U.S. Property Markets Shake Off Slowdown and …. Research Report CAPITAL FLOWS 2017 Midyear Update...

Transcript of U.S. Property Markets Shake Off Slowdown and …. Research Report CAPITAL FLOWS 2017 Midyear Update...

U.S. Research Report

CAPITAL FLOWS 2017 Midyear Update

U.S. Property Markets Shake Off Slowdown and Power OnAndrew J Nelson, Chief Economist | USA

The slowdown in U.S. commercial property markets that began last year has continued into the first half of 2017, though activity picked up during the second quarter and transactions levels remain relatively robust by historical standards. After peaking in Q4 2015, year-over-year transaction volumes have declined in five of the last six quarters, including Q1 and Q2 this year. However, the rate of decline has been falling, perhaps suggesting markets are stabilizing.

More encouraging for investors and landlords is that price appreciation has renewed after some market weakness this winter. Price gains have been broad-based across most sectors, particularly in the major markets. Nonetheless, pricing per square foot has been flat to falling in some sectors, reflecting the inferior quality of buildings being offered for sale. But prices for assets of a given quality — and especially trophy assets — are pushing further into record territory, even if the investor pool is shrinking.

The news of the summer was China’s announcement that offshore investment will receive greater scrutiny from Beijing, likely sharply reducing direct acquisitions from Chinese entities, particularly for big-dollar properties. But impacts from any Chinese pullback are likely to be relatively limited and focused on a few key markets (especially New York), and overall demand for U.S. property remains robust.

Key Observations

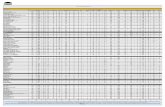

> Overall transaction volumes for the first half of 2017 (1H 2017) are down 19% from 2H 2016 and down 7% from a year ago (1H 2016). While these are meaningful declines, the rate of decrease has been falling in the last two quarters. Indeed, volumes gained modestly in Q2, up 4% since Q1.

> Investment capital flows remain robust by historical standards. Sales volumes are on pace to log the third greatest annual total since the recession.

> Portfolio and entity purchases continue to account for a disproportionate share of the recent sales declines, while individual property transactions have been relatively stable.

> Office and industrial buildings account for larger shares of all transactions than they did a year ago, while retail and especially multifamily transactions have decreased.

> Investment momentum continues to shift from primary into secondary markets, and from CBDs into inner suburban submarkets, particularly for offices and apartments, as both foreign and domestic investors eschew premium pricing in the top markets.

> Despite the slowdown in sales activity this year, pricing remains strong and most sectors saw increased values per square foot in 1H 2017 over 2H 2016 and a year ago. Appreciation was particularly strong in Q2 2017 after several quarters of moderate gains and losses. In general, appreciation was greater in the primary markets, especially for office and industrial properties, while multifamily and especially retail property prices lagged.

> The relative strength and stability of the U.S. economy and ultra-low interest rates will continue to make real estate a compelling option for investors, which is likely to keep property capital markets strong, attracting offshore capital to our markets.

2 U.S. Capital Flows Research Report | 2017 Midyear Update | Colliers International

Transaction Volumes 2010–2017

Source: Real Capital Analytics

Overall Transaction Volumes and Investment Flows

Property markets in the United States continued to slow during the first half of 2017, though they remain relatively robust. After peaking in Q4 2015, year-over-year transaction volumes have declined in five of the last six quarters, including both this year. Though the U.S. markets remain attractive globally, the foreign share of acquisitions has been falling.

> U.S. property markets saw an estimated $214.2 billion in property transactions in 1H 2017, down 19% from 2H 2016 and 7% from 1H 2016. Nonetheless, investment volumes remained strong by historical standards. Sales volumes are on pace to log the third greatest yearly total since the recession. In fact, volumes this year are 20% higher than the average of all first-half-year periods since the economic recovery began in earnest in 2011.

Property Sector Trends

The composition of transactions by property type has shifted over the past decade away from office and hotels and decisively toward apartments, though these trends have reversed somewhat in the past year. Every property sector experienced lower transaction volumes in 1H 2017 compared to 2H 2016, though some more than others.

> Hotels and multifamily have declined the most this year, while industrial, development sites, retail and office declined more modestly. Apartments and hotels are losing favor with investors, despite strong tenant/lodging rates, although both sectors also saw volume increase in the second quarter over the first. However, the drop-off in both sectors also reflected exceptionally strong comparisons in 2016, where a few huge deals swelled the totals (e.g., the $1.95 billion Waldorf Astoria hotel acquisition in early 2016).

> Compared to volumes a year ago, development sites and apartments saw the biggest declines, while industrial gained over the year.

> Individual asset sales have accounted for 78% of the transaction volume this year, up from its historical average of 70%. While overall deal volume is down 7.2% over the past year, single-property deal volume is down only 4.5% over this period and the single-property deal volume in Q2 2017 was up 5.3% above Q1 2017, compared to +4.0% for all transactions. On the other hand, portfolio and entity deals are down substantially so far this year versus a year ago, at 10.1% and 35.5%, respectively.

> The U.S. is still viewed as a safe haven for global investors, though its share of the global market has dipped slightly this year to date. Overall the United States accounts for virtually half of all property investment globally, though the share declined year-over-year from 47.2% to 46.9%. One factor is the drop in the foreign capital inflows, as the offshore share of U.S. property transactions fell from its peak of 22.3% in 2015 to just 13.3% in 1H 2017.

> Focusing on the top investment markets, U.S. metros account for seven of the top 10 markets globally, with 73% of the investment volumes in these top 10 markets, about the same share as last year. New York and Los Angeles remain the two top markets globally, as they were last year, though volumes have slid this year, by 40% and 7%, respectively, year over year. Dallas and Atlanta both gain significantly year-over-year (both +27% year-over-year), though they are much smaller markets than New York and Los Angeles.

$0

$50

$100

$150

$200

$250

$300

2010 2011 2012 2013 2014 2015 2016 2017

Bill

ions

1H 2H

Top Global Investment MarketsMETRO 1H 2017 VOLUME YOY% CHANGE

New York City $20.2 billion -40.0%

Los Angeles $15.1 billion -7.0%

London $14.8 billion 0.0%

San Francisco $11.9 billion 0.0%

Hong Kong $8.3 billion +5.0%

Boston $8.1 billion +1.0%

Dallas $8.0 billion +27.0%

Washington, D.C. $7.8 billion -3.0%

Atlanta $6.5 billion +27.0%

Tokyo $6.2 billion -33.0%

Change in Transaction Volumes by Property Type1H 2017 VS.

2H 20161H 2017 VS.

1H 2016Q2 2017 VS.

Q1 2017Office -16.2% -1.4% -6.2%

Industrial -7.4% +12.0% +5.6%

Retail -13.0% -13.2% -22.5%

Multifamily -25.4% -16.4% +29.1%

Hotel -39.3% +2.8% +16.7%

Development Site -11.3% -18.7% +14.8%

All -19.4% -7.2% +4.0%

Source: Real Capital Analytics

Source: Real Capital Analytics and Colliers International

3 U.S. Capital Flows Research Report | 2017 Midyear Update | Colliers International

The composition of transactions by property type has changed significantly in recent years:

> In 2007, at the last investment peak, office buildings accounted for 37% of all property sales by dollar volume, far outpacing all other sectors. The distribution across property types is more balanced now, with the office share falling to 27% in the second half of 2015, before inching back up to 30% in 2017.

> Apartments surged from just 18% in 2007 to 32% last year, falling back to 30% this year. The industrial and retail sectors gained since 2007, though less dramatically while hotels and development sites lost shares.

Transaction Volumes by Property Type > Industrial has been the strongest sector, the only sector to gain both over the past six months and the past year, helped by falling cap rates. These trends reflect the consumer shift from in-store retail to e-commerce, which favors warehouses over shopping centers.

> Quarterly pricing figures tend to be volatile as a few unrepresentative transactions can swing the averages. As such, price shifts between quarters are best viewed as directional gauges. On this basis, prices seem to have stabilized during the second quarter or even increased modestly, after falling in prior quarters.

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Office Industrial Retail Apartment Hotel Dev Site

Billio

ns

1H 2016 2H 2016 1H 2017

Commercial Property Investment Volume

Source: Real Capital Analytics

$0

$100

$200

$300

$400

$500

$600

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 1H 2017

Billio

ns

Office Industrial Retail Apartment Hotel Development Site

37%

11%

14%

18%

14%

5%

29%

12%

16%

32%

7%4%

30%

14%

16%

30%

6%4%

Property Prices

The continued slowdown in sales activity is starting to impact pricing, though prices have recovered some lost ground in recent months. However, with cap rates generally stable — even falling modestly for industrial and apartments — the average price declines mostly seem to reflect lower asset quality rather than more general price weakness.

> Excluding the volatile land sector, retail has experienced the greatest price declines both over the past six months and the past year, though the sector did gain back some ground in the second quarter. Since cap rates for this property type were essentially unchanged, one can assume the primary driver was the lower quality of product transacting this year.

> Looking at the long term trends illustrated by the chart below, apartments and office buildings have made the greatest gains overall in terms of pricing. Appreciation in the industrial and retail sectors has lagged.

> In the last two years only industrial has continued to log consistent gains while retail and apartments both have seen declining average prices, again mostly attributable to the lower quality of product being sold. Rents and income generally continue to rise while cap rates are stable overall.

Source: Real Capital Analytics

Source: Real Capital Analytics and Colliers International

Note: Change is expressed per unit for apartments and hotels

Change in Price per Square Foot 1H 2017 VS.

2H 20161H 2017 VS.

1H 2016Q2 2017 VS.

Q1 2017Office +4.2% -2.2% -8.4%

Industrial +2.1% +3.2% +1.0%

Retail -16.5% -11.2% +8.0%

Apartment -4.6% -2.6% +3.6%

Hotel -5.2% -2.2% +5.6%

Development Site +10.7% -32.3% +20.1%

Change in Capitalization Rates (in Basis Points)1H 2017 VS.

2H 20161H 2017 VS.

1H 2016Q2 2017 VS.

Q1 2017Office +7.96 +5.24 -8.14

Industrial +0.06 -15.16 -56.67

Retail +1.19 +0.23 +6.26

Apartment -7.88 -14.26 +3.36

Hotel +4.03 +10.77 +8.40

Source: Real Capital Analytics and Colliers International

4 U.S. Capital Flows Research Report | 2017 Midyear Update | Colliers International

A more accurate gauge of price movements is afforded by the RCA Commercial Property Price Indices (CPPI), which measures price changes in U.S. commercial real estate based on “repeat sales,” or completed sales of the same properties, which implicitly controls for product quality (unlike in the prior data).

Properties have broadly continued to appreciate this year, with gains this spring overcoming some temporary weakness this winter. Looking back over the past decade, price gains have been concentrated within the major markets,1 particularly in the multifamily and office sectors while the gains for retail and industrial have been much more modest. Outside of the major markets, only the apartment sector has established new pricing peaks significantly above those reached in the prior cycle.

> The index for all property types nationally rose 7.9% over the past year and 3.5% during 2017. However, all gains this year occurred during the second quarter, up 4% over the first quarter, which actually saw a net decline overall.

> CBD office and industrial properties in the major markets have seen by far the greatest gains this year, though apartments and suburban office both saw decent appreciation, both in major and non-major markets. However, retail continues to struggle, flat for the year in the top metros and down slightly in non-major markets.

> Overall, appreciation in the primary markets continues to outpace that in the secondary and tertiary markets, despite the pickup in absorption and property sales outside these top markets.

> Over the past decade, price gains have been concentrated within the major markets, particularly for apartments and CBD offices, which are now each up at least 70% over their prior peaks in nominal (not inflation-adjusted) terms.

> The gains for retail and industrial have been much more modest, up 17% and 29% respectively over their 2007 peaks.

Sales Prices by Unit: Two-Quarter Moving Average

Source: Real Capital Analytics

$60

$70

$80

$90

$100

$110

$120

$130

$140

$150

$160

$0

$50

$100

$150

$200

$250

$300

Q1 2

007

Q2 2

007

Q3 2

007

Q4 2

007

Q1 2

008

Q2 2

008

Q3 2

008

Q4 2

008

Q1 2

009

Q2 2

009

Q3 2

009

Q4 2

09Q1

201

0Q2

201

0Q3

201

0Q4

201

0Q1

201

1Q2

201

1Q3

201

1Q4

201

1Q1

201

2Q2

201

2Q3

201

2Q4

201

2Q1

201

3Q2

201

3Q3

201

3Q4

201

3Q1

201

4Q2

201

4Q3

201

4Q4

201

4Q1

201

5Q2

201

5Q3

201

5Q4

201

5Q1

201

6Q2

201

6Q3

201

6Q4

201

6Q1

201

7Q2

201

7

Thou

sand

s

Apartment Office Industrial Retail

1 The top six markets are Boston, New York, District of Columbia, Chicago, San Francisco, and Los Angeles. All other metros in this report are considered secondary or tertiary.

Source: Real Capital Analytics and Colliers International

Property Prices Over Time | Indexed to 2001Top Six U.S. Metro Markets

75

125

175

225

275

325

375

Q1 2

001

Q3 2

001

Q1 2

002

Q3 2

002

Q1 2

003

Q3 2

003

Q1 2

004

Q3 2

004

Q1 2

005

Q3 2

005

Q1 2

006

Q3 2

006

Q1 2

007

Q3 2

007

Q1 2

008

Q3 2

008

Q1 2

009

Q3 2

009

Q1 2

010

Q3 2

010

Q1 2

011

Q3 2

011

Q1 2

012

Q3 2

012

Q1 2

013

Q3 2

013

Q1 2

014

Q3 2

014

Q1 2

015

Q3 2

015

Q1 2

016

Q3 2

016

Q1 2

017

National: All Properties Apartment Retail Industrial CBD Office Suburban Office

CBD Office = +70%

Apartment = +78%

Retail = +17%

Industrial = +29%

All Properties = +26%

Suburban Office = +3%

Percent over prior peak

Source: Real Capital Analytics and Colliers International

Change in Price per Square Foot Q2 2017 VS. Q2 2016 Q2 2017 VS. Q4 2016 Q2 2017 VS. Q1 2017

National: All Properties +7.9% +3.5% +4.0%MAJOR MARKETS (TOP SIX METROS)Apartment +8.5% +2.8% +3.6%

Industrial +13.0% +6.1% +7.8%

CBD Office +19.5% +11.4% +12.2%

Suburban Office +9.0% +6.5% +4.3%

Retail +0.0% +0.1% +2.2%

SECONDARY AND TERTIARY MARKETSApartment +9.8% +4.6% +4.0%

Industrial +4.6% +0.5% -1.3%

CBD Office +4.3% -5.0% -1.2%

Suburban Office +4.1% -0.6% +0.4%

Retail -1.0% -0.3% +1.8%

5 U.S. Capital Flows Research Report | 2017 Midyear Update | Colliers International

> Outside of the primary markets, only the apartment sector has established new pricing peaks significantly above those reached in the prior cycle. Prices for industrial and CBD offices in the secondary markets have only recently regained new peak levels over those reached a full decade ago.

> Both retail and suburban office outside of the major markets are still well below their prior peaks, reflecting consumer and tenant shifts away from these product types, especially for secondary locations.

Property Prices Over Time | Indexed to 2001Secondary and Tertiary Markets

> All capital sources purchased less this year than they did in the second half of 2016, but foreign entities and institutions represent the most substantial declines, 34% and 26%, respectively, compared to only 6% drops for REITs and owner/users. The volume from private buyers fell 19%. However, year-over-year, REITs experienced a significant 78% increase, followed by private buyers at +18%, but foreign entities and institutions together declined about 11%.

> Despite their decline in acquisitions, the share of total U.S. property holdings owned by foreign sources continued to rise modestly in 1H 2017 as new acquisitions virtually doubled the volume of dispositions (+95%). Foreign buyers are likely attracted by the relative strength and stability of the U.S. economy, as well as compelling returns compared to returns in their home markets.

> Domestic capital sources collectively were net sellers (-7%). Within this group, however, only institutional investors and owner/users were strong net sellers (each about -25%). REITs and private investors were modestly net buyers (+5% and 4%, respectively). For REITs, this marks the first half-year of net buying since early 2015.

Source: Real Capital Analytics and Colliers International

60

80

100

120

140

160

180

200

220

240

Q1 2

001

Q3 2

001

Q1 2

002

Q3 2

002

Q1 2

003

Q3 2

003

Q1 2

004

Q3 2

004

Q1 2

005

Q3 2

005

Q1 2

006

Q3 2

006

Q1 2

007

Q3 2

007

Q1 2

008

Q3 2

008

Q1 2

009

Q3 2

009

Q1 2

010

Q3 2

010

Q1 2

011

Q3 2

011

Q1 2

012

Q3 2

012

Q1 2

013

Q3 2

013

Q1 2

014

Q3 2

014

Q1 2

015

Q3 2

015

Q1 2

016

Q3 2

016

Q1 2

017

National: All Properties Apartment Retail Industrial CBD Office Suburban Office

Buyers and Sellers

Private Investors were once again the dominant buyers of U.S. property in 1H 2017 and increased their share of acquisitions, while foreign and institutional shares declined. However, the dollar value of acquisitions declined for all capital sources in the year through mid-2017, though both REITs and private buyers increased their acquisitions in the first half of this year versus the second half of 2016. Public pension funds have reduced their real estate commitments by 30% in the first half of 2017 compared to a year early, according to an industry report.

Taking dispositions into account as well, foreign entities, REITs and private sources of capital were all net buyers in the first half of 2017, while institutional investors and owner/users were once again net sellers. Collectively, all domestic sources together were net sellers. In contrast, foreign buyers again led all capital sources in net acquisition volume, as they have almost every quarter since late 2013.

> Private buyers accounted for almost half (49.3%) of the total transaction volume while institutional buyers comprised a fifth (21.8%), with both buyer types increasing their shares of the market. On the other hand, both foreign entities and institutions registered declines in their shares.

Acquisitions by Type of Investor

Source: Real Capital Analytics

$0

$20

$40

$60

$80

$100

$120

$140

Cross-Border Institutional/Equity Fund Listed/REITs Private User/Other

Billio

ns

1H 2015 2H 2015 1H 2016 2H 2016 1H 2017

Net Investment by Type of Investor

Source: Real Capital Analytics

-$30

-$20

-$10

0

$10

$20

$30

$40

Cross-Border Institutional/Equity Fund Listed/REITs Private User/Other

Billio

ns

1H 2015 2H 2015 1H 2016 2H 2016 1H 2017

66 U.S. Capital Flows Research Report | 2017 Midyear Update | Colliers International

> Despite the modest net acquisition this year, REITs have disposed of roughly $43 billion more in property than they purchased over the past two years. Moreover, they have been raising an increasing stockpile of both debt and equity.

Debt and Equity Capital Raising by REITs

Source: National Association of Real Estate Investment Trusts (NAREIT)

0

20

40

60

80

100

120

140

160

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Pace

Total Capital Raised Unsecured Debt

Where Foreign and Domestic Capital Buy U.S. Properties

The top six U.S. markets still account for a disproportionate share of investment activity nationally, but their share continues to drop as investors seek out greater returns (and risk) in secondary markets. However, relative to domestic investors, foreign buyers tend to focus on the leading markets.

> The top six metros accounted for 39.5% of investment dollars this year, but this share has been declining since peaking at 47.4% in 2011.

> There is a huge spread between U.S. and foreign buyers: the top six share is just 37.2% among domestic investors, compared to 57.1% for offshore.2 And while the top six market share fell this

past half year among all investors, the drop was greater among domestic investors (-5.4%) than for foreign buyers (-2.7%). On top of also being net buyers, it is clear foreign entities are less motivated by short-term yield and less comfortable investing in smaller, less familiar metros.

Domestic vs. Foreign CapitalTop Six U.S. Metro Markets

Source: Real Capital Analytics and Colliers International

2 Note that these figures are not additive. Rather, these figures refer to the proportion of each source’s investments that are concentrated in the top six metros.

0%

10%

20%

30%

40%

50%

60%

70%

80%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 1H 2017

Domestic Foreign Domestic Average Foreign Average

> Manhattan is the dominant metro market for attracting offshore capital. Thus far in 2017, foreign investors purchased twice as much property in Manhattan ($5.4 billion) as in the next-largest metro (Washington, D.C. with $2.6 billion). New York has taken in more than one-fifth of the dollars that flowed into the U.S. from overseas this year. Manhattan is clearly seen as the investment destination of choice for overseas investors

> However, New York has relinquished its crown among U.S.-based investors this year. So far, Los Angeles has edged out New York, with 9.9% of the domestic capital, just ahead of New York’s 9.8%

> Together, the top nine metros account for two-thirds of foreign capital invested in U.S. property markets but for less than half of the domestic capital.

Top Markets for Domestic and Foreign Buyers of U.S. PropertyFOREIGN CAPITAL DOMESTIC CAPITAL

RANK METRO VOLUME (MILLIONS) SHARE METRO VOLUME

(MILLIONS) SHARE

1 New York $5,384.20 21.5% Los Angeles $18,638.90 9.9%

2 Washington, D.C. $2,595.90 10.4% New York $18,482.20 9.8%

3 Los Angeles $1,874.20 7.5% San Francisco $12,688.70 6.7%

4 San Francisco $1,761.40 7.0% Dallas $8,865.60 4.7%

5 Boston $1,653.70 6.6% Boston $7,536.40 4.0%

6 Seattle $909.80 3.6% Atlanta $7,008.80 3.7%

7 Houston $764.30 3.1% Miami/South Florida $6,506.80 3.5%

8 Chicago $761.10 3.0% Washington, D.C. $6,119.60 3.2%

9 Miami/South Florida $743.90 3.0% Chicago $5,426.10 2.9%

10 Other $8,609.00 34.4% Other $97,280.40 51.6%

Total $25,057.40 100% Total $188,553.40 100.0%Source: Real Capital Analytics

7 U.S. Capital Flows Research Report | 2017 Midyear Update | Colliers International

> Last year saw major shifts in the source of foreign capital as China surged past Canada to outpace all other countries. This year is seeing a return to customary patterns as Canada again tops the rankings of foreign investors. Nonetheless, the Chinese share rose from last year (+0.6 percentage points), but not nearly as much as Canada (+8.4 percentage points).

> Countries climbing the ranks this year include Singapore, Japan and Israel, while Germany, Hong Kong and especially South Korea all fell.

Debt Markets

Despite the decline in property transactions, debt originations for commercial real estate are up versus a year ago, though down so far this year. Commercial mortgage-backed securities (CMBS) issuances rose the most in the past year, though levels are still a far cry from volumes during the last cycle. On the other hand, lending from commercial banks, life insurance companies and the agencies (Fannie Mae and Freddie Mac) are up slightly over a year ago, but their combined lending volumes are more than double than at the peak of the last cycle.

> Debt originations are up 6% over midyear 2016 but down almost 10% since year end 2016. Declining transaction volumes are restraining the lending volume, but low interest rates and expiring CMBS loans are encouraging refinancings.

> CMBS issuances rose the most in the past year, up 40% over 1H 2016, compared to just 2% for non-CMBS lending. Still, CMBS levels are far below those during the last cycle, when CMBS accounted for two-thirds of the CRE lending volume, compared to just 14% currently.

> The Mortgage Bankers Association reports that lending by commercial banks is down about 20% over the last year, life insurance company lending is about flat and agency lending is up 26%. Year to date, life insurance companies are still about flat, commercial banks are down modestly and the agencies continue to increase their lending.

> Looking forward, the MBA reports that lenders still have a strong, but declining, desire to make loans, and borrowers have comparable strong, but declining, desire to take out loans.

Commercial Real Estate Lending

Source: Real Capital Analytics

$0

$20

$40

$60

$80

$100

$120

$140

Q1 2

012

Q2 2

012

Q3 2

012

Q4 2

012

Q1 2

013

Q2 2

013

Q3 2

013

Q4 2

013

Q1 2

014

Q2 2

014

Q3 2

014

Q4 2

014

Q1 2

015

Q2 2

015

Q3 2

015

Q4 2

015

Q1 2

016

Q2 2

016

Q3 2

016

Q4 2

016

Q1 2

017

Q2 2

017

Billio

ns

CMBS Non-CMBS

Top Foreign Sources of Capital 1H 2017 2016

RANK COUNTRY VOLUME (MILLIONS) SHARE COUNTRY VOLUME

(MILLIONS) SHARE

1 Canada $7,161.80 28.6% China $13,757.80 20.7%

2 China $5,335.10 21.3% Canada $13,367.50 20.2%

3 Singapore $3,495.60 14.0% Germany $6,185.90 9.3%

4 Germany $2,339.00 9.3% South Korea $3,912.00 5.9%

5 Japan $1,390.20 5.5% Singapore $3,355.40 5.1%

6 Israel $901.10 3.6% Hong Kong $3,352.40 5.1%

7 Hong Kong $738.30 2.9% Switzerland $3,301.90 5.0%

8 Denmark $584.20 2.3% Qatar $3,198.70 4.8%

9 Norway $540.30 2.2% Japan $2,590.40 3.9%

10 Other $2,571.80 10.3% Other $13,285.00 20.0%

Total $25,057.40 100.0% Total $66,306.90 100.0%Source: Real Capital Analytics

88 U.S. Capital Flows Research Report | 2017 Midyear Update | Colliers International8 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International

Copyright © 2017 Colliers International.The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report.

Colliers International 101 Second Street, 11th FloorSan Francisco, CA 94105+1 415 788 3100colliers.com

FOR MORE INFORMATIONAndrew J Nelson Chief Economist | USA+1 415 288 7864 [email protected]

RESEARCH CONTACTPete Culliney Director of Research | USA & Global+1 212 716 3698 [email protected]

What to Expect in Late 2017

U.S. property transaction volumes are continuing to trend down this year, while price appreciation generally remains moderate, consistent with our conclusion that we are nearing the end of this real estate markets cycle. While property markets seem to have peaked for this cycle, they are by no means crashing, or even falling. Transaction levels remain relatively robust by historical standards while prices continue to edge further into peak territory, particularly in major markets.

The increase in leasing and sales transactions during the second quarter was encouraging and likely reflected the improvement in GDP and job growth this spring. But absent significant changes in policy directions from Washington that would recharge economic growth, we anticipate the recent slowing trends in the property markets to continue. Consensus economic forecasts call for continued moderate growth during the rest of this year and into 2018, providing little additional fuel for space absorption or rent growth.

On the other hand, the fed is unlikely to raise rates again more than once this year, if at all. This should keep interest rates down and financing expenses relatively affordable for funding new acquisitions. Moreover, risk-adjusted rates of return for U.S. real estate remain attractive for domestic and foreign investors alike, which will keep attracting more capital to the sector.

Finally, concerns about the Chinese pullback are likely to be relatively isolated to a few markets, as investors from other countries are stepping up to acquire. The exception may be for trophy assets, where Chinese investors had been emerging as the top bidders in many transactions. Pricing for these assets may be less aggressive without Chinese buyers.