Utility Regulators—The Independence...

Transcript of Utility Regulators—The Independence...

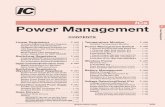

Note No. 127 October 1997

The World Bank Group ▪ Finance, Private Sector, and Infrastructure Network

Utility Regulators—The IndependenceDebate

Warrick Smith The global trend of utility privatization haspushed regulatory issues to the fore, amongthem the role of regulatory agencies. Theseagencies have a long history in the UnitedStates, and creating or strengthening them hasbecome a central goal of reforms around theworld. But many issues remain contentious,particularly the notion of agency indepen-dence. Some governments are reluctant tosurrender political control over regulatorydecisions. And even those who agree on thedesirability of independent agencies may ques-tion whether they are feasible or appropriatein all country settings. This Note considers thedebate over the independence of utility regu-lators, focusing on the position of developingcountries.

Independence—What and why?

Independence is subject to different interpre-tations. Some use it interchangeably with au-tonomy; others perceive greater or lesserdifferences in meaning between the terms. ThisNote defines independence for utility regula-tors as consisting of three elements:▪ An arm’s-length relationship with regulated

firms, consumers, and other private interests.▪ An arm’s-length relationship with political

authorities.▪ The attributes of organizational autonomy—

such as earmarked funding and exemptionfrom restrictive civil service salary rules—necessary to foster the requisite expertise andto underpin those arm’s-length relationships.

The rationale for giving regulators independenceas broadly defined here lies in the special chal-lenges posed by utility regulation, including thecritical role of regulatory discretion.

Regulatory challenges

Utility regulation has three main aims: to protectconsumers from abuse by firms with substan-tial market power, to support investment byprotecting investors from arbitrary action bygovernment, and to promote economic effi-ciency. While there is growing recognition thatcompetition can reduce the need for regula-tion in utility industries, most industries containsome areas of monopoly where the benefits ofregulation potentially outweigh the costs.

Regulating utilities is complicated by three re-lated considerations. First, prices for utility ser-vices are usually political. There are no votesin raising utility prices, and history is repletewith examples of justifiable price increasesbeing withheld at the expense of investors andthe long-term interests of consumers.

Second, investors are aware of these pressuresand of the vulnerability of their usually large,long-term, and immobile investments. Unlessa government has made a credible commitmentto rules that ensure an opportunity to earn rea-sonable returns, private investment will notflow. Weak credibility will be reflected in highercapital costs and thus higher tariffs. In privat-ization, this translates into smaller proceedsfrom sales of existing enterprises and higherfinancing costs for new projects.

Third, the long-term nature of most infrastruc-ture investments makes creating credible com-mitments difficult. Highly specific rules, ifconsidered sustainable, can provide assuranceto investors and lower the cost of capital. Butthey make it difficult to adjust regulation tounforeseen developments, including changes

PrivatesectorP U B L I C P O L I C Y F O R T H E

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Pub

lic D

iscl

osur

e A

utho

rized

Utility Regulators—The Independence Debate

in technology and market conditions. They alsomake it difficult to tailor responses to situa-tions and to provide incentives for efficiency.There is thus an important tradeoff betweenreducing the risk of expropriation, and with itthe cost of capital, and retaining the flexibilityto pursue efficiency and other objectives.

In designing regulatory systems, then, policy-makers need to resolve two fundamental chal-lenges: How much discretion should regulatorysystems contain? And how should that discre-tion be managed to reduce the risk of misuseand thus the cost of capital?

How much discretion?

The discretion in regulatory systems differswidely among countries and industries. At oneextreme, U.S. laws typically delegate broad dis-cretion to regulators, often vaguely definingpricing standards as “just and reasonable” andlimiting other powers only by reference tobroad public interest criteria. At the other endof the spectrum, some countries implementregulation through tightly specified laws or con-tracts that seek to eliminate discretion. Theyattempt to deal with all contingencies foreseenat the time an arrangement is finalized, usuallyrelying on detailed cost-based formulas for tariffadjustments. This approach—sometimes called“regulation by contract”—is often favored byinvestors who perceive a high risk of misuseof discretion by the government or regulator.Adjustments to the initial arrangement will re-quire renegotiation, which can be difficult ifthe bargaining power of the parties changesonce the investment is made.

Most regulatory systems lie somewhere be-tween these extremes. Key policies and prin-ciples tend to be defined in laws, licenses, orcontracts, which carefully delimit residual dis-cretion through reference to criteria, factors,and objectives. Greater flexibility and discre-tion are usually more important in industriesin which there is rapid technological change,in which the introduction of competition re-quires continuous adaptation of rules to chang-ing market conditions, and in which highpriority is placed on providing incentives for

efficient operation. Discretion is thus typicallymore important for telecommunications thanfor toll roads. Another consideration is acountry’s stability and reputation for respect-ing private property rights: the higher a coun-try scores on these criteria, the more discretionit can retain without significantly increasing thecost of capital. This consideration is especiallyrelevant for reforming and developing coun-tries, many of which lack a long track recordof good performance in these areas.

How to manage discretion?

When discretion is retained on tariffs or otherissues of concern to investors, the challenge isto manage it in a way that minimizes the riskof misuse. The exercise of discretion needs tobe insulated from short-term political pressuresand other improper influences and to be basedon competent analysis.

Entrusting discretion to ministers will not meetthese tests, particularly when the state contin-ues to own utility enterprises. In this case, therewill be no arm’s-length relationship betweenthe regulator and the firm, and there may beconcerns that, in exercising discretion, minis-ters will favor the state enterprise over rivalprivate firms. But even if the state has no own-ership role, ministers will still be subject toshort-term political pressures, and changes ingovernment can lead to abrupt changes in regu-latory policy. Restrictive civil service salary rulesin many countries also make it difficult forministries to attract and retain well-qualifiedprofessional staff. What is required is an agentat arm’s length from political authorities, utili-ties, and consumers. Organizational autonomyhelps to foster the requisite expertise and pre-serve those arm’s-length relationships.

The quest for independence

Creating an independent agency, no easy taskin any setting, is even more challenging incountries with a limited tradition of indepen-dent public institutions and limited regulatoryexperience and capacity. The two main ele-ments of independence—insulation from im-proper influences and measures to foster the

development and application of technicalexpertise—are mutually supporting: technicalexpertise can be a source of resistance to im-proper influences, and organizational autonomyhelps in fostering (and applying) technicalexpertise.

There is strong consensus on the formal safe-guards required:▪ Providing the regulator with a distinct legal

mandate, free of ministerial control.▪ Prescribing professional criteria for appoint-

ment.▪ Involving both the executive and the legisla-

tive branches in the appointment process.▪ Appointing regulators for fixed terms and

protecting them from arbitrary removal.▪ Staggering terms so that they do not coin-

cide with the election cycle, and, for a boardor commission, staggering the terms of themembers.

▪ Exempting the agency from civil service sal-ary rules that make it difficult to attract andretain well-qualified staff.

▪ Providing the agency with a reliable sourceof funding, usually earmarked levies on regu-lated firms or consumers.

Formal safeguards of this kind are especiallyimportant in countries with a limited traditionof independent public institutions. But they arenot enough. Persons appointed to these posi-tions must have personal qualities to resistimproper pressures and inducements. And theymust exercise their authority with skill to winthe respect of key stakeholders, enhance thelegitimacy of their role and decisions, and builda constituency for their independence.

Some argue that governance traditions in somecountries make independence illusory—“If thePalace calls, the regulator will comply.” Certainly,adopting even the most sophisticated law willnot magically transform the basic institutionalenvironment. Nevertheless, for several reasons,creating such agencies is worth the effort, evenin more challenging environments.

First and foremost, independence must be un-derstood as a relative rather than an absoluteconcept. In any system, the goal can only be

to reduce the risk of improper political inter-ference, not to provide ironclad guarantees.Progress must be measured at the margin—and relative to the outcome of ministers re-taining direct control over regulatory decision-making. Second, the ability of independentagencies to sidestep civil service salary restric-tions and to have access to earmarked fundingmakes it possible to recruit and retain better-qualified staff and to hire external consultants.This can improve the technical quality of deci-sions and thus enhance the agency’s authority.Adequate salaries can also help to reduce con-cerns about corruption. Finally, even if thereare reasons to doubt that an agency will exer-cise truly independent judgment in the shortterm, that may change in the longer term. Con-centrating expertise in a body with a specialistmandate sharpens commitment to professionalnorms, which can be an important source ofresistance to improper influences. And as theregulator enters the fray, it will have the op-portunity to build a constituency of its own,increasing insulation from political interference.

Reconciling independence withaccountability

Independence needs to be reconciled withmeasures to ensure that the regulator is ac-countable for its actions. Checks and balancesare required to ensure that the regulator doesnot stray from its mandate, engage in corruptpractices, or become grossly inefficient. Strik-ing the proper balance between independenceand accountability is notoriously difficult, butthe following measures to do so have beenadopted by a growing number of countries:▪ Mandating rigorous transparency, including

open decisionmaking and publication of deci-sions and the reasons for those decisions.

▪ Prohibiting conflicts of interest.▪ Providing effective arrangements for appeal-

ing the agency’s decisions.▪ Providing for scrutiny of the agency’s bud-

get, usually by the legislature.▪ Subjecting the regulator’s conduct and effi-

ciency to scrutiny by external auditors orother public watchdogs.

▪ Permitting the regulator’s removal from officein cases of proven misconduct or incapacity.

Utility Regulators—The Independence Debate

Possible paths of transition

Resistance to independent agencies is break-ing down. Ministers once adamant about main-taining political control over tariffs and otherregulatory matters increasingly see the bene-fits of creating such agencies, which includeimproving offers from investors, helping to sus-tain reforms, and shifting responsibility for un-popular decisions to someone else. But whatif the government resists?

The choice can be stark. Governments can re-duce discretion by adopting highly specificrules, forfeiting flexibility and other advantages.Or they can retain discretion, pay investors riskpremiums, and accept reduced proceeds fromprivatization, higher tariffs or both. In eithercase, ministerial structures will usually make itdifficult to develop expertise to deal with regu-latory problems arising after privatization.

But several options lie between the traditionalministerial model and the delegation of broaddiscretionary authority to a fully independentagency. These options can form a path of tran-sition to greater independence and delegationof discretionary authority. First, a dedicatedregulatory unit can be created within a minis-try, to coordinate regulatory activity and fosterthe development of technical skills and pro-fessional norms. The autonomy of the unit canoften be enhanced by placing it under the re-sponsibility of a minister other than a sectoralminister—particularly important if there is po-tential for conflict between private firms andstate enterprises under the purview of thesectoral minister. Once such a unit has beencreated, governments can increase the trans-parency of regulatory processes and approxi-mate an independent agency in other ways.Exempting staff from civil service salary ruleswill usually be more problematic, but concernsabout technical competence can be addressedby contracting out certain tasks to consultants.

Second, an agency can be created with manyof the attributes of an independent agency, butwith one or more ministers taking part in

Viewpoint is an openforum intended toencourage dissemina-tion of and debate onideas, innovations, andbest practices for ex-panding the privatesector. The views pub-lished are those of theauthors and should notbe attributed to theWorld Bank or any ofits affiliated organiza-tions. Nor do any of theconclusions representofficial policy of theWorld Bank or of itsExecutive Directors or the countries theyrepresent.

To order additionalcopies please call202-458-1111 or contactSuzanne Smith, editor,Room F6P-188,The World Bank,1818 H Street, NW,Washington, D.C. 20433,or Internet [email protected] series is alsoavailable on-line(www.worldbank.org/html/fpd/notes/notelist.html).

Printed on recycledpaper.

decisionmaking (as in Colombia). This ap-proach can improve the technical quality ofregulatory decisionmaking, particularly com-pared with the first option. But as long as min-isters retain significant influence, the risk ofmisuse of regulatory discretion remains.

Third, a more truly independent agency canbe created, but with some or all of its powerslimited to making recommendations to theminister (as in Hungary). A variant is to givethe agency decisionmaking authority but haveappeals go to the minister rather than anotherindependent authority (as in Argentina). Thisapproach reinforces the separation of profes-sional and political considerations in decision-making and usually provides the agency withgreater insulation than under the second op-tion. Political considerations are not excludedfrom the regulatory process, but the agencycan build a reputation for professionalism andbalanced judgment, enhancing its authority andreducing the likelihood of being overruled.Models can also be devised in which the min-ister is permitted to depart from the agency’srecommendations or decisions only in narrowlydefined circumstances.

Even where the minister has withdrawn com-pletely from regulatory decisions, a transitionstrategy may still be appropriate. Delegatingbroad discretionary powers to an untestedagency poses risks, particularly in countrieswith limited regulatory experience and capac-ity. The broader the agency’s authority, themore enticing a target it will be for those withincentives to undermine its independence. Andlack of detailed standards—like those that havetaken more than a century to develop in theUnited States—can create uncertainty and riskfor investors. The prudent course is to take thetime to carefully define a new agency and en-sure that it has access to adequate resourcesand other support. These issues are examinedin two companion Notes.

Warrick Smith ([email protected]),Private Participation in Infrastructure Group