Trade Winds - Volume II Issue III

-

Upload

gangadhar-biradar -

Category

Documents

-

view

226 -

download

0

Transcript of Trade Winds - Volume II Issue III

-

8/3/2019 Trade Winds - Volume II Issue III

1/10

1

China opens world's longest sea bridgeChina has opened the world's longest sea crossing. Theeight-lane, 35-metre-wide structure cost 1.4bn. 26-mileJiaozhou Bay crossing connects Qingdao to Huangdao,took four years to build and uses 5,000 pillars. China,which seems to complete mammoth infrastructure

projects on a routine basis, has claimed anotherworld-beater with the opening of the longest sea bridge.

China is constructingan even moreambitious bridge.

Work began inDecember 2009 on aY-shaped structurelinking Guangdong

province in southernChina to Hong Kong and Macau. Building is expected to

be finished in 2015, and the bridge is expected to coverabout 31 miles, although only about 22 miles will spanthe sea.

Goldman, Clive Capital to launch

commodities indexGoldman Sachs is to launch a commodities index withClive Capital, the world's largest commodity hedge fund.The index will aim to minimize the risk of large losses bychanging its exposure to individual commodities overtime. Goldman has started marketing the index to its

News SnippetsContents

News Snippets 1

Edible Oil Industry in

South India 5

Macroeconomic factors

& Gold Price volatility 7

Anti-Dumping in the In-

dian Context 9

Chief Editor

Oojwal Manglik

Editorial Team

Ankush Mehta

Abhijith Vasudevan

Shiv Kumar Gupta

IIFTs Monthly Newsletter on

National & International Trade

July 2011 Volume II, Issue III

mailto:mailto:[email protected]?subject=Reg:%20Trade%20Wind%20magazinemailto:mailto:[email protected]?subject=Reg:%20Trade%20Wind%20magazinemailto:mailto:[email protected]?subject=Reg:%20Vyapar%20Magazinemailto:mailto:[email protected]?subject=Reg:%20Vyapar%20Magazinemailto:mailto:[email protected]?subject=Reg:%20Vyapar%20Magazinemailto:mailto:[email protected]?subject=Reg:%20Trade%20Wind%20magazine -

8/3/2019 Trade Winds - Volume II Issue III

2/10

2

clients. It will track 19 raw materialsincluding crude oil, gold, wheat, sugarand live cattle, using the components ofthe Dow Jones-UBS benchmark as itsstarting point. London-based CliveCapital will decide each month howmuch of each commodity the indexshould hold.

June exports rise 46.4% to

$29.2bnIndias exports in June rose an annual

46.4% to $29.2 billion, while imports forthe month rose 42.4% to $36.9 billion .Trade deficit in June stood at $7.7 billion.The countrys exports grew a record

37.6% in the 2010-11 fiscal year thatended in March, as demand soared forengineering goods, oil products and gemsmanufactured in Asias third-largesteconomy.

MSP for Kharif Crops Hiked

by 8-19%The government has increased theminimum support prices for the kharifseason by 8% to 19% to incentivize

farmers and compensate for higher inputcosts, but the higher purchase pricescould stoke the already high foodinflation.

The Committee on Economic Affairs(CCEA) raised the MSP of paddy by Rs

80 per quintal and those of pulses by Rs200-Rs 400 per quintal.

"The overall strategy of the governmentwas that since there is more thansufficient stock of food grain, there is noneed for a big jump in support prices,

said Ashok Gulati, chairman,Commission for Agricultural Costs &Prices (CACP).

The MSP for oilseeds was increasedsharply to incentivize cultivation toreduce dependence on imports amidsigns that global food prices will remainhigh through to 2012. According to a

recent FAO recent report, prices foredible oil are likely to be high in theglobal market all of 2012 due toincreased pressure on availability againstdemand.

Palm oil prices have gone up by 20%over one year globally. India is among

-

8/3/2019 Trade Winds - Volume II Issue III

3/10

3

the world's biggest importers of palm andsoybean oil. In line with the goals ofreducing import dependence fortraditional pulses over time and enthused

by record production over the last twoyears the government also decided tomaintain the momentum and announceddecent increase.

The support prices for Arhar and Moong

have been fixed at a level higher by 100per quintal than that recommended by theCACP. In addition, similar to last year anadditional incentive at the rate of Rs 500

per quintal for tur, urad and moong soldto government procurement agenciesduring the harvest/arrival period of twomonths shall also be given.

Iron ore exports likely to fall

20 MTIndian iron ore exports for the currentfinancial year may drop by a fifth to 75million tonnes (MT), the Federation ofIndian Mineral Industries (FIMI) said.

This is attributed to the delay in lifting ofexport ban by Karnataka. Also the Indianiron ore is turning uncompetitive in theoverseas market due to increased exportduty and freight rates, thereby losingmarket share in countries such as China.Curbs on exports by Orissa andKarnataka during different periods lastyear had resulted in a 19-per cent declineat 95 MT in 2010-11 from 117 MT in

previous year.Karnataka is among the top three iron ore

producers and accounts for about a thirdof India's exports. The State, as part of itsstrategy to curb illegal mining, hadimposed a ban on exports in July lastyear.

DEPB Scheme Extended for 3

Months Till SeptThe government has extended the

popular exports scheme - DEPB for threemore months till September. The schemewas due to end on June 30. we have

extended Duty Entitlement Pass Book(DEPB) till September, Finance

Secretary Sunil Mitra said. However, hesaid that the scheme will be phased outand replaced by duty drawback Thegovernment spends annually about 8,000CR reimbursing exporters on the taxes

paid on import content of export products. Under the scheme, exportersare given refunds of tax incidence on theimport content of their export products.

-

8/3/2019 Trade Winds - Volume II Issue III

4/10

4

World Bank in push for foodprice hedgingThe World Bank is taking the rare step ofencouraging companies in developingcountries to buy insurance in thederivatives markets against suddenchanges in food prices with a deal thatshould allow them to hedge $4bn worthof commodities.

The deal, struck with investment bankJPMorgan, comes as countries such asChina and India weather a second surgein agricultural commodities pricesfollowing the 2007-08 food crisis. Butthe initiative, timed to coincide with thefirst G20 meeting of agriculturalministers, could prove controversial as

lawmakers in countries from the US toFrance try to clamp down on what theydescribe as excessive speculation incommodities derivatives.

Decline in coffee productionIndia's coffee production may decline byabout 10 per cent in 2011-12 season

beginning October due to sporadic rains

early this year, industry experts havesaid. According to the latest CoffeeBoard data, production of the brew in the2010-11 period is estimated at 2.99 lakhtones.

China to encourage coalimports

China will encourage coal imports and

urge miners to boost output to increase

supplies to power plants, China's

economic planning agency said on

Wednesday, as the world's largest energy

consumer tackles its worst power

shortages in seven years.

Miners at Australia's BHP BillitonMitsubishi Alliance (BMA), the world's

biggest exporter of metallurgical coal,voted in favor of the right to takeindustrial action but gave no indicationthat they were preparing to strike. Astoppage would hit BHP Billiton just asAustralia's coal mining sector, which

supplies nearly two-thirds of the world'straded steel-making coal and more than10 percent of the country's goods exports,was getting back on its feet after heavysummer rains hobbled operations at doz-ens of collieries.

-

8/3/2019 Trade Winds - Volume II Issue III

5/10

5

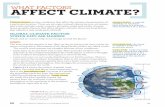

Edible Oil Industry in SouthIndia

Shiv Kumar GuptaMBA(IB), 2nd year, IIFT Delhi

The edible oil industry in south India isessentially a palmolein in and sunfloweroil market. Majority of the oil refiningunits are located along the coastline. Thenumber of refining units is more on theeastern side of the coastline as comparedto the western side. The reason for this isthe fact that India being an oil deficitcountry, majority of the palm crude palmoil is imported from Malaysia andIndonesia. India consumes over 4.5million tons Palm Oil and other Palm OilProducts per annum, while domestic

production of Crude Palm Oil in India ishardly 60,000 tons per annum and rising

very slowly. The crude palm oil is takento the refineries where it is refined,

bleached and deodorized (RBD) in therefineries. Efforts are being made to growoil palm in Andhra Pradesh, Karnataka,Tamil Nadu in addition to Kerala andAndaman & Nicobar Islands. The major

refinery locations are as shown in thefigure.

Companies like Cargill, Adani Wilmar,Ruchi Soya, Gemini, Bunge and a largenumber of local companies have theirrefineries in south India. With effect from1st April, 2008, the customs duty oncrude and refined forms of Palm Oil,Palmolein, Palm Kernel Oil, SoybeanOil, Rapeseed/Mustard Oil, SunflowerOil, Safflower Oil, Groundnut Oil,Coconut Oil and some other VegetableOils has been reduced to zero percent and7.5% respectively. Therefore thesecompanies have taken advantages of this

policy and have accordingly set up theirrefineries. These companies expect the

-

8/3/2019 Trade Winds - Volume II Issue III

6/10

6

customs duty to remain zero since Indiais an oil deficit country and its demandhas been on a constant rise. The mainreasons for the rise in demand aregrowing population and the rise in the percapita consumption. The changinglifestyle has also contributed significantlyto an increase in demand. The monthly

consumption of Palmolein and sunfloweroil in southern states is as shown in thefigure above

From the chart we see that the monthlyconsumption of palm oil is higher in allthe states except Tamil Nadu. The gap

between the consumption of Palmoleinand sunflower oil is going to widen and

Palmolein consumption in Tamil Naduwill overtake sunflower oil consumptionin the coming years. The reason for this

being the fact that Palmolein is relativelycheaper than sunflower oil.

Also 100% Foreign Direct Investment isallowed in the India vegetable oils

industry. Many multinational companieslike Cargill, Wilmar, Archer DanielsMidland (ADM) and Louis Dreyfus haveentered this business to meet the everincreasing oil demand. These MNCs arecollaborating with the local refineries andmaking use of their existing supply chainto reduce their costs. Using the supplychain of the parent company allows theMNCs to understand the market better

and retain the existing customers. Insome cases, the company is still sellingunder the brand name of its parentcompany due to the brands popularity

among the locals. There are certainadvantages of big multinationalsentering the industry. Due to the entranceof MNCs the adulteration levels havecome down significantly and also the

industry is consolidating with smallercompanies being sold out. The edible oilindustry which is very cluttered andunorganized is coming up as anorganized sector with better workingstandards.

-

8/3/2019 Trade Winds - Volume II Issue III

7/10

7

Macroeconomic factors &Gold Price volatility

Oojwal ManglikMBA(IB), 2nd year, IIFT Delhi

Volatility in the price of Gold over thepast one month has been a lesson in theindirect impact of macroeconomic cueson the price of this commodity. Since 21June, Gold has fluctuated between $1483/ounce (a 60 day low) & $1579/ounce (alifetime high). This fluctuation has

primarily been caused due todevelopments in the European SovereignDebt crisis & economic weakness in theUS. A brief overview of thesedevelopments follows.

Background of Macroeconomic

eventsThe sovereign debt crisis in Europe arosedue to fears that major EU economies,such as Portugal, Ireland, Greece & Spain(P.I.G.S), would default on the debts theyhad undertaken to finance their fiscaldeficit during the 2000s. These

economies were weak because of highdebt (a resultant of excessive borrowingat low interest rates), property price

bubbles & the severe impact of the2007-09 global recession on majorindustries such as tourism & shipping. Inits aftermath, IMF bailed out Greece &Portugal through loans 188 billion @

5% though recent developments raise

serious questions as to the effectivenessof this package.

Impact of Macroeconomic factors

on Gold PricesGold is presently in the longest bull rallyin its history & is generally consideredone of the safest investments in times ofmacroeconomic turbulence. Investors

move their assets to Gold in order tosafeguard against currency bear rallies.As a result, Gold normally moves against

price changes in the greenback. Thebelow chart depicts the movement in the price of Gold since 22 June along withthe associated macroeconomic event

1. On June 22nd, the government ofGreece passed a vote of confidence forP r i m e M i n i s t e r G e o r g ePapandreous reshuffled government.Though it was a signal that the

-

8/3/2019 Trade Winds - Volume II Issue III

8/10

8

sovereign default was not imminent,adverse news from other P.I.G.Snations dulled sentiments. The Dollaron the other hand strengthened as aresult of better than expected numbersof consumer durable sales .Consequently in the trading sessions,the Dollar gained strength vis-a-vis theEuro & Gold fell 2%.

2. On June 30th, Greek lawmakers passed

austerity measures including taxincreases & spending cuts in order tomeet requirements for the IMF funded

bailout. As fears of a debt defaultsubsided, investor interest in the safehaven commodity eroded & Gold fell1.5%

3. On July 4th, the IMF released a 8.7 billion loan to Greece. This, coupled

with speculation of a rise in Europeaninterest rates by the ECB gave strengthto the Euro vis-a-vis the Dollar. As aresult of this, Gold rose for the firsttime in 8 trading sessions & climbed1%

4. On July 6th, Moody's gave the marketsa painful reminder yesterday that thedebt crisis in the peripheral Euro zone

countries is far from over when itlowered Portugal's credit rating to JunkCategory. Investors abandoned riskyassets for Gold & Gold rose 1.14%

Outlook for the coming daysIn addition to the sovereign debt crisis,developments in raising the US public

debt ceiling will provide the majormacroeconomic cues till August.The US public debt ceiling is the limit towhich the Congress can borrow on thecredit of the United States. Public debt isa principal source for the US governmentto raise money in order to finance itsspending on social security programs,war efforts, salaries of civil servants, etc.This ceiling currently stands at $14.29

trillion & was reached in May. In order tocontinue financing the government,Congress (comprising of Republicans &Democrats) needs to pass a resolution

before August 2nd. Though both partiesagree on the need to control the US debt

but differ in their views on how. A failureto address this issue may force the US todefault raising serious questions on the

status of the Dollar as the worlds reservecurrency.Moody put Americas credit rating on

negative watch on 14th July threateningthe US economys prized AAA rating

which it has held since 1917. If the ratingdoes downgrade, it would technically bar

banks from using US debt as collateralwith central banks putting severe

pressure on the entire financial system.Though such an outcome may notmaterialize, the uncertainty is likely toaffect investor risk appetite, weaken theDollar & drive Gold prices up further.

-

8/3/2019 Trade Winds - Volume II Issue III

9/10

9

Anti-Dumping in the IndianContext

Jayant RanaMBA(IB), 2nd year, IIFT Kolkata

Protectionism is considered a bad word

in trade by many economists, and theyhave their reasons for it. In contrast, freetrade, where government barriers to tradeand movement of capital are kept to aminimum, is thought and said to promoteequal access to domestic resources fordomestic participants and foreign

participants alike. But, like with othergood things, theres something bad

associated with free trade as well.Dumping is one such flipside of freetrade.

Dumping is an unfair trade practicewhich can have a distortive effect oninternational trade. It is said to occurwhen a product is introduced into thecommerce of another country at less thanits normal value, which means that if acompany exports a product at a pricelower than the price it normally charges

on its own home market, it is said to bedumping the product. Now, this can be

very harmful to the domestic industry ofthe importing country, even though theWorld Trade Organization keeps advocat-ing free trade in a big way.

The primary purpose of Anti-dumping is

to rectify the trade distortive effect ofdumping and re-establish fair trade.Anti-dumping action generally involveslevying extra import duty on thedumped product in order to bring its

price closer to the normal value or to

remove the injury to domestic industry inthe importing country.

To proceed with Anti-dumping, it is

imperative to establish that that thedumping has caused injury to thedomestic industry. Hence, a detailedinvestigation needs to be first conductedaccording to specified rules. No duty can

be recommended without theestablishment of this causal relationship.

Anti-dumping measures assume special

significance in the Indian context as Indiais currently in the process of phasing outits quantitative restrictions regime asregards to imports. Taking advantage ofthe removal of licensing restrictions onimports, several trading partners of Indiahave tried to dump different kinds oftheir goods into India, thereby creating asituation of unfair competition in the

domestic market. Anti-dumping isimportant for dealing with such ascenario of unfair trade, and for

providing the much needed relief to thedomestic industry from the injury caused

by dumping.

Anti-dumping is not a protectionist

-

8/3/2019 Trade Winds - Volume II Issue III

10/10

10

measure per se, but is only a remedy forremoval of injury to the domesticindustry. The object behind thesemeasures is to re-establish faircompetition and to provide the domesticindustry a level playing field.

The WTO allows the national authoritiesto impose duties up to the margin ofdumping i.e. the difference between the

normal value and the export price. TheIndian law too provides that theanti-dumping duty to be levied shall notexceed the dumping margin. In India, theanti-dumping investigations areconducted under the national law as perthe Customs Tariff Amendment Act,

1975, as amended in 1995, which is inconsonance with the provisions of WTO.

These measures are country neutral andtheres no question of discrimination

against any particular trade partner.

To sum up, anti-dumping and the likemeasures are essentially linked to thenotion of fair trade. The aim is to guardagainst the situation arising out of unfairtrade practices. With the removal of

quantitative restrictions, India has movedtowards the regime of free trade, but atthe same time, anti-dumping measureshave also assumed greater significance,in the interest of fair trade.

About IIFTIndian Institute of Foreign Trade (IIFT)

is Indias nodal institution of excellence in

the field of International Trade and

Business. Since its inception in 1963, IIFT

has kept pace with the extremely dynamic

Global business environment by

focusing on International Trade and

Logistics-related issues. The rigorous,extremely dynamic and up-to-date course

curriculum stands testimony to this fact.

Supplementing the classroom, IIFT

organizes several events and discussions on

currently relevant issues in the field of

Trade and Logistics, which are graced

by pre-eminent professionals, industry

veterans and academicians, alike.

Our students have maintained andsustained IIFTs rich legacy by

successfully exhibiting their skills time and

again in various Live Projects and

Competitions. The institution has groomed

international business managers for over

40 years and boasts alumni base spread over

geographies and business verticals