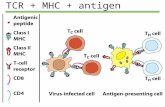

MHC Polymorphism. MHC Class I pathway Figure by Eric A.J. Reits.

Trustees of MountainOne Financial, MHC · Trustees of MountainOne Financial, MHC Directors of...

Transcript of Trustees of MountainOne Financial, MHC · Trustees of MountainOne Financial, MHC Directors of...

Trustees of MountainOne Financial, MHC

Directors of MountainOne Financial, Inc.

Directors of MountainOne BankPamela B. Art

James J. Bailey, Jr.

Daniel E. Bosley

Richard B. Bullett

Noreen Carey-Neville

David W. Crane

Robert J. Fraser

Susan S. Hogan

Stephen P. Klass

Kevin A. Maguire

Thomas P. O’Connell

William F. Spence

Joseph C. Thompson

CorporatorsFaisal Ali

Billie Lynn Allard

William Apkin

James Art

Pamela B. Art

James J. Bailey, Jr.

Ann Bartlett

Ray Belanger, Jr.

Blair Benjamin

Daniel E. Bosley

John Bradley

Diana D. Brooks

Andrew B. Budz

Richard B. Bullett

Daniel H. Campbell

Noreen Carey-Neville

Gailanne M. Cariddi

Lynne Carlotto

David Carver

Donald B. Clark

Eileen M. Clark

Paula J. Clough

Jonathan Cluett

Carol A. Colantuono

Robert W. Collins

David W. Crane

Stephen G. Crowe

Richard D. Curtis, Jr.

Steven Del Negro

Suzanne R. Dewey

Donald R. Dubendorf

Paul R. Dupuis

Rosemary T. Earley

William E. Elder

J. Adam Filson

David F. Fowle

Robert J. Fraser

Thomas A. Gajda

Michael J. Gardner, Jr.

Michael J. Gardner, Sr.

Brice George

Dean M. Grimes

Vincent P. Guntlow

Michael Haddad, Jr.

Allen L. Hall

Kevin Hanley

Paula Harris

Ruth G. Harrison

Paul Hart

Susan S. Hogan

John C. Holden

Thomas P. Kaegi

Christopher Kapiloff

Stephen P. Klass

Kevin A. Lamb

Richard C. Lamb

Teresa H. Lamb

Kevin A. Maguire

Robert Manzella

Marcia McFarland-Gray

Corlis A. McGee

Jon McGrath

Maureen N. McGuire

Amy Moresi

David Moresi

K. Elaine Neely

Kimberly P. Nelson

Linda Neville

Edward F. Nimmons

Thomas P. O’Connell

Maureen M. O’Mara

Steven Owens

Charles Perfetuo

Felicia Pharr

Leslie Reed-Evans

Denise C. Richardello

Mireille Roy

Jonathan B. Sabin

Robert J. Scerbo

Graham Shalgian

Ann P. Shannon

Matt Sheehy

Eva Sheridan

Anthony M. Smeglin

Edwin L Smith

William F. Spence

Susan B. Spooner

Roger E. St. Pierre

Suzanne J. Stinson

Bradley C. Svrluga

Joseph C. Thompson

F. Steven Triffletti

Donald Trimarchi

Robert C. Ware

Susannah Wells

David J. Westall

Susan J. Yates-Mulder

Our Mission

To deliver solutions of real value that help individuals, businesses, and community

institutions manage their financial lives with clarity and confidence.

INVESTMENT AND INSURANCE PRODUCTS:

• ARE NOT A DEPOSIT

• ARE NOT FDIC-INSURED

• ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• ARE NOT GUARANTEED BY THE BANK

• MAY GO DOWN IN VALUE

MountainOne Financial is a mutual holding company headquartered in North Adams,

MA. MountainOne Bank is a subsidiary of MountainOne Financial, and includes the

following divisions: Coakley, Pierpan, Dolan & Collins Insurance; True North Insurance;

and True North Financial (financial professionals offering securities and advisory

services through Commonwealth Financial Network,® Member FINRA/SIPC, a

Registered Investment Advisor). Founded in 1848, MountainOne Bank has assets

of over $840 million and provides a broad range of banking services to personal

and business customers. MountainOne Bank has three full service offices serving

the Berkshires, three serving Boston South, and one serving Boston North.

MountainOne Bank is Member FDIC. Member DIF. Equal Housing Lender.

Danvers | North Adams | Pittsfield | Quincy | Rockland | Scituate | Williamstown

Dear MountainOne Community:

I am pleased to report that our Net

Income of $2.7 million in 2015 represented

a 97% increase from earnings in 2014

and is the highest level of profitability for

MountainOne since 2005. Our 2015

financial performance should be considered

a baseline going forward. The ongoing

improvement in earnings, starting in 2013,

is the result of executing upon strategic

initiatives to improve asset quality, increase

commercial construction lending in

eastern Massachusetts, grow our residential

mortgage business, increase deposits and shed high-cost borrowings.

During the summer and fall of 2015, I held informal “Coffee with Corporators”

breakfast meetings in North Adams and Rockland, in an attempt to

keep Corporators abreast of our interim financial results, provide updates

on initiatives, introduce business unit leaders and maintain an overall

sense of engagement with MountainOne. These meetings began as a result

of feedback that as MountainOne evolved from three banks into one,

our Corporators had become less informed, confused as to our strategic

direction, and disengaged. I am hopeful the effort to improve communication,

as well as the opportunity to meet with me in smaller informal settings, has

provided all interested Corporators with a much better understanding

of MountainOne. It is my intent to continue with these meetings during 2016

and I encourage all Corporators to attend whenever possible.

Last year I reported on our decision to repopulate our building at 296 Main

Street in Williamstown, which includes a MountainOne drive-up ATM

and offices for Coakley, Pierpan, Dolan & Collins Insurance Agency and True

North Financial Services. We have recently finished leasing out the remaining

space in the building and have now achieved 100% occupancy. I am thrilled

that we were able to bring this beautiful and centrally-located Williamstown

building back to life.

It is with a deep sense of gratitude and thanks that I acknowledge the

contributions of our retiring director, Richard J. Phelps. Dick became a

Corporator of Rockland Savings Bank in 1966 and joined the board in 1967.

Upon the merger of South Coastal into MountainOne in 2007, Dick joined the

MountainOne board as a trustee. Dick also served as Chair of South Coastal

Bank until its merger into Hoosac Bank creating MountainOne Bank. His

dedication and commitment to our organization has been unwavering and

a critical component of our success. He has been a friend and mentor to me.

Thank you, Dick!

And, to our Community, your continued support of MountainOne

is greatly appreciated!

Robert J. Fraser

President & Chief Executive Officer

Banking I Insurance I Investments I Group Benefits

MountainOne 2015 Annual Report

Trustees of MountainOne Financial, MHC

Directors of MountainOne Financial, Inc.

Directors of MountainOne BankPamela B. Art

James J. Bailey, Jr.

Daniel E. Bosley

Richard B. Bullett

Noreen Carey-Neville

David W. Crane

Robert J. Fraser

Susan S. Hogan

Stephen P. Klass

Kevin A. Maguire

Thomas P. O’Connell

William F. Spence

Joseph C. Thompson

CorporatorsFaisal Ali

Billie Lynn Allard

William Apkin

James Art

Pamela B. Art

James J. Bailey, Jr.

Ann Bartlett

Ray Belanger, Jr.

Blair Benjamin

Daniel E. Bosley

John Bradley

Diana D. Brooks

Andrew B. Budz

Richard B. Bullett

Daniel H. Campbell

Noreen Carey-Neville

Gailanne M. Cariddi

Lynne Carlotto

David Carver

Donald B. Clark

Eileen M. Clark

Paula J. Clough

Jonathan Cluett

Carol A. Colantuono

Robert W. Collins

David W. Crane

Stephen G. Crowe

Richard D. Curtis, Jr.

Steven Del Negro

Suzanne R. Dewey

Donald R. Dubendorf

Paul R. Dupuis

Rosemary T. Earley

William E. Elder

J. Adam Filson

David F. Fowle

Robert J. Fraser

Thomas A. Gajda

Michael J. Gardner, Jr.

Michael J. Gardner, Sr.

Brice George

Dean M. Grimes

Vincent P. Guntlow

Michael Haddad, Jr.

Allen L. Hall

Kevin Hanley

Paula Harris

Ruth G. Harrison

Paul Hart

Susan S. Hogan

John C. Holden

Thomas P. Kaegi

Christopher Kapiloff

Stephen P. Klass

Kevin A. Lamb

Richard C. Lamb

Teresa H. Lamb

Kevin A. Maguire

Robert Manzella

Marcia McFarland-Gray

Corlis A. McGee

Jon McGrath

Maureen N. McGuire

Amy Moresi

David Moresi

K. Elaine Neely

Kimberly P. Nelson

Linda Neville

Edward F. Nimmons

Thomas P. O’Connell

Maureen M. O’Mara

Steven Owens

Charles Perfetuo

Felicia Pharr

Leslie Reed-Evans

Denise C. Richardello

Mireille Roy

Jonathan B. Sabin

Robert J. Scerbo

Graham Shalgian

Ann P. Shannon

Matt Sheehy

Eva Sheridan

Anthony M. Smeglin

Edwin L Smith

William F. Spence

Susan B. Spooner

Roger E. St. Pierre

Suzanne J. Stinson

Bradley C. Svrluga

Joseph C. Thompson

F. Steven Triffletti

Donald Trimarchi

Robert C. Ware

Susannah Wells

David J. Westall

Susan J. Yates-Mulder

Our Mission

To deliver solutions of real value that help individuals, businesses, and community

institutions manage their financial lives with clarity and confidence.

INVESTMENT AND INSURANCE PRODUCTS:

• ARE NOT A DEPOSIT

• ARE NOT FDIC-INSURED

• ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• ARE NOT GUARANTEED BY THE BANK

• MAY GO DOWN IN VALUE

MountainOne Financial is a mutual holding company headquartered in North Adams,

MA. MountainOne Bank is a subsidiary of MountainOne Financial, and includes the

following divisions: Coakley, Pierpan, Dolan & Collins Insurance; True North Insurance;

and True North Financial (financial professionals offering securities and advisory

services through Commonwealth Financial Network,® Member FINRA/SIPC, a

Registered Investment Advisor). Founded in 1848, MountainOne Bank has assets

of over $840 million and provides a broad range of banking services to personal

and business customers. MountainOne Bank has three full service offices serving

the Berkshires, three serving Boston South, and one serving Boston North.

MountainOne Bank is Member FDIC. Member DIF. Equal Housing Lender.

Danvers | North Adams | Pittsfield | Quincy | Rockland | Scituate | Williamstown

Dear MountainOne Community:

I am pleased to report that our Net

Income of $2.7 million in 2015 represented

a 97% increase from earnings in 2014

and is the highest level of profitability for

MountainOne since 2005. Our 2015

financial performance should be considered

a baseline going forward. The ongoing

improvement in earnings, starting in 2013,

is the result of executing upon strategic

initiatives to improve asset quality, increase

commercial construction lending in

eastern Massachusetts, grow our residential

mortgage business, increase deposits and shed high-cost borrowings.

During the summer and fall of 2015, I held informal “Coffee with Corporators”

breakfast meetings in North Adams and Rockland, in an attempt to

keep Corporators abreast of our interim financial results, provide updates

on initiatives, introduce business unit leaders and maintain an overall

sense of engagement with MountainOne. These meetings began as a result

of feedback that as MountainOne evolved from three banks into one,

our Corporators had become less informed, confused as to our strategic

direction, and disengaged. I am hopeful the effort to improve communication,

as well as the opportunity to meet with me in smaller informal settings, has

provided all interested Corporators with a much better understanding

of MountainOne. It is my intent to continue with these meetings during 2016

and I encourage all Corporators to attend whenever possible.

Last year I reported on our decision to repopulate our building at 296 Main

Street in Williamstown, which includes a MountainOne drive-up ATM

and offices for Coakley, Pierpan, Dolan & Collins Insurance Agency and True

North Financial Services. We have recently finished leasing out the remaining

space in the building and have now achieved 100% occupancy. I am thrilled

that we were able to bring this beautiful and centrally-located Williamstown

building back to life.

It is with a deep sense of gratitude and thanks that I acknowledge the

contributions of our retiring director, Richard J. Phelps. Dick became a

Corporator of Rockland Savings Bank in 1966 and joined the board in 1967.

Upon the merger of South Coastal into MountainOne in 2007, Dick joined the

MountainOne board as a trustee. Dick also served as Chair of South Coastal

Bank until its merger into Hoosac Bank creating MountainOne Bank. His

dedication and commitment to our organization has been unwavering and

a critical component of our success. He has been a friend and mentor to me.

Thank you, Dick!

And, to our Community, your continued support of MountainOne

is greatly appreciated!

Robert J. Fraser

President & Chief Executive Officer

Banking I Insurance I Investments I Group Benefits

MountainOne 2015 Annual Report

Trustees of MountainOne Financial, MHC

Directors of MountainOne Financial, Inc.

Directors of MountainOne BankPamela B. Art

James J. Bailey, Jr.

Daniel E. Bosley

Richard B. Bullett

Noreen Carey-Neville

David W. Crane

Robert J. Fraser

Susan S. Hogan

Stephen P. Klass

Kevin A. Maguire

Thomas P. O’Connell

William F. Spence

Joseph C. Thompson

CorporatorsFaisal Ali

Billie Lynn Allard

William Apkin

James Art

Pamela B. Art

James J. Bailey, Jr.

Ann Bartlett

Ray Belanger, Jr.

Blair Benjamin

Daniel E. Bosley

John Bradley

Diana D. Brooks

Andrew B. Budz

Richard B. Bullett

Daniel H. Campbell

Noreen Carey-Neville

Gailanne M. Cariddi

Lynne Carlotto

David Carver

Donald B. Clark

Eileen M. Clark

Paula J. Clough

Jonathan Cluett

Carol A. Colantuono

Robert W. Collins

David W. Crane

Stephen G. Crowe

Richard D. Curtis, Jr.

Steven Del Negro

Suzanne R. Dewey

Donald R. Dubendorf

Paul R. Dupuis

Rosemary T. Earley

William E. Elder

J. Adam Filson

David F. Fowle

Robert J. Fraser

Thomas A. Gajda

Michael J. Gardner, Jr.

Michael J. Gardner, Sr.

Brice George

Dean M. Grimes

Vincent P. Guntlow

Michael Haddad, Jr.

Allen L. Hall

Kevin Hanley

Paula Harris

Ruth G. Harrison

Paul Hart

Susan S. Hogan

John C. Holden

Thomas P. Kaegi

Christopher Kapiloff

Stephen P. Klass

Kevin A. Lamb

Richard C. Lamb

Teresa H. Lamb

Kevin A. Maguire

Robert Manzella

Marcia McFarland-Gray

Corlis A. McGee

Jon McGrath

Maureen N. McGuire

Amy Moresi

David Moresi

K. Elaine Neely

Kimberly P. Nelson

Linda Neville

Edward F. Nimmons

Thomas P. O’Connell

Maureen M. O’Mara

Steven Owens

Charles Perfetuo

Felicia Pharr

Leslie Reed-Evans

Denise C. Richardello

Mireille Roy

Jonathan B. Sabin

Robert J. Scerbo

Graham Shalgian

Ann P. Shannon

Matt Sheehy

Eva Sheridan

Anthony M. Smeglin

Edwin L Smith

William F. Spence

Susan B. Spooner

Roger E. St. Pierre

Suzanne J. Stinson

Bradley C. Svrluga

Joseph C. Thompson

F. Steven Triffletti

Donald Trimarchi

Robert C. Ware

Susannah Wells

David J. Westall

Susan J. Yates-Mulder

Our Mission

To deliver solutions of real value that help individuals, businesses, and community

institutions manage their financial lives with clarity and confidence.

INVESTMENT AND INSURANCE PRODUCTS:

• ARE NOT A DEPOSIT

• ARE NOT FDIC-INSURED

• ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• ARE NOT GUARANTEED BY THE BANK

• MAY GO DOWN IN VALUE

MountainOne Financial is a mutual holding company headquartered in North Adams,

MA. MountainOne Bank is a subsidiary of MountainOne Financial, and includes the

following divisions: Coakley, Pierpan, Dolan & Collins Insurance; True North Insurance;

and True North Financial (financial professionals offering securities and advisory

services through Commonwealth Financial Network,® Member FINRA/SIPC, a

Registered Investment Advisor). Founded in 1848, MountainOne Bank has assets

of over $840 million and provides a broad range of banking services to personal

and business customers. MountainOne Bank has three full service offices serving

the Berkshires, three serving Boston South, and one serving Boston North.

MountainOne Bank is Member FDIC. Member DIF. Equal Housing Lender.

Danvers | North Adams | Pittsfield | Quincy | Rockland | Scituate | Williamstown

Dear MountainOne Community:

I am pleased to report that our Net

Income of $2.7 million in 2015 represented

a 97% increase from earnings in 2014

and is the highest level of profitability for

MountainOne since 2005. Our 2015

financial performance should be considered

a baseline going forward. The ongoing

improvement in earnings, starting in 2013,

is the result of executing upon strategic

initiatives to improve asset quality, increase

commercial construction lending in

eastern Massachusetts, grow our residential

mortgage business, increase deposits and shed high-cost borrowings.

During the summer and fall of 2015, I held informal “Coffee with Corporators”

breakfast meetings in North Adams and Rockland, in an attempt to

keep Corporators abreast of our interim financial results, provide updates

on initiatives, introduce business unit leaders and maintain an overall

sense of engagement with MountainOne. These meetings began as a result

of feedback that as MountainOne evolved from three banks into one,

our Corporators had become less informed, confused as to our strategic

direction, and disengaged. I am hopeful the effort to improve communication,

as well as the opportunity to meet with me in smaller informal settings, has

provided all interested Corporators with a much better understanding

of MountainOne. It is my intent to continue with these meetings during 2016

and I encourage all Corporators to attend whenever possible.

Last year I reported on our decision to repopulate our building at 296 Main

Street in Williamstown, which includes a MountainOne drive-up ATM

and offices for Coakley, Pierpan, Dolan & Collins Insurance Agency and True

North Financial Services. We have recently finished leasing out the remaining

space in the building and have now achieved 100% occupancy. I am thrilled

that we were able to bring this beautiful and centrally-located Williamstown

building back to life.

It is with a deep sense of gratitude and thanks that I acknowledge the

contributions of our retiring director, Richard J. Phelps. Dick became a

Corporator of Rockland Savings Bank in 1966 and joined the board in 1967.

Upon the merger of South Coastal into MountainOne in 2007, Dick joined the

MountainOne board as a trustee. Dick also served as Chair of South Coastal

Bank until its merger into Hoosac Bank creating MountainOne Bank. His

dedication and commitment to our organization has been unwavering and

a critical component of our success. He has been a friend and mentor to me.

Thank you, Dick!

And, to our Community, your continued support of MountainOne

is greatly appreciated!

Robert J. Fraser

President & Chief Executive Officer

Banking I Insurance I Investments I Group Benefits

MountainOne 2015 Annual Report

MountainOne Financial Consolidated Statements of Income

Years Ended December 31

2015 2014

(Dollars in Thousands)

Interest and dividend income:

Loans, including fees $27,683 $25,627

Securities 1,793 2,222

Federal funds sold and other 23 21

Total interest and dividend income 29,499 27,870

Interest expense:

Deposits 3,946 3,860

Federal Home Loan Bank borrowings 2,715 3,155

Subordinated debt 914 783

Notes payable and other items — 6

Total interest expense 7,575 7,804

Net interest income 21,924 20,066

Provision for loan losses 1,600 1,300

Net interest income after provision for loan losses 20,324 18,766

Non-interest income:

Customer service charges on deposits 873 892

Commissions on insurance and investment products 8,418 9,580

Net gain on sales of loans 1,538 778

Net gain (loss) on securities transactions 326 (205)

Writedowns of securities — (265)

Other income 1,656 1,300

Total non-interest income 12,811 12,080

Non-interest expense:

Salaries and employee benefits 17,084 16,502

Occupancy expense 2,736 2,491

Equipment expense 826 857

Computer services 1,612 1,442

FDIC deposit insurance assessments 601 640

Other expense 6,366 6,379

Total non-interest expense 29,225 28,311

Income before income taxes 3,910 2,535

Income tax expense 1,184 1,151

Net income $2,726 $1,384

MountainOne Financial Consolidated Balance Sheets

As of December 31

2015 2014

(Dollars in Thousands)

Assets

Cash and due from banks $12,055 $19,625

Interest-bearing time deposits with other banks 1,000 1,000

Securities available for sale, at fair value 87,259 92,381

Federal Home Loan Bank of Boston stock, at cost 7,529 8,789

Loans held for sale 12,436 7,800

Loans:

Residential real estate 225,696 223,279

Home equity 60,678 59,955

Commercial real estate 243,535 226,023

Construction and land 69,387 49,060

Commercial 72,691 68,317

Consumer 1,678 1,810

Total loans 673,665 628,444

Deferred loan costs, net 1,472 1,930

Allowance for loan losses (9,019) (8,024)

Net loans 666,118 622,350

Other real estate owned 507 707

Premises and equipment 16,454 16,867

Deferred tax asset, net 10,538 10,333

Bank-owned life insurance 24,089 23,441

Goodwill and other intangible assets 3,506 3,574

Other assets 8,087 8,197

Total assets $849,578 $815,064

Liabilities and Capital

Deposits:

Non-interest-bearing $105,004 $82,563

Interest-bearing 515,884 485,230

Total deposits 620,888 567,793

Federal Home Loan Bank borrowings 119,800 142,800

Subordinated debt 20,620 20,620

Other liabilities 19,352 16,025

Total liabilities 780,660 747,238

Total capital 68,918 67,826

Total liabilities and capital $849,578 $815,064

MountainOne FinancialOfficers

Daniel E. Bosley Chair

Pamela B. Art Vice Chair

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management Officer

Steven J. Owens EVP, CFO, COO, CIO, Treasurer

Noelle M. Pandell Corporate Secretary

I. Michelle Devine Assistant Secretary

True North Financial, A Division of MountainOne BankOfficers

Linda B. Levesque Supervising Principal, Chief Administrative Officer

Robert G. Abel Senior Financial Advisor

James E. Durand Vice President, Chief Investment Officer

True North Insurance, A Division of MountainOne BankOfficers

Holly A. Taylor President & Chief Operating Officer

Jean M. Stone Vice President

Coakley, Pierpan, Dolan & Collins, A Division of MountainOne BankOfficers

Jonathan S. Denmark President & Chief Operating Officer

William R. Robinson Senior Vice President, Sales

Donna M. Bishop Vice President, Commercial Lines

Linda A. Febles Vice President

Grace J. Gray Vice President, Agency Administration

& Customer Service

Eric P. Pratt Vice President, Bonding Manager

MountainOne BankOfficers

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management & CRA Officer

Steven J. Owens EVP, CFO, CIO, COO, Treasurer

Robert G. Abel SVP, Financial Services

Paul E. Brindle SVP, Team Leader Commercial Banking

Richard W. Bromberg SVP, IT Director, Information Security Officer

Stacy D. Litke SVP, Senior Operations Officer

Michael Z. Pang SVP, Credit Administration Officer

Peter W. Radigan SVP, Senior Mortgage Banking Officer

Timothy P. Rhuda SVP, Senior Commercial Banking Officer

Eva Sheridan SVP, Senior Human Resources Officer

Debra A. Wooley SVP, Controller

Kim E. Anderson VP, Loan Compliance Officer

Elizabeth A. Bissell VP, Senior Marketing Officer

Judith A. Cogan VP, Commercial Banking

Jonathan S. Denmark VP, Insurance Services

Richard W. Fanning VP, Mortgage Sales

John J. Hubbard VP, Eastern Mortgage Banking Sales Manager

Matthew B. Kreiser VP, Commercial Banking Officer

Linda B. Levesque VP, Financial Services

Tracy L. McConnell VP, Commercial Banking

Brian W. McDavitt VP, Commercial Banking & Portfolio Manager

Mary M. Morrow VP, Senior Community Banking Officer

Cheryl A. Scioscia VP, Mortgage Banking Production Officer

Joel C. Scussel VP, Commercial Banking

Jean L. Sherman VP, Compliance & BSA Officer

Elizabeth C. Trifone VP, Commercial Banking

Donna M. Choquette AVP, Branch Administration

Paula J. Clough AVP, Finance

Adam C. Conrad AVP, Community Banking Officer

Maureen Courtney AVP, Regional Branch Operations Manager

Paula M. Dolan AVP, Loan Operations

Marie A. Harris AVP, Credit Administrator

Elizabeth D. Kapner AVP, Marketing Manager

Kelli E. Kozak AVP, Community Engagement Officer

Cynthia P. Noyes AVP, IT Operations Officer

Erika L. Bailey Consumer Loan Resolution Officer

Alfred L. Bedini, Jr. Community Banking Officer

Alicia A. Benoit Electronic Banking Officer

Gwenn D. Bishop Mortgage Underwriter

Brandon D. Cannata Portfolio Manager

Rachel E. Caryofilles Community Banking Officer

I. Michelle Devine Asst. to President & CEO, HR Liasion Officer, Asst. Sec.

Kelly L. Dubie Customer Care Officer

Meghan L. Dunphy Community Banking Officer

Sarah E. Gaffey Community Development Lending Officer

Kelly C. Grant Community Banking Officer

Nellie M. Homen Community Banking Officer

Jessica A. McGovern Executive Commercial Banking Assistant & Officer

Lisa J. Mineau Human Resources Officer

Lisa M. Noseworthy Loan Quality Control Officer

Rebecca L. O’Regan Mortgage Banking Officer & Administrative Officer

Noelle M. Pandell Executive Administrator, Corporate Secretary

Jeffrey P. Polucci Facilities, Security & Real Estate Officer

Stephanie Scott Risk and Fraud Analytics Officer

Jacquelyn L. Shambaugh Business Development Officer

Timothy J. Shepard Information Technology Officer

Lucille A. Weare Community Banking Officer

MountainOne Financial Consolidated Statements of Income

Years Ended December 31

2015 2014

(Dollars in Thousands)

Interest and dividend income:

Loans, including fees $27,683 $25,627

Securities 1,793 2,222

Federal funds sold and other 23 21

Total interest and dividend income 29,499 27,870

Interest expense:

Deposits 3,946 3,860

Federal Home Loan Bank borrowings 2,715 3,155

Subordinated debt 914 783

Notes payable and other items — 6

Total interest expense 7,575 7,804

Net interest income 21,924 20,066

Provision for loan losses 1,600 1,300

Net interest income after provision for loan losses 20,324 18,766

Non-interest income:

Customer service charges on deposits 873 892

Commissions on insurance and investment products 8,418 9,580

Net gain on sales of loans 1,538 778

Net gain (loss) on securities transactions 326 (205)

Writedowns of securities — (265)

Other income 1,656 1,300

Total non-interest income 12,811 12,080

Non-interest expense:

Salaries and employee benefits 17,084 16,502

Occupancy expense 2,736 2,491

Equipment expense 826 857

Computer services 1,612 1,442

FDIC deposit insurance assessments 601 640

Other expense 6,366 6,379

Total non-interest expense 29,225 28,311

Income before income taxes 3,910 2,535

Income tax expense 1,184 1,151

Net income $2,726 $1,384

MountainOne Financial Consolidated Balance Sheets

As of December 31

2015 2014

(Dollars in Thousands)

Assets

Cash and due from banks $12,055 $19,625

Interest-bearing time deposits with other banks 1,000 1,000

Securities available for sale, at fair value 87,259 92,381

Federal Home Loan Bank of Boston stock, at cost 7,529 8,789

Loans held for sale 12,436 7,800

Loans:

Residential real estate 225,696 223,279

Home equity 60,678 59,955

Commercial real estate 243,535 226,023

Construction and land 69,387 49,060

Commercial 72,691 68,317

Consumer 1,678 1,810

Total loans 673,665 628,444

Deferred loan costs, net 1,472 1,930

Allowance for loan losses (9,019) (8,024)

Net loans 666,118 622,350

Other real estate owned 507 707

Premises and equipment 16,454 16,867

Deferred tax asset, net 10,538 10,333

Bank-owned life insurance 24,089 23,441

Goodwill and other intangible assets 3,506 3,574

Other assets 8,087 8,197

Total assets $849,578 $815,064

Liabilities and Capital

Deposits:

Non-interest-bearing $105,004 $82,563

Interest-bearing 515,884 485,230

Total deposits 620,888 567,793

Federal Home Loan Bank borrowings 119,800 142,800

Subordinated debt 20,620 20,620

Other liabilities 19,352 16,025

Total liabilities 780,660 747,238

Total capital 68,918 67,826

Total liabilities and capital $849,578 $815,064

MountainOne FinancialOfficers

Daniel E. Bosley Chair

Pamela B. Art Vice Chair

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management Officer

Steven J. Owens EVP, CFO, COO, CIO, Treasurer

Noelle M. Pandell Corporate Secretary

I. Michelle Devine Assistant Secretary

True North Financial, A Division of MountainOne BankOfficers

Linda B. Levesque Supervising Principal, Chief Administrative Officer

Robert G. Abel Senior Financial Advisor

James E. Durand Vice President, Chief Investment Officer

True North Insurance, A Division of MountainOne BankOfficers

Holly A. Taylor President & Chief Operating Officer

Jean M. Stone Vice President

Coakley, Pierpan, Dolan & Collins, A Division of MountainOne BankOfficers

Jonathan S. Denmark President & Chief Operating Officer

William R. Robinson Senior Vice President, Sales

Donna M. Bishop Vice President, Commercial Lines

Linda A. Febles Vice President

Grace J. Gray Vice President, Agency Administration

& Customer Service

Eric P. Pratt Vice President, Bonding Manager

MountainOne BankOfficers

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management & CRA Officer

Steven J. Owens EVP, CFO, CIO, COO, Treasurer

Robert G. Abel SVP, Financial Services

Paul E. Brindle SVP, Team Leader Commercial Banking

Richard W. Bromberg SVP, IT Director, Information Security Officer

Stacy D. Litke SVP, Senior Operations Officer

Michael Z. Pang SVP, Credit Administration Officer

Peter W. Radigan SVP, Senior Mortgage Banking Officer

Timothy P. Rhuda SVP, Senior Commercial Banking Officer

Eva Sheridan SVP, Senior Human Resources Officer

Debra A. Wooley SVP, Controller

Kim E. Anderson VP, Loan Compliance Officer

Elizabeth A. Bissell VP, Senior Marketing Officer

Judith A. Cogan VP, Commercial Banking

Jonathan S. Denmark VP, Insurance Services

Richard W. Fanning VP, Mortgage Sales

John J. Hubbard VP, Eastern Mortgage Banking Sales Manager

Matthew B. Kreiser VP, Commercial Banking Officer

Linda B. Levesque VP, Financial Services

Tracy L. McConnell VP, Commercial Banking

Brian W. McDavitt VP, Commercial Banking & Portfolio Manager

Mary M. Morrow VP, Senior Community Banking Officer

Cheryl A. Scioscia VP, Mortgage Banking Production Officer

Joel C. Scussel VP, Commercial Banking

Jean L. Sherman VP, Compliance & BSA Officer

Elizabeth C. Trifone VP, Commercial Banking

Donna M. Choquette AVP, Branch Administration

Paula J. Clough AVP, Finance

Adam C. Conrad AVP, Community Banking Officer

Maureen Courtney AVP, Regional Branch Operations Manager

Paula M. Dolan AVP, Loan Operations

Marie A. Harris AVP, Credit Administrator

Elizabeth D. Kapner AVP, Marketing Manager

Kelli E. Kozak AVP, Community Engagement Officer

Cynthia P. Noyes AVP, IT Operations Officer

Erika L. Bailey Consumer Loan Resolution Officer

Alfred L. Bedini, Jr. Community Banking Officer

Alicia A. Benoit Electronic Banking Officer

Gwenn D. Bishop Mortgage Underwriter

Brandon D. Cannata Portfolio Manager

Rachel E. Caryofilles Community Banking Officer

I. Michelle Devine Asst. to President & CEO, HR Liasion Officer, Asst. Sec.

Kelly L. Dubie Customer Care Officer

Meghan L. Dunphy Community Banking Officer

Sarah E. Gaffey Community Development Lending Officer

Kelly C. Grant Community Banking Officer

Nellie M. Homen Community Banking Officer

Jessica A. McGovern Executive Commercial Banking Assistant & Officer

Lisa J. Mineau Human Resources Officer

Lisa M. Noseworthy Loan Quality Control Officer

Rebecca L. O’Regan Mortgage Banking Officer & Administrative Officer

Noelle M. Pandell Executive Administrator, Corporate Secretary

Jeffrey P. Polucci Facilities, Security & Real Estate Officer

Stephanie Scott Risk and Fraud Analytics Officer

Jacquelyn L. Shambaugh Business Development Officer

Timothy J. Shepard Information Technology Officer

Lucille A. Weare Community Banking Officer

MountainOne Financial Consolidated Statements of Income

Years Ended December 31

2015 2014

(Dollars in Thousands)

Interest and dividend income:

Loans, including fees $27,683 $25,627

Securities 1,793 2,222

Federal funds sold and other 23 21

Total interest and dividend income 29,499 27,870

Interest expense:

Deposits 3,946 3,860

Federal Home Loan Bank borrowings 2,715 3,155

Subordinated debt 914 783

Notes payable and other items — 6

Total interest expense 7,575 7,804

Net interest income 21,924 20,066

Provision for loan losses 1,600 1,300

Net interest income after provision for loan losses 20,324 18,766

Non-interest income:

Customer service charges on deposits 873 892

Commissions on insurance and investment products 8,418 9,580

Net gain on sales of loans 1,538 778

Net gain (loss) on securities transactions 326 (205)

Writedowns of securities — (265)

Other income 1,656 1,300

Total non-interest income 12,811 12,080

Non-interest expense:

Salaries and employee benefits 17,084 16,502

Occupancy expense 2,736 2,491

Equipment expense 826 857

Computer services 1,612 1,442

FDIC deposit insurance assessments 601 640

Other expense 6,366 6,379

Total non-interest expense 29,225 28,311

Income before income taxes 3,910 2,535

Income tax expense 1,184 1,151

Net income $2,726 $1,384

MountainOne Financial Consolidated Balance Sheets

As of December 31

2015 2014

(Dollars in Thousands)

Assets

Cash and due from banks $12,055 $19,625

Interest-bearing time deposits with other banks 1,000 1,000

Securities available for sale, at fair value 87,259 92,381

Federal Home Loan Bank of Boston stock, at cost 7,529 8,789

Loans held for sale 12,436 7,800

Loans:

Residential real estate 225,696 223,279

Home equity 60,678 59,955

Commercial real estate 243,535 226,023

Construction and land 69,387 49,060

Commercial 72,691 68,317

Consumer 1,678 1,810

Total loans 673,665 628,444

Deferred loan costs, net 1,472 1,930

Allowance for loan losses (9,019) (8,024)

Net loans 666,118 622,350

Other real estate owned 507 707

Premises and equipment 16,454 16,867

Deferred tax asset, net 10,538 10,333

Bank-owned life insurance 24,089 23,441

Goodwill and other intangible assets 3,506 3,574

Other assets 8,087 8,197

Total assets $849,578 $815,064

Liabilities and Capital

Deposits:

Non-interest-bearing $105,004 $82,563

Interest-bearing 515,884 485,230

Total deposits 620,888 567,793

Federal Home Loan Bank borrowings 119,800 142,800

Subordinated debt 20,620 20,620

Other liabilities 19,352 16,025

Total liabilities 780,660 747,238

Total capital 68,918 67,826

Total liabilities and capital $849,578 $815,064

MountainOne FinancialOfficers

Daniel E. Bosley Chair

Pamela B. Art Vice Chair

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management Officer

Steven J. Owens EVP, CFO, COO, CIO, Treasurer

Noelle M. Pandell Corporate Secretary

I. Michelle Devine Assistant Secretary

True North Financial, A Division of MountainOne BankOfficers

Linda B. Levesque Supervising Principal, Chief Administrative Officer

Robert G. Abel Senior Financial Advisor

James E. Durand Vice President, Chief Investment Officer

True North Insurance, A Division of MountainOne BankOfficers

Holly A. Taylor President & Chief Operating Officer

Jean M. Stone Vice President

Coakley, Pierpan, Dolan & Collins, A Division of MountainOne BankOfficers

Jonathan S. Denmark President & Chief Operating Officer

William R. Robinson Senior Vice President, Sales

Donna M. Bishop Vice President, Commercial Lines

Linda A. Febles Vice President

Grace J. Gray Vice President, Agency Administration

& Customer Service

Eric P. Pratt Vice President, Bonding Manager

MountainOne BankOfficers

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management & CRA Officer

Steven J. Owens EVP, CFO, CIO, COO, Treasurer

Robert G. Abel SVP, Financial Services

Paul E. Brindle SVP, Team Leader Commercial Banking

Richard W. Bromberg SVP, IT Director, Information Security Officer

Stacy D. Litke SVP, Senior Operations Officer

Michael Z. Pang SVP, Credit Administration Officer

Peter W. Radigan SVP, Senior Mortgage Banking Officer

Timothy P. Rhuda SVP, Senior Commercial Banking Officer

Eva Sheridan SVP, Senior Human Resources Officer

Debra A. Wooley SVP, Controller

Kim E. Anderson VP, Loan Compliance Officer

Elizabeth A. Bissell VP, Senior Marketing Officer

Judith A. Cogan VP, Commercial Banking

Jonathan S. Denmark VP, Insurance Services

Richard W. Fanning VP, Mortgage Sales

John J. Hubbard VP, Eastern Mortgage Banking Sales Manager

Matthew B. Kreiser VP, Commercial Banking Officer

Linda B. Levesque VP, Financial Services

Tracy L. McConnell VP, Commercial Banking

Brian W. McDavitt VP, Commercial Banking & Portfolio Manager

Mary M. Morrow VP, Senior Community Banking Officer

Cheryl A. Scioscia VP, Mortgage Banking Production Officer

Joel C. Scussel VP, Commercial Banking

Jean L. Sherman VP, Compliance & BSA Officer

Elizabeth C. Trifone VP, Commercial Banking

Donna M. Choquette AVP, Branch Administration

Paula J. Clough AVP, Finance

Adam C. Conrad AVP, Community Banking Officer

Maureen Courtney AVP, Regional Branch Operations Manager

Paula M. Dolan AVP, Loan Operations

Marie A. Harris AVP, Credit Administrator

Elizabeth D. Kapner AVP, Marketing Manager

Kelli E. Kozak AVP, Community Engagement Officer

Cynthia P. Noyes AVP, IT Operations Officer

Erika L. Bailey Consumer Loan Resolution Officer

Alfred L. Bedini, Jr. Community Banking Officer

Alicia A. Benoit Electronic Banking Officer

Gwenn D. Bishop Mortgage Underwriter

Brandon D. Cannata Portfolio Manager

Rachel E. Caryofilles Community Banking Officer

I. Michelle Devine Asst. to President & CEO, HR Liasion Officer, Asst. Sec.

Kelly L. Dubie Customer Care Officer

Meghan L. Dunphy Community Banking Officer

Sarah E. Gaffey Community Development Lending Officer

Kelly C. Grant Community Banking Officer

Nellie M. Homen Community Banking Officer

Jessica A. McGovern Executive Commercial Banking Assistant & Officer

Lisa J. Mineau Human Resources Officer

Lisa M. Noseworthy Loan Quality Control Officer

Rebecca L. O’Regan Mortgage Banking Officer & Administrative Officer

Noelle M. Pandell Executive Administrator, Corporate Secretary

Jeffrey P. Polucci Facilities, Security & Real Estate Officer

Stephanie Scott Risk and Fraud Analytics Officer

Jacquelyn L. Shambaugh Business Development Officer

Timothy J. Shepard Information Technology Officer

Lucille A. Weare Community Banking Officer

MountainOne Financial Consolidated Statements of Income

Years Ended December 31

2015 2014

(Dollars in Thousands)

Interest and dividend income:

Loans, including fees $27,683 $25,627

Securities 1,793 2,222

Federal funds sold and other 23 21

Total interest and dividend income 29,499 27,870

Interest expense:

Deposits 3,946 3,860

Federal Home Loan Bank borrowings 2,715 3,155

Subordinated debt 914 783

Notes payable and other items — 6

Total interest expense 7,575 7,804

Net interest income 21,924 20,066

Provision for loan losses 1,600 1,300

Net interest income after provision for loan losses 20,324 18,766

Non-interest income:

Customer service charges on deposits 873 892

Commissions on insurance and investment products 8,418 9,580

Net gain on sales of loans 1,538 778

Net gain (loss) on securities transactions 326 (205)

Writedowns of securities — (265)

Other income 1,656 1,300

Total non-interest income 12,811 12,080

Non-interest expense:

Salaries and employee benefits 17,084 16,502

Occupancy expense 2,736 2,491

Equipment expense 826 857

Computer services 1,612 1,442

FDIC deposit insurance assessments 601 640

Other expense 6,366 6,379

Total non-interest expense 29,225 28,311

Income before income taxes 3,910 2,535

Income tax expense 1,184 1,151

Net income $2,726 $1,384

MountainOne Financial Consolidated Balance Sheets

As of December 31

2015 2014

(Dollars in Thousands)

Assets

Cash and due from banks $12,055 $19,625

Interest-bearing time deposits with other banks 1,000 1,000

Securities available for sale, at fair value 87,259 92,381

Federal Home Loan Bank of Boston stock, at cost 7,529 8,789

Loans held for sale 12,436 7,800

Loans:

Residential real estate 225,696 223,279

Home equity 60,678 59,955

Commercial real estate 243,535 226,023

Construction and land 69,387 49,060

Commercial 72,691 68,317

Consumer 1,678 1,810

Total loans 673,665 628,444

Deferred loan costs, net 1,472 1,930

Allowance for loan losses (9,019) (8,024)

Net loans 666,118 622,350

Other real estate owned 507 707

Premises and equipment 16,454 16,867

Deferred tax asset, net 10,538 10,333

Bank-owned life insurance 24,089 23,441

Goodwill and other intangible assets 3,506 3,574

Other assets 8,087 8,197

Total assets $849,578 $815,064

Liabilities and Capital

Deposits:

Non-interest-bearing $105,004 $82,563

Interest-bearing 515,884 485,230

Total deposits 620,888 567,793

Federal Home Loan Bank borrowings 119,800 142,800

Subordinated debt 20,620 20,620

Other liabilities 19,352 16,025

Total liabilities 780,660 747,238

Total capital 68,918 67,826

Total liabilities and capital $849,578 $815,064

MountainOne FinancialOfficers

Daniel E. Bosley Chair

Pamela B. Art Vice Chair

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management Officer

Steven J. Owens EVP, CFO, COO, CIO, Treasurer

Noelle M. Pandell Corporate Secretary

I. Michelle Devine Assistant Secretary

True North Financial, A Division of MountainOne BankOfficers

Linda B. Levesque Supervising Principal, Chief Administrative Officer

Robert G. Abel Senior Financial Advisor

James E. Durand Vice President, Chief Investment Officer

True North Insurance, A Division of MountainOne BankOfficers

Holly A. Taylor President & Chief Operating Officer

Jean M. Stone Vice President

Coakley, Pierpan, Dolan & Collins, A Division of MountainOne BankOfficers

Jonathan S. Denmark President & Chief Operating Officer

William R. Robinson Senior Vice President, Sales

Donna M. Bishop Vice President, Commercial Lines

Linda A. Febles Vice President

Grace J. Gray Vice President, Agency Administration

& Customer Service

Eric P. Pratt Vice President, Bonding Manager

MountainOne BankOfficers

Robert J. Fraser President & Chief Executive Officer

Lynne M. Carlotto EVP, Senior Risk Management & CRA Officer

Steven J. Owens EVP, CFO, CIO, COO, Treasurer

Robert G. Abel SVP, Financial Services

Paul E. Brindle SVP, Team Leader Commercial Banking

Richard W. Bromberg SVP, IT Director, Information Security Officer

Stacy D. Litke SVP, Senior Operations Officer

Michael Z. Pang SVP, Credit Administration Officer

Peter W. Radigan SVP, Senior Mortgage Banking Officer

Timothy P. Rhuda SVP, Senior Commercial Banking Officer

Eva Sheridan SVP, Senior Human Resources Officer

Debra A. Wooley SVP, Controller

Kim E. Anderson VP, Loan Compliance Officer

Elizabeth A. Bissell VP, Senior Marketing Officer

Judith A. Cogan VP, Commercial Banking

Jonathan S. Denmark VP, Insurance Services

Richard W. Fanning VP, Mortgage Sales

John J. Hubbard VP, Eastern Mortgage Banking Sales Manager

Matthew B. Kreiser VP, Commercial Banking Officer

Linda B. Levesque VP, Financial Services

Tracy L. McConnell VP, Commercial Banking

Brian W. McDavitt VP, Commercial Banking & Portfolio Manager

Mary M. Morrow VP, Senior Community Banking Officer

Cheryl A. Scioscia VP, Mortgage Banking Production Officer

Joel C. Scussel VP, Commercial Banking

Jean L. Sherman VP, Compliance & BSA Officer

Elizabeth C. Trifone VP, Commercial Banking

Donna M. Choquette AVP, Branch Administration

Paula J. Clough AVP, Finance

Adam C. Conrad AVP, Community Banking Officer

Maureen Courtney AVP, Regional Branch Operations Manager

Paula M. Dolan AVP, Loan Operations

Marie A. Harris AVP, Credit Administrator

Elizabeth D. Kapner AVP, Marketing Manager

Kelli E. Kozak AVP, Community Engagement Officer

Cynthia P. Noyes AVP, IT Operations Officer

Erika L. Bailey Consumer Loan Resolution Officer

Alfred L. Bedini, Jr. Community Banking Officer

Alicia A. Benoit Electronic Banking Officer

Gwenn D. Bishop Mortgage Underwriter

Brandon D. Cannata Portfolio Manager

Rachel E. Caryofilles Community Banking Officer

I. Michelle Devine Asst. to President & CEO, HR Liasion Officer, Asst. Sec.

Kelly L. Dubie Customer Care Officer

Meghan L. Dunphy Community Banking Officer

Sarah E. Gaffey Community Development Lending Officer

Kelly C. Grant Community Banking Officer

Nellie M. Homen Community Banking Officer

Jessica A. McGovern Executive Commercial Banking Assistant & Officer

Lisa J. Mineau Human Resources Officer

Lisa M. Noseworthy Loan Quality Control Officer

Rebecca L. O’Regan Mortgage Banking Officer & Administrative Officer

Noelle M. Pandell Executive Administrator, Corporate Secretary

Jeffrey P. Polucci Facilities, Security & Real Estate Officer

Stephanie Scott Risk and Fraud Analytics Officer

Jacquelyn L. Shambaugh Business Development Officer

Timothy J. Shepard Information Technology Officer

Lucille A. Weare Community Banking Officer

Trustees of MountainOne Financial, MHC

Directors of MountainOne Financial, Inc.

Directors of MountainOne BankPamela B. Art

James J. Bailey, Jr.

Daniel E. Bosley

Richard B. Bullett

Noreen Carey-Neville

David W. Crane

Robert J. Fraser

Susan S. Hogan

Stephen P. Klass

Kevin A. Maguire

Thomas P. O’Connell

William F. Spence

Joseph C. Thompson

CorporatorsFaisal Ali

Billie Lynn Allard

William Apkin

James Art

Pamela B. Art

James J. Bailey, Jr.

Ann Bartlett

Ray Belanger, Jr.

Blair Benjamin

Daniel E. Bosley

John Bradley

Diana D. Brooks

Andrew B. Budz

Richard B. Bullett

Daniel H. Campbell

Noreen Carey-Neville

Gailanne M. Cariddi

Lynne Carlotto

David Carver

Donald B. Clark

Eileen M. Clark

Paula J. Clough

Jonathan Cluett

Carol A. Colantuono

Robert W. Collins

David W. Crane

Stephen G. Crowe

Richard D. Curtis, Jr.

Steven Del Negro

Suzanne R. Dewey

Donald R. Dubendorf

Paul R. Dupuis

Rosemary T. Earley

William E. Elder

J. Adam Filson

David F. Fowle

Robert J. Fraser

Thomas A. Gajda

Michael J. Gardner, Jr.

Michael J. Gardner, Sr.

Brice George

Dean M. Grimes

Vincent P. Guntlow

Michael Haddad, Jr.

Allen L. Hall

Kevin Hanley

Paula Harris

Ruth G. Harrison

Paul Hart

Susan S. Hogan

John C. Holden

Thomas P. Kaegi

Christopher Kapiloff

Stephen P. Klass

Kevin A. Lamb

Richard C. Lamb

Teresa H. Lamb

Kevin A. Maguire

Robert Manzella

Marcia McFarland-Gray

Corlis A. McGee

Jon McGrath

Maureen N. McGuire

Amy Moresi

David Moresi

K. Elaine Neely

Kimberly P. Nelson

Linda Neville

Edward F. Nimmons

Thomas P. O’Connell

Maureen M. O’Mara

Steven Owens

Charles Perfetuo

Felicia Pharr

Leslie Reed-Evans

Denise C. Richardello

Mireille Roy

Jonathan B. Sabin

Robert J. Scerbo

Graham Shalgian

Ann P. Shannon

Matt Sheehy

Eva Sheridan

Anthony M. Smeglin

Edwin L Smith

William F. Spence

Susan B. Spooner

Roger E. St. Pierre

Suzanne J. Stinson

Bradley C. Svrluga

Joseph C. Thompson

F. Steven Triffletti

Donald Trimarchi

Robert C. Ware

Susannah Wells

David J. Westall

Susan J. Yates-Mulder

Our Mission

To deliver solutions of real value that help individuals, businesses, and community

institutions manage their financial lives with clarity and confidence.

INVESTMENT AND INSURANCE PRODUCTS:

• ARE NOT A DEPOSIT

• ARE NOT FDIC-INSURED

• ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• ARE NOT GUARANTEED BY THE BANK

• MAY GO DOWN IN VALUE

MountainOne Financial is a mutual holding company headquartered in North Adams,

MA. MountainOne Bank is a subsidiary of MountainOne Financial, and includes the

following divisions: Coakley, Pierpan, Dolan & Collins Insurance; True North Insurance;

and True North Financial (financial professionals offering securities and advisory

services through Commonwealth Financial Network,® Member FINRA/SIPC, a

Registered Investment Advisor). Founded in 1848, MountainOne Bank has assets

of over $840 million and provides a broad range of banking services to personal

and business customers. MountainOne Bank has three full service offices serving

the Berkshires, three serving Boston South, and one serving Boston North.

MountainOne Bank is Member FDIC. Member DIF. Equal Housing Lender.

Danvers | North Adams | Pittsfield | Quincy | Rockland | Scituate | Williamstown

Dear MountainOne Community:

I am pleased to report that our Net

Income of $2.7 million in 2015 represented

a 97% increase from earnings in 2014

and is the highest level of profitability for

MountainOne since 2005. Our 2015

financial performance should be considered

a baseline going forward. The ongoing

improvement in earnings, starting in 2013,

is the result of executing upon strategic

initiatives to improve asset quality, increase

commercial construction lending in

eastern Massachusetts, grow our residential

mortgage business, increase deposits and shed high-cost borrowings.

During the summer and fall of 2015, I held informal “Coffee with Corporators”

breakfast meetings in North Adams and Rockland, in an attempt to

keep Corporators abreast of our interim financial results, provide updates

on initiatives, introduce business unit leaders and maintain an overall

sense of engagement with MountainOne. These meetings began as a result

of feedback that as MountainOne evolved from three banks into one,

our Corporators had become less informed, confused as to our strategic

direction, and disengaged. I am hopeful the effort to improve communication,

as well as the opportunity to meet with me in smaller informal settings, has

provided all interested Corporators with a much better understanding

of MountainOne. It is my intent to continue with these meetings during 2016

and I encourage all Corporators to attend whenever possible.

Last year I reported on our decision to repopulate our building at 296 Main

Street in Williamstown, which includes a MountainOne drive-up ATM

and offices for Coakley, Pierpan, Dolan & Collins Insurance Agency and True

North Financial Services. We have recently finished leasing out the remaining

space in the building and have now achieved 100% occupancy. I am thrilled

that we were able to bring this beautiful and centrally-located Williamstown

building back to life.

It is with a deep sense of gratitude and thanks that I acknowledge the

contributions of our retiring director, Richard J. Phelps. Dick became a

Corporator of Rockland Savings Bank in 1966 and joined the board in 1967.

Upon the merger of South Coastal into MountainOne in 2007, Dick joined the

MountainOne board as a trustee. Dick also served as Chair of South Coastal

Bank until its merger into Hoosac Bank creating MountainOne Bank. His

dedication and commitment to our organization has been unwavering and

a critical component of our success. He has been a friend and mentor to me.

Thank you, Dick!

And, to our Community, your continued support of MountainOne

is greatly appreciated!

Robert J. Fraser

President & Chief Executive Officer

Banking I Insurance I Investments I Group Benefits

MountainOne 2015 Annual Report