Tp Invst RFID Real OptionApproach

-

Upload

nixon-patel -

Category

Documents

-

view

217 -

download

0

Transcript of Tp Invst RFID Real OptionApproach

-

7/27/2019 Tp Invst RFID Real OptionApproach

1/14

Investments in RFID: A Real Options ApproachMilind Patil

A Patni White Paper

-

7/27/2019 Tp Invst RFID Real OptionApproach

2/14

COPYRIGHT Copyright Patni Computer Systems Ltd. All Rights Reserved.December 2004

Restricted RightsThis document may not, in whole or in part, be copied photocopied, reproduced, translated, or reduced to any electronic medium or machine readable form without prior consent, in writing, fromPatni Computer Systems Ltd.

Information in this document is subject to change without notice and does not represent acommitment on the part of Patni. This document is provided "as is" without warranty of any kindincluding without limitation, any warranty of merchantability or fitness for a particular purpose.Further, Patni does not warrant, guarantee, or make any representations regarding the use, or theresults of the use, of the written material in terms of correctness, accuracy, reliability, or otherwise.

All other brand and product names are trademarks of their respective companies.

Patni Computer Systems Limited India

Akruti, MIDC Cross Road No.21 Andheri (E), Mumbai 400 093Tel: +91 22 5693 0205Fax: +91 22 5693 0211

North America

238 Main StreetCambridge MA 02142Tel: +1 617-354-7424Fax: +1 617-876-4711

UK & Europe

Vistacentre, 50 Salisbury RoadHounslow, Middlesex, UK. TW4 6JQTel: +44 20 8538 0120Fax: +44 20 8538 0276

Japan

4th floor, Aoyagi Building, Chuo 5-39-11,Nakano-ku, Tokyo 164-0011Tel: +81 3 53281952Fax: +81 3 53281951

-

7/27/2019 Tp Invst RFID Real OptionApproach

3/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 1

Table of Contents

Overview..................................................................................................................................................................2 Introduction ...................... ................... ...................... ...................... ...................... .................. ....................... ..........2 What is Real Options Theory?..................................................................................................................................2 Strategic Nature of RFID Investment ..................... ........................ .................. ...................... ...................... .............3 Why Real Options Theory? ................... .................... ...................... ................... ......................... .................. ...........5 Common Real Options and Scenarios with RFID Investment ................ ...................... .................. ....................... ....5

An illustrative Example ................. ..................... ................... ..................... ...................... .................. .......................6 Conclusion ................. ..................... ................... ..................... ...................... .................. ....................... ..................8

Appendix A ...................... ................... ...................... ...................... ...................... .................. ....................... ..........9 Appendix B ...................... ................... ...................... ...................... ...................... .................. ........................ .......10 Appendix C ...................... ................... ...................... ...................... ...................... .................. ........................ .......11 About the Author .................. ...................... .................. ...................... ..................... ................... ........................ ....12 About Patni ...................... ................... ...................... ...................... ...................... .................. ........................ .......12

-

7/27/2019 Tp Invst RFID Real OptionApproach

4/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 2

OVERVIEW Net Present Value (NPV) and Return on Investment (ROI) are commonly used to evaluateinvestment in initiatives like new technology or any reengineering project. But sometimes measuringthe value of investment in technology becomes very difficult due to its wide scope of application

coupled with embedded options in its adoption. Projected cash flows seem meager in comparison tothe investment required, or the discount rate chosen to compensate for the risk is so high that itrenders the NPV unpalatable. RFID being a disruptive technology 1 i.e. it cannot match theperformance that customers expect from product and services in the short term, Real Options

Analysis should be a better way to evaluate its adoption in the Supply Chain.

INTRODUCTION This paper reviews the financial and business logic behind investing in RFID. Managers the worldover are facing increasing uncertainty while taking complex strategic decisions, having an enduringimpact on organization profitability and sustained growth. Usually, this type of uncertainty erodesreal value when such decisions are evaluated using conventional techniques, such as NPV or ROI,since larger discounting rates are applied to riskier projects. We argue that the dominant form of financial analysis, Discounted Cash Flow (DCF) and Net Present Value (NPV) calculations, are toolimited a basis on which to make RFID investment decisions because they undervalue returns andfocus management attention on short term cash flow when, perhaps, the biggest benefits lie inbuilding a strategic asset.

The cash-flow calculations significantly undervalue RFID since it fails to account for all the effects of better customer centric strategies, such as, learning and innovation, reduced risk and improvementsin shareholder value. Finance scholars also suggest real options may be a better means of valuingstrategic management investments (Copeland and Keenan, 1998; Luehrman, 1998) 2. Tounderstand these customer-related and business-related benefits more comprehensively, this paper demonstrates how a real options approach builds a stronger business case for RFID investmentsand focuses managerial attention on the areas of RFID that would perhaps offer the firm greater value than cash flow alone.

WHAT IS REAL OPTIONS THEORY ? An option represents freedom of choice, after the revelation of information. An option is the act of choosing, the power of choice, or the freedom of alternatives. An option is a right but not anobligation. In financial markets, it is the freedom of choice after revelation of additional informationthat increases or decreases the value of the asset on which the option owner holds the option. Areal option is an option relating to things, as opposed to illusory things. Strategic investment andbudget decisions within any organization are decisions to acquire, exercise, abandon or let expirereal options. Following table shows the analogy between financial options and real options.

1 Humberto Moran (2002), "Real Options for strategy development in the introduction of technologyfor business and process innovation: New applications for the Automatic Identification technologyin the Healthcare Industry. Dissertation Project, Judge Institute of Management University of Cambridge.

2 Copeland, T. and Keenan, D. (1998), How much is f lexibility worth? The McKinsey Quarterly,No. 2, pp. 38-49.

-

7/27/2019 Tp Invst RFID Real OptionApproach

5/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 3

Table 1: Analogy Between Financial and Real Option

Financial Options Real Options

Call Option Option to InvestStock Price Present Value of ProjectExercise Price Present Value of InvestmentTime to Expiration Time to ExpirationRisk Free Rate Risk Free RateVolatility of Stock Price Volatility of Project ValueDividends Project Cash Flow

S TRATEGIC N ATURE OF RFID INVESTMENT Investment in RFID is of strategic nature since it is clearly linked to business strategy in the followingway:

By Process Innovation (positioning of the firm), By importance of its adoption in Business Process Reengineering and By enabling IT Capabilities.

In short term RFID can be deployed for Focused Differentiation 3 i.e. providing something unique thatis valuable to the buyer beyond simply offering a low price. Broad and narrow target especiallysuggests to focus on particular customer segment based on the contribution margin or the mandate.

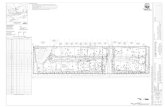

Figure 1: Path to Cost Leadership

3 Porter, M.E. (1985), "Competitive advantage: creating and sustaining superior performance", TheFree Press, New York.

-

7/27/2019 Tp Invst RFID Real OptionApproach

6/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 4

For example, this can be done by deploying RFID technology exclusively in a Warehouse or Distribution center and only for some class of items in compliance to Wal-Marts mandate. The key iscreating value for few customers and subsequently be utilized for Full Differentiation to CostLeadership through staged investment approach (Figure-1). This staged investment approachmakes RFID a good case of Real Options Analysis.

The scope of RFID technology adoption is limited to Organizational Resources Control. Broadlythese resources can be of five types: (1) People, (2) Material, (3) Time, (4) Knowledge and (5) BrandEquity. RFID tag or reader can only be applied to tangible resources like People and Material butother remaining resources get indirectly benefited from RFID application. For People and Materialtype of resources, RFID application scope can be widened slowly from Class A items to Class Bitems in the same facility. Then, after availability of some concrete information about the results andfurther developments in technology and cost, it can be extended to other facilities as well. Similarlythere are several opportunities to extend this technology to multiple applications as well as multipleresources at multiple facilities to achieve cost leadership. Refer to Appendix A that illustrates sampleoption that are available with, RFID investment of pallet level tagging of Class B items.

According to Davenport and Shorts methodology 4 of Process Innovation, Information Technology'scapabilities involve improving coordination mechanism and information access across organizationalunits, thereby facilitating more effective management of task interdependence. In general RFIDsatisfies all the requirements of IT capabilities in some way or other as shown in the table below.

Table 2: RFID Capabilities (Adopted and Modified from Davenport and Short, 1990)

Capability Organizational Impact/Benefit

TransactionalIt can transform unstructured processes into routinizedtransactions

GeographicalIt can transfer information with rapidity and ease across largedistances, making processes independent of geography

Automational It can replace or reduce human labor in a process

Analytical It can bring complex analytical methods to bear on a process

Informational It can bring vast amounts or detailed information into a process

SequentialIt can enable changes in the sequence of tasks in a process, oftenallowing multiple tasks to be worked on simultaneously

Knowledgemanagement

It allows the capture and dissemination of knowledge andexpertise to improve the process

Tracking It allows the detailed tracking of task status, inputs, and outputs

DisintermediationIt can be used to connect two parties within a process that wouldotherwise communicate through an intermediary (internal or external)

Security/Safety It allows to build security and safety in Process as well as Product

Benefits from few Capabilities like Automational, Tracking and Transactional can be reaped in a veryshort time but other Capabilities need some stabilization of the technology and further integrationand investment.

4 Davenport, Thomas H.; Short, James E. (1990), "The New Industrial Engineering: InformationTechnology", Sloan Management Review, 31(4), 11-28.

-

7/27/2019 Tp Invst RFID Real OptionApproach

7/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 5

WHY REAL OPTIONS THEORY ?For the purpose of valuation, one should view RFID Technology as a bundle of functions that canserve as the basis of certain applications whose value changes over time. While these bundles of enabling functions cannot be adjusted in the short run, one can decide on the basket of applications

to be developed, implemented and operated on the basis of the respective costs and benefits after proper observation. In other words, RFID not only generate value directly but also enables differentvalue generating applications to be implemented.

Traditional tools neglect the value of flexibility thorough RFID. We argue that these profoundchanges require a new logic for investment in IT and other similar strategic assets. A typical RFIDinvestment project requires significant initial outlay and is generally irreversible or partiallyirreversible. In addition, RFID investments usually have huge business and technologicaluncertainties. All these characteristics make Real Option Theory an appropriate approach inevaluating RFID investment projects 5.

The real value of the real options approach is that it shows how uncertainty creates value. Managersmust recognize that the uncertainty associated with current strategic business opportunities isdifferent because flexibility can be used to both avoid losses and to tap upon opportunities thatunexpectedly emerge. Uncertainty is the driver of upside potential and the real options approachcaptures this value-creating aspect of RFID investments.

COMMON REAL OPTIONS AND S CENARIOS WITH RFIDINVESTMENT

Waiting-To-Invest Options: The value of waiting to adopt RFID, till better marketinformation becomes available, may exceed the value of its immediate adoption. The optionto postpone can be applied when current investment decisions would impede or hurdlefuture ones. An early adoption of the wrong RFID technology or substituting it couldincrease future costs of adopting a more appropriate one. Similarly, in applications wherestandards are important, there is a clear value in the option of waiting to see whichtechnology becomes the industry standard.

Growth Options: An entry investment may create opportunities to pursue valuable follow-on projects. The most obvious options in RFID implementation projects are the futurepossibilities of using infrastructure to further applications. This is particularly evident in aubiquitous technology like the RFID, in which existing tags and readers can be used for multiple purposes. For example, from Pallet level to Item level tracking.

Flexibility Options: An option to reallocate resources or switch has a value. For example,adopting at two locations instead of one to serve need-based requirements by switching theresources (e.g. reader) as conditions dictate. Reader, which is used at the checkoutprocess, can be utilized for cycle counting operation when there is no rush in the retail

store. Exit (or Abandonment) Options: The option to walk away from a project in response to

new information increases the value of the project. Similarly to the flexibility options, theoptions to disinvest are related with technology failures. The possibility of selling the RFIDinfrastructure and partially recovering investment in case of adoption failure has to beconsidered and valued in early adoption decisions.

5 Xiaotong Li and John D Johnson (2002), "Evaluate IT investment opportunities using real optionstheory", Information Resources Management Journal. 15(3), 32-47.

-

7/27/2019 Tp Invst RFID Real OptionApproach

8/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 6

Innovation and Learning Options: An initial investment creates better information aboutthe market opportunity. This is one interesting options available to the management. AsRFID makes it possible to gather information from moving objects, decisions in RFIDimplementations would enhance information collection possibilities. Whether thisinformation will be useful or not or reveal areas of improvement is uncertain. However having the information would provide managers with the flexibility to undertake futurecorrecting projects and improve value, if needed. For example data collected from tracingand tracking of products will give important information about new changes required inplanning and scheduling mechanisms.

With regard to RFID implementation decision; arriving at the different types of applications (usages),options and, opportunities and risks associated with each option is a very complex procedure andtakes most of the time in a RFID implementation project. Entire Supply Chain spectrum has differenttypes of applications of RFID technology. Available budget and time are the most important factorsto be considered while embarking on a RFID implementation projects. Strategic Value Grid andRFID Application Decision Tree (see appendix B and C) can be used to arrive at the appropriatevalue by deploying RFID in the Supply Chain.

AN ILLUSTRATIVE EXAMPLE Following example of growth option/expansion option explains one simple case of how Real OptionsValuation will help organization to arrive at a decision to invest into RFID technology if they consider the embedded options available in future (i.e. active management perspective). Consider, for example, a European call option, which offers its holder the right but not obligation, to buy at maturitythe underlying share of stock for a specified strike price. Similarly, an application that can beimplemented using RFID technology offers the firm the opportunity (but not obligation) to obtain thebenefits of the application (underlying asset) by investing a given implementation cost (strike price)at certain implementation decision points (maturity). So the NPV with options value taken intoaccount will be:

Expanded NPV = (Ordinary NPV of Expected Cash Flows) + (Value of Options from Active

Management)

In a particular RFID case it will be:

Value of RFID Implementation = (NPV of Applying Only at Pallet Level in a Warehouse Class BItems) + (Option Value of Extending to Case Level Class BItems) + (Option Value of Extending to Cycle Counting

Application)

If we consider only the investment in Time T=0 and benefits for the same time period the NPV isnegative, on the basis of which the decision of investing in RFID should be rejected (Refer toTable3).

-

7/27/2019 Tp Invst RFID Real OptionApproach

9/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 7

Table 3: Base-line NPV

Investment Cost (Time T=0) PV

Hardware 100,000

Software 100,000

Labor 10,000Training 10,000

Total 220,000

Benefits (Time T=0)

Inventory Reduction 30,000

Labor Reductions 20,000

Shrinkage Reduction 20,000

Total 70,000

Net Present Value -150,000

But considering further expansion opportunities and calculating the option value using Black ScholesModel6 (for simplicity) for the expansion decision the expanded NPV will be positive. Following stepswill show how to calculate the option value for above example. Lets assume that:

S = The present value of expansion potential (as assessed today) = $750,0002 = The annualized standard deviation in ln (present value of CF) = 34.64%K = The initial investment needed for expansion option (in PV $) = $1,000,000t = The number of years you have rights to project = 5 yearsC = The cost associated with waiting an extra year to expand = 0.00%r = The risk-less rate that corresponds to the option lifetime = 6.50%

So in terms of option pricing:

Stock Price = $750,000.00 T-Bone rate = 6.50%Strike Price = $1,000,000.00 Variance = 0.12Expiration (in years) = 5 Cost of delay = 0.00%

)()(Optionof Value 21 d N Ked SN rt =

Where,

(.) = Cumulative Normal Distribution

Logarithm Natural ln(.) =

So,Value of the option = $235,938.60

Expanded NPV = ($235,938.60 - $150,000.00) = $85938.60

6 Damodaran, Aswath (2004), Option Pricing Theory and Applications, Lecture Notes

t

t r

d

++

= 2K Sln

2

1

t d d = 12

-

7/27/2019 Tp Invst RFID Real OptionApproach

10/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 8

CONCLUSION Though NPV and DCF are not useful in presence of high uncertainty, it will always be useful for basic analysis. The Real Options theory gives us a better structured decision making process for complex and interdependent investment decisions. As investment in RFID is of very complex nature

due to its application scope, compound real options is the right methodology for valuation.

-

7/27/2019 Tp Invst RFID Real OptionApproach

11/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 9

APPENDIX ARFID Application Tree with Options

Resources

Capital Inventory

Customers

MaterialPeople Brand

Revenue Inventory

Suppliers

Stationary Non-Stationary

Machines Pallets Forklifts CranesRacks

Spares(Internal) Class AItems Class BItems Class CItems

SKU PalletCase

Employees

Returns

KnowledgeTime

Recycled Pallets

12

3 4 5

6 7 8 9 10

11

12 13

Procurement Manufacturing Warehouse Retail StoreOR OR OR Procurement Manufacturing Warehouse Retail StoreOR OR OR

Procurement Manufacturing Warehouse Retail StoreOR OR OR

Indirect Application

-

7/27/2019 Tp Invst RFID Real OptionApproach

12/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 10

APPENDIX BStrategic Value Grid for RFID Application (Adopted and Modified from Humberto Moran, 2000)

Implementation Decisions Uncertain OutcomesDeferral of Alternative Implementations Standard Emergence Pace & Success

Versatility of Technology Lack of Investment & Commitment

Standard Adoption Complementary Technologies Surge

Type & Placement of Readers Inter-Application Dependence

Type & Placement of Tags Critical Mass Achievement

Technological Competition Surge

RFID Technology Success

Industry Inertia

Regulations

Cost Increase/Decrease

Applications

Direct Identification of Product Inventory Management & Control Tracing

Tracking

Transportation/Movement Storage

Display

Spares Management Critical Asset Management

Staff Access & Control Customer Service

Dynamic Pricing

Security

Counterfeit

Managerial FlexibilityExtend to Other Applications $ $ $ $ $ $ $ $ $ $Connect With Other Technologies $ $ $ $ $ $ $ $ $ $Inter-Organizational Interchange

Adapt to Future Standards

Disinvest $ $ $ $ $ $ $ $ $ $Switch to Alternative Usage $ $ $ $ $ $ $ $ $ $Adopt Future Better Technologies

R i s k s /

O p p o r t u n

i t i e s

S t r a t e g

i c V a l u e

-

7/27/2019 Tp Invst RFID Real OptionApproach

13/14

Copyright Patni Computer Systems Ltd., 2004. All rights reserved. 11

APPENDIX CRFID Application Decision Tree

When to

Adopt RFID?

Invest Now in RFID

Invest Now in Barcode

Wait and See WhatHappens With RFID

WhichResource?

People

Material

Employees

Customers

Suppliers

CapitalEquipments

InventoryItems

Pallet Level

Case Level

SKU Level

Replace BarcodeWith RFID

Keep Barcode As It Is

Implement RFID

Implement Barcode

WhatType of

Tag?

Active

Passive

Procurement

Warehouse

Manufacturing

Retail Store

Where?

-

7/27/2019 Tp Invst RFID Real OptionApproach

14/14