'UDIW - snlp.org.uk account Aug 2016.pdf · Independent reporting accountant's report on regularity...

Transcript of 'UDIW - snlp.org.uk account Aug 2016.pdf · Independent reporting accountant's report on regularity...

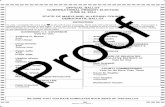

Draft

Company Registration No. 07703784 (England and Wales)

THE ST NEOTS LEARNING PARTNERSHIP

(A COMPANY LIMITED BY GUARANTEE)

TRUSTEES' REPORT AND AUDITED ACCOUNTS

FOR THE YEAR ENDED 31 AUGUST 2016

Draft

THE ST NEOTS LEARNING PARTNERSHIP

CONTENTS

Page

Reference and administrative details 1 - 2

Trustees' report 3 - 14

Governance statement 15 - 20

Statement on regularity, propriety and compliance 21

Statement of trustees' responsibilities 22

Independent auditor's report on the accounts 23 - 24

Independent reporting accountant's report on regularity 25 - 26

Statement of financial activities including income and expenditure account 27 - 28

Balance sheet 29

Statement of cash flows 30

Notes to the accounts including accounting policies 31 - 49

Draft

THE ST NEOTS LEARNING PARTNERSHIP

REFERENCE AND ADMINISTRATIVE DETAILS

- 1 -

Trustees Karl Wainwright (Chairman)

Graham Wright (Local Community Governor)

Julie Smith (Vice Chair)

Martin Critcher (Parent Governor)

Karen Kircher (Parent Governor)

Judith Burt (Parent Governor)

Helen Bryson (Parent Governor)

Rick Carroll (Executive Head and Accounting Officer)

Margaret Carpenter (Staff Governor)

Ian Dumbleton (Local Community Governor)

Roger Henthorne (Partnership Governor)

Christine Lewis (Partnership Governor)

Catherine Hutton (Community (Authority) Governor) (Resigned 9 September 2015)

Sandy Law (Community (Authority) Governor)

Graham Hughes (Parent Governor)

Michael Norton (Staff Governor) (Resigned 4 December 2015)

Andrew Truett (Staff Governor)

Martin Paine (Headteacher) (Appointed 10 September 2015)

Tracy Grinnell (Headteacher) (Appointed 1 September 2016)

Members

- Chair Karl Wainwright

- Community (Authority) Governor Graham Wright

- Vice Chair Julie Smith

- Vice Chair Julie Smith

Senior management team

- Headteacher Longsands Academy Martin Paine

- Acting Headteacher Ernulf Academy (resigned 31 December 2015)

Di Beddow

- Acting Headteacher Ernulf Academy (1 January 2016 - 31 August 2016)

Rick Carroll

- Headteacher Ernulf (appointed 1 September 2016)

Tracy Grinnell

- Deputy headteacher Karen Dodsworth

- Deputy headteacher Andrew Rowe

- Deputy headteacher Clare Greaney

- Senior assistant headteacher Rosalind Mathews

- Senior assistant headteacher Cathy Chilman

- Senior assistant headteacher Lisa Plowman

- Assistant headteacher Alison Blacow

- Assistant headteacher Lindsay Townley

- Assistant headteacher Daniel Berry

- Chief Executive Office Rick Carroll

Company secretary Ann Christie

Company registration number 07703784 (England and Wales)

Draft

THE ST NEOTS LEARNING PARTNERSHIP

REFERENCE AND ADMINISTRATIVE DETAILS

- 2 -

Registered office Longsands Road

St Neots

Huntingdon

Cambridgeshire

PE19 1LQ

Academies operated Location Principal

Longsands Academy St Neots, Cambridgeshire Martin Paine

Ernulf Academy St Neots, Cambridgeshire Tracy Grinnell

Independent auditor Rawlinsons Chartered Accountants

Ruthlyn House

90 Lincoln Road

Peterborough

Cambridgeshire

PE1 2SP

Bankers Lloyds plc

99 High Street

Huntingdon

Cambridgeshire

PE29 3DU

Solicitors Leeds Day

1a South Street

St Neots

PE19 2BW

Stone King Solicitors

Cambridge Office

30 Station Road

Cambridge

CB1 2RE

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT

FOR THE YEAR ENDED 31 AUGUST 2016

- 3 -

The trustees present their annual report together with the accounts and independent auditor's report of the charitable company for the period 1 September 2015 to 31 August 2016. The annual report serves the purposes of both a trustees' report, and a directors' report under company law.

The trust operates 2 secondary schools in St Neots, Cambridgeshire. Its academies have a combined pupil capacity of 3,188 (Ernulf 1,331 students and Longsands 1,857 students) and had a roll of 2,449 (Ernulf 566 students and Longsands 1,883 students) in the school census in May 2016.

Structure, governance and management

Constitution

The academy trust is a company limited by guarantee and an exempt charity. The charitable company's memorandum and articles of association are the primary governing documents of the academy trust.

The charitable company is known as St Neots Learning Partnership and comprises Longsands Academy and Ernulf Academy.

The trustees of The St Neots Learning Partnership are also the directors of the charitable company for the purposes of company law. Details of the trustees who served during the year are included in the Reference and Administrative Details on page 1.

Members' liability

Each member of the charitable company undertakes to contribute to the assets of the charitable company in the event of it being wound up while they are a member, or within one year after they cease to be a member, such amount as may be required, not exceeding £10, for the debts and liabilities contracted before they ceased to be a member.

Trustees' indemnities

In accordance with normal commercial practice the Academy has purchased insurance to protect Governors and officers from claims arising from negligent acts, errors or omissions occurring whilst on Academy business.

The Governors, who were in office at 31 August 2015 and served throughout the period, except whereshown, are listed on page 1. Parent Governors are elected by the parents of registered pupils at therelevant Academies. Staff Governors are elected by a secret ballot of all staff employed under a contract of employment or a contract for services at the relevant Academy. If a Staff Governor ceases to work for the Company then they shall be deemed to have resigned and shall cease to be a Governor automatically ontermination of employment. The Governors may appoint up to 3 co-opted Governors.

Method of recruitment and appointment or election of trustees

The training and induction provided for new Governors will depend on their existing experience. All new Governors are invited to attend an introductory meeting and/or a tour of each Academy. As there are normally only two or three new Governors a year, induction tends to be tailored specifically to the individual. There is a checklist of activities and information to be provided to help ensure that induction is effective.

All Governors are provided with copies of policies, procedures, minutes, accounts, budgets, plans and other documents that they will need to undertake their role as governors. In addition, the Governing Body may each year decide to organise training collectively or for individual Governors.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 4 -

Organisational structure

The Trust is led by a Chief Executive Officer who is also the Accounting Officer. Each individual school in the Trust has its own Headteacher. There is also a Partnership Chief Operating Officer who acts as Chief Finance Officer. For the period September 2015 – August 2016, the post of Headteacher at Ernulf Academy was held by Di Beddow on a temporary basis until 31st December 2015, and then by the CEO in a joint role until 31stAugust. A new Headteacher has been appointed from 1st September 2016. There has also been a process of restructuring during this period which will see the reduction of the number of deputy heads across the Trust.

In addition to the CEO and the Headteachers the SLT will consist of one lead deputy in each Academy, one Operations Director across the MAT who will also act as Chief Finance Officer, and five assistant Headteachers

The role of Accounting Officer is currently held by the CEO of the Multi Academy Trust.

The Board of Trustees has overall responsibility for the administration of the Academy’s finances. The main responsibilities of the Governing Body are prescribed in the Funding Agreement between the Academy and the Secretary of State.

There is a Partnership Improvement and Leadership Team (PILT), which controls the Partnership at an executive level. The PILT and the Senior Leadership Team in each Academy implement the policies laid down by the Governors and report back to them.

Headteachers, members of the Senior Leadership Team and Partnership CFO are responsible for the authorisation of spending within agreed budgets; a summary of this is in the Scheme of Delegation. Some spending control is devolved to Budget Holders, which is also authorised in line with the authorised Scheme of Delegation.

Related parties and other connected charities and organisations

Huntingdonshire District Council (HDC), through its leisure service One Leisure, historically managed the leisure facilities located on the site of Ernulf Academy. There was a Dual Use Agreement in place. When the school converted to foundation status, ownership of all of the land and buildings was transferred to the Governing Body of the Longsands Learning Partnership, and subsequently was transferred to The St Neots Learning Partnership. In July 2013, the Department for Education agreed Heads of Terms for the SNLP to draw up a lease agreement, for 60 years, with HDC, which will replace the Dual Use agreement. In April 2014 Ernulf Academy entered into a 5 year agreement with HDC to ensure continued use of the facility by Ernulf Academy. Having received the approval of the EFA to enter into a new agreement, the Trust is still continuing to work with professional advisers to ensure that the best interests of the Trust are secured.

The Partnership provides a pre-school setting on the Ernulf site (Little Acorns), and an external company, Sunhill Daycare independently operates a day nursery on the Longsands Academy site. Adult and Community Learning was provided on both sites until 31st August 2015. Unfortunately due to uncertainties regarding future funding for Adult and Community Education it has been decided by the Board of Trustees to cease this provision.

The Trust also operates a facility for students educated other than at school (EOTAS), which is known as Prospect House and is located at Bargroves, Cromwell Road, St Neots. From September 2015, Ernulf Academy has been funded by the Local Authority to run a specialist unit for students on the autistic spectrum, this unit is known as the Cabin. Ernulf Academy also has an active Parent Teacher Group.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 5 -

The Trust has strong collaborative links with all of the primary schools and the special school, which along with Ernulf and Longsands form the St Neots Schools Forum.

SNLP has entered into a sub-contracting arrangement with Stageworks Performing Arts and St Neots Town Football Club for the delivery of specialist classes for post 16 students. This has enhanced the curriculum offering to sixth form students and has increased student numbers with some students travelling from outside the catchment area. Stageworks rent facilities at Longsands Academy to enable this delivery to take place while the Football club has specialist teaching space on its own site to provide these lessons.

There are no related parties which either control or significantly influence the decisions and operations of The St Neots Learning Partnership.

Objectives and activities

Objects and aims

The core purpose of the Learning Partnership is to secure the best possible experience, learning and outcomes for each young person for whom we have responsibility.

The Partnership's Statement of Purpose, Values and Outcomes identifies values which will be promoted and outcomes which will be pursued. These are shown below:

Core values� care and respect for self and others; honesty; creativity;� clear and open communication;� high aspirations and the determination to fulfil them;� strong relationships and shared goals achieved through teamwork.

Desired outcomes

Each young person should:� be safe; be healthy; give and receive respect as an individual; enjoy and achieve in school and

beyond;� develop the confidence, skills and attitudes necessary for economic well-being;� understand their rights and responsibilities as citizens and the importance of making a positive

contribution to society;� develop moral awareness, cultural understanding and appreciation of diversity.

The Trust seeks to comply with all appropriate statutory and curriculum requirements. It conducts all business in accordance with the highest standards of integrity, probity and openness.

Objectives, strategies and activities

Key priorities for the year were contained in our Partnership Improvement Plan, which is available in its latest form from the PA to the Executive Principal, or on the Partnership's website. Improvement focuses identified for this year were expressed as a small number of Strategic Intents with associated planned actions. These are summarised below:

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 6 -

Strategic intent 1: Learning and outcomes

We intend to continue to raise standards at Ernulf and Longsands by:� increasing the range and impact of actions aimed at overcoming educational disadvantage;� further enhancing the ways in which the best possible progress and outcomes are secured for all

students;� further strengthening the information, advice and guidance provided for students.

Action that is focused on overcoming actual or potential disadvantage:� ensure that all teachers and TAs are enabled and determined to narrow the gap through appropriate

focus on the progress and outcomes of disadvantaged students;� evaluate and develop the use of the Pupil Premium and Year 7 Catch Up funds and their impact on

learning;� evaluate levels of participation in trips, visits and extra-curricular activities by disadvantaged and other

groups of students, and develop impact assessment, e.g. on attitudes to learning;� improve attendance overall and reduce levels of persistent absence, e.g. by further tracking and

intervention;� collaborate with the local authority and others in relation to Not in Education, Employment or Training,

Risk of Non-participation Index and the Together for Families initiative;� implement leadership and co-ordination of all of the above by named senior team members.

Action focused on securing the best possible progress and outcomes for all students including the disadvantaged:

� ensure consistent use of programs (SISRA and SIMS Discover) to track students’ progress and secure appropriate follow-up action;

� continue to focus on students’ literacy and numeracy across the curriculum and phases (primary andsecondary):

� implement Think-Plan-Communicate Mathematically;� enhance leadership and management of literacy development within each Academy;� evaluate Opening Minds and i2L5 in terms of students’ core skills and broader development;

(Longsands) extend i2L into Year 8;� (Ernulf) implement a revised KS3 curriculum including increased time for English in Y7 and the

reintroduction of Technology;� co-ordinate Partnership provision of Modern Foreign Languages and International Education, PE,

Mathematics and Science;� further strengthen the effectiveness of learning and teaching in key areas including Mathematics at

Ernulf Academy;� maintain and enhance alternative provision for students unable to access mainstream education;� investigate new technologies, e.g. tablet devices, to promote students’ literacy and independent

learning;� plan and co-ordinate the sixth form curriculum and related activity to include:� a Partnership response to the raising of the school leaving age;� the development of joint pathways and plans for provision in otherwise non-viable subjects;

Action focused on further strengthening information, advice and guidance:� analyse health and well-being survey data in order to address identified issues such as anxiety (home

and school);� supplement the recent focus on disadvantaged groups with renewed attention to gender;� further refine the options process as appropriate in each Academy;� further evaluate the planning for and impact of Work Experience across the Partnership;� evaluate and refine Mentoring for All and Assertive Mentoring programmes;� evaluate the appropriate use of Restorative Approaches and implement targeted student and staff

training.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 7 -

Objectives, strategies and activities

Strategic intent 2: Context for learning

We intend to enhance the context for learning by:� continuing to improve the physical context for learning;� continuing to uphold IiP principles through improvements to the professional context for learning.

Physical context� access opportunities, e.g. from the Academies Capital Fund and the Community Infrastructure Levy,

to fund major site works;� implement a further programme of internally managed refurbishment.

Professional context� implement coaching programmes for staff;� modify review and development processes (appraisal) in the context of a revised pay policy;� investigate and, if possible, participate in the establishment of alternative routes into teaching;� implement a revised model for the work, development and management of teaching assistants;� implement the final phase of the Succession Plan for senior leadership.

Public benefit

The trustees have complied with their duty to have due regard to the guidance on public benefit issued by the Charity Commission in exercising their powers and duties.

Strategic report

Key performance indicators

The Governors compare costs as a percentage of income to monitor financial performance as these are commonly used and benchmarked within the sector. Benchmarking between the two schools in the AcademyTrust routinely takes place as well as benchmarking costs among the Huntingdonshire Academies Secondary Partnership and Cambridge & Peterborough Academies Group (CPAG).

Staffing costs are monitored as a percentage of total income. For the period ended 31 August 2016 staffing costs, amounted to 70% of total income (68% in 2015).

General Annual Grant (GAG) per pupil is £4,900 for the period to 31 August 2016 (£4,630 in 2015). It is important to the Trust to monitor this due to the historic low funding for Cambridgeshire as a whole.

The Academy Trust also uses a number of non-financial key performance indicators to monitor its performance.

Ernulf AttendanceThe pattern of attendance has shown a greater level of consistency throughout the year; apart from a slight dip to 93.8% in the Spring term (still higher than in previous years) the overall attendance has been consistently above 94%. This is higher than at any time during the past 4 years and reflects the impact of more rigorous attendance monitoring and the diligent, effective work of the new attendance officer.

Longsands AttendanceLongsands attendance showed a similarly consistent pattern, with levels of attendance around 95% in each term, with a peak attendance of 95.8% in the Autumn term. The pattern of attendance was maintained

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 8 -

Achievements and performanceThe following is a summary of some of the principal achievements of the Partnership and/or each Academy in 2015-2016:

� continued development and participation in the work of the St Neots Schools Forum including the Restorative Approaches project, "Think ~ Plan ~ Communicate" (literacy and language learning), Think, Plan Communicate (mathematically), with project funding for the latter two projects the subject of a successful bid to the local authority (Cambridgeshire County Council). Also enhanced partnership working with primary feeders especially the Diamond Learning Partnership Trust to ensure closer transition work for Year 6 students into year 7. Agreement has also been reached to provide an MFL teacher from the SNLP on a 0.4FTE for supporting the provision of languages at primary level;

�

�

continued development of management functions across the partnership but more so at Ernulf. Student support and middle leadership has been reviewed and strengthened. Greater emphasis has been placed on progress and curriculum development;SLT support and leadership has been strengthened at Ernulf including the appointment of a new Headteacher;

� additional capital work upgrades at both Ernulf and Longsands Academies through successful bids for capital projects. The recent roof collapse at Longsands has left the Trust with significant shortfall in funds approximately £300,000. This has impacted on the works the Trust was hoping to implement and has affected future plans and staffing levels. Redundancies have been made;

� continued development of the of SIMS (Schools Management Information Systems) as a means of reporting in real time to parents (SIMS Learning Gateway);

� continued offer of a broad balanced curriculum to take into account national parameters and financial restrictions;

�

�

enhanced focus on the impact of Assertive Mentoring and a shift of the learning day to a new mentoring slot on a Tuesday period 5;continual review of best practice, marking and feedback, use of resources and interventions against specific progress targets and outcomes;

� review of the focus of PSHE to ensure that it meets the needs of learners with regards to mental health and radicalisation;

� continued development of the Learning Moves programme to strengthen the Continual Professional Development of staff at both Academies. Also, development of cross-partnership working with use of voluntary shared best working practice through twilight sessions to look at joint planning and sharing expertise.

Ernulf Academy achievementsDespite a significantly weaker cohort, the GCSE achievement of 5A*-C including English and Maths rose by 1% compared to 2014, to 36%. Notably, there was very strong progress in English, with 31% of students achieving more than expected progress; overall 72% of students achieved at least expected progress in English, leading to an overall pass rate of 60% A*-C. There has been a sustained focus on improving Maths results this year, which has resulted in a 20% rise in the number of students achieving expected progress, from 40% to 60%. A*-C performance in Maths at 46% A*-C, though a 1% improvement on 2014, still lags behind English. 96.1% of students achieved 5 or more A*-G grades, close to the national average, with particularly good performance in English, Maths, the Sciences and Btec vocational subjects.

Longsands Academy achievementsAs in Ernulf Academy, this was not an academically strong cohort. The English results were significantly affected by a coursework moderation decision, and we are still (October 2015) awaiting the outcome of an appeal, which could result in an increase to the current 57% 5A*-C including English and Maths, as 64% of students achieved at least 5 A*-C GCSE grades overall. Maths was particularly strong, achieving 74% A*-C and 100% in Further Maths.

A Level results continued the upward trend of the past two years, with 29% of all grades at A-A*, 48% at A*-B, mainly due to a surge in boys’ achievement, Maths, English, Law and Btec subjects achieved particularly well.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 9 -

Going concern

After making appropriate enquiries, the board of trustees has a reasonable expectation that the academy trust has adequate resources to continue in operational existence for the foreseeable future. For this reason the board of trustees continues to adopt the going concern basis in preparing the accounts. Further details regarding the adoption of the going concern basis can be found in the statement of accounting policies.

Financial review

Most of the Academy’s income is obtained from the DfE in the form of recurrent grants disbursed via the Education Funding Agency (EFA), the use of which is restricted to particular purposes. The grants received from the EFA during the period ended 31 August 2016 and the associated expenditure are shown as restricted funds in the statement of financial activities.

The Academy also received grants for fixed assets from the EFA and other funding bodies. In accordance with the Charities Statement of Recommended Practice, ‘Accounting and Reporting Charities’ (SORP 2015), such grants are shown in the Statement of Financial Activities as restricted income in the fixed asset fund. The restricted fixed asset fund balance is reduced by annual depreciation charges over the expected useful life of the assets concerned.

During the period ended 31 August 2016, total expenditure of £15,920,553 (2015 - £16,048,068) was covered by recurrent grant funding from the EFA together with other incoming resources. The deficit of income over expenditure for the year (excluding restricted fixed asset funds and pension fund adjustments) was £437,439 (2015 - £736,780). The governors budgeted to spend some of the reserve brought forward and forecast a breakeven position for 2016/17.

The FRS 102 and pension scheme deficit was valued as at 31 August 2016 at £4,681,000 (2015 -£2,495,000).

At 31 August 2016 the net book value of fixed assets was £24,991,952 (2015 - £25,458,174) and movements in tangible fixed assets are shown in note 11 to the financial statements. The assets were used exclusively for providing education and the associated support services to the pupils of the Academy.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 10 -

Reserves policy

Reserves are held by the Trust to ensure that it can operate effectively, specifically to:

� Meet any unforeseen emergency or unexpected needs for funds e.g. urgent repairs. In September 2015, during CIF funded roofing works, the roof above the main servery collapsed. Fortunately nobody was injured during this collapse and this event is under investigation by the HSE. The EFA were informed immediately and agreed to fund part of the remedial works, but not all. Insurers haverefused to pay out due to inherent defects in the structure. Trust reserves were required to the tune of £400,000 to fund the works. At Ernulf Academy reserves were required to fund emergency works in the science laboratories and water pumps, these works totalled £90,000. Provide time to take actionshould funding levels fall e.g. to enable the Trust the option to respond through natural wastage rather than through staff redundancy. However, a drop in student numbers at Ernulf Academy meant that some of the reserves held were required to meet redundancy costs in 2015/16. This fall in numbers isa demographic issue in the local area.

� Meet planned commitments that cannot be met through future income alone e.g. major asset purchase, renovation, refurbishment or extension. Longsands Academy holds reserves specifically for this purpose and in the 2015/16 Academic year saw the completion of the planned refurbishment of the outdated science classrooms, budgeted to cost £55,000 which cannot be met fully from recurrent funding. Governors have therefore agreed to release some of the reserves for this purpose.

� To enable the Academies to meet future needs in terms of expansion due to the addition of 5,000 new homes in the catchment areas. Although any expansion will be funded via C.I.L, historic experience has shown that significant investment is required to enable the effective furnishing, provision of ICT, and additional educational supplies which expansion inevitably brings. Longsands Academy has historically built up some reserves for this purpose, but governors are now seeking to address some of this surplus with the expenditure mentioned earlier.

The Governors review the level of reserves regularly.

The Academy is confident that it will meet the required pension contributions from its projected income without significantly impacting on its planned level of charitable activity. It continues to calculate its ‘free’ or general unrestricted reserves without setting aside designated reserves to cover the pension liability.

Investment policy and powers

Due to the nature of funding, the Academy may at times hold cash balances surplus to its short term requirements. The Governors have authorised the opening of additional short term bank investment accounts to take advantage of higher interest rates. No other form of investment is authorised.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 11 -

Principal risks and uncertainties

The principal risks and uncertainties facing the Trust are as follows:

Financial - the Academies have considerable reliance on continued Government funding through the EFA. In the last period 97% of the Trust’s incoming resources was ultimately Government funded and whilst this level is expected to continue, there is no assurance that Government policy or practice will remain the same or that public funding will continue at the same levels or on the same terms. The proposed introduction of a national funding formula in 2017 has been delayed due to recent changes in the UK government.

Failures in governance and/or management - the risk in this area arises from potential failure to effectively manage the Academy's finances, internal controls, compliance with regulations and legislation, statutory returns, etc. The Governors continue to review and ensure that appropriate measures are in place to mitigate these risks.

Fraud and mismanagement of funds - The Academy has appointed a Responsible Officer to carry out checks on financial systems and records as required by the Academy Financial Handbook. All finance staff receive training to keep them up to date with financial practice requirements and develop their skills in this area.

Safeguarding and Child Protection - the Governors continue to ensure that the highest standards are maintained in the areas of selection and monitoring of staff, the operation of child protection policies and procedures, health & safety and discipline.

Staffing - the success of the Academies is reliant on the quality of its staff and so the Governors monitor and review policies and procedures to ensure continued development and training of staff as well as ensuring there is clear succession planning.

Reputational - the continuing success of the Academies is dependent on continuing to attract applicants in sufficient numbers by maintaining the highest educational standards. To mitigate this risk Governors ensure that student success and achievement are closely monitored and reviewed.

The Academy's risk management procedures are outlined above. The Trustees believe that its risk management procedures mitigate as far as reasonably possible the principal risks and uncertainties facing the Academy Trust.

The Academy Trust does not have significant trade debtors as invoiced income is a minor ancillary activity.

Cash flow is monitored by the Academy Trust. The Academy has limited cash reserves which enable it to plan for future small capital projects.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 12 -

Plans for future periods

St Neots Learning Partnership (SNLP) Partnership Improvement Plan (PIP) 2014-2017: THE ‘ROAD MAP’Core Purpose of the SNLP: To secure the best possible outcome for every child.Core StrategiesThe SNLP seek to:

� maximise students' academic outcomes by establishing minimum expected and aspirational levels of progress;

� overcome disadvantage, identify potential, implement agreed interventions and offer stretch and challenge to all;

� embed Quality First teaching and tutoring;� ensure teacher input establishes vibrant learning environments with high expectations;� strengthen all partnerships with stakeholders who value mutual respect;� further develop learning and teaching teams - create a Thinking School to ensure all staff play a full

role in the leadership and management of students across the Partnership.

Student Outcomes and Progress� For students from vulnerable groups, including Pupil Premium, the percentages making expected and

above expected progress are similar to those for other students from both Academies and show accelerated progress.

� Students in the SNLP make rapid and sustained progress throughout the Year Groups across all subjects.

� There are high standards of literacy and numeracy for all students; students develop the ability to Think Plan and Communicate (TPC) via reading, writing, communication and mathematics.

� Students maximise their achievement at GCSE and A Level so as to unlock the door to the next exciting stage of their educational provision.

� Standards of attainment and progress of all groups of students are at least in line with national averages and many students’ attainment is above this.

Quality of Teaching� Teaching across all Key Stages and all subjects in the Partnership is usually at least Good, with

examples of Outstanding teaching.� Vibrant learning environments have been created which are conducive to positive attitudes to

learning.� Teachers set consistently high expectations of all students.� Teachers plan lessons with consistently high quality marking and constructive feedback which

ensures student engagement; students are not passive receivers of information but active learners who take shared responsibility for their progress.

Teaching has at its core 'stretch and challenge' with appropriate differentiation. This will include effective teaching strategies including setting of appropriate homework and effectively targeted support and intervention to identify students who are not making sustained and accelerated progress. The outcome is students who develop a range of skills across the curriculum.

Personal development, behaviour and well-being�

�

�

�

�

�

�

Students display a positive attitude to learning, whether working as individuals, groups or as whole classes. They show pride in achievement and commitment to learning.All stakeholders (students, staff, parents and the wider local community) are positive about behaviour and safety. Students are proud of their school and value partnership opportunities.Staff and students value mutual respect. Incidents of bullying and exclusions are few and excellent conduct, manners and punctuality are the norm.Teaching and learning is supported by consistent use of behaviour management strategies centred on restorative approaches. Students understand how to keep themselves safe. Students are punctual in arriving at school and at lessons; attendance at school is very high.Students receive high quality, impartial careers guidance to ensure they are prepared for the nextstage of their education, employment, self-employment and training.Students progress well from their different starting points and achieve or exceed standards expected for their age in all subjects.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 13 -

Effective Leadership and Management�

�

�

�

�

�

Leadership and management at all levels is focused on our desire to achieve the best possible outcome for all learners in St Neots.All leaders and managers 'walk the talk' and lead by example. Leadership and management decisions are evidence based and actions are taken to ensure students maximise their achievement.Governor scrutiny holds senior leaders to account.Partnership policies are clear, understood and consistently employed by all staff in the Partnership. The curriculum is broad and balanced and meets learners’ needs, and with the support of independent advice and guidance ensures clear progression routes. Students engage in the curriculum to ensure academic success. Support is in place to ensure students’ well-being and their spiritual, moral, social and cultural development. Parents are valued as important stakeholders in the SNLP and every opportunity is taken to engage with parents. Clear timelines, centred around Plan-Do-Review, ensure a continuous cycle of Partnership improvement.

Funds held as custodian trustee on behalf of others

St Neots Schools Forum is a voluntary group of schools working together to improve the opportunities and outcomes for children in St Neots. The group is managed by committee and employs a part time member of staff to coordinate agreed projects across the member schools. Membership of the forum is open to all schools in the St Neots locality and is funded by subscription, with responsibility for holding and managing the finance, and leadership of the forum, being decided by majority vote each September. Bushmead School had been the banker school since September 2009 and resigned from this role at the forum meeting on 16thSeptember 2014 anticipating a change of leadership in September 2015. SNLP volunteered to take over as the banker school and this was passed unanimously by Heads - see extract of the minutes below.

i) Identify new banker school

Thanks to Bushmead for acting as the banker school for the past five years. SNLP volunteered to take it on from April with Longsands as the banker, Ann Christie as administrator.

DECISION: Unanimous agreement by all present

From September 2016, administration of the account will become the responsibility of the Partnership Finance Manager.

For the period September 2015 – August 2016 the movement on the account is as below:

Opening balance £49,153.43

IncomeSubscriptions £19,848.00Other income £895.46

£20,743.46

ExpenditureL Hilton salary £13,818.85Membership costs £2,497.28

£16,316.13

Carry forward £53,580.76

Draft

THE ST NEOTS LEARNING PARTNERSHIP

TRUSTEES' REPORT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 14 -

Auditor

In so far as the trustees are aware:�

�

there is no relevant audit information of which the charitable company's auditor is unaware; andthe trustees have taken all steps that they ought to have taken to make themselves aware of any relevant audit information and to establish that the auditor is aware of that information.

A resolution proposing that Rawlinsons Chartered Accountants be reappointed as auditor of the charitable company will be put to the members.

The trustees' report, incorporating a strategic report, was approved by order of the board of trustees, as the company directors, on ......................... and signed on its behalf by:

..............................

Karl Wainwright

Chairman

Draft

THE ST NEOTS LEARNING PARTNERSHIP

GOVERNANCE STATEMENT

FOR THE YEAR ENDED 31 AUGUST 2016

- 15 -

Scope of responsibility

As trustees we acknowledge we have overall responsibility for ensuring that The St Neots Learning Partnership has an effective and appropriate system of control, financial and otherwise. However, such a system is designed to manage rather than eliminate the risk of failure to achieve business objectives, and can provide only reasonable and not absolute assurance against material misstatement or loss.

The board of trustees has delegated the day-to-day responsibility to the principal, as accounting officer, for ensuring financial controls conform with the requirements of both propriety and good financial management and in accordance with the requirements and responsibilities assigned to it in the funding agreement between The St Neots Learning Partnership and the Secretary of State for Education. They are also responsible for reporting to the board of trustees any material weaknesses or breakdowns in internal control.

Governance

The information on governance included here supplements that described in the Trustees' Report and in the Statement of Trustees' Responsibilities. The board of trustees has formally met 5 times during the year. Attendance during the year at meetings of the board of trustees was as follows:

Trustees Meetings attended Out of possible

Karl Wainwright (Chairman) 12 13

Graham Wright (Local Community Governor) 12 12

Julie Smith (Vice Chair) 8 12

Martin Critcher (Parent Governor) 9 9

Karen Kircher (Parent Governor) 4 7

Judith Burt (Parent Governor) 3 7

Helen Bryson (Parent Governor) 12 15

Rick Carroll (Executive Head and Accounting Officer) 16 17

Margaret Carpenter (Staff Governor) 7 7

Ian Dumbleton (Local Community Governor) 6 7

Roger Henthorne (Partnership Governor) 6 7

Christine Lewis (Partnership Governor) 10 10

Catherine Hutton (Community (Authority) Governor) (Resigned 9 September 2015) 0 0

Sandy Law (Community (Authority) Governor) 9 9

Graham Hughes (Parent Governor) 8 12

Michael Norton (Staff Governor) (Resigned 4 December 2015) 1 3

Andrew Truett (Staff Governor) 7 7

Martin Paine (Headteacher) (Appointed 10 September 2015) 7 10

Tracy Grinnell (Headteacher) (Appointed 1 September 2016) 0 0

Draft

THE ST NEOTS LEARNING PARTNERSHIP

GOVERNANCE STATEMENT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 16 -

The finance and resources committee is a sub-committee that came into effect in the spring term of 2014-15.

The Committee’s key functions are to:� support purpose and values of the Partnership by ensuring the best possible use of available financial

resources;� within an overall aim of promoting the well-being of students and staff, consider health and safety policy

and associated practice.Attendance at meetings in the year was as follows:

Trustee Meetings attended Out of possible

G Wright 5 5K Wainwright 3 5G Hughes 3 5H Bryson 3 5R Carroll 4 5M Paine 1 4

The standards and curriculum committee is a sub-committee of the main governing body and became effective during the spring term of 2014-15.

The Committee's key functions are to:� monitor and evaluate standards of student attainment and achievement;� monitor and evaluate the quality of teaching;� monitor the development of curricular and extra-curricular provision for all students;� monitor the Partnership’s internal self-evaluation processes.

Attendance at meetings in the year was as follows:

Trustee Meetings attended Out of possible

K Wainwright 3 3M Critcher 3 3K Kircher 2 3J Burt 1 3H Bryson 3 3G Hughes 2 3I Dumbelton 3 3J Smith 3 3R Henthorne 2 3C Lewis 3 3S Law 3 3M Carpenter 3 3R Carroll 3 3M Norton 0 1A Truett 3 3

Draft

THE ST NEOTS LEARNING PARTNERSHIP

GOVERNANCE STATEMENT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 17 -

The strategy committee is a sub-committee of the main governing body and became effective during the spring term of 2014-15.

The Committee's key functions are to:� lead and co-ordinate the work of the Governing Body;� lead and/or organise Governing Body representation in matters of strategic importance;� promote effective staff development and good employment practice.

Attendance at meetings in the year was as follows:

Trustee Meetings attended Out of possible

H Bryson 2 3K Wainwright 3 3R Carroll 3 3J Smith 3 3G Wright 3 3C Lewis 3 3

The audit committee is a sub-committee of the main board of trustees.

The Committee's key functions are to:� review the school's internal and external financial statements and reports to ensure that they reflect best

practice;� discuss with the external auditor the nature and scope of each forthcoming audit and the findings of the

audit once completed;� consider all relevant reports by the Responsible Officer or the appointed external auditor, including

reports on the school's accounts, achievement of value for money and the response to any management letters;

� monitor the implementation of action to address adverse control findings by the Responsible Officer or the appointed external auditor;

� review the effectiveness of the school's internal control system established to ensure that the aims, objectives and key performance targets of the organisation are achieved in the most economic, effect ive and environmentally preferable manner;

� consider and advise the Governing Body on the school's annual and long-term audit programme, ensuring that the school's internal controls are subject to appropriate independent scrutiny at least in accordance with Government standards;

� review the operation of the school's code of practice for Governors and code of conduct for staff;�

�

consider any other matters where requested to do so by the Governing Body; andreport at least once a year to the Governing Body on the discharge of the above duties.

Attendance at meetings in the year was as follows:

Trustee Meetings attended Out of possible

J Smith 1 2M Critcher 2 2R Carroll 2 2S Law 2 2

Draft

THE ST NEOTS LEARNING PARTNERSHIP

GOVERNANCE STATEMENT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 18 -

Review of value for money

The accounting officer has responsibility for ensuring that the academy trust delivers good value in the use of public resources. The accounting officer understands that value for money refers to the educational and wider societal outcomes achieved in return for the taxpayer resources received.

The accounting officer considers how the academy trust’s use of its resources has provided good value for money during each academic year, and reports to the board of trustees where value for money can be improved, including the use of benchmarking data where available. The accounting officer for the academy trust has delivered improved value for money during the year by robust governance and oversight of Academy Trust finances.The Trust benefits from the provision by CEFM Limited to provide the internal audit function which is required by the Governing Body Audit Committee.

The checks include a review of key financial policies, systems and procedures, including the use of tenders and presents reports on compliance to the Audit Committee.

The external audit function is carried out by Rawlinsons who complete the paperwork required to produce the final accounts, as well as the Annual Accounts return.

The Finance and Resources Committee receive termly budget monitoring reports and reports detailingcompliance with Academy Trusts tender policy, if required. The full Governing Body approves the budget each year and is mindful of the need to balance expenditure against income to ensure the Academy Trust remains a 'going concern'. The Governing Body also receives and approves the Annual Accounts and the External Auditors Management Letter.

To ensure the operation of the Trust demonstrates good value for money and efficient and effective use of resources the Partnership benchmarks financial performance against other academy trusts, including our partner schools in the Huntingdonshire Academies Secondary Partnership, to demonstrate that the Trust provides good value for money.

Exercises are undertaken to ensure that high value contracts are assessed against the marketplace on a regular basis to ensure that long term contracts remain competitive.

For purchases above £5,000 but below the tender limit 3 quotes are generally required. The Partnership also operates a preferred supplier list.

Maximising income generationThe Partnership explores every opportunity to generate income through hire of Academy facilities and provision of Adult Education.

Reviewing controls and managing risks.Monthly budget monitoring reports are produced and reviewed by the Governors, Deputy Heads and theHeadteachers and any necessary remedial action taken to address any significant variances that may have an impact on the budget out-turn.

The Chair of the Finance and Resources committee also meet with the Governors each term, to scrutinize budget statements. The Audit Committee meets twice each year to also review the audit and consider the RO reports.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

GOVERNANCE STATEMENT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 19 -

The Academy Trust ensures that all surplus cash balances are invested to maximise interest earning potential. Currently, due to low interest rates the balances are being held in the current accounts which historically earned a rate of 0.25% above the Bank base rate. In 2014 a comparison was made against Government Bond rates but governors agreed to hold the surplus balances in the main bank accounts as it was felt that the investment return on Government Bonds would not be any more favourable in the medium term. In 2016, the rate of interest paid by the bank on the current accounts was reduced to 0.5% in April and reduced further to 0.25% in September.

The Academy Trust maintains a risk register which is reviewed annually. The register is also reviewed by the Responsible Officer and External Auditor. There are currently no major risks which have not had adequate control measures applied.

Reviewing operation to maximize use of resources.The Academy Leadership Teams review expenditure within each budget heading annually and make adjustments based on the effectiveness of strategies introduced in previous years, curriculum offer and any new strategies identified in the Partnership Improvement Plan.

The purpose of the system of internal control

The system of internal control is designed to manage risk to a reasonable level rather than to eliminate all risk of failure to achieve policies, aims and objectives. It can therefore only provide reasonable and not absolute assurance of effectiveness. The system of internal control is based on an on-going process designed to identify and prioritise the risks to the achievement of academy trust policies, aims and objectives, to evaluate the likelihood of those risks being realised and the impact should they be realised, and to manage them efficiently, effectively and economically. The system of internal control has been in place in The St Neots Learning Partnership for the period 1 September 2015 to 31 August 2016 and up to the date of approval of the annual report and accounts.

Capacity to handle risk

The board of trustees has reviewed the key risks to which the academy trust is exposed together with the operating, financial and compliance controls that have been implemented to mitigate those risks. The board of trustees is of the view that there is a formal ongoing process for identifying, evaluating and managing the academy trust's significant risks that has been in place for the period 1 September 2015 to 31 August 2016 and up to the date of approval of the annual report and accounts. This process is regularly reviewed by the board of trustees.

The risk and control framework

The academy trust's system of internal financial control is based on a framework of regular management information and administrative procedures including the segregation of duties and a system of delegation and accountability. In particular it includes:

�

�

�

�

�

�

comprehensive budgeting and monitoring systems with an annual budget and periodic financial reports which are reviewed and agreed by the board of trustees;regular reviews by the finance and personnel committee of reports which indicate financial performance against the forecasts and of major purchase plans, capital works and expenditure programmes;setting targets to measure financial and other performance;clearly defined purchasing (asset purchase or capital investment) guidelines;delegation of authority and segregation of duties;identification and management of risks.

The board of trustees has considered the need for a specific internal audit function and has decided:

� not to appoint an internal auditor. However the trustees have appointed CEFM to carry out the role of Responsible Officer and report back to the audit committee.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

GOVERNANCE STATEMENT (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

- 20 -

The RO has appointed the Centre for Education and Finance Management to perform a range of checks on the Academies’ financial systems on a termly basis, as well as giving advice on financial matters the RO reports to the board of trustees, through the Audit Committee on the operation of the systems of control and on the discharge of the board of trustees' financial responsibilities. No material control issues were reported in this period.

Review of effectiveness

As accounting officer the principal has responsibility for reviewing the effectiveness of the system of internal control. During the year in question the review has been informed by:

�

�

�

the work of the responsible officer;the work of the external auditor;the work of the executive managers within the academy trust who have responsibility for the development and maintenance of the internal control framework.

The accounting officer has been advised of the implications of the result of their review of the system of internal control by the Audit and Finance and Personnel committees and a plan to address weaknesses and ensure continuous improvement of the system is in place.

Approved by order of the board of trustees on ......................... and signed on its behalf by:

Karl Wainwright Rick Carroll

Chairman Executive Head and Accounting Officer

Draft

THE ST NEOTS LEARNING PARTNERSHIP

STATEMENT OF REGULARITY, PROPRIETY AND COMPLIANCE

FOR THE YEAR ENDED 31 AUGUST 2016

- 21 -

As accounting officer of The St Neots Learning Partnership I have considered my responsibility to notify the academy trust board of trustees and the Education Funding Agency of material irregularity, impropriety and non-compliance with EFA terms and conditions of funding, under the funding agreement in place between the academy trust and the Secretary of State for Education. As part of my consideration I have had due regard to the requirements of the Academies Financial Handbook 2015.

I confirm that I and the academy trust's board of trustees are able to identify any material irregular or improper use of funds by the academy trust, or material non-compliance with the terms and conditions of funding under the academy trust's funding agreement and the Academies Financial Handbook 2015.

I confirm that no instances of material irregularity, impropriety or funding non-compliance have been discovered to date. If any instances are identified after the date of this statement, these will be notified to the board of trustees and EFA.

Rick Carroll

Accounting Officer

.........................

Draft

THE ST NEOTS LEARNING PARTNERSHIP

STATEMENT OF TRUSTEES' RESPONSIBILITIES

FOR THE YEAR ENDED 31 AUGUST 2016

- 22 -

The trustees (who also act as governors for The St Neots Learning Partnership and are also the directors of The St Neots Learning Partnership for the purposes of company law) are responsible for preparing the Trustees' Report and the accounts in accordance with the Annual Accounts Direction issued by the Education Funding Agency, United Kingdom Accounting Standards (United Kingdom Generally Accepted Accounting Practice) and applicable law and regulations.

Company law requires the trustees to prepare accounts for each financial year. Under company law the trustees must not approve the accounts unless they are satisfied that they give a true and fair view of the state of affairs of the charitable company and of its incoming resources and application of resources, including its income and expenditure, for that period.

In preparing these accounts, the trustees are required to:

�

�

�

�

�

select suitable accounting policies and then apply them consistently;observe the methods and principles in the Charities SORP 2015 and the Academies Accounts Direction2015 to 2016;make judgements and accounting estimates that are reasonable and prudent;state whether applicable UK Accounting Standards have been followed, subject to any material departures disclosed and explained in the accounts; andprepare the accounts on the going concern basis unless it is inappropriate to presume that the charitable company will continue in business.

The trustees are responsible for keeping adequate accounting records that are sufficient to show and explain the charitable company's transactions and disclose with reasonable accuracy at any time the financial position of the charitable company and enable them to ensure that the accounts comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the charitable company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

The trustees are responsible for ensuring that in its conduct and operation the charitable company applies financial and other controls, which conform with the requirements both of propriety and of good financial management. They are also responsible for ensuring that grants received from EFA/DfE have been applied for the purposes intended.

The trustees are responsible for the maintenance and integrity of the corporate and financial information included on the charitable company's website. Legislation in the United Kingdom governing the preparation and dissemination of accounts may differ from legislation in other jurisdictions.

Approved by order of the board of trustees on ......................... and signed on its behalf by:

Karl Wainwright

Chairman

Draft

THE ST NEOTS LEARNING PARTNERSHIP

INDEPENDENT AUDITOR'S REPORT ON THE ACCOUNTS TO THE MEMBERS OF THE ST NEOTS LEARNING PARTNERSHIP

- 23 -

We have audited the accounts of The St Neots Learning Partnership for the year ended 31 August 2016 set out on pages 27 to 49. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards (United Kingdom Generally Accepted Accounting Practice), including FRS 102 'The Financial Reporting Standard applicable in the UK and Republic of Ireland’, the Charities SORP 2015 and the Academies Accounts Direction 2015 to 2016 issued by the Education Funding Agency.

This report is made solely to the charitable company's members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the charitable company's members those matters we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the charitable company and its members as a body, for our audit work, for this report, or for the opinions we have formed.

Respective responsibilities of trustees and auditors

As explained more fully in the Trustees' Responsibilities Statement set out on page 22, the trustees, who are also the directors of The St Neots Learning Partnership for the purposes of company law, are responsible for the preparation of the accounts and for being satisfied that they give a true and fair view. Our responsibility is to audit and express an opinion on the accounts in accordance with applicable law and International Standards on Auditing (UK and Ireland). Those standards require us to comply with the Auditing Practices Board's Ethical Standards for Auditors.

Scope of the audit of the accounts

An audit involves obtaining evidence about the amounts and disclosures in the accounts sufficient to give reasonable assurance that the accounts are free from material misstatement, whether caused by fraud or error. This includes an assessment of: whether the accounting policies are appropriate to the charitable company's circumstances and have been consistently applied and adequately disclosed; the reasonableness of significant accounting estimates made by the trustees; and the overall presentation of the accounts. In addition, we read all the financial and non-financial information in the Trustees' Report including the incorporated strategic report to identify material inconsistencies with the audited accounts and to identify any information that is apparently materially incorrect based on, or materially inconsistent with, the knowledge acquired by us in the course of performing the audit. If we become aware of any apparent material misstatements or inconsistencies we consider the implications for our report.

Opinion on accounts

In our opinion the accounts:�

�

�

�

give a true and fair view of the state of the charitable company's affairs as at 31 August 2016 and of its incoming resources and application of resources, including its income and expenditure, for the year then ended;have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice;have been prepared in accordance with the requirements of the Companies Act 2006; andhave been prepared in accordance with the Charities SORP 2015 and the Academies Accounts Direction2015 to 2016.

Opinion on other matter prescribed by the Companies Act 2006

In our opinion the information given in the Trustees' Report including the incorporated strategic report for the financial year for which the accounts are prepared is consistent with the accounts.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

INDEPENDENT AUDITOR'S REPORT ON THE ACCOUNTS TO THE MEMBERS OF THE ST NEOTS LEARNING PARTNERSHIP (CONTINUED)

- 24 -

Matters on which we are required to report by exception

We have nothing to report in respect of the following matters where the Companies Act 2006 requires us to report to you if, in our opinion:�

�

�

�

adequate accounting records have not been kept, or returns adequate for our audit have not been received from branches not visited by us; orthe accounts are not in agreement with the accounting records and returns; orcertain disclosures of trustees' remuneration specified by law are not made; orwe have not received all the information and explanations we require for our audit.

Mark Jackson FCA DChA (Senior Statutory Auditor)

for and on behalf of Rawlinsons Chartered Accountants

Chartered Accountants

Statutory Auditor

Ruthlyn House

90 Lincoln Road

Peterborough

Cambridgeshire

PE1 2SP

Dated: .........................

Draft

THE ST NEOTS LEARNING PARTNERSHIP

INDEPENDENT REPORTING ACCOUNTANT'S ASSURANCE REPORT ON REGULARITY TO THE ST NEOTS LEARNING PARTNERSHIP AND THE EDUCATION FUNDING AGENCY

- 25 -

In accordance with the terms of our engagement letter dated 12 March 2015 and further to the requirements of the Education Funding Agency (EFA) as included in the Academies Accounts Direction 2015 to 2016, we have carried out an engagement to obtain limited assurance about whether the expenditure disbursed and income received by The St Neots Learning Partnership during the period 1 September 2015 to 31 August 2016 have been applied to the purposes identified by Parliament and the financial transactions conform to the authorities which govern them.

This report is made solely to The St Neots Learning Partnership and EFA in accordance with the terms of our engagement letter. Our work has been undertaken so that we might state to the The St Neots Learning Partnership and EFA those matters we are required to state in a report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than The St Neots Learning Partnership and EFA, for our work, for this report, or for the conclusion we have formed.

Respective responsibilities of The St Neots Learning Partnership's accounting officer and the reporting accountant

The accounting officer is responsible, under the requirements of The St Neots Learning Partnership’s funding agreement with the Secretary of State for Education dated 29 July 2011 and the Academies Financial Handbook, extant from 1 September 2015, for ensuring that expenditure disbursed and income received is applied for the purposes intended by Parliament and the financial transactions conform to the authorities which govern them.

Our responsibilities for this engagement are established in the United Kingdom by our profession’s ethical guidance, and are to obtain limited assurance and report in accordance with our engagement letter and the requirements of the Academies Accounts Direction 2015 to 2016. We report to you whether anything has come to our attention in carrying out our work which suggests that in all material respects, expenditure disbursed and income received during the period 1 September 2015 to 31 August 2016 have not been applied to purposes intended by Parliament or that the financial transactions do not conform to the authorities which govern them.

Approach

We conducted our engagement in accordance with the Academies Accounts Direction 2015 to 2016 issued by EFA. We performed a limited assurance engagement as defined in our engagement letter.

The objective of a limited assurance engagement is to perform such procedures as to obtain information and explanations in order to provide us with sufficient appropriate evidence to express a negative conclusion on regularity.

A limited assurance engagement is more limited in scope than a reasonable assurance engagement andconsequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in a reasonable assurance engagement. Accordingly, we do not express a positive opinion.

Our engagement includes examination, on a test basis, of evidence relevant to the regularity and propriety of the academy trust's income and expenditure.

The work undertaken to draw to our conclusion includes:

�

�

�

a review of the activities of the academy, by reference to sources of income and other informationavailable to us;

sample testing of expenditure, including payroll;

a review of minutes of Governors’ meetings.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

INDEPENDENT REPORTING ACCOUNTANT'S ASSURANCE REPORT ON REGULARITY TO THE ST NEOTS LEARNING PARTNERSHIP AND THE EDUCATION FUNDING AGENCY (CONTINUED)

- 26 -

Conclusion

In the course of our work, nothing has come to our attention which suggests that in all material respects the expenditure disbursed and income received during the period 1 September 2015 to 31 August 2016 has not been applied to purposes intended by Parliament and the financial transactions do not conform to the authorities which govern them.

Mark Jackson FCA DChA

Reporting Accountant

Rawlinsons Chartered Accountants

Ruthlyn House

90 Lincoln Road

Peterborough

Cambridgeshire

PE1 2SP

Dated: .........................

Draft

THE ST NEOTS LEARNING PARTNERSHIP

STATEMENT OF FINANCIAL ACTIVITIES INCLUDING INCOME AND EXPENDITURE ACCOUNT

FOR THE YEAR ENDED 31 AUGUST 2016

- 27 -

Unrestricted Restricted funds: Total Total

Funds General Fixed asset 2016 2015

Notes £ £ £ £ £

Income and endowments from:

Donations and capital grants 2 - - 452,555 452,555 1,144,137

Charitable activities:

- Funding for educational operations 3 346,378 13,656,802 - 14,003,180 13,187,369

Other trading activities 4 431,511 15,465 - 446,976 467,535

Investments 5 10,357 - - 10,357 15,328

Total income and endowments 788,246 13,672,267 452,555 14,913,068 14,814,369

Expenditure on:

Raising funds 6 336,412 47,218 - 383,630 412,798

Charitable activities:

- Educational operations 7 715,283 13,725,532 1,096,108 15,536,923 15,635,270

Total expenditure 6 1,051,695 13,772,750 1,096,108 15,920,553 16,048,068

Net income/(expenditure) (263,449) (100,483) (643,553) (1,007,485) (1,233,699)

Transfers between funds (73,507) - 73,507 - -

Other recognised gains and losses

Actuarial gains/(losses) on defined benefit pension schemes 19 - (1,944,000) - (1,944,000) (163,000)

Net movement in funds (336,956) (2,044,483) (570,046) (2,951,485) (1,396,699)

Reconciliation of funds

Total funds brought forward 851,626 (2,472,300) 25,636,272 24,015,598 25,412,297

Total funds carried forward 514,670 (4,516,783) 25,066,226 21,064,113 24,015,598

Draft

THE ST NEOTS LEARNING PARTNERSHIP

STATEMENT OF FINANCIAL ACTIVITIES (CONTINUED)INCLUDING INCOME AND EXPENDITURE ACCOUNT

FOR THE YEAR ENDED 31 AUGUST 2016

- 28 -

Comparative year information Unrestricted Restricted funds: Total

Year ended 31 August 2015 Funds General Fixed asset 2015

Notes £ £ £ £

Income and endowments from:

Donations and capital grants 2 1,852 - 1,142,285 1,144,137

Charitable activities:

- Funding for educational operations 3 245,216 12,942,153 - 13,187,369

Other trading activities 4 446,865 20,670 - 467,535

Investments 5 15,328 - - 15,328

Total income and endowments 709,261 12,962,823 1,142,285 14,814,369

Expenditure on:

Raising funds 6 402,598 10,200 - 412,798

Charitable activities:

- Educational operations 7 567,202 14,497,004 571,064 15,635,270

Total expenditure 6 969,800 14,507,204 571,064 16,048,068

Net income/(expenditure) (260,539) (1,544,381) 571,221 (1,233,699)

Transfers between funds (14,047) 964,187 (950,140) -

Other recognised gains and losses

Actuarial gains/(losses) on defined benefit pension schemes 19 - (163,000) - (163,000)

Net movement in funds (274,586) (743,194) (378,919) (1,396,699)

Reconciliation of funds

Total funds brought forward 1,126,212 (1,729,106) 26,015,191 25,412,297

Total funds carried forward 851,626 (2,472,300) 25,636,272 24,015,598

Draft

THE ST NEOTS LEARNING PARTNERSHIP

BALANCE SHEET

AS AT 31 AUGUST 2016

- 29 -

2016 2015

Notes £ £ £ £

Fixed assets

Tangible assets 12 24,991,952 25,458,174

Current assets

Debtors 13 541,593 510,053

Cash at bank and in hand 1,432,659 1,910,872

1,974,252 2,420,925

Current liabilities

Creditors: amounts falling due within one year 14 (1,196,216) (1,368,501)

Net current assets 778,036 1,052,424

Total assets less current liabilities 25,769,988 26,510,598

Creditors: amounts falling due after more than one year 15 (24,875) -

Net assets excluding pension liability 25,745,113 26,510,598

Defined benefit pension liability 19 (4,681,000) (2,495,000)

Net assets 21,064,113 24,015,598

Funds of the academy trust:

Restricted funds 17

- Fixed asset funds 25,066,226 25,636,272

- Restricted income funds 164,217 22,700

- Pension reserve (4,681,000) (2,495,000)

Total restricted funds 20,549,443 23,163,972

Unrestricted income funds 17 514,670 851,626

Total funds 21,064,113 24,015,598

The accounts set out on pages 27 to 49 were approved by the board of trustees and authorised for issue on ......................... and are signed on its behalf by:

..............................

Karl Wainwright

Chairman

Company Number 07703784

Draft

THE ST NEOTS LEARNING PARTNERSHIP

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 AUGUST 2016

- 30 -

2016 2015

Notes £ £ £ £

Cash flows from operating activities

Net cash used in operating activities 20 (887,897) (1,471,149)

Cash flows from investing activities

Dividends, interest and rents from investments 10,357 15,328

Capital grants from DfE and EFA 452,555 1,142,285

Payments to acquire tangible fixed assets (73,507) (14,047)

389,405 1,143,566

Cash flows from financing activities

New long term government loan 27,000 -

Financing costs (6,721) (9,940)

20,279 (9,940)

Change in cash and cash equivalents in the reporting period (478,213) (337,523)

Cash and cash equivalents at 1 September 2015 1,910,872 2,248,395

Cash and cash equivalents at 31 August 2016 1,432,659 1,910,872

Draft

THE ST NEOTS LEARNING PARTNERSHIP

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 AUGUST 2016

- 31 -

1 Accounting policies

A summary of the principal accounting policies adopted (which have been applied consistently, except where noted), judgements and key sources of estimation uncertainty, is set out below.

1.1 Basis of preparation

The accounts of the academy trust, which is a public benefit entity under FRS 102, have been prepared under the historical cost convention in accordance with the Financial Reporting Standard Applicable in the UK and Republic of Ireland (FRS 102), the Accounting and Reporting by Charities: Statement of Recommended Practice applicable to charities preparing their accounts in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland (FRS 102) (Charities SORP (FRS 102)), the Academies Accounts Direction 2015 to 2016 issued by EFA, the Charities Act 2011 and the Companies Act 2006.

The St Neots Learning Partnership meets the definition of a public benefit entity under FRS 102.

These accounts for the year ended 31 August 2016 are the first accounts of The St Neots Learning Partnership prepared in accordance with FRS 102, The Financial Reporting Standard applicable in the UK and Republic of Ireland. The date of transition to FRS 102 was 1 September 2014. The reported financial position and financial performance for the previous period are not affected by the transition to FRS 102.

1.2 Going concern

The trustees assess whether the use of going concern is appropriate, ie whether there are any material uncertainties related to events or conditions that may cast significant doubt on the ability of the charitable company to continue as a going concern. The trustees have made the assessment in respect of a periodof at least one year from the date of authorisation for issue of the accounts and have concluded that the academy trust has adequate resources to continue in operational existence for the foreseeable future and there are no material uncertainties about the academy trust’s ability to continue as a going concern. Thus they continue to adopt the going concern basis of accounting in preparing the accounts.

1.3 Income

All incoming resources are recognised when the academy trust has entitlement to the funds, the receipt is probable and the amount can be measured reliably.

Grants receivable

Grants are included in the statement of financial activities on a receivable basis. The balance of income received for specific purposes but not expended during the period is shown in the relevant funds on the balance sheet. Where income is received in advance of meeting any performance-related conditions there is not unconditional entitlement to the income and its recognition is deferred and included in creditors as deferred income until the performance-related conditions are met. Where entitlement occurs before income is received, the income is accrued.

General Annual Grant is recognised in full in the statement of financial activities in the period for which it is receivable, and any abatement in respect of the period is deducted from income and recognised as a liability.

Capital grants are recognised when there is entitlement and are not deferred over the life of the asset on which they are expended. Unspent amounts of capital grant are reflected in the balance in the restricted fixed asset fund.

Donations

Donations are recognised on a receivable basis (where there are no performance-related conditions)where the receipt is probable and the amount can be reliably measured.

Draft

THE ST NEOTS LEARNING PARTNERSHIP

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR ENDED 31 AUGUST 2016

1 Accounting policies (Continued)

- 32 -

Other income

Other income, including the hire of facilities, is recognised in the period it is receivable and to the extent the academy trust has provided the goods or services.

Donated goods, facilities and services

Goods donated for resale are included at fair value, being the expected proceeds from sale less the expected costs of sale. If it is practical to assess the fair value at receipt, it is recognised in stock and ‘Income from other trading activities’. Upon sale, the value of the stock is charged against ‘Income from other trading activities’ and the proceeds are recognised as ‘Income from other trading activities’. Where it is impractical to fair value the items due to the volume of low value items they are not recognised in the financial statements until they are sold. This income is recognised within ‘Income from other trading activities’.

Where the donated good is a fixed asset it is measured at fair value, unless it is impractical to measure this reliably, in which case the cost of the item to the donor should be used. The gain is recognised as income from donations and a corresponding amount is included in the appropriate fixed asset category and depreciated over the useful economic life in accordance with the academy trust‘s accounting policies.