crop 62

8.4. PIESTEC Framework 65

8.5. Impact of GST over Soybean value chain: 67

Chapter 9- Proposed Intervention and Investments 68

9.1. Intervention areas for Value chain strengthening 68

9.2. Envisaged Post-intervention Value Chain Map of Soybean 72

9.2.1. Proposed Post Intervention Value Chain Map 72

9.2.2. Intervention through FPC in the Soybean Value Chain Crop 74

9.3. Outcomes of value chain study 76

9.4. Conclusion 77

Annexure 1: Stakeholder’s consulted over the study 79

Annexure 2: List of Central Warehousing Corporation (CWC) Warehouses in Rajasthan 80

Annexure 3: List of State Warehousing Corporation (SWC) Warehouses in Rajasthan 82

Annexure 4: Product wise GST rates of Food Products 84

Annexure 5: Detailed PIESTEC Analysis of Soybean 88

Value Chain Analysis – Soybean iii

List of Table

Table 1: Nutritional Value of Soybean ............................................................................................................ 7 Table 2: World Soybean Production (in Million MT)................................................................................... 8 Table 3: Major Imports of Soybean (2014-2016) .......................................................................................... 9 Table 4: Total quantity of Imports by the country........................................................................................ 9 Table 5: Major Exports of Soybean in the world ........................................................................................ 10 Table 6: Total Quantity of Exports in the world ........................................................................................ 11 Table 7: Soy oil production data .................................................................................................................... 11 Table 8: State Wise Production of Soybean in India (Million MT) ......................................................... 12 Table 9: Ranking of India in World Soy Industry ....................................................................................... 12 Table 10: Area, Production, Yield of Major Crops in Rajasthan during 2014-15 .................................. 16 Table 11: Total Production of Soybean in Rajasthan ................................................................................. 16 Table 12 Major Soybean producing districts in the catchment areas ....................................................... 16 Table 13: Catchment & State production ..................................................................................................... 16 Table 14: Surveyed Major Stakeholders for Value Chain Analysis ........................................................... 17 Table 8: Resource mapping of value chain ................................................................................................... 17 Table 9: Marketable surplus of Soybean in cluster ...................................................................................... 18 Table 15: Major Varieties of Soybean in Rajasthan ..................................................................................... 20 Table 16: Nutrient management of Soybean ............................................................................................... 22 Table 17 Grade designation and definition of quality of Soybean seeds ................................................. 31 Table 18 Type of deformation in soybean regarding grading ................................................................... 31 Table 19: Grade Specification of Soybean .................................................................................................... 32 Table 20: Grade specification ......................................................................................................................... 32 Table 21 Codex standards for Soybean......................................................................................................... 33 Table 22 list of is Insects and their control measures ................................................................................. 34 Table 23 Control Measures ............................................................................................................................. 34 Table 24: Chemical residues testing laboratories ......................................................................................... 34 Table 25: Cost of Production ......................................................................................................................... 36 Table 26 crop seasonal availability ................................................................................................................. 38 Table 27 Market Arrivals & Prices ................................................................................................................. 38 Table 28: Benefits of contract farming ......................................................................................................... 41 Table 29: Existing Price Spread table at every stage of value chain ......................................................... 49 Table 30: Short Term and Long Term loans ............................................................................................... 51 Table 31: Tax Structure ................................................................................................................................... 67 Table 32: List of CWC warehouses in Rajasthan ........................................................................................ 80 Table 33: List of SWC warehouses in Rajasthan ......................................................................................... 82

Value Chain Analysis – Soybean iv

List of Figure

Figure 1: Total value of Imports by the countries......................................................................................... 9 Figure 2 Total quantities of Imports by the country .................................................................................. 10 Figure 3: Major Exporters of Soybean in World (Million MT) ................................................................. 10 Figure 4: Total quantity of exports in the world ......................................................................................... 11 Figure 5: Imports of Soybean ........................................................................................................................ 13 Figure 6: Average Prices of Soybean ............................................................................................................. 14 Figure 7: Major Soybean Producing Parts in India ..................................................................................... 15 Figure 8: Seasonal Availability Pattern .......................................................................................................... 21 Figure 9: Post Harvest Management ............................................................................................................ 28 Figure 10 Post Harvest Losses of Soybean .................................................................................................. 29 Figure 11: Supply Chain of Commodity ....................................................................................................... 37 Figure 12: Proposed Post Intervention Value chain map of Soybean ..................................................... 39 Figure 13: Soy Oil ............................................................................................................................................. 43 Figure 14: Animal Feed .................................................................................................................................. 43 Figure 15: Process flow chart of Soya Oil .................................................................................................... 44 Figure 16: Process Flow chart of Soy oil ...................................................................................................... 45 Figure 17: Process Flow chart of Soya Flakes.............................................................................................. 46 Figure 18: Process Flow chart of Soya Tofu ................................................................................................ 47 Figure 19: Process Flow chart of Soya Sauce ............................................................................................... 48 Figure 20: Discussion with Farmers at village Samlopur, Pratapgarh ..................................................... 59 Figure 21: Discussion with Mr. Goyal .......................................................................................................... 61 Figure 22: PIESTEC Analysis of Soybean ................................................................................................... 66 Figure 23: Intervention Plan of soybean along with stakeholders’ matrix .............................................. 71 Figure 24: Proposed Post Intervention Value chain map of Soybean ..................................................... 73 Figure 25: FPC Development Approach ...................................................................................................... 74

Value Chain Analysis – Soybean 1

Executive Summary: Soybean

Soybean (Glycine max) is known as the “Golden Bean” of the 20th century. It is grown in tropical,

subtropical, and temperate climates and is the world’s largest cultivated oilseed. It is the world's

foremost provider of protein having a significant amount of essential amino acids and oil. Soybean

is a legume crop, yet it is widely cultivated as oilseed crop. It is now the second largest oilseed in

India after groundnut. Due to its popularity, the international trade is importing Soybean to

supplement their domestic requirement for human consumption and cattle feed.

Notably, the commodity has been commercially exploited for its utility as edible oil and animal feed.

On crushing the mature beans, around 18% oil could be obtained, the rest being oil cake/meal,

which forms the prime source of protein in animal feeds. Of late, the commodity is being exploited

for manufacturing of a variety of value added snack foods like edible grade soya meal, soya milk,

tofu, nuggets, flour, extruded proteins, etc.

In the global context, US, Brazil, Argentina, China and India are the major producers in decreasing

order of production of soybean. USA is followed by France, Canada, UK and South Korea in the

global export of Soybean. Ukraine is followed by Benin, Germany, India and USA in the global

import of Soybean.

With 12 million tonnes of production, soybean is one of the fastest growing crops in India. Soybean

is grown in the Kharif season in India. Importantly, The top three largest soybean growing states are

Madhya Pradesh, Maharashtra and Rajasthan. Madhya Pradesh and Maharashtra have 45% and 40%

share in production respectively. Indore, Ujjain, Dewas, Mandsore in Madhya Pradesh, Nagpur in

Maharashtra, Kota in Rajasthan are the major trading centres of Soybean.

Baran is the highest soybean cultivating district in Rajasthan with a production of 155787 MT. Other

major soybean producing districts are Kota, Jhalawar, Pratapgarh, Chittorgarh and Bundi..The major

clusters in the RACP project where Soybean is cultivated are Kushalgarh, Palayatha, Orai Bassi,

Jakham and Sangod Among the pool of varieties, the highest yielding early variety of soybean

grown is JS95-60 which yields around 2000-3000 kg/ha. It is followed by the variety JS93-05 which

yields around 2500-3000 kg/ha.

Post-harvest losses occur at different stages viz. harvesting, threshing, winnowing, storage,

packaging, and transportation, processing and marketing of soybean. Harvesting of soybean is done

manually. After harvesting, thresher is the main post harvest equipment used. During storage at

farmer’s level, spoilage and losses may occur due to mishandling, use of very old and damaged

gunny bags and rodents. The post- harvest losses from harvesting ascribed to threshing are 1 to 2%

Value Chain Analysis – Soybean 2

and at the time of cleaning and winnowing it is 3.5 to 5 %. During harvesting and storage at farm

level losses have been estimated to be about 1 to 2 %. Maximum loss takes place at these stages.

The Soybean crop sown in rainfed areas in the kharif season is normally sown in June-July and is

harvested in Oct-Nov. Farmers do not give more focus on grading of grains. They only clean and

remove diseased, damaged, foreign materials from heap of the grains. Farmers check moisture

content in soybean by teeth. To separate the diseased, damaged and foreign materials from healthy

grain, farmers use local sieve. At last, they grade the grains on the basis of physical appearance,

colour, size and availability of foreign material in the grain heap.

Soybean oil, flour, soy milk, soy paneer, tofu, soybean flakes are some value added products of

Soybean. A range of support institutions exist in the region. These include a range of farmer’s level

advisory service and service providers including Society for soybean research and development and

Indian institute of soybean research which supports the farmers regarding the information

dissemination of market intelligence and agricultural extension services. Some important support

institutions for Soybean in Rajasthan are Department of Agriculture, Govt. of Rajasthan who

provides extensive support through their team of State/District/ Tehsil and Panchayat level officials

on; recommended package and practices for the crop, mini kits for crop demonstration and subsidy

support on certified seed distribution to farmers.

Other support structures of the Department of Agriculture are the Rajasthan State Seed and Organic

Production Certification Agency, The Rajasthan State Seeds Corporation Ltd, the State Institute of

Agriculture Management, Rajasthan State Warehousing Corporation, Department of Agriculture

Marketing and Rajasthan State Agriculture Marketing Board who contribute to the productivity,

storage and market linkage of the crop. Apart from this, there are various Krishi Vigyan Kendras

around Jaipur, Alwar and Kota attached through State Agriculture Universities/ ICAR also

contribute in terms of seed production, technology demonstration and post-harvest management of

the crop. RARI, Durgapura has also played a significant role in production of improved varieties of

Soybean contributing to both production and productivity in the State.

A SWOT analysis of the Soybean value chain highlights that Soybean continues to be number one

oilseed crop in India, currently occupying 9.21 million ha with an estimated production of 9.81

million tonnes (Kharif 2010-11). Rajasthan ranked third in area (7.10 lakh ha) with annual

production (6.0 lakh tonnes) after Madhya Pradesh and Maharashtra The crop also plays an

important role in the oil economy and foreign earnings as among nine major oilseed crops, during

2009-10; it contributes 40 and 23 % to the total oilseeds and edible oil production of the country

and earns valuable foreign earnings (Rs. 4258 corers) by exporting soya meal.

But when it comes to its disposition in the target clusters of RACP, one finds that there is lack of

knowledge of Soybean production technologies among the local farmers. In spite of availability of

improved crop production technologies; the adoption of recommended production technologies

among farmers is not very encouraging. The average productivity of soybean in the state is very low

as compared to potential yield. The reason may be that most of the technologies have not yet

reached to the farmer’s field. Hence, to percolate the scientific know how amongst soybean growers

and to have direct interaction with farmers, there is scope to undertake a project on frontline

demonstration. The main objective of frontline demonstration is to demonstrate the productivity

potentials and profitability of the latest and improved soybean production technologies under real

farm conditions.

Value Chain Analysis – Soybean 3

They also face the non-availability of improved & good quality seed. There is lack of grading and

storage facilities. There is inadequate infrastructure/ facilities with producers, traders, millers and at

market level resulting in marketing inefficiencies. The large number of intermediaries in the chain

leads to low income to producer which eats into the margins of farmers. Obsolete techniques are

being used in processing, which reduces output. Fluctuations in supply (based on production),

coupled with export-import dynamics, make prices of Soybean unstable which obviously affects

producers and consumers both. Inadequate sorting, grading facility near production site fetches

lesser price to farmers. There are sizeable post-harvest losses due to in-efficient storage practices.

The procurement is mostly controlled by large players apart from State governments. There is also

non-availability of private storage facilities/ silos near production centres for storing round the year.

These weaknesses can be removed with the intervention opportunities such as setting up a FPC in

the cluster which would then have a scope for tie up of FPCs through FCSC with firms like adani

wilmar, Ruchi soya, local processors, MSME firms, housing societies in urban areas and retail

outlets. There is also scope for facilitation of start-ups from amongst FPCs or individual

entrepreneurs, in secondary processing of value added products of Soybean like flour, bakery

products, etc. There is also scope for establishment of quality sorting and grading facilities as part of

FCSC, along with facilities for packaging and vehicle to facilitate transportation. The FPC can then

promote good agricultural practices with regard to planting, harvesting, use of inputs, disease

management, pest control, etc. through FCSC. FPCs can also undertake joint input sourcing

activities for seeds, fertilizers, pesticides, etc. under the umbrella of CFC or FCSC as well as facilitate

custom hiring services and hence lead farm mechanization through CFC.

The price spread and values accrued to stakeholders across the chain reflects the profit margins

accrued to different stakeholders. Farmer shares 25% of the consumer’s rupee while the shares of

traders, processors, wholesalers and retailers are about 1%, 13%, 4% and 57% respectively. 74% of

the value accruals are accrued to processors, wholesalers and retailers. Producers’ incomes are

apparently dependent on yield as well as their dependency on the type of end product (eg. Soybean

seeds, oil, soy tofu, soy milk, etc.). Here in the existing value chain of Soybean, the price build up

has been calculated for the important first channel where the target consumers are urban households

and institutional buyers. The product considered is soybean oil.

Typically farmers sell the raw Soybean at about Rs 3000 per quintal to traders. In the local mandis, it

was sold by traders to the processors at Rs 3150 per quintal (with commission about 3.5% and cess

of 1.5%). The processors, upon primary and secondary value addition, sell soybean oil to

wholesalers at Rs 4725 (gross margin about 50%). Thereafter the wholesale and retail prices are set

up at Rs 5150 per quintal and 12000 per quintal with a gross margin of 9% and 133% respectively.

Due to limited infrastructure facilities at the dispersal of various stakeholders, marketing efficiency is

adversely affected. Due to limited infrastructure facilities at the dispersal of various stakeholders,

marketing efficiency is adversely affected.

The pre and post intervention value chain for the commodity may be viewed as follows:

Pre Intervention Value Chain: Soybean

The present pre-intervention or value chain for Soybean may be viewed as one with three critical

production-distribution or activity-marketing channels. The product is largely marketed by farmers

through the APMC. Channel 1 may be viewed in terms of one for soybean oil while channel 2 is for

feed market. The producers market their produce in both value chains through local traders/

processors and APMC Commission agents largely. Channel 3 is meant for export. The producers

Value Chain Analysis – Soybean 4

market their produce in both value chains through local traders and APMC Commission agents

largely. There are total post-harvest losses of 5-9% in the storage, handling, transportation of

soybean at every stakeholder’ point.

Proposed Post Intervention Value Chain: Soybean

The post intervention value chain map for Soybean may be visualised as one with three production-

distribution or activity-marketing channels: edible oil, feed and value added products like soy paneer,

tofu and Soybean flakes. It is also envisaged that PCs of producers with FCSCs is evolved. Such

FCSCs only undertake storage, grading and sorting and packaging of produce activity. These FCSCs

may offer other related services in terms of input facilitation, custom hiring, facilitating B2B

connectivity etc. Farmers’ income from Soybean cultivation may be enhanced.

In the proposed value chain map of Soybean, the FPC intervention would take away the direct share

of 4% in the channel 1 while there would be direct benefit of additional 1% to the farmers. The

remaining stakeholders would remain directly unaffected as such from the FPC intervention except

for secondary processors who would get aggregated volumes with required quality parameters being

met by the FPCs. The FPC intervention would benefit the farmers by providing them with the

appropriate storage facility as well as cleaning & grading systems. This would positively impact the

post-harvest losses which would reduce to 3-4% as compared to previously. It would also improve

the holding period at the cluster level any FPCs would have an added benefit of storage system.

Enhancing post-harvest practices could potentially lead to higher acceptability in the global market.

Also, the restructured value chain will have PC/s and their FCSC/s replacing Mandis and

undertaking aggregation plus grinding and sorting and packaging services. The PCs need input

facilitation, custom hiring and marketing of produce.

The constraints and intervention plan for various stakeholders, such as farmers, processors, NGO

and RACP, in the value chain of Soybean may be considered in context of three stages/activities,

namely the production, post-harvest and processing stage. The constraints may be viewed in terms

of pest and fungus attack in crops. These may be addressed through provision of resistant varieties

to producers through an envisaged FCSC/s, which in addition to input facilitation may also provide

custom hiring services.

At the post-harvest stage, critical constraints may be viewed in terms of inadequate storage facilities

and enormous intermediaries in the value chain which can be corrected through PC/s facilitator

service. Also there is limited access to market intelligence about price arrivals of the soybean in

different markets which can be facilitated through the market intelligence system developed by

FCSC/s. These may be addressed through interventions.

At the processing stage there are limited processing units in the regions and state into producing

value added Soybean products including soybean oil mill, Soy, Paneer, Tofu and flakes, etc.

Appropriate start up counselling may address this issue.

In terms of intervention on the production front, productivity is low which is also partly because of

inadequate availability of high yielding varieties. There is, therefore, scope for intervention by the

way of introduction of new high yielding varieties in the region. Line departments under RACP and

NGO service-provider may support the initiatives in terms of dissemination of benefit of going in

for new high yielding varieties. Traditional package of practices results in lower yield as against

potential. There is therefore need to train farmers on the best package of practices. This could also

be undertaken by stakeholders like large processors.

Value Chain Analysis – Soybean 5

There have been limited efforts in capacity building of farmer leaders (entrepreneurs) and BODs at

the field- level. In this regard, it may be appropriate for ABPF to enable formation of FPCs to meet

minimum scale requirements for upgrading as well as developing alternate market channels. Also,

bank linkages under KCC scheme etc. may be explored. The RACP and line departments need also

work in coordination with the NGO/service providers and the KVK etc. on high moisture content

in harvested Soybean, harvesting of immature grains and inadequate post-harvest infrastructure

facilities for storage and drying at farm level. The storage facility may be established as an FCSC

with assistance under the project.

There is also need for awareness seminars and B2B meets amongst processors and producers on the

options for Special Licence and to source directly from producers (effectively aggregated into FPCs/

FPCs). Scope for re-orientation of Agri- marketing policy with reduced mandi taxes on direct

procurement; and related capacity building interventions for farmers is a necessity that may be

facilitated by the ABPF.

It is felt that the project has further scope of strengthening Soybean value chain by (a) creation of

more FPCs (b) incentivizing FPCs to undertake activities such as primary processing, custom hiring

centre and seed production programme (c) convergence among State Govt. of Rajasthan,

Universities, industry and FPCs regarding supply of breeder seed and building strategies for

conversion of breeder to foundation and certified seeds. Connecting farmers to Commodity

exchange, scientific storage under Central/state warehousing corporation and linking farmers to

banks as all farmers who transact with large processors would hold bank account and have

improved marketability of Soybean under PPPP model. This should be promoted in big way.

The report on the value chain analysis of Soybean clearly brings out that unlike any other

enterprises, agriculture is highly dependent on external factors like nature for its success. This

perpetual environment of high risk and vulnerability has significantly lowered farmers’ confidence

and suppressed their entrepreneurial instincts as was depicted in the discussions held at the cluster

level meetings. In soybean value chain, farmers have not been able to gain higher

remuneration/value for their produce due to lack of direct linkages with processors/consumer

market. Thus RACP along with the market driven intervention of ABPF, aims to integration of

farmers to join hands for a collective cause, help and even push them move up the agriculture value

chains to actively participate in market functions, an unexplored lucrative territory for them so far.

This would spur vertical business integration and diversify portfolios to reduce their vulnerabilities.

Thus in the Common facility centre of FPC as per the proposed intervention, cleaning, grading and

packaging would primarily be done, leading to uniform grades of soybean seeds with appropriate

quality and packaging. Moreover, the moisture content would be monitored to avoid any infestation

during storage. Moreover, the harvesting process would also be more mechanized, which reduces

losses due to post harvest farm activities (threshing, separating, etc.). Storage would largely be done

in the large silos/bins which are monitored & treated regularly to prevent losses from pest attacks.

The transportation would primarily through closed locked and tracked vehicles. This reduces both

the natural losses and pilferage

The major role of ABPF- GT would in this circumstance also be to carry out capacity building

initiatives of the potential leaders (BoDs) of the FPC, NGO staff and PMU staff line, conducting

value chain studies of the crops (market led), plan interventions to improve the returns to the

farmers in the 17 project clusters, develop the business plan for registered producer companies in

clusters, support and assist agri start-ups in the region, and thus develop overall market linkages.

Value Chain Analysis – Soybean 6

The formation of FPC supported by RACP ABPF, local NGOs and facilitation centres like KVKs,

provides the much needed opportunity to farmers to favourably and positively change their outlook

in years to come.

Value Chain Analysis – Soybean 7

Chapter 1- Introduction

The soybean (Glycine max) is known as the “Golden Bean” of the 20th century. It is grown in

tropical, subtropical, and temperate climates. Soybean is the world’s largest cultivated oilseed. The

soybean is often called the miracle crop. It is the world's foremost provider of protein and oil. It is a

good source of protein because it contains a significant amount of essential amino acids. Soybean is

a legume crop, yet it is widely used as oilseed. Due to its very poor cook ability and digestibility on

account of inherent presence of trypsin inhibitor, it cannot be utilized as a pulse. It is now the

second largest oilseed in India after groundnut. It has emerged as one of the important commercial

crop in many countries. Due to its popularity, it is also being imported to supplement the domestic

requirement for human consumption and cattle feed, soy mill/Deoiled cake is being exported to

many countries.1

Table 1: Nutritional Value of Soybean

Sr. No. Components Percentage

1 Proteins 40

2 Carbohydrates 30

3 Fiber 5

4 Lecithin 0.5

5 Saponin 4

6 Oil 18-20

The commodity has been commercially exploited for its utility as edible oil and animal feed. On

crushing the mature beans, around 18% oil could be obtained, the rest being the oil cake/meal,

which forms the prime source of protein in animal feeds of late, the commodity is being exploited

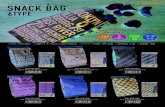

for manufacturing of various snack foods like edible grade soy meal, soya milk, tofu, nuggets, flour,

extruded proteins, etc.

1.1. Global Scenario

1.1.1. Continent Wise Production, Area and Yield of Soybean

Soybean is an important global crop and processed soybean is the largest source of protein feed and

second largest source of vegetable oil in the world. The major portion of the global and domestic

crop is solvent-extracted with hexane to yield soy oil and obtain soymeal, which is widely used in the

animal feed industry. It is estimated that above 85% of the output is crushed worldwide. Though, a

very small proportion of the crop is consumed directly by humans, soybean products appear in a

large variety of processed foods.

Value Chain Analysis – Soybean 8

The cultivation of soybean is successful in climates with hot summers, with temperatures between

20°C to 30°C being optimum. Temperatures below 20°C and over 40°C are found to retard growth

significantly. It can grow in a wide range of soils, with optimum growth in moist alluvial soils with a

good organic content. Modern soybean varieties generally reach a height of around 1 m (3 ft), and

take 80-120 days from sowing to harvesting. The annual global soybean production has been in the

range of 278-342 million tonnes in the recent years (2013-14 to 2015-16), accounting for 55-58% of

total global oilseed output of around 390-400 million tonnes. US, Brazil, Argentina, China and India

are the major soybean producing countries with production in order of 91-117, 82-107, 49-56, 12-13

and 10-12 million tonnes in the recent couple of years. Weather, acreage under other competitive

crops like corn, cotton and pests & diseases are the major factors influencing production. While in

US, India and China crop starts arriving from Aug-Sept, it starts from Jan-Feb in U.S. America.

1.1.2. World Soybean Production2

As per recent SOPA statistics, it has been observed that USA was the global leader in Soybean

production with a production quantity of 116 Million MT for the year 2016-17. USA has been the

consistent leader since past 5 years followed by Brazil and Argentina. Other major countries with

respect to production are China, India, Paraguay, Canada, Mexico and other EU countries. The

following table shows the exact figures of the Global Production of Soybean country wise.

Table 2: World Soybean Production (in Million MT)

Year US Brazil Argentina China India Paraguay Canada Other Total

2016-17 117 107 57 13 10 9 6 20 333

2015-16 107 97 57 12 7 9 6 18 313

2014-15 107 97 61 12 9 8 6 19 320

2013-14 91 87 53 12 9 8 5 16 282

2012-13 83 82 49 13 12 8 5 16 269

Source http://www.sopa.org/statistics/

1.1.3. Important World Soy Markets

Chicago Mercantile Exchange, which acquired Chicago Board of Trade - the world's oldest soy

futures market; Dalian Commodity Exchange - trades the most liquid soybean contracts in the world

Argentina and Brazil FOB determine the physical prices

1.1.4. Major Imports of Soybean in World (Million MT)3

As per reports of January 2014 to November 2016, the global leader in imports of Soybean was

Ukraine with an import value of USD 5,492,361 followed by Benin, Germany, India and USA. The

detailed numerical of the global import value of the top 5 countries and their share percentage have

been given in the table below. Ukriane, being the leader, accounts for 33.6% of the total value of

global soybean imports for the period January 2014 to November 2016. The figure given below

represents the share of the top 5 countries which lead in total value of global soybean imports:

2 http://www.sopa.org/statistics/world-soybean-production/ (Retrieved on 10th April 2017)

3 Zauba technologies & data search( https://www.zauba.com/import-soybean-hs-code.html)(Retrieved on 11th April 2017)

Value Chain Analysis – Soybean 9

Table 3: Major Imports of Soybean (2014-2016)

Country Total Value of Imports (USD) Total Share in Imports Value (In %)

Ukraine 5,492,361 33.6

Benin 2,166,897 15.2

Germany 1,966,517 13.8

India 1,693,583 11.9

USA 1,012,393 7.1

Others 1,889,922 18.4

Figure 1: Total value of Imports by the countries

With respect to the country’s leading in terms of quantity of global Soybean imports, Saudi Arabia

topped the list and forms 18% of the global share with export value of 12,419,930 MT. It is

followed by Benin and further India and so on. The following table shows the top 5 countries in

terms of total quantity of global imports of Soybean and their global share. It is observed that

Ukraine, being the global leader, accounts for 55.3% share in the total quantity of global soybean

imports. It is succeeded by Benin with 20.1% share and further by India with 12.5% share. The

following figure shows the distribution of the top 5 countries with respect to the quantity of global

Soybean imports during the period January 2014 to November 2016:

Table 4: Total quantity of Imports by the country

Country Total Quantity of Imports (In MT) Total Share in Imports Quantity (In %)

Ukraine 12,419,930 55.3

Benin 4,519,825 20.1

India 2,802,912 12.5

Ethiopia 1,168,000 5.2

USA 805,522 3.6

Others 731,298 3.3

34%

15% 14%

12%

7%

18%

Value of Import

Ukraine

Benin

Germany

India

USA

Others

Value Chain Analysis – Soybean 10

Figure 2 Total quantities of Imports by the country

1.1.5. Major Exporters of Soybean in World (Million MT)4

As per reports of January 2014 to November 2016, the global leader in exports of soybean was USA

with an export value of USD 66,329,577. USA is followed by France, Canada, UK and South Korea.

The detailed numerical of the global export value of the top 5 countries and their share percentage

have been given in the table below. USA, being the leader, accounts for 18.8% of the total value of

global soybean exports for the period January 2014 to November 2016. The figure given below

represents the share of the top 5 countries which lead in total value of global soybean exports.

Table 5: Major Exports of Soybean in the world

Country Total Value of Exports (USD) Total Share in Exports Value (In %)

USA 66,329,577 18.8

France 38,590,505 10.9

Canada 36,568,234 10.4

UK 28,967,464 8.2

South Korea 25,035,971 7.1

Others 157,100,826 44.6

Figure 3: Major Exporters of Soybean in World (Million MT)

4 Zauba technologies & data search(https://www.zauba.com/export-indian+soybean+meal-hs-code.html) ( Retrieved on 11th April 2017)

55% 20%

13%

5% 4% 3%

Quantity of Import

Ukarine

Benin

India

Ethiopia

USA

Others

19%

11%

10%

8% 7%

45%

Value of Export

USA

France

Canada

UK

South Korea

Others

Value Chain Analysis – Soybean 11

With respect to the countries who are leading in terms of quantity of global soybean exports, USA

tops the list and forms 16.4% of the global share with export value of 91,872,507 MT. It is followed

by France and further Canada and others. The following table shows the top 5 countries in terms of

total quantity of global exports of soybean and their global percent share. USA is succeeded by

France with 11.8% share and further by Canada with 9.3% share. The following figure shows the

distribution of the top 5 countries with respect to the quantity of global soybean exports during the

period January 2014 to November 2016:

Table 6: Total Quantity of Exports in the world

Country Total Quantity of Exports Total Share in Exports Quantity (In %)

USA 91,872,507 16.4

France 66,368,273 11.8

Canada 52,115,169 9.3

South Korea 48,939,580 8.7

UK 41,070,256 7.3

Others 261,111,779 46.5

Figure 4: Total quantity of exports in the world

Source http://www.sopa.org/statistics/

Considering the world Soy oil production data for the past 5 years, it can be observed that the year

2011-2012 witnessed the highest quantity of soy oil production with a total production quantity of

21.03 Million MT. Since 2011-2012, the soy oil production has seen a declining trend as the

production quantity has been decreasing gradually. The exact figures for the past 5 years have been

given in the table below.

Table 7: Soy oil production data

Oil Year Soybean Crushed (In Million Metric Ton)

Extraction Produced (In Million Metric Ton)

Oil Produced (In Million Metric Ton)

Total

2015-16 5.75 4.715 1.035 11.5

2014-15 6.8 5.576 1.224 13.6

2013-14 8.126 6.664 1.462 16.25

16%

12%

9%

9% 7%

47%

Quantity of Export

USA

France

Canada

South Korea

UK

Others

Value Chain Analysis – Soybean 12

2012-13 10.121 8.299 1.822 20.24

2011-12 10.516 8.623 1.893 21.03

Source: http://www.sopa.org/statistics/

1.2. Indian Scenario

1.2.1. Major Trading Centres

Indore, Ujjain, Dewas, Mandsore in Madhya Pradesh, Akola, Sangli, Nagpur in Maharashtra and

Kota in Rajasthan are major trading centres in India.

1.2.2. State Wise Production of Soybean in India (Million MT)5

Table 8: State Wise Production of Soybean in India (Million MT)

Name of State

2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17

Madhya Pradesh

6.41 5.6 6 5.7 5.24 6.35 3.41 5.72

Maharashtra 2.2 2.7 3.75 4.65 4.75 2.38 2.2 3.95

Rajasthan 0.91 1.1 0.65 1.01 0.97 0.96 0.79 0.95

Andhra Pradesh

0.13 0.16 0.15 0.34 0.4 0.26 0.16 0.24

Karnataka 0.08 0.18 0.18 0.3 0.27 0.19 0.18 0.25

Others 0.24 0.06 0.06 0.24 0.23 0.23 1.83 3.01

All India 9.96 9.5 11.5 12.24 11.86 10.37 8.57 14.12

Source: Directorate of Economics and Statistics, Department of Agriculture and Cooperation5

With 14.12 million tonnes of production, soybean is one of the fastest growing crops in India.

Soybean is grown as a kharif crop in India. The top three largest soybean growing states are Madhya

Pradesh, Maharashtra and Rajasthan. Madhya Pradesh having 41% and 28% share in production

respectively. Soybean is recognized as one of the premier crops around the world. It’s a major

source of vegetable oil, protein and animal feed.

1.2.3. Major Indian Markets

Indore, Ujjain, Dewas, Mandsore in Madhya Pradesh, Nagpur in Maharashtra, Kota in Rajasthan are

the major trading centers. India’s main growing areas are Madhya Pradesh and Maharashtra, which

account for 80% percent of production.

Table 9: Ranking of India in World Soy Industry

India (In Million tonnes) World (In Million tonnes) % Share

Annual Seed Production 6 180 3

Annual Oil Production 1 30 3.3

Annual Oil Imports 1.5 9 16.7

Annual Oil Consumption 2.5 30 8.3

Annual Meal Production 3.5 130 3.5

Annual Meal Exports 2.5 43 5.8

5 Directorate of Economics and Statistics, Department of Agriculture and Cooperation

Value Chain Analysis – Soybean 13

Annual Meal Consumption 1 130 0.7

1.2.4. Imports of Soybean 6

As per statistics from January 2014 to November 2016, the total value of global soybean imports has

been calculated to be USD 14,221,673. The soybean market has seen huge changes with respect to

the value of soybeans imported globally. During the year 2016, the prices have drastically increased

above previous levels. The following figure shows the total values (in USD) of global soybean

imports month wise for the period January 2014 to November 2016. The total quantity of global

soybean imports for the period January 2014 to November 2016 amounts to 22,447,487 MT. The

year 2016 has witnessed an increase in the quantity metric tonnes of global soybean import.

Compared to the previous years, the year 2016 has seen the highest quantity of global soybean

imports. The details of global imports of soybean in terms of quantity for the period January 2014 to

November 2016 have been given in the figure below

Figure 5: Imports of Soybean

1.2.5. Export of Soybean7

It has been observed that global prices trend for soybean export has not improved much as there are

no significant increases in the value of global soybean exports over the past few months. Instead,

the year 2014 proved to be good in terms of value of global soybean exports. During the year 2016,

the prices have more or less remained at normal levels as compared to the previous years though

there has been some value addition towards the end of the year. The following figure shows the

total values (in USD) of global soybean exports month wise for the period January 2014 to

November 2016. The total quantity of global Soybean exports for the period January 2014 to

November 2016 amounts to 561477564 MT. The year 2016 was initially stable in terms of quantity

of global soybean export but increased during the period of October-November 2016. The details of

global exports of soybean in terms of quantity for the period January 2014 to November 2016 have

been given in the figure below:

5 Source: Directorate of Economics and Statistics, Department of Agriculture and Cooperation

7 Zauba technologies & data search(https://www.zauba.com/export-indian+soybean+meal-hs-

code.html) ( Retrieved on 11th April 2017)

0500000

100000015000002000000250000030000003500000400000045000005000000

Total Value USD

Total Quantity

Value Chain Analysis – Soybean 14

Figure 7: Export of soybean

The average price of global soybean exports during the period January 2014 to November 2016 was

INR 43.6 Average prices have more or less remained in the range of INR 35-48 throughout the

years. But in June 2016, prices were the highest and reached INR 53.6. The monthly average prices

of global soybean exports have been given in the figure below

Figure 6: Average Prices of Soybean

140000000

120000000

100000000

80000000

60000000

40000000

20000000

Total Value USD

Total Quantity

60

40

20

Months

Ave

rag

e P

rice

Value Chain Analysis – Soybean 15

Figure 7: Major Soybean Producing Parts in India

1.3. State Scenario: Rajasthan

The country's third largest soybean producing state Rajasthan after Madhya Pradesh and

Maharashtra has drastically lowered the soybean production estimates. During the first advance

estimates of kharif crop in September 2015, the Rajasthan Department of Agriculture estimated

soybean production of 15.40 million tonnes. As per the second advance estimates for kharif 2015-

16, Rajasthan Department of Agriculture estimated that soybean production was estimated to be

down to 8.38 million tons. The comparison between first and second advance estimates indicates

Value Chain Analysis – Soybean 16

that soybean production estimates has been cut down by 46.55% .The major reason for this cut

down was because the beginning of the kharif season saw Rajasthan receiving strong rains ultimately

raising the prospect of a bumper output. But in September, drought conditions of Rajasthan

affected the crop productivity which resulted in low production.

Table 10: Area, Production, Yield of Major Crops in Rajasthan during 2014-15

Area Production Yield

Crop Kharif Rabi Total Kharif Rabi Total Kharif Rabi Total

Soybean 923135 - 923135 973342 - 973342 1054 - 1054

1.4. District & Cluster Scenario

Table 11: Total Production of Soybean in Rajasthan

Total Production in the catchment Area (2015-16) 766969

Total Production in Rajasthan (2015-16) 804066

Percentage share in the State Production 95%

Top Producing Districts in the catchment zone Baran, Kota, Jhalawar

Table 12 Major Soybean producing districts in the catchment areas

Sr. No. District in the Catchment Area Production in MT Rank of District in the catchment

1 Baran 155787 1

2 Kota 145442 2

3 Jhalawar 140961 3

4 Pratapgarh 109923 4

5 Bundi 80817 5

Total Production in Catchment Area 632930

Rajasthan is major soybean producing state in India. Baran is the highest soybean cultivating district

in Rajasthan with the production of 155787 MT. Other major soybean producing districts are Kota,

Jhalawar, Pratapgarh and Bundi.

Table 13: Catchment & State production

Year Catchment Production (in MT) Rajasthan State Production (in MT)

2013-14 952543 974987

2014-15 1735184 956640

2015-16 766969 804066

Value Chain Analysis – Soybean 17

1.5. Approach to Value Chain Analysis

Evaluation of the value chain of the commodity was held in consultations with major stakeholders

in the chain including Farmers, Consumers, Processors, Traders, supporting public and private

service providers and institutions etc. Some major clusters were considered for the survey within the

state.

Table 14: Surveyed Major Stakeholders for Value Chain Analysis

Surveyed Markets for the Value Chain Analysis

Within and Outside Rajasthan

Soyabean 1. Farmers in Bansur cluster (5) 2. Framer in Baswara cluster (5) 3. Farmer in Baran cluster (5) 4. Farmer in Orai-Basii cluster (5) 5. Farmers in Jakham cluster (5) 6. Farmers in Sangod cluster (5) 7. Shyam Dhani Industries Pvt Ltd., Jaipur 8. MDH Masala, Nagaur 9. M/S Premchand, Kota 10. Sohan Agro Mills PVT. LTD, Kota 11. Manish Enterprises, Kota 12. Khnana Khazana Foods, Ajmer 13. Mr. Mukesh Agrawal, Nagaur 14. Azad Agro Enterprises, Kota (Trader) 15. Bansilal Nagar, Palathya 16. Vinay Bansal, Anaj Mandi, Kota 17. Kamlesah Dhamani,Anaj Mandi, Kota 18. Ankit Mehta, Kota 19. DPM,Dep.of Agriculture , Palathya 20. DC,Water recourses, Palathya 21. PC, KVK. Baran 22. SMS, KVK, Baran 23. DD, Dept. of Agriculture, Baran 24. JD, Dept. of Agriculture, Palathya 25. T.L, NGO, Palathya 26. CMS, NGO, Palathya 27. PC, KVK, Baran 28. Director, Agriculture University, Kota 29. PD, ATMA, Kota 30. T.L, NGO, Sangod 31. SMS,NGO, Sangod

1.6. Resourcing mapping of value chain

Resource mapping of Soybean value chain is done by identification cluster, major mandis, major

markets, warehouses, etc. Following is the detail resource mapping of value chain:

Table 15: Resource mapping of value chain

Cluster Major mandi/s around cluster Distance from major cities nearby

Major Markets

Warehouses/ Cold store with Capacity in MT

No of FPCs targeted

Value Chain Analysis – Soybean 18

Palayatha (Baran)

a. Atru b. Baran c. Kawai Salpura

60 km 30 km 80 Km

Baran (3), Jalore (1), Chittorgarh (2), Kota (2), Bundi

Baran (27520) Antah (9200) Atru (5400) Chhabra (11550) Siswali (6750)

2

Kushalgarh (Banswara)

a. Bundi, b. Kota

83 km 88 km

Bhilwara (4), Chittorgarh (6), Pali (3), Kota (3)

Banswara (12200 MT)

2

Gudha (Bundi)

a. Bundi b. Kishoraipatan c. Sumerganj d. Dei

-17 km -70 km -120 km -70 km

Ajmer (6), Baran (4), Kota (3), Sawai Madhopur (1), Tonk (4)

Bundi (24620 MT) Kapren (6750 MT) Keshoraipatan (6000 MT)

2

Jakham (Pratapgarh)

a. Pratapgarh b. Dhariawad c. Nimbaheda

-20 Km -10 Km -20 km

Baran (4), Bundi (4), Chittorgarh (6), Kota (3)

Pratapgarh (18450)

2

Orai bassi (Chittorgarh)

a. Chittorgarh b. Nimbahera c. Pratapgarh d. Begu e. Badisadri f. Neemuch

-25-40 km -55 km -145 km -20 Km -60 Km -60-70 km

Ajmer (6), Bhilwara (4), Bundi (4), Chittorgarh (6), Kota (3), Tonk (4)

Chittorgarh (17250 MT) Nimbahera (13500 MT)

2

Manoharthana (Jhalawar)

a. Aklera b. BhawaniMandi c. Jhalarapatan d. Khanpur

Bhavanimandi (14550 MT) Jhalrapatan (18900 MT) Khanpur (6750 MT)

2

Sangod (Kota)

a. Kota b. Baran c. Sangod d. Khanpur

Itawa (4400 MT) Ramganjmandi (9650 MT) MT) Sultanpur

2

1.7. Marketable surplus of Soybean in Cluster

Following is the marketable surplus of Soybean in cluster:

Table 16: Marketable surplus of Soybean in cluster

Value Chain Analysis – Soybean 19

Cluster Area under

crop

cultivation

(in Ha)

Production

(in T)

Marketable surplus in MT (as % of total production; 95% for Soybean)

Market Value @ Rs

30000/MT

(in Rs Lakh)

Palayatha

(Baran) 6840 9576 9097 2729

Kushalgarh

(Banswara) 1236 2304 2189 657

Gudha (Bundi) 2225 2072 1968 591

Jakham

(Pratapgarh) 6498.6 6154 5846 1754

Orai bassi

(Chittorgarh) 5934.1 10285 9771 2931

Manoharthana

(Jhalawar) 1258 1228 1167 350

Sangod (Kota) 15525 14020 13319 3996

Total 39516.7 45639 43357 13008

Value Chain Analysis – Soybean 20

Chapter 2- Pre Harvest Management

2.1. Major Commercial Varieties Grown in Rajasthan

There are numerous varieties, both traditional, hybrid and newly developed of soybean grown in the

state of Rajasthan. Among the pool of varieties, the highest yielding variety of soybean grown is PK-

416 which yields around 3200-3800 kg/ha. Also, this variety has the highest oil percent which ranges

from 41% to 56%. It is followed by the variety PK-1042 which yields around 3300 kg/ha. Detailed

yields and oil percentages of the major commercial varieties grown in Rajasthan are given below:8

Table 17: Major Varieties of Soybean in Rajasthan

State Name of Variety Yield (Kg./ha.) Oil percent

Uttar Pradesh and Rajasthan

Alankar 2200 --

Ankur 2300 --

Clark – 63 1800 --

PK-1042 3300 --

PK-262 2800 --

PK-308 2600 20-23

PK-327 2300 --

PK-416 3200-3800 41-56

PK-564 3000 --

Shilajeeth 2200 --

2.2. New Initiatives & Practice

Soybean is filled with a variety of products designed to provide significant yield improvements,

improved weed- and insect-control options, as well as products designed to produce the

nutritionally-improved oil profiles that consumers are demanding. Soybean breeding research

focuses on developing varieties that improve yield and yield stability while providing resistance to

insects and disease.

Nutritionally-Improved Oils on the Horizon

Consumers and food companies are increasingly demanding better oils and farmers are eager to

deliver them. Vistive® Gold high oleic and Soymega™ SDA Omega-3 Soybeans are two of the

soybean products in that are designed to help farmers deliver on that demand. Vistive® Gold

Soybeans combine breeding and biotechnology to produce soybean oil with mono-unsaturated fat

levels similar to olive oil and the low saturated fat content of canola oil. This would allow the food

industry to cost-effectively eliminate trans fats and significantly lower saturated fat content in food

8 http://agmarknet.gov.in

Value Chain Analysis – Soybean 21

products to help consumers meet recent dietary guidelines. This oil product would also significantly

improve frying stability of the oil while maintaining the flavor and economics of soybean oil.

Vistive® Gold would allow farmers to help meet the growing demand for better oils with a

domestically produced soybean-based option. Soymega™ SDA Omega-3 Soybeans are designed to

produce oil with omega-3 fatty acids. Omega-3 fatty acids traditionally found in fatty fish have

reported health benefits including heart health*. Similar to soybean oil in taste and shelf life, oil from

these soybeans could be used as an ingredient in a wide range of food applications such as yogurt,

granola bars and spreads. Soymega™ SDA Omega-3 Soybeans could provide consumers a new

option to obtain desirable omega-3 fatty acids from foods rich in SDA omega-3—a further

opportunity for farmers to help deliver health benefits to consumers.

2.3. Seasonality Pattern of Soybean in Rajasthan visa-vis other parts of the

world

Soybean is sown in the period of June to July. The harvesting time for soybean in Rajasthan is from

October and continued till November.

Figure 8: Seasonal Availability Pattern

Crop Calendar Jan Feb Mar April May June July Aug Sept Oct Nov Dec

US Sowing Harvesting

Brazil Harvesting Sowing

Argentina Harvesting Sowing

China Sowing Harvesting

India Sowing Harvesting

Rajasthan Sowing Harvesting

2.4. Land Preparation9

It requires a good seedbed with a reasonable fine texture and not too many clods. Land should be

well levelled and be free from crop stubble. One deep ploughing with mould board plough followed

by two harrowing or two ploughing with local plough are sufficient. There should be optimum

moisture in the field at the time of sowing.

2.5. Sowing/Planting/Cultivation10

A. Seed Rate

1) CO 1 - 80 kg/ha Optimum plant population 3, 33,000/ha.

2) CO 2 (irrigated) Pure crop: 60-70 kg/ha; Inter crop: 25 kg/ha

3) CO (Soy) 3 Pure crop: 50 kg/ha

B. Seed Treatment with Fungicides

1) Treat the seeds with Carbendezim or Thiram @ 2g/kg of seed 24hrs before sowing or with

talc formulation of Trichoderma viride @ 6 g/kg seed (or) Pseudomonas fluorescens @ 10

g/kg seed.

2) Biocontrol agents are compatible with bio fertilizers.

3) First treat the seeds with biocontrol agents and then with Rhizobium.

4) Fungicides and biocontrol agents are incompatible.

9 http://www.thepatriot.co.zw/old_posts/preparation-and-planting-of-soybeans/

1010 http://www.thepatriot.co.zw/old_posts/preparation-and-planting-of-soybeans/

Value Chain Analysis – Soybean 22

C. Seed Treatment with Bio fertilizer

1) Treat the seeds at least 24 hours before sowing.

2) Treat the seeds with 3 packets (600 g/ha) of Rhizobial culture and 3 packets (600 g/ha) of

Phosphobacteria P5B using surfacants rice kanji as binder. If the seed treatment is not

carried out apply 10 packets of Rhizobium (2000 g/ha) and 10 packets (2000 of

Phosphobacteria with 40-50 kg of FYM before sowing. Dry the bacterial culture treated

seeds in shade for 15 minutes before sowing.

D. Plant Spacing

The planting depth is critical. In sandy or light soils, seeds can be placed up to four centimetres (cm)

deep. In heavy soils (high clay content) a depth of two – three cm is adequate. If planted too deep,

soybean will fail to emerge. If it rains soon after planting, a crust may form that will hinder

germination. A light spike harrowing across the rows will aid germination. Line rowing is generally

preferred and seed drill is required to grow soybean in appropriate depth in line keeping row to row

30-45 cm and plant to plant 10-15 cm.

2.6. Climatic & Soil Requirement11

Soybean grows well in warm and moist climate. A temperature of 26.5°C to 30°C appears to be the

optimum for most of the varieties. Soil temperatures of 15.5°C or above favour rapid germination

and vigorous seedling growth. The minimum temperature for effective growth is about 10°C. A

lower temperature tends to delay the flowering. Day length is the key factor in most of the soybean

varieties as they are short day plants and are sensitive to photo-periods. Most of the varieties will

flower and mature quickly if grown under condition where the day length is less than 14 hours

provided that temperatures are also favourable.

Well drained and fertile loam soils with a pH between 6.0 and 7.5 are most suitable for the

cultivation of soybean. Sodic and saline soils inhibit germination of seeds. In acidic soils, liming has

to be done to raise the pH up to seven. Water logging is injurious to the crop and resistant to the

soybean growth.

2.7. Nutrient Management

It is recommended to apply 20 kg of Nitrogen/ha, 40 kg P2O5/ha and 40 kg K2O/ha as basal

application for higher yield. The application of 10 tonnes FYM/ha is also recommended during the

field preparation. The seed of soybean treated with biofertilizer (Rhizobium) then 20 kg N/Ha is

sufficient but in case of no seed enoculation then apply 40 kg N/Ha as base dose.

Table 18: Nutrient management of Soybean

Sr. No Fertilizers Average Dose

1 Urea 20-40

2 SSP 250

3 MOP 66

4 ZnSO4 25

5 Borax 5.0

(Source: Agmarknet)

11 www.spuvvn.edu

Value Chain Analysis – Soybean 23

2.8. Water Management

The soybean crop generally does not require any irrigation during kharif season. However, if there is

a long spell of drought at the time of pod filling, irrigation would be desirable. During excessive

rains, proper drainage is also equally important.

2.9. Weed Management12

Alachlor may be applied to the irrigated crop at 2 kg ai/ha or Pendimethalin 1 kg ai/ha after sowing

followed by one hand weeding at 30 days after sowing. If herbicide spray is not given it requires two

hands weeding at 20 and 35 days after sowing.

2.10. Disease & pest Management

The various insects, diseases, and pests infecting the soybean crop at various stages of cultivation are

given below-

1. Steam Fly

This is major pest of soybean in all the soybean growing

areas in India as well as in world.

Symptoms of damage: The adult flies are shining black

and about 2 mm long. The damaging stage is maggot which

is white in colour and remains inside the stem. Female adults

lay eggs inside the cotyledon or leaves. After hatching from

eggs, the maggots mine through the leaf and reach the

petiole. From petiole, they enter the branch and stem, and feed on xylem and phloem. This results

in non-availability of food material to the plants. When the plant are attacked in an early stage of

leaf, then upper half of the leaf show sign of gradual withering. When grown up plants are attacked,

they do not show any external symptoms of damage except the exit holes made by the maggots for

emergence of adults. Infestation due to flies reduces the grain yield by 16 to 20%. With proper

control measures at least 12% yield loss can be avoided.

Control Measures: Soil application of Phorate 10 G @ 10 kg/ha or Carbofuran 3 G @ 30 kg/ha at

the time of sowing will prevent early infestation by stem fly. One or two sprays of 0.07%, or 0.03%,

Dimethoate 30 EC or 0.05%, Quinalphos 25 EC can stop the damage. Thimethoxam 30 FS 5-6

ml/kg seed treatment is applied.

2. Thrips

They attack soybean from August to October during

Kharif. Long, hot and humid atmosphere during Kharif

season is found to be more congenial for their

multiplication. Adults are minute, yellowish brown in

colour wit feeble wings.

12 https://www.spuvvn.edu/academics/academic_centres/agro_economic_centre/research_studies/R.%20 No.%20152%20Pre%20&%20Post%20Harvets%20Losses-%20Raj.pdf

Value Chain Analysis – Soybean 24

Nymphs are pale yellow. Both nymphs and adults scratch the leaf surface and lick the sap coming

out of the scratches. This results into brownish spots on the leaves.

Control measures: Spray 0.05 Quinalphos 25 EC, Dimethoate 30 EC, 875 ML/Ha

3. White fly

Though this pest appears regularly on soybean from July to

October in Rajasthan, it does not cause economic damage.

Adults are small, yellow bodied insects with white. Wings

which are densely covered with a waxy Powder Nymphs and

pupae are black and round or oval. Pupae have marginal

bristles. Both adults and nymphs suck the plant sap from

tender leaves and stem, and transmit YMV disease. Plants

suffering from this disease have reduced pod formation and

yield. It is reported that if infection occurs when plants are 30

days old, reduction in yield is up to 19% compared to healthy

plants.

Control measures: Spry 0.05 quinalphos 25 EC, Thimethoxan 100g/ha.

4. Blue beetle

This is a new pest of soybean, first reported to feed on

soybean from M.P. during Kharif. It appears at seedling stage

(June-July) and feeds on Cotyledons unifoliate and young

trifoliate by making holes on the leaves. Adults are dark

shining deep blue with yellowish brown head.

Control measures: Spray 0.05 quinalphos 25 EC, dusting of methyl parathion 2% or malathion 5% dust 25 kg/Ha

5. Girdle Beetle

This is more common in M.P, Rajasthan and West Bengal. Its

first occurrence was seen in M.P. It has become a more

devastating insect through years, infesting 60 to 80% Soybean

in recent years the initial damage is caused by the female which

makes two parallel girdles with its mandibles either on petiole,

branch or main stem, for egg laying. These girdles reduce the

water supply and thus ensure successful hatching. A female

can make 4-6 pairs of girdles on a single plant; eventually the

entire portion above the girdles dries. This insect remains

active from July to October damaging most severely during August-September. The grubs after

hatching from egg move downwards by tunnelling the petiole or branch or the stem as the case may

be, finally reaching up to the ground level. It has been found that about 75% of the plants get totally

damaged when the insect attacks a 15-17 days old crop. When the crop is attacked between one and

a half to two months, the plants will appear healthy from outside, but there may be a reduction up

to 53% in pod number, 65.5% in pod weight, 56.5% in grain number and 66.6% in grain weight.

This loss is further increased when the grubs cut the stem of maturing plants from 5 to 25 cm above

the ground level causing a net loss of 5.43 kg of grains for every per cent of infestation. In general, if

Value Chain Analysis – Soybean 25

25% of the total plant population is infested by girdle beetle, an inevitable loss of about 136 kg/ha is

observed. Early sowing is more prone to attack. The grubs of this insect which tend to fail to

complete their development within the same season enter into diapauses during winter. The grubs

cut small portion of the stem and crawl along with it by remaining inside and closing one end of it.

Finding a suitable place in the crevices they close the other end also and remain till the onset of

monsoon (July) when the grubs develop into pupae from which adults emerge out in 8-11 days and

again start infesting the crop.

Control Measures

Mechanical removal of dried (infested) leaves can reduce the population of eggs and grubs of girdle

beetle and grow resistant varieties. Soil application of Phorate 10 G @ 10 kg/ha or Carbofuran 3G

@ 30 kg/ha at the time of sowing will prevent early infestation by girdle beetle and stem fly. One or

two sprays of 0.03% Dimethoate 30 EC or 0.05% Quinalphos 25 EC or 0.05% Methyl demethon 25

EC or 0.04% Monocrotophos 36 SC can check further damage. These insecticides have been

reported to have detrimental effect on eggs and newly hatched grubs of girdle beetle reducing 90%

of their population.

Diseases

1. Bacterial Pustule

This disease is caused by Xanthomonas Campestris Pv. Glycine Dowson. This is one of the most

important diseases of soybean in India and causes up to 18 % losses to the soybean crops. Small

yellowish- green spots with reddish brown Centre are formed at upper surface of the leaf lamina.

The individual spot in the Centre appears slightly raised. Small bacterial Pustules are also found on

the lower lamina of the leaves. The necrotic tissues some time rupture and tear away. Heavy infected

leaves turn yellow in highly susceptible cultivars leading to complete defoliation.

Management: Seed treatment with mixture of copper oxychloride+streptocycline @1.15% + 200

ppm could control the disease effectively. Copper fungicides alone or in combination with the

antibiotic were equally effective. Stabilized Bordeaux mixture spray was also effective against

bacterial pastule, pod blight and brown spot of soybean. Bacterial pastule of soybean can be

effectively controlled through the sprays of a mixture of Fytolan (0.3%) + Streptocycline (300 ppm)

or copper oxychloride 50 wp (1.6 kg) + streptocycline (160g)

2. Bacterial Blight

Bacterial blight is distributed widely and appears on the leaves, stems and pods as light to dark-

brown irregular spots without any marginal halo. The lesions become confluent as they enlarge the

necrotic tissues dry and drop out. With humidity, limited amount of grey or brown exudates

accumulates on the surface of lesions. Defoliation and injury to the pods are rarely found due to this

disease.

Management: Infected crop residues should invariably be burnt. Foliar sprays immediately after the

initiation of the disease symptoms should be given with a mixture of copper oxychloride @0.3%

and streptocycline @100 pm.

3. Seed and Seedling Rot

Seed rot, pre and post emergence seedling mortality and root rot of soybean in the field cause major

problems for soybean cultivation. Majority of these seed and seedling diseases are caused by various

Value Chain Analysis – Soybean 26

species of fungi available in the seed or soil. Seed rotting fungi cause damage to the crop to the

extent of 25.8% and allowed only 39-40% seed germination.

Management: Selection of disease free healthy seeds with less than 5-6% moisture is the first

criteria for the desired disease management. Use only certified disease free seeds; seeds should

always be stored in a cool and dry place to avoid any fungal growth in a seed lot.

2.11. Recommended Good Agricultural Practices

A New Weed Management Option for Soybeans

Dicamba is an economical herbicide that controls a wide spectrum of broadleaf weed species,

including tough-to-control and glyphosate-tolerant weeds. The addition of dicamba tolerance to the

existing Genuity® Roundup Ready 2 Yield® soybean platform would provide soybean farmers with

another important tool for a highly-effective and high-yielding weed management system.

The Next Level of Soybean Yield Potential

Collaboration with BASF

One of the most important priorities to a soybean farmer is higher yield. That’s why scientists are

developing multiple generations of higher-yielding soybeans that are designed to boost the intrinsic

yield potential of soybeans through the insertion of key genes. These yield traits are expected to be

stacked with Genuity® Roundup Ready 2 Yield®, dicamba tolerance and other traits in soybean

pipeline, to provide farmers with a significant yield boost over today’s Roundup Ready® soybean

varieties on a highly-effective weed management platform.

In some parts of the world, soybean farmers face costly yield losses due to insect damage. Insect-

protected soybeans use the same Bt technology widely adopted in corn and cotton. The Bt soybean

trait is envisioned to be stacked with Genuity® Roundup Ready 2 Yield® to provide excellent insect

control, weed control and yield enhancement. The second- generation insect-protected trait is

designed to enhance the insect spectrum, to provide enhanced durability and to provide the

opportunity to reduce the refuge for the first-generation insect- protected trait.

Breeding for Resistance to Disease and pests

Scientists use the most advanced technologies available to evaluate the progression of several

damaging soybean diseases globally. This helps to identify which soybeans possess disease resistance

genes and the specific regions of DNA within these soybeans that can be bred into our elite soybean

varieties to enhance resistance to specific diseases. In addition, Monsanto breeders are working on a

family of products with resistance to soybean cyst nematode, as well as phytophthora root rot

resistance.

2.12. Harvesting13

Soybean grows best in temperate, tropical and subtropical regions. They can be grown throughout

the year in the tropics and subtropics, if water is available. It requires well-drained and fertile soil,

400 to 500 mm of precipitation in a season for a good crop. High moisture requirement is critical at

the time of germination, flowering and pod forming stage. Dry weather is essential for ripening. The

flow of grains from the field to consumers includes several operations. All of these operations have

to be appropriately done in order to reduce the risk of altering negatively the quality of the grain.

13 http://unctad.org/en/PublicationsLibrary/INFOCOMM_cp10_Soybeans_en.pdf

Value Chain Analysis – Soybean 27

Because of the availability of harvesting machinery, handling and loading equipment, all operations

from cultivation to transportation, are done in the shorter time possible to avoid grain condition

changes or damages that might affect its conservation and storage. It is necessary to highlight the

importance cultivation processes, including pre-harvest operations (preparation of the land, planting,

irrigation) and post-harvest operations (transport, threshing, drying, cleaning, processing, packaging

and storage).

2.13. Pre-Harvesting Constraints

The constraints faced in cultivation of soybean crop are presented in indicating the severity of

various constraints faced by the selected households in cultivation of soybean crop.

The most important constraint in soybean cultivation as reported by the producers is pests and

disease problem which was also followed by poor seed quality and high cost of inputs. Low output

price and water deficiency was also important constraints faced by farmers in cultivation of soybean.

The major problems of these constraints as reported by producer are as below.

1. Pests and disease problem

The Pests and diseases are not easily controllable Pesticides and fungicides sometimes fail to control

pests and disease. The cost of purchasing pesticides and other medicines is on the higher end,

making them inaccessible to the farmers.

2. Poor seed quality Duplicate seeds or high price of seeds, low quality or low pest resistance power of seeds Producers

face problems regarding the poor seed quality, seed delicacy and low pest resistance.

3. High cost of inputs High price of pesticides, fungicides and fertilizer; Shortage of farm inputs and labour not available

due to high wage rate.

4. Low price of output The farmers do not get expected price for their produce, there is a high fluctuation of crop price.

Government should interfere in price decision.

5. Water deficiency There is a constant lack of irrigation facility electricity and water logging in soybean.

6. Others

At times the climate is not suitable. The wild animals such as blue bulbs and dry cows destroy the

crop. There is even a lack of knowledge in farmers on scientific cultivation of soybean

Value Chain Analysis - Soybean 60

Chapter-3: Post-Harvest Management

Post- harvest management is the technology handling of an agricultural produce after harvest to

prolong the shelf life, freshness and an attractive appearance. Nearly, 9 to 10 per cent of grains are

wasted due to faulty post-harvest management during harvesting, threshing, packaging, storage, and

transportation etc. Proper scientific post-harvest management can minimize these losses. Like post-

harvest management, the proper pre-harvest steps such as use of proper harvesting tools and

assessment of maturity stage also improve the shelf life of the grains and reduce the post-harvest

losses to a great extent.

Figure 9: Post Harvest Management

Threshing consists of separating the beans from the pods. Usually it is done mechanically during the

harvest. The soybean is then transported by truck, road or rail to the storage warehouse (at the

loading port) where it will be dried, cleaned and packaged. At the end, the soybean is refined in

function of its purpose. It could be for livestock feed or oil.

3.1. Post-Harvest Losses, Harvesting Care and Post–Harvest Equipment14

Post- harvest losses are those that occur from natural causes before harvest. These losses result