UNITED NATIONS CASE STUDY ON EMPLOYEE BENEFITS …ipsastraining.un.org/Course 5/c/resources/36....

Transcript of UNITED NATIONS CASE STUDY ON EMPLOYEE BENEFITS …ipsastraining.un.org/Course 5/c/resources/36....

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 1 of 31

IPSAS 25 EMPLOYEE BENEFITS GUIDANCE NOTE 1

UNITED NATIONS CASE STUDY ON EMPLOYEE BENEFITS

Executive Summary IPSAS 25 Employee Benefits (IPSAS 25) sets out requirements for the accounting and reporting of employee benefits, which the Standard defines as all forms of consideration given by an entity in exchange for services rendered by employees. A previous policy paper, ED 31 Employee Benefits dated 23 March 2007, provided general guidance on the recognition, measurement and disclosure requirements relating to employee benefits.

This Guidance Note:

• Focuses on the experience of the United Nations as regards the recognition, measurement and disclosures of employee benefits relating to After Service Health Insurance (ASHI).

• Discusses briefly the work done to date on employee benefits relating to unused annual leave and end-of-service repatriation.

• Traces the road to compliance with IPSAS 25, from the initial recognition of the liabilities for ASHI, unused annual leave and repatriation benefits in the interim financial statements of the United Nations as at 31 December 2006 to projected full compliance with the Standard by 2010.

• Examines a number of related issues resulting from the recognition of the employee benefit liabilities, specifically looking at the funding of the liabilities, and the recording and presentation of unbudgeted expenses.

• Highlights the importance of the information system requirements for successful implementation of IPSAS 25.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 2 of 31

DRAFT: IPSAS 25 EMPLOYEE BENEFITS: GUIDANCE NOTE 1

United Nations Case St udy on Employee Benefits

February 2008

This guidance is subordinate to IPSAS

1 The final authority on IPSAS 25 Employee Benefits is IPSAS 25. If a conflict between this guidance and the Standard is identified, the requirements of the Standard apply.

Guidance Notes

2 Guidance Notes aim to support United Nations System organizations as they implement IPSAS requirements. Guidance Notes may include explanations of what a particular standard means and how a standard should be applied to United Nations System specific situations, transactions or events, descriptions of the range of acceptable practices which may include identification of a best practice where one exists, and guidance on practical implementation tasks.

Guidance requested on employee benefits

3 Guidance on the recognition, measurement and disclosure requirements for benefits provided to employees was first provided in the policy paper ED 31 Employee Benefits dated 23 March 2007 that was considered at the April 2007 meeting of the Task Force on Accounting Standards (Task Force). That meeting considered and approved the use of the “Corridor” method when accounting for defined benefit plans. The “Corridor” method allows an entity to recognize only a portion of its actuarial gains and losses when the net cumulative unrecognized gains and losses at the end of the previous reporting period exceeded certain limits (IPSAS 25, paragraphs 105 and 106).

4 During the Focus Group discussions of the policy paper ED 31 Employee Benefits, United Nations System organizations such as UNICEF and UNIDO requested guidance on the accounting and reporting for post-employment benefits, specifically for the After Service Health Insurance (ASHI) and the United Nations Joint Staff Pension Fund (UNJSPF). In addition, United Nations System organizations have directly contacted the United Nations and requested the sharing of its experience relating to the accounting and reporting of items of employee benefits liabilities that have been recognized in its financial statements.

5 This Guidance Note provides a response to the requests for guidance by detailing the experience of the United Nations as regards the accounting and reporting of its post-employment benefits for ASHI and looking briefly at the work done to date on employee benefits relating to unused annual leave and end-of-service repatriation. Guidance on the accounting and reporting relating to the UNJSPF will be provided separately. After-Service Health Insurance (ASHI) ASHI – the programme 6 The ASHI programme at the United Nations extends subsidized health insurance coverage to retirees and their dependants under the same health insurance schemes as for active staff, if the eligibility requirements are met. Refer to ST/IC/2007/20 dated 31 May

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 3 of 31

2007, which can be found at www.un.org/insurance, for complete eligibility requirements and programme benefits.

7 The United Nations health benefits programmes are self- funded with insurance companies engaged as third-party administrators for the general management of the plans and for the adjudication of claims. All claims paid by the third-party administrators are reimbursed by the United Nations and, in addition, an administrative fee is paid. At present, expenditures relating to the Organization’s subsidy of the ASHI programme are appropriated under Section 32 of the Programme Budget and recorded on a ‘pay-as-you- go’, basis. Commencing 31 December 2006, the Organization’s liability for ASHI benefits to be paid in the future was recognized in the United Nation’s financial statements. At present, no assets have been segregated to provide for these ASHI benefits.

ASHI – the extent of the liability at the United Nations

8 Since the inception of the ASHI programme at the United Nations in 1967, the programme has grown both in terms of the number of participants and the related costs. With the growth of the programme funded on a ‘pay-as-you- go basis’, came a growth in an unrecognized liability for ASHI benefits to be paid in the future. This liability was first actuarially calculated and disclosed in the notes to the financial statements of the United Nations as at 31 December 1995. At that time, the ASHI liability was determined to be $786.8 million, participants totalled about 3,400 enrolees and the Organization’s biennial cost of the subsidy was about $28.7 million.

9 Beginning in 1999, the increase in ASHI enrolment began to accelerate and as at 31 December 2007, enrolees stood at about 8,000, the 2006/2007 ‘pay-as-you-go’ amount was about $102.7 million, and the most recent ASHI liability stood at $2.1 billion (actuarially determined as at 31 December 2005). Based on historical trends, it is anticipated that enrolment and the ‘pay-as-you-go’ amount will continue to surge upwards, fuelled by demographic change, increases in the rate of medical care utilization and increases in the costs of medical treatment. A study1 conducted in 2006 projected these figures 25 years in the future, and anticipated that ASHI participants by the year 2031 will exceed 14,000 enrolees, ‘pay-as-you-go’ requirements will be about $666 million and the ASHI liability will be approaching $5 billion.

The liability at other United Nations System organizations

10 While most United Nations System organizations have programmes similar in nature to ASHI, the organizations are at significantly varying positions as regards the recognition of the related liabilities and meeting the other requirements of IPSAS 25. At one end, some organizations such as UNEP, have not yet completed an actuarial valuation of its liability, while other organizations, such as the United Nations, have fully accrued the liability. IFAD is the only organization within the United Nations System that has fully recognized and funded its liability. Appendices 1 and 2 provide a summary status of the most recently collated information on liabilities for post-employment health benefits within the United Nations System.

1 Refer presentation of A/61/730 to the Fifth Committee dated 14 March 2007

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 4 of 31

Why the United Nations chose to recognize the liabilities now

Recognition of the liabilities to support funding requests

11 The Board of Auditors in its report A/57/201 which summarized the principal findings, conclusions and recommendations contained in the audit reports on the accounts of fifteen United Nations System organizations for the period ended 31 December 2001, highlighted the issue of the rapid growth in the ASHI liabilities and recommended that the United Nations and its various funds and programmes review mechanisms and targets for providing for post-employment benefit liabilities.

12 As a result, a study of the post-employment liabilities for ASHI was commissioned by the United Nations General Assembly and, in the related report (A/60/450 of 27 October 2005), the Secretary General sought approval to recognise the liability in support of his request to fund the liability. The study highlighted that the ‘pay- as-you-go’ approach was no longer prudent as it captures only a portion of the current costs attributable to the ASHI programme and does not address the accumulated liability. The study recognized the need to build a reserve to address the rapidly escalating annual requirements, so as to avoid putting undue burden on subsequent years. The United Nations General Assembly agreed to recognize the ASHI liability but to date, no decision has been made regarding funding of the ASHI liability.

The move to best practices

13 Prior to December 2006, the United Nations liability for post-employment health benefits was not recognized on the face of the financial statements but disclosed in the notes, as allowed under United Nations System Accounting Standards (UNSAS). However, best accounting practices on employee benefits, including IPSAS 25 and IAS 19, require that post-employment benefits be accounted for on a full accrual basis under which the liability associated with ASHI is to be recognized when the employee has provided the service in exchange for benefits to be paid in the future.

14 Further, best accounting practices have highlighted that for employee benefit programmes such as ASHI , the recording of expenses only on a ‘pay-as you-go’ basis generally understates the full expenses of the programme that should be reflected in the entity’s financial statements. For example, for the 2004-2005 biennium, the actuarially determined ASHI expenses for service costs2 and interest costs3 of $84.1 million and $113.2 million respectively totalled significantly more than the ‘pay-as-you-go’ amount of $79.9 million. Having considered these best practices requirements, as detailed in A/60/450, the United Nations General Assembly, in its resolution 60/255 of 15 June 2006, recognized the liabilities for ASHI which initiated recognition of the liabilities in the Organization’s financial statements.

‘Phased-roll-out’ of IPSAS requirements

15 The recognition of the post-employment benefits for ASHI is also consistent with the IPSAS adoption strategy of ‘phased roll-out’ of IPSAS requirements, which is to progressively implement the detailed requirements of IPSAS prior to the IPSAS adoption date, to the extent possible and where there is no conflict with the requirements of UNSAS. 2 The post-retirement benefits earned during the current period of employee active service. 3 The accrual of interest on the present value of the liability due to the passage of time.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 5 of 31

16 The post-employment benefits for ASHI have now been recognized with the goal being full compliance with IPSAS 25 by 2010.

Overview of IPSAS requirements for employee benefits

17 The objective of IPSAS 25 is to prescribe the accounting, presentation and disclosure requirements for employee benefits. Detailed guidance on the requirements of this standard was presented in the policy paper on ED 31 Employee Benefits of March 2007. In summary, the standard requires an entity to recognize a liability when an employee has provided service in exchange for employee benefits to be paid in the future, and an expense when the entity consumes the economic benefits or service potential arising from service provided by an employee in exchange for employee benefits. The Standard categorizes employee benefits into four categories.

18 Short-term employee benefits fall due within twelve months after the end of the period in which the employees render the related services. Unused annual leave and accrued repatriation benefits are classified as short-term employee benefits unless they fall due beyond twelve months after the end of the related period.

19 Post-employment benefits are classified as either a defined contribution plan or a defined benefit plan. Under a defined contribution plan, an entity agrees to pay fixed contributions into a separate entity/fund and the reporting entity’s obligation is limited to the agreed amount. Under a defined benefit plan, the entity is obligated to provide the agreed benefits and bears the actuarial risk4 and investment risk5, accordingly a liability must be recognized for the discounted value of employees’ benefits to be paid in the future. Further, IPSAS 25 requires the recording of an expense to reflect the increase in the obligation resulting from employees’ service during the current period and prescribes detailed disclosure requirements for defined benefit plans. The ASHI programme at the United Nations is a defined benefit plan.

20 Other long-term employee benefits are payable twelve months or more after the end of the related period. IPSAS 25 requires the discounting and actuarial determination of the liability for other long-term employee benefits.

21 Termination benefits are payable as a result of either an entity’s decision to terminate an employee before the normal retirement date or an employee’s decision to accept voluntary redundancy in exchange for those benefits. Where termination benefits fall due more than twelve months after the related period, IPSAS 25 requires discounting.

ASHI: accounting and reporting as at 31 December 2006

ASHI liability – recognition as at 31 December 2006

22 In accordance with RES/60/255 of 15 June 2006, the United Nations General Assembly recognized the post-employment liability relating to ASHI and requested the Secretary General to disclose the liability in the financial statements of the Organization. Prior to this, the liability was disclosed in the notes to the financial statements.

23 The liability was initially recognized in the United Nations Volume I interim financial statements as at 31 December 2006 based on the actuarially calculated amounts as at 31 December 2005. The accounting entry was recorded as a debit adjustment to 4 The risk that benefits will cost more than expected. 5 The risk that assets invested will be insufficient to meet expected benefits.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 6 of 31

reserves and fund balances and a credit to the ASHI liability. At that time, the liability was not distributed by fund.

ASHI liability – measurement as at 31 December 2006

24 The ASHI liability is determined by a firm of consulting actuaries and the valuation is currently conducted every two years. The actuarial method used for the calculation is the projected unit credit method6, which is the method required by IPSAS 25.

25 The major actuarial assumptions used during the most recent valuation as at 31 December 2005 are: a discount rate of 5.5%, referenced to high quality corporate bonds, retirement and mortality assumptions based on those used by the UNJSPF, and an 8 year health care trend rate of 10.0%-5.0% for plans in the United States and 6.75% - 4.5% for plans outside the United States.

26 For the interim financial statements as at 31 December 2006, a single ASHI liability amount was recognized and no current period costs were recorded beyond the ‘pay-as-you-go’ amount.

ASHI liability – disclosures as at 31 December 2006

27 The change in accounting policy (from disclosure of the liabilities to recognition on the face of the financial statements) and the fact that the ASHI liability had not been distributed by fund were disclosed in the notes to the Volume I financial statements as at 31 December 2006.

ASHI: accounting and reporting as at 31 December 2007

ASHI liability – recognition as at 31 December 2007

28 For the interim financial statements as at 31 December 2006, a single ASHI liability amount was presented. However, for the financial statements as at 31 December 2007, separate valuations have been requested for general and related funds, extra-budgetary funds and peacekeeping funds. Further breakdowns have been requested for each peacekeeping fund.

ASHI liability – measurement as at 31 December 2007

29 The consulting actuaries have been requested to update the valuation of the ASHI liability as at 31 December 2007. The projected unit credit method will continue to be used; at time of writing, the actuarial assumptions were not yet known. The consulting actuaries have also been requested to provide roll forward figures7 for the peacekeeping portion of the liability to be reported as at 30 June 20088, 30 June 2009 and for the general and related funds and extra-budgetary funds as at 31 December 2008.

ASHI liability – disclosures as at 31 December 2007

30 The proposed disclosures in the notes to the financial statements include an accounting policy note describing the change in the accounting policy from disclosure in the financial statement notes to full recognition of the liabilities on the face of the

6 The Projected Unit Credit Method sees each period of service as giving rise to an additional unit of benefit entitlement and measures each unit separately to build up the final obligation. 7 Actuarial valuations as at a previous date adjusted for service costs, interest and benefit payments. 8 The reporting period for the United Nations Peacekeeping Operations is 1 July - 30 June.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 7 of 31

financial statements. The amounts of the liability and the service costs, interest costs and other costs by fund groupings will be detailed.

31 The disclosures will also include a summarized description of the ASHI plan, the fact that the liability is determined by a consulting actuary and the major actuarial assumptions used (the discount rate, the actuarial method, medical costs trend rates). A definition of major terms used will be provided in the notes to aid to user understanding of the new disclosures.

ASHI liability – detailed accounting as at 31 December 2007

32 General Assembly resolution 61/264 of 4 May 2007 approved the establishment of an independent, segregated special account to record the ASHI liabilities and to account for the related transactions. This special account for ASHI will consist of three sub-funds namely ASR, ASE and ASP that will separately account for the ASHI liabilities and transactions by group of funds (general and related funds, extra-budgetary funds and peacekeeping funds respectively). Appendix 3 details the accounting rules for the major transactions of these ASHI sub-funds, showing the recording on non-budgeted expenses to reflect the increase in the liability over the reporting period.

The Road to full compliance with IPSAS 25

Employee Benefits for ASHI – the remaining gaps to IPSAS compliance

33 The major gaps that remain to IPSAS compliance for ASHI are the detailed disclosures required for defined benefit plans as per IPSAS 25. Such detailed disclosures required but not being provided as at 31 December 2007 include a reconciliation of the opening and closing balances of the present value of the liability, movements in the recognized/unrecognized actuarial ga ins and losses and the effects of a one percentage point change in the medical cost trend rates on current service cost, interest cost and the benefit obligation. Appendix 4, extracted from the notes to the financial statements of the OECD, gives an example of the type of detailed disclosures that are required and Appendix 5 highlights the major disclosure gaps that remained as at 31 December 2007.

34 A further consideration regarding compliance with IPSAS25 is the frequency of the actuarial valuation, which is currently done every two years at the United Nations. IPSAS 25, paragraph IN7(b) requires an entity to determine the present value of the defined benefit obligation ‘with sufficient regularity that the amounts recognized in the financial statements do not differ materially from the amounts that would be determined at the reporting date’. Given the significant increases in the ASHI liability in recent years, the United Nations will consider if annual actuarial valuation of the liability is required and will review the value of roll forwards of the liability to satisfy this requirement of the Standard.

Unused annual leave and repatriation benefits

35 Full compliance with IPSAS 25 will require satisfying the remaining gaps to compliance for ASHI as well as satisfying the recognition, measurement and disclosure requirements relating to all other forms of employee benefits paid by the United Nations; significant among these are unused annual leave and repatriation benefits.

36 When the ASHI liability was initially recognized in the United Nations Volume I interim financial statements as at 31 December 2006, a decision was made to also recognize the other end-of-service liabilities, which up to that point, had been disclosed

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 8 of 31

in the notes to the financial statements. This decision included the recognition of the liabilities for unused annual leave and repatriation benefits.

Unused annual leave and repatriation benefits – the remaining gaps to compliance

37 The liabilities for unused annual leave and repatriation benefits were recognized in the accounting records of the Organizations as a debit adjustment to reserves and fund balances and a credit to the deferred payable account; the amounts recognized in the Volume I interim financial statements as at 31 December 2006 were the amounts of $133.6 million and $101.1 million respectively.

38 Unused annual leave and repatriation benefits fall into the category of short-term employee benefits except to the extent that portions of the liabilities are expected to be settled beyond twelve months after the end of the period in which the employees have rendered the related services, in which case, the Standard requires that those portions be classified as long-term employee benefits. Based on IPSAS 25, the liabilities and current costs for long-term employee benefits must be actuarially measured and the actuarial method used for the calculation must be the projected unit credit method. However, to date, the United Nations has not yet made a distinction between the short-term and long-term portions of these liabilities, no actuarial assumption have been applied to the calculation of the liabilities and the amounts have not been discounted.

39 Appendix 5 shows that in addition to these measurement gaps, there are a number of disclosure gaps relating to the long-term portion of the liabilities that will have to be satisfied for IPSAS compliance. Planned disclosures relating to these liabilities in the Volume I financial statements as at 31 December 2007 include the accounting policy note describing the change in the accounting policy, the amounts of the liabilities and the change over the biennium.

40 Appendices 6 and 7 share the United Nations detailed accounting for unused annual leave and repatriation benefits respectively. The appendices show that special funds have been established to account for the liabilities by fund grouping and that the increase in the liabilities over the reporting period is being recorded as unbudgeted expenses. The actual disbursements related to accrued annual leave utilized or paid upon separation and repatriation benefits paid will continue to be recorded as expenditure against the budgets of the relevant posts. One exception is the repatriation grant payments to staff retired from extra-budgetary posts which will be recorded as expenditure against the special account for extra-budgetary repatriation grant; this exception results from the decision to record an 8 per cent of staff costs accrual against extra-budgetary funds as income to the special fund for extra-budgetary repatriation grant.

41 Note that the accounting procedures detailed in the appendices to this Guidance Note are a work- in-progress and will be refined as the United Nations moves towards IPSAS compliance, to reflect future funding of the liabilities and the establishment of any plan assets, and as best accounting practice in this regards is studied and adopted.

Other employee benefits to be recognized

42 A comprehensive review of all staff entitlements is currently being undertaken and the results will inform the Organization’s IPSAS-compliant procedures for employee benefits, which are currently being developed. The review has highlighted that accruals will have to be effected for employee benefits such as education grants and deferred home leave and for estimates relating to any planned termination packages and buyouts.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 9 of 31

Related issues Funding of the liabilities

43 IPSAS 25 requires recognition of the liabilities for employee benefits but does not require funding of the liabilities. However, to the extent that the Standard presents detailed measurement and disclosure requirements for plan assets, funding is encouraged by the Standard. Also funding is considered to be prudent as it spreads the cash flow burden over extended financial periods.

44 In his report A/61/730 of 7 February 2007, the United Nations Secretary General detailed a proposal to fund the liabilities relating to ASHI over a period of 13 biennia. While the decision regarding funding was deferred by the General Assembly, the recognition of the ASHI liability and the request for funding has brought about a new awareness of the implications of this growing liability to the Organization. To address this, a tightening of the eligibility requirements for ASHI has been approved and the Board of Auditors has been requested to perform a detailed review of the ASHI actuarial study and the ASHI liability recorded in the accounting records of the Organization.

45 The issue of funding for the ASHI liabilities will again be presented to the General Assembly for consideration during the upcoming 63rd session.

46 As noted, funding of the extra-budgetary portion of the liability for repatriation grants is already in place. The current mechanisms and targets are being reviewed to incorporate the travel component of the liability and the extra-budgetary portion of the liabilities for ASHI and unused annual leave. Presentation of unbudgeted expenses 47 The budgets of the United Nations are currently maintained on a modified accrual basis, which incorporates cash disbursements and obligations for commitments that have not yet been disbursed. Currently there are no plans in place for the Organization to move to accrual budgeting. Prior to the 2006-2007 biennium, the accounting records and financial statements were also maintained on the modified accrual basis. As the Organization moves towards full accrual accounting for ASHI, unused annual leave and repatriation benefits and records accrued expenses such as the current service costs for which there are no budgets, these unbudgeted expenses present gaps between the financial statements and the budget records.

48 Such gaps are addressed by the detailed reconciliation required under as per IPSAS 24. Until that standard is adopted, these unbudgeted expenses will be shown on a separate line in the financial statements with details in the notes to aid user understanding.

Challenges and lessons learned Information system requirements

49 The major challenge with respect to the adoption of IPSAS 25 is the information system requirements to appropriately capture and track the detailed employee information required to account accurately for employee benefits as per the Standard. For example, time and attendance records should be maintained in a single database to support multi-dimensional analyses across the Organization world-wide; systems must be in place to assign the fund source of the liabilities and to track and account for movements of the liability between funds as staff change posts. The United Nations currently does not have

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 10 of 31

such a system in place. As highlighted by the United Nations Advisory Committee on Administrative and Budgetary Questions (ACABQ) in its report A/60/870 of 9 June 2006, IPSAS adoption is dependent upon the project for the introduction of the new ERP system for the Organization.

Lack of guidance on detailed accounting – IPSAS 25 not prescriptive

50 IPSAS 25 is not prescriptive as regards the detailed accounting for employee benefits and there appears to be little guidance outside of the Standard in this regard, especially within the context of fund accounting. Currently there are varying positions as regards the reflection of the liabilities within the accounting records of each substantive fund and the events that should result in the recording of an expense as opposed to a reduction of the liability. Best practices research in these areas will continue.

The value of ‘phased roll-out’ of IPSAS requirements

51 Perhaps the most important lesson learned is the value of early efforts to implement the requirements of complex standards such as IPSAS 25. The adage that ‘the devil is in the details’ proved correct as attempts were made to document IPSAS-compliant detailed procedures for employee benefits. The strategy of ‘phased roll-out’ of IPSAS requirements, described in paragraph 15 above, gives good opportunity to thoroughly examine the practical implementation issues relating to the adoption of the Standards, allowing for early consideration of the required changes to detailed procedures, workflows and information systems.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 11 of 31

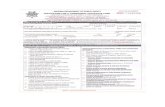

Appendix 19

Status of accumulated post-employment liabilities for after-service health benefits for United Nations System Organizationsa (Millions of United States dollars)

Organization

Actuarial Valuation

Completed Actuarial

method b Pay-as-you-go, current retirees

Accruing liability

Accrued liability

Amount funded

Unfunded liability

United Nations Yes PUC Yes Yes 2 072.8 — 2 072.8

International Labour Organization Yes PUC Yes No 389.0 — 389.0

World Health Organization (as of 2003) Yes PUC Yes Yes 371.2d 290.0 81.2

United Nations Educational, Scientific and Cultural Organization Yes PUC Yes No 601.0 — 601.0

Food and Agriculture Organization of the United Nations Yes PUC Yese Yes 533.4 135.8 397.6

United Nations Development Programme Yes PUC Yes Yes 406.9 162.0 244.9

United Nations Children’s Fund (as of 2006) Yes PUC Yes Yes 292.3 90.0 202.3

Office of the United Nations High Commissioner for Refugees Yes PUC Yes No 248.6 — 248.6

International Atomic Energy Agency Yes PUC Yes No 93.0 — 93.0

International Telecommunication Union Yes PUC Yes No 160.9 — 160.9

United Nations Industrial Development Organizationf Yes PUC Yes No 82.3 — 82.3

United Nations Population Fundg Yes PUC Yes No 61.6 — 61.6

World Food Programme Yes PUC Yesh Yes 67.9 64.7 3.2

World Intellectual Property Organization Yes PUC Yes No 41.8 —i 41.8

United Nations Office for Project Services Yes PUC Yes No 41.7 — 41.7

International Trade Centre UNCTAD/WTO Yes PUC Yes No 41.2 — 41.2

International Fund for Agricultural Development (as of 2006) Yes PUC Yes Yes 32.9 32.9 —j

International Civil Aviation Organization Yes n/k Yes No 36.2 — 36.2

International Criminal Tribunal for Rwanda Yes PUC Yes No 24.7 24.7

World Meteorological Organizationk Yes PUC Yes Yes 15.6 1.1 14.5

International Tribunal for the Former Yugoslavia Yes PUC Yes No 17.5 — 17.5

United Nations University Yes PUC Yes No 3.6 — 3.6

United Nations Institute for Training and Research Yes PUC Yes No 1.9 — 1.9

United Nations Compensation Commission Yes PUC Yes No 2.9 — 2.9

Total 5 640.9 704.5 4 936.4

9 Source A/61/791

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 12 of 31

aThe accrued liability represents the present value of benefits (net of retiree contributions) that

has accrued from the date of the employees’ hire to the valuation date. Information is as at 31 December 2005 unless otherwise stated.

b PUC is the projected unit credit method; this method is required by IPSAS 25. c The United Nations has been accounting and paying for after-service health insurance

liabilities on a pay-as-you-go basis with the accrued liability disclosed in the notes to the financial statements. On the basis of section III of General Assembly resolution 60/255, the accrued liability was disclosed in the interim financial statements as at 31 December 2006.

d The global estimated liability of WHO as at 31 December 2003 is $371.2 million, of which $290.0 million is funded as at 31 December 2006.

e Formerly paid on a pay-as-you-go basis. Post-retirement funds have now been established and a liability of $145.1 million has been recorded at 31 December 2005, of which $135.8 million has been funded (as per the market value of the investments at 31 December 2005).

f Reflects the accrued liability as at 31 December 2005. g UNFPA has reserved an amount of $12 million for 2006 and has also started to levy a 4 per

cent charge on the payroll, which will result in an incremental reserve of approximately $2.2 million for 2006, resulting in a total of $14.2 million funded by 31 December 2006.

h The accrued liability in the accounting valuation is $94.6 million. The accrued liability using a higher discount rate for funding is $67.9 million.

i The actuarial valuations of WIPO are done in Swiss francs; 54.7 million Swiss francs are equivalent to $41.8 million.

j IFAD has fully funded the after-service medical benefit liability. The liability reflects the actuarial valuation results as at 31 December 2006.

k The liability pertaining to retired staff is valued in United States dollars and for active staff in Swiss francs.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 13 of 31

Appendix 210

United Nations funds, programmes and other organizations: an overview of the reporting of liabilities for after-service health benefits

1. This appendix provides an overview of the estimates and details pertaining to the recognition and funding of the accrued liability and “current service costs” for after-service health benefits at United Nations funds, programmes and other organizations. The data is based on the most recently collated information obtained from the respective organizations and is as at 31 December 2005, except for the World Health Organization (WHO), the figures are as at 31 December 2003, and the United Nations Children’s Fund (UNICEF) and the International Fund for Agricultural Development (IFAD), these figures are as at 31 December 2006. For most organization, the liability is calculated every two years and as at time of writing, the figure as at 31 December 2007 was not yet available.

International Trade Centre UNCTAD/WTO

2. The actuarial study estimated the accrued liability for the International Trade Centre UNCTAD/WTO (ITC) as at 31 December 2005 to be $41.2 million. ITC has not yet put any funding measures in place; it plans to establish a mechanism after funding of the United Nations’ liabilities has been approved by the General Assembly.

United Nations University

3. The net accrued liability of the United Nations University (UNU) at 31 December 2005 as determined by the actuarial study was $3.6 million. UNU has not yet funded any portion of the liability, but plans to establish a mechanism after funding of the United Nations’ liabilities has been approved by the General Assembly.

United Nations Institute for Training and Research

4. The net accrued liability at 31 December 2005 attributable to the United Nations Institute for Training and Research (UNITAR) was determined to be $1.9 million. UNITAR has not yet put any funding measures in place. It plans to establish a funding mechanism after funding of the United Nations’ liabilities has been approved by the General Assembly.

United Nations Children’s Fund

5. The actuarial valuation estimated the accrued liability (net of offset of retiree contributions) of UNICEF at 31 December 2005 at $292.3 million. In 2005, UNICEF established a reserve of $90 million to partially fund the estimated liability. The UNICEF Executive Board has approved the gradual increase of this funded reserve to reach $180 million by the end of the current medium-term strategic plan in 2009.

10 Source A/61/791

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 14 of 31

United Nations Development Programme

6. The actuarial study determined the net accrued liability of the United Nations Development Programme (UNDP) for after-service health insurance benefits at 31 December 2005 to be $406.9 million. UNDP has funded $54.0 million for each of the biennia ended 31 December 2001 to 2005. On a cumulative basis, UNDP has funded $162 million for after-service health insurance liabilities as at 31 December 2005. The amount set aside is over and above disbursements by UNDP for after-service health insurance for current retirees, which were included as part of the biennial support budget expenditure. UNDP is now accounting for future costs for current employees by accruing current service costs on an annual basis.

United Nations Population Fund

7. The actuarial study for the United Nations Population Fund (UNFPA) estimated the accrued liability (net of offset from retiree contributions) of $61.6 million as at 31 December 2005. UNFPA has not specifically provided for these accrued liabilities. Expenditures are charged against the budget appropriations of the periods when actual payments are made for current retiree benefits.

8. In 2006, UNFPA started to fund the liability. A one-time amount of $12 million has been reserved against prior period liability and a 4 per cent charge has been introduced on all payrolls to partially fund the current portion of this liability.

United Nations Office for Project Services

9. The actuarial valuation estimated the accrued liability for the United Nations Office for Project Services (UNOPS) at $41.7 million as at 31 December 2005.

10. UNOPS commenced accruing for the biennial cost of after-service health insurance benefits in 2004-2005 based on the actuarial review and in order to correctly account for these expenses as they are incurred. UNOPS will consider the funding of the provision made and the accrual for past years’ liabilities not recorded. UNOPS will explore solutions to cover the accumulated liability for past years’ service.

Office of the United Nations High Commissioner for Refugees

11. The actuarial report for the Office of the United Nations High Commissioner for Refugees (UNHCR) estimated the accrued liabilities as at 31 December 2005 at $248.6 million, made up of $68.8 million for current retirees, $65.4 million for active staff currently eligible to retire and $114.4 million for active staff not yet eligible to retire.

12. The current subsidy relating to retiree premiums is included in the corresponding annual programme budget and the actual costs incurred in each financial period are reported as current year expenditure. UNHCR has not created any reserve to fund the liability for after-service health insurance benefits nor are any plans in place to accrue the estimated service costs.

Food and Agriculture Organization of the United Nations

13. The actuarial valuation as at 31 December 2005 for the Food and Agriculture Organization of the United Nations (FAO) estimated an accrued past service liability of $533.4 million of which $340.7 million related to retired staff members and $192.7 million related to active staff members. Some $135.8 million of the total liability was

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 15 of 31

funded at 31 December 2005 (using the market value of the investments) and $145.1 million of the total liability was recorded in the financial statements of FAO at 31 December 2005.

14. The principal assumptions used were: a discount rate of 4.5 per cent; expected salary increases of 2.5 per cent; medical cost increases of 6.5 per cent declining linearly to 4.5 per cent over 10 years; and general inflation of 2.0 per cent. Beginning in 1998, FAO has accounted for the annual costs of employees in active service by accruing these costs, while providing for the amortization of the prior service liability over a 30-year period.

15. FAO is partially funding the accrued liability for prior service from any excess of investment income over the requirements for other schemes such as the separation payments scheme and the staff compensation plan. The FAO Conference, recognizing that funding from excess investment income was insufficient to close the funding deficit, approved an additional biennium contribution from Member States of $14 million starting from the biennium 2004-2005. However, recognizing that this additional contribution is still insufficient to achieve full funding of the past service liability over the amortization period, the amounts to be approved for future funding will be reviewed in subsequent biennia.

International Fund for Agricultural Development

16. From 2006, IFAD has had a stand-alone actuarial valuation performed. The actuarial valuation estimated a total accrued liability of $32.9 million at 31 December 2006. IFAD has fully funded the liability and the related assets are held in a separated trust fund. Beginning in 2006, IFAD has fully accounted for the annual current service cost as current year expenditure even though it exceeded the related provisions in the administrative budget. Any actuarial losses incremental to the current service costs are recorded in the income statement outside the administrative budget.

World Food Programme

17. The valuation of after-service health insurance benefits for the World Food Programme (WFP) was part of a joint study of the multiorganization scheme administered by FAO in 1997. The study estimated the accrued liability of WFP to be $44.8 million. This amount was fully funded based on approval by the WFP Executive Board in 1999. WFP commissioned separate studies for 2000-2001, 2002-2003 and 2004-2005. The actuarial assumptions used to determine the accrued liability at 31 December 2005 were: discount rate of 4.75 per cent (accounting), discount rate of 6.5 per cent (funding), expected salary increases of 2.5 per cent, medical cost increases of 5.5 per cent and general inflation of 2.0 per cent.

18. The study as at 31 December 2005 estimated the accrued liabilities for after-service health insurance benefits to be $94.6 million. This resulted in an excess of actuarial liabilities over assets ($64.7 million) of $29.8 million. Using a higher discount rate for funding results in an unfunded liability of $3.2 million.

United Nations Educational, Scientific and Cultural Organization

19. The actuarial consultants’ report for the United Nations Educational, Scientific and Cultural Organization (UNESCO) estimated an accrued liability for after-service health insurance benefits as at 31 December 2005 of $601.0 million.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 16 of 31

20. The figure results from a comprehensive actuarial study carried out by Towers Perrin in accordance with International Accounting Standard 19. There was a significant increase over the 2003 liability amount, which was explained by the use of a reduced discount factor and a substantial increase in the average claim cost.

21. There are no plans for funding the liability or any proposals to recognize current service cost for the current biennium. UNESCO provides resources to pay current retiree premiums in a specific budget line during the year of operation.

International Labour Organization and International Telecommunication Union

22. The International Labour Organization (ILO) and the International Telecommunication Union (ITU) share a staff health insurance fund. The latest actuarial valuation dated April 2006 projected the liability through December 2005 in accordance with International Financial Reporting Standard 19. The assumptions are: medical cost inflation of 5 per cent declining to 3 per cent over 10 years, a discount factor of 4.5 per cent, general inflation of 2.0 per cent and salary increases of 2.5 per cent.

International Labour Organization

23. The accrued liability of ILO at 31 December 2005 was estimated at $388.6 million. ILO expenses payments of benefits in respect of retired staff on a pay-as-you-go basis, charging the regular budget for premiums in the financial period in which they are paid. ILO has made no provision for current service costs and has no plans to fund the accrued liability; decisions by the United Nations General Assembly in this regard would inform discussions in the ILO Governing Body.

International Telecommunication Union

24. The accrued liability of the International Telecommunication Union (ITU) at 31 December 2005 was estimated at $160.9 million. ITU expenses payments of benefits to retired staff on a pay-as-you-go basis, charging its contributions to the staff health insurance fund in the biennium that they are paid, and makes no provision for current service costs of active staff members. There are no plans to fund the accrued liability at this time.

World Health Organization

25. The World Health Organization (WHO) was the first organization to make provisions for post-retirement benefits and funded part of the accrued liability by special annual contributions starting in 1989. The Organization established a reserve (Reserve 470.2) under paragraph 470 of the rules of the Staff Health Insurance Plan. As at 31 December 2006, the assets of the Plan amounted to $350 million of which $290 million are to be allocated to the specific 470.2 Reserve.

26. The WHO actuarial study dates from July 2004. The WHO accrued liability following Financial Accounting Standard 106 methodology, using a discount rate of 6.25 per cent, was estimated at $232.8 million with respect to retirees and $138.4 million for active staff (for a global estimated liability of $371.2 million as at 31 December 2003).

27. WHO is in the process of having a comprehensive actuarial study carried out which should provide up-to-date projections of future liabilities for the Plan. In addition, an

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 17 of 31

asset/liability study will be conducted to assist the Organization in its evaluation of the investment strategy for the Plan’s assets.

Universal Postal Union

28. In view of the relatively minor amounts involved, the Universal Postal Union does not estimate the value of after-service medical benefits nor does it account for the liability.

World Meteorological Organization

29. An actuarial study of the accumulated liabilities for after-service health benefits for the World Meteorological Organization (WMO) as at 31 December 2005 estimated $8.9 million for retired staff and 8.8 million Swiss francs (equivalent to $6.7 million based on the 31 December 2005 operational rate of exchange) for active staff. The amounts have not been included in the financial statements but were disclosed in the notes to the statements. WMO had been making its contributions to after-service medical costs on a “pay-as-you-go” basis, and, beginning in 2002 is funding the reserve for post-retirement benefits with a 2 per cent loading on payroll costs. The balance of the reserve amounted to 1.5 million Swiss francs ($1.1 million) at 31 December 2005.

World Intellectual Property Organization

30. Based on an actuarial study as at the end of 2005, the liability for post-service medical benefits for staff members of the World Intellectual Property Organization (WIPO) was estimated at 54.7 million Swiss francs and the separation from service-benefits at 16.2 million Swiss francs. These figures are disclosed in a note to the financial statements. Also, end of December 2005, WIPO had accrued 11.1 million Swiss francs for separation from service benefits and 12.7 million Swiss francs for after-service health insurance benefits.

United Nations Industrial Development Organization

31. On the basis of an actuarial study carried out in 2006, the estimated accrued liability of the United Nations Industrial Development Organization (UNIDO) was $82.3 million (equivalent to 69.6 million euros). The study is based on the census data as at 1 January 2006, using United Nations Joint Staff Pension Fund’s withdrawal, retirement and mortality assumptions, a health care trend rate of 6.75 per cent, and a discount rate of 5.5 per cent. There has been no funding of the liability nor are there any plans to expense current service costs in the present biennium; instead actual payments are recorded on a pay-as-you-go basis and reported as expenditures of the current period.

International Atomic Energy Agency

32. The International Atomic Energy Agency (IAEA) conducted an actuarial valuation of post-retirement health insurance benefits using the projected unit credit cost method. The accrued liability at 31 December 2005 was projected to be $93 million based on assumptions of an interest rate of 8.5 per cent and a medical inflation rate of 6 per cent.

33. No provision has yet been made to accrue the current service costs or fund the liability, although IAEA is currently considering various funding options and

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 18 of 31

continues to estimate and disclose these liabilities. The manner in which the Agency ultimately deals with the issue of funding will be influenced by decisions taken in this regard by the United Nations’ General Assembly.

International Civil Aviation Organization

34. An actuarial study for the International Civil Aviation Organization (ICAO) estimated the after-service health benefits liability as at 31 December 2005 to be $36.2 million. The study was performed in accordance with the professional standards of the Canadian Institute of Actuaries and the Canadian Accounting Standards and in accordance with generally accepted actuarial principles.

35. ICAO does not accrue the liability. Payments made with regard to after-service health benefits in each financial period are reported as expenditure for that period. The Organization has not funded the liability and this issue has been brought to the attention of its governing body for consideration. The estimated liability is disclosed as a note to the financial statements.

Organizations for which no valuations have been conducted

36. No valuation has been conducted to show liabilities at 31 December 2005 for the United Nations Environment Programme, the United Nations Human Settlements Programme, the United Nations Relief and Works Agency for Palestine Refugees in the Near East, the World Trade Organization and the United Nations Office on Drugs and Crime. Some of these organizations are currently in the process of have actuarial valuation done as at 31 December 2007.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 19 of 31

Appendix 3

Detailed Accounting for Post-Employment Health Benefits relating to After Service Health Insurance (ASHI) at the United Nations11 12

A. Recognition of the ASHI Liabilities

1. In accordance with RES/60/255 of 15 June 2006, the United Nations General

Assembly recognized the post-retirement liability relating to ASHI and requested the Secretary General to disclose the liability in the financial statements of the Organization.

2. The liability was initially recognized in the interim financial statements as at 31 December 2006 based on the actuarially calculated amounts as at 31 December 2005. The accounting entry was recorded as a debit adjustment to reserves and fund balances and a credit to the ASHI liability. At that time, the liability was not distributed by fund.

B. Measurement of the ASHI Liabilities

1. The ASHI liability is determined by a firm of consulting actuaries and the

valuation is currently conducted every two years. 2. The actuarial method used for the calculation is the projected unit credit

method, which is the method required by IPSAS 25. 3. The major actuarial assumptions used during the most recent valuation as at

31 December 2005 are: a discount rate of 5.5%, referenced to high quality corporate bonds, retirement and mortality assumptions based on those used by the UNJSPF, and an 8 year health care trend rate of 10.0%-5.0% for plans in the United States and 6.75% to 4.5% for plans outside the United States.

4. For the interim financial statements as at 31 December 2006, a single ASHI liability amounts was presented. However, for the financial statements as at 31 December 2007, separate valuations have been requested for general and related funds, extra-budgetary funds and peacekeeping funds; further breakdowns have been requested for each peacekeeping fund.

C. Accounting for ASHI

The ASHI fund and sub-funds 1. General Assembly resolution 61/264 of 4 May 2007 approved the

establishment of an independent, segregated special account to record the ASHI liabilities and to account for the related transactions.

2. This special account for ASHI will consist of three sub-funds namely ASR, ASE and ASP that will separately account for the ASHI liabilities and

11 This information is preliminary as, at time of writing, the accounting treatment, presentation and disclosures as at 31 December 2007 had not been finalized. 12 These procedures are not yet fully IPSAS compliant.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 20 of 31

transactions by group of funds (general and related funds, extra-budgetary funds and peacekeeping funds respectively).

3. The ASHI liabilities for general and related funds and extra-budgetary funds will be reflected within the related sub-fund and each sub-fund will carry the unbudgeted portion of the current period expense relating to ASHI.

4. The ASHI liabilities and expenses relating to current staff assigned to peacekeeping posts will be shown separately in the individual funds for each peacekeeping mission.

5. The ASHI liabilities relating to retired staff of peacekeeping funds will be reflected within the ASP sub-fund and that sub-fund will carry the current period expense relating to retired peacekeeping staff. Because the retiree population was not previously tracked by fund source, there is currently no verifiable basis to allocate this portion of the ASHI liability to individual peacekeeping funds nor is it meaningful, given that some of the related peacekeeping missions have since ceased operations.

6. The ASHI liability will be recognized in the biennium financial statements as at 31 December 2007. The initial recognition will be based on the balance as at 31 December 2005, in accordance with IPSAS 25, paragraphs 166-167 and any increase in the liability over the biennium will be recorded as an expense. The initial accounting entry will be as a debit to reserves and fund balances in the ASHI sub-funds and a credit to the ASHI liability account in the ASHI sub-funds. In the case of Peacekeeping funds, the ASHI liability for current staff will be recorded in the individual funds; the ASHI liability attributable to retirees shall be show in the PK sub-fund.

Accounting Entries

7. Explanation of General Ledgers (GL) and funds: GL 1110 = Cash GL 1320 = ASHI Accounts Receivable GL 2311 = Deferred Payable Medical Insurance GL 2320 = ASHI liability GL 3160 = ASHI adjustment to reserves and fund balances GL 6310 = Expenses Fund UNA = General Fund

8. Accounting Entry: Initial recognition of liabilities (amounts at as 31 December 2005).

Dr. Fund ASR GL 3160 Dr. Fund ASE GL 3160 Dr. Fund ASP GL 3160 (amount for retired staff) Dr. Individual PK funds GL 3160 (amounts for current staff)

Cr. Fund ASR GL 2320 Cr. Fund ASE GL 2320 Cr. Fund ASP GL 2320 (amount for retired staff) Cr. Individual PK funds GL 2320(amounts for current staff)

9. Accounting Entry: The “pay as you go” Organization subsidy which is funded from the General Fund UNA and from the peacekeeping support account fund

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 21 of 31

QSA; the amount is paid out for claim reimbursements and administration fees.

Dr. Fund UNA GL 6310 Dr. Fund QSA GL 6310

Cr. Fund UNA GL 2311 Dr. Fund UNA GL 2311

Cr. Fund UNA GL 1110 10. Accounting Entry: Retiree contribution billed to retirees and paid out for

claim reimbursement.

Dr. Fund UNA GL 1320 Cr. Fund UNA GL 2311

Dr. Fund UNA GL 2311 Cr. Fund UNA GL 1110

11. To record end of year increase in ASHI liabilities due to service costs, interest

costs, amortization of actuarial losses, other adjustments (based on proportion by fund grouping). Debit unfunded expenses by fund/sub-fund and credit the ASHI liability in the ASHI sub-funds.

Dr. Fund ASR GL 6310 (unbudgeted) Dr. Fund ASE GL 6310 (unbudgeted) Dr. Fund ASP GL 6310 (unbudgeted amount for retired staff) Dr. Individual PK funds GL 6310 (unbudgeted amounts for current staff)

Cr. Fund ASR GL 2320 Cr. Fund ASE GL 2320 Cr. Individual PK funds GL 2320(amounts for current staff)

The result will be an increase in the negative fund balance; the sum of the ASHI liability across all funds will total the actuarial valuation.

D. ASHI disclosures in the financial statements

The following information will be disclosed in the notes to the financial statements as at 31 December 2007 for Volume I and 30 June 2008 for Volume II:

1. The accounting policy note describing the change in the accounting policy with a summarized description of the ASHI plan and definition of major terms used.

2. The amounts of the liability and the service costs and interest costs. 3. The fact that the liability is determined by a consulting actuary and the

major actuarial assumption used (the discount rate, the actuarial method, medical costs trend rates).

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 22 of 31

Appendix 4 Sample Financial Statement Note on Post-Employment Health Benefits: Extracted from the notes to the financial statements of the OECD as of 31 December 2006 The Organization operates defined employee benefit plans that include post employment health coverage. In 2006 the Organization reviewed its main financial actuarial assumptions: discount rates, future salary and benefit levels and future medical costs. All demographic assumptions are reviewed at least every five years and the last review was in 2003. Actuarial losses that exceed the 10% “corridor” are amortized over the expected average remaining working lives of the employees participating in the scheme, 11 years in 2006 (2005: 11 years). An increase or decrease of one half percentage point in the assumed discount rate would result in a change in the benefit obligation of approximately 5% for post employment health benefits as 31 December 2006.The increase in the discount rate, for post employment benefits, from 3.6% at 31 December 2005 to 4.1% at 31 December 2006, is the main reason for the decrease in the 31 December 2006 obligation of approximately 18M€ over 2005. The following table sets out the changes in the accumulated benefits obligation for post-employments health benefits and the amounts recognized in the Statements of Financial Position and the evolution of actuarial assumptions:

31 December

2006 31 December

2005

The amounts recognized in the balance sheet are as follows: 000€ 000€

Employee future benefits obligation (255,527) (273,342)

Unrecognized actuarial (gain)/losses 57,115 102,119

Liability recognized in Statement of Financial Position (198,412) (171,223)

The movements of actuarial (gains) and losses are:

Unrecognized actuarial losses at beginning of the year 102,119 52,071

Actuarial (gains)/losses for the year (38,205) 52,926

Losses recognized in the year (6,799) (2,878)

Unrecognized actuarial losses ate end of December 57,115 102,119 Limit of the corridor and recognized actuarial (gains)/losses are:

Unrecognized actuarial losses at beginning of the year 102,119 52,071 Limit of the corridor, 10% in the defined benefits obligation at the beginning of the year (27,334) (20,409) Actuarial losses to be amortized over the expected average remaining working lives of the employees participant in the plan 74,785 31,662 Expected average remaining working lives of the employees participating in the plan 11 11

Actuarial losses recognized 6,799 2,878

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 23 of 31

The amounts recognized in the Statements of Financial Performance for Post employment health benefits are as follows:

31 December

2006 31 December

2005

000€ 000€ Current service cost 12,760 8,989 Interest cost 9,802 9,343 Actuarial losses recognized in the year 6,799 2,878 Other expenses (tax reimbursements, post employment health costs) 276 366 Expenses for the 12 months to 31 December 29,637 21,576

Changes in the present value of the employee future benefits obligations for post employment health benefits are as follows: Opening employee future benefits obligation Expense for the year Benefits paid Net actuarial gains/(losses) for the period Employee future benefits obligations at end of December Principal actuarial assumptions for post employment health benefits at 31 December (expressed as weighted averages) were: Discount rates Future health cost increase Assumed healthcare cost trends have a significant effect on the amounts recognized in the Statement of Financial Performance. A one-percentage point change in assumed healthcare cost trend rates would have the following effects:

One percentage point increase

One percentage point decrease

Effect on the aggregate of the service cost and interest cost 6,967 (5,069)

Effect on defined benefit obligation 67,556 (51,463) The liability recognized in the Statements of Financial Position in regard to the defined employee benefits obligation are as follows: 31December 2006 31 December 2005

000€ 000€

Present value of employee future benefits obligation (255,527) (273,342)

Unrecognized actuarial losses 57,115 102,1198

Net liability in the Statements of Financial Position (198,412) (171,223)

31 December 2006 31 December 2005

000€ 000€ (273,342) (204,092) (22,562) (18,332)

2,172 2,008 38,205 (52,926)

(255,527) (273,342)

2006 2005

% % 4.10 3.60 3.80 3.80

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 24 of 31

Appendix 5 Recognition of Liabilities and current costs for ASHI, Repatriation Benefits and Unused Annual Leave at the United Nations: Summary of Main IPSAS Requirements completed/not completed as at 31 December 2007

13 This list is not exhaustive. 14 Requirements related to plan assets are not listed as no assets have been set aside to fund these liabilities. Requirements related to plan changes are not listed.

ASHI Repatriation Benefits Unused Annual Leave

Main IPSAS Requirements13,14 Requirement Completed? Yes/No

Requirement Completed? Yes/No

Requirement Completed? Yes/No

Recognition Recognize liability on the face of financial statements Y Y Y Initial recognition of liability: adjust opening fund balance Y Y Y Measurement of long-term portion: Liability is actuarially determined Y N N Projected Credit Unit method used to measure liability Y N N Initial liability includes accumulated actuarial gains/losses Y N N Disclosures: Present Value of liability Y N N Reconciliation of opening and closing balance of liability N N N Current service costs Y N N Interest costs Y N N Actuarial gains/losses recognized N N N Actuarial gains/losses not recognized N N/A N/A Contributions by the Organization N N N Contributions by participants N N N Benefits paid to participants N N N Discount rate used Y N N Basis for discount rate Y N N Trend rates Y N N Effect of changes in trend rates N N N Expected salary rate increases N N N

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 25 of 31

Appendix 6

Detailed Accounting for Unused Annual Leave (UAL) at the United Nations15 16

A. Recognition of the UAL Liability

1. United Nations Staff who separate from the Organization are entitled to be

paid for any unused vacation days that they may have accrued, up to a maximum of 60 days.

2. When the ASHI liability was initially recognized in the United Nations Volume I interim financial statements as at 31 December 2006, a decision was made to also recognize the other end-of-service liabilities, which up to that point, had been disclosed in the notes to the financial statements; this decision included the recognition of the liability for unused annual leave.

3. The liability was recorded as a debit adjustment to reserves and fund balances and a credit to the deferred payable account. At that time, the liability was not distributed by fund in the accounting records of the Organization.

B. Measurement of the UAL Liabilities

1. Unused annual leave generally falls into the category of short-term employee

benefits; however, to the extent that a portion of amount is expected to be settled beyond twelve months after the reporting date, that portion is classified as long-term employee benefits.

2. Based on IPSAS 25, the liabilities and current costs for long-term employee benefits should be actuarially measured; the actuarial method used for the calculation should be the projected unit credit method. However, as of 31 December 2007, no actuarial assumptions were used to calculate the liability and the amount was not discounted.

3. The liability is currently measured by taking the actual number of unused vacation days within the 60-day limit (extracted from the Organization’s time and attendance records) and multiplying by the current pay rate. For the interim financial statements as at 31 December 2006, a single liability amount of $ 133.6 million was presented. However, for the Volume I financial statements as at 31 December 2007, separate valuations will be determined for general and related funds and extra-budgetary funds; for the Volume II peacekeeping financial statements as at 30 June 2008, the liabilities will be presented separately in the individual financial statements of the missions, as was done as at 30 June 2007. The amounts assigned to each fund will be based on the assigned post as at reporting date; no adjustment will be made for staff movement between funding sources.

15 This information is preliminary as, at time of writing, the accounting treatment, presentation and disclosures as at 31 December 2007 had not been finalized. 16 These procedures are not yet fully IPSAS compliant.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 26 of 31

C. Accounting for the UAL liabilities

The UAL funds

1. Two special accounts for unused annual leave liabilities, funds ALR and ALE, have been established to account for these liabilities and related costs for the regular and related funds and extra-budgetary funds respectively.

2. The UAL liability will be recognized in the biennium financial statements as at 31 December 2007. The initial recognition will be based on the balance as at 31 December 2005, and any increase in the liability over the biennium will be recorded as an unbudgeted expense. The initial accounting entry will be a debit adjustment to reserves and fund balances in the ALR/ALE funds and a credit to the liability account. In the case of Peacekeeping funds, this entry will be recorded separately in the accounting records of the individual missions.

Accounting Entries

3. Explanation of General Ledgers (GL) and funds: GL 2320 = UAL Deferred Payable GL 3160 = UAL adjustment to reserves and fund balances GL 6310 = Expense Fund ALR = Annual Leave Liabilities – general and related Funds Fund ALE = Annual Leave Liabilities – extra-budgetary funds

4. Accounting Entry: Initial recognition of liabilities (amounts at as 31

December 2005 for Volume I and as at 30 June 2007 for Volume II).

Dr. Fund ALR GL 3160 Dr. Fund ALE GL 3160 Dr. Individual PK funds GL 3160

Cr. Fund ALR GL 2320 Cr. Fund ALE GL 2320 Cr. Individual PK funds GL 2320

5. To record end of period increase in UAL, debit unfunded expenses and credit

the liability (opposite entries will be effected if there is a reduction in the liability).

Dr. Fund ALR GL 6310 (unbudgeted) Dr. Fund ALE GL 6310 (unbudgeted) Dr. individual PK funds GL 6310 (unbudgeted)

Cr. Fund ALR GL 2320 Cr. Fund ALE GL 2320 Cr. Individual PK funds GL 2320

The expenditure relating to accrued annual leave paid out on separation will continue to be recorded as staff costs directly against the funds of the relevant posts.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 27 of 31

D. UAL financial statement disclosures

The following information will be disclosed in the notes to the financial statements as at 31 December 2007 for Volume I and 30 June 2008 for Volume II:

1. The accounting policy note describing the change in the accounting

policy. 2. The amounts of the liability and the change over the period. 3. The amount of unbudgeted expenses which will be shown in a separate

line item in the financial statements.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 28 of 31

Appendix 7

Detailed Accounting for Repatriation Benefits at the United Nations17 18

A. Recognition of the liability for repatriation benefits

1. United Nations Staff who separate from the Organization are entitled to be

paid repatriation benefits based on the number of years of service with the Organization. These benefits consist of a grant as well as travel costs to return the staff member and his dependents to his home country.

2. When the ASHI liability was initially recognized in the United Nations Volume I interim financial statements as at 31 December 2006, a decision was made to also recognize the other end-of-service liabilities, which up to that point, had been disclosed in the notes to the financial statements; this decision included the recognition of the liability for repatriation benefits.

3. As at 31 December 2006, the liability for repatriation benefits was recorded as a debit adjustment to reserves and fund balances and a credit to the deferred payable account. At that time, the liability was not distributed by fund in the accounting records of the Organization.

B. Measurement of the liabilities for repatriation benefits

1. Repatriation benefits fall into two categories of employee benefits as per

IPSAS 25: the portion of the amount that is expected to be settled within twelve months after the reporting date should be classified as short-term employee benefits and the balance should be classified as long-term employee benefits.

2. Based on IPSAS 25, the liabilities and current costs for long-term employee benefits should be actuarially measured and discounted; the actuarial method used for the calculation should be the projected unit credit method. However, as of 31 December 2007, no actuarial assumptions were used to calculate the long-term portion of the liability for repatriation benefits and the amount was not discounted.

3. As at 31 December 2006, the liability for repatriation benefits was based only on the grant portion and measured based on the currently eligible staff members at current pay rates. For the Volume 1 interim financial statements as at 31 December 2006, a single liability amount for repatriation grant benefits of $101.1 million was presented.

4. For the Volume I financial statements as at 31 December 2007, the liability will include the travel component of repatriation benefits. The travel component will be estimated based on the level of the repatriation grant liability using a five-year comparison of actual repatriation grants to related actual repatriation travel costs to derive the ratio.

17 This information is preliminary as, at time of writing, the accounting treatment, presentation and disclosures as at 31 December 2007 had not been finalized. 18 These procedures are not yet fully IPSAS compliant.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 29 of 31

5. For the Volume I financial statements as at 31 December 2007, separate valuations of the repatriation liability will be determined for general and related funds and extra-budgetary funds; for the Volume II peacekeeping financial statements as at 30 June 2008, the liabilities will be presented separately in the individual financial statements of the missions, as was done as at 30 June 2007. The amounts assigned to each fund will be based on the assigned post as at reporting date; no adjustment will be made for staff movements between funding sources.

C. Funding of the liabilities for repatriation benefits

1. In 2005, fund RGE was established to account for income and expenditures

for extra-budgetary repatriation entitlements, excluding the travel component. At that point, amounts that had been previously accrued for repatriation entitlements in technical cooperation funds were transferred to this fund. Fund RGE currently accrues income at 8% of salary costs charged to extra-budgetary funds. The rate was established to cover current costs as well as to build a reserve that would eventually cover the liability.

2. Presently, this funding mechanism and accounting scope is being reviewed to consider the expansion of RGE to include the travel component of repatriation benefits and also funding and accounting for unused annual leave for extra-budgetary funds.

D. Accounting for Repatriation Benefits

1. In addition to fund RGE, another special account for repatriation benefits liabilities, fund RGR, has been established to account for these liabilities and related costs for regular funds and related funds.

2. The repatriation benefits liability will be recognized in the Volume I biennium financial statements as at 31 December 2007. The initial recognition will be based on the balance as at 31 December 2005, and any increase in the liability over the biennium will be recorded as an unbudgeted expense. The initial accounting entry will be a debit adjustment to reserves and fund balances in the RGR/RGE fund and a credit to the liability account. In the case of Peacekeeping funds, this entry will be recorded separately in the accounting records of the individual missions.

Accounting Entries

3. Explanation of General Ledgers (GL) and funds: GL 1110 = Cash GL 2320 = Repatriation Grant Deferred Payable GL 3160 = Repatriation Grant adjustment to reserves and fund balances GL 5110 = Income GL 6310 = Expense Fund UNA = General Fund Fund XBF = Extra-budgetary fund (representative) Fund RGR = Repatriation Benefit Liabilities – general and related funds Fund RGE = Repatriation Benefit Liabilities – extra-budgetary funds.

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 30 of 31

4. Accounting Entry: To record the funding of RGE

Dr. Fund XBF GL 6310

Cr. Fund RGE GL 5110

5. Accounting Entry: Initial recognition of liabilities (amounts at as 31 December 2005 for Volume I and 30 June 2007 for Volume II).

Dr. Fund RGR GL 3160 Dr. Fund RGE GL 3160 Dr. Individual PK funds GL 3160

Cr. Fund RGR GL 2320 Cr. Fund RGE GL 2320 Cr. Individual PK funds GL 2320

6. To record expenditure related to paid repatriation benefits: for extra-budgetary

funds this entry is recorded in fund RGE but for the general and related funds, the actual repatriation costs will continue, for now, to be recorded against the budgets of relevant fund.

Dr. Fund UNA GL 6310 Dr. Fund RGE GL 6310 (extra-budgetary funds actual repatriation grant costs) Dr. Individual PK funds GL 6310

Cr. Fund UNA GL 1110 Cr. Fund RGE GL 1110 Cr. Individual PK funds GL 1110

7. Currently, fund RGE does not include an accrual for repatriation travel and as

such, actual repatriation travel costs will continue to be recorded against the budgets of relevant extra-budgetary fund until the scope of fund RGE is expanded.

8. To record end of year increase in repatriation liabilities, debit unbudgeted

expenses and credit the liability (opposite entries will be effected if there is a reduction in the liability).

Dr. Fund RGR GL 6310 (unbudgeted) Dr. Fund RGE GL 6310 (unbudgeted) Dr. Individual PK funds GL 6310 (unbudgeted)

Cr. Fund RGR GL 2320 Cr. Fund RGE GL 2320 Cr. Individual PK funds GL 2320

E. Repatriation benefits disclosures The following information relating to repatriation benefits will be disclosed in the notes to the financial statements as at 31 December 2007 for Volume I and 30 June 2008 for Volume II:

36. Employee Benefits - UN Case Study.doc 04/04/2008 Page 31 of 31

1. The accounting policy note describing the change in the

accounting policy, including the re-statement of the liability to include the travel portion of the benefit.

2. The amounts of the liability and the change over the biennium. 3. The amount of unbudgeted expenses which will be shown in a

separate line item in the financial statements.