Typhoon Haiyan Response Experience. PHILIPPINES Innovations in Cash Programming.

-

Upload

hugh-henry -

Category

Documents

-

view

215 -

download

0

Transcript of Typhoon Haiyan Response Experience. PHILIPPINES Innovations in Cash Programming.

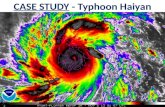

- Slide 1

- Typhoon Haiyan Response Experience. PHILIPPINES Innovations in Cash Programming

- Slide 2

- 2 BACKGROUND 1 Adapted from The Use of Cash and Vouchers in Humanitarian Crises DG ECHO Funding Guidelines 2 Adapted from New technologies in Cash Transfer Programming and Humanitarian Assistance Report Cash Learning Partnership Cash Programming the use of money or similar instrument to assist beneficiaries through cash, e-payments, and/or vouchers Grants Funds directly from donors; beneficiary is not expected to pay back or contribute to funds or service provided Microfinance Loans and other financial services such as insurance, savings, etc.; require the beneficiary to repay the funds or goods provided Funding Mechanism Cash/Cash Transfer Programming Provision of money to individuals or households, either as emergency relief intended to meet their basic needs for food and non-food items, or services, or to buy assets essential for the recovery of their livelihoods. Program Model Conditional Cash Transfer Beneficiaries are required to fulfil a specific activity (eg. attending school, health check-ups, building shelter) to receive benefit Program Modality Unconditional Cash Transfer Beneficiary does not have to do anything specific to receive the benefit Electronic Payment (E-payment) Systems Use of pre-paid debit cards, smart cards, mobile money transfer systems to replace the use of physical cash 2 Traditional Cash Delivery Disbursement of cash or currency to the beneficiary Traditional Vouchers and E-vouchers Can be exchanged for pre-defined commodities in designated places.. May be denominated either in cash, commodity or service value. Delivery Channel

- Slide 3

- The Disaster Response and Resilience Cycle Disaster Model adapted from Disaster and Development, Dr Andrew E. Collins Relief A day after a Typhoon hits- WVI is on the ground providing food and other much needed necessities Mobile communications allow WVI to provide aid allowing families to register and access commodities through phone WVI ensured food is already available at the regional grocery store through e-vouchers Preparedness Bank account through a savings program with an optional insurance policy through the online platform offered by VisionFund Using mobile money network to access loans including disaster insurance Recovery Loan insurance payout is disbursed directly to their bank/mobile money account Cash loans can be used to buy belongings that were lost during the disaster & repaid in installments through mobile platform Rehabilitation Start-up loans to restore business

- Slide 4

- Cash Programming in Typhoon Haiyan Response Cash Transfers Conditional/Unconditional vouchers with cash, commodity, or service value Enhanced by Last Mile Mobile Solutions (LMMS) Microfinance Providing access to credit, insurance, and/or savings vehicles Partnership with CEV/Visionfund E- payment systems Using pre-paid debit cards, smart cards, mobile money transfer systems and electronic vouchers to replace the use of physical cash or equivalent currency 2

- Slide 5

- LMMS Gathers complete, accurate and verifiable aid recipient registration information Strengthens the delivery of humanitarian services such as planning and running commodity distribution and monitoring metrics Enables fast access to detailed reports and digital data for tracking and analysis to ensure that program quality and humanitarian standards are met Last Mile Mobile Solutions

- Slide 6

- Verify registration Scan ID card Claim cash LMMS on the field in the past it took us almost a day before we get our entitlements. But here, its fast and efficient - like getting money from the local remittance center. -Victoria Sombito from Concepcion, Iloilo

- Slide 7

- 572,366 individuals benefited from LMMS which fast-tracked cash for work, unconditional cash transfers and general food distribution.

- Slide 8

- MICROFINANCE (CEV / VisionFund)

- Slide 9

- Slide 10

- E-PAYMENT SYSTEMS (BanKO) Rosemarie Borja, survivor in Dagami, Leyte - Benefited from a start-up business as part Of WVs livelihood/recovery intervention - Used Bankos mobile bank system to purchase goods worth Php10,000 ($230) for her sari-sari store

- Slide 11

- E-PAYMENT SYSTEMS (Mastercard Aid Solution) To be used in the rehabilitation phase, Master Card Aid Solution 1.Allows the NGO client full control of the program 2. Fast and can be effectively monitored anytime 3. Can adapt to our own internal system(LMMS) 4. Reports to Ops and Finance on a real-time basis 5. Reporting timelines are greatly enhanced and turnover times are significantly reduced

- Slide 12

- Options in Various Contexts Mastercard Aid ToolYes Yes

- Slide 13

- OrganizationCash Programming Microfinance/ Inclusive Financial Services Mobile Money Unrestricted Cash Transfer for 8,000 families and partnership with BanKO/Globe during Haiyan Response Partnership with IDEO for longer- term financial security offerings (2014) Reached over 244,000 people with $327M in outstanding loans Used mobile money when T-cash was introduced in Haiti in 2010 Utilized partnership with BanKO to disburse unrestricted cash transfer for victims of Haiyan Cash transfer for Syrian refugees in Turkey Shelter and rent assistance in Syria Cash-based program in shelter in Central African Republic Cash for work to clear debris targeting ; assisted 15,000 people after Haiyan CRS microfinance programs has helped over 1M in 35 countries with savings of around $10.7M Utilized T-Cash in Haiti in 2011 Partnered with Tufts University for a m-money program in Ghana (2013) Cash transfer programs, Hurricane Mitch (Agricultural Support Program) Cash program with debit cards for Syrian refugees, in Jordan (2013) Cash Assistance, Haiyan (2014) Long history of micro-economic initiatives (Kosovo, 2001-2004; Kashmir, 2007, etc.) Used mobile money for cash for work program in Kenya (2010) Cash for Work program in Haiti (2010) as Cash for Work partnership with Oxfam for Haiyan (2014) Microfinance Initiative started in 1995 Microfinance involvement in West Africa, including in Ghana with Barclays Bank and Hopeline (2011) Piloted mobile money program in Uganda in 2012 Other INGOs which have adopted Cash Programming

- Slide 14

- OrganizationCash Programming Microfinance/ Inclusive Financial Services Mobile Money Typhoon Haiyan, Philippines - Cash grants to re-build livelihood Syria - Cash assistance through debit cards Vietnam - Small loans to groups of women who guarantee each other Azerbaijan - Azeristar created in 1999 and financing 3,630 active borrowers Malawi - Cash transfer program provided participant with mobile phone with a monthly SMS entitling them to collect cash from Airtel Vodafone research used mobile carriers to achieve goal of reaching 10m children/year by 2015 Oxfam and its subsidiaries have been using various forms of cash programming since the 1990s Cash for Work program Haiti (2010) Cash for work in Niger (2012) Russia Supporting young entrepreneurs; Haiti Financing community canteen; Afghanistan Small loans for women Guatemala, partnered with Tigo to distribute aid using mobile money to people affected by malnutrition Mogadishu - E-Cash Program used free mobile phones for families Provide cash assistance through various microfinance initiatives Philippines - MABS encouraged the rural banking industry provide Housing Microfinance Agricultural Microfinance Micro insurance Offered mobile phone banking services, such as Text-A-Payment, Text-A-Deposit and Text-A-Sweldo (salary). Philippine Disaster Recovery Foundation Provide cash assistance through various small loans/microfinance initiatives Livelihood rehabilitation program granted worth P30,000 ($700) start-up loans for small store business Some INGOs/NGOs which have adopted Cash Programming

- Slide 15

- Cash Programming supports Child Well-Being Children are well nourished Children are protected from infection, disease and injury Adolescents are ready for economic opportunity Children and caregivers have access to health care Children are cared for in a loving safe family and community Parents and caregivers provide well for their children Cash Programming redefines the added value in humanitarian work.

- Slide 16

- Slide 17

- Humanitarian and Disaster Management Trends Rural vs urban Growth of urban population Applicability of rural disaster response solutions in urban context Growing government/private sector roles in resilience and sustainability Traditional vs market-based solution Business models to design and sustain solutions Shifting ecosystems Increasing role of private sector CURRENT Private funding in humanitarian response grew from 17% in 2006 to 32% in 2010 (totaled US$5.8 billion that year). FUTURE Contributing skills and capacity more direct role in service delivery + scale UN agencies have dedicated unit to engage private sector. Growing role of technology Early warning (ex. Via SMS during Hurricane Sandy ) Programming innovations (mobile banking, 3D printing) Real-time monitoring (ex. crowd- sourcing, equipping groups with cellphones to give emergency updates) Real-time feedback (ex. Used by Danish Refugee Council in Somalia) Monitoring and evaluation New Funding technologies (Bitcoin) Increasing cash transfers To reduce cost in transporting food, surplus production to dispense as food aid Widens choice to cash transfers & vouchers More countries develop safety-net programs (through employment guarantee schemes, conditional or unconditional cash transfers, unemployment or agricultural insurance, etc.) Redefining Humanitarian value add Sets the space for experimentation, innovation, and partnerships Changing Donor Scene CURRENT UN agencies International donors iNGOS FUTURE Private sector Emerging donors Local NGOs Citizen groups OECD donor aid fell by 11% (biggest fall) in 2012 Turkey 4 th largest donor in 2012 Privatized aid donors funded 26% of all reported aid in 2012 The old ways of working were no longer relevant

- Slide 18

- Learnings from Consortium and Potential Partnerships show that Partnership Interviews withKey Themes / Learnings Partnerships/Role of Consortium Organizations 1 Partnerships mostly share information and best practices; Opportunities lie in shared infrastructure to reduce costs Consortiums focus on capacity building, advocacy, and providing technical expertise; coordination across humanitarian organizations is key gap Cash-Related Challenges Identified at INGOs 2 Benefits of cash programming are appreciated, but NGOs still learning to use the tools Training and internal advocacy steadily changing perceptions Scale remains biggest challenge; many pilots didnt scale up Private Sector seeking partnerships with NGOs 3 Mobile operators offer partnership agreements tested with other NGOS to disburse and collect payments NGO community seen as partners in driving programming opportunities Partnerships are key to delivering cash and mobile programming.

- Slide 19

- Peer Organizations InterviewsKey Themes / Learnings Cash Based Approach is Still Limited to Pockets 1 Mostly applied in Cash for Work and food substitution Other bigger NGOs have explored multi-sectorial approach Leading NGOs are developing standard procedures and testing cash models; limited to geographic priority areas Biggest Challenge Remains Organizational Attitudes 2 Many NGOs have accepted the value of cash based programming, but biggest challenge remains changing organizational attitudes E-Payment Initiatives 3 E-payment adoption is slower among interviewed organizations- exceptions include Mercy Corps and limited initiatives within CRS Some INGOs which have adapted Cash Programming