Transforming America’s Power Industry: The Investment ... · Copper Wire Nonferrous Wire GDP...

Transcript of Transforming America’s Power Industry: The Investment ... · Copper Wire Nonferrous Wire GDP...

© 2008 The Brattle Group

Transforming America’s Power Industry:

The Investment ChallengePreliminary Findings

Peter S. Fox-PennerMarc W. ChupkaRobert L. EarleThe Brattle Group

Edison Foundation ConferenceKeeping the Lights On: Our National Challenge

April 21, 2008

1Transforming America’s Power Industry © 2008 The Brattle Group

Contents

• The Investment Challenge: Overview

• Drivers of Utility Cost Increases

• Investment Scenarios

• Generation Investment in Carbon Scenarios

• Investment Impacts of Enhanced Energy Efficiency

• Transmission and Distribution

2Transforming America’s Power Industry © 2008 The Brattle Group

Power Industry Transformation

America’s electric utilities are facing the greatestchallenge in their history:

• Fuel costs remain at record-setting levels• Plant construction costs have soared in the past several years• Combating global climate change requires

► “decarbonization” of supply► enhanced energy efficiency

• New technologies require a larger, “smarter” grid

3Transforming America’s Power Industry © 2008 The Brattle Group

The American Power Industry: 20th vs. 21st Century

• Economies of scale create ever-cheaper power

• Traditional fuels and sources

• Primarily supply-focused

• Passive “one-way” grid

• Cost of key materials and fuels increasing costs for all parts of the industry

• Cleaner supply technologies and greatly reduced carbon emissions

• Energy efficiency and demand response critical for customer value, reliability, and environment

• Transformation to “Smart”Power Grid

4Transforming America’s Power Industry © 2008 The Brattle Group

The New Capital Investment Challenge – New Generation

• Even with substantial energy efficiency measures, new and replacement plant through 2030 is at least 150,000 MW at an approximate cost of $560 billion. Much of this will be new renewable power

• Global climate policies will increase overall cost of electricity supply, affect the mix of new capacity built and add to the capital cost of new capacity.

• More aggressive efficiency improvements and price effects can significantly reduce demand and new generating capacity builds – but overall capital needs may not decline in the same proportion

5Transforming America’s Power Industry © 2008 The Brattle Group

The Investment Challenge – Transmission and Distribution

• Transmission and distribution together require nearly twice the investment in generation -- $900 billion by 2030

• Grid must be expanded to connect renewable and distributed sources

• “Smart Grid” technologies enable greater efficiency improvements, better service, and small-scale resources

• Plug-in hybrid vehicles create a large new grid use

6Transforming America’s Power Industry © 2008 The Brattle Group

Drivers of Utility Cost Increases

7Transforming America’s Power Industry © 2008 The Brattle Group

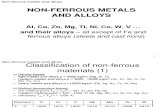

Commodity Prices Continue to Rise

Steel Mill Products Price Index

80

90

100

110

120

130

140

150

160

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Year

Inde

x (1

997=

100)

Steel Mill Products

GDP Deflator

Aluminum and Copper Price Indexes

50

100

150

200

250

300

350

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Year

Inde

x (1

997=

100)

Copper

Aluminum

GDP Deflator

Electric Wire and Cable Price Index

80

100

120

140

160

180

200

220

240

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Year

Inde

x (1

997=

100)

Copper Wire

Nonferrous Wire

GDP Deflator

Electric Wire and Cable

Cement and Crushed Stone Price Indexes

90

100

110

120

130

140

150

160

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Year

Inde

x (1

997=

100)

Cement

GDP Deflator

Crushed Stone

8Transforming America’s Power Industry © 2008 The Brattle Group

Utility Construction Costs Also Rising

National Average Utility Infrastructure Cost Indices

90

100

110

120

130

140

150

160

170

180

190

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Year

Inde

x (1

991=

100)

Total Plant-All Steam Generation Gas Turbogenerators GDP Deflator Transmission Distribution

Source: The Handy-Whitman© Bulletin, No. 165 and the Bureau of Economic Analysis.Simple average of all regional construction and equipment cost indexes for the specified components.

NOTE: These indices reflect actual costs trends – proposed future projects show even higher cost escalation

9Transforming America’s Power Industry © 2008 The Brattle Group

EIA Price Projections Rising Over Time

Comparison of AEO U.S. End-Use Price Forecasts

0

1

2

3

4

5

6

7

8

9

10

11

2005 2010 2015 2020 2025 2030

Ave

rage

Ann

ual P

rice

(200

6 C

ents

/kW

h)

AEO 2006AEO 2007AEO 2008 (Final)

EIA electricity price projections up about 15-20% since 2006, mostly due to higher fuel cost.

EIA projections reflect only “current policy” i.e., no climate policy included

10Transforming America’s Power Industry © 2008 The Brattle Group

EIA Sales Forecasts Falling

Comparison of AEO U.S. Annual Sales Forecasts

3,000

3,500

4,000

4,500

5,000

5,500

6,000

2005 2010 2015 2020 2025 2030

Ann

ual S

ales

(TW

h)

AEO 2006AEO 2007AEO 2008 (Preliminary)AEO 2008 (Final)

1.6% Annual Growth

1.5% Annual Growth

1.3% Annual Growth1.1% Annual Growth

Difference between AEO 2008 Preliminary and AEO 2008 Final is the estimated impact of Energy Act of 2007

11Transforming America’s Power Industry © 2008 The Brattle Group

Renewable Standards Ratcheting Up

NOTE: The renewable standards rise rapidly over the next decade.

Renewable generation capacity will have to be built to meet these standards regardless of load growth or regional reserve margins.

12Transforming America’s Power Industry © 2008 The Brattle Group

Investment Scenarios

13Transforming America’s Power Industry © 2008 The Brattle Group

An Illustrative Carbon Policy Scenario

Two simplified carbon policy scenarios presented:

• No change from present U.S. carbon policies (EIA assumption)• Replace all new conventional coal builds with Advanced Coal

Technology (ACT) w/carbon capture & storage (CCS)

Our illustrative “Replace with ACT” carbon scenario estimates new plant investment impacts only – it is not an integrated climate policy analysis that account for all costs

• Only consider “first-order” impact on new capacity cost• Demand response and fuel price substitution effects are not

reflected in these estimates

14Transforming America’s Power Industry © 2008 The Brattle Group

Impacts of Two Enhanced Energy Efficiency Cases Considered (Based on EPRI/EEI Study)

Realistic Achievable Potential (RAP):• Most likely impact of expanded energy efficiency

programs► Forecast of moderate customer changes and penetration

rates of existing efficient technologies► Accounts for existing market, financial, political &

regulatory barriers – but not full price effects

Maximum Achievable Potential (MAP):• Higher-end of potential impact of cost-effective

energy efficiency programs► Accounts for customer preferences and budget constraints► An aggressive but feasible customer participation rate

15Transforming America’s Power Industry © 2008 The Brattle Group

Generation Impacts Analyzed Using Brattle’sRECAP Model

• The Brattle Regional Capacity (RECAP) model was used to project capacity additions and costs

• RECAP model results calibrate closely to the EIA Annual Energy Outlook (AEO) capacity additions when using AEO assumptions (fuel prices, demand growth, no carbon policies)

► We assume higher construction costs than EIA, implying higher future customer rates

► We also assume state-level Renewable Portfolio Standards (RPS) are met, also adding rate pressure

► Full price feedbacks are not yet included, overstating sales growth

16Transforming America’s Power Industry © 2008 The Brattle Group

Generation Investments by Carbon Scenario

17Transforming America’s Power Industry © 2008 The Brattle Group

Assumed Impact of Carbon Policy on Capacity Mix

New Capacity Mix by Carbon Scenario (2010 - 2030)

0

50

100

150

200

250

"No Carbon Policy" Scenario

"Replace w/ACT-CCS" Scenario

GW

RenewableNuclearCTCCCoalACT-CS

224 GW

18Transforming America’s Power Industry © 2008 The Brattle Group

Capital Investment 2010-2030 is $190 Billion Higher in the ACT-CCS Scenario

Cumulative Capital Investment by Scenario (Billions of Nominal $)

0

100

200

300

400

500

600

700

800

2010 2015 2020 2025 2030

Bill

ions

of N

omin

al D

olla

rs

"Replace w/ACT-CCS" Scenario

"No Carbon Policy" Scenario

$559 Bn

$751 Bn

19Transforming America’s Power Industry © 2008 The Brattle Group

Electricity CO2 Emissions Reduced by 25% in 2030 Under Assumed ACT-CCS Carbon Policy

NOTE: the CO2 policy modeled only affects new plant construction, limiting overall CO2reductions compared to an economy-wide emission cap policy.

Forecast of Annual CO2 Emissions by Scenario

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2010 2015 2020 2025 2030Year

Mill

ions

of T

ons

of C

O2

"No Carbon Policy" Scenario

"Replace w/ACT-CCS" Scenario

25%Reduction

20Transforming America’s Power Industry © 2008 The Brattle Group

Investment Impact of Enhanced Energy Efficiency Measures

Energy Efficiency measures in the power industry take many forms, including enhanced codes & standards, utility-sponsored investments at customer sites, and “demand response” programs that enable customers to respond to short-run price signals, enabled by advanced metering infrastructure (AMI) –sometimes called the “smart grid.” Collectively, these programs are sometimes called “Demand-Side Management” (DSM).

21Transforming America’s Power Industry © 2008 The Brattle Group

Enhanced Efficiency Reduces Capacity Built by at Least 17-33%

Illustration of Enhanced Efficiency Impacts Based on "No Carbon Policy" Build Scenario (2010 - 2030)

0

50

100

150

200

250

Reference Demand Growth

Case

RAP Efficiency Scenario

MAP Efficiency Scenario

GW

RenewableNuclearCTCCCoal

224 GW

188 GW

151 GW-17%

-33%

Because No- Carbon Policy is

used as a reference build scenario, most

additions are coal in this analysis

22Transforming America’s Power Industry © 2008 The Brattle Group

Enhanced Energy Efficiency Reduces Capital Investment to Meet Demand by 5% to 18% in 2030

Summary of Avoided Capital Investment Due to EnhancedEfficiency Illustrated Using "No Carbon Policy" Scenario

0

100

200

300

400

500

600

700

"No Carbon Policy"Scenario

RAP Efficiency Scenario

MAP Efficiency Scenario

Bill

ions

of D

olla

rs (N

omin

al)

AMI Investment

$19 BGeneration Investment

$512 B

AMI Investment

$27 BGeneration Investment

$430 B

Total Investment $559 B

Total Investment $531 B

(5% Reduction)

Total Investment $457 B

(18% Reduction)

23Transforming America’s Power Industry © 2008 The Brattle Group

Capital Savings and Energy Efficiency Policies

• The percentage reduction in generation capital costs ($) is smaller than the reduction in new capacity builds (MW) in the enhanced energy efficiency scenarios:

► Mostly peaking capacity avoided (e.g., gas CTs), which have lower $/kW installation cost than coal or nuclear.

► In RAP Scenario, new coal capacity decreases by 8% while peakingcapacity decreases by 54%

► In MAP Scenario, new coal capacity decreases by 30% while peaking capacity decreases by 68%

► Mandated renewable investments largely unaffected, which are also more expensive than peaking units on a $/kW installed basis.

► These impacts are a function of the assumed mix of enhanced energy efficiency measures that focus on demand response. Greater emphasis on overall energy saving measures would slow the rate of baseload plant additions but also increase energy efficiency investments

• Investment in AMI also offsets some of the capital savings in generating capacity

► In RAP Scenario, AMI investment is 42% of avoided capacity cost► In MAP Scenario, AMI investment is 21% of avoided capacity cost

• Other efficiency investments may also be capitalized by the industry –these would add still more to the industry’s capital needs.

24Transforming America’s Power Industry © 2008 The Brattle Group

Transmission and Distribution

25Transforming America’s Power Industry © 2008 The Brattle Group

Transmission & Distribution Forecasts

The T&D forecasts 2010 – 2030 reflect only recent cost and expenditure trends

• Not a formal investment analysis of future needs

• Near term transmission capital forecasts & data:► NERC ES&D data on transmission project miles proposed to

2015 (by region, voltage classes ≥ 230 kV)► EEI member survey data on actual spending and planned

expenditures ($) through 2010► Project costs ($/mile, $/MW-mile) from actual & proposed

• Historic distribution capital expenditures from EEI member survey data are only source for distribution

26Transforming America’s Power Industry © 2008 The Brattle Group

Transmission Investments Could Reach $233 Billion 2010 - 2030

PROJECTED COST OF NEW TRANSMISSION (2010-2030)

0

50

100

150

200

250

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

Nom

inal

Bill

ion

$'s

Projects ≥ 230 kV Derived from NERC ES&D Data and Current Costs

Other Transmission Investments Projected

from EEI Data

27Transforming America’s Power Industry © 2008 The Brattle Group

Distribution Investments Could Reach $675 Billion 2010 – 2030

Cumulative Forecasted Distribution Costs (2010-2030)

0

100

200

300

400

500

600

700

800

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

Year

Nom

inal

Bill

ion

$'s

28Transforming America’s Power Industry © 2008 The Brattle Group

Overall Study Results

Investment on the order of $1.5 trillion will be required over the 2010 – 2030 period

• Distribution - $675 billion• Transmission - $233 billion• Generation - $560 billion, with no changes in carbon policy

While enhanced energy efficiency measures will reduce sales growth and generating capacity needs substantially, overall capital requirements are less affected:

• Reduced peak demand tends to displace less expensive generation capacity

• Costs of energy efficiency measures add back significant cost

29Transforming America’s Power Industry © 2008 The Brattle Group

Overall Study Results

Climate initiatives will add to new generation capital needs, in our illustrative carbon policy case:

• Use of Advanced Coal Technology with Carbon Capture and Storage could add about $200 billion in capital cost

• As applied to new capacity builds only, this hypothetical policywould reduce CO2 from electric utilities by about 25% in 2030