Trailblazer Camp 2007 Welcome! Trailblazer Camp 2007.

-

date post

21-Dec-2015 -

Category

Documents

-

view

233 -

download

0

Transcript of Trailblazer Camp 2007 Welcome! Trailblazer Camp 2007.

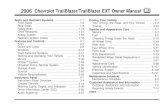

What does college cost?

Based on estimated expenses at Louisiana State University – Baton Rouge for a dependent student living on campus who graduates from high school in 2008 assuming a 4% annual increase

Academic Year

Tuition & Fees

Room & Board

Books & Supplies

Trans-portation

Personal Expense

Total

2008-2009 $4,898 $9,587 $1,040 $992 $1,697 $18,214

2009-2010 $5,094 $9,970 $1,082 $1,032 $1,765 $18,943

2010-2011 $5,298 $10,369 $1,125 $1,073 $1,836 $19,701

2011-2012 $5,510 $10,784 $1,170 $1,116 $1,909 $20,489

Total $20,800 $40,710 $4,417 $4,213 $7,207 $77,347

Tra

ilbla

zer

Cam

p

20

07

How are you going to pay for it? A TOPS Scholarship pays tuition and

certain fees at a Louisiana public institution TOPS does not cover:

Technology Fees Academic Excellence Fees Energy Surcharges Mandatory fees imposed after January 1, 1998 Room & Board Books & Supplies Transportation or Personal Expenses

Tra

ilbla

zer

Cam

p

20

07

Basis of Aid Merit-Based aid is based on a student’s

academic achievement, grades, ACT/SAT scores, talent, ability, athletic achievement, etc

Need-based aid is based on the student’s

financial need

Tra

ilbla

zer

Cam

p

20

07

Financial Need

COST OF ATTENDANCE

- EXPECTED FAMILY CONTRIBUTION

FINANCIAL NEED

Tra

ilbla

zer

Cam

p

20

07

Financial Need Cost of Attendance (COA)

Tuition and fees Room and board Books and supplies Transportation Miscellaneous personal expenses

Expected Family Contribution (EFC) Income Assets (excluding the family home) Family size Number of family members attending college

(excluding parents) Age of parents

Tra

ilbla

zer

Cam

p

20

07

Types of Financial Aid Scholarships

Gift Aid – Based on Merit

Grants Gift Aid – Based on Need

Employment Opportunities

Loans Must be repaid – may be based on need

Tra

ilbla

zer

Cam

p

20

07

Rockefeller State Wildlife Scholarship Open to students majoring in Forestry,

Wildlife or Marine Science

Awarded competitively

Maximum Annual Award: $1,000 Total Maximum Award: $7,000

5 years undergraduate study 2 years graduate study

Must attain a degree in one of the eligible fields or repay funds

Tra

ilbla

zer

Cam

p

20

07

Rockefeller Eligibility Requirements Be a U.S. Citizen, national, or eligible non-

citizen, and be registered with selective service if required

Be a Louisiana Resident for at least one year prior to July 1 of the scholarship award year

Must complete the Rockefeller State Wildlife Scholarship application and the FAFSA by July 1 preceding the award year

Be enrolled full-time in one of the designated programs at a Louisiana public institution

Tra

ilbla

zer

Cam

p

20

07

Rockefeller Eligibility Requirements If you have earned fewer than 24 hours by the

June preceding the award year, you must have: 2.50 cumulative high school GPA and have a 20 on

the ACT (or equivalent SAT score); or must have completed the 12th grade level of a BESE

Approved Home Study program, have a 22 on the ACT (or an equivalent SAT score), and if a high school was previously attended, provide certification that you were in good standing at the time you last attended

If you have earned 24 or more hours of college credit you must have a minimum 2.50 cumulative college GPA

Graduate students must have a minimum 3.00 cumulative GPA on all credits earned in graduate school

Tra

ilbla

zer

Cam

p

20

07

Rockefeller Continuation Requirements

Maintain continuous full-time enrollment unless granted an exception by LOSFA

Achieve a cumulative college GPA of at least 2.50 at the end of each academic year as an undergraduate student; or at least a 3.00 as a graduate student

Earn at least 24 hours for the academic year

Have received the award for not more than 7 academic years (5 undergraduate and 2 graduate)

Continue to pursue a course of study in a qualified major

Sign a promissory note each term prior to receiving funds

Tra

ilbla

zer

Cam

p

20

07

Institutional Aid Each institution has its own merit-based

scholarship programs

Many schools have their own need-based aid programs

Investigate aid opportunities early Each institution has its own aid application

process and deadline

Upperclassmen should also check with their department for aid opportunities for students in a specific major

Tra

ilbla

zer

Cam

p

20

07

Private Aid The best source of information on private

aid is the Internet. There are numerous free scholarship search services available See LOSFA website Useful Internet Links

page or Surfing the Web for a listing

Private aid can be based on merit or financial need

Providers of private aid include companies, civic organizations, religious organizations, clubs, etc.

Tra

ilbla

zer

Cam

p

20

07

Federal Pell Grant General Information

Gift aid Portable - can receive at any eligible

institution Maximum Award: $4,050

Eligibility Criteria Undergraduates without a bachelor’s degree

or first professional degree Must demonstrate financial need

Tra

ilbla

zer

Cam

p

20

07

Campus-Based Federal Aid Programs FSEOG

LEAP

Academic Competitiveness Grant

National SMART Grant

Federal Work Study

Perkins Loans

Stafford Loans

Tra

ilbla

zer

Cam

p

20

07

Federal Supplemental Educational Opportunity Grant (FSEOG) General Information:

Gift aid Maximum award $4,000

Eligibility Criteria: Undergraduates without bachelor’s or first

professional degree Must demonstrate exceptional financial need

Tra

ilbla

zer

Cam

p

20

07

Leveraging Educational Assistance Partnership (LEAP) LEAP uses federal and state funds to

provide need-based grants to academically qualified students

Maximum Award: $4,000

Recipients determined by the institution’s financial aid office

Tra

ilbla

zer

Cam

p

20

07

LEAP Eligibility Requirements Be a U.S. citizen or eligible non-citizen Be a Louisiana resident Be enrolled as a full-time undergraduate

student Apply by completing the FAFSA Demonstrate substantial financial need Must have one of the following:

2.00 cumulative high school GPA 45 on the GED 20 on the ACT 2.00 cumulative college GPA

Schools may establish additional criteria

Tra

ilbla

zer

Cam

p

20

07

Academic Competitiveness Grant General Eligibility Requirements

U.S. Citizen Pell Grant eligible Full-time student

Tra

ilbla

zer

Cam

p

20

07

Academic Competitiveness Grant First Year Students

Must have completed a rigorous high school program of study Achieve a specified score on 2 Advanced

Placement or International Baccalaureate Courses Complete a State Scholars Initiative Program

Louisiana Academic Diploma Endorsement Complete a set of course requirements similar to

the State Scholars requirements TOPS Core Curriculum

Complete one of 19 Advanced or Honors programs Maximum Award Amount: $750

Second Year Students Must have a 3.0 cumulative college GPA Maximum Award Amount: $1,300

Tra

ilbla

zer

Cam

p

20

07

National SMART Grant National Science and Mathematics

Access to Retain Talent Grant

Available for third and fourth year students

Maximum Award Amount: $4,000

Tra

ilbla

zer

Cam

p

20

07

National SMART Grant Eligibility Requirements

U.S. Citizen Pell Grant eligible Full-time student Must be enrolled in a four-year institution Must major in mathematics, science (including

physical, life and computer sciences), technology, engineering, or a critical foreign language

Must have a 3.0 cumulative college GPA

Tra

ilbla

zer

Cam

p

20

07

Federal Work Study General Information:

Wages must be not less than current minimum wage

Eligibility Criteria: Undergraduate, graduate or professional

students, including less-than-half-time students

Must demonstrate financial need

Tra

ilbla

zer

Cam

p

20

07

Federal Perkins Loan General Information:

5% interest rate Annual Loan limits -

$4,000 for undergraduates; $6,000 for graduate or professional students

Repayment begins 9 months after leaving school

10 year repayment period

Eligibility Criteria: Undergraduate, graduate, and professional

students Must demonstrate financial need Must be willing to repay the loan

Tra

ilbla

zer

Cam

p

20

07

Federal Family Education Loan Program (FFELP) Largest source of long-term, low-interest

loans for undergraduate, graduate, and professional students, and parents of dependent students

Subsidized Stafford Loan Unsubsidized Stafford Loan Parental Loans for Undergraduate

Students (PLUS) Consolidation Loans

Tra

ilbla

zer

Cam

p

20

07

Why Should Your Loan be Louisiana Guaranteed? LOSFA uses revenues derived from the

student loan program to offset the cost of state aid programs such as the popular but expensive TOPS program and outreach programs such as Trailblazers

Income earned from the administration of Louisiana Guaranteed loans stays in Louisiana and is reinvested to the benefit of Louisiana students, parents and educators

Tra

ilbla

zer

Cam

p

20

07

Why Should Your Loan be Louisiana Guaranteed? The State of Louisiana will pay the 1%

Default Fee for borrowers whose lender does not pay the fee

Revenues from loans guaranteed by out-of-state guarantors leave the state forever

Last year LOSFA representatives made personal contact with more than 68,000 Louisiana citizens by participating in high school, college, and parish-wide educational outreach activities

Tra

ilbla

zer

Cam

p

20

07

Why Should Your Loan be Louisiana Guaranteed? Our local service representatives are

familiar with the special needs of Louisiana students

Information about your loan is just a toll-free call or e-mail message away at (800) 259-5626 Ext. 1012, (225) 922-1012 or [email protected]

Tell your Financial Aid Officer that you want a Louisiana Guaranteed loan!