USM305: Export Entry Trade User Guide - gov.uk · USM305: Export Entry Trade User Guide _____ _____...

Transcript of USM305: Export Entry Trade User Guide - gov.uk · USM305: Export Entry Trade User Guide _____ _____...

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 1 of 108

Version: 4.0

USM305: Export Entry Trade User Guide

Abstract

This document provides a guide to the operation of the CHIEF Export declaration transactions available to the Trade.

Origin/Author: John Walker

Approved By: Glen Robe

Date Approved: 11/01/2016

Status: Approved

Prepared by: HMRC (CDIO (C&IT) – CHIEF) Dukes Court Duke Street Woking GU21 5XR 03000 577107

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 2 of 108

Version: 4.0

Contents

1. Introduction .............................................................................................................................................. 8

1.1 Purpose and Scope .......................................................................................................................... 8

1.2 Contents ........................................................................................................................................... 8

1.3 Scope of Exports Facilities ................................................................................................................ 8

2. Business Overview................................................................................................................................... 9

2.1 Purpose ............................................................................................................................................ 9

2.1.1 Access to Entries and Movements ............................................................................................. 9

2.2 Export Declarations ......................................................................................................................... 10

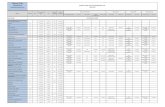

3. Data Field Details ................................................................................................................................... 11

3.1 Field Details .................................................................................................................................... 11

3.1.1 Header Data ............................................................................................................................ 11

3.1.2 Item Data ................................................................................................................................. 17

3.1.3 Tax Line Data .......................................................................................................................... 20

3.2 Cross-Field Validation Checks ........................................................................................................ 20

4. IEFD – Insert Export Full Declaration ..................................................................................................... 23

4.1 Business Description ...................................................................................................................... 23

4.2 Starting the Transaction .................................................................................................................. 23

4.3 Document Data ............................................................................................................................... 23

4.4 Document Structure ........................................................................................................................ 27

4.5 Field Completion Rules ................................................................................................................... 27

4.5.1 Header Data ............................................................................................................................ 27

4.5.2 Item Data ................................................................................................................................. 28

4.5.3 Tax Line Data (47) ................................................................................................................... 29

4.6 Field Details .................................................................................................................................... 29

4.7 Cross-Field Validation Checks ........................................................................................................ 29

5. IELP – Insert Export LCP Pre-Shipment Advice ..................................................................................... 30

5.1 Business Description ...................................................................................................................... 30

5.2 Starting the Transaction .................................................................................................................. 30

5.3 Document Data ............................................................................................................................... 30

5.4 Document Structure ........................................................................................................................ 34

5.5 Field Completion Rules ................................................................................................................... 34

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 3 of 108

Version: 4.0

5.5.1 Header Data ............................................................................................................................ 34

5.5.2 Item Data ................................................................................................................................. 35

5.6 Field Details .................................................................................................................................... 36

5.7 Cross-Field Validation Checks ........................................................................................................ 36

6. IESP – Insert Export SDP Pre-Shipment Advice .................................................................................... 37

6.1 Business Description ...................................................................................................................... 37

6.2 Starting the Transaction .................................................................................................................. 37

6.3 Document Data ............................................................................................................................... 37

6.4 Document Structure ........................................................................................................................ 41

6.5 Field Completion Rules ................................................................................................................... 41

6.5.1 Header Data ............................................................................................................................ 41

6.5.2 Item Data ................................................................................................................................. 42

6.6 Field Details .................................................................................................................................... 43

6.7 Cross-Field Validation Checks ........................................................................................................ 43

7. IECR – Insert Export Clearance Request (C21) ..................................................................................... 44

7.1 Business Description ...................................................................................................................... 44

7.2 Starting the Transaction .................................................................................................................. 44

7.3 Document Data ............................................................................................................................... 44

7.4 Document Structure ........................................................................................................................ 47

7.5 Field Completion Rules ................................................................................................................... 47

7.5.1 Header Data ............................................................................................................................ 47

7.5.2 Item Data ................................................................................................................................. 48

7.5.3 Tax Line Data (47) ................................................................................................................... 48

7.6 Field Details .................................................................................................................................... 49

7.7 Cross-Field Validation Checks ........................................................................................................ 49

8. IESD – Insert Export Supplementary Declaration ................................................................................... 50

8.1 Business Description ...................................................................................................................... 50

8.2 Starting the Transaction .................................................................................................................. 50

8.3 Document Data ............................................................................................................................... 50

8.4 Document Structure ........................................................................................................................ 53

8.5 Field Completion Rules ................................................................................................................... 53

8.5.1 Header Data ............................................................................................................................ 53

8.5.2 Item Data ................................................................................................................................. 54

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 4 of 108

Version: 4.0

8.5.3 Tax Line Data (47) ................................................................................................................... 55

8.6 Field Details .................................................................................................................................... 55

8.7 Cross-Field Validation Checks ........................................................................................................ 55

9. IEXS – Insert Exit Summary Declaration ................................................................................................ 56

9.1 Business Description ...................................................................................................................... 56

9.2 Starting the Transaction .................................................................................................................. 56

9.3 Document Data ............................................................................................................................... 56

9.4 Document Structure ........................................................................................................................ 59

9.5 Field Completion Rules ................................................................................................................... 59

9.5.1 Header Data ............................................................................................................................ 59

9.5.2 Item Data ................................................................................................................................. 60

9.6 Field Details .................................................................................................................................... 60

9.6.1 Header Data ............................................................................................................................ 60

9.6.2 Item Data ................................................................................................................................. 61

9.7 Cross-Field Validation Checks ........................................................................................................ 62

10. AEXD – Amend Export Entry .............................................................................................................. 63

10.1 Business Description ...................................................................................................................... 63

10.1.1 Detailed Considerations ........................................................................................................... 64

10.2 Starting the Transaction .................................................................................................................. 64

10.3 Document Data ............................................................................................................................... 64

10.4 Document Structure ........................................................................................................................ 65

10.5 Field Completion Rules ................................................................................................................... 65

10.6 Field Details .................................................................................................................................... 66

10.7 Cross-Field Validation Checks ........................................................................................................ 66

11. AEAL – Notify Export Arrival ............................................................................................................... 67

11.1 Business Description ...................................................................................................................... 67

11.1.1 Arrival of an Individual Declaration (Declaration UCR) ............................................................. 67

11.1.2 Arrival of a Consolidation (Master UCR) .................................................................................. 68

11.2 Starting the Transaction .................................................................................................................. 68

11.3 Document Data ............................................................................................................................... 68

11.3.1 Initial Parameter Screen ........................................................................................................... 69

11.3.2 Input and Acceptance Screens for Arrival of a Single Declaration ............................................ 69

11.3.3 Input and Acceptance Screens for Arrival of a Consolidation ................................................... 71

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 5 of 108

Version: 4.0

11.4 Document Structure ........................................................................................................................ 71

11.5 Field Completion Rules ................................................................................................................... 72

11.6 Field Details .................................................................................................................................... 72

11.7 Cross-Field Validation Checks ........................................................................................................ 74

12. ACST – Change Consolidation Status ................................................................................................ 75

12.1 Business Description ...................................................................................................................... 75

12.2 Starting the Transaction .................................................................................................................. 75

12.3 Document Data ............................................................................................................................... 75

12.4 Document Structure ........................................................................................................................ 76

12.5 Field Completion Rules ................................................................................................................... 76

12.6 Field Details .................................................................................................................................... 76

12.7 Cross-Field Validation Checks ........................................................................................................ 76

13. AEAC – Maintain Export Consolidation ............................................................................................... 77

13.1 Business Description ...................................................................................................................... 77

13.1.1 Shutting a Consolidation .......................................................................................................... 77

13.1.2 Associating Consignments with a Consolidation ...................................................................... 77

13.1.3 Disassociation of a Consignment from its Owning Consolidation ............................................. 78

13.2 Starting the Transaction .................................................................................................................. 78

13.3 Document Data ............................................................................................................................... 78

13.4 Document Structure ........................................................................................................................ 80

13.5 Field Completion Rules ................................................................................................................... 80

13.6 Field Details .................................................................................................................................... 81

13.7 Cross-Field Validation Checks ........................................................................................................ 81

14. AEDL – Notify Export Departure ......................................................................................................... 82

14.1 Business Description ...................................................................................................................... 82

14.2 Starting the Transaction .................................................................................................................. 83

14.3 Document Data ............................................................................................................................... 83

14.3.1 Initial Parameter Screen ........................................................................................................... 83

14.3.2 Input and Acceptance Screens for Departure of a Single Declaration ...................................... 84

14.3.3 Input and Acceptance Screens for Departure of a Consolidation ............................................. 85

14.4 Document Data ............................................................................................................................... 85

14.5 Field Completion Rules ................................................................................................................... 86

14.6 Field Details .................................................................................................................................... 86

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 6 of 108

Version: 4.0

14.7 Cross-Field Validation Checks ........................................................................................................ 87

15. DEVD – Display Entry Version Details ................................................................................................ 89

15.1 Business Description ...................................................................................................................... 89

15.2 Starting the Transaction .................................................................................................................. 90

15.3 Document Data ............................................................................................................................... 90

15.3.1 Initial Parameter Screen – All Entries ....................................................................................... 91

15.3.2 Summary Screens ................................................................................................................... 91

15.3.3 Generated Data Screens ......................................................................................................... 92

15.3.4 Account Details Screens – (Exporters/Submitting Traders only) .............................................. 93

15.3.5 Data As Input Screens ............................................................................................................. 94

15.3.6 Reason for Action Screens – (Exporters/Submitting Traders only) ........................................... 95

15.4 Document Structure ........................................................................................................................ 95

15.5 Field Completion Rules ................................................................................................................... 95

15.6 Field Details .................................................................................................................................... 95

15.6.1 Parameter Fields...................................................................................................................... 96

15.6.2 Displayed Data Fields .............................................................................................................. 97

15.7 Cross-Field Validation Checks ........................................................................................................ 98

16. RACD – Request Accompanying Document ....................................................................................... 99

16.1 Business Description ...................................................................................................................... 99

16.2 Starting the Transaction .................................................................................................................. 99

16.3 Document Data ............................................................................................................................... 99

16.4 Document Structure ...................................................................................................................... 100

16.5 Field Completion Rules ................................................................................................................. 100

16.6 Field Details .................................................................................................................................. 101

16.7 Cross-Field Validation Checks ...................................................................................................... 101

17. RCP3 – Request SAD COPY 3 ........................................................................................................ 102

17.1 Business Description .................................................................................................................... 102

17.2 Starting the Transaction ................................................................................................................ 102

17.3 Document Data ............................................................................................................................. 102

17.4 Document Structure ...................................................................................................................... 103

17.5 Field Completion Rules ................................................................................................................. 104

17.6 Field Details .................................................................................................................................. 104

17.7 Cross-Field Validation Checks ...................................................................................................... 104

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 7 of 108

Version: 4.0

18. Glossary and References ................................................................................................................. 105

18.1 Glossary ....................................................................................................................................... 105

18.2 References ................................................................................................................................... 105

Document Control ....................................................................................................................................... 107

Statement of Confidentiality ........................................................................................................................ 108

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 8 of 108

Version: 4.0

1. Introduction

1.1 Purpose and Scope

This document is one of the Trade Entry User Guides. It provides a guide to the operation of the Export Entry declaration transactions – insert, amend and display. These transactions establish or maintain a DTI Export Entry or provide facilities for the notification of movements (e.g., arrivals, departures). The entry handling transactions that are common with Imports are described in the Common Entry Trade User Guide, Reference [4]. The Common User Facilities User Guide, Reference [5] provides a description of the common transactions (e.g. retrieval from store) supporting these transactions. Reference [4] defines the reports that are triggered by these transactions.

This and other guides should be read in conjunction with References [1], [2] and [3] that together give a general explanation of CHIEF terms and concepts. Together, the guides form a source of reference for the CHIEF system.

This guide describes the data validation which takes place on the input you provide but you will also need to refer to the Tariff (see Reference [9]) published by HM Customs and Excise for the correct codes to be used for the completion of declaration documents.

Other tasks that you may also need to perform, such as the retrieval of Reference Data, are covered in other User Guides. You can find an index to these in Reference [1]. You should note that this Guide covers only the transactions that are available via the CHIEF HCI. Where a transaction is available in EDI, this fact will be indicated in its Business Description., with full details being found in Reference [6].

1.2 Contents

Two main subject areas are described in this user guide. The first gives a brief business overview of Customs Export Entry requirements and the various methods of declaration. This is followed by a detailed description of each Export Entry declaration transaction (Section 4 onwards), explaining its function, how it should be used, and the information that you will need to provide to the system. The declared data is detailed in Section 3 rather than being replicated for each input transaction.

N.B. Screen layouts shown in this document (in common with screen layouts shown in other User Guides) are indicative only as page breaks may vary to accommodate display content.

1.3 Scope of Exports Facilities

The Entry User Guides describe a number of standard CHIEF features or facilities that are not currently fully supported by Exports. For example, it is not anticipated that a levy on Exports will be imposed in the near future but the declarations include all Methods of Payment and a Deferment Approval Number (DAN) for deferred payment. There is also an Entry Accounting Advice (X9) for Exports (see Reference [4]). The tax line is used for CAP refund claims but the other features are included to provide a degree of future proofing and to align with Imports.

END OF SECTION 1

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 9 of 108

Version: 4.0

2. Business Overview

2.1 Purpose

The Export Entry transactions of CHIEF support the declaration of Export entries under a number of schemes, for example, Full SAD, Simplified Local Clearance Procedure (LCP). All declarations are based upon the Single Administrative Document (SAD) supplemented if required by data from the C88 (CAP) for CAP goods. The transactions described here also support the progress of an Export entry from declaration through to departure from the UK.

With the introduction of the ECS Release, the current (‘fiscal’) export declarations become ‘Combined Declarations’, because they include both the existing fiscal data and new Safety and Security data. Exit Summary Declarations are introduced which contain only Safety and Security data. There is no requirement to support ‘fiscal only’ declarations.

Entries can also be listed and cancelled, though accepted Entries for goods which are on hand may only be cancelled by Customs. (The term ‘accepted’ covers an Entry which has been input to the system without errors either as a Pre-lodged Entry if the goods are not on hand, or as a Legally Accepted Entry if the goods are on hand.) The Export Entry transactions incorporate:

validation with the option to ‘store’ invalid data for later correction and submission;

interrogation of Entries and their movements;

advice of goods arrival. This is either an arrival when a declaration was previously recorded on CHIEF as provisionally accepted (pre-lodged) thereby establishing a legally accepted entry or an arrival at a subsequent location (an interim location or the Office from which the goods depart from the UK). CHIEF distinguishes between the initial arrival which establishes the Office of Export, further arrivals at the Office of Export (Related or Additional arrivals) and arrivals elsewhere at the Office of Exit (see Reference [4] Section 3.4);

advice of goods departure;

for Customs only, the opportunity to release the goods for Export by granting permission to progress or to set query or detention status etc., to amend the route and to simulate the interaction with another system when that system is not available.

This user guide specifically addresses the transactions that the Trade may use in order to create, amend or cancel Entries (or request to cancel if the entry is legally accepted and the goods are on-hand). There are some further transactions which can affect the status of an Entry which are not triggered directly by a user (e.g. processes which run in the background and perhaps overnight). These transactions are not described here.

All Export Entry data collected is transferred daily to related systems from which, for example, the monthly UK Trade Statistics are derived.

2.1.1 Access to Entries and Movements

Submitting Traders may only amend Entries that are ‘owned’ by them, in accordance with the access security data privacy features of the system, and may only view the declaration details of their own DTI Entries. Handling Agents, normally via a CSP, may notify anticipated or actual arrival or departure and perform consolidations on Export declarations but may not make changes to declaration details. Such actions result in the creation of movements reflecting the anticipated or actual existence of goods at the nominated location.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 10 of 108

Version: 4.0

2.2 Export Declarations

Exports supports two main procedures - Full and Simplified.

The Full procedures are single declarations based upon either the Single Administrative Document (SAD) or Customs Clearance Request (CCR or C21). The procedures supported include:

Full pre-entry of standard consignments (i.e. neither Low Value (LV) nor non-Statistical (NS));

Full pre-entry of LV consignments;

Full pre-entry of NS consignments;

Customs Clearance Request (C21).

The Simplified procedures are two part declarations comprising a Pre-shipment advice (PSA) followed at a later stage by a Supplementary Declaration (SD) containing full details of the declaration with accompanying tax details where applicable. Such declarations are available to the Submitting Trader via electronic means only. Customs do not accept Simplified procedure declarations on paper for Customs keying.

The SD discharges the financial liabilities of all PSAs which it addresses. The Simplified Procedures supported by New Exports are:

Simplified Declaration Procedure (SDP) of standard consignments;

Simplified Local Clearance Procedure (LCP) of standard consignments.

SDP operates at the UK frontier, Inland Clearance Depots (ICD) and Designated Export Places (DEP), whilst LCP operates inland at the trader’s premises and Customs approved warehouses. A Trader must be authorised to operate the SDP or LCP simplified procedures. A Trader may also use normal procedures either at the UK frontier or inland (e.g. at the Trader’s premises).

There is also a special use of the Supplementary Declaration to declare CAP Export Simplified Victualling and which is not associated with Simplified Procedures. In this case, a single Supplementary Declaration is declared containing all goods exported in a calendar month. The tax point on such declarations carries the date of the last day in the month.

For shipments that have no fiscal aspect, the Exit Summary declaration can be used to lodge safety and security related information.

Declaration transactions are available to both Customs and the Trade. Traders are provided with facilities to input declarations:

via a Customs and/or Government gateway (using EDI via e-mail, Web Forms etc.);

via a CSP at the HCI;

via a CSP by EDI.

END OF SECTION 2

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 11 of 108

Version: 4.0

3. Data Field Details

CHIEF supports five export related Entry types based on the SAD with corresponding insert transactions (IEFD, IELP, IESP, IESD, IEXS). Since they are all based on the SAD they share common field definitions and cross-field validation rules. To avoid replication within this guide and to highlight the differences, the definitions are given in this section rather than being repeated in the sections for the respective transactions.

The C21 also uses the same data and box numbers as the SAD so the field definitions and cross-field validation rules also apply to the C21 insert transaction (IECR).

3.1 Field Details

The following sub-sections give details of the data content and business use for the input fields used by IEFD, IELP, IESP, IESD, IECR and IEXS. Note that not all fields described below apply to all of these transactions. In the case of Exit Summary Declarations the validation applying to Consignee and Consignor differ from that defined for other Export declarations and the description for these fields are described in Section 9 (9.7.1 and 9.7.2).

3.1.1 Header Data

Decln(1) The first 2 characters must be completed with:

‘CO’ – for the export of goods in free circulation to a special territory of the Community; ‘EU’ – for the export of goods to an EFTA or Common Transit country; ‘EX’ – for the export of goods not in free circulation to another EC member state and all

goods to non-EC and non-EFTA / Common Transit countries.

The third character identifies the entry type (Full Dec, SFD, Supp Dec) and whether the declaration is being pre-lodged or is for an arrived consignment, as follows:

“A” – full declaration (IFD), arrived; “C” – non-transit simplified declaration (PSA), arrived; “D” – full declaration (IFD), pre-lodged; “F” – non-transit simplified declaration (PSA), pre-lodged; “J” – C21, arrived; “K” – C21, pre-lodged; “Y” – SDP supplementary declaration; “Z” – LCP supplementary declaration.

An arrived value may only be declared if the goods are on hand and the CPC of the first non-deleted Item so allows; otherwise a pre-lodged value must be declared. When the entry’s goods have already been notified as arrived by an Inventory system or a Movement Agent, CHIEF ignores the value entered into this field. The field cannot be changed on amendment (AEXD).

Items(5) The number of Items that are included on the declaration. This is compared with the number input as a form of batch control.

Pkgs(6) The number of packages that comprise the consignment.

D/Ref(7) The Declarant’s Reference is a commercial reference supplied by the declarant (or consignor) for his own purposes. CHIEF does not support this field as a key to the Entry.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 12 of 108

Version: 4.0

Cnsgnor(2) The following fields are used to identify the consignor. If there is more than one consignor, the consignor is declared for each item except for some circumstances when details of the individual consignors do not have to be supplied. In this case “GB888888811005” is declared as the Consignor’s Id.

Id The Consignor’s TID. When “GBPR”, “GBUNREG” or not a GB trader id, name and address must be supplied. “GB888888811005” is declared for bulk consignors when details do not have to be supplied. Note that if the country code of the TID indicates an EU Member State, then the Trader must be known to CHIEF (see Reference [4], section 5.4.1.).

Name Consignor’s name.

Language The code for the language in which the Consignor’s name and address is written.

Street Consignor’s address – street.

City Consignor’s address – city.

Pstcde Consignor’s address – postcode.

Ctry Consignor’s address – country.

Cnsgnee(8) The following fields are used to identify the consignee. If there is more than one consignee, the consignee is declared for each item. Name and address details must be supplied because the foreign trader will not have a GB TURN, and unlike GB Traders, no name and address details are available on CHIEF.

Id The Consignee’s TID. This is optional. Note that if specified, and the country code of the TID indicates an EU Member State, then the Trader must be known to CHIEF (see Reference [4], section 5.4.1.).

Name Consignee’s name.

Language The code for the language in which the Consignee’s name and address is written.

Street Consignee’s address – street.

City Consignee’s address – city.

Pstcde Consignee’s address – postcode.

Ctry Consignee’s address – country.

Declrnt(14) The following fields are used to identify the declarant. If the Trader Identifier (TID) of the declarant is not supplied then the declarant defaults to the Consignor in which case only the ‘Rep’ field is supplied.

Id Except for representation “1” (see ‘Rep’ field), the Trader Identifier (TID) of the declarant must be supplied. TIDs start with a country code. GB identifiers are the current TURN including PR and UNREG. When “GBPR”, “GBUNREG” or not a GB trader id, name and address must be supplied. Note that if the country code of the TID indicates an EU Member State, then the Trader must be known to CHIEF (see Reference [4], section 5.4.1.).

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 13 of 108

Version: 4.0

Rep Declares the way in which the declarant is representing the Consignor:

“1” – Declarant;

“2” – Direct representative;

“3” – Indirect representative.

If there is only one consignor and the consignor is the declarant the value is “1”. “Consignor” should be written in Box 14 and Box 44 on any paper SAD.

Otherwise a declarant is declared with a value dependent on the type of representation authority given by the consignor or all the consignors for bulk.

Name Declarant’s name.

Language The code for the language in which the Declarant’s name and address is written.

Street Declarant’s address – street.

City Declarant’s address – city.

Pstcde Declarant’s address – postcode.

Ctry Declarant’s address – country

Disp ctry(15a) The country code of the country (or pseudo country) from which the consignment was dispatched. The country of dispatch must either be declared at the header or item level but not both.

Goods avail For goods declared inland (i.e. at an approved warehouse or trader’s premises), these fields identify when the goods will be available for examination. The fields are only used by LCP authorised traders. Both dates must lie in the future with the ‘to’ date set ahead of the ‘from’ date.

from Date and time at which the goods are intended to be available for examination at the approved inland premises (also known as the intended date into control). The Entry is automatically arrived at this date-time.

to Date and time at which the goods are expected to be removed from the approved inland premises. If the Entry is on Route 3 or 6, Permission to progress will be automatically granted at this date-time.

Dest ctry(17a) The code for the country of ultimate destination. The country of destination must either be declared at the header or item level but not both.

Inlnd Trpt Id(18)

The inland transport identity.

Trpt (21) Id The intended Identity of Transport if known when the declaration is prepared.

Nat The intended Nationality of active means of Transport if known when the declaration is prepared.

Inv Curr(22) The currency that will be used for invoicing the consignee for the goods covered by the Entry.

This is collected for statistical purposes and is not necessarily the same as the Declaration Currency, in which monetary values on the Entry are input.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 14 of 108

Version: 4.0

Trpt Mode(25) The Mode of Transport for the active means of Transport by which the goods will be exported if known when the declaration is prepared.

Inlnd Trpt Mode(26)

The Mode of Transport for the Inland means of Transport when export formalities are carried out away from the point of exit of the goods from the UK.

Goods Dep Date

Date the goods departed from the place of loading (“Pl loading”) or the last day of the period for an aggregated declaration (e.g. a victuallers CAP refund claim).

Exit Offce(29) The intended Office of Exit from the EU.

Locn goods(30)

The location where the goods first come under Customs control. For supplementary declarations it is the ‘place of loading’. Except for a SASP supplementary declaration for goods exported from another Member State, the field identifies a UK Freight Location and optionally the Shed Operator. UK locations are formatted:

“GB”<freight location><shed operator>.

A Shed Operator (characters 6-8) is supplied when the Location of Goods needs to be more fully specified (e.g. by a Transit Shed code).

Where the goods are situated at the authorised Trader premises or within a warehouse, a numeric code can be given to identify the precise location. Such codes are agreed with the local Customs office and are not known to CHIEF. Otherwise the code must be valid for the specified Freight Location (characters 3-5).

ADDITIONAL INFORMATION(44)

Declaration Currency

Identifies the currency in which the declaration is made. In particular it is the currency in which Item Statistical Value (46), Base Amount (47b) and Declared Tax Amount (47d) are declared. Other declared amounts have an associated currency code.

Only the currencies as defined in Tariff Volume 3 can be specified. The declaration currency defaults to GBP.

Regd Consignor

The TURN of the Registered Consignor responsible for the VAT where this differs from the Consignor as declared in box 2.

Premise The name and address of the premises. When premises have to be declared all fields must be supplied. The following fields are used to identify the premises:

Name Name of the approved premises.

Street Approved premises address – street.

City Approved premises address – city.

Pstcde Approved premises address – postcode.

Ctry Approved premises address – country.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 15 of 108

Version: 4.0

Sup Off The following fields are used to identify the Supervising Office for the premises:

Name Supervising Office name.

Street Supervising Office address – street.

City Supervising Office address – city.

Pstcde Supervising Office address – postcode.

Ctry Supervising Office address – country.

AI Statement Text as required for the AI Statement code.

Code The code identifying the type of AI Statement.

Language The code for the language in which the text is written.

Decln The Unique Consignment Reference (UCR) and part number allocated to the goods by the Trader. The Decln UCR/Part must uniquely identify the Export (pre-shipment) Entry on CHIEF. Note, that a PSA and a related Supplementary Declaration may be given the same UCR/ Part. If not supplied, CHIEF generates a Declaration UCR based upon the CHIEF Entry reference (see Reference [4]).

UCR 9DCR-

The UCR (see Reference [4]).

Part A part number of up to three digits is required when more than one declaration is made to cover the goods identified by the same UCR. The field may also contain a one-character alphabetic check character following the Part number (if supplied). The check character covers the UCR and any Part number.

Mastr UCR 9MCR-

If the goods are known to be in a consolidation with the goods covered by other declarations, the Master UCR for the consolidation can be declared. On amendment no change is allowed and any value submitted in this field will be ignored. After initial declaration the associate facility must be used to modify the consolidation in which the consignment resides.

Doc Details of a document that applies to the whole entry.

Code The code identifying the type of document.

St The status of the document which must be specified when required for the type of document. See Reference [4] for details of the values entered into this field.

Document Reference

The reference identifying the document.

Part This is optionally specified to identify a part of the document, for example, the line of a multi-line Licence (defaulting to 1).

Quantity This is optionally specified for a document to identify a quantity, for example, the quantity to be attributed to the licence. The units in which the quantity is given is defined for the document.

Lang The code for the language in which the document reference is written.

Reason For some status values a reason must be given.

DAN(48) (2 fields)

The Deferment Approval Number (DAN) and associated prefix (A, B, C or D) identifying the deferment account from which revenue is to be debited. The validation that applies to DANs is more fully described in Reference [4].

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 16 of 108

Version: 4.0

Premise Id(49) The identity of the warehouse which is required for Items for which the associated Customs Procedure Code relates to warehousing.

Repr The trader’s representative. On CHIEF only the Submitting trader can amend the declaration. The details are optional for a possible future enhancement when EXSs might be lodged for other MS and then this could indicate a trader who acts as an agent at the Office of Exit

Id Trader identifier for the representative. Note that if the country code of the TID indicates an EU Member State, then the Trader must be known to CHIEF (see Reference [4], section 5.4.1.).

Name Name of the representative.

Language The code for the language in which the Representative’s name and address is written.

Street Address of the representative – street.

City Address of the representative – city.

PstCde Address of the representative – postcode.

Ctry Address of the representative – country.

Seal Details of a seal.

Id The seal identifier.

Lang The code for the language in which the seal identifier is written.

Trpt Chrge MOP

The Method of Payment for transport charges.

Ctry on route A country through which the goods have moved or are intended to move between the country of dispatch and the country of destination.

Pl loading The code for the intended Place of Loading (i.e. place of departure of the vessel or flight or other transport).

Notify Prty Details of the party to be notified on Export. Note that notification on Export is not supported by CHIEF.

Id Trader identifier for party to be notified. Note that if the country code of the TID indicates an EU Member State, then the Trader must be known to CHIEF (see Reference [4], section 5.4.1.).

Name Name of the party to be notified.

Street Address of party to be notified – street.

City Address of party to be notified – city.

Pstcde Address of party to be notified – postcode.

Ctry Address of party to be notified – country.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 17 of 108

Version: 4.0

3.1.2 Item Data

Cnsgnor(2) The following fields are used to identify the consignor for the item. When consignors are declared for each item the consignor is not declared at the header level. The same consignor must not be supplied at the item level for every item.

Id The Consignor’s TID. When “GBPR”, “GBUNREG” or not a GB trader id, name and address must be supplied. Note that if the country code of the TID indicates an EU Member State, then the Trader must be known to CHIEF (see Reference [4], section 5.4.1.).

Name Consignor’s name.

Language The code for the language in which the Consignor’s name and address is written.

Street Consignor’s address – street.

City Consignor’s address – city.

Pstcde Consignor’s address – postcode.

Ctry Consignor’s address – country.

Cnsgnee(8) The following fields are used to identify the consignee for the item. When consignees are declared for each item the consignee is not declared at the header level. Name and address details must be supplied because the foreign trader will not have a GB TURN, and unlike GB Traders, no name and address details are available on CHIEF. The same consignee must not be supplied at the item level for every item.

Id The Consignee’s TID. This is optional. Note that if specified, and the country code of the TID indicates an EU Member State, then the Trader must be known to CHIEF (see Reference [4], section 5.4.1.).

Name Consignee’s name.

Language The code for the language in which the Consignee’s name and address is written.

Street Consignee’s address – street.

City Consignee’s address – city.

Pstcde Consignee’s address – postcode.

Ctry Consignee’s address – country.

Disp ctry(15a) The country code of the country (or pseudo country) from which the consignment was dispatched. The country of dispatch must either be declared at the header or item level but not both. The same country of dispatch must not be supplied at the item level for every item.

Dest ctry(17a) The code for the country of ultimate destination. The country of destination must either be declared at the header or item level but not both. The same country of destination must not be supplied at the item level for every item.

Goods Description(31)

Description of the goods.

Language The code for the language in which the goods description is written.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 18 of 108

Version: 4.0

Package(31) Details of the packages containing the goods. The same packages may be declared for more than one item so the Total Packages for the declaration is not expected to be the total of the packages declared for the items.

Marks Marks to enable the packages of the given kind to be identified.

Number The number of packages or pieces of the kind identified in the next field. The number must not be supplied for bulk goods.

Kind The code identifying the kind of package.

Lang The code for the language in which the package marks are written.

Contnr Id(31) The container number.

Comm code (33)

The Commodity Code for the goods being declared as an Item and any associated EC Supplementary Measure codes.

(field 1) the Base (8 digit) Commodity Code. On amendment, an Item is deleted by replacing the commodity code with ‘DEL’ (other fields of the Item should be left unchanged).

(field 2) the first EC Supplementary Measure code. For a CAP refund claim it contains the ERN prefixed with “9”.

(field 3) the second EC Supplementary Measure code. This field may only be completed if first EC Supplementary Measure code is provided and must be a different code to the first one.

Orig ctry(34a) The code of the Country of Origin identifying the country from which the commodity originates.

Gross mass (35)

The gross mass in kilograms (to 3 decimal places) of the commodity or goods being declared. The field must be completed on ex-warehouse declarations. The Item net mass must not exceed Item gross mass.

UNDG code UN Dangerous Goods code.

CPC(37) The Customs Procedure Code (CPC) which applies to the goods being declared as an Item. The value of the CPC determines the requirement for other Item data. The CPCs quoted on all Items must be in the same CPC series.

Net mass(38) The net mass in kilograms of the associated goods. The quantity can be expressed up to three decimal places. When supplied it must be greater than zero. This information may be used for revenue calculation.

Prev Doc/ Decln (40)

Identifies the previous document relating to the declaration.

(field 1) This field identifies the class or kind of previous document being declared.

(field 2) The previous document type. Both class and type must be recognised as a valid combination (table PRDD).

(field 3) The reference to identify the previous document.

Lang The code for the language in which the reference is written (optional).

Supp units(41) The quantity of the associated goods in terms of the second unit identified in the Tariff. The quantity can be expressed up to three decimal places. When supplied it must be greater than zero. This information may be used for revenue calculation.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 19 of 108

Version: 4.0

ADDITIONAL INFORMATION (44)

Third Quantity Third Quantity is a quantity whose units are related to the commodity where this information is required for revenue calculation. The quantity can be expressed up to three decimal places. When supplied it must be greater than zero.

The third quantity is optional on a Non-Stat declaration. Otherwise it is required when specified in the Tariff for the Commodity.

AI Statement Text as required for the AI Statement code.

Code The code identifying the type of AI Statement.

Language The code for the language in which the text is written.

Sup Off The following fields are used to identify the Supervising Office.

Name Supervising Office name.

Street Supervising Office address – street.

City Supervising Office address – city.

Pstcde Supervising Office address – postcode.

Ctry Supervising Office address – country.

(Document) Details of a document. Code The code identifying the type of document.

St The status of the document which must be specified when required for the type of document. See Reference [4] for details of the values entered into this field.

Document Reference

The reference identifying the document.

Part This is optionally specified to identify a part of the document, for example, the line of a multi-line Licence (defaulting to 1).

Quantity This is optionally specified for a document to identify a quantity, for example, the quantity to be attributed to the licence. The units in which the quantity is given is defined for the document.

Lang The code for the language in which the document reference is written.

Reason For some status values a reason must be given.

Stat value(46) The Statistical Value of the Commodity in the declaration currency.

Trpt Chrge MOP

The Method of Payment for transport charges.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 20 of 108

Version: 4.0

3.1.3 Tax Line Data

CALCULATION OF TAXES(47)

Type(a) The Tax Type identifying the category of revenue being declared.

Base Amount(b)

The Tax Base amount that may be used for revenue calculation. An amount cannot be declared as well as a Tax Base quantity.

Base Quantity The Tax Base amount that may be used for revenue calculation. A quantity cannot be declared as well as a Tax Base amount. A Composite Quantity may only be declared for a tax Rate (47c) of ‘C’.

Rate(c) The Tax Rate identifying the rate at which the revenue has been calculated.

Ovr The Tax Override code identifying an exception to the normal calculation of the associated revenue.

Amount(d) The amount of revenue declared for the tax line.

MOP(e) The Method of Payment by which the revenue is to be paid or refunded. Valid MOP codes are listed in Reference [4].

3.2 Cross-Field Validation Checks

Where fields are defined as a group in Section 3.1 the checks between the fields in the group are included in the field descriptions.

1. Decln(1), Cnsgnor(2) Id, Declrnt(14) Id, Goods avail from/to, Locn goods(30)

When the Location of Goods indicates an inland location (i.e. an approved ‘warehouse’ or ‘Trader’s premises’), the Consignor or Declarant must be authorised for Simplified procedures (SDP or LCP) and the Goods availability dates must be supplied. In addition, the entry must be declared pre-lodged. The Goods availability dates must not be supplied on a Full declaration entered at the frontier.

2. Cnsgnor(2)

A Consignor must be declared for each item unless a Consignor is declared at the header level in which case a Consignee must not be declared for an item. The same consignor must not be specified at the item level for every item

3. Cnsgnee(8)

A Consignee can be declared for each item as required unless a Consignee is declared at the header level. The same consignee must not be specified at the item level for every item

4. Disp ctry(15a)

A Dispatch country must be declared for each item unless a Dispatch country is declared at the header level in which case a Dispatch country must not be declared for an item. The same country must not be specified at the item level for every item.

5. Dest ctry(17a)

A Destination country must be declared for each item unless a Destination country is declared at the header level in which case a Destination country must not be declared for an item. The same country must not be specified at the item level for every item.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 21 of 108

Version: 4.0

6. Trpt nat(21), TrptMode(25)

Nationality of Transport is not supplied for Modes of Transport 2, 5 and 7.

7. Regd Consignor(44 RCONR), Cnsgnor(2)

If a Registered Consignor is declared then Consignor must be declared at header level (i.e. not for each item).

8. DAN(48), MOP(e)

If a method of payment representing deferment is specified on any of the tax lines then the Deferment Account Number and prefix must be specified, and vice versa.

9. CPC(37), Stat value(46)

The Statistical value is optional or mandatory depending on the CPC.

10. Item Document Code, St and Licence Type(44)

For a Licence document the combination of Code, Status and the Licence type declared must be valid on CHIEF. For other categories of document the combination of Code and Status must be valid.

11. Trpt Chrge MOP

When required by Tariff (e.g. Customs Procedure, Commodity), or elsewhere, details must be declared either at the header or item level (not both). When declared at the item level the same details must not be declared for all items.

12. Package(31), Header AI statement(44)

For Exit Summary Declarations (EXS), except for Specific Circumstance “A” (header AI code “SPCIA”), package details are required.

13. Package Marks(31), Package Kind(31)

Package Marks must be supplied when the Package Kind identifies that the goods are in packages, otherwise marks are optional.

14. Package Number(31), Package Kind(31)

Package Number must not be supplied when the Package Kind identifies that the goods are bulk, otherwise Package Number must be supplied.

15. Declrnt(14)

Must be declared if a Consignor is not declared at the header level.

16. Ctry on route, Disp ctry(15a), Dest ctry(17a)

Country on route will be rejected if it contains either the country of dispatch of the country of destination. The country of dispatch and the country of destination can be defined at either the header or item level.

17. Disp ctry(15a), Header AI statement(44)

For Exit Summary Declaration entries, the dispatch country is required except for Specific Circumstance “A” (header AI code “SPCIA”). Note, the dispatch country cannot be declared at the item level on an EXS entry.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 22 of 108

Version: 4.0

18. Goods Description(31), Comm code(33)

For Exit Summary Declarations (EXS) either “Goods Description” or “Comm code” must be declared. Both may be declared. Only the first 4 digits of the commodity code need to be declared in the “Comm code”.

19. CPC(37), Inld Trpt Id(18)

Inland transport identity is optional unless:

prohibited by the CPC or CAP refund is claimed, when it is mandatory regardless of any CPC prohibition.

20. CPC(37), Gross Mass(35) , Header AI statement(44)

Gross Mass is mandatory except for Specific Circumstances “E” (header AI code “SPCIE”). For Specific Circumstance “E”, Gross Mass is optional or mandatory depending on the CPC.

21. Decln UCR(44), Header AI Statement (44), Item Document Code(44)

Except for Specific Circumstance “A” (header AI code “SPCIA”), a transport document must be declared for an item unless a DECLN-UCR is declared at the header level.

22. Inv Curr(22), Stat value(46)

Invoice Currency must be declared when the Entry’s items have a Statistical Value at or above a configurable threshold.

This rule does not apply to low value Bulk Entries (as indicated by the CPC on the Entry’s first item).

23. Cnsgnee (8)

Either Consignee Name and Address details or the Consignee Trader id is required for a particular Consignee declared at the header or item level.

24. Cnsgnor(2)

For EXS Declarations, either Consignor Name and Address details or the Consignor Trader id is required for a particular Consignor declared at the header or item level.

25. Cnsgnee(8), Header AI statement(44)

For EXS Declarations, where the Consignee Details (at Entry Header or on any Item) are not supplied, CHIEF requires an AI statement 30600 to be declared. Conversely, CHIEF rejects an Exit Summary declaration where AI Statement 30600 is declared but no Consignee details are omitted (i.e. the AI Statement is superfluous).

END OF SECTION 3

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 23 of 108

Version: 4.0

4. IEFD – Insert Export Full Declaration

4.1 Business Description

This transaction supports the creation of a declaration on CHIEF representing a SAD Export declaration input under the Normal Procedure (also known as Full Pre-entry). The transaction allows for the initial creation of an entry on CHIEF or to allow the user to continue inserting data for such an Entry which was previously stored from within IEFD and which has now been retrieved from store via LSTR for this purpose.

The transaction is available to the Trade and to Customs and can be used via EDI (Trade only) or HCI interfaces. The facility to store is available only in the HCI context.

The CHIEF transaction provides a facility for the supply of a Declaration UCR and optional Part by which the entry may be referenced in later transactions. It is recommended that a Declaration UCR and optional Part is supplied (see Reference [4]). For locations which are inventory controlled, the UCR provides the means by which those systems may notify advice of a consignment arrival at the location, consignment amendment or shipment from the frontier.

The Full Export declaration can operate either at the UK frontier or inland (e.g. at the Trader’s premises). When used in an inland context by a Trader authorised under simplified procedures, this transaction allows the Trader to supply dates defining when the goods will be available to Customs for examination at the inland premises.

Front End Credibility (FEC) checks are applied to the data at this point (see Reference [4]). If a FEC failure is detected, CHIEF automatically offers you the opportunity to address these by amending the data upon which the FEC challenge is based or by confirming the data is correct as input.

Depending on the circumstances, various reports are generated as a result of this transaction (see Reference [4]).

4.2 Starting the Transaction

You may enter this transaction by typing the command code “IEFD” on the command line. There are no parameters for this transaction.

You may also enter this transaction as a downward selection from the LSTR transaction (see Reference [5]) of an Entry that was previously stored by IEFD.

4.3 Document Data

This section shows how the data for this transaction appears as a Document on your screen.

After you have input all the data from the SAD declaration and completed a visual check for accuracy you should validate or commit the data. It first undergoes validation and any errors found will be identified for correction. If errors are found you may store the Entry for subsequent retrieval and correction, or you may correct the errors and validate or attempt to commit the data again.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 24 of 108

Version: 4.0

a. IEFD – Header Part 1 Data Input screen ]TRADER-ROLE O INSERT EXPORT FULL DECLARATION CHIEF/CIES 01/10/09 12:15

SADKEY:1P

EPU []*** EPS *

Decln(1) [ ] Items(5) [ ] Pkgs(6) [ ] D/Ref(7) [ ]

Cnsgnor(2) Id [ ]

Name [ ] Language [ ]

Street [ ]

City [ ] PstCde [ ]Ctry [ ]

Cnsgnee(8) Id [ ]

Name [ ] Language [ ]

Street [ ]

City [ ] PstCde [ ]Ctry [ ]

Declrnt(14) Id [ ] Rep [ ]

Name [ ] Language [ ]

Street [ ]

City [ ] PstCde [ ]Ctry [ ]

Disp ctry(15a) [ ] Goods avail from [ / / ][ : ] to [ / / ][ : ]

Dest ctry(17a) [ ] Inlnd Trpt Id(18) [ ] Lang [ ]

Trpt (21): Id [ ] Nat [ ] Inv Curr(22) [ ]

Trpt Mode(25) [ ] Inlnd Trpt Mode(26) [ ]

Exit Offce(29) [ ] Locn goods(30) [ ]

C10058 Beginning of Document

VALIDATE,COMMIT,STORE,RETURN [ ]

b. IEFD – Header Part 2 Data Input screen ]TRADER-ROLE O INSERT EXPORT FULL DECLARATION CHIEF/CIES 01/10/09 12:15

SADHDR4:1H

EPU []*** EPS *

ADDITIONAL INFORMATION(44) Declaration Currency [ ]-DCURR

Regd Consignor [ ]-RCONR

Premise Name [ ]-PREMS

Street [ ]

City [ ] PstCde [ ]Ctry [ ]

Sup Off Name [ ]-SPOFF

Street [ ]

City [ ] PstCde [ ]Ctry [ ]

AI Statement Code

[a ]–[a ]

Language [a ]

Decln UCR 9DCR-[ ] Part [ ]

Mastr UCR 9MCR-[ ]

Code St Document Reference Part Quantity Lang

[b ]-[b ] [b ] [b ] [b ] [b ]

Reason [b ]

DAN(48) [ ] [ ] Premise Id(49) [ ]

VALIDATE,COMMIT,STORE,RETURN [ ]

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 25 of 108

Version: 4.0

c. IEFD – Header Part 3 Data Input screen ]TRADER-ROLE O INSERT EXPORT FULL DECLARATION CHIEF/CIES 01/10/09 12:15

SADHDR4:1H

EPU []*** EPS *

Repr(50) Id [ ]

Name [ ] Language [e ]

Street [ ]

City [ ] PstCde [ ] Ctry [ ]

Seal Id/Lang [c ] / [ ] [ ] / [ ]

Trpt Chrge MOP [ ]

Ctry on route [d ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ]

Pl loading [ ]

Notify Prty Id [ ]

Name [ ]

Street [ ]

City [ ] PstCde [ ]Ctry [ ]

VALIDATE,COMMIT,STORE,RETURN [ ]

d. IEFD – Item Data Part 1 Input screen ]TRADER-ROLE O INSERT EXPORT FULL DECLARATION CHIEF/CIES 01/10/09 12:15

SADITKEY:1P

EPU []*** EPS *

ITEM No(32) ***

Cnsgnor(2) Id [e ]

Name [e ] Language [e ]

Street [e ]

City [e ] PstCde [e ]Ctry [e ]

Cnsgnee(8) Id [e ]

Name [e ] Language [e ]

Street [e ]

City [e ] PstCde [e ]Ctry [e ]

Disp ctry(15a) [e ] Dest ctry(17a) [e ]

Goods Description(31) Language [e ]

[e ]

Package(31) Marks Number Kind Lang

[f ] [f ] [f ] [c ]

Contnr Id(31) [g ] [ ] [ ]

Comm code(33) [e ] [e ] [e ]

Orig ctry(34a) [e ] Gross mass(35) [e ] UNDG code [ ]

CPC(37) [e ] Net mass(38) [e ]

Prev Doc/Decln(40) [i]-[i ]-[i ] Lang [i ]

VALIDATE,COMMIT,STORE,RETURN [ ]

Should you wish to insert a new Item or Delete/Remove an Item already keyed then your cursor should be placed on one of the Comm Code (box 33) fields or the CPC (box 37) field. Note that Items can only be inserted or deleted during an insert transaction. On amend (AEXD) Items can be appended and deletion is by replacing the Commodity Code with ‘DEL’.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 26 of 108

Version: 4.0

e. IEFD – Item Part 2 Data Input screen ]TRADER-ROLE O INSERT EXPORT FULL DECLARATION CHIEF/CIES 01/10/09 12:15

SADITKEY:1P

EPU []*** EPS *

ITEM No(32) ***

Supp units(41) [e ]

ADDITIONAL INFORMATION (44) Third Quantity [ ]-THRDQ

AI Statement Code

[j ]-[j ]

Language [j ]

Sup Off Name [e ]-SPOFF

Street [e ]

City [e ] PstCde [e ]Ctry [e ]

Code St Document Reference Part Quantity Lang

[k ]-[k ] [k ] [k ] [k ] [k ]

Reason [k ]

Stat value(46) [e ] Trpt Chrge MOP [ ]

CALCULATION OF TAXES(47)

Type(a) Base Amount(b) Base Quantity Rate(c)Ovr Amount(d) MOP(e)

[l ][l . ][l . ] [l ] [l ] [l ] [l]

[ ][ . ][ . ] [ ] [ ] [ ] [ ]

[ ][ . ][ . ] [ ] [ ] [ ] [ ]

C10059 End of Document

VALIDATE,COMMIT,STORE,RETURN [ ]

f. IEFD – Entry Acceptance screen ]TRADER-ROLE O INSERT EXPORT FULL DECLARATION CHIEF/CIES 01/10/09 12:15

SADKEY:1P

EPU []*** EPS * Entry Number []******* Date **/**/**** Time **:**

ACCEPTANCE DETAILS Prelodged on **/**/**** at **:**

Accepted on **/**/**** at **:**

REVENUE SUMMARY: MOP Type Amount

[]* []*** *************

[]* []*** *************

Dfrd tot ************* Immed tot ************* Rev tot *************

Refund tot *************

Route []**

MRN ******************

C10004 Data successfully committed

IEFD,ABORT,PRINT [ ]

There are minor differences in the Entry Acceptance screens for Legally Accepted Entries and for Pre-lodged Entries. The refund total excludes CAP refunds as the amount of refund is only determined when RPA receive the claim from CHIEF (generally after the goods have departed from the UK). The layout of the display screens following the Entry Acceptance screen mirror the layout of the input screens but with the data protected.

USM305: Export Entry Trade User Guide _______________________________________________________________________________________

_______________________________________________________________________________________

Filename: USM305 Page 27 of 108

Version: 4.0

4.4 Document Structure

The repeating segments for the data input screens are shown in the table below.

Seg. Level

Seg. Id.

Segment Description Min Segs in Set

Max Segs in Set

Add’l Segs

1 a Header AI Statement 0 40 1 2 b Header Document 0 40 1 3 c Seal 0 99 1 4 d Country on route 0 99 1 5 e Item 1 99 1

5.1 f Package 1 99 1 5.2 g Container 0 99 1 5.4 i Previous document 1 9 1 5.5 j Item AI Statement 0 99 1 5.6 k Item Document 0 99 1 5.7 l Tax line 0 10 2

4.5 Field Completion Rules