Transfer Price Case Study 2

-

Upload

professor-sameer-kulkarni -

Category

Documents

-

view

1.835 -

download

1

description

Transcript of Transfer Price Case Study 2

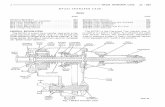

1. Division A of L Company manufacturers Product X, which is sold to Division B as a component of Product Y. Product Y, is sold to Division C, which uses it as a component in Product Z. Product Z is sold to customers outside the company. The intra company pricing rule is that products are transferred between divisions at standard cost plus a 10% return on Inventories and fixed costs. From the information provide below, calculate the transfer price for product X and Y and the standard cost of Product Z. Standard cost per unit Product-X Product-Y Product-Z Materials purchased outside Rs.2 Rs.3 Rs.1 Direct Labour 1 1 2 Variable Overhead 1 1 2 Fixed overhead/unit 3 4 1 Standard Volume 10,000 10,000 10,000 Inventories (Average) Rs.70,000 Rs.15,000 Rs.30,000 Fixed Assets (net) Rs.30,000 Rs.45,000 Rs.16,000 2. Assume the same facts as stated in (1), except that the transfer price rule is as follows; Goods are transferred among divisions at the standard variable cost per unit transferred plus a monthly charge. This charge is equal to the fixed costs assigned to the product plus a 10% return on the average inventories and fixed assets assignable to the product. Calculate the transfer price for product X and Y and calculate the unit standard costs for product Y and Z. 3. The present selling price of product Z is Rs.28. Listed below is a series of possible price reductions by competition and probable impact of these reductions on the volume of sales if Division C does not reduce its price offering. Possible Competitive Price Rs.27 Rs.26 Rs.25 Rs.23 Rs.22 Sales Volume if price of Product Z is maintained at Rs.28

9000 7000 5000 2000 0

Sales Volume if price of product Z is reduced to competitive levels

10,000 10,000 10,000 10,000 10,000

Required: (a) With transfer prices calculated in (1), is Division C better advised to maintain its price at Rs.28 or to

follow competition in each of the instances above? (b) With the transfer prices calculated in (2), Division C better advised to maintain its price at Rs.28 or

to follow competition in each of the instances above? (c) Which decisions are to the best economic interests of the company, other things being equal? (d) Using the transfer prices calculated in (1), is manager of Division C making a decision contrary to

the overall interests of the company? If so, What is the opportunity loss to the company in each of the competitive pricing options discussed above.

Division C is interested in increasing the Sales of Product Z. A survey is made and sales increases resulting from increases in television advertisement are estimated. The results of this survey are provided below. (Note that this particular type of advertising can be purchased only in units of Rs.1, 00,000) Advertising Expenditure

Rs.100,000 Rs.200,000 Rs.300,000 Rs.400,000 Rs.500,000

Additional volume resulting from additional advertising

10,000 19,000 27,000 34,000 40,000

Required: (A) As manager of Division C, how much television advertising would you use if you purchased product

Y at the transfer price calculated in (1). (B) How much Television advt. would you use if you purchased Product Y at the transfer price,

calculated in (2) (C) Which is correct from the overall company point? (D) How much would the company lose in suboptimum profits from using the first transfer price?

----xxxx----

Top S

ecret

PDF created with pdfFactory Pro trial version www.pdffactory.com