UB v KB.doc

-

Upload

jo-ana-desuyo -

Category

Documents

-

view

223 -

download

0

Transcript of UB v KB.doc

-

7/28/2019 UB v KB.doc

1/3

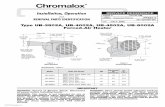

POINT OFDISTINCTION

UNIVERSAL BANK(Sec. 24-28)

COMMERCIALBANK (Sec.

30-32)Total investment

in alliedenterprises

50% of net worth 35% of net worth

Total investmentin non-alliedenterprises

50% of net worth N/A

Equityinvestment in

any oneenterprise

25% of net worth25% of net worth

(Allied only)

Equityinvestment in

financial alliedenterprise: TB,RB or any

financial alliedenterprise (Sec.

25)

A publicly-listedbank may ownup to 100% of

the voting stock

of only one otherUB / KB (Sec. 25)

100% of equity

100% of equity

In other financialallied enterprises,investment shall

remain a minorityholding (Sec. 31).

Equityinvestment innon-financial

allied enterprise

100% of equity 100% of equity

Equityinvestment in asingle non-allied

enterprise

Shall not exceed 35%of the total equity inthat enterprise nor

shall it exceed 35% ofthe voting stock in that

enterprise

N/A

Equityinvestment inQuasi-Banks

40% 40%

Allied Enterprises - those entities which enhance or complement banking

-

7/28/2019 UB v KB.doc

2/3

Non-Financial Allied Enterprise - pertains to activities that do not involve money

matters (such as warehousing, safety deposit boxes).

Financial Allied Undertakings

With prior BSP approval, banks may invest in equities of the following financial allied

undertakings, subject to limitations:

a. Leasing companies including leasing of stalls and spaces in a commercial

establishment: Provided, That bank investment in/acquisition of shares of such

leasing company shall be limited/ applicable only in cases of conversion of

outstanding loan obligations into equity;

b. Banks;

c. IHs;

d. Financing companies;

e. Credit card companies;

f. FIs catering to small and medium scale industries including venture capital

corporation (VCC).

g. Companies engaged in stock brokerage/securities dealership; and

h. Companies engaged in foreign exchange dealership/brokerage.

In addition, UBs may invest in the following as financial allied undertakings:

(1) Insurance companies; and

(2) Holding company: Provided, That the investments of such holding company are

confined to the equities of allied undertakings and/or non-allied undertakings of UBs

allowed under BSP regulations.

The Monetary Board may declare such other activities as financial allied

undertakings of banks.

The determination of whether the corporation is engaged in a financial allied

undertaking shall be based on its primary purpose as stated in its articles of

incorporation and the volume of its principal business.

Non-Financial Allied Undertakings

A bank may acquire up to100% of the equity of a non-financial alliedundertaking:Provided,That the equityinvestment of a TB/RB in any singleenterprise shallremain less than fiftypercent (50%) of the voting shares in thatenterprise:Provided, further,That priorMonetary Board approval is required if theinvestment

-

7/28/2019 UB v KB.doc

3/3

is in excess of forty percent(40%) of the total voting stock of such alliedundertaking.

The determination of whether the corporation is engaged in a non-financial alliedundertaking shall be based on the primary purpose as stated in its articles ofincorporation and the volume of its principal business.

UBs/KBs and TBs may invest in equities of the following non-financial alliedundertakings:

(1) Warehousing companies;

(2) Storage companies;

(3) Safe deposit box companies;

(4) Companies primarily engaged in the management of mutual funds but not inthe mutual funds themselves;

(5) Management corporations engaged or to be engaged in an activity similar tothe management of mutual funds;

(6) Companies engaged in providing computer services;

(7) Insurance agencies/brokerages;

(8) Companies engaged in home building and home development;