Transversal Activity Report Activity Report 2014 4 FOREWORD AFROSAI-E plays a facilitative role in...

-

Upload

duongkhanh -

Category

Documents

-

view

214 -

download

0

Transcript of Transversal Activity Report Activity Report 2014 4 FOREWORD AFROSAI-E plays a facilitative role in...

Transversal Activity Report

2014 Presented at the AFROSAI-E Governing Board meeting in Cape Town, May 2015

Transversal Activity Report 2014

2

Contents

FOREWORD ............................................................................................................................................. 4

EXECUTIVE SUMMARY ............................................................................................................................ 5

CHAPTER 1 .............................................................................................................................................. 8

INTRODUCTION ....................................................................................................................................... 8

INSTITUTIONAL CAPACITY BUILDING FRAMEWORK (ICBF) .................................................................... 9

The new SAI-Performance Measurement Framework (SAI-PMF) ................................................ 10

AFROSAI-E DEVELOPMENT TOOLS ........................................................................................................ 10

CHAPTER 2 ............................................................................................................................................ 12

METHODOLOGY .................................................................................................................................... 12

CHAPTER 3 ............................................................................................................................................ 14

SAIS ASSESSMENT AGAINST THE FIVE DOMAINS IN ICBF ..................................................................... 14

Averages for the domains within ICBF .............................................................................................. 14

Performance on domains from 2010 to 2014 .................................................................................. 19

CHAPTER 4 ............................................................................................................................................ 21

SAIS ASSESSMENT AGAINST THE STRATEGIC IMPERATIVES ................................................................. 21

CHAPTER 5 ............................................................................................................................................ 24

Strategic imperatives related to the five domains in ICBF.................................................................... 24

Performance along six strategic imperatives: ................................................................................... 24

Independence of SAIs ................................................................................................................... 24

Human Resources ......................................................................................................................... 26

Quality Assurance ......................................................................................................................... 30

Performance Audit ........................................................................................................................ 34

Use of IT in Audit ........................................................................................................................... 36

Communication ............................................................................................................................. 39

GENERAL PERFORMANCE OF THE SAIs ................................................................................................. 40

New focus areas ................................................................................................................................ 40

Timeliness and audit coverage ......................................................................................................... 42

Size and composition of audit staff................................................................................................... 43

Financial Resourcing of SAIs .............................................................................................................. 43

CONCLUSIONS ....................................................................................................................................... 45

Progress seen in the strategic areas for 2014 ................................................................................... 45

3 FOREWORD

APPENDICES .......................................................................................................................................... 49

Appendix 1: AFROSAI-E INSTITUTIONAL CAPACITY BUILDING FRAMEWORK (ICBF): A GENERIC

FORMAT OF THE INSTITUTIONAL PERSPECTIVE ............................................................................... 50

Appendix 2: Country Level Presentations 2014 ................................................................................ 52

Angola .............................................................................................................................................. 53

Botswana .................................................................................................................................... 53

Eritrea.......................................................................................................................................... 54

Ethiopia ....................................................................................................................................... 54

Ghana ........................................................................................................................................... 55

Kenya ........................................................................................................................................... 56

Lesotho ........................................................................................................................................ 56

Liberia ......................................................................................................................................... 57

Malawi ......................................................................................................................................... 57

Mauritius ..................................................................................................................................... 58

Mozambique ............................................................................................................................... 58

Namibia ....................................................................................................................................... 59

Nigeria ......................................................................................................................................... 59

Rwanda ........................................................................................................................................ 60

Seychelles ................................................................................................................................... 60

Sierra Leone ............................................................................................................................... 61

South Africa ................................................................................................................................ 61

South Sudan ................................................................................................................................ 62

Sudan ........................................................................................................................................... 62

Swaziland .................................................................................................................................... 63

Tanzania ...................................................................................................................................... 63

Uganda ......................................................................................................................................... 64

Zambia ......................................................................................................................................... 64

Zimbabwe ................................................................................................................................... 65

Appendix 3: Quality Assurance Questions – average for all countries per question........................ 66

Appendix 4: Quality assurance questions compared to quality assurance visits ............................. 67

Appendix 5: Number of auditors in the region ................................................................................. 68

Transversal Activity Report 2014

4

FOREWORD

AFROSAI-E plays a facilitative role in empowering member Supreme Audit Institutions (SAIs) to

optimize their audit performance through sharing information and supporting them toward better

performance in executing their mandates. The desire is to make a difference in the performance of

SAIs through supporting them in their capacity building interventions.

During the 2006 Governing Board meeting the Auditors General adopted the Institutional Capacity

Building Framework (ICBF) as a self-assessment guidance tool to member SAIs as well as a

benchmark for regional development that would assist the member SAIs to reach the level of audit

performance necessary to fulfill their mandates. The ICBF is used by the SAIs to report on own

performance. It also provides the opportunity to consolidate the performance of member SAIs on a

regional level. The ambition to improve and consolidate the performance of the SAIs is reflected in

the targets set for the strategic imperatives in the AFROSAI-E Corporate Plan for 2010 to 2014. These

targets are continually reviewed based on the results from the Transversal Activity Reports.

However, the goal is that as many SAIs as possible will reach level 3 and above of the ICBF.

The ICBF is now a well-accepted and understood tool in the region. Its adoption by the AFROSAI-E

Auditors General has stimulated a spirit of constructive competition amongst the SAIs with a positive

impact on the development activities in the region. Whilst the challenges are ambitious it is certainly

within the capability of all SAIs to continue improving their performance and thus facilitate public

service accountability throughout the region. The progress made by SAIs is visible and will eventually

demonstrate the impact of their work in the years ahead by means of improved accountability,

transparency and governance in the region’s public sector. It is with great joy and pride that the six

strategic imperative set at the beginning of the strategic period have been achieved satisfactorily.

However, there are still development gaps that we believe will be addressed in the next strategic

period of 2015-2019.

For the first time in the history of the Transversal Activity Report this year’s report was prepared by

a team of two resource persons, Dr Wilfred Marube of SAI Kenya and Mr Lawrence Z.E. Chinkhunda

from SAI Malawi and Mr Gorden Amon Kandoro, the AFROSAI-E Senior Manager responsible for

institutional strengthening and capacity building who was the team leader.

This Transversal Activity Report was presented at the AFROSAI-E governing board meeting in Cape

Town, South Africa in May 2014. Time was given for comments from the SAIs until the end of June

2015.

Wessel Pretorius

Chief Executive Officer

AFROSAI-E Secretariat

5 EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

This transversal activity report for 2014 is compiled from the self-assessments by 23 out of the 25

member-SAIs in the AFROSAI-E region. Both the surveys questionnaire and this activity report is

premised on the Institutional Capacity Building Framework (ICBF) with focus on the strategic

imperatives that agree upon by the Governing Board.

The response rate for 2014 was 92% meaning that 23 out of the 25 member countries responded to

the survey. The results presented in this report are primarily based on the responses provided by the

23 member SAIs. However, the results are moderated by quality assurance support visit reviews by

the Secretariat to eleven member SAIs, as well as the 2014 AFROSAI-E Integrated Annual Report.

This year is the last of AFROSAI-E’s five-year contemporary strategic plan ending December 2014.

Based on the achievement of 2.5 level and above of the ICBF, it is concluded that most the targeted

development targets set in 2009 have been achieved. The critical step needed is the establishment

of mechanisms to maintain and ensure continuous achievement of higher levels of development in

the next strategic cycle to enable the region to achieve the overall target.

Although remarkable progress has been made the overall objective position of 70% of the member-

SAIs achieving level three and above of the ICBF has not been achieved. There are still weak areas

that require further developments. For example, the alignment of the strategic and

operational/business planning level and the ability of SAIs to clearly link operations to their strategic

plans still require attention. However, in our view this observation raises several questions because

there are different dimensions and reasons that can be used to explain the differences. For instance,

in the domain of independence and the legal framework of SAIs the weak link has been observed to

be in the slow progress in operationalizing SAIs’ legal frameworks that include among others the

setting up of robust follow-up of audit recommendations mechanisms and annual reporting on SAIs’

performance in the public arena.

The improvements observed in this report also highlighted a further need to develop communication

strategies; strategies for planning and managing financial and human resources; the development of

quality assurance strategies; the continued development of performance audit; and developing

processes to enhance timeliness in reporting.

Although the human resource imperative ratings have improved compared with the previous period,

the report observes that the human resource division/unit as a strategic partner and facilitator of

the SAI’s development requires further alignment with other SAI functions. For example, on

operational levels these weaknesses are observed in the lack of effective appraisal systems,

ineffective deployment and use of time recording systems as tools for performance management.

Transversal Activity Report 2014

6

Another weak link was on whether or not there is specific management and leadership development

programmes in place that encourage the professionalization of the various SAI disciplines.

Conclusions

Considering the overall observations and analysis of the self-assessments the following

conclusions have been made:

Independence

In the AFROSAI-E member SAIs should focus more towards the attainment of financial and

administrative independence under appropriate oversight without the involvement of the

executives. As such SAIs are encouraged to use UN resolutions to lobby both the executive and

legislatives structures in their respective countries to obtain and maintain independence. Secondly,

the Secretariat should assist SAIs to operationalise their independence by developing a regional

toolkit with a framework to guide them on how to influence the development and implementation

of primary and secondary legislations.

Human Resources

SAIs and the Secretariat should continue to develop and implement human resource management

tools like organizational development policies/plans, performance management systems and time

recording systems to assist in the achievement of higher development levels. Secondly, SAIs should

continue to focus on the establishment of management and leadership development programme to

improve the capacity of their management teams. Thirdly, SAIs should also start to invest in the

professionalization of their staff in order to ensure the development of capable organisations.

Communication

Communication is a cross cutting issue in any organization which should be treated as a strategic

channel for the implementation of the SAI’s development goals. Given the important value of

communication it is recommended that robust external and internal communication policies and

strategies be developed, implemented and monitored at senior management level of the SAI.

Quality Assurance

This is an area that needs to be focused continuously given that the quality control aspects for the

audit disciplines are evolving. For example, quality control aspects of especially HR, management

and communication – apart from the audit disciplines – are also necessary to focus before the SAI

can achieve quality audit services. Quality Assurance is a continuous activity and there is still a need

to focus on the quality assurance issues in the different parts and on the different levels of the SAIs

7 EXECUTIVE SUMMARY

Performance Audit

Together with continuous training and development of performance auditors there should be

deliberate prioritization in the development and implementation of quality control management

systems focusing on the audit review skills necessary for performance auditing and enhancing

recruitment, training and retention for auditors and managers with a wide mix of different

professional backgrounds.

Use of IT in Audit

There has been satisfactory progress in the development of this imperative. However, there is still

room to develop this imperative even in the next strategic period. As such there is need for

development not only in the area of knowledge and skills for IT auditing but also in the innovative

and creative use of the same. It is also clear that there should be an intensive focus on the

development and implementation of comprehensive IT strategies and IT support systems that are

aligned with the IT development landscape.

Transversal Activity Report 2014

8

CHAPTER 1

INTRODUCTION

The Lima declaration (ISSAI 1) of 1977 endorsed at the INCOSAI meeting in Lima, Peru, provides a

strong foundation for supreme audit institutions (SAIs). Subsequent standards have been developed

since then, focusing on different areas. Of late, a set of new internationally agreed standards for SAIs

have been developed and continue to be developed. The development of International Standards

for Supreme Audit Institutions (ISSAIs) is a result of cooperation between INTOSAI member SAIs

through the Professional Standards Committee, and endorsements at the triennial International

Congress of SAIs (INCOSAI) where each attending member has one vote. These standards are built

on the expectation that member SAIs would adapt and adopt them based on their unique context

and legislative realities of their environments. In the AFROSAI-E environment an Institutional

Capacity Building Framework (ICBF) was developed for the same purpose to assist in the effective

implementation of the ISSAIs. As the number of international standards increase the AFROSAI-E

institutional capacity building framework is continuously amended to align with these ISSAIs. This

Transversal Activity Report has its starting point in the AFROSAI-E Institutional Capacity Building

Framework.

The AFROSAI-E Institutional Capacity Framework was developed to help SAIs enhance their capacity

through operationalizing and adopting the various ISSAIs. It summarizes the different standards and

regulations into key areas a SAI needs to focus on to succeed in its operations and development. It is

put together from an organizational perspective rather than from the specifications made in the

standards. The purpose is to assist the SAIs in identifying their strengths and weaknesses to be able

to allocate the resources in an efficient and effective way.

This transversal activity report is part of capacity building through the ICBF framework. It gives a

cross sectional and longitudinal view on how SAIs have performed and progressed with the ICBF

framework the last twelve month reporting period. The report aims to facilitate the analysis by

providing the members of AFROSAI-E with information from an institutional perspective on the

status of their development and that of the public sector auditing in the region through self-

assessments made by the member SAIs. This provides a platform for broad comparison within the

region and could be of benefit for benchmarking among members SAIs as well as use by AFROSAI-E

development partners and other key stakeholders including the donor community.

The activity report is further an important instrument for the governing board and its executive

secretariat to monitor the development in the region against agreed objectives and activities in the

corporate plan. AFROSAI-E’s enabling role to better support its members in the execution of their

mandates, is as well enhanced by the information provided in the activity report.

9 Institutional capacity building framework (ICBF)

INSTITUTIONAL CAPACITY BUILDING FRAMEWORK (ICBF)

The AFROSAI-E Board adopted at its annual meeting in 2006 an institutional capacity building

framework as a basis for the development and the strategic planning of the regional organization.

The framework has its roots in a capability model developed in 2001 and updated in 20051. The

Institutional Capacity Building Framework consists of five development levels, level 1 to 5, and five

institutional development areas or domains: Independence and Legal Framework, Organization and

Management, Human Resources, Audit Standards and Methodology and finally Communication and

Stakeholder Management. Each domain contains a number of elements as shown in appendix 1.

The ICBF is primarily a tool for the SAI to support its endeavors to reach level 3 and beyond in the

best possible way and not only an instrument for assessment as most of the other capacity building

models. The objective is to help the SAI focus on how it can improve its results and thereby its

position in relation to its counterparts in the INTOSAI community. Thus, the ICBF can be used as a

tool to improve the performance of a SAI. The idea is to enhance the possibilities to develop the SAI

in its different branches in parallel. That is; the different lines of business and objectives in the

institution (strategic management, core business and corporate services) can be linked to support

each other. This is especially important when it comes to the linkages to the strategic plan. Different

divisions’ operational plans and practices are as well linked to the overall strategic plan and the idea

of where the SAI is heading in its work.

Further, in the ICBF, the institutional perspective in a SAI is based on, and consists of, the following

five areas or domains as shown in Table 1:

Independence and legal framework

Organization and management

Human resources

Audit standards and methodology

Communication and stakeholder management

An illustration of the development levels of the institutional capacity building framework (ICBF) is

presented in table 1. Each domain in the framework is composed of a number of issues or topics,

here called elements (see appendix 1). These are seen as the elements needed to build a sustainable

institution. The elements in the framework are common for all levels, although the quality differs. A

guideline has been developed to assist the SAIs to assess their position in accordance with the

indicators developed for each element in the Framework, to help the SAIs to position themselves on

the right development level.

1 AFROSAI-E: A good practice guide to enhance the independence of Supreme Audit Institutions (SAIs) in

English-Speaking African countries, 2005.

Transversal Activity Report 2014

10

Institutional Capacity Building Framework (ICBF)

INSTITUTIONAL PERSPECTIVE D

EVEL

OP

MEN

T LE

VEL

Independence

and

Legal Framework

Organization

and

Management

Human

Resources

Audit Standards

and

Methodology

Communication

and

Stakeholder

Management

Level 5 ------------------------------------------OPTIMI ZED LE VEL ----------------------------------------------------

Level 4 ------------------------------------------MANAGE D LE VEL ------------------------------------------------------

Level 3 ------------------------------------------EST ABL I SHE D LE VEL -------------------------------------------------

Level 2 ------------------------------------------DEVELOPI NG LE VEL --------------------------------------------------

Level 1 ------------------------------------------FOUNDI NG LE VEL -----------------------------------------------------

Table 1: The five levels and the institutional perspective on each level in the AFROSAI-E institutional capacity building

framework

The five domains are divided into five development levels which include; the founding level; the

developing level; the established level; the managed level; and the optimized level (See Table 1).

Further each level has indicators that require to be fulfilled before the SAI can claim to have

achieved the said level of development. Currently, in the AFROSAI-E region, this is achieved through

a self-assessment questionnaire which members SAIs are expected to respond to annually.

The new SAI-Performance Measurement Framework (SAI-PMF)

On a similar dimension AFROSAI-E participated in the development of a new assessment tool kit –

Performance Measurement Framework (SAI-PMF) – for measuring the performance of SAIs. The

development of this tool is being spearheaded by the INTOSAI Development Initiative (IDI) in

cooperation with selected member SAIs from the INTOSAI community. Of significance though is the

fact that the SAI-PMF has a lot of similarities with the ICBF and is partly based on this work made in

AFROSAI-E. The current draft version of the SAI-PMF is in the pilot phase of its development and will

be presented for endorsement in 2016 during the International Congress of Supreme Audit

Institutions (ICOSAI) conference.

In the meantime, the ICBF will remain parallel with the development of SAI-PMF. Efforts are already

underway to align the ICBF to the SAI-PMF version in line with the requirements of ISSAI 12. As a

self-assessment tool, the ICBF is expected to complement the SAI-PMF and will provide a simplified

version of the same for the SAIs in the region. As such, in the aligned version the ICBF will continue

to provide a good tool for sustainable follow-ups in the AFROSAI-E region.

AFROSAI-E DEVELOPMENT TOOLS

In supporting the development of SAIs in the region, the AFROSAI-E Secretariat produces different

kinds of developmental capacity building tools. The work comprise the development of course

11 AFROSAI-E DEVELOPMENT TOOLS

materials, delivery of workshops and support visits of different types, like quality assurance review

visits or management development program (MDP) rollout and follow-up visits. The Secretariat’s

work also involves the development of different materials like manuals, guidelines and other tools

developed and provided for the region. The following tools and guidance materials were developed

and launched during 2014:

The regularity audit e-learning module;

Exposure Draft of the Performance Audit Manual;

Guidance on Report Writing;

Exposure Draft on Audit of Fraud and Corruption (second draft);

Exposure Draft on Forensic Auditing; and

Guideline on Audit of Environmental Impact Assessment (EIA) Studies.

During the 2014 Governing Board in Addis Ababa, AFROSAI-E in partnership with the Swedish

National Audit Office launched the Executive Leadership Development Programme (ELDP). This

programme’s main goal is to support the establishment of professional, relevant and competent top

executive teams at SAIs in the region to lead their organisations towards full compliance with

international standards for public sector auditing. The recruitment process for the first group to

participate in this programme will commence in 2015. Details of this programme are addressed in

the 2014 AFROSAI-E Integrated Annual Report.

Further, as part of its institutional development support the Secretariat assisted four SAIs to

customize and rollout the Management Development Programme (MDP). In addition, two regional

workshops were delivered to assist those SAIs that were at different levels of rolling out the

programme at the SAI level. To further strengthen and build the pool of regional MDP champions, a

third Facilitation Skills workshop was held. A more detailed presentation of the production can be

found in the AFROSAI-E’s Integrated Annual Report for the year 2014.

The development of SAIs in the region is not only based on resource persons from the member SAIs,

but is also materially dependent on support from institutional partners. AFROSAI-E is working with

experts from its institutional partners together with member SAIs who are willing to support their

counterparts at regional and bilateral events. In view of the need to strengthen this model of

working relationships, AFROSAI-E is organizing resource persons into different networks in order to

enable the building of capacity within the different strategic imperatives

Transversal Activity Report 2014

12

CHAPTER 2

METHODOLOGY

This report has been derived from the 2014 self-assessment survey feedback received from member

SAIs, based on the five ICBF domains. This report provides a broad overview on how the region has

progressed and developed based on the ICB frame work. Suffice to say that the AFROSAI-E corporate

plan came to an end in December 2014, and therefore this report will reveal how the SAIs have

developed on within the five ICBF domains and the six strategic imperatives for this strategic period

under review.

The questions used in the survey are aligned to the ICBF framework, ISSAIs and best practices.

Lessons learnt from previous surveys were also captured and helped shape the questions to be used

in this survey. It must be appreciated that the survey is based on self-assessment and thus could be a

product of perceptions on performance by the individual SAIs. However, to mitigate on this, the ICBF

guide was shared with various SAIs to help them internalize the application in order to come up with

a more objective judgment on their ranking. Further, the validity of the results could also be

compromised by the possibility of different people answering the questions over the years 2010 to

2014. Moreover, the averaging of the questions under each domain and imperative for period under

review may also blur the true development level of the SAI. To mitigate against these weaknesses,

results of the eleven quality assurance support visits by the Secretariat were used to interpret and

develop conclusions under each domain and strategic imperatives.

Response rates

Over the years the numbers of countries responding to the survey have varied. For instance, in the

year 2011, 20 of the then 23 AFROSAI-E members responded to the survey, while in the year 2012 it

was 21, and in 2013 it was 24 out of the 24 members SAIs. In 2014 we had 23 out of 25 members

SAIs responding (See Table 2).

Year Number of SAIs who responded

2006 12

2007 13

2008 17

2009 22

2010 23

2011 20

2012 21

2013 24

2014 23

Table 2: Number of SAIs responding to the survey over the years 2006-2014

13 METHODOLOGY

The 25th member (SAI Sudan) was accepted during the 2014 Governing Board meeting in Addis

Ababa, Ethiopia. A 92% response rate is a positive trend as members have been forthcoming in

providing us with required feedback. As can be seen in the table that, since 2006, the number of

SAIs responding have more than doubled.

Structure of the report

Over the 2010-2014 strategic period, the AFROSAI-E Institutional Capacity Building Framework and

its six strategic imperatives were used as the basis for structuring this report. The data is presented

in two forms, that is, aggregated averages on clustered responses from SAIs and a more detailed

analysis on key issues on the six strategic imperatives. These strategic imperatives are derived from

the five domains in the ICBF framework. Thereafter the report moves into conclusions and

recommendations.

Transversal Activity Report 2014

14

CHAPTER 3

SAIS ASSESSMENT AGAINST THE FIVE DOMAINS IN ICBF

Introduction

The survey as earlier mentioned was based on the five domains and depicts how various SAIs are

performing in the region against the Institutional Capacity Framework. This will be looked at in

terms of regional performance as a whole, and individual SAI performance against each of the

domains. The individual SAI performance is captured in appendix 2.

Averages for the domains within ICBF

The self-assessment on the domains ranges from level 0-5. As can be observed from the results of

the self-assessment, SAIs are doing well towards achieving the target on independence and Legal

framework. Generally speaking, on average over the last five year period there has been a marginal

movement towards the targeted level 3. More work still needs to be done in Organization and

Management, Human Resources, Audit Standards and Methodology and Communication &

Stakeholder Management, as we strive to get the SAIs to level three in those domains.

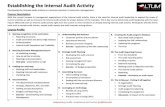

Figure 1: Average self-assessed level for the region - Comparison between domains years 2010, 2011, 2012

2013 and 2014.

It is necessary to depict how SAIs self-evaluation across the five domains and how they compare

with each other. This would help individual SAIs make decisions on benchmarking and other forms of

SAI to SAI engagement as a way of fostering improved performance. This is shown in the figures

below addressing each domain separately.

Independence and legal framework

This domain addresses itself to criteria that include among others: constitutional and legal

framework; financial/managerial/administrative autonomy and appropriate human, financial and

0.00

1.00

2.00

3.00

4.00

5.00

Independence &

Legal Framework

Organization &

Management

Human Resources Audit Standards &

Methodology

Communication &

Stakeholder

Management

DOMAINS

2010 2011 2012 2013 2014

15 SAIS ASSESSMENT AGAINST THE FIVE DOMAINS IN ICBF

material resources; independence of Head of SAI and staff of SAI; SAI has a broadly sufficient

mandate; have mandate and discretion to discharge its function through access to information; have

mandate and discretion to discharge its function through discretion of selection of audit topics;

there is freedom to decide on content, timing of audit reports and to publish and disseminate them;

have mandate to a direct submission of reports to Parliament; effective follow up mechanisms on

recommendations; SAI reporting on its activities and use of resources; Parliament or an oversight

body appoints the SAIs external auditors.

Results on this domain in 2014 among the 25 SAIs are captured in figure2.

Figure 2: SAI Comparisons on Independence and Legal Framework domain (2013 figures were used

Angola and Mozambique)

Under this domain from the above figure it can be seen that the majority of countries have achieved

or about to achieve level 3 in the independence and legal framework domain. More than 60% of the

SAIs have reached the target of level 3 and above. It is also apparent that more than two thirds of

the SAIs are above level 2.5. A more detailed analysis is given under chapter four of this report

Organization and management

Organization and Management is the second domain in the institutional capacity building framework

and covers important issues concerning how the SAI is run and organized. The key aspects of

organization and management are based on organization planning processes and their

implementation, thus integrating both strategic and operational levels of the organization. The

domain covers leadership and direction, strategic planning, annual operational planning,

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Ango

la

Bots

wan

a

Eri

trea

Eth

iopia

Gam

bia

Ghan

a

Kenya

Leso

tho

Lib

eri

a

Mal

awi

Mau

ritius

Moza

mbiq

ue

Nam

ibia

Nig

eri

a

Rw

anda

Seyc

helle

s

Sierr

a Leone

South

Afr

ica

South

Sudan

Sudan

Swaz

iland

Tan

zania

Uga

nda

Zam

bia

Zim

bab

we

Level

2014 SAI Comparison on Independence & Legal Framework

SAI

Transversal Activity Report 2014

16

organization of the SAI, internal control system, use of resources and code of ethics and its

monitoring. The performance for this year under review is presented in figure 3.

Figure 3: SAI comparisons on organization and Management domain (2013 figures were used for

Angola and Mozambique)

The overall picture from this domain shows that only a handful of SAIs have been able to achieve the

established level of 3 with 24% of the SAIs at this level. It is significant to note that about 32% of the

SAIs are below level 2.5.

Human Resources

This domain comprises aspects that include a Human Resource and professional development policy,

development plans, management of personnel, training aspects with monitoring and evaluation

mechanism and capacity to train staff. An overview on how SAIs have performed in this domain in

2014 is presented in figure 4.

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Ango

la

Bots

wan

a

Eri

trea

Eth

iopia

Gam

bia

Ghan

a

Kenya

Leso

tho

Lib

eri

a

Mal

awi

Mau

ritius

Moza

mbiq

ue

Nam

ibia

Nig

eri

a

Rw

anda

Seyc

helle

s

Sierr

a…

South

Afr

ica

South

Sudan

Sudan

Swaz

iland

Tan

zania

Uga

nda

Zam

bia

Zim

bab

we

Level

2014 SAI Comparison on Organisation & Management

SAI

17 SAIS ASSESSMENT AGAINST THE FIVE DOMAINS IN ICBF

Figure 4: SAI comparisons on Human Resources domain (2013 figures were used for Angola and

Mozambique)

It may be observed that Human Resources is still a challenge as majority of the SAIs are below level

2.5, with only 24% being at level 3 and above; and 40% below level 2.5.

Audit standards and methodology

This domain has the following key elements that include: SAIs developed and implemented annual

audit plans, audit manuals that are aligned and compliant with international standards linked to a

training programme and reviewed and updated regularly, quality control measures and quality

assurance, audit techniques such as electronic working papers and Computer Assisted Audit

Techniques (CAATS), implementation of the SAI communication strategy for the audit process with

the auditees, SAI communication with relevant experts, professional bodies, relevant journals,

internal audit and other public sector audit institutions; SAI reporting ensuring of follow up of

previous recommendations, user friendly and standardised structures of reports with materiality

considerations.

In 2014, SAIs in the region performed on this domain as presented in figure 5.

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Ango

la

Bots

wan

a

Eri

trea

Eth

iopia

Gam

bia

Ghan

a

Kenya

Leso

tho

Lib

eri

a

Mal

awi

Mau

ritius

Moza

mbiq

ue

Nam

ibia

Nig

eri

a

Rw

anda

Seyc

helle

s

Sierr

a Leone

South

Afr

ica

South

Sudan

Sudan

Swaz

iland

Tan

zania

Uga

nda

Zam

bia

Zim

bab

we

Level

2014 SAI Comparison on Human Resources

SAI

Transversal Activity Report 2014

18

Figure 5: SAI comparisons on Audit Standards and methodology domain (2013 figures were used

for Angola and Mozambique)

From the figures above it can be observed that SAIs still need to do more within the domain of audit

standards and methodology. For instance only 16% (4 SAIs) of the SAIs are at level 3 and above while

12 (48%) are at level 2.5 and above. However, it should be noted that the region has come a long

way in terms of implementing ISSAIs since 2010 although they still acknowledge that more still

needs to be done especially in the setting up of quality control management systems, monitoring of

the same systems, computirising working papers and use of CAATs in the audit processes.

Communication and stakeholder management

This domain focuses on aspects such as communication policy and strategy covering internal and

external communication, channels of communication between SAI and Parliament, PAC and judiciary

and other stakeholders like Ministry of Finance and other oversight bodies, promotion of the SAI via

engagement with the media, public, academic institutions and international community and

organizations; communication audit performance and results. The performance among the 25 SAIs

on this domain is summarized in figure 6.

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Ango

la

Bots

wan

a

Eri

trea

Eth

iopia

Gam

bia

Ghan

a

Kenya

Leso

tho

Lib

eri

a

Mal

awi

Mau

ritius

Moza

mbiq

ue

Nam

ibia

Nig

eri

a

Rw

anda

Seyc

helle

s

Sierr

a Leone

South

Afr

ica

South

Sudan

Sudan

Swaz

iland

Tan

zania

Uga

nda

Zam

bia

Zim

bab

we

Level

2014 SAI Comparison on Audit Standards & Methodology

SAI

19 SAIS ASSESSMENT AGAINST THE FIVE DOMAINS IN ICBF

Figure 6: SAI comparisons on Communication & Stakeholder Management domain (2013 figures

were used for Angola and Mozambique)

The communication and stakeholder management domain also shows that majority of the SAIs are

yet to get to level 3 in the ICBF framework. Only 4 (16%) of the SAIs are at level 3 and above 13 (

52%) of the SAIs are at level 2.5 and above. There has been marked improvement in this domain as

SAIs are acknowledging the need for setting communication effective systems and structures to

ensure both internal and external seamless communication. However, it must be pointed out that in

this domain several SAIs are still to set up robust communication channels that demonstrate their

value and benefits to their publics.

The differences on how the SAIs have performed will be revealed in details when we address the

individual domains and the strategic imperatives in our subsequent presentations.

Performance on domains from 2010 to 2014

During the strategic period (2010-2014) the target was that SAIs in the region would strive to reach

level 3 of the ICBF framework. The targeted level was that 40% of the SAIs would attain level three

and above during this period under review. Table 3 depicts the trend from 2010 to 2014

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Ango

la

Bots

wan

a

Eri

trea

Eth

iopia

Gam

bia

Ghan

a

Kenya

Leso

tho

Lib

eri

a

Mal

awi

Mau

ritius

Moza

mbiq

ue

Nam

ibia

Nig

eri

a

Rw

anda

Seyc

helle

s

Sierr

a Leone

South

Afr

ica

South

Sudan

Sudan

Swaz

iland

Tan

zania

Uga

nda

Zam

bia

Zim

bab

we

Level

2014 SAI Comparison on Communication & Stakeholder

Management

SAI

Transversal Activity Report 2014

20

Number of SAIs in the region on level 3 and 4 in the years 2010, 2011, 2012,2013 and 2014

2010 Year 2011 Year 2012 Year 2013 Year 2014

Level 3

Level 4

Level 3

Level 4

Level 3

Level 4 Level3 Level 4 Level 3 Level 4

Independence 11 0 11 0 12 0 12 0 15 0

Organization & Management

8 0 11 0 8 0 9 0 6

0

Human Resources

9 0 6 0 7 0 7 0 6

0

Audit Standards & Methodology

6 0 3 1 4 0 6 0 4

0

Communication & Stakeholder Management

6 1 5 0 3 0 4 0

4

0

Table 3: Comparison between the number of SAIs on level 3 and 4 in the years 2010, 2011, 2012, 2013 and 2014 all 25

countries included (2013 figures were used for Angola and Mozambique)

As can be observed from Table 3 above there has been a good number of SAIs that have reached

level 3 and above in the independence and Legal Framework. For instance, 15 (60%) SAIs reporting

that they are at level 3 and above. On the other hand there is no significant difference in the

number of SAIs who report that they are now at level 3 on organization and Management, with the

numbers dropping from 9 (36%) the previous year to 6 ( 24%) in 2014. A similar marginal drop is

noted in Human Resources from 28% in 2013 to 24% in 2014. Moreover, Audit Standards and

Methodology has seen a drop from 24% to 12% for 2013 and 2014 respectively. On

Communications & Stakeholders Management, there was no movement over the last two years.

There are various reasons that explain the movement of the ratings under each of the domains

which will be discussed under the strategic imperatives evaluations in the following chapter.

To enable us get more precise information on the development on the above domains, we shall look

at the performance of strategic imperatives in the next chapter.

21 CHAPTER 4

CHAPTER 4

SAIS ASSESSMENT AGAINST THE STRATEGIC IMPERATIVES

Introduction

Following the AFROSAI-E governing board annual meeting of 2006, the following strategic

imperatives were identified for the corporate plan for 2007 – 2009 and also adopted for the just

ended corporate plan (2010 – 2014):

Independence of the SAI

Human resource practices and management development

Communication and stakeholder management

Quality assurance

Performance auditing

Use of information technology in auditing

These strategic imperatives are key to capacity building in the AFROSAI-E region. Three of these

imperatives, that is, Human Resources, Communication & Stakeholder Management and

Independence are also part of the five domains in the ICBF framework. Other imperatives include

quality assurance, performance audit and use of IT in audit. These last three imperatives are based

on elements mainly but not exclusively within the Audit Standards and Methodology.

A glance at the imperatives over the years starting from 2010 to 2014 shows how the region has

performed over this period as shown in the figure 7 below. This has been made possible by

computing averages on the six imperatives as shown on figure 7.

Figure 7: Comparison between the average numbers of the six strategic imperatives for SAIs participating in surveys in the years 2010, 2011, 2012, 2013 and 2014 (based on 25 countries but note that 2013 figures were used for Angola and Mozambique).

The graph shows marginal increases across all six imperatives over the five years. Despite the slight

increase in the score, it is worth noting that five imperatives comprising Human Resources,

Communication, Quality assurance, Performance audit and use of IT in audit are still below the

regional target of level 3. This possible reasons for this will be explained under each imperative.

0.00

1.00

2.00

3.00

4.00

5.00

Independence Human

Resources

Communication Quality

assurance

Performance

audit

Use of IT in

audit

STRATEGIC IMPERATIVES

2010 2011 2012 2013 2014

Transversal Activity Report 2014

22

Monitoring the strategic imperatives

The table below shows the percentage number of SAIs that had achieved level three in these

targeted six strategic imperatives from 2009 to 2014.

Comparison to the strategic imperatives on level 3 in the corporate plan for 2012-2014 - estimated position for 2009 in percentage on level 3 - the calculated positions for 2009, 2010, 2011, 2012, 2013 and 2014 based on the

surveys on level 3 - targeted position for 2014 in the corporate plan (2010-2014) on level 3

STRATEGIC IMPERATIVES

Estimated position in 2009; % of

23 SAIs

Calculated position in 2009; % of

22 SAIs

Calculated position in 2010; % of

23 SAIs

Calculated position in 2011; % of 20

SAIs

Calculated position in

2012; % of 21 SAIs

Calculated position in 2013; % of

24 SAIs

Calculated position in 2014 % of

25 SAIs

Targeted position in 2014; % of 25

SAIs

Independence of the SAI

20% 63% 48% 45% 50% 50%

56% 40%

Human Resource practices and management development

10% 27% 39% 25% 25% 29%

24% 35%

Communication and stakeholder management

10% 41% 30% 15% 13% 17% 16%

40%

Quality assurance 5% 41% 39% 10% 8% 8.3% 20%

60%

Performance auditing

25% 45% 35% 20% 13% 25% 20%

60%

Use of Information Technology (IT) in auditing

20% 23% 13% 15% 13% 13%

12%

40%

Table 4: Positions on level 3 in percentage for the strategic imperatives in the corporate plan for 2010-2014. Year 2009 is

estimated, years 2010-2014 are calculated based on the activity report survey. Year 2009 was first estimated when the

decision about the strategic imperatives was made, then calculated from the self-assessments gathered for the year.

Year 2014 presents the targeted position (level 3) for the strategic imperatives presented in the corporate plan for 2010-

2014. (The percentages were calculated from the SAIs that responded and figures for Angola and Mozambigue were

estimated based on 2013 data)

During the start of the strategic period in 2009, AFROSAI-E set up specific targets on each of the six

imperatives indicating the percentage number of SAIs that should have achieved level 3 in those

strategic imperatives. As noted from the table above, the targets ranged from 40% to 60 % of the

SAIs. Taking note that December 2014 was the end of the strategic period, when the targets set out

in 2009 were set, it would be helpful to examine how far AFROSAI-E has been able to help SAIs

enhance their capacity in those six imperatives. As observed, 60% of SAIs are at level 3 on

independence of the SAI against a set target of 40%. Human Resources practices and management

development has 24% of the SAIs at level 3 and above against a target of 35% of them. On

Communication and Stakeholder Management, 16% of the SAIs are at level 3 and above against a

target of 60%. This is a drop from 2013, where 17% of the SAIs were at level 3. Quality assurance has

20% at level 3 and above against a target of 60%, a remarkable improvement from 8.3% in 2013.

23

Performance audit has 20% of the SAIs at level 3 and above against a target of 60%, while use of IT in

audit has 12% at level 3 and above against a target of 40%. By and large, apart from the first

imperative of independence, the other strategic imperatives were not on target as per the 2014

targets. Perhaps this could be a pointer to some of the challenges being experienced by SAIs or the

targets set appear to have been overambitious?

A clearer indication on how the SAIs performed on the imperatives in 2014 is shown in figure 8. It

should be noted that despite the exact level 3 and above targets not being met, the majority of SAIs

are at level 2.5 and above across all the imperatives. This is notably on independence (88%), Human

Resources (64%), Communication (52%), Quality Assurance (56%) and performance audit (64%).

However, as can be seen figure 8, use of IT in audit is still a challenge as only 32% of the SAIs are at

level 2.5 and above. .

Figure 8: Comparison between the percentages of the SAIs that have reached level 3 and above and the percentages of

the SAIs that have reached level 2.5 or above (Based on all 25 SAIs in the region except that for Angola and Mozambique

estimated positions were used based on 2013 figures)

Based on the figures of level 2.5 and above it can be concluded that the 2009 targets were to a great

extend achieved. In the next chapter each of the imperative is further interrogated so as to get

more in depth information on what worked well and not worked well within these imperatives

towards the achievement of level 3 and above of the ICBF.

40%

35%

40%

60% 60%

40%

60%

24%

16% 20% 20%

12%

88%

64%

52% 56%

64%

32%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Independence HumanResources

Communication Qualityassurance

Performanceaudit

Use of IT inaudit

Achievements against Targeted Development Level

Target Dev Level

3 and above

2.5 and above

Transversal Activity Report 2014

24

CHAPTER 5

Strategic imperatives related to the five domains in ICBF

Introduction

Our foregoing discussions have dwelt on aggregated numbers for domains and strategic imperatives.

This has some inherent weaknesses as some interesting observations from some questions are not

captured. An examination on how these questions have been answered will help provide a more

balanced view on the SAIs development. The focus of this chapter will be on particular aspects of the

strategic imperatives where SAIs are not performing well, hence affecting the attainment of the

targeted level 3 established level. However, in some instances we shall point out areas where

particular SAIs excelled. Each of the strategic imperatives will be handled separately as indicated in

subsequent presentation in this chapter.

Performance along six strategic imperatives:

Independence of SAIs Details on this imperative were discussed in chapter two following the description of the

independence domain. We acknowledge, however, that Independence is the foundation of SAIs as

declared in the Lima and Mexico declarations (ISSAIs 1&10) and thus it is important to closely

analyse some key independence principles. Figure 9 below captures some key questions under this

imperative.

Figure 9: How SAIs responded in terms of their operationalised independence against key

questions.

0%20%

40%60%

80%100%

The executive does not take part in the preparation of the

SAI's budget appropriation or the final decision on the SAI's

budget

The SAI decides upon all human resource matters

(recruitment, remuneration, promotion etc)

The SAI has an effective follow-up mechanism on SAI

performance audit recommendations as well as those made by

the legislature

The SAI submits an annual report on its own performance to

Parliament and other key stakeholders

The Parliament or another oversight body appoints the SAI's

external auditors

60%

52%

60%

40%

48%

40%

48%

40%

60%

52%

2014 Independence & Legal Framework Detailed Strategic Imperative

Analysis

3 and above

Below 3

25 Strategic imperatives related to the five domains in ICBF

Despite the overall indicators showing that most SAIs are at level 3 in the independence and legal

framework domain the following observations derived from figure 9 are important to consider:

SAIs that indicated that they are at level 3 and above in determining their budgets include,

for example, Ethiopia, Rwanda, Sierra Leone, South Africa, South Sudan, Sudan, Tanzania,

Uganda and Zambia which is only 40% of the SAIs. 60% are below level 3, that is, the SAIs do

not independently determine and decide on their budget. The SAIs indicated that the

executive arm of their governments and not their national assemblies are still in control of

the determination their final budget figures before approval by their National Assemblies.

When it comes to administrative independence it can be observed that 52% of the SAIs are

below level 3 in making decisions on human resources matters such as recruitment,

remuneration and promotion. However, we have 48% of SAIs have sufficient administrative

independence of level 3 and above and these include, for example, Ethiopia, Kenya, Liberia,

Rwanda, Seychelles, Sierra Leone, South Africa, South Sudan, Sudan, Tanzania and Uganda.

Based on findings of quality assurance reviews carried out in 11 SAIs in 2014, it is our

considered view that more still need to be done for the regional SAIs to achieve sufficient

administrative independence.

Another observation is that 60% of the SAIs are below level 3 in ensuring that the SAI has an

effective follow-up mechanism on SAI audit recommendations as well as those made by the

legislature. However, some SAIs indicated that they are at level 3 and above and they

include Ghana, Malawi, Namibia, Rwanda, Sierra Leone, South Africa, Sudan, Tanzania and

Uganda. A robust follow-up mechanism for audit recommendations would ensure that

government is made to account fully for gaps identified during audits.

When it comes to submission of the SAI’s own performance report annually a significant

number of SAIs comprising 40% are at below level 3. In other words we still have a number

of SAIs that are not adequately reporting on their own performance to Parliament and other

key stakeholders by way of publishing their annual performance report. Examples, of those

SAIs that responded that they were at level 3 and above include: Ethiopia, The Gambia,

Ghana, Kenya, Liberia, Malawi, Mauritius, Rwanda, Seychelles, Sierra Leone, South Africa,

Sudan, Tanzania, Uganda and Zambia. However, from this group of SAIs it was not clear how

many of the same SAIs publish the same performance reports.

It is encouraging to note that more than half of the SAIs have Parliament or another

oversight body appointing external auditors to audit their annual financial statements. SAIs

that are at level 3 and above comprise Ethiopia, The Gambia, Ghana, Kenya, Malawi,

Rwanda, Seychelles, Sierra Leone, South Africa, South Sudan, Tanzania, Uganda and

Transversal Activity Report 2014

26

Zimbabwe. But, there is still 48% of SAIs who are auditing their own annual financial

statements.

The above observations reveal that the main challenges facing SAIs is the operationalization of their

independence, mostly financial autonomy and administrative independence.

Human Resources Human Resource is the third domain in the institutional capacity building framework. This domain is

also one of the strategic imperatives for the period ending December 2014. Apart from addressing

human resources issues with the SAI this imperative also covers organization and management as

well as other related elements within the other domains of the ICBF.

The development of the Human Resources Management Handbook was finalized in 2012 and since

then a number of annual HR workshops have been conducted. Since the development of the Human

Resources Handbook and its distribution to SAIs there has been noticeable positive movements

within this domain. In figure 10 we show aggregated development levels of the SAIs under this

imperative.

Figure 10: Level of development in the area of Human Resources for 2013 and 2014

As observed in figure 10, the majority of the SAIs responded that there were above level 2.5 in

mandate, strategic work and training. Monitoring and evaluation and follow up in other words

implementation of the same policies and strategies is still below level 2.5 in several SAIs. However,

SAIs still tend to overrate themselves in responding to questions under this domain. Detailed insight

to what is happening within the individual imperatives has been shown in figure 11, which will be

discussed next.

2.71 2.70

2.32

2.83 2.71 2.75

2.26

2.88

Mandate Strategic work (optimizing

and policies)

Monitoring/evaluation and

follow-up of HR

Training

Human Resources

2013 2014

27 Strategic imperatives related to the five domains in ICBF

Figure 11: Analysis of selected questions under the Human Resources Strategic Imperative for 2014

60% of SAIs are below level 3 in implementing a monitoring and evaluation system of the different

aspects of training and results achieved. SAIs that are at level 3 and above in this area include

Eritrea, Ghana, Malawi, Rwanda, Sierra Leone, South Africa, Sudan, Tanzania and Zimbabwe.

When it comes to the SAIs managing their performance appraisal systems in accordance with

international standards and good practices, 56% of them responded that they were below level 3.

On the other hand, 44% of the of the SAIs responded that they were at level 3 and above and they

include; Kenya, Malawi, Mauritius, Rwanda, Seychelles, Sierra Leone, South Africa, South Sudan,

Tanzania and Zambia. Again there appears that some SAIs were assessing themselves higher than

what an independent quality assurance review would indicate. However, it is encouraging to observe

that SAIs responded that setting up of robust and effective performance management systems was

fundamental for the effective development of their human resources.

When responding to the question of establishing human resource policies including provisions of

remuneration of staff based on performance, a few SAIs responded that there were at level 3 and

above. For example only seven SAIs responded that they had achieved level 3 and above and these

include; Malawi, Namibia, Rwanda, Sierra Leone, South Africa, South Sudan and Tanzania. The

majority of SAI responded that they were at below level 3. This observation has also been noted on

the independence domain that most SAIs had no full control of recruitment and remuneration of

staff in their SAIs. As such it may be logical that 68% of SAIs are below level 3 in implementing a

monitoring and evaluation system of the various aspects of the Human Resource development

policies.

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

The SAI has implemented a Human Resource policy in line with bestpractice including provisions for remuneration of staff based on

performance

The SAI has implemented a monitoring and evaluation system of thedifferent aspects of a Human Resource development policy

The SAI is managing its performance appraisal system in accordancewith international standards and good practice

The SAI has implemented a monitoring and evaluation system of thedifferent aspects of training and results achieved

64%

68%

56%

60%

36%

32%

44%

40%

2014 Detailed Analysis of some selected questions on development of

Human Resources

(Not Implemented) Below 3 (Implemented)3 and above

Transversal Activity Report 2014

28

Further, analysis in terms of the functions that HR is responsible over as to their coordinative and

facilitative roles within the SAI reveals the need for more work to be done to reach the desired

levels. For example, two selected questions provide some insight into what is happening in SAIs.

These are captured in figure 12 with the main focus being in two areas of time recording systems

and organization development strategies.

Figure 12: SAI that have put in place effective time recording systems and organization

development policies

It should be noted that 68% of the SAIs are below level 3 in implementing a time recording system to

enable reporting on cost of staff. SAIs that indicated they are above level 3 and above in this area

include, for example, Eritrea, Mauritius, Namibia, Seychelles, South Africa and South Sudan. Further,

from the general questions SAIs were asked to rate themselves on whether they cost their audits.

From the responses only 32% of the SAIs responded that they were above level 3 in implementing a

time recording system enabling reporting on costs of staff and audits and these include, for instance,

Ghana, Malawi, Rwanda, South Africa, Sudan, Tanzania, Uganda, Zambia and Zimbabwe are at level

3 and above. However, results of the quality assurance support visits in this area showed that most

SAIs still need to set up effective time recording systems that would enable the costing of audits.

Another important point to consider is that 56% of the SAIs responded that they were below level 3

in terms of having implemented an organizational development plan or policies. SAIs that were at

level 3 and above include Ethiopia, Ghana, Kenya, Malawi, Mozambique, Namibia, Sierra Leone,

South Africa, Tanzania and Zimbabwe. However, when compared against the results of quality

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%100%

The SAI has an organizational development(OD) plan/policy in place

The SAI has implemented a time recordingsystem, which enables reporting on costs of

staff

56%

68%

44%

32%

2014:SAIs that have Effective Time Recording Systems and

Organisation Development Policies

(Not fully implemented) Below 3

(Fully implemented) 3 and above

29 Strategic imperatives related to the five domains in ICBF

assurance support visits this assessment seem to be in line with the SAIs’ assessments. Another

important dimension under this domain is the development of managers within member SAIs

Management Development

Management development is one of the important factors that affect the transformation of a SAI’s

capacity to capability. After realizing the leadership and management gaps that was present in SAIs

AFROSAI-E and IDI cooperated in designing and implementing the Management Development

Programme (MDP) in 2009. This programme has become part of the AFROSAI-E capacity building

tools in SAIs. Figure 13 shows the development levels of SAIs in terms of setting up structures and

programmes for the development of their managers.

Figure 13: Developments in the area of Management Development for 2013 and 2014

As can be seen in figure 13 there has been progress in the development of clear mandates,

organizational cultures, programme systems and procedures and audit related management

development. Although the development level of SAIs within the planning dimension is still below

level several 3, SAIs responded that they have set localized MDPs for development of their current

and future managers.

The foregoing developments on human resource and management development could be an

indication that the presence of a Management Development Programme is important to enhance

performance in this strategic imperative. Results from the 2014 survey a show that 52% of SAIs have

some MDP in place whilst 48% still need more assistance in to develop their managers as is shown in

figure 14.

3.23 3.06

2.38 2.64

3.04 3.33

2.96

2.47 2.71

2.92

Mandate Organizational

Culture

Planning Programs/Systems Audit Related

Management

Management Development

2013 2014

Transversal Activity Report 2014

30

Figure 14: Presence of a specific management development programme

As shown in figure 14, 52% of the SAIs are below level 3 in the implementation of a specific

management development programmes in accordance with international standards and good

practice. For instance, SAIs that responded being at level 3 and above comprise Eritrea, Ethiopia,

Malawi, Namibia, Nigeria, Rwanda, South Africa, Tanzania, Uganda, Zambia and Zimbabwe.

However, considering the results of quality assurance support visits in some of the countries

mentioned there were no specific evidence produced during the reviews to prove the existence of

specific management development programmes within some of the countries.

Quality Assurance Quality assurance is one of the strategic imperatives that can be looked upon as an area of strategic

focus within the domain of audit standards and methodology and the other four domains. The fairly

low score (24%) for quality assurance shown in table 4 has been analysed further. As can be seen,

the average score given is only 24% of the SAIs – the same if all 25 SAIs are taken into consideration

– had passed level 3. The score is compiled out of a number of questions. Development levels of the

SAIs on this imperative since 2012 to 2014 is summarized in figure 15.

52%

48%

The SAI has a specific management development program (MDP) in

place in accordance with international standards and good practice

(No) Below 3

(Yes) 3 and above

31 Strategic imperatives related to the five domains in ICBF

These questions cover different parts of quality aspects including quality in IT and questions about

peer reviews. However, the IT issues are part of the strategic imperative of Use of IT in Audit and

have thus been taken into consideration within two of the imperatives. This has pulled down the

result for quality assurance in a noticeable way. Recalculating the numbers by taking out the

questions2 for quality concerning IT will thereby give a higher score on quality assurance, which

better corresponds to the efforts put into this imperative.

In figure 15 there is a notable improvement on the number of SAIs on level three and above on

quality assurance levels in 2014, with 24% of the SAIs on level 3 and above. This can be explained by

the significant drop on the number of SAIs on level 2.5 and above with 56% of the SAIs on this level

down from 67% in 2013.

From the questionnaire the questions on quality and mainly on quality control and not on quality

assurance have been extracted. In figures 16 and 17 the scores on quality control measures in place

for regularity audit and performance audit can be seen.

The result shows that 58% of the SAIs have implemented quality control measures for regularity

audit and 46% of the SAIs for performance audit. The number is an average from four key questions

on quality control for both regularity audit and performance audit.

2 The questions for the quality assurance imperative and the changes are attached in appendix 3

25%

63%

17%

67%

24%

56%

0%

10%

20%

30%

40%

50%

60%

70%

Percentage of SAIs on level 3 and

above

Percentage of SAIs on level 2.5 and

above

Quality assurance levels based on assorted questions

2012

2013

2014

Figure 15: Quality Assurance Level calculated on a subset of the original quality assurance questions in the self-assessment questionnaire. The percentage is based on the number of SAIs, taken all 25 into consideration, that have reached level 3 and higher or respectively level 2.5 or higher[note that estimates were used for Angola and Mozambique based on 2013 figures].

Transversal Activity Report 2014

32

In order to improve the quality of the actual audits well-developed quality control systems need to

be in place. Part of such systems require the development and implementation of robust quality

control measures for the SAIs to be able to continuously follow up on the improvements, identify

possible gaps, strengths and weaknesses and design strategies that address the gaps and

weaknesses.

Eleven quality assurance reviews visits were made by the AFROSAI-E secretariat during 2014.

Comparing the rating for 10 key issues – as another subset of questions in the self-assessment

questionnaire3 – with the rating in the quality assurance reviews, the tendency to rate oneself higher

than an external reviewer would is seen. However, it must also be said that the majority of the

ratings are on the same level for the self-assessment and the external reviews. Table 5 shows a

comparison between the ratings done by the eleven SAIs and results of quality assurance support

visits reports by AFROSAI-E.

SELF ASSESSED LEVELS OF 11 SAIS COMPARED WITH THE RESULTS OF QA REPORTS 2014

Table 5: A number of 11 SAIs in the region were subject to quality assurance visits by AFROSAI-E during 2014. The table

shows the difference between the maturity level in accordance to the quality assurance report on the one hand and the

SAIs own self assessed rating in the self-assessment questionnaire for 2014.

The result in table 5 shows that the insight and understanding of the actual development stage in

the SAIs on a general level corresponds well to what is interpreted from an external perspective,

thus providing an opportunity for a better prerequisite for further development. This result is also in

line with the aforementioned interpretation of the stabilization for the scoring on the aggregated

general level for the domains and strategic imperatives; though one needs to note that there are still

some few SAIs that tend to overrate themselves.

3 The questions compared with the quality assurance visits are attached in appendix 4

Comparison between the SAIs self assessed level on a number of relevant questions in the questionnaire and the SAI’s level according to the QA reports for year 2014

QUESTION 1 2 3 4 5 6 7 8 9 10 Total %

Self assessed level is higher than in QA report

5 4 3 1 1 3 1 1 2 3 24 23%

Self assessed level is equal to QA report

5 6 7 9 8 7 9 8 8 8 75 75%

Self assessed level is lower than in QA report

0 0 0 0 1 0 0 1 0 0 2 2%

33 Strategic imperatives related to the five domains in ICBF

Looking at quality assurance from the perspective of regularity audit from 2012 to 2014, the results

over the years are shown in figure 16.

Figure 16: Quality assurance from the perspective of regularity audit