UK Real Estates

-

Upload

vishnuchaithanya -

Category

Documents

-

view

215 -

download

2

description

Transcript of UK Real Estates

UK real estates

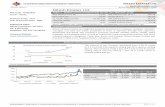

UK &Canada Real Estate Markets-by Adit Agrawal (13P185)Kumar Nittin (13P212)In 2000, directly owned real estate accounted for some 7% of the value of the institutional investment market throughout the worldThis represents the third largest market (at 12% of global RE market) after the US ($380 billion, or 30%) and Japan ($217 billion, or 17%).The cult of the equity has dominated western investment strategy in the 1980s and 1990s to the extent that equities now dominate most institutional portfolios, especially in the US, the UK and Hong Kong. On the other hand, in Germany and some other continental European countries, bonds have always been the largest component of the mixed asset portfolio. In either case, property has been treated as the third asset class.UK institutions held over 20% of their investments in real estate in 1980. The average is now around 7%. There are two reasons for the decline. First, the returns on property relative to equities were low in the 1980s, so that the allocations to equities have increased as a result of the unmatchable growth in the capital values of equity portfolios. Second, the positive performance characteristics of property, traditionally seen as reasonable return, low risk and a good diversifi er, have been challenged.Real estate investment: the rationaleProperty is differentiated from other assets by four main factors. First, it is a physical asset, requiring maintenance and suffering obsolescence. Second, its income delivery is governed by lease contracts. Third, its supply side is inelastic and is regulated by both central and local government policy. Finally, it is not traded in a centralised market, and as every property is unique, it is valued consequently without the benefi t of direct reference to quoted trading prices for identical properties.Income through Lease contractsThe payment of rent is governed by the provisions of the lease. The UK has begun to move away from the previously standard 25-year lease, which appears to favour UK landlords and to suggest their peculiar strength in the market. The UK lease of commercial property usually fi xes rents for fi ve-year intervals with upward-only reviews, while continental European leases often have rents indexed annually. Longer North American leases may have rents tied to the rate of infl ation or, more often, for retail tenants, to the tenants turnover; this is rare in the UK. The rental pattern in the typical prime UK investment property is therefore stepped upwards (in a period of infl ation or growth) at fi ve-yearly intervals.Rents at each review point are renegotiated in line with the open market rent. It is arguable that market rents (ERVs; estimated rental values) refl ect the fi xed nature of the review period and are higher than annually reviewable rents would be. Similarly, longer review periods will attract even higher rents.Planning and supplyUnlike equities, the supply of property is regulated to some extent by central government. Unlike gilts, the spatial nature of property as an asset means that local government also has a say in the supply side. Unlike both, supply is inelastic in response to economic conditions. This has several effects, most important of which is the exaggeration of the well-known property cycle and the occasional boom and bust.The sectors: principal characteristicsCommercial property risk and return characteristics vary from property to property and fThere are over 500,000 shops in the UK and thousands of shopping parades. There are about 500 locations which attract a reasonable spread of multiple retailers. However, there are only 100200 prime retail locations, typically with at least 100 shops each and minimum catchment populations of 50,000 266 Institutional Aspects of National Real Estate Marketsplus. High-street shop unit values typically range from 100,000 to 5 million and offer the potential for effective diversifi cation. rom sector to sector.As single tenant investments they are straightforward to manage. They depreciate very little, as much of the value resides in the land. Supply is restricted by the importance of the location, so owners are protected from competition in many cases. Nonetheless, smaller high streets have suffered in recent years as shoppers have sought greater shopping choice and convenience in out-of-town retail warehouses and shopping centres.Retail warehouses and parksHighly popular with the price-conscious, time-poor, car-borne shopper in the 1990s, retail warehouses were the best performing sector for investors through most of the 1990s. Planning limitations usually restrict sales to bulk goods (DIY, furniture, carpets, white goods). Single units have lost popularity at the expense of retail parks, typically of 75,000150,000 sq ft (1030 million capital value). The few retail parks combining areas of 200,000 sq ft and more with open A1 (unrestricted retail) planning consents can become open-air shopping centres and command much higher rents. Rents in Fosse Park, Leicestershire, the most notable example, are now 10 times the rate of stand-alone DIY units in many locations. Good parking and highway access are vital. Recent poor performance may be explained by excessive buying pressure though the mid-1990s and general doubts about the retail sector in the midst of the e-commerce revolution. However, out-of-town retail planning consents have become increasingly diffi cult to obtain, supporting investor interest.Shopping centres- Refurbishment, depreciation and service charges for common parts are big issues for shopping centre owners and their tenants. Offices and business parks- Traditional town centre offi ces have been the worst performing UK property sector over 30 years, Depreciation and obsolescence have badly affected performance as occupiers needs have changed and fl exibility of layout and services has become the key issue. Many of the earlier buildings have been incapable of providing air-conditioning and raised floors for computer cablingIndustrials and distribution warehouses - Traditional industrial estates have historically performed best late in the cycle: strong performance following strong retail performance was a typical pattern for the 1970s1990sResidential- UK allocations to this sector are tiny but growing. Traditionally excluded from the institutional market due to legislative risks and small lot sizes. Returns have been high in recent years but falling.vehicles available for property investmentWhile many larger investors choose to invest by assembling portfolios of buildings (segregated portfolios) or by appointing managers to do the same (separate accounts), smaller investors may choose indirect investment in property through the purchase of property shares or by participating in pooled property vehicles.These include illiquidity, the bias of pension fund minimum solvency requirements against relatively illiquid assets, poor comparative returns during the 1980s and 1990s, and a lack of trust in property return indices.The success of the REIT in the US has prompted many investors and managers to encourage the creation of a similar quoted, tax-transparent product in the UK. Unfortunately, the UK government has made it clear that it regards such a development as tax negative. In addition, investing in property shares has tended to deliver performance which is linked to the performance of the stock market and fails to provide the diversifi cation advantages of property. Recent work by ABN-AMRO also suggests that returns have been very similar as for direct property investment, but for much greater risk. Hence, this means of investing in property has become less popular in recent years.

The UK has been no exception in its development of securitised and other indirect forms of property ownership. The packaging of listed securities into funds which provide exposure to a countrys property sector, or to a region or a sector, gathered pace in the late 1990s.However, for the supply of property share funds to grow requires growth in the number and size of listed property companies. In 2000, market pressure in the UK was operating in the opposite direction, as large discounts of share price to net asset value made it more attractive to take property companies private and exploit the property values in other ownership formats whose performance is unlinked to the stock market. Over the longest time series available, property companies have outperformed direct property investment by around 1.5% each year. Both have signifi cantly underperformed the UK equity market.Investment vehiclesLimited partnerships-The limited partnership enables a pool of investors to invest together in one or more assets. The number of partners was limited to 20 but is now unlimited. While at least one, the general partner, must have unlimited liability, the other partners may be limited. The investment is, therefore, passive and, importantly, the investment itself is tax transparent.regularly heard of in the UK property market since the 1990s.In establishing the pool of capital required, the GP may appoint a promoter to raise capital from limited partners (LPs); in some cases, the promoter may be the originator of the concept and seek a GP to act as lead investorsLimited partnerships are tax-neutral or tax-transparent vehicles, meaning that the vehicle itself does not attract taxation, and partners are treated exactly as if they owned the assets of the limited partnership directly.Although the legislation for limited partnerships has been in existence since the passing of the Limited Partnership Act of 1907, conspicuously few were established as a vehicle for property prior to 1997The gross asset value of all the limited partnerships presently equates to approximately 14 billion. There is almost 4 billion of gross asset value in the top 10 funds Limited partnerships do not appear to favour particular types of property over others, but a key theme is that in many cases a fund will often be sharply focused on a single specialist property type. Examples include Airport Hotels Partnership, Apreit V Nursing Homes and MWBs leisure funds. Some are more similar to property unit trusts, diversifi ed partnerships including Lionbrook Property Partnership, and the Threadneedle Tandem Property Fund.Investment vehiclesProperty unit trustsManaged fundsProperty investment trusts - are listed investment trust companies which specialise in property investment, primarily by holding portfolios of listed property shares. Property investment trusts have the ability to invest directly in property, but direct investment is restrictedSpecial-purpose corporate vehicles and cross-border structures- For a variety of reasons connected with fi nancing, accounting and tax, many corporate vehicles have been created as special-purpose vehicles for holding property assets off balance sheet. In addition, some property funds have been created in offshore corporate form, but usually for the purpose of holding overseas assets in a tax-effi cient way

Other trendsDecline of traditional owners- The structure of ownership (or, more accurately, control) of UK commercial property has been changing in both obvious and subtle ways over the last 25 years.1. To take an example, the overseas ownership of City of London offi ce buildings increased from around 35% to 2025% over the period from 1972 to 19982. there has been a less apparent shift in management away from the insurance companies and pension funds which were so dominant in 1980, when property made up as much as 22% and 12% respectively of their total assets, towards fund managers and property companiesProperty companies have been successful at surviving two severe challenges to their existence, in 197375 and in 199193. In both property recessions many famous property companies became insolvent and disappeared. The extremely strong performance of the stock market in the 1980s and again since 1993, coupled with a growing demand for liquid (easily traded) property investment vehicles, has provided some support to the albeit poorly performing share prices of the survivors. However, the weighting of property companies as a proportion of the stock market has declined significantly since 1989 and suffered greatly again in the technology boom of the late 1990sRole of governmentThe principal legislative and regulatory issues of current concern to the UK property industry corporation tax, capital gains tax, health and safety law, employment law, accounting standards, land-use planning system, construction law, landlord and tenant mattersStamp duty - The industrys competitiveness is damaged by charging capital invested in the property sector 4% stamp duty while capital invested in the equities sector is charged 0.5%. This issue distorts the effi cient working of the market to the detriment of the industry and its customers.

Other issuesIssue of European Monetary UnionThe UK government position on monetary union is complicated. It appears committed to entry, but also to sticking by the outcome of a future referendum which appears unlikely to confi rm the government positionEMU membership, when it comes, seems likely to have one signifi cant benefi cial effect on UK property investment and for UK investors. It will eliminate currency risk for cross-border European investors, and reduce currency concerns for global investors with pan-European strategiesThe Commercial Leases Code- Following lobbying by tenants concentrated in the retail sector, the UK government wants to encourage more choice and fl exibility in the commercial property market and to promote a better understanding of property matters, particularly among small business occupiers. In particular, the industry is focusing on the long lease with upward-only rent reviews as a possible restraint of trade. This led to the publication of the 2002 Commercial Leases Code.The principal requirement of the Code is that landlords should offer fl exible and alternative terms for consideration by a prospective tenant and for both parties to ensure that they have obtained professional advice before committing themselves to a lease and fully understand the basis on which the lease is issued. In assessing fl exibility and alternative terms, landlords are encouraged to re- fl ect on the terms that they are prepared to accept and tenants are required to ensure that such terms truly represent the circumstances upon which they are prepared to be bound during the course of the lease. Where alternative terms are offered, rents will differ accordingly. The market has already moved forward considerably from the days when the standard 25-year lease term was adopted by both landlords and tenants, regardless of the circumstances. Nonetheless, the government is hoping to encourage more leases of short duration. Break clauses are an effective compromise.