Transamerica CI Portfolio Review Conservative Portfolio ... › orderform › pdf ›...

Transcript of Transamerica CI Portfolio Review Conservative Portfolio ... › orderform › pdf ›...

Portfolio Review Second Quarter 2015

Transamerica CI Conservative Portfolio

Portfolio Review – Second Quarter 2015 as at June 30, 2015Transamerica CI Conservative Portfolio

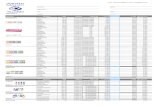

Portfolio Performance

Transamerica CI Portfolios are available as Guaranteed Investment Portfolios within select Transamerica segregated funds contracts and as Managed Portfolio Index Interest Options within select Transamerica Universal Life Products.

Segregated Fund Net Returns below are for the Transamerica Guaranteed Investment Funds (TGIF) product. Please refer to www.transamerica.ca for the returns on other products.

3 Month 6 Months 1 Year 3 Years 5 Years Since Inception Inception Date†

-2.4% 3.1% 5.8% 8.4% 6.9% 6.2% October 2009

Past results should not be construed as indicative of future performance. Actual fund performance is expected to vary.†On September 21, 2012, the Transamerica TOP GIPs began investing in a new portfolio managed by CI Investments. The Transamerica TOP GIPs are now referred to as Transamerica CI GIPs.

Asset Allocation Overview and Activity

Different types of investments will respond differently to the markets, reinforcing the importance of a multi-level diversification strategy. A balanced asset mix ensures that investors are not dependent on any one asset class or security type to provide returns.

This report is designed to provide you with an up-to-date portfolio overview of the Transamerica CI Conservative Portfolio, including the allocations across asset class, geographic region, equity sector and market capitalization. The arrows indicate whether the allocation for each category has increased or decreased since the previous quarter-end.

— — —

30,4 %11,7 %11,5 %9,8 %9,5 %9,2 %7,4 %4,0 %3,4 %3,0 %0,1 %

— — — — — — — — — — —

Actions par secteur

30.4%11.7%11.5%9.8%9.5%9.2%7.4%4.0%3.4%3.0%0.1%

— — — — — — — — — — —

84,4 %13,1 %

2,6 %

Capitalisation boursière

84.4%13.1%

2.6%

— — —

43,9 %27,2 %13,8 %

4,4 %3,2 %2,6 %1,6 %1,5 %1,1 %0,9 %

— — — — — — — — — —

Régions géographiques

43.9%27.2%13.8%

4.4%3.2%2.6%1.6%1.5%1.1%0.9%

— — — — — — — — — —

35,4 %21,5 %16,1 %

8,5 %7,1 %6,7 %3,0 %0,9 %0,8 %

— — — — — — — — —

Catégories d’actif

35.4%21.5%16.1%

8.5%7.1%6.7%3.0%0.9%0.8%

— — — — — — — — —

Equity Market Cap

Asset Class

Equity Industry Sector

Geographic Regions

▼ Canadian bond▲ Foreign bond▼ U.S. equity▲ Canadian equity■ Cash▼ European equity■ Asian equity▲ Emerging markets equity■ Other equity

▼ Large-cap▲ Mid-cap▲ Small-cap

▲ Financial services▼ Industrials▲ Consumer discretionary▼ Information technology▼ Energy▲ Health care▲ Consumer staples▼ Materials▼ Utilities▼ Telecommunication services▲ Other

▼ Canada▲ U.S.▲ Cash and other countries▲ Japan▲ U.K.▼ France■ Switzerland▲ Emerging markets■ Australia■ Germany

Portfolio Review – Second Quarter 2015 as at June 30, 2015Transamerica CI Conservative Portfolio

Underlying Fund Allocations

Aegon Capital Management Canadian Bond Pool 31.2%

Signature Global Bond Fund 17.0%

Cambridge Income Corporate Class 6.6%

Signature Diversified Yield II Fund 5.8%

Signature High Income Fund 5.7%

CI American Value Corporate Class 5.5%

Synergy Canadian Corporate Class 4.1%

Signature Select Canadian Corporate Class 3.8%

CI International Value Corporate Class 3.2%

Cambridge Global Equity Corporate Class 3.1%

Signature International Corporate Class 3.0%

Harbour Corporate Class 2.6%

CI Canadian Investment Corporate Class 2.6%

Synergy American Corporate Class 2.5%

Cambridge American Equity Corporate Class 2.5%

Cash 0.8%

Top Ten Holdings

Gov't of Canada 3.5% 01Dec45 2.2%

U.S. Treasury Note 1.75% 15Feb22 1.1%

U.S. Treasury Note 3.125% 15May21 1.0%

Aimia Inc. 5.6% 17May19 1.0%

Enercare Solutions 4.6% 03Feb20 0.9%

Gov't of Japan 1.5% 20Jun34 0.9%

Wells Fargo 3.874% 21May25 0.8%

CIBC 9.976% FRN 30Jun08 0.8%

Gov't of France 3.25% 25May45 0.8%

Home Trust 3.4% 10Dec18 0.7%

Portfolio Review – Second Quarter 2015 as at June 30, 2015

Portfolio Commentary

The portfolio declined 2.4% during the quarter, underperforming its benchmark (20% S&P/TSX Composite Index, 60% FTSE TMX Canada Universe Bond Index, 20% MSCI World Index, C$), which fell 1.5%. Exposure to high-yield bonds and cash added relative value, but this did not fully offset underperformance of the dividend-paying equities and global bonds. In the portfolio’s equity component, holdings in all global regions detracted from relative returns.

Overall, bond markets sold off during the quarter on improving economic data while stock markets took a breather despite the positive news. While enhanced diversification relative to the broad-based indexes reduced portfolio volatility as intended, it did not make strong contributions to the portfolio’s returns. We have been holding higher than normal cash levels, which helped to dampen volatility and mitigate declines. Despite recent short-term volatility, it is important to preserve a longer-term view. We continue to take advantage of the opportunities market corrections typically create and maintain our discipline of allocating assets to both preserve capital and grow investor account balances in a prudent manner.

Bond yields in Europe rose from record lows, elevating yields elsewhere, as the European Central Bank’s monetary policy began to support expectations for economic growth and higher inflation. Stock markets in North America and Europe declined, while stocks in Japan gained. Japanese equities were boosted by the Bank of Japan’s quantitative easing program and stock purchases by quasi-government organizations. In Canada, shares of commodities producers slid with base metals prices amid worries that demand will weaken in China, the largest user of industrial metals. Although crude oil prices recovered somewhat after last year’s sharp decline, their reduced level continued to have a negative impact on energy producers.

In the portfolio’s income portion, Signature High Income Fund added relative value, benefiting from its exposure to high-yield corporate bonds. Signature Global Bond Fund’s exposure to foreign-denominated government bonds detracted from relative performance, as yields rose during the quarter.

The government debt market in Canada continues to offer very low yields across all maturities, including longer-term issues. Meanwhile, interest rate risk, as measured by duration, has increased in recent years. It will be challenging to earn a return in excess of inflation during the next three to five years. We favour securities that offer more attractive returns than those offered

by government bonds, including foreign-denominated issues, short-duration investment-grade bonds and high-yield corporate bonds and high-quality dividend-paying equities.

Having a diversified and flexible framework allows us to take advantage of changes in market valuations and provide steady income returns. We continue to adjust our bond weightings to manage downside risk and volatility. Our portfolio is positioned with less interest rate sensitivity and enhanced diversification relative to the benchmark.

In the equity portion, Signature Select Canadian Corporate Class detracted from relative value due in part to its health care and consumer discretionary holdings.

The sector allocation of the portfolio is more diversified than that of the Canadian economy and the S&P/TSX Composite Index. We continued to have underweight exposure to the resource sectors, and overweight positions in information technology and the consumer sectors. From a regional perspective, we continued to have an overweight position in the United States, an underweight allocation to Canada and a neutral position in international equities. The U.S. market is supported by a diverse economy, with large exposure to global markets and strong representation in all major industrial sectors, making it an attractive asset class on a risk-adjusted basis.

Alfred Lam, CFA, Senior Vice-President and Portfolio ManagerYoonjai Shin, CFA, Vice-President and Associate Portfolio ManagerMarchello Holditch, CFA, Senior AnalystLewis Harkes, CFA, Senior AnalystAndrew Ashworth, AnalystDesta Tadesse, Analyst

Transamerica CI Conservative Portfolio

18

Portfolio Management Teams

Aegon Capital Management (ACM) oversees more than $10 billion in traditional, institutional and asset liability matching investments. ACM is backed by the strength of Aegon N.V., a Netherlands-based insurance and financial services company that manages more than US$300 billion in assets. ACM’s focus is to provide exceptional income and capital preservation solutions for our clients.

Altrinsic Global Advisors, LLC follows a fundamental value approach in which the team seeks out high-quality undervalued companies worldwide. Founded by John Hock and associates, Altrinsic is based in Greenwich, Connecticut.

Cambridge Global Asset Management is led by Co-Chief Investment Officers Alan Radlo and Brandon Snow and Chief Market Strategist Robert Swanson. They invest in companies building long-term economic value. Cambridge Global Asset Management is a division of CI Investments and has offices in Boston and Toronto.

CI Investment Consulting is the portfolio management team responsible for over $25 billion of assets in CI’s managed solutions and oversight of all CI funds. Led by Portfolio Manager Alfred Lam, the team’s mandate is centred on asset allocation, manager oversight and selection, and risk management.

Epoch Investment Partners, Inc. is a New York-based investment management firm founded by Wall Street veteran William Priest and associates. Epoch uses a value-based approach that focuses on companies with superior shareholder yield.

Harbour Advisors, a division of CI Investments, is led by Portfolio Managers Stephen Jenkins and Roger Mortimer. Harbour’s approach entails buying high-quality businesses at a sensible price, and following a patient, long-term outlook.

Marret Asset Management Inc. focuses on fixed-income investing and alternative strategies on behalf of institutional, high net worth and retail clients. The firm is led by Chief Investment Officer Barry Allan.

Signature Global Asset Management is among the largest portfolio management teams in Canada, managing a full range of global and Canadian income, equity and balanced mandates. Chief Investment Officer Eric Bushell was named Morningstar’s Fund Manager of the Decade in 2010.

Picton Mahoney Asset Management is led by David Picton and Michael Mahoney and uses quantitative analysis as the foundation of its approach.

Tetrem Capital Management, led by Chief Investment Officer Daniel Bubis, is based in Winnipeg and has an office in Boston. Tetrem uses a disciplined approach to invest in undervalued Canadian and U.S. companies.

Transamerica CI Portfolios

Strength and experience

The Transmerica CI Portfolios are managed by CI Investments Inc. on behalf of Transamerica Life Canada.

Transamerica Life Canada is a leading life insurance company in Canada. Through a number of distribution channels, resulting in a national network of thousands of independent advisors, Transamerica provides a full spectrum of individual life insurance and protection products, designed to help Canadians take responsibility for their financial future. Transamerica Life Canada is an Aegon company.

Aegon Capital Management (ACM) oversees more than $10 billion in traditional, institutional and asset liability matching investments. ACM is backed by the strength of Aegon N.V., a Netherlands-based insurance and financial services company that manages more than US$300 billion in assets. ACM’s focus is to provide exceptional income and capital preservation solutions for its clients.

CI Investments has been managing money for over four decades and today is one of Canada’s largest investment fund companies. CI manages approximately $108 billion on behalf of two million Canadian investors. CI provides one of the industry’s widest selection of investment funds and leading portfolio managers on a variety of platforms, including mutual and segregated funds, managed solutions and alternative investments.

CI is a subsidiary of CI Financial Corp. (TSX: CIX), an independent, Canadian-owned wealth management firm with approximately $140 billion in assets as at June 30, 2015.

1506-1001_E (07/15)

2 Queen Street East, Twentieth Floor, Toronto, Ontario M5C 3G7 I www.ci.comCalgary403-205-43961-800-776-9027

Head Office / Toronto416-364-1145 1-800-268-9374

Montreal 514-875-00901-800-268-1602

Vancouver 604-681-33461-800-665-6994

Client Services English: 1-800-563-5181French: 1-800-668-3528

All commentaries are published by CI Investments Inc., CI Investments Inc. is the Manager of all the funds described herein, other than Aegon Capital Management Canadian Bond Pool which is managed by Aegon Capital Management. The commentaries are provided as a general source of information and should not be considered personal investment advice or an offer or solicitation to buy or sell securities. Every effort has been made to ensure that the material contained in the commentaries is accurate at the time of publication. However, CI Investments Inc. cannot guarantee their accuracy or completeness and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

This report may contain forward-looking statements about the funds, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments.

SUBJECT TO ANY APPLICABLE DEATH AND MATURITY GUARANTEE, ANY PART OF THE PREMIUM OR OTHER AMOUNT THAT IS ALLOCATED TO A SEGREGATED FUND IS INVESTED AT THE RISK OF THE CONTRACT HOLDERS AND MAY INCREASE OR DECREASE IN VALUE ACCORDING TO FLUCTUATIONS IN THE MARKET VALUE OF THE ASSETS OF THE SEGREGATED FUND. If you wish to obtain a copy of the simplified prospectus and/or financial statements of any of the underlying funds, please contact the appropriate mutual fund company. Transamerica Life Canada is the issuer and guarantor of the Transamerica CI Guaranteed Investment Portfolio contract.

®CI Investments, the CI Investments design, Synergy Mutual Funds, Harbour Advisors, Harbour Funds, Cambridge and American Managers are registered trademarks of CI Investments Inc. ™Signature Funds and Signature Global Asset Management are trademarks of CI Investments Inc. Cambridge Global Asset Management is a business name of CI Investments Inc. used in connection with its subsidiary, CI Global Investments Inc. Certain portfolio managers of Cambridge Global Asset Management are registered with CI Investments Inc.

®Aegon and the Aegon logo are registered trademarks of Aegon N.V. Transamerica Life Canada and its affiliated companies are licensed to use such marks.

®Transamerica and the pyramid design are registered trademarks of Transamerica Corporation. Transamerica Life Canada is licensed to use such marks. Published July 2015.

For more information on Transamerica CI Portfolios, please contact your advisor or visit www.transamericaciportfolios.com.