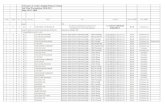

US$ 50m Alam Sutra share-backed financing Termsheet

-

Upload

rishav-sinha -

Category

Documents

-

view

228 -

download

2

description

Transcript of US$ 50m Alam Sutra share-backed financing Termsheet

USD Mezzanine Loan

8

USD [50] million Alam Sutera Share-backed Loan Facility (Loan)

Indicative Terms and Conditions15 October 2012

This draft term sheet is strictly for discussion purposes only and does not constitute a commitment of Deutsche Bank AG or any of its affiliates to provide any financing. Any transaction will be subject to, inter alia, legal and financial due diligence, credit approval, compliance clearance and regulatory approval, if required.

Borrower:[ ], a company incorporated in [ ], being the entity owning [ ] Alam Sutera Shares.

Arranger:Deutsche Bank AG, Singapore Branch.

Lenders:Deutsche Bank AG, Singapore Branch and other investors.

Loan Amount:Up to aggregate USD [50],000,000.

Use of Loan Proceeds:The loan proceeds shall be applied by the Borrower towards the following:

i. [TBD];

ii. Initial funding of the Debt Service Reserve Account; and

iii. Payment of fees and expenses under this Loan

Agreement Date:[ ] 2012

Utilisation Date :Subject to satisfaction of conditions precedent, a Business Day falling within the Availability Period.

Availability Period:Within [5] Business Days of the Agreement Date.

Upfront Fees:[3.0] % of the Loan Amount payable by the Borrower to the Arranger on the earlier of the Utilisation Date or the expiry of the Availability Period

Extension Fees:[3.0]% of the Loan Amount payable by the Borrower to the Arranger on the Extension Date.

Interest Period:Interest shall be payable on a quarterly basis, commencing from the Utilisation Date.

Interest Rate:[9.5]% p.a. on the Loan Amount, calculated on a 30/360 daycount basis, payable in arrears.

Default Interest:2.0% p.a. above Interest Rate.

Initial Maturity Date:[12] months from the Utilisation Date.

Final Maturity Date: [24] months from the Utilisation Date, subject to the Lenders approval for an extension at least 10 Business Days before Initial Maturity Date (Extension Date) after a written extension request from the Borrower.

For the avoidance of doubt, if the extension is not approved by Lenders on or before the Extension Date, the Initial Maturity Date shall be the Final Maturity Date.

Loan Repayment:The Loan Amount will be payable on the Final Maturity Date or the date of Voluntary Prepayment.

Loan Repayment Amount:The Loan Repayment Amount shall be determined by the Calculation Agent, being the aggregate of the Loan Amount, accrued and unpaid Interest, and the break costs (if any)

Voluntary Prepayment:The Borrower will be permitted to voluntarily prepay the Loan, in whole but not in part, on any date after the Utilisation Date, provided that it has given 5 Business Days prior written notice to the Facility Agent, and payment of the Loan Repayment Amount and Minimum Payment Amount is made on the date of prepayment.

Minimum Payment Amount:An amount, as determined by the Facility Agent, being equivalent to the total Interest which would have been paid from the date of prepayment up to the Final Maturity Date as if the Loan had not been prepaid.

Debt Service Reserve Amount:An amount equivalent to the next [ ] months of Interest based on the Loan Amount, to be maintained in the Debt Service Reserve Account at all times.

Debt Service Reserve AccountThe Borrower shall maintain a cash account with the Offshore Account Bank for the Debt Service Reserve Amount. The account shall be pledged in favour of the Lenders.

The balance in the cash account shall be used solely for the purpose of making payments to the Lenders under the Loan.

Cash Collateral AccountThe Borrower shall maintain a cash account with the Offshore Account Bank for the purpose of pledging USD cash as collateral. The account shall be pledged in favour of the Lenders.

The balance in the cash account shall be used solely for the purpose of making payments to the Lenders under the Loan.

IDR Account:The Borrower shall maintain an onshore IDR cash account with the Custodian. The account shall be pledged in favour of the Lenders.

FX Rate:The prevailing USD / IDR exchange rate on any day shall be the USD / IDR exchange rate as set out on the Bloomberg page IDRXFIX at 10:30 a.m. Jakarta time fixing on the respective Business Day, otherwise on the immediately preceding day, or if no such rate is published for such day, the latest available rate of exchange on the most recent prior day for which such rate was published.

JSX:Jakarta Stock Exchange.

Alam Sutera Realty Shares On the Utilisation Date, [ ] common shares of PT Alam Sutera Realty Tbk (Alam Sutera)(Bloomberg Ticker: ASRI IJ), that are freely tradeable and unrestricted.

On the Utilisation Date, the Security Coverage Ratio in respect of Alam Sutera Shares immediately prior to utilisation shall not be lower than the Initial Coverage Ratio.

Security:The Security shall include but not be limited to

1. fixed and floating charge on all assets of the Borrower;

2. pledge over the Alam Sutera Shares;

3. pledge of 100% Borrower shares; and

4. first ranking charge over the Debt Service Reserve Account, Cash Collateral Account, IDR Account and Custodian Account.

Application of Dividends from Security:Any Dividends (in the form of cash, in specie or otherwise) paid from the Security shall be retained by the Security Agent throughout the life of the Facility and shall be paid into the IDR Account or Cash Collateral Account, as applicable, provided that the Borrower can request for the release of all Dividends paid into the collateral account if following the release, the Security Coverage Ratio is greater than the Initial Coverage Ratio.

Security Coverage Ratio:The Security Coverage Ratio on any Jakarta Business Day shall be determined by the Calculation Agent in accordance with the following formula:A divided by B, where

A means the Alam Sutera Shares Market Value; and

B means the Outstanding Amount.

Alam Sutera Shares Market Value:As determined by the Calculation Agent, the product of

i. the prevailing daily volume weighted average traded price of the Alam Sutera Shares as traded on the JSX for each relevant Business Day, converted into USD at the then prevailing FX Rate; and

ii. the outstanding number of Alam Sutera Shares pledged in the Custodian Account at that point in time.

Outstanding Amount:On the Utilisation Date, the Outstanding Amount shall be the Loan Amount to be drawn.

On any other day, the Outstanding Amount shall be the aggregate of:

i. the outstanding Loan Amount; plus

ii. any accrued and unpaid Interest; plus

iii. the Minimum Payment Amount; minus

iv. the outstanding Cash Collateral; minus

v. the balance in the IDR Account.

For the purpose of this calculation, any balance in the IDR Account shall be converted into USD at the FX rate for that day.

Initial Coverage Ratio:Minimum of [2.75]x of the Outstanding Amount.

For the purpose of calculating the Initial Coverage Ratio on the date falling 3 Business Days before the Utilisation Date, the Alam Sutera Shares Market Value shall be calculated using the volume weighted average traded price of the Alam Sutera Shares on the [ ] immediately preceding trading days of the JSX.

Top Up Trigger:In the event that the Security Coverage Ratio on any Jakarta Business Day is equal to or less than the Top Up Threshold, additional USD cash collateral shall be pledged by the Borrower (rounded up to the nearest US$ 100,000) (Cash Collateral) and deposited into the Cash Collateral Account within 2 Jakarta Business Days from the date on which the Top Up notice is issued, such that the Security Coverage Ratio shall be no less than the Initial Coverage Ratio.

Top Up Threshold:[2.35]x of the Outstanding Amount.

Top Down Trigger:In the event that the Security Coverage Ratio on any 2 consecutive Business Days is equal to or more than the Top Down Threshold, any outstanding Cash Collateral that was previously pledged by the Borrower shall be returned to the Borrower (subject to a minimum of US$ 100,000) upon the Borrowers request, such that the Security Coverage Ratio shall be no less than the Initial Coverage Ratio.

Top Down Threshold:[2.75]x of the Outstanding Amount.

For purpose of calculating the Top Down Threshold, item (iv) of the Outstanding Amount definition shall be excluded in this computation.

Liquidation Trigger:In the event that the Security Coverage Ratio on any Jakarta Business Day is less than or equal to Liquidation Threshold, the Lenders shall have the right to immediately liquidate the pledged Alam Sutera Shares and/or outstanding balance in the Debt Service Reserve Account, Cash Collateral Account or IDR Account without notice or delay. Any excess security remaining after payment of the amount due to the Lenders, shall be returned to the Borrower.

Liquidation Threshold:[2.15]x of the Outstanding Amount.

In the event that Liquidation Threshold is breached, the Facility Agent shall notify the Borrower accordingly. For the avoidance of doubt, any failure to do so shall not affect the Lenders rights to liquidate the Pledged Alam Sutera Shares.

Liquidity Trigger:In the event that the [ ]-Jakarta Business Day average value traded on Alam Sutera shares on the JSX is below USD [ ] (Liquidity Threshold), the Lenders shall have the right to immediately liquidate the pledged Alam Sutera Shares and/or outstanding balance in the Debt Service Reserve Account, Cash Collateral Account or IDR Account without notice or delay. Any excess security remaining after payment of the amount due to the Lenders, shall be returned to the Borrower.In the event that Liquidity Threshold is breached, the Facility Agent shall notify the Borrower accordingly. For the avoidance of doubt, any failure to do so shall not affect the Lenders rights to liquidate the Pledged Alam Sutera Shares.

Covenants (including Financial Covenants):Covenants shall be usual for a transaction of this type in form and substance acceptable to the Lenders including, but not limited to (a) No further indebtedness;(b) No granting of security interest over assets over than for the purpose of this Loan;(c) Restricted payments, including dividends;(d) Margining and daily monitoring requirements;(e) Any other covenants as requested by the Lenders.For the avoidance of doubt, the covenants shall be maintained at all times throughout the life of the deal and tested on all Jakarta Business Days.

Representations, Warranties and Undertakings:Representations, Warranties and Undertakings shall be usual for a transaction of this type in form and substance acceptable to the Lenders including, but not limited to.

(a) Non-disposal of assets by the Borrower without prior written consent of the Lenders;(b) No breach of any regulations including securities laws; (c) Any other representations, warranties and undertakings as requested by the Lenders.

Events of Default:Events of default shall be usual for a transaction of this type in form and substance acceptable to the Lenders including, but not limited to:(a) Cross default into any PT Alam Sutera Realty Tbk indebtedness; (b) Failure to post additional collateral within 2 Jakarta Business Days (see Top Up Trigger)(c) Suspension (5 Trading Days in the case of voluntary suspension and 3 Trading Days in the case of involuntary suspension) or delisting of Alam Sutera Shares; (d) Failure to pay principal, interest, or any other sums due under the Loans;(e) Change of control of the Borrower or Alam Sutera ;(f) Breach of covenants, misrepresentations;(g) Insolvency, bankruptcy or analogous event;(h) Illegality of the Borrower to perform any of its obligations under this transaction;(i) Security ceases to be in effect;(j) Breach of the Liquidation Threshold or Liquidity Threshold; and(k) Any other events of defaults as requested by the Lenders.Upon an Event of Default, the Lenders shall be able to accelerate and enforce on the Security.

Conditions Precedent:Conditions precedent for the Utilisation shall be usual for a transaction of this type in form and substance acceptable to the Lenders including, but not limited to:

(a) Constitutive documents and corporate authorisations (including board resolutions, and if required, shareholder resolutions) of the Borrower, evidencing all Borrower approvals have been obtained;

(b) Financial, business and legal due diligence shall have been conducted to the satisfaction of the Lenders;

(c) Lenders obtaining all final internal approvals;

(d) Execution of the Documentation satisfactory to the Arranger/Lenders;

(e) Execution and perfection of Security for which all the requirements, notices and any other procedural steps required, to perfect such Security have been received or completed to the Security Agent's satisfaction;(f) Legal opinions of external counsel in a form acceptable to the Lenders;

(g) Representations and warranties are true and correct in all material aspects on and as of the Utilisation Date;

(h) Payment by the Borrower of all fees and expenses incurred in relation to preparation, negotiations and execution of the Loan and any ancillary documents, shall be in the form of a deduction from the Loan proceeds; (i) Security Coverage Ratio (using the Alam Sutera Shares Market Value immediately prior to the Utilisation) is not lower than the Initial Coverage Ratio;

(j) Perfection of security (including but not limited to the Alam Sutera Shares being pledged in the Custodian Account); and

(k) Such other documents / conditions as the Lenders may request.

Documentation:Facility agreement, Security agreements and other documentation, all in form and substance acceptable to the Lenders, shall include provisions usual for a transaction of this type.

Taxes:All repayments of principal and payments of interest, fees and other amounts due under the Loan will be made free and clear of all present and future taxes, charges, duties, imposts, levies, withholdings or other deductions whatsoever. If the Borrower is required to withhold or deduct any taxes, it will pay such additional amounts as are necessary to ensure the amount received by the Lenders will be equal the full amount which would have been received had no such deduction or withholding been required.

Expenses:The Borrower shall be responsible for all expenses incurred by the Arranger in connection with the Loan.

The Borrower undertakes to reimburse the Arranger for all out-of-pocket costs and expenses (including fees, charges and disbursements of the legal counsel) incurred by the Lenders in connection with the preparation and negotiation of this proposed transaction.

Transferability:The Lenders shall have the right to transfer or assign the Loan or any part of the Loan to any third party without the consent of the Borrower.

Confidentiality:The Term Sheet and its content are intended for the exclusive use of the Borrower group and shall not be disclosed by the Borrower to any person other than the Borrowers legal and financial advisors for the purpose of the proposed transaction unless the prior written consent of the Arranger is obtained.

Calculation Agent:DB Trustees (Hong Kong) Limited

Custodian Account:A segregated pledge account held with the Custodian

Custodian:Deutsche Bank AG, Jakarta Branch

Offshore Account Bank:Deutsche Bank AG, Singapore Branch

Facility Agent and Security Agent:DB Trustees (Hong Kong) Limited

Business Days:New York, Jakarta and Hong Kong

Governing Law & Jurisdiction:The laws of England and the non-exclusive jurisdiction of the courts of England and applicable local laws in respect of the Security.

We confirm that in making our decision to request the execution of the above transaction, we have (a) not relied on DB, whom we acknowledge is neither acting as our advisor nor in a fiduciary capacity, (b) conducted a detailed analysis of the appropriateness, merits and risks of the proposed transaction in light of our objectives, financial situation and needs and (c) obtained, independently of DB, such professional advice as we deem necessary.Agreed and accepted by BorrowerSignature:

Name: (Authorised Signatory)

Title: Important Notice

This term sheet is intended for discussion purposes only and does not create any legally binding obligations on the part of Deutsche Bank AG and/or its affiliates (DB). Without limitation, this term sheet does not constitute an offer, an invitation to offer or a recommendation to enter into any transaction. When making an investment decision, you should rely solely on the final documentation relating to the transaction and not the summary contained herein.

DB transacts business with counterparties on an arms length basis and on the basis that each counterparty is sophisticated and capable of independently evaluating the merits and risks of each transaction. DB is not acting as your financial adviser or in any other fiduciary capacity with respect to this proposed transaction unless otherwise expressly agreed by us in writing; therefore this document does not constitute advice or a recommendation. This transaction may not be appropriate for all investors and before entering into any transaction you should take steps to ensure that you fully understand the transaction and have made an independent assessment of the appropriateness of the transaction in the light of your own objectives and circumstances, including the possible risks and benefits of entering into such transaction. You should also consider seeking advice from your own advisers in making this assessment. If you decide to enter into this transaction, you do so in reliance on your own judgment.

Although we believe the contents of this document to be reliable, we make no representation as to the completeness or accuracy of the information. To the extent permitted by applicable law, DB does not accept liability for any direct, consequential or other loss arising from reliance on this document. The distribution of this document and availability of these products and services in certain jurisdictions may be restricted by law. Copyright 2012 Deutsche Bank AG.

For internal use only

8