Using VIX Futures as Option Market-Makers’ Short Hedge

description

Transcript of Using VIX Futures as Option Market-Makers’ Short Hedge

1

Using VIX Futures as Option Market-

Makers’ Short Hedge10 December 2010

Yueh-Neng Lin, Anchor Y. LinNational Chung Hsing University

[email protected]+886-4-22857043

2

Volatility Risk• Given the large and frequent shifts in

volatility in the recent past, especially in periods like Black Monday of Stock Market Crash in 1987, Gulf War I in 1990, Asian Currency Crises in 1997, Russian Default and LTCM in 1998, Bursting of Dot-Com Bubble in 2000, 9-11 in 2001, Gulf War II in 2003, Subprime Mortgage Crises of 2007, and Leman Brothers bankruptcy in September 2008, there is a growing need for instruments to hedge volatility risk.

3

Volatility Risk Management

• Financial instruments to hedge volatility risk: 1. Traditional Call and Put options

• also have delta and gamma risk2. Volatility/Variance Swaps

• A forward contract on realized or implied volatility/variance

• Only available at OTC3. Strategies

• Options on a straddle (Carr and Madan, 1998)• Options on at-the-money forward-start straddle (Brenner,

Ou and Zhang, 2006)• Forward-start strangle (Rebonato, 1999)

4

Volatility Risk Management (continued..)

4. Futures or options on a volatility index• Brenner and Galai (1989) believe that different volatility

measures that are highly correlated to the volatility exposures of all market participants are different.

• Hence, the volatility index may be based on standard deviation of historical data, implied volatility of options, or the combination of historical and option data.

• Then, the futures or options on alternate volatility index may satisfy the hedging demand of different participants.

• VIX futures and VIX options

5

VIX• The Chicago Board Options Exchange

(CBOE) introduces the VIX (volatility index) in 2003, which is the sentiment volatility implicit in S&P 500 index (SPX) option prices.

• VIX squared is the forward price of annualized total variance of S&P 500 index returns over 30 days (τ=30/365), implied in SPX option prices:

2

2

02

02

2var

VIX

1)(1),(

),(2),(),(2

/)]([E/)(

0

0

t

tit

K i

itK

i

t

t uuuFtt

KTF

TtBKTC

KK

TtBKTP

KK

dNJduTP

6

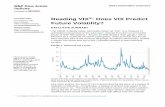

VIX & S&P 500• VIX tends to rise when the S&P 500 falls.• VIX tends to decline or remain constant

when the S&P 500 rises.• Historically, VIX hits its highest levels

during times of financial turmoil and investor fear.

• Hence, VIX is also known as the investor “Fear Index” (Whaley, 2000) in the marketplace.

7

8

VIX & VIX Derivatives• VIX futures are launched on March 26,

2004.• VIX options are launched on February 24,

2006.• VIX term structure are built in December

2008.• Negative Correlation between S&P

500 Index and VIX• VIX futures and VIX options could be a

“catastrophe hedging” tool for stock portfolios.

9

VIX Futures

• Since VIX futures settle to the forward 30-day implied volatility of the S&P 500 (forward VIX), they are natural to hedge the “forward vega” risk of S&P 500 options.

Hedging a Futures Call Option’s Forward Vega

Risk• A short position on S&P 500 futures call

options is chosen as our target instrument, since it consists of the volatility risk between option’s expiry and its underlying futures’ expiry, or equivalently the “forward vega” risk.

10

11

The aim of this paper is to investigate

whether and by how much VIX

futures improve hedging a futures call option’s vega

risk

12

Hedge a Call Option’s Spot Vega Risk

• Psychoyios and Skiadopoulos (2006) use the short position on a standard European-style call option as the target instrument.• Two hedging schemes with two traditional option

models and three volatility option models to investigate which combination gets the best hedging performance.

• They find that the traditional option is a more efficient instrument than the volatility option for hedging a traditional option.

American-Style Futures Option

• For options with early exercise potential, compute the BAW (Barone-Adesi and Whaley, 1987) early-exercise premium, treating it as if the stock volatility.

• Adding this early-exercise adjustment component to the European futures option price in the pricing formula should result in a reasonable approximation of the corresponding American futures option price.

13

14

Implicit Features of S&P 500 Index Prices

1. Stochastic volatility (SV)• Heston (1993), Cox, Ross and Ingersoll (1985)• The volatility is allowed to be mean-reverting

and stochastic.2. Price jumps (SVJ)• Bates (1996), Bakshi, Cao and Chen (1997)• To internalize more skewness and kurtosis.

American-Style Futures Options (continued..)

• For stochastic volatility and jump-diffusions, the constant-volatility analytic approximation results in Bates’ (1996) American currency futures options.

15

16

VIX Futures Valuation Formula

17

18

19

VIX - VIX Futures

• What is the relationship?• Futures prices can swing from a premium to a

discount to VIX. • VIX futures prices are based purely on

expectations. • No cost of carry between spot VIX and VIX futures.

20

Fair Price of VIX Futures (continued..)

• Carr and Wu (2006) present that the price of the VIX futures has a lower bound and an upper bound.

• Dupire (2006) finds the concavity adjustment which needs to be subtracted from the price of forward variance to arrive at the fair value of VIX futures.

• Zhang and Zhu (2006) choose a Heston-type stochastic-variance model and developed a numerical expression for VIX futures.

• Lin (2007) drives VIX futures price formulas under affine stochastic-volatility index processes with the convexity adjustment.

21

Fair Price of VIX Futures

• By Martingale pricing theory, the current VIX futures prices expiring at t can be computed under a risk-neutral probability measure Q as,

2/32

22VIX

)]VIX(E[8)VIX(var)VIX(E)VIX(E)(F

TQt

TQt

TQtT

Qtt T

22

Strategies for Hedging Forward

Volatility Risk

Hedging Strategies• This study uses a short position on the futures

option as the target portfolio at time t, i.e. TARt= - Ct(F) • The expiration dates of SPX futures options and SPX

futures are respectively T1 and T2 , where t <T1<T2 .

• T2 - T1 ≡ 30 days

• The hedged portfolio consists of• (1) N1,t shares of underlying SPX futures Ft , and

• (2) N2,t shares of either forward-start strangle portfolios (HS1) or VIX futures (HS2), both denoted as INSTt .

23

Hedging Strategies (continued..)

• The profit of this hedging portfolio is defined as

• Further add the constraints of delta-neutral and vega-neutral by

24

)(,2,1 FCINSTNFN tttttt

0)(,2,1

t

t

t

ttt

t

t

FFC

FINSTNN

F

0)(,2

t

t

t

tt

t

t FCINSTN

Two Hedging Schemes• Hedging Scheme 1 (HS1): • The hedged portfolio consists of N1,t shares of

underlying futures, and N2,t shares of forward-start strangle portfolios. • The forward-start strangle portfolio consists of

• (1) a short position of short-term strangle (the expiration date of the standard call and standard put is T1 ; the strikes of the call and put are K2 and K1 with K1 < K2 ) ; and

• (2) a long position of long-term strangle (the expiration date of the standard call and standard put are T2 ; the strikes of the standard call and put are K2 and K1 ). 25

Two Hedging Schemes (continued..)

• Hedging Scheme 1 (HS1):

26

),(),(),(),( 12221121 KTPKTCKTPKTCINST ttttt

Two Hedging Schemes (continued..)

• Hedging Scheme 2 (HS2):• The hedged portfolio consists of N1,t shares of

underlying futures, and N2,t shares of the VIX futures, i.e.

27

)(FVIX TINST tt

Hedging Error• The hedging error is defined as the additional

profit (loss) over the risk-free return :

28

1, 2,

1, 2,

( ) ( 1)( ) ( ) ( )

[ ]( 1)

r tt t t t

t t t t t t t t t t t

r tt t t t t

HE t t eC C N F F N INST INST

C N F N INST e

Absolute Hedging Error• The absolute hedging error through a hedging

period (T1 - t) is calculated as

where

29

M

l

lMtrtlt etltHETtTDHE

1

)()1(1 | )(|),(

ttTM /)( 1

30

Empirical Data• In order to assess the hedging performance of forward

volatility risk, we use the SPX futures, the SPX options and the VIX futures to hedge a short position on the SPX futures call option.

• The data period: from July 3, 2006 to June 30, 2009. • The daily prices for the SPX futures and the SPX futures

option are obtained from the CME. • The daily prices for the SPX options are obtained from

CBOE, and the daily prices for the VIX futures are captured from CBOE.

• The interest rate data are daily annualized Treasury-bill rates obtained from DataStream Database.

• The daily dividend-yield ratio data are obtained from the S&P Corporation.

31

Empirical Data (continued..)

1. SPX futures that expire in March, June, September, and December.

2. SPX futures call options that expire in February, May, August, and November.

3. Forward-start strangle portfolio involves in two strangles. • 1ST strangle: SPX options that expire in February, May,

August, and November.• 2nd strangle: SPX options that expire in March, June,

September, and December. 4. VIX futures that expire in February, May, August,

and November.

32

Empirical Results• Our findings show that VIX futures outperform

forward-start strangle strategies at most moneyness-maturity categories and the results are robust across models and hedging strategy.

• Overall, VIX futures are a better hedging instrument than standard options if the target option is a futures option, or equivalently if the risk exposure is the forward volatility risk.

• In particular, incorporating SV on average outperforms in OTM hedging.

• However, adding price jumps further enhances the hedging performance for SR options during the post-crash-relaxation period.

33

The End.

Thank you.