UKnews Jobs growth

-

Upload

natalie-croker -

Category

Documents

-

view

62 -

download

1

Transcript of UKnews Jobs growth

4 ★ FINANCIAL TIMES FRIDAY JULY 16 2010

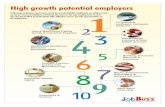

Total UK jobs createdfrom 2010 to 2015 (forecast)

-0.35m

1.67mPrivatesector

Publicsector

North-east

22,0002.0%

Wales

4,1000.3%

Northern Ireland

21,8002.6%

LondonLLoon

384,900388844338844,83338 ,9008.3%8 388..33%%%888.33%%%

East

151,2005.5%

WestMidlands

77,9003.1%

EastMidlands

56,7002.7%

Yorkshire& Humber

67,3002.7%

North-west

96,8002.9%

Scotland

65,3002.5%

South-west

105,0004.0%

South-east

265,1006.2%

Source: Oxford Economics

Employmentgrowth forecastNet number of jobs created and % growth,2010-15, by region

Regions forecast to miss out on jobs

By Brian Groom,Business and Employment Editor

London and south-east Englandare poised to create jobs at morethan twice the rate of the rest ofthe UK during the next fiveyears, according to forecastsmade for the Financial Times.

Wales and the west Midlands,by contrast, could take until2025 or beyond to recover to pre-recession employment levelswhile northern and outerregions struggle to cope withpublic sector cuts, says OxfordEconomics, a consultancy.

The data show the Con-Libcoalition has a tough task toachieve its aim of rebalancingthe economy and ending thecountry’s reliance on serviceindustry growth in the south-east.

The consultancy forecasts

that London will lead the recov-ery, with growth in output aver-aging 3.8 per cent a year in 2010-2015 – higher than its 3.4 percent average in the 10 yearsbefore recession – and creating385,000 jobs. That would mean itwould return to its previousemployment peak by 2013.

It expects England’s foursouthern regions to generatemore than two-thirds of the net1.3m jobs it believes that theeconomy will create in thatperiod. Jobs growth will beweaker in Wales, Scotland,

northern England, Northern Ire-land and the Midlands – widen-ing the north-south divide.

Public sector jobs are poisedto fall everywhere but effectswill be felt hardest in areasmost dependent on the state sec-tor. Business leaders believethat faster private sector growthcan be achieved – but not neces-sarily in time to fill the gap.“There will probably be a timelag between business invest-ment in some of those poorerregions picking up in time tocompensate for the squeeze in

the public sector,” said RichardLambert, director-general of theCBI employers’ group.

Oxford expects net jobsgrowth in all regions but fore-casts only 4,000 extra jobs inWales during the five years,22,000 in north-east England andNorthern Ireland, 65,000 in Scot-land, 57,000 in the east Midlandsand 67,000 in Yorkshire and theHumber. It expects 353,000 jobsto be lost in the public sector –less than the Office for BudgetResponsibility, which forecasts610,000 by 2015-16. But its fore-

cast of 1.67m extra private sec-tor jobs is also lower, making its1.3m net forecast the same asthe OBR’s.

Wales’s poor outlook flowsfrom above-average reliance onmanufacturing, health, educa-tion and public administrationand the lowest proportion ofjobs in private services of allregions except Northern Ireland.

The west Midlands, forecast togenerate a net 78,000 jobs, isseen doing better than the eastMidlands and the north duringthe five years but this follows a

weak performance over the pre-vious decade because of depend-ence on low-margin engineering.

Oxford expects business serv-ices, including finance, to gener-ate jobs at a faster rate thanmanufacturing.

Tim Leunig, at the LondonSchool of Economics, said evenon Oxford’s optimistic forecastof output growth averaging 3per cent a year across the UK,he would expect at least oneregion to suffer a net job loss.

For analysis see www.ft.com/uk

Back to work: how the regions are looking for a boost

Renewable energy has beenidentified as one ofScotland’s best hopes forgrowth, with the Holyroodgovernment estimating thesector could create 26,000jobs over the next 10 yearsand provide up to £15bn ofinvestment opportunities.

There is also optimism thatmanufacturing will benefitfrom sterling’s decline, withScottish Engineeringreporting that orders, outputvolume and employeenumbers have all returned topositive territory for the first

time in three years. However,it also warned thatcompanies remained cautiousabout capital investment andmanufacturers complainedthere was still little evidenceof banks making moneyavailable for the sector.

The biggest concern isover the impact of thecoming squeeze on publicexpenditure, with the Fraserof Allender Institute atStrathclyde Universityestimating Scotland couldlose up to 90,000 publicsector jobs over the next fewyears. Professor BrianAshcroft said: “The speed ofScotland’s slow recoveryfrom recession is threatenedby the massive consolidationpackage introduced by thenew ConservativeLiberalDemocrat coalitiongovernment in theemergency Budget.”

Garry Clark, head of policyand public affairs at theScottish Chambers ofCommerce, said businesseswere expecting the publicspending cuts at Scottishand UK level to damp downthe recovery, as would nextyear’s rise in VAT.

Andrew Bolger

The northwest is looking toforeign investment to providemany of its future jobs. Ithas been the biggestbeneficiary of foreign directinvestment in the UK outsideLondon and the southeastfor the fourth consecutiveyear.

SPX, a big USmanufacturer, yesterdayopened its European backoffice centre in Manchester,which will soon employ 100people.

Chris Kearney, chiefexecutive, said: “Thelanguage skills are here, thefinance skills are here. Thereis a big talent pool and it iseasy to get in and out with amajor airport.” The companyjoins 1,500 foreignownedbusinesses with operations ingreater Manchester.

The region began its movefrom manufacturing to amore diversified, serviceledeconomy in the 1990s andcities such as Liverpool andManchester, where thattransition has gone furthest,are outperforming.

However, big public sectorrelocations, such as theHealth and Safety Executiveand the NHS’s NationalInstitute for ClinicalExcellence, also helped it

create more jobs than anyregion outside the southbetween 19982008. Theymay be harder to secure inthe future and have madethe region more vulnerable topublic sector job cuts.

The BBC’s move to Salfordcould transform a significantcluster of creative and digitalbusinesses into a worldclassone. The Northwest RegionalDevelopment Agency, whichis being wound up, also citestourism, advancedmanufacturing such asaerospace, food and drinkand the biomedical sector asproviding future jobs growth.

Andrew Bounds

David Stevens, chiefoperating officer of Admiral,the insurer and Wales’largest quoted company, wasunsurprised that OxfordEconomics forecast lowergrowth for Wales than forany other part of the UK. Hesaid: “It is depressinglyinevitable that over the nextfew years Wales will struggleeconomically because it is soreliant on publicsectoremployment, and that will bedepressed by the correctionof budgetary balances.”

Wales faced a “hugechallenge” to bolster itsbusiness stock. The task washampered by low criticalmass of existing companiesto spawn other businesses,and geographic isolation.“The further you get fromLondon, the harder it gets,and that is a powerfulfeature of the UK economy,”Mr Stevens said.

Admiral plans to increasestaff numbers in south Wales

from 3,000 to more than3,500, but Mr Stevensbelieves “another four or fiveAdmirals” are needed.

Ian Price, assistant directorof CBI Wales, said devolutionwould soften the blow ofpublic spending cuts. TheWelsh Assembly Governmenthad surplus funds it coulduse to cushion reductions inthe budget allocated toWales by Westminster.

Mr Price said: “It is hard tosee the number of jobs thatwill be lost in the publicsector being absorbed in theprivate sector.”

The historic focus of jobcreation programmes inWales has been on attractingmultinational manufacturerswith grants. However, MrStevens said that results hadbeen disappointing, becausesome of the companies hadrelocated production tolowercost centres in easternEurope and Asia.

Jonathan Guthrie

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2025+2024

When will employment return to its previous peak in each region?

East,South-east,South-west

East Midlands

Wales,WestMidlands

North-west North-east NorthernIreland

Yorkshire& Humber,Scotland

London

Chris Clifford, CBI regionaldirector in the west Midlands,said it was encouraging thatthe UK’s traditionalmanufacturing heartland wasforecast to grow faster thanthe east Midlands and thenorth. “These are not figuresto be despondent about,given the starting point,” hesaid.

The west Midlands, with itsweak skills base anddependence on lowmarginengineering, was the regionworst hit by the recession.According to OxfordEconomics, employment fell4.3 per cent between 2008and 2010, while gross valueadded shrank 2.3 per cent.

John Russell, chiefexecutive of ManganeseBronze, the Coventrybasedmanufacturer of black taxis,said: “Since the 1970s wehave had a consistent trendof underperforming againstnational averages.”

Business leaders in

Birmingham, whereunemployment among youngmen has ballooned to almost20 per cent in somedistricts, do not expect theprivate sector to absorbredundant publicsectorworkers smoothly. Mr Cliffordsaid: “We are the onlyEnglish region that hasproduced no growth inprivatesector jobs over thelast 10 years, and that ispretty damning.”

Mr Russell said businesswould eventually take up theslack, as new enterprisesflourished, but not before ahiatus that triggered anotherspike in unemployment.

Business figures are criticalof the expected abolition ofAdvantage West Midlandsalong with other regionaldevelopment agencies at atime when small businessesneed extra help. “We have atough job ahead of us,” MrClifford said.

Jonathan Guthrie

“There is no doubt that ifany region is going to leadthe recovery it’s going to beLondon, if only because of itslack of dependence on thepublic sector,” says ColinStanbridge, chief executive ofLondon Chamber ofCommerce and Industry.“But the job growth forecastsare really challenging.”

Unemployment has crept

up to 9.3 per cent of theworkforce, second only tonortheast England.Nonetheless, OxfordEconomics believes London’seconomy can grow at 3.8 percent a year over the nextfive years – above its 3.4 percent average in 19982008 –and generate 385,000 jobs.

The London mayor’s officesays employment couldsurpass prerecession levelsby 2015 or earlier. It foreseesbusiness and financialservices growing from 1.56min 2007 to 1.98m in 2031and strong growth in leisure,personal services, hotels andrestaurants.

Mr Stanbridge saysconditions must be right,including avoiding a doubledip recession and being“incredibly careful” aboutregulation. Transport is vital.“Things like CrossRail andthe Tube upgrade have to gothrough.”

Brian Groom

For northeast England,restructuring has been thekey theme of the last 30years as the economyconfronts the move fromtraditional, heavy industry toa more diversified base.

Now it faces morerestructuring as the publicsector is forcibly shrunk – achallenge underlinedyesterday by immediatefunding cuts imposed by OneNorthEast, the regionaldevelopment agency, on 25bodies which are drivers ofgrowth. These include theNational Renewable EnergyCentre and the Centre forProcess Innovation.

To counter the growth inthe northsouth divide, theregion needed to fosterdigital companies, said JonBradford, chief executive ofThe Difference Engine, anacceleration programme fornew businesses. “You areless dependent on yourgeographical location and canserve national and globalmarkets.”

Martyn Pellew, president ofthe northeast Chamber ofCommerce and groupdevelopment director of PDPorts, the UK’s thirdbiggestport, said that the regionneeded clarity quickly about

government policies in areassuch as green energy so theprivate sector could build onthe northeast’s strengths.

Brian Moore, a Newcastlebased entrepreneur who ismanaging director of SinoUK, which brings overseasstudents to the UK, hasexperienced both businessfailure and growth during therecession. There was nopoint in opting for old, failedpolicies of trying to attractoutposts of overseasbasedcompanies. “We need tosubsidise people to createtheir own business,” he said.

Chris Tighe

London

NortheastScotland

Wales

Northwest

West Midlands

Wind farm in Caithness

Salford Quays, Manchester

Capital is eyeing an upturn

Open arms for local talent

Geared for growth: Land Rover’s Solihull plant Alamy

Rebalancing the economy

Northsouth divideis set to widenWales and Midlandsto be among worst hit