Univariate Time Series - UCLuctpsc0/Teaching/GR03/TS1.pdf · (Dynamic causal e⁄ect) What is the...

-

Upload

truongdung -

Category

Documents

-

view

225 -

download

0

Transcript of Univariate Time Series - UCLuctpsc0/Teaching/GR03/TS1.pdf · (Dynamic causal e⁄ect) What is the...

Univariate Time Series

Fall 2008

Environmental Econometrics (GR03) TSI Fall 2008 1 / 16

Time Series I

A time series Yt is a process (or data) observed in sequence overtime, t = 1, ...,T .

macroeconomic series: e.g., in�ation rate, GDP, unemployment,....temperature over time in global warmingmonthly or annual returns of �nancial assets

The key issue in time series is temporal dependence.In order to have a meaningful regression analysis, we need somerestrictions on temporal dependence.

Environmental Econometrics (GR03) TSI Fall 2008 2 / 16

Time Series I

A time series Yt is a process (or data) observed in sequence overtime, t = 1, ...,T .

macroeconomic series: e.g., in�ation rate, GDP, unemployment,....

temperature over time in global warmingmonthly or annual returns of �nancial assets

The key issue in time series is temporal dependence.In order to have a meaningful regression analysis, we need somerestrictions on temporal dependence.

Environmental Econometrics (GR03) TSI Fall 2008 2 / 16

Time Series I

A time series Yt is a process (or data) observed in sequence overtime, t = 1, ...,T .

macroeconomic series: e.g., in�ation rate, GDP, unemployment,....temperature over time in global warming

monthly or annual returns of �nancial assets

The key issue in time series is temporal dependence.In order to have a meaningful regression analysis, we need somerestrictions on temporal dependence.

Environmental Econometrics (GR03) TSI Fall 2008 2 / 16

Time Series I

A time series Yt is a process (or data) observed in sequence overtime, t = 1, ...,T .

macroeconomic series: e.g., in�ation rate, GDP, unemployment,....temperature over time in global warmingmonthly or annual returns of �nancial assets

The key issue in time series is temporal dependence.In order to have a meaningful regression analysis, we need somerestrictions on temporal dependence.

Environmental Econometrics (GR03) TSI Fall 2008 2 / 16

Time Series I

A time series Yt is a process (or data) observed in sequence overtime, t = 1, ...,T .

macroeconomic series: e.g., in�ation rate, GDP, unemployment,....temperature over time in global warmingmonthly or annual returns of �nancial assets

The key issue in time series is temporal dependence.

In order to have a meaningful regression analysis, we need somerestrictions on temporal dependence.

Environmental Econometrics (GR03) TSI Fall 2008 2 / 16

Time Series I

A time series Yt is a process (or data) observed in sequence overtime, t = 1, ...,T .

macroeconomic series: e.g., in�ation rate, GDP, unemployment,....temperature over time in global warmingmonthly or annual returns of �nancial assets

The key issue in time series is temporal dependence.In order to have a meaningful regression analysis, we need somerestrictions on temporal dependence.

Environmental Econometrics (GR03) TSI Fall 2008 2 / 16

Example: Disposal income and consumption in USA

8000

1000

012

000

1400

016

000

1800

0pe

r cap

ita re

al d

isp.

inc.

/per

cap

ita re

al c

ons.

1960 1970 1980 1990 200019591995

per capita real disp. inc. per capita real cons.

Environmental Econometrics (GR03) TSI Fall 2008 3 / 16

Example: Average temperature in Central London

78

910

11te

mp

1700 1800 1900 2000year

Environmental Econometrics (GR03) TSI Fall 2008 4 / 16

Example: Return on three-month T-bills in USA

05

1015

3 m

o. T

bill

rate

1960 1970 1980 1990 200019591995

Environmental Econometrics (GR03) TSI Fall 2008 5 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.

(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ationthe e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ationthe e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ation

the e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ationthe e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ationthe e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ationthe e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?

the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ationthe e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Time Series II

The two main economic problems from time series are dynamiccausal e¤ects and economic forecasting.(Dynamic causal e¤ect) What is the e¤ect of X on Y over time?

the short-run/long-run e¤ect of a change in an interest rate (by centralbank) on in�ationthe e¤ect of a decrease of carbon dioxide (by regulation) on globalwarming in 1/10/100 years later

(Economic forecasting) What are predicted future values of Y , givenavailable information?

average temperature in 2050?the forecasting is not necessarily based on the causality relationship.

We can separate time series into two categories: univariate (Yt isscalar) and multivariate (Yt is vector-valued).

Environmental Econometrics (GR03) TSI Fall 2008 6 / 16

Stationarity: future will be like past

A time series fYtg is covariance stationary if its mean and(co-)variances are constant across time periods:

E (Yt ) = µ, Var (Yt ) = σ2 for all t

Cov (Yt ,Yt+k ) = γ (k) for all t and k

γ (k) is called the autocovariance function and ρ (k) = γ (k) /γ (0)is the autocorrelation function.

fYtg is said to be strictly stationary if the joint distribution of(Yt , ...,Yt+k ) is independent of all t and k.

Thus, a stationary time series is one whose probability distributionsare stable over time.

Environmental Econometrics (GR03) TSI Fall 2008 7 / 16

Stationarity: future will be like past

A time series fYtg is covariance stationary if its mean and(co-)variances are constant across time periods:

E (Yt ) = µ, Var (Yt ) = σ2 for all t

Cov (Yt ,Yt+k ) = γ (k) for all t and k

γ (k) is called the autocovariance function and ρ (k) = γ (k) /γ (0)is the autocorrelation function.

fYtg is said to be strictly stationary if the joint distribution of(Yt , ...,Yt+k ) is independent of all t and k.

Thus, a stationary time series is one whose probability distributionsare stable over time.

Environmental Econometrics (GR03) TSI Fall 2008 7 / 16

Stationarity: future will be like past

A time series fYtg is covariance stationary if its mean and(co-)variances are constant across time periods:

E (Yt ) = µ, Var (Yt ) = σ2 for all t

Cov (Yt ,Yt+k ) = γ (k) for all t and k

γ (k) is called the autocovariance function and ρ (k) = γ (k) /γ (0)is the autocorrelation function.

fYtg is said to be strictly stationary if the joint distribution of(Yt , ...,Yt+k ) is independent of all t and k.

Thus, a stationary time series is one whose probability distributionsare stable over time.

Environmental Econometrics (GR03) TSI Fall 2008 7 / 16

Nonstationarity

A time series process that is not stationary is called a nonstationaryprocess.

changing mean:Yt = β0 + β1t + ut

changing variance:Yt = Yt�1 + ut

This process is called the random walk.changing mean and variance:

Yt = β0 + Yt�1 + ut

This process is called the random walk with drift.

It is easier to spot certain nonstationary series rather than stationaryones.

Environmental Econometrics (GR03) TSI Fall 2008 8 / 16

Nonstationarity

A time series process that is not stationary is called a nonstationaryprocess.

changing mean:Yt = β0 + β1t + ut

changing variance:Yt = Yt�1 + ut

This process is called the random walk.changing mean and variance:

Yt = β0 + Yt�1 + ut

This process is called the random walk with drift.

It is easier to spot certain nonstationary series rather than stationaryones.

Environmental Econometrics (GR03) TSI Fall 2008 8 / 16

Nonstationarity

A time series process that is not stationary is called a nonstationaryprocess.

changing mean:Yt = β0 + β1t + ut

changing variance:Yt = Yt�1 + ut

This process is called the random walk.

changing mean and variance:

Yt = β0 + Yt�1 + ut

This process is called the random walk with drift.

It is easier to spot certain nonstationary series rather than stationaryones.

Environmental Econometrics (GR03) TSI Fall 2008 8 / 16

Nonstationarity

A time series process that is not stationary is called a nonstationaryprocess.

changing mean:Yt = β0 + β1t + ut

changing variance:Yt = Yt�1 + ut

This process is called the random walk.changing mean and variance:

Yt = β0 + Yt�1 + ut

This process is called the random walk with drift.

It is easier to spot certain nonstationary series rather than stationaryones.

Environmental Econometrics (GR03) TSI Fall 2008 8 / 16

Nonstationarity

A time series process that is not stationary is called a nonstationaryprocess.

changing mean:Yt = β0 + β1t + ut

changing variance:Yt = Yt�1 + ut

This process is called the random walk.changing mean and variance:

Yt = β0 + Yt�1 + ut

This process is called the random walk with drift.

It is easier to spot certain nonstationary series rather than stationaryones.

Environmental Econometrics (GR03) TSI Fall 2008 8 / 16

Example 1: Changing mean

Yt = β0 + β1t + ut , where β0 = 0, β1 = 1 and ut � iid N (0, 1)

020

4060

8010

0y/

mea

n_y

0 20 40 60 80 100time

y mean_y

Environmental Econometrics (GR03) TSI Fall 2008 9 / 16

Example 2: Random walk

Yt = Yt�1 + ut , where Y0 = 0 and ut � iid N (0, 1)

50

510

y

0 20 40 60 80 100time

Environmental Econometrics (GR03) TSI Fall 2008 10 / 16

Example 3: Random walk with drift

Yt = β0 + Yt�1 + ut , where β0 = 1, Y0 = 0 and ut � iid N (0, 1)

050

100

y/m

ean_

y

0 20 40 60 80 100time

y mean_y

Environmental Econometrics (GR03) TSI Fall 2008 11 / 16

Ergodicity

In most of stationary time series analysis, we will still use the OLSestimation method.

In order to have properties of consistency and asymptotic normality ofestimators, we need another property of stationary time series.

A stationary time series is (loosely) said to be ergodic if γ (k)! 0as k ! ∞. Sometime a similar property is called weakly dependent.(Ergodic Theorem) If Yt is strictly stationary and ergodic andE jYt j < ∞, then as T ! ∞,

1T

T

∑t=1Yt !p E (Yt )

Using the Ergodic theorem, we can establish the consistency andasymptotic normality of OLS estimatiors in the regression withstationary and ergodic time series.

Environmental Econometrics (GR03) TSI Fall 2008 12 / 16

Ergodicity

In most of stationary time series analysis, we will still use the OLSestimation method.

In order to have properties of consistency and asymptotic normality ofestimators, we need another property of stationary time series.

A stationary time series is (loosely) said to be ergodic if γ (k)! 0as k ! ∞. Sometime a similar property is called weakly dependent.(Ergodic Theorem) If Yt is strictly stationary and ergodic andE jYt j < ∞, then as T ! ∞,

1T

T

∑t=1Yt !p E (Yt )

Using the Ergodic theorem, we can establish the consistency andasymptotic normality of OLS estimatiors in the regression withstationary and ergodic time series.

Environmental Econometrics (GR03) TSI Fall 2008 12 / 16

Ergodicity

In most of stationary time series analysis, we will still use the OLSestimation method.

In order to have properties of consistency and asymptotic normality ofestimators, we need another property of stationary time series.

A stationary time series is (loosely) said to be ergodic if γ (k)! 0as k ! ∞. Sometime a similar property is called weakly dependent.

(Ergodic Theorem) If Yt is strictly stationary and ergodic andE jYt j < ∞, then as T ! ∞,

1T

T

∑t=1Yt !p E (Yt )

Using the Ergodic theorem, we can establish the consistency andasymptotic normality of OLS estimatiors in the regression withstationary and ergodic time series.

Environmental Econometrics (GR03) TSI Fall 2008 12 / 16

Ergodicity

In most of stationary time series analysis, we will still use the OLSestimation method.

In order to have properties of consistency and asymptotic normality ofestimators, we need another property of stationary time series.

A stationary time series is (loosely) said to be ergodic if γ (k)! 0as k ! ∞. Sometime a similar property is called weakly dependent.(Ergodic Theorem) If Yt is strictly stationary and ergodic andE jYt j < ∞, then as T ! ∞,

1T

T

∑t=1Yt !p E (Yt )

Using the Ergodic theorem, we can establish the consistency andasymptotic normality of OLS estimatiors in the regression withstationary and ergodic time series.

Environmental Econometrics (GR03) TSI Fall 2008 12 / 16

Ergodicity

In most of stationary time series analysis, we will still use the OLSestimation method.

In order to have properties of consistency and asymptotic normality ofestimators, we need another property of stationary time series.

A stationary time series is (loosely) said to be ergodic if γ (k)! 0as k ! ∞. Sometime a similar property is called weakly dependent.(Ergodic Theorem) If Yt is strictly stationary and ergodic andE jYt j < ∞, then as T ! ∞,

1T

T

∑t=1Yt !p E (Yt )

Using the Ergodic theorem, we can establish the consistency andasymptotic normality of OLS estimatiors in the regression withstationary and ergodic time series.

Environmental Econometrics (GR03) TSI Fall 2008 12 / 16

Autoregressions

We �rst focus on the case with univariate time series, fYtgTt=1. LetIt�1 = fYt�1,Yt�2, ...g denote the past history of the series.

The primary example in the univariate time series is a model ofautoregression specifying that only a �nite number of past lagsmatter:

E (Yt jIt�1) = E (Yt jYt�1, ...,Yt�k ) .An autoregressive process of order k, called AR (k), is

Yt = µ+ ρ1Yt�1 + ...+ ρkYt�k + ut ,

whereE (ut jIt�1) = 0.

Environmental Econometrics (GR03) TSI Fall 2008 13 / 16

Autoregressions

We �rst focus on the case with univariate time series, fYtgTt=1. LetIt�1 = fYt�1,Yt�2, ...g denote the past history of the series.The primary example in the univariate time series is a model ofautoregression specifying that only a �nite number of past lagsmatter:

E (Yt jIt�1) = E (Yt jYt�1, ...,Yt�k ) .

An autoregressive process of order k, called AR (k), is

Yt = µ+ ρ1Yt�1 + ...+ ρkYt�k + ut ,

whereE (ut jIt�1) = 0.

Environmental Econometrics (GR03) TSI Fall 2008 13 / 16

Autoregressions

We �rst focus on the case with univariate time series, fYtgTt=1. LetIt�1 = fYt�1,Yt�2, ...g denote the past history of the series.The primary example in the univariate time series is a model ofautoregression specifying that only a �nite number of past lagsmatter:

E (Yt jIt�1) = E (Yt jYt�1, ...,Yt�k ) .An autoregressive process of order k, called AR (k), is

Yt = µ+ ρ1Yt�1 + ...+ ρkYt�k + ut ,

whereE (ut jIt�1) = 0.

Environmental Econometrics (GR03) TSI Fall 2008 13 / 16

AR(1) Model

AR(1) Model:Yt = µ+ ρYt�1 + ut

if jρj < 1, thenE (Yt ) =

µ

1� ρ

Var (Yt ) =σ2

1� ρ2

Cov (Yt ,Yt�k ) = σ2ρk

1� ρ2

If jρj < 1, the process fYtg is stationary and ergodic.(Estimation) In order to estimate µ and ρ, we just need to run theOLS regression of Yt�1 on Yt .

Environmental Econometrics (GR03) TSI Fall 2008 14 / 16

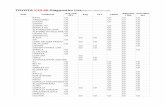

Example: Consumption growth in USA

We model the consumption growth series in USA as AR(1):

gct = µ+ ρgct�1 + ut

Coe¤. Std. Err.

gc_1 0.45 0.156constant 0.01 0.003

.01

0.0

1.0

2.0

3.0

4lc

lc

[_n

1]/L

inea

r pre

dict

ion

.01 0 .01 .02 .03 .04gc[_n1]

lc lc[_n1] Linear predictionEnvironmental Econometrics (GR03) TSI Fall 2008 15 / 16

Moving Average

Another example is a model of moving average process of order q,fYtg, that is a weighted sum of lagged i.i.d. shocks:

Yt = µ+ ut + λ1ut�1 + ...+ λqut�q

The simplest case is a moving average process of order 1, calledMA (1):

Yt = µ+ ut + λut�1

E (Yt ) = µ, Var (Yt ) =�1+ λ2

�σ2

Cov (Yt ,Yt�1) = γ(1) = λσ2

Cov (Yt ,Yt�k ) = γ(k) = 0 for k � 2

Thus, an MA(1) process is stationary and ergodic.

Environmental Econometrics (GR03) TSI Fall 2008 16 / 16

Moving Average

Another example is a model of moving average process of order q,fYtg, that is a weighted sum of lagged i.i.d. shocks:

Yt = µ+ ut + λ1ut�1 + ...+ λqut�q

The simplest case is a moving average process of order 1, calledMA (1):

Yt = µ+ ut + λut�1

E (Yt ) = µ, Var (Yt ) =�1+ λ2

�σ2

Cov (Yt ,Yt�1) = γ(1) = λσ2

Cov (Yt ,Yt�k ) = γ(k) = 0 for k � 2

Thus, an MA(1) process is stationary and ergodic.

Environmental Econometrics (GR03) TSI Fall 2008 16 / 16

Moving Average

Another example is a model of moving average process of order q,fYtg, that is a weighted sum of lagged i.i.d. shocks:

Yt = µ+ ut + λ1ut�1 + ...+ λqut�q

The simplest case is a moving average process of order 1, calledMA (1):

Yt = µ+ ut + λut�1

E (Yt ) = µ, Var (Yt ) =�1+ λ2

�σ2

Cov (Yt ,Yt�1) = γ(1) = λσ2

Cov (Yt ,Yt�k ) = γ(k) = 0 for k � 2

Thus, an MA(1) process is stationary and ergodic.

Environmental Econometrics (GR03) TSI Fall 2008 16 / 16

Moving Average

Another example is a model of moving average process of order q,fYtg, that is a weighted sum of lagged i.i.d. shocks:

Yt = µ+ ut + λ1ut�1 + ...+ λqut�q

The simplest case is a moving average process of order 1, calledMA (1):

Yt = µ+ ut + λut�1

E (Yt ) = µ, Var (Yt ) =�1+ λ2

�σ2

Cov (Yt ,Yt�1) = γ(1) = λσ2

Cov (Yt ,Yt�k ) = γ(k) = 0 for k � 2

Thus, an MA(1) process is stationary and ergodic.

Environmental Econometrics (GR03) TSI Fall 2008 16 / 16