TREND INVESTMENT

-

Upload

mba-corner-by-babasab-patil-karrisatte -

Category

Education

-

view

752 -

download

0

description

Transcript of TREND INVESTMENT

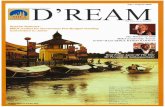

North America Equity Research 02 January 2008

Nothing But Net

2008 Internet Investment Guide

Internet

Imran KhanAC

(1-212) 622-6693 [email protected]

Bridget Weishaar (1-212) 622-5032 [email protected]

Lev Polinsky, CFA (1-212) 622-8343 [email protected]

Joseph Boushelle, CFA (1-212) 622-8523 [email protected]

www.morganmarkets.com J.P. Morgan Securities Inc.

See page 309 for analyst certification and important disclosures, including investment banking relationships.JPMorgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Customers of JPMorgan in the United States can receive independent, third-party research on the company or companies covered in this report, at no cost to them, where such research is available. Customers can access this independent research at www.morganmarkets.com or can call 1-800-477-0406 toll free to request a copy of this research.

China Internet

Dick WeiAC (852) 2800 8535 [email protected]

Please see our notes changing ratings for Priceline, and our note changing estimates for the remainder of our coverage released simultaneously. All data and valuation in this report priced as of 26 Dec 2007.

2007 saw Internet companies outperform the broader stock market, as the HHH rose ~14%, vs. a ~5% rise in the S&P 500. We believe some of the factors that drove F’07 outperformance will persist into F’08, and thus expect the sector to outperform the broader market.

• Expect 34% EPS Growth, vs. 8% for the S&P 500. We expect revenue growth to decelerate to 21.2% in F’08, from 25.6% in F’07. We are projecting 34% earnings growth for our coverage universe, compared to 8% for the S&P 500.

• Expect Blended CPM Pricing Growth Rate to Accelerate. We think blended CPM pricing bottomed out in F’07. We expect tighter offline inventory and better monetization techniques will lead to a re-acceleration of growth in F’08.

• We Project Global Search Revenue to Hit $60B by 2011. We are raising our F’08 global search revenue estimate to $30.5B, from $26.2B, driven by strong volume trends, better-than-expected monetization, and continued robust growth in Continental Europe. We expect the global search market to reach $60B by 2011, growing at a 28% CAGR over the next four years.

• Global Consumer Growth Should Benefit Internet Companies. World GDP growth has outpaced US growth in recent years, and a projected 3-year CAGR of 6.5% for emerging economies means hundreds of millions of new consumers. We think large Internet companies’ global reach means they’ll benefit from this rising tide.

• M&A Market Likely to Remain Healthy. The five biggest companies in our universe generated $8.8B in FCF in F’07, a number we project will grow to $12.5B in F’08. While some of that cash should continue to fund share repurchases, we think a significant portion of the incremental cash flow is likely to lead to continued M&A in the sector.

• Top Picks. The above trends translate into our top Overweight ideas going into the new year: GOOG, YHOO, EXPE, OMTR, SFLY and MNST.

2

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Table of Contents Key Investment Themes ..........................................................5 Dot.Khan’s Top Ten for 2008.................................................13 U.S. Sector Outlooks..............................................................15 China Outlook.........................................................................99 Amazon.com, Neutral ($92.85) ............................................121 Blue Nile, Neutral ($74.16) ...................................................129 CNET Networks, Neutral ($8.90) ..........................................136 eBay, Overweight ($34.49) ...................................................144 Expedia, Overweight ($32.56)..............................................154 Google, Overweight ($710.84) .............................................161 HouseValues, Underweight ($2.94) .....................................169 InfoSpace, Neutral ($18.96)..................................................177 InnerWorkings, Neutral ($18.40)..........................................183 Liberty Interactive, Neutral ($19.79) ....................................190 Mercadolibre, Overweight ($72.85) .....................................199 Monster Worldwide, Overweight ($33.91)...........................208 Move, Inc., Neutral ($2.70) ...................................................215 Omniture, Overweight ($34.95)............................................222 Priceline, Overweight ($118.23)...........................................229 Shutterfly, Overweight ($27.38) ...........................................239 ValueClick, Overweight ($23.39)..........................................247 Yahoo!, Overweight ($23.96) ...............................................255 Baidu, Overweight ($399.67)................................................267 China Finance Online, Overweight ($23.75) .......................272 NetEase, Neutral ($19.33).....................................................276 Ninetowns, Underweight ($3.45) .........................................281 Shanda, Overweight ($34.39)...............................................285 Sina, Neutral ($45.50) ...........................................................290 Sohu, Overweight ($56.58)...................................................294 The9, Overweight ($23.50) ...................................................299 The authors acknowledge the contribution of Deval Delivala and Rachna Srivastava of J.P. Morgan Services India Private Ltd., Mumbai, and John Ventimiglia of J.P. Morgan Securities Inc. to this report.

3

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Figure 1: JPMorgan Internet Technology Universe $ in millions, except per share data

Ticker Rating Price Mkt Cap Ent .Val. EPS Cal PE LT EPS PEG EBITDA ($M) Ent. Val/EBITDA Rev ($M)12/26 12/26 12/26 2007E 2008E 2009E 2007E 2008E 2009E Grth (%) 2007E 2008E 2009E 2007E 2008E 2009E 2007E 2008E 2009E 2007E 2008E 2009E

Search/AdvertisingCNET CNET N 8.90 1,350 1,364 NM 0.14 0.22 NM NM 40.4 15 NM NM 2.7 82 100 118 16.7 13.7 11.6 411 451 494 Google GOOG OW 710.84 225,035 211,948 15.42 20.92 26.33 46.1 34.0 27.0 35 1.3 1.0 0.8 6,958 9,917 12,647 30.5 21.4 16.8 11,719 16,957 22,332 Infospace INSP N 18.96 629 54 (1.49) (0.88) 0.11 NM NM 167.0 5 NM NM 33.4 (9) 17 18 (5.8) 3.2 3.0 240 139 141 ValueClick VCLK OW 23.39 2,343 2,092 0.71 0.84 1.01 33.0 27.7 23.1 20 1.6 1.4 1.2 164 190 220 12.8 11.0 9.5 639 735 859 Yahoo* YHOO OW 23.96 33,426 25,615 0.43 0.49 0.58 55.9 49.4 41.0 25 2.2 2.0 1.6 1,906 2,248 2,533 13.4 11.4 10.1 5,095 5,895 6,433 Group Average 45.0 37.0 59.7 1.7 1.4 7.9 18.3 12.1 10.2

Leading e-Commerce brandsAmazon AMZN N 92.85 39,461 39,294 1.10 1.51 1.87 84.5 61.6 49.7 20 4.2 3.1 2.5 1,093 1,474 2,178 35.9 26.7 18.0 14,488 17,938 21,269 Blue Nile NILE N 74.16 1,254 1,180 1.03 1.23 1.50 71.9 60.4 49.5 20 3.6 3.0 2.5 30 36 44 38.8 32.6 26.9 322 388 454 Dice DHX R 8.14 505 587 eBay EBAY OW 34.49 46,727 42,283 1.48 1.70 1.98 23.3 20.3 17.4 25 0.9 0.8 0.7 2,863 3,337 3,754 14.8 12.7 11.3 7,685 9,007 10,506 Expedia EXPE OW 32.56 10,183 10,326 1.23 1.39 1.58 26.5 23.4 20.6 10 2.6 2.3 2.1 725 808 887 14.3 12.8 11.6 2,643 3,006 3,318 InnerWorkings INWK N 18.34 921 852 0.32 0.52 0.73 57.3 35.1 25.1 20 2.9 1.8 1.3 27 46 65 31.8 18.6 13.1 288 472 641 InterActive Corp IACI N 27.56 8,410 7,421 1.55 1.81 NA 17.8 15.2 NA 10 1.8 1.5 NA 867 958 NA 8.6 7.7 NA 6,352 6,897 NALiberty Interactive LINTA N 19.79 12,428 16,810 0.73 0.80 0.89 27.1 24.8 22.2 10 2.7 2.5 2.2 1,707 1,766 1,871 9.8 9.5 9.0 7,721 8,094 8,583 Mercadolibre MELI OW 72.85 3,227 3,164 0.21 0.58 0.86 354.1 126.2 84.6 30 11.8 4.2 2.8 24 43 68 132.2 73.7 46.3 84 134 195 Monster.com MNST OW 33.91 4,434 3,807 1.42 1.90 2.27 23.9 17.8 14.9 20 1.2 0.9 0.7 301 441 514 12.7 8.6 7.4 1,350 1,519 1,727 Orbitz Worldwide OWW R 9.43 784 1,320 Priceline.com PCLN OW 118.23 5,430 4,930 3.96 4.87 6.08 29.8 24.3 19.4 15 2.0 1.6 1.3 161 296 408 30.5 16.6 12.1 1,402 1,710 2,026 Shutterfly SFLY OW 27.38 671 576 0.38 0.53 0.75 71.6 51.3 36.3 20 3.6 2.6 1.8 32 45 61 18.1 12.9 9.4 183 251 328 Group Average 63.6 38.1 30.7 3.1 2.1 1.7 28.2 19.1 14.8

Online ServicesMove.com MOVE N 2.70 419 233 (0.05) 0.03 0.05 NM 88.6 56.1 25 NM 3.5 2.2 29 42 49 8.1 5.6 4.8 294 320 349 HouseValues SOLD UW 2.94 72 7 (0.09) 0.02 0.07 NM 191.8 40.3 10 NM NM NM 3 7 8 2.2 1.0 0.9 60 49 54 Group Average NM 140.2 48.2 NM 3.5 2.2 5.1 3.3 2.8

Enabling PlatformsAkamai^ AKAM NR 36.80 6,590 5,859 1.29 1.66 2.01 28.6 22.2 18.3 25 1.1 0.9 0.7 275 368 469 21.3 15.9 12.5 628 805 994 Omniture OMTR OW 34.95 2,248 2,270 0.20 0.39 0.70 NA NM 49.8 35 NA NM 1.4 22 37 71 101.1 60.8 32.0 141 213 309 Salesforce.com^ CRM NR 63.87 7,682 7,176 0.13 0.32 0.65 NA 199.4 98.9 40 NM 5.0 2.5 38 77 NA 189.4 92.7 NA 741 1,030 1,372 Visual Sciences VSCN NR 19.31 369 394 0.59 0.75 0.74 32.9 25.6 26.1 20 1.6 1.3 1.3 15 21 NA 26.2 19.1 NA 82 90 NAWebsense^ WBSN NR 17.16 777 496 0.90 1.13 1.35 19.1 15.1 12.8 15 1.3 1.0 0.9 53 47 85 9.4 10.5 NA 226 309 338 Group Average 26.9 65.6 41.2 1.4 2.0 1.4 69.5 39.8 22.2

Average 59.0 55.7 42.8 2.7 2.1 3.2 33.6 21.7 14.0

JP Morgan Internet Technology Universe

Source: Company reports and JPMorgan estimates for JPMorgan rated companies. First Call consensus for non-covered companies. Note: Yahoo! EV assumes Yahoo! Japan is worth $26.9B. EBITDA – Operating Income + D&A +/- extraordinary charges Data in this table and this report is priced as of December 26, 2007 close JPMorgan is currently subject to a research blackout period for Dice Holdings, Inc and Orbitz Worldwide, Inc. Company write-ups are omitted here in compliance with NYSE and NASD provisions relating to lock-up agreements.

4

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Table 1: JPMorgan Estimates vs. Consensus Estimates $ in millions, except per share data EPS Revenue Company Ticker FC 08 JPM 08 FC 09 JPM 09 FC 08 JPM 08 FC 09 JPM 09 Amazon.Com Inc AMZN 1.62 1.51 2.41 1.87 18,256 17,938 22,373 21,269 CNET Networks Inc CNET 0.14 0.14 0.20 0.22 450 451 487 494 eBay Inc EBAY 1.66 1.70 1.94 1.98 9,031 9,007 10,603 10,506 Expedia Inc EXPE 1.46 1.39 1.74 1.58 3,008 3,006 3,371 3,318 Google Inc GOOG 20.65 20.92 25.89 26.33 16,547 16,957 21,306 22,332 IAC/Interactivecorp IACI 1.81 1.81 2.06 6,862 6,897 7,206 Infospace Inc INSP -0.29 -0.88 -0.42 0.11 137 139 144 141 Innerworkings Inc INWK 0.52 0.52 0.72 0.73 468 472 625 641 Liberty Media Interactive LINTA 0.79 0.80 1.02 0.89 8,156 8,094 8,727 8,583 Mercadolibre Inc MELI 0.53 0.58 0.83 0.86 131 134 186 195 Monster Worldwide Inc MNST 1.83 1.90 2.22 2.27 1,561 1,519 1,815 1,727 Move Inc MOVE 0.04 0.03 0.17 0.05 318 320 374 349 Blue Nile Inc NILE 1.32 1.23 1.67 1.50 394 388 470 454 Omniture Inc OMTR 0.41 0.39 0.69 0.70 220 213 327 309 Priceline.Com Inc PCLN 4.78 4.87 5.79 6.08 1,690 1,710 1,870 2,026 Shutterfly Inc SFLY 0.57 0.53 0.90 0.75 252 251 326 328 HouseValues Inc SOLD -0.07 0.02 N/A 0.07 46 49 #N/A 54 Valueclick Inc VCLK 0.82 0.84 1.06 1.01 741 735 869 859 Yahoo Inc YHOO 0.55 0.49 0.72 0.58 5,954 5,895 6,833 6,433 Source: Company filings, First Call, and JPMorgan estimates

5

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Key Investment Themes We Expect CPMs to Rise in 2008 While we think CPM growth was relatively muted in 2007, we expect 2008 will see it accelerate, driven by several factors, including easier comps, better inventory sell-through, behavioral and geographic targeting, and ad exchanges.

Tighter Offline Inventory Broadcast network total day ratings were ~8% lower in 2007, and we expect inventory is likely to continue shrinking further in 2008. Additionally, the reduced supply will face higher demand, as we believe as much as 6% of spot TV ads in 2008 may be taken up by political ads. We expect the inventory tightness will have a spillover effect online, as advertisers continue to shift a greater percentage of their spend away from traditional media.

The Rise of Ad Networks More than 80% of online inventory currently sells for less than a $1 CPM. As such, we think ad networks present a significant opportunity for publishers to increase yield, and, given the low base, the CPM enhancement from using ad networks will not have to be very large, in absolute terms, to move the needle.

Inventory Aggregation Many companies are aggregating traffic through partnerships and acquisitions. We think aggregation is likely to lead to a certain degree of pricing power for the aggregators. More importantly, we expect advertisers to be more willing to buy from aggregators that offer them sufficient scale.

Easier Comps 2007 saw pressure on graphical ad CPMs, driven primarily by increases in non-premium inventory, from sites such as MySpace and Facebook. We think the 2007 softness in the market is likely to set a lower base for 2008.

Free Cash Flow Likely to Drive M&A Activity Large Internet companies are generating a significant amount of cash flow: looking at the five largest Internet-only companies in our coverage universe, we estimate they generated nearly $8.8B in FCF in F’07, and are poised to produce $12.5B FCF in F’08.

Table 2: Free Cash Flow Generation at 5 Large Internet Companies $ in millions

2007 2008 GOOG $ 3,490 $ 5,675 YHOO $ 1,307 $ 1,643 AMZN $ 1,351 $ 1,705 EBAY $ 2,067 $ 2,612 EXPE $ 566 $ 860 Top 5 Total $ 8,781 $ 12,494 Source: Company reports, JPMorgan estimates

6

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

While we believe some of these companies will use part of their income stream on share repurchases, we expect that a significant part will continue to spur increased M&A activity in the sector.

Table 3: Uses of Free Cash Flow at 5 Large Internet Companies, TTM $ in million, 4Q’06 – 3Q’07

TTM FCF ($M) Cash Acquisitions/FCF Buyback/FCF GOOG 2,902 33.4% 0.0% YHOO 1,300 33.6% 104.9% AMZN 801 6.1% 31.0% EBAY 2,052 15.5% 105.8% EXPE 777 8.0% 179.8% Top 5 Total 7,831 23.4% 66.1% Source: Company reports, JPMorgan Estimates Note: Table does not include acquisitions made with stock, such as Google’s YouTube acquisition In particular, we believe large companies will continue to seek out investments in social media, where sites often grow virally and the large-caps appear satisfied, for the most part, to let the public pick the winners out of a crowded field before making acquisitions.

In the ad network and ad exchange space, we expect the need for scale to lead to continued consolidation and M&A activity, although perhaps not at the scale we have witnessed in F’07, most sizably with the DoubleClick and aQuantive transactions.

We expect continued M&A to be motivated by one or more of these key factors:

• Traffic. Developing high-traffic sites is difficult, and larger companies are often willing to pay for sites that have proven an ability to generate traffic.

• Technology. Companies that develop a technology that is difficult or uneconomical to replicate are often targets for acquisitions; such companies may also generate traffic, but the technology is a motivator for the buyer.

• Transactional. Companies with a proven track record of revenue and sales generation make attractive targets, as well; a recent example of a transactional-focused acquisition is the 2007 purchase of Mezimedia by ValueClick.

Additionally, we continue to believe that there are synergies to be captured by a strategic partnership among large-cap Internet companies, due to (1) increased scale, (2) strengthened global footprint, (3) broadened user insights and (4) improved operational efficiencies. We believe continuing share gains and product introductions by Google may compel other large-cap Internet companies to explore strategic alliances.

7

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Table 4: Selected M&A Activity in the Internet Space, 2007 (Please see Appendix of this section for full list) Ticker Date Target Acquirer Seller Annc’d Tot Payment Status

AMZN 5/14/2007 www.Dpreview.Com Amazon.com Inc NA Undisclosed Complete AMZN 5/23/2007 Brilliance Audio Inc Amazon.com Inc NA Cash Complete CNET 10/25/2007 Webshots American Greetings Corp Cnet Networks Inc 45 Cash Complete CNET 11/5/2007 Findarticles.Com CNET Neworks Looksmart 20.5 Cash Pending EBAY 1/10/2007 Stubhub eBay 310 Cash Complete EBAY 2/27/2007 Beijing Union Mobile Pay Ltd eBay 105 Cash Pending EBAY 5/3/2007 Gittigidiyor.Com eBay NA Cash Complete EBAY 5/30/2007 Stumbleupon Inc eBay 75 Cash Complete EBAY 10/4/2007 Via-Online Gmbh eBay NA Cash Complete EBAY 12/20/2007 Tom Online Inc eBay NA Undisclosed Pending EXPE 2/28/2007 Smarter Travel Media Llc Expedia Inc NA Undisclosed Complete EXPE 5/23/2007 Independent Traveler Inc Expedia Inc NA Undisclosed Complete GOOG 10/31/2006 Jotspot Inc Google NA Undisclosed Complete GOOG 1/4/2007 Shenzen Xunlei Netwk Tech Google NA Undisclosed Complete GOOG 3/16/2007 Adscape Media Inc Google NA Undisclosed Complete GOOG 4/13/2007 Doubleclick Google Multiple Sellers 3100 Cash Pending GOOG 4/17/2007 Tonic Systems Google NA Undisclosed Complete GOOG 4/20/2007 Video Conf. Software Google Marratech Ab NA Cash Complete GOOG 5/29/2007 Greenborder Tech Ltd Google NA Undisclosed Complete GOOG 5/31/2007 Panoramio.Com Google 7 Cash Pending GOOG 6/1/2007 Feedburner Inc Google NA Undisclosed Complete GOOG 6/6/2007 Peakstream Inc Google NA Undisclosed Complete GOOG 6/20/2007 Zenter Google NA Undisclosed Complete GOOG 7/2/2007 Grandcentral Communicat. Google NA Undisclosed Complete GOOG 7/9/2007 Postini Google 625 Cash Pending GOOG 7/19/2007 Beijing Feixiangren Informat Google NA Undisclosed Complete GOOG 9/28/2007 Zingku Google NA Undisclosed Complete GOOG 10/9/2007 Jaiku Ltd Google NA Undisclosed Complete GOOG 12/18/2007 Endoxon Google NA Undisclosed Complete IACI 12/20/2006 Ilike.Com IAC/ Interactive corp NA Complete IACI 2/27/2007 Edodo.Com IAC/ Interactive corp NA Complete IACI 2/27/2007 Netclub IAC/ Interactive corp NA Complete IACI 3/1/2007 Insider Pages IAC/ Interactive corp NA Pending IACI 3/19/2007 Echomusic IAC/ Interactive corp NA Complete IACI 4/19/2007 Rqi Holdings Ltd IAC/ Interactive corp Gaylord Entertainment Co 109.12 Complete IACI 5/17/2007 Front Line Mgmt IAC/ Interactive corp NA Complete IACI 5/24/2007 Emma Enterntainment Hold IAC/ Interactive corp NA Complete IACI 7/2/2007 Paciolon IAC/ Interactive corp NA Pending INSP 9/17/2007 Switchboard.Com Idearc Inc Infospace Inc 225 Cash Pending LINTA 5/11/2007 Backcountry.Com Liberty Media Interactive NA Cash Pending MELI 10/1/2001 Ibazar Com Br Ltd MercadoLibre Inc Ebay Inc NA Stock Complete MELI 11/13/2005 Deremate.Com MercadoLibre Inc NA Undisclosed Complete MNST 1/17/2007 Arbeidskamerater As Monster Worldwide NA Undisclosed Complete MSFT 5/18/2007 Aquantive Microsoft 5460.65 Cash Complete MSFT 8/30/2007 Screentonic Microsoft NA Undisclosed Complete MSFT 10/3/2007 Jellyfish.Com Microsoft NA Undisclosed Complete MSFT 10/7/2007 Newsvine Inc MULTIPLE ACQUIRERS NA Undisclosed Complete MSFT 10/24/2007 Facebook Inc Microsoft 240 Cash Pending OMTR 1/18/2007 Instadia Omniture Inc 14.41 Cash Complete OMTR 2/14/2007 Touch Clarity Omniture Inc 48.5 Cash Pending OMTR 9/7/2007 Offermatica Omniture Inc 65 Cash & Stock Pending OMTR 10/25/2007 Visual Sciences Inc Omniture Inc 390.27 Cash & Stock Pending PCLN 11/8/2007 Agoda Co Priceline.com Inc NA Cash Complete SFLY 6/27/2007 Make It About Me! Shutterfly NA Undisclosed Complete TFSM 5/17/2007 24/7 Real Media Inc WPP Group PLC 580.67 Cash Complete VCLK 12/4/2006 Shopping.Net ValueClick Inc 26.28 Cash Complete VCLK 7/16/2007 Mezimedia Inc ValueClick Inc 100 Cash Pending YHOO 1/9/2007 Mybloglog Yahoo! Inc Complete YHOO 4/30/2007 Right Media Inc Yahoo! Inc 340 Cash & Stock Complete YHOO 6/21/2007 Rivals.Com Yahoo! Inc NA Undisclosed Pending YHOO 9/4/2007 Bluelithium Inc Yahoo! Inc 300 Cash Complete YHOO 9/14/2007 Buzztracker.Com Yahoo! Inc Participate Media NA Cash Complete YHOO 9/17/2007 Zimra Inc Yahoo! Inc 350 Undisclosed Pending Source: Bloomberg, company reports, news reports

8

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Worldwide Growth and Economic Prosperity Creating an Ever-Larger Consumer Base JPMorgan estimates that GDP growth has been stronger outside the US than domestically in all but one year since 2000. At the same time, worldwide Internet penetration has been growing rapidly, as well. As such, we believe that, for larger Internet companies, the importance of the US, while remaining high, will continue to fade in relative terms in coming years.

Table 5: JPMorgan’s Global GDP growth projections 2001 2002 2003 2004 2005 2006 2007E 2008E 2009E

World 1.6% 1.9% 2.5% 3.8% 3.2% 3.6% 3.4% 3.0% 3.4% Developed mkts 1.2% 1.3% 1.8% 2.9% 2.4% 2.8% 2.4% 2.1% 2.7% G-7 1.0% 1.2% 1.8% 2.8% 2.3% 2.7% 2.2% 2.1% 2.7% Emerging Econ. 3.0% 4.1% 5.0% 7.0% 6.3% 6.9% 6.9% 6.3% 6.2% Latin America 0.5% 0.1% 1.8% 6.2% 4.3% 5.3% 5.1% 4.5% 4.4% Emerging Asia 5.1% 6.6% 7.2% 7.9% 7.8% 8.4% 8.5% 7.7% 7.6% ex China 2.7% 4.8% 5.1% 6.3% 6.0% 6.5% 6.3% 5.8% 5.9% China 8.3% 9.1% 10.0% 10.1% 10.4% 11.1% 11.4% 10.5% 10.0% Emerging Eur. 1.6% 4.5% 5.7% 6.8% 5.8% 6.4% 6.3% 5.8% 5.7% ex Russia -0.6% 4.4% 4.7% 6.6% 5.5% 6.2% 5.5% 5.1% 5.2% Russia 5.1% 4.7% 7.3% 7.2% 6.4% 6.7% 7.5% 6.8% 6.3% Developed Eur. 1.9% 1.1% 1.1% 2.2% 1.8% 3.0% 2.8% 1.9% 2.4% World ex-US 1.9% 2.0% 2.5% 3.8% 3.2% 4.0% 3.9% 3.2% 3.5% United States 0.7% 1.6% 2.5% 3.6% 3.1% 2.9% 2.2% 2.5% 3.1% Source: JPMorgan Economic and Policy Research We believe the continued global GDP growth is creating an ever-expanding consumer class. Twinned with the trend of rising Internet penetration, we believe an ever-growing market opportunity exists outside the US for Internet companies, especially those with the scale to invest meaningfully in their international operations.

Table 6: Revenue Mix Is Shifting Away from US at Large Ad-driven, eCommerce and Travel Sites % of revenue derived from US

2006 2007E 2008E 2009E Amazon (see note) 54.8% 55.0% 54.7% 54.0% eBay 52.1% 49.3% 47.5% 47.0% Expedia (see note) 74.2% 70.0% 67.1% 64.6% Google 57.0% 52.4% 50.6% 49.4% Priceline 59.4% 44.9% 35.8% 29.8% Yahoo! 75.0% 74.9% 73.5% 68.9% Total (revenue wtd) 59.0% 55.8% 54.0% 52.4% Source: Company reports, JPMorgan estimates Note: For Amazon and Expedia, the percentage given is North America revenue share, rather than US. In this respect, we believe Internet companies are somewhat ahead of the broader market: based on FactSet data we estimate that ~64% of the revenue of S&P 500 companies is derived from US/North American sales.

We see no reason for the shift away from the US to abate in the near future, and as such we believe that the large-cap companies in our coverage universe are likely to retain at least a somewhat firm footing even if the US economy and US consumer experience a slowdown. At the same time, given the significant exposure of these companies to the US, we believe it would be a mistake to think of them as “recession-proof”.

Internet companies are more internationally diversified: we estimate that ~64% of the revenue of S&P 500 companies is derived from US/North American sales, compared to less than 60% for large Internet firms.

9

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Rising Broadband Penetration Remains Growth Catalyst We believe faster Internet connections are necessary for a variety of online functions – obvious ones such as media and gaming, but even eCommerce – to achieve mainstream use. As such, we think rising broadband penetration across the world remains a key catalyst for the growth of the companies in our coverage universe.

We note that, in the US, eCommerce spend as tracked by the Department of Commerce has increased at a similar pace as Broadband penetration. We believe this is not coincidental: speed is a key component of user experience, and a positive user experience is likely to drive greater use of eCommerce sites.

Figure 2: US eCommerce has grown hand-in-hand with Broadband penetration $ in millions; eCommerce quarterly average spend

0

10000

20000

30000

1H'02 2H'02 1H'03 2H'03 1H'04 2H'04 1H'05 2H'05 1H'06 2H'06 1H'07

0%5%10%15%20%25%30%

eCommerce, $M Broadband Penetration, %

Source: Department of Commerce, OECD, JPMorgan estimates OECD data suggests many countries in Continental Europe remain 1-2 years behind the US and UK in terms of broadband penetration. As such, we think higher broadband usage is likely to be a growth catalyst in those countries as well as in the US in coming years.

While eCommerce has grown in parallel with Broadband penetration, online ad spend, as measured by the IAB, has grown at a more rapid pace in recent years than Broadband adoption:

Figure 3: US Online ad spend rising faster than Broadband penetration $ in millions; IAB quarterly average ad spend

0

2500

5000

1H'02 2H'02 1H'03 2H'03 1H'04 2H'04 1H'05 2H'05 1H'06 2H'06 1H'07

0%5%10%15%20%25%30%

Ad spend, $M Broadband Penetration, %

Source: OECD, IAB, JPMorgan estimates

10

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

We believe the faster rate of growth can be attributed in part to network effects: as more users have access to a faster, more complete Internet experience, a greater number of advertisers find it economical to direct part of their spend online. An additional factor is the ability of richer media ads – which take advantage of higher bandwidth – to command higher CPMs.

Newspaper Ad Spend Declining Advertising spend at US newspapers is continuing to decline: 2007 saw an acceleration of newspaper ad spend declines, and we think this trend is likely to continue as time spent on newspapers declines in favor of time spent online. We expect a continuation of the shift away from newspapers to be a tailwind for Internet advertising in the coming year.

Figure 4: Newspaper Ad Spend Continues to Decline $ in billions

44.9 46.7 47.4 46.642.6

1.9%3.9%

1.5%

-1.7%

-8.6%

35.0

45.0

55.0

2003 2004 2005 2006 2007

-10.0%-8.0%-6.0%-4.0%-2.0%0.0%2.0%4.0%

Source: NAA.org, JPMorgan estimates

Involvement of Regulatory Authorities Likely to Grow As the industry grows and becomes entwined in more and more aspects of people’s lives, we think regulators are going to take more and more notice of Internet companies. Going forward, regulatory risk will likely grow, although we believe it will remain relatively small, compared to other industries.

M&A in question 2007 saw several large mergers take place within the Internet space, most notably Google’s purchase of DoubleClick and Microsoft’s acquisition of aQuantive. While the latter was able to achieve regulatory clearance, European authorities are still (as of mid-December) examining whether the Google – DoubleClick merger will create a player in the online ad industry that is too dominant.

We think such regulatory flare-ups are likely to reoccur. Further, as online advertising continues to take share away from traditional avenues, we expect the incumbent players to pursue a variety of approaches, including lobbying for regulatory/legislative intervention, to attempt to defend their position.

Privacy concerns abound As search companies become larger and ad networks begin to capture more and more data about users, privacy concerns have become more common.

11

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

In response, several companies have made voluntary steps to lower the quantity of personalized data collection they do. For example, Google has said it will anonymize searcher data after 18 months, while Ask has given users the option of erasing their search history immediately.

Social networking sites, which often collect more personal information than do search engines, have also faced attention in regards to their data practices. As we note in the Social Networks Primer, below, we think history indicates that users are willing to sacrifice incremental erosions of their privacy in exchange for features they find useful, especially if sites do not over-reach. Thus far, the desire of users to express themselves has been stronger than the desire to hide, and we think that is likely to continue.

Internet Taxation: Likely Not on the Horizon in US Two key Internet tax issues exist in the US: an Internet access tax and a sales tax. A bill renewing the ban on an Internet access tax for seven years passed the US Congress in October 2007.

As regards sales taxes on online retail sales, JPMorgan’s Senior Vice President for Government Relations, Tom Block, believes that a recently proposed bill, intended to allow states to implement an Internet sales tax under certain conditions, does not have a significant chance of passing in the foreseeable future. While offline retailers and state governors have lobbied for rules such as this, voting for this bill could be construed as a tax increase, and Tom Block thinks that makes passage of the bill a non-starter, especially in an election year.

Internet IPO Market Remains Healthy 2007 saw solid IPO activity in the Internet and online space, with deals in the double digits (please see chart below). We believe the trend is likely to continue in F’08, as an ever-evolving marketplace gives rise to new opportunities.

Table 7: Selected Internet IPOs, F’07 $ in millions except per-share amounts Pricing Date Issuer Name Symbol Amt ($mm) Mkt cap ($mm) % mcap Offering Price Price, 12/7 Performance 06/26/07 Comscore Inc SCOR 101 457 22% 16.50 36.13 119% 10/02/07 Constant Contact CTCT 123 433 28% 16.00 21.69 36% 07/17/07 Dice Holdings Inc DHX 221 805 27% 13.00 10.01 -23% 03/21/07 Glu Mobile Inc GLUU 86 327 26% 11.50 5.33 -54% 11/16/07 Internet Brands Inc INET 48 334 14% 8.00 7.99 0% 06/07/07 Limelight Networks Inc LLNW 276 1,192 23% 15.00 8.01 -47% 08/09/07 MercadoLibre Inc MELI 333 752 44% 18.00 43.77 143% 07/19/07 Orbitz Worldwide Inc OWW 510 1,244 41% 15.00 9.87 -34% 07/25/07 Perfect World Co Ltd PWRD 217 894 24% 16.00 31.53 97% 02/15/07 Salary.com Inc SLRY 69 158 44% 10.50 13.27 26% 05/16/07 TechTarget Inc TTGT 115 508 23% 13.00 13.66 5% 02/08/07 U.S. Auto Parts Network Inc PRTS 115 298 39% 10.00 8.59 -14% 03/08/07 Xinhua Finance Media Ltd XFML 300 883 34% 13.00 6.80 -48% Source: Company reports, FactSet, JPMorgan estimates

We see the Internet landscape continuing to undergo changes in F’08. We expect several types of companies to start achieving a level of scale and operational visibility where a public offering makes sense. Particularly, we think the growing maturity of sectors of the Internet previously thought to be not yet mature, such as social networks, will spur deal activity.

12

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

We Think 2008 Could Bring Greater Profitability In 2006, 12 of the Internet companies in our coverage universe saw EBITDA margins decline, and nine had increases. In F’07, the numbers were reversed, with 12 risers and nine decliners. We think, as some of the companies in our universe reach greater maturity, profitability becomes a higher priority than growth, and more achievable, and are forecasting rising EBITDA margins at 16 of these companies in F’08.

At the same time, we do not believe that, given the scale of these firms, the leverage that can be achieved in the short term is significant: of the 16 companies whose margins we expect to improve, we are modeling greater than 100 bps EBITDA margin improvement at only eight.

Finally, we would note that, should an economic downturn in F’08 be more severe than currently expected, it is possible that our projected margin levels could see pressure.

Table 8: Change in EBITDA margins for the JPMorgan Internet Coverage Universe 2006 2007E 2008E EBITDA mgn Y/Y change EBITDA mgn Y/Y change EBITDA mgn Y/Y change

AMZN 6.6% -1.0% 7.5% 1.0% 8.2% 0.7% CNET 20.8% 1.5% 19.9% -0.8% 22.1% 2.2% DHX 35.0% -0.4% 41.4% 6.4% 41.5% 0.2% EBAY 34.4% -6.3% 33.1% -1.3% 33.3% 0.1% EXPE 27.3% -3.2% 27.4% 0.2% 26.9% -0.6% GOOG 63.2% -2.0% 59.4% -3.8% 58.5% -0.9% IACI 15.2% 0.7% 13.6% -1.6% 13.9% 0.2% INSP -7.5% -28.3% -3.9% 3.6% -11.2% -7.3% INWK 9.0% 2.4% 9.3% 0.3% 9.7% 0.4% LINTA 36.3% 3.0% 35.2% -1.1% 34.8% -0.4% MELI 14.2% 5.8% 28.3% 14.1% 32.1% 3.8% MNST 25.1% 2.1% 22.3% -2.8% 29.0% 6.7% MOVE 8.4% 6.3% 9.8% 1.4% 13.0% 3.2% NILE 8.9% -0.8% 9.5% 0.5% 9.3% -0.1% OMTR 10.1% 24.1% 16.0% 5.9% 17.5% 1.6% OWW -8.3% -8.3% 11.6% 19.9% 16.8% 5.2% PCLN 9.5% 2.3% 11.5% 2.0% 17.3% 5.8% SFLY 16.8% -0.8% 17.4% 0.6% 17.8% 0.5% SOLD 8.3% -19.5% 5.7% -2.6% 15.1% 9.4% VCLK 26.6% -1.8% 25.6% -0.9% 25.8% 0.2% YHOO 41.8% -0.3% 37.4% -4.4% 38.1% 0.7% Source: Company reports, JPMorgan estimates

13

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Dot.Khan’s Top Ten for 2008 1. CPM growth rate will accelerate

2. M&A market will remain robust

3. Audience Fragmentation: Will the Ad Network strategy work?

4. Domestic eCommerce growth will slow: Can Amazon continue to deliver above-market growth?

5. Can Jerry Yang turn Yahoo! around?

6. Mobile ads will be like video ads: A whole lot of talk, not a whole lot of $

7. Booking fees are not going away: consider that USAirways just introduced fees

8. Economic slowdown may impact profitability somewhat, but we expect margins to stabilize

9. Internet will continue to cannibalize Newspaper ad spend, which declined ~8% in F’07

10. Battle of Facebook vs. MySpace: both will thrive, but we think Facebook will do better

17

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

2008 Search Advertising Outlook Given a very strong 2007 performance, we are increasing our outlook for the global paid search market heading into 2008. We now believe global paid search revenues will reach $30.5B in 2008, up from our prior estimate of $26.2B. We believe that 2008 paid search growth will be driven by:

• International growth due to continued adoption of paid search as a marketing vehicle

• Keyword price inflation due to increased volume in advertisements

• Volume growth driven by increases in web usage

• CTR improvement driven by improvements in relevancy

Within search, we continue to believe that Google will take volume market share from competitors as we have greater faith in the company’s ability to execute relevancy enhancements and technological improvements and in its superior brand. However, we believe that on a dollar market share basis, Yahoo! will grow its share over Google due to the improved monetization from the global rollout of Project Panama.

We estimate that Google has a 73% dollar market share currently (including revenues from AOL, Ask, and other affiliates). We believe that this may decline to 71% by the end of 2008 as AOL and Ask have renegotiated their TAC rates and Yahoo! has improved its monetization. While Internet and broadband usage appears to be flattening out in developed countries, we believe that advertiser adoption of this well-targeted marketing vehicle is in its infancy and that there is still much room for monetization and click-through rate improvements.

Lessons Learned from 2007 In our “Nothing but Net" preview and outlook for 2007, we stated that we preferred paid search to other Internet sub-sectors such as e-commerce, travel, and graphical advertising. Looking back on the year, paid search actually exceeded our expectations. Entering 2007, we expected the paid search market to grow 39% over 2006 (29% in the US and 52% internationally). However, due to better monetization by Google, Yahoo!, and MSN, as well as volume gains, we now expect global paid search revenues to grow 48% in 2007 (37% in the US and 64% internationally). We were surprised by how robust search volume growth was during F'07. At the beginning of the year we thought that much of F’07’s US search market growth would come from increases in coverage and were modeling a 190 bp improvement in coverage vs. 18% Y/Y growth in search volume. We now think that F’07 US coverage will only improve 70 bps vs 25% growth in volume. We are encouraged by this trend as it demonstrates that the market is less mature than we thought and that search companies have not had to resort to increasing the number of ads on a page.

Global Search Overview: Global Search Expected to Grow 39% in F’08 We believe 2008 will be another strong year for global paid search. On the back of 48.3% growth in 2007, we forecast that global paid search revenues will grow 38.7%

Yahoo! will grow its share over Google due to the improved monetization from the global rollout of Project Panama.

18

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

in 2008. From a metrics standpoint, we believe query volumes will grow 29.9% in F’08, while RPS will grow 6.8%. We believe substantial monetization opportunities exist and we anticipate a climb in search usage. In 2008, we expect local search, personalized search and vertical search to be hot topics. Beyond 2008, we expect the global paid search market to grow at a 28.4% CAGR through 2011.

Table 9: JPMorgan's Global Search Advertising Revenue Forecast Units as indicated

Global 2002 2003 2004 2005 2006E 2007E 2008E 2009E 2010E 2011E 07-'11 CAGR

Internet Population (M) 593 710 820 924 1,020 1,113 1,205 1,295 1,380 1,471 7.2% Queries / Month / User 12 17 22 29 36 44 53 61 68 74 14.2% Number of Queries (M) 83,030 142,017 220,128 323,827 441,796 585,395 760,474 943,475 1,123,558 1,313,311 22.4%

RPS (per 1,000 searches) $14.57 $19.04 $23.42 $28.17 $33.58 $37.58 $40.12 $41.98 $44.75 $45.59 4.9% % Coverage 31.7% 35.3% 38.7% 41.7% 43.9% 44.5% 44.5% 45.2% 45.6% 47.1% 1.4%

% Clickthrough Rate 15.1% 16.3% 17.3% 18.8% 20.6% 21.5% 22.2% 22.7% 23.5% 23.3% 2.0% $ Revenue / Click $0.30 $0.33 $0.35 $0.36 $0.37 $0.39 $0.41 $0.41 $0.42 $0.42 1.4%

Global Search Forecast ($M) 1,210 2,704 5,156 9,121 14,835 21,999 30,511 39,606 50,275 59,868 28.4% Y/Y Growth 197.0% 123.4% 90.7% 76.9% 62.6% 48.3% 38.7% 29.8% 26.9% 19.1%

Source: JPMorgan estimates, Company reports, comScore, Nielsen//NetRatings, IDC, IWS

Increasing F’08 US Search Growth Estimate: Now We Expect to Grow 32% Based on out-performance in 2007, we are increasing our 2008 growth estimate for the domestic paid search market. We are now modeling 31.9% growth in 2008, up from our prior estimate of 19.9%. Broken down by metrics, we are modeling US query volume growth of 23.5% in 2008 (a very minor deceleration from the 25.4% we observed in 2007), driven by an increase in the number of searches conducted per user and a slight increase (3.0%) in the domestic Internet population.

On the monetization front, we expect the domestic RPS to reach $87.21 in 2008, up from $81.65 in 2007 (6.8% Y/Y growth). We expect increases in RPS to be driven by advertiser demand for keywords as well as continued increases in sponsored-link relevancy.

Table 10: JPMorgan's US Search Advertising Revenue Forecast Units as indicated

United States 2006 2007E 2008E 2009E 2010E 2011E 07-'11 CAGR

Internet Population (M) 203 211 217 222 227 231 2.4% Queries / Month / User 47 57 68 81 92 102 15.6% Number of Queries (M) 114,896 144,080 177,938 215,305 249,754 282,222 18.3%

RPS (per 1,000 searches) $74.86 $81.65 $87.21 $88.73 $94.62 $94.91 3.8% % Coverage 62.8% 63.5% 64.2% 64.3% 64.3% 64.5% 0.4%

% Clickthrough Rate 26.2% 27.3% 28.3% 28.6% 30.0% 30.0% 2.4% $ Revenue / Click $0.46 $0.47 $0.48 $0.48 $0.49 $0.49 1.0%

US Search Forecast ($M) 8,602 11,764 15,518 19,104 23,631 26,786 22.8% Y/Y Growth 47.2% 36.8% 31.9% 23.1% 23.7% 13.4%

Source: JPMorgan estimates, Company reports, comScore, Nielsen//NetRatings, IDC, IWS

Our Proprietary Research Shows... Market Share Shifts Are Likely to Continue In November, the JPMorgan Internet Team surveyed over 1,200 US residents to determine Internet usage behavior. Our market research found that Google is the dominant search engine with 54.6% of participants listing it as their most frequently used search engine. Yahoo! ranked second among participants with 21.8% of

We expect the domestic RPS to reach $87.21 in 2008, up from $81.65 in 2007 (6.8% Y/Y growth)

19

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

participants using it most frequently. MSN and AOL trailed with 8.6% and 7.2% of participants using them most frequently, respectively.

Figure 5: Most Frequently Used Search Engine % of participants

Google54%

MSN9%

Yahoo!22%

Other3%

AOL7%

Don't use/Don't know2% Ask

3%

Source: JPMorgan research However, we note that while Google was the overwhelming favorite among participants, 38.5% of respondents use search engines other than their favorite at least 30% of the time. Thus, it appears that respondents are willing to try different search engines for better results.

Surprisingly, older participants were more likely to try different brand search engines than younger participants. 44% of participants older than 42 used a search engine other than their favorite more than 30% of the time vs. only 32% of participants in the 18-41 age category. This difference was statistically significant (t=-4.37, p<.05).

62% of Respondents Would Be Willing to Consider Switching Search Engines When asked what improvements by other search engines would cause you to switch from your preferred brand, only 38% of respondents stated that nothing would cause them to switch as they were satisfied with their current search engine. The most frequently selected improvement was results that better matched the search term, with 43% of respondents stating that this would cause them to switch search engines. Other factors that would cause respondents to consider switching search engines were the user-friendliness of the site (28% of participants) and search engine speed (28% of participants).

Table 11: Factors that Would Cause Search Engine Switching % of Respondents

Results that better match search term 42.9% Results that include video, music, and other forms of information 14.2% A more uncluttered easy to navigate site 27.8% Ability to preview web content 22.5% Faster response speed to searches 27.5% Other 1.7% Nothing, happy with current search engine 37.6% Source: JPMorgan research

44% of participants older than 42 used a search engine other than their favorite more than 30% of the time vs. only 32% of participants in the 18-41 age category.

20

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

What would make participants try a different search engine? Friend and family recommendations held the most weight, with 33.8% of respondents stating this as a driver to try a new search engine. 21.7% of respondents stated that the recommendation of a tech expert would influence them to try a new engine. Trailing in the rankings of persuasiveness were TV ads (11.3% of respondents), billboards (4.1% of respondents), newspapers and magazines (7.7% of respondents), and radio (3.5% of respondents).

Over Half of Respondents Use Their Toolbar for Less than 40% of Searches Approximately 75% of respondents to our survey use a search toolbar. Google was the predominant choice of toolbars, with 40.7% of respondents having downloaded it. Yahoo! came in second with 24.1% of respondents having downloaded it. MSN, Ask, and AOL all had under 10% usage by respondents. Surprisingly, while almost three-fourths of our respondents had toolbars, their usage of them was infrequent. 42.4% of respondents who had toolbars used them less than 20% of the time.

Figure 6: Toolbar Usage Frequency % of respondents

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

Less than 20% 21-40% 41-60% 61-80% 81-100%

Source: JPMorgan research

International Market to Top the US by F’09 We continue to believe the opportunities for paid search in the international marketplace are even more significant than in the US. In our estimate, while the U.K. is at par or ahead of the US market, the overall international paid search market is still 2+ years behind the US in terms of development.

However, we now believe that the international market will be larger than the domestic market in F’09 with a market size of $20.5B vs. the US estimated market size of $19.1B. As such, we believe that the international markets will be a key growth driver in the upcoming year. We believe a key driver in the international markets will be query growth. While we expect the US to experience query growth of 23.5% Y/Y, we believe international markets will see a 32% Y/Y lift in the number of queries.

We expect the international market to reach $20.5B in F’09 vs. the US market size of $19.1B.

21

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Figure 7: US vs. International Query Volume millions

020,00040,00060,00080,000

100,000120,000140,000160,000180,000200,000

3Q06 4Q06 1Q07 2Q07 3Q07

U.S. International

Source: comScore data and JPMorgan estimates We are modeling paid search revenues to grow 46.5% in F’08, up from our prior estimate of 34.9% driven primarily by higher growth in queries and, to a lesser extent, monetization gains. Broken down by metrics, we are modeling international query volume growth of 32.0% in 2008 (a very minor deceleration from the 35.0% we observed in 2007), driven by an increase in the number of searches conducted per user and an increase (9.5%) in the domestic Internet population. On the monetization front, we expect the international RPS to reach $25.74 in 2008, up from $23.19 in 2007 (11.0% Y/Y growth). We expect increases in RPS to be sustainable as the international market RPS is significantly below US levels ($81.65 in F’07). Gains will likely be driven by advertiser demand for keywords as well as continued increases in sponsored-link relevancy.

Table 12: JPMorgan's International Search Advertising Revenue Forecast Units as indicated

International 2006E 2007E 2008E 2009E 2010E 2011E 07-'11 CAGR

Internet Population (M) 817 903 988 1,072 1,153 1,239 8.2% Queries / Month / User 33 41 49 57 63 69 14.2% Number of Queries (M) 326,900 441,315 582,536 728,170 873,804 1,031,0

89 23.6%

RPS (per 1,000 searches) $19.07 $23.19 $25.74 $28.16 $30.49 $32.08 8.5% % Coverage 37.2% 38.3% 38.5% 39.5% 40.2% 42.3% 2.5%

% Clickthrough Rate 17.2% 18.4% 19.1% 19.8% 20.5% 20.5% 2.8% $ Revenue / Click 0.30 0.33 0.35 0.36 0.37 0.37 2.9%

Int'l Search Forecast ($M) 6,233 10,235 14,993 20,502 26,644 33,082 34.1% Y/Y Growth 90.1% 64.2% 46.5% 36.7% 30.0% 24.2%

Source: JPMorgan estimates, Company reports, comScore, Nielsen//NetRatings, IDC, IWS

22

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

2008 Graphical Advertising Outlook After a difficult 2007 where CPMs were pressured from a non-premium inventory glut, we believe that 2008 will see stronger graphical advertising growth. Specifically, we think that 2008 growth will be driven by:

• Easier comps as growth will be computed off of this year’s depressed CPMs

• Improving CPMs as companies employ targeting techniques and use ad exchanges

• Improving RPMs due to higher sell-through and increased ads per page

• Increased advertiser interest due to the increased TV ad demand due to political campaigns

• Increased page views from rising broadband usage and social networking

As a result, we are slightly increasing our F’08 graphical advertising global growth estimate to 22.1% from 20.6% to reflect better monetization (CPMs) through the use of targeting and exchanges and expected growth from social networking sites and blogs. We favor web publishers who are organically growing their page views at a rapid pace and who have targeting capabilities.

Lessons Learned from 2007 In our “Nothing but Net” preview and outlook for 2007, we expressed our view that the US graphical advertising market was poised to grow 20% in 2007. Now that the year is almost complete, we have revised our F’07 US growth estimate to 23.4%. We believe that we correctly recognized the audience fragmentation trend due to the rise of social networking and blog usage. We also forecasted the resulting depressed CPMs from the glut of non-premium inventory. However, we did overestimate the impact of video advertising. We thought that the increase in video inventory, coupled with lower CPMs, would cause many graphical advertisers to shift their advertising budgets toward video and away from more traditional graphical advertising. We now recognize that reaching revenue sharing agreements and developing unobtrusive video ads accepted by viewers will be a longer process than we first thought.

Global Graphical Advertising Overview: Expect to Grow 22.1% in F’08 We believe that 2008 will be a strong year for graphical advertising publishers, particularly those with targeting capabilities. On the back of expected 23.4% growth in 2007, we believe global graphical advertising revenues will grow 22.1% in F’08. From a metrics standpoint, we believe page views and RPMs will grow 11.1% and 9.9% in 2008, respectively. We expect the global Internet population to expand 8.3% to 1.2B in 2008 and web usage to expand by 2.7% per Internet user. We believe RPM growth will be driven by (1) improving CPMs as companies employ targeting techniques and use ad exchanges, (2) increased sell-through rates, and (3) increased ads per page. We expect the global graphical advertising market to grow at a 17.6% CAGR from 2007 through 2011.

23

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Table 13: JPMorgan's Global Graphical Advertising Revenue Forecast Units as indicated

Global 2002 2003 2004 2005 2006E 2007E 2008E 2009E 2010E 2011E 07-'11 CAGR

Internet Population (M) 593 710 820 924 1,020 1,113 1,205 1,295 1,380 1,471 7.2% Pages Viewed / User / Day 33 34 36 37 38 39 40 41 43 44 2.7%

Total Pages Viewed (B) 7,209 8,897 10,724 12,607 14,275 15,986 17,768 19,563 21,469 23,487 10.1% RPM (per 1,000 pages) $1.02 $0.75 $0.81 $0.87 $0.97 $1.07 $1.17 $1.26 $1.33 $1.39 6.8%

Global Graphical Forecast ($M) 7,354 6,674 8,642 10,984 13,829 17,068 20,846 24,561 28,573 32,685 17.6% Y/Y Growth -19.6% -9.2% 29.5% 27.1% 25.9% 23.4% 22.1% 17.8% 16.3% 14.4%

Source: JPMorgan estimates, Company reports, comScore, Nielsen//NetRatings, IDC, IWS, IAB

We Think that US CPMs Will Rise in 2008 We expect the US graphical advertising market to grow 19.9% in 2008, slightly below our estimate from a year ago. We believe that page view growth will slow to 6.5% in 2008 (down from 8.0% in 2007) as social networking sites and blogs begin to mature and reach saturated penetration levels. In our estimate, page view growth will be driven by an increase of 3.0% in Internet users and an increase of 3.4% in usage per Internet user. We are modeling RPMs to grow 12.6% in 2008, driven by an 8.3% increase in the number of ad impressions per page view and a 3.9% increase in CPMs. We expect the US graphical advertising market to grow at a 14.2% CAGR from 2007 through 2011.

Table 14: JPMorgan's US Graphical Advertising Revenue Forecast Units as indicated United States 2006 2007E 2008E 2009E 2010E 2011E 07-'11

CAGR Internet Population (M) 203 211 217 222 227 231 2.4% Pages Viewed / User / Day 45 47 49 50 52 53 3.3% Total Pages Viewed (B) 3,341 3,608 3,843 4,093 4,297 4,512 5.7% Impressions / Page 0.50 0.60 0.65 0.68 0.70 0.70 3.9% Total Impressions (B) 1,671 2,165 2,498 2,783 2,987 3,158 9.9% CPM (per 1,000 impressions) $3.50 $3.31 $3.44 $3.60 $3.76 $3.86 3.9% RPM (per 1,000 pages) $1.75 $1.99 $2.24 $2.45 $2.61 $2.70 8.0% US Graphical Forecast ($M) 5,847 7,166 8,593 10,019 11,230 12,192 14.2% Y/Y Growth 23.0% 22.6% 19.9% 16.6% 12.1% 8.6% Source: JPMorgan estimates, Company reports, comScore, Nielsen//NetRatings, IDC, IWS, IAB

Political Advertising Likely to Drive Up Scatter Inventory We estimate that political ad spend on TV will total approximately $2.2B in the 2008 political cycle, up about 38% from 2006 levels. We estimate that presidential TV ad spending alone should total over $600M in the 2008 election cycle. Since 1982, political advertising revenues have contributed about 34% of spot TV ad growth in even-numbered years.

Given the fixed quantity of available TV inventory and our expectation that political ads may account for 6% of 2008 spot TV ads, we think that it is likely that some advertisers will shift their ad spend to online display advertising.

Political advertising revenues have contributed about 34% of spot TV ad growth in even-numbered years.

24

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Table 15: Political Ad Spending, 1992-2008E $ in millions 1992 1994 1996 1998 2000 2002 2004 2006 2008E Presidential $331.1 - $425.7 - $528.9 - $880.5 - $1,454.4 + Senate $397.1 $480.8 $435.8 $455.1 $547.5 $458.8 $573.1 $664.8 $758.8 + House $530.7 $573.6 $653.5 $677.9 $691.3 $761.8 $784.8 $1,012.2 $1,160.5 + Gubernatorial $60.3 $423.0 $68.6 $471.0 $97.8 $833.3 $112.6 $937.9 $136.9 + Other $263.7 $232.6 $310.2 $273.7 $364.9 $285.5 $406.3 $252.0 $447.0 = Total Political Dollars Raised $1,582.8 $1,710.0 $1,893.8 $1,877.6 $2,230.4 $2,339.5 $2,757.3 $2,866.9 $3,957.5 x % $$ Spend 95.0% 95.0% 95.0% 95.0% 95.0% 95.0% 95.0% 95.0% 95.0% = Total Political Dollars Spent $1,503.7 $1,624.5 $1,799.1 $1,783.7 $2,118.9 $2,222.5 $2,619.5 $2,723.6 $3,759.6 x % Allocated to TV Advertising 35.6% 31.3% 34.6% 40.1% 41.0% 45.6% 53.4% 58.7% 58.7% = Political TV Advertising $534.8 $508.3 $621.9 $714.4 $868.9 $1,013.0 $1,400.0 $1,600.0 $2,208.6 % Change from Prior Election Year --- (4.9)% 22.4% 14.9% 21.6% 16.6% 38.2% 14.3% 38.0% Source: Opensecrets.org and JPMorgan estimates. Note: Other $$ includes funds raised by political parties, interest groups, etc.

Aggregators of Traffic Poised for Growth Audience Fragmentation Creates Difficulty for Advertisers While portals were once dominant, Yahoo!, AOL, and Microsoft only accounted for ~29% of minutes spent online in August 2007, down from 42% in August 2002. Meanwhile, blogs, online gaming, and social networking websites have experienced double to triple digit Y/Y growth rates in page views. This fragmented audience not only makes it more difficult for advertisers to reach their target audience through only a few publishers, but also makes it difficult for publishers to attract advertisers given their limited scale. We believe that companies that can aggregate traffic through the development of ad networks or partnerships will be more successful in driving growth in 2008. Please see the Ad Network section of this report for additional details.

Targeting Capabilities Successful on Inventory with Overlapping User Base While increasing user reach is half the battle, we recognize that many page views are meaningless to advertisers unless user information can be gathered and ads are targeted. In order to most effectively target the ads, publishers need to have access to user behavior on multiple sites to collect data and to repeatedly show ads to the same user. We believe that companies with targeting capabilities will be able to command a premium CPM. Revenue Science estimates that there is a 15x CPM premium for behaviorally targeted ads.

While portals were once dominant, Yahoo!, AOL, and Microsoft only accounted for ~29% of minutes spent online in August 2007, down from 42% in August 2002.

25

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Figure 8: Behavioral Targeting Effects on CPM

0

200

400

600

800

1000

1200

1400

1600

1 2 3 4 5 6 7 8 9

Web impressions Percent

Aver

age C

PM D

ollar

s

80

70

12

10

8

6

4

2

020 40 60 80

Tier 3< $1

Tier 2$1-10

Tier 1$10+

Revenue Science Targeting~$10.00 - 12.00

Exchange modelpotential benefits~$0.75 - 1.50

Traditional optimizedad network$0.50 - 1.00

Source: Revenue Science Presentation

International Growth Is Still a Big Theme International markets continue to benefit from increased broadband penetration and increased ad spend moving online. Even in markets where broadband is approaching saturation, such as in the UK, display ad prices are likely to rise as more advertisers compete for a more limited quantity of inventory. We estimate that international display advertising will grow at 23.8% in 2008 and at a 19.9% 2007-2011 CAGR.

Table 16: JPMorgan's International Graphical Advertising Revenue Forecast Units as indicated International 2006E 2007E 2008E 2009E 2010E 2011E 07-'11

CAGR Internet Population (M) 817 903 988 1,072 1,153 1,239 8.2% Pages Viewed / User / Day 37 38 39 40 41 42 2.8% Total Pages Viewed (B) 10,934 12,378 13,925 15,470 17,172 18,975 11.3% RPM (per 1,000 pages) $0.73 $0.80 $0.88 $0.94 $1.01 $1.08 7.8% Int'l Graphical Forecast ($M) 7,982 9,902 12,254 14,542 17,344 20,493 19.9% Y/Y Growth 28.1% 24.1% 23.8% 18.7% 19.3% 18.2% Source: JPMorgan estimates, Company reports, comScore, Nielsen//NetRatings, IDC, IWS, IAB

We estimate that international display advertising will grow at 23.8% in 2008 and at a 19.9% 2007-2011 CAGR.

26

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Ad Networks on the Rise What Are Ad Networks? We see ad networks defined by the following:

transacts, serves, tracks and reports the distribution of advertiser ads to publisher pages.

enables marketers to advertise on multiple publisher sites through one central location

publishers enjoy the benefit of advertising revenue without investing in a sales force or as a source to sell remnant inventory

varies in the ability to target a specific audience and in methods of payment (CPM, CPC, and CPA)

revenues are determined by revenue share agreements

The definition of ad networks is fuzzy with lead generation sometimes included. However, we are differentiating between the ad network and lead generation space. We are defining lead generation as much more targeted and deep into specific verticals. As a result, we believe that this commands much higher CPM's, in the $100-$150 range. While we believe that this is also an interesting ad model, we believe it deserves a more detailed consideration and will thus save it for a later note.

A Significant Market Opportunity We estimate that the global graphical advertising market as a whole will grow over 22% through 2008. The sector should benefit from 1) increased online viewership as more people turn to the Internet as a source of content and 2) increased RPMs as audience targeting improves.

Additionally, increasing keyword prices and the ability of networks to provide response advertising in addition to branding campaigns will likely drive more marketers to ad networks. On the publisher side, as the long tail of information is increasing, more publishers are looking to monetize their content. We estimate that the top 20 ad networks will earn approximately $2B+ in revenue in 2007 (~14% of the display ad market) and are growing much faster than the general graphical advertising industry. We estimate ad networks to contribute ~17% of the total display ad market in 2010 (25% F’08-F’10 CAGR).

Lead generation is more vertical specific and performance oriented than ad networks

Int'l Ad Network penetration is so small that it is not yet tracked by ComScore. We expect that it is ~3-5 yrs developmentally behind the US and will be a significant future growth driver.

27

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Figure 9: Global Ad Network Market Forecast $ in millions

0

1000

2000

3000

4000

5000

6000

2005 2006 2007E 2008E 2009E 2010E

Source: ComScore data, Company reports, and JPMorgan estimates Table 17: Ad Networks by Page Views millions

August Page Views (M) August Y/Y Growth Advertising.com 72,598.6 56% AdBrite 28,529.9 901% Traffic Marketplace 25,629.0 321% ValueClick 22,732.2 64% 24/7 Real Media 13,532.5 104% Tribal Fusion 10,829.5 -4% CPX Interactive 9,764.1 N/A Casale Media Network 9,575.9 -59% Blue Lithium 5,450.2 211% Specific Media 5,407.0 N/A Vibrant Media 5,096.6 168% ContextWeb 5,065.6 122% PrecisionClick 4,497.8 -52% Burst Media 3,746.3 26% DRIVEpm 2,993.1 140% Interclick 1,992.1 N/A Kontera 1,894.7 N/A adconion media group 943.6 N/A AdDynamix.com 918.3 264% Undertone Networks 441.2 734% Indieclick 175.8 N/A Rydium Network 27.3 -52% Total 231,841.3 77% Source: ComScore and JPMorgan estimates

The Future of Ad Networks The ad network space is becoming increasingly competitive as new ventures are launched and as Google, Yahoo!, AOL, and Microsoft enter the space through acquisitions. We believe that differentiation will be key to success. Following are capabilities that we see important to market leadership.

Behavioral Targeting We believe that advertisers used to pay for audiences on websites but will now start to pay for specific users. Marketers appear to value targeted advertising as evidenced by Google’s well targeted search ads generating RPQs of more than double Yahoo!'s.

Behavioral targeting will increase CPMs and drive volume.

28

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

We expect that this same principal will apply to graphical advertising and note that Revenue Science estimates a 15x CPM premium for behaviorally targeted ads.

Figure 10: Behavioral Targeting Effects on CPM

0

200

400

600

800

1000

1200

1400

1600

1 2 3 4 5 6 7 8 9

Web impressions Percent

Aver

age C

PM D

ollar

s

80

70

12

10

8

6

4

2

020 40 60 80

Tier 3< $1

Tier 2$1-10

Tier 1$10+

Revenue Science Targeting~$10.00 - 12.00

Exchange modelpotential benefits~$0.75 - 1.50

Traditional optimizedad network$0.50 - 1.00

Source: Revenue Science Presentation

Video Capabilities Google’s $1.65B acquisition of video sharing site YouTube gives insight into the value placed on video property. Traditional media companies have also moved onto the Internet by offering TV episodes online and with Internet designed webisodes. However, monetization of Internet videos has trailed its growth. Various companies have experimented with pre-roll, post-roll and in-video ads. Google has experimented with in video ads on select YouTube videos in which the ad is overlaid on the bottom 20% of the video soon after it is launched. If the user does not click on it, it simply disappears.

Mobile Ads An even younger industry is mobile phone advertising. The development of the iPhone and speculation of Google phone devices or services have placed a growing interest in the field.

Performance-based Advertising While many graphical ads were originally used for branding purposes with less of a focus on conversion, the developments in behavioral and contextual advertising have put more pressure on ad networks to deliver conversions.

Email Marketing Ad networks have entered the realm of email marketing by placing advertisements in emails sent by other companies to their customers. As in the other categories, ROI is enhanced by careful pairing of the ad with a related company or email content. Email marketing is a preferred method of advertising with its easy trackability and ROI calculation. Furthermore, unlike other advertisements, email is pushed to targeted customers rather than assuming that specific websites will pull these customers to the ad.

We believe that the development of a non-intrusive video ad delivery system with contextual advertising capabilities will be valued by the ad network space.

Success in mobile ads will be dependent on targeting, non-intrusiveness, and ability to load on slow-loading platforms.

We see payment structures shifting with objectives to include CPA models in addition to CPMs.

We believe marketers will turn to targeted email distribution given its high usage and push vs. pull ad model.

29

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Ultimately, we believe successful ad networks are going to need to be able to provide a diversity of advertising platforms to its marketers with clear targeting capabilities.

Dominant Portals’ Role in the Growing Ad Network Market In our view, potential consolidation in the ad network space is strategically feasible. We believe that consolidation will occur throughout the industry as ad networks grow their user base and leverage user information through behavioral targeting across a larger audience base. We believe large portals are well positioned as it is easier for both advertisers and publishers to fulfill all of their needs on fewer platforms while a consolidated network yields greater leverage of technology and advertiser/publisher relationships.

Creating Ad Networks Could be the Answer to an Ever-Fragmenting Audience While portals were once the dominant source of news and information, Yahoo!, AOL and Microsoft only accounted for ~27% of total minutes spent online in October vs. 42% in 2002. A similar trend can be seen in page views as October page views on the top 3 portals declined 22% from October 2004 vs. 22% total Internet growth in page views. We note that some of these losses can be attributed to losses in dial-up subs. We believe portals will become more significant players in ad networks as they turn to networks to grow their user reach, leverage user information through behavioral targeting, and leverage their existing capabilities to sell, place, and analyze display ads. Figure 11: Total Minutes Spent on Portal in October 2002 and 2007 millions

0

10,000

20,000

30,000

40,000

50,000

60,000

Yahoo! Sites Time Warner Network Microsoft Sites

Oct '02 Oct '07

34% growth

21% decline

43% decline

Source: ComScore data and JPMorgan estimates

Minutes spent on portals has declined over the last 5 years despite 37% growth in total minutes spent on the Internet.

30

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Figure 12: Total Page Views for Leading Portals, October 2004 and 2007 millions

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

Yahoo! Sites Time Warner Network Microsoft Sites

Oct '04 Oct '07

7% decline

54% decline

4% growth

Source: comScore data and JPMorgan estimates User Information Will Lead to Dominance Accurate and rich user information is among an Internet company’s most valuable assets. Additionally, the ability to leverage accurate user information to deliver relevant content to users is the key to increasing conversion rates. We think large cap companies are particularly well suited to running ad networks as they can lever their user information with that of the publisher network to provide well targeted advertising. This should increase user conversion and monetization capabilities. A combination between any of the search players, a large publisher network, and a company with behavioral targeting capabilities would make sense, in our view.

One Platform for Multiple Advertising Products=Higher Ad Dollar Allocation From the standpoint of an advertiser, advertising campaign management would be easier with a single ad firm offering multiple products (search, graphical, cost-per-lead, cost-per-action, in-game advertising, mobile advertising, video). Publishers would benefit from the scale of various advertisers across verticals and the higher CPMs accompanying better targeted ads.

If a company had demographic, search query, and web navigation data on a user, we believe it could provide advertising that is more user relevant and could tailor the ads to the user as he/she navigates the web.

31

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Figure 13: Online Advertising Services by Company

Service AOL GOOG MSN YHOOSearchAd NetworkAd Serving***Traffic Exchange***TargetingLead GenerationAffiliate Marketing***Rich MediaMobileEmail

***Assumes DoubleClick/Performics acquisition Source: JPMorgan estimates, Company data Cost Synergies Entering the ad network space would allow large cap Internet companies to lever their existing sales force, technology, and publisher relationships in expanding their product offering. The sales team could expand its offering of graphical advertising to include properties on the ad network. Technology used to place graphical ads on owned and operated properties and for behavioral targeting could be extended for use on network sites. Finally, search network relationships could be leveraged in building the ad network.

Scale Is Critical to Build a Market-Leading Product While we have established that the goal of ad networks should be to increase their exposure to an overlapping user base across a variety of properties for targeting, such an undertaking requires scale.

Small Companies must choose between generalization across a variety of publishers or going deep into a few verticals. Both options carry risk, as generalization limits targeting capabilities while focusing on limited verticals exposes companies to industry risk (for example, the current mortgage industry weakness).

Large Cap Companies, however, have the resources to be both broad and deep, offering targeting capabilities while maintaining diversification of risk.

AOL Advertising.com revenue growth is not dependent on AOL usage trends Advertising.com has been a major contributor to advertising revenue growth in the past 12 months, driving 43% of ad revenue increase at AOL while accounting for 27% of total advertising revenue. Because its revenue is derived from placing third-party advertising on third-party sites, Advertising.com grew mainly through acquisition of new customers rather than through improved monetization of AOL traffic.

32

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

Figure 14: Advertising.com has contributed the largest portion of Y/Y advertising revenue increases $ in millions

38.0

60.0

34.0

9.0

40.050.0 51.8 55.7

29.0

50.063.0 75.0 74.0

35.039.0

0.0

20.0

40.0

60.0

80.0

Q2-06A Q3-06A Q4-06A Q1-07A Q2-07ASearch Graphical Ad.com

Source: Company reports and JPMorgan estimates.

We think that Advertising.com will continue to grow faster than AOL’s search and graphical revenue streams, helped by an industry-wide shift to more targeted adverting, increased CPM due to behavioral targeting added through acquisition of TACODA as well as overall Internet advertising market growth.

Figure 15: We expect Advertising.com revenue to continue growing faster than search and graphical %

13.4% 15.4%20.1%

16.5%

36.9%

18.0%

0.0%

10.0%

20.0%

30.0%

40.0%

07E 08E

Search Graphical Adv ertising.com

Source: Company reports and JPMorgan estimates.

Acquisition of TACODA Adds Behavioral Targeting Capability We believe that the acquisition of TACODA, a behavioral targeting network, completed by AOL on September 6, ’07, makes sense strategically:

• The deal’s logic is consistent with our view that improved monetization of non-premium inventory will continue to gain importance as premium inventory pricing growth is slowing industry-wide.

• We expect TACODA technology to improve targeting at advertising.com thus driving CPM and helping maintain revenue growth rates.

33

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

• Bringing behavioral targeting function in house is a prudent defensive move given recent consolidation, in our view.

Recent M&A Activity Intensifies the Competitive Environment As discussed above, we see acquisition of TACODA as a positive strategic development that should help offset potential impact from the recent changes in the competitive landscape, two deals in particular:

• Acquisition of Blue Lithium by Yahoo! We believe that Yahoo! used advertising.com as well as other networks to monetize its non-premium inventory, relationships that maybe scaled down following the acquisition of Blue Lithium. Furthermore, we expect Yahoo! to combine Blue Lithium with a recently acquired ad exchange, Right Media, and pursue third-party business, thus competing with Advertising.com.

• Acquisition of Aptimus by The Apollo Group (University of Phoenix Online). The Apollo Group has been the single largest contributor to advertising.com growth. We estimate that it accounted for 73%, 60% and 62% of Y/Y revenue increase in Q3 ’06, Q4 ’06 and Q1 ’07, respectively. Although it's possible that The Apollo Group will re-direct some of the inventory from ad.com to Aptimus, we expect the gains from the integration of TACODA to at least offset any potential impact.

Google Becoming More than Just a Search Engine and Search Network A latecomer to the display advertising field, Google has made recent strides to enter it and, in our view, would be a likely candidate for building its AdSense network to include display advertising. As the leader in search market share, Google has much information about user preferences for hosting behaviorally targeted ads.

Table 18: Search Market Share, October 2007 millions Core Search Searches Search Market Oct-07 Share Google Sites 6,151 59% Yahoo! Sites 2,405 23% Microsoft Sites 1,023 10% Ask Network 491 5% Time Warner Network 443 4% Source: ComScore

Strategic Acquisitions Provide Fast-Paced Industry Entrance Recent acquisitions have positioned it well to quickly gain market share. With the pending acquisition of DoubleClick, Google gains ownership of two key technologies:

the DART suite: a comprehensive set of technologies that enable advertisers to effectively manage their online advertising campaigns while providing publishers with the ability to dynamically place ads on their sites.

the DoubleClick Advertising Exchange: a platform for buyers to gain immediate access to inventory with goal-based bid rules, defined budgets,

34

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]

targeting, and frequency caps on inventory purchases, while sellers increase overall yield by reducing unsold and undervalued inventory

DoubleClick has relationships with both publishers and advertisers that enable it to serve hundreds of billions of ad impressions per year. In 2004 (the most recent full-year data available), DoubleClick served over 800 billion online ad impressions (we expect it will serve ~2 trillion impressions in F’07). Beginning with display advertising tests within the AdSense for Content environment, Google has been exploring the serving of graphical advertisements for a couple of years. But we believe the acquisition of DoubleClick emphasizes the importance that Google places on entering the ad network market.

Figure 16: Graphical Ad Market Will Represent 36% of Total in 2010 % of industry revenues

Graphical Adv ertising

36%

Search Adv ertising64%

Source: JPMorgan estimates, Company Reports, ComScore, Nielsen//NetRatings, IDC, IWS, IAB

MSN Rich Targeting and Performance-based Advertising Capabilities With the acquisition of aQuantive, Microsoft obtained the DRIVE performance media platform, which provides premium advertising solutions to aQuantive advertisers and agencies. With a selective inventory from only the top 250 publishers, DRIVEpm offers brand protection to its advertisers. The collection of visitor data over several years and CPA payment options allows for behavioral targeting and performance-based capabilities. While the selectivity of the publisher network will likely limit its scale, this premium network will offer a point of differentiation from competitive networks.

Figure 17: DRIVEpm Ad Network

DRIVEpmNetwork

Top 250Publishers

RemnantInventory

Behavioral Targeting

CPA Solution

Advertiser andAgency Clients

Source: aQuantive reports and JPMorgan estimates

35

North America Equity Research 02 January 2008

Imran Khan (1-212) 622-6693 [email protected]