TOP MALAYSIAN SMALL CAP COMPANIES - listed...

Transcript of TOP MALAYSIAN SMALL CAP COMPANIES - listed...

The OSK Top Malaysian Small Cap Companies is published by OSK Research Sdn. Bhd (OSKRSB)., a wholly-owned subsidiary of OSK Investment Bank Berhad (OSKIB). The research contained in the book is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This publication is prepared for internal circulation. Any recommendation contained in this report does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This publication is for the information of addresses only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. OSKRSB and OSKIB accept no liability whatsoever for any direct or consequential loss arising from any use of this publication or further communication given in relation to this report. This publication is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. OSKRSB, OSKIB and their associates, their directors, and/or employees may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other services for the companies covered in this report.

Distribution in Singapore

This research report produced by OSK Research Sdn Bhd is distributed in Singapore only to “Institutional Investors”, “Expert Investors” or “Accredited Investors” as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an “Institutional Investor”, “Expert Investor” or “Accredited Investor”, this research report is not intended for you and you should disregard this research report in its entirety. In respect of any matters arising from, or in connection with, this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd (“DMG”).

All Rights Reserved. No part of this publication may be used or re-produced in any manner without the expressed and written permission from OSK Research. The publication is printed on 15 April 2010.

OSK RESEARCH SDN. BHD. (206591-V)(A wholly-owned subsidiary of OSK Investment Bank Berhad)

Kuala Lumpur Hong Kong Singapore Jakarta Shanghai

Malaysia Research OfficeOSK Research Sdn. Bhd.

6th Floor, Plaza OSKJalan Ampang

50450 Kuala LumpurMalaysia

Tel : +(60) 3 9207 7688Fax : +(60) 3 2175 3202

Hong Kong OfficeOSK Securities Hong Kong Ltd.

12th Floor,World-Wide House

19 Des Voeux RoadCentral, Hong Kong

Tel : + (852) 2525 1118Fax : + (852) 2810 0908

Singapore OfficeDMG & Partners

Securities Pte. Ltd.#22-01 Ocean Towers

Singapore 048620Tel : +(65) 6533 1818Fax : +(65) 6532 6211

Jakarta OfficePT OSK Nusadana Securities Indonesia

Plaza Lippo, 14th Floor,Jln. Jend. Sudirman

Kav. 25,Jakarta 12920

IndonesiaTel : + (6221) 520 4599Fax : + (6221) 520 4598

Shanghai OfficeOSK (China) Investment

Advisory Co. Ltd.Room 6506, Plaza 66

No. 1266 West Nan Jing Road200040, Shanghai

China Tel: +(8621) 6288 9611Fax: +(8621) 6288 9633

The Small Cap Research Team

Jeffrey Tan ([email protected])Ng Sem Guan ([email protected])Jason Yap ([email protected])Mervin Chow ([email protected])Jeremy Goh ([email protected])Lim Vi Ming ([email protected])Ahmad Maghfur Usman ([email protected])Norfauzi Nason ([email protected])Law Mei Chi ([email protected])Eing Kar Mei ([email protected])Lim Mei Ching ([email protected])

CONTENTSListing of Top 10 By Alphabetical Order

Listing of Companies By Alphabetical Order

Alam Maritim Resources .....................................................................................................................................17C.I. Holdings ........................................................................................................................................................19Faber Group ........................................................................................................................................................21Freight Management Holdings ............................................................................................................................23Glomac ................................................................................................................................................................25Hai-O Enterprise ..................................................................................................................................................27KPJ Healthcare ...................................................................................................................................................29Leader Universal Holdings ..................................................................................................................................31Lion Industries .....................................................................................................................................................33Naim Holdings ....................................................................................................................................................35

Adventa ...............................................................................................................................................................37AEON Credit Service ...........................................................................................................................................39Ajiya .....................................................................................................................................................................41Axis REIT .............................................................................................................................................................43CBS Technology..................................................................................................................................................45Century Logistics .................................................................................................................................................47Coastal Contracts ................................................................................................................................................49Delloyd Ventures .................................................................................................................................................51Efficient E-Solutions ............................................................................................................................................53Eng Teknologi......................................................................................................................................................55EP Manufacturing ................................................................................................................................................57Evergreen Fibreboard..........................................................................................................................................59Handal Resources ...............................................................................................................................................61Hektar REIT ........................................................................................................................................................63Help International ................................................................................................................................................65Hock Seng Lee ....................................................................................................................................................67Kawan Food ........................................................................................................................................................69Kian Joo Can Factory ..........................................................................................................................................71Kossan Rubber Industries ...................................................................................................................................73Lingkaran Trans Kota Holdings ...........................................................................................................................75Malaysia Steel Works (KL) .................................................................................................................................77Mamee-Double Decker........................................................................................................................................79MBM Resources ..................................................................................................................................................81Multi Sports Holdings...........................................................................................................................................83New Hoong Fatt Holdings....................................................................................................................................85Notion Vtec ..........................................................................................................................................................87NTPM Holdings ...................................................................................................................................................89Padini Holdings....................................................................................................................................................91Pantech Group Holdings .....................................................................................................................................93Pelikan International ............................................................................................................................................95

Listing of Companies By Industry Classification

Plenitude..............................................................................................................................................................97Protasco ..............................................................................................................................................................99QL Resources....................................................................................................................................................101Salcon................................................................................................................................................................103Signature International ......................................................................................................................................105Southern Steel ..................................................................................................................................................107Sunway Holdings ...............................................................................................................................................109Trans-Asia Shipping ..........................................................................................................................................111Yi Lai Holdings...................................................................................................................................................113Zhulian ...............................................................................................................................................................115

Automotive Delloyd Ventures .............................................................................................................................................51 EP Manufacturing .............................................................................................................................................57 MBM Resources ...............................................................................................................................................81 New Hoong Fatt Holdings ...............................................................................................................................85

Building Materials Ajiya..................................................................................................................................................................41 Evergreen Fibreboard ......................................................................................................................................59 Yi-Lai ..............................................................................................................................................................113 Signature International ..................................................................................................................................105

Conglomerate Faber Group .....................................................................................................................................................21

Construction Hock Seng Lee .................................................................................................................................................67 Naim Holdings ..................................................................................................................................................35 Protasco ...........................................................................................................................................................99 Sunway Holdings............................................................................................................................................109

Consumer C.I. Holdings .....................................................................................................................................................19 Hai-O Enterprise ..............................................................................................................................................27 Kawan Food ....................................................................................................................................................69 Kian Joo Can Factory ......................................................................................................................................71 Mamee-Double Decker ....................................................................................................................................79 Multi Sports Holdings .......................................................................................................................................83 NTPM Holdings ...............................................................................................................................................89 Padini Holdings ...............................................................................................................................................91 Pelikan International ........................................................................................................................................95 QL Resources ................................................................................................................................................101 Zhulian............................................................................................................................................................115

Education HELP International ...........................................................................................................................................65

Financial Services AEON Credit Service........................................................................................................................................39

Healthcare / Bio-Technology KPJ Healthcare ...............................................................................................................................................29

Industrial Products Leader Universal Holdings ...............................................................................................................................31

Logistics Century Logistics Holdings ...............................................................................................................................47 Freight Management Holdings .........................................................................................................................23 Trans-Asia Shipping Corp ..............................................................................................................................111

Oil and Gas Alam Maritim Resources .................................................................................................................................17 Coastal Contracts ............................................................................................................................................49 Handal Resources ............................................................................................................................................61

Others Salcon ............................................................................................................................................................103

Property Glomac .............................................................................................................................................................25 Plenitude .........................................................................................................................................................97

REIT Axis REIT .........................................................................................................................................................43 Hektar REIT .....................................................................................................................................................63

Rubber Gloves Adventa ............................................................................................................................................................37 Kossan Rubber Industries ................................................................................................................................73

Steel Lion Industries Corp ........................................................................................................................................33 Malaysia Steel Works (KL) ...............................................................................................................................77 Pantech Group Holdings .................................................................................................................................93 Southern Steel................................................................................................................................................107

Technology CBS Technology ..............................................................................................................................................45 Efficient E-Solutions .........................................................................................................................................53 Eng Teknologi ..................................................................................................................................................55 Notion Vtec ......................................................................................................................................................87

Toll Concession Lingkaran Trans Kota Holdings .......................................................................................................................75

FOREWORDThe OSK Top Malaysian Small Cap Companies (50 jewels) has come a long way from its humble

beginnings in 2005 as a reference material showcasing good small cap companies that are under-researched and little known to the investment community. The publication has since evolved into the leading small cap investment compendium in Malaysia helping investors make better and more informed investment decisions. The latest publication marks its 6th edition.

Over the years, the contents of the book have been refreshed to reflect changes within the Malaysian capital market landscape and in meeting the rising demands for value investing by the more sophisticated investors. New themes have been progressively introduced in support of the government’s efforts to make Malaysia a preferred investment destination and to attract the listing of more foreign companies. The number of small caps companies listed on Bursa Malaysia continues to increase and with the added breadth and scope comes the greater challenge of uncovering true jewels. The book captures the spirit of investing in smaller caps with fundamental reviews on the leading names that are under-appreciated.

At the core of this annual publication is a passionate team of small cap research analysts and the unequivocal support of our esteemed clients and readers, now spanning the breadth of our regional network of offices. We are especially grateful to our partners being the management of the companies featured herein for providing valuable updates and a peek into the future prospects of the companies.

As the research arm of OSK Investment Bank, a regional financial services provider, we remain committed to taking client relationships to a higher level via equity research that offers unparalleled insight, leveraging on the virtues of integrity and independence. We are humbled by our leading position in the small cap space, a testament of our widest coverage of the small cap companies in Malaysia. In recognition of our efforts, we have been voted the leading research house by Asiamoney for Small Cap Research since 2006.

Happy Investing!

The Malaysian Small Caps Research Team

OSK Research Sdn. Bhd.Level 6, Plaza OSKJalan Ampang50450 Kuala LumpurMalaysia

27th April 2010

Research

1

Introduction

For the 2010 edition, the market capitalisation threshold has been raised to RM1.5bn (USD 440m) from RM1bn previously as to maintain the breadth of coverage and to ensure that the better small cap companies are represented. This indirectly reflects the increased optimism on the market against the backdrop of the global economic recovery and rotational themes prevalent within the small cap space. The selection process has never been made more difficult with many jewels having already been uncovered in the past and their share prices approaching intrinsic values. The fact that our 2009 picks have performed remarkably challenges the team to be more vigilant when pitching for new ideas and winners. On the other hand, stocks that remain under-appreciated were not left out and continue to be promoted. On this basis, 31 companies from the previous edition have been retained as their fundamentals remain strong. As before, the individual stock reports are preceded by a section detailing our headline views on key sectors which we believe would provide investors with a more holistic view on the prospects of the respective industries.

OSK Research does not in any way warrant that the share prices will adjust to the levels as depicted by the target prices determined by our analysts. It is hoped that with the improved profiling via primary research, the market prices of these companies would reflect their intrinsic values over time.

A Review

Our 2009 edition saw all but 4 stocks recording positive absolute share price returns, marking a hit rate of 92%. 32 of the 50 companies featured posted absolute returns of 50%-375%, outperforming the FBM KLCI and FBM EMAS. Most of our Top 10 picks fared well, with notable winners being Mudajaya, our top construction pick which rallied 347%, while O&G player Alam Maritim surged 201%. In all, half of our Top 10 picks posted an average return of 211%. The glove makers were the runaway sector winners, racking up an average return of 253%, courtesy of the strong YTD gains by Adventa and Hartalega of 375% and 288% respectively. This was followed by the steel sector, where share prices doubled on average while the O&G sector posted a mean return of 97%. We see the party on small caps spilling into the 3Q10 with the key catalysts coming from their still attractive valuations vis-a-vis their forward earnings growth (our Top 50 small cap earnings universe show a forward PER 9.1x), thematic interests as well as the extension of the rotational play on sectors deemed cyclical. Our house view is to trade small caps into the 3Q10 where we see stocks that are exposed to the following sectors gaining most- healthcare, rubber gloves, technology, construction, steel and oil& gas. By way of their lower foreign ownership levels, smaller cap stocks are also fairly insulated from a sell-down or a major correction in the market and hence should remain an inherent part of investors’ portfolio given the expected volatility in the market.

The 2010 edition sees the addition of 19 new companies from a cross-section of industries and sectors. 2 new categories were added, namely financial services and conglomerate. The stocks (in no particular order) are CI Holdings, Delloyd Ventures, Signature International, Axis REIT, EP Manufacturing (EPMB), Notion VTec, Glomac, Sunway Group, Mamee-Double Decker, Multi Sports, Salcon, Faber, AEON Credit, Protasco, Zhulian, Handal, Engtek, Southern Steel and Evergreen Fibreboard. The research team has handpicked the stocks for their positive share price catalysts moving forward, undemanding valuations and strong/improving fundamentals, having met the internal thresholds/benchmarks for inclusion in the book. Among the notable mentions are Multi Sports- China’s first shoe sole manufacturer to be listed on Bursa, C.I. Holdings-the maker and distributor of carbonated and non-carbonated beverages in Malaysia, AEON Credit- the micro-credit financier, Zhulian- Malaysia’s largest producer of gold plated jewellery for the direct selling market and Signature International- the award winning kitchen cabinet specialist that has made significant strides overseas. 3 of the newly added stocks are in our Top 10 list, namely Faber, C.I. Holdings and Glomac with C.I. Holdings making it into the Top 5.

2

Figure 1: % distribution of the Top 50 companies for the 2010 Edition

Automotive8%

Building Materials8%

Conglomerate2%

Construction8%

Consumer22%

Education 2%

Finance 2% Healthcare

2%

Industrial Products2%

Logistics 6%

Oil and Gas6%

Others 2%

Property 4%

REIT 4%

Rubber Gloves4%

Steel8%

Technology8%

Figure 2: Top 10 stocks (2009 Edition) performance in ascending order of absolute share price returns for 2009

0% 50% 100% 150% 200% 250% 300% 350% 400%

Mudajaya

Alam Maritim

KPJ Healthcare

Hai-O Resources

Wah Seong Corporation

Kossan

QL Resources

Hektar REIT

Malaysian Steel Works

New Hoong Fatt

Figure 3: Market capitalisation distribution for the 2010 Edition

10%

46%32%

8%4%

0 -100m

100m - 500m

500m - 1000m

1000m - 1500m

1500m - 2000m

Table 1: Number of stocks listed by sector in the 2009 and 2010 Editions

Sector classification 2010 2009Automotive 4 2Building Materials 4 2Conglomerate^ 1 0Construction 4 4Consumer 11 11Education* 1 1Financial Services^ 1 0Healthcare 1 3Industrial Products 1 3Logistics 3 3Oil and Gas 3 3Others 1 3Property 4 1Rubber Gloves 2 3Steel 4 4Technology 4 3Toll Concession 1 1

^ new categories in 2010 edition* reclassification from “others”

46 of the 50 companies featured in the 2009 edition recorded positive returns with 64% of the stocks outperforming the FBM KLCI and FBM Emas. Our top 10 picks (Fig. 2) recorded commendable absolute share price returns of 52-347% in 2009.

3

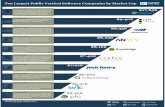

Market Capitalisation of the Top 50 (RMm)

0 400 800 1,200 1,600

Handal ResourcesEP ManufacturingCBS Technology

Trans-Asia ShippingFreight Management

Signature InternationalYi-Lai

Efficient E-SolutionsCentury Logistics

AjiyaKawan Food

New Hoong FattMulti Sports

HELP InternationalMalaysia Steel Works

Delloyd VenturesC.I. Holdings

ProtascoEng Teknologi

SalconPantech Group

Hektar REITPlenitude

GlomacLeader Universal

Mamee-Double DeckerAEON Credit

PadiniNotion Vtec

Kian Joo Can FactoryAdventa

Axis REITNTPM

MBM ResourcesPelikan International

ZhulianNaim

Evergreen FibreboardHai-O Enterprise

Coastal ContractsHock Seng Lee

Faber GroupSunway

Alam MaritimSouthern SteelKossan RubberQL ResourcesLion Industries

Lingkaran Trans KotaKPJ Healthcare

Return on Equity (ROE) of the Top 50 (%)

0% 10% 20% 30% 40%

EP ManufacturingYi-Lai

Kian Joo Can FactoryGlomac

Trans-Asia ShippingPlenitudeAxis REIT

SalconHektar REIT

MBM ResourcesLion Industries

Malaysia Steel WorksPelikan International

Leader UniversalProtasco

Delloyd VenturesNew Hoong Fatt

AjiyaNaim

SunwayCentury Logistics

Evergreen FibreboardKawan Food

Efficient E-SolutionsFreight Management

KPJ HealthcareHELP International

Alam MaritimSouthern SteelEng Teknologi

Lingkaran Trans KotaFaber Group

QL ResourcesC.I. Holdings

PadiniMamee-Double Decker

Hock Seng LeeAEON Credit

CBS TechnologyHandal Resources

NTPMCoastal Contracts

Notion VtecKossan Rubber

ZhulianSignature International

AdventaMulti Sports

Pantech GroupHai-O Enterprise

4

FY10 PER of the Top 50 (x) FY10 Dividend Yields of the Top 50 (%)

0 5 10 15 20

Lingkaran Trans KotaQL Resources

KPJ HealthcareNTPM

Hock Seng LeeHai-O Enterprise

Axis REITSalcon

Kossan RubberHektar REIT

HELP InternationalGlomac

C.I. HoldingsYi-LaiPadini

Kawan FoodNotion Vtec

Faber GroupAdventa

AEON CreditNaim

Kian Joo Can FactoryAlam Maritim

ZhulianMamee-Double DeckerEvergreen Fibreboard

Pelikan InternationalSunway

EP ManufacturingMBM Resources

Pantech GroupEfficient E-Solutions

CBS TechnologyDelloyd Ventures

PlenitudeProtasco

Leader UniversalSignature International

Southern SteelFreight Management

Eng TeknologiTrans-Asia Shipping

Coastal ContractsNew Hoong Fatt

AjiyaCentury Logistics

Malaysia Steel WorksLion Industries

Handal ResourcesMulti Sports

0% 5% 10% 15%

CBS TechnologyEp Manufacturing

Lion IndustriesSunway

Coastal ContractsAlam Maritim

SalconHELP International

Kossan RubberAdventa

Signature InternationalNaim

Kawan FoodDelloyd Ventures

Hock Seng LeeEfficient E-Solutions

Pantech GroupFaber Group

Handal ResourcesAjiya

QL ResourcesMalaysia Steel Works

KPJ HealthcareMBM Resources

Evergreen FibreboardNotion Vtec

Leader UniversalPelikan International

PlenitudePadini

Southern SteelGlomac

Century LogisticsNTPM

Hai-O EnterpriseAEON Credit Service

Eng TeknologiLingkaran Trans Kota Kian Joo Can Factory

C.I. HoldingsProtasco

New Hoong Fat Freight ManagementTrans-Asia Shipping

ZhulianAxis REIT

Yi-LaiHektar REITMulti Sports

Mamee-Double Decker

5

The Screening Methodology

The 50 companies are selected based on the following measures and scorecards.

• Market Capitalization* (<= RM1.5bn) • Profit track record• Price earnings ratio (PER) • Price to NTA (P/NTA)• Net gearing • Return on Equity (ROE)• Compounded Annual Growth Rate (CAGR) in earnings • Dividend outlook • Management track record

* note that the actual market capitalisation may differ slightly from the cut-off date used for the publication

The companies are then ranked based on the following parameters

• Lowest FY10 PER• Lowest FY10 Price/Book Value• Highest FY10 Dividend Yield• Highest FY10 ROE• Highest 3 year EPS CAGR • Lowest Price/Earnings Growth (PEG)• Lowest Relative Sector PER

The sectors and/or industries that the companies in the 2010 edition represent are:

• Automotive• Building Materials• Consumer• Conglomerate • Construction • Education • Financial Services• Healthcare/Bio-Technology• Industrial Products• Logistics• Oil & Gas• Property • Rubber Gloves• Steel • Technology • Toll Concession • Real Estate Investment Trust (REIT)

6

Ranking Based on Forward FY10 PER (x)

Stock (X)

1 Multi Sports Holdings Ltd 2.2 2 Handal Resources 4.1 3 Lion Industries Corporation 4.5 4 Malaysia Steel Works (KL) 4.7 5 Century Logistics Holdings 5.0 6 Ajiya 5.5 7 New Hoong Fatt Holdings 5.5 8 Coastal Contracts 5.6 9 Trans-Asia Shipping Corporation 5.7 10 Eng Teknologi Holdings 6.0

Ranking Based on Forward FY10 P/BV (x)

Stock (X)

1 EP Manufacturing 0.42 Trans-Asia Shipping Corporation 0.43 Lion Industries Corporation 0.54 Malaysia Steel Works (KL) 0.55 Plenitude 0.66 Multi Sports Holdings Ltd 0.67 Yi-Lai 0.68 Kian Joo Can Factory 0.69 New Hoong Fatt Holdings 0.710 MBM Resources 0.7

7

Ranking Based on Highest FY10 Gross Dividend Yield (%)

Stock (%)

1 Mamee-Double Decker 12.42 Multi Sports Holdings Ltd 9.53 Hektar REIT 8.94 Yi-Lai 8.35 Axis REIT 8.16 Zhulian 7.77 Trans-Asia Shipping Corporation 7.48 Freight Management Holdings 6.89 New Hoong Fatt Holdings 6.610 Protasco 6.3

Ranking Based on Highest FY10 ROE (%)

Stock (%)

1 Hai-O Enterprise 33.72 Pantech Group Holdings 31.43 Multi Sports Holdings Ltd 31.04 Adventa 27.75 Zhulian 26.66 Signature International 26.67 Kossan Rubber Industries 26.08 Notion Vtec 25.99 Coastal Contracts 25.810 NTPM Holdings 24.6

8

Ranking Based on Highest 3-Year CAGR (FY07-FY10) (%)

Stock (%)

1 Salcon 83.92 Mamee-Double Decker 59.13 Adventa 57.34 Eng Teknologi 54.85 C.I. Holdings 52.76 Hai-O Enterprise 50.37 Delloyd Ventures 45.78 AEON Credit Service 39.39 Alam Maritim Resources 34.010 Coastal Contracts 32.1

Ranking Based on Lowest PEG (x)

Stock (%)

1 Multi Sports Holdings Ltd 0.12 2 C.I. Holdings 0.12 3 Eng Teknologi 0.14 4 Mamee-Double Decker 0.17 5 Coastal Contracts 0.17 6 Delloyd Ventures 0.18 7 Salcon 0.19 8 Adventa 0.20 9 Pantech Group Holdings 0.25 10 AEON Credit Service 0.26

9

Top

10 C

ompa

nies

(201

0 Ed

ition

)

Sect

orSe

ctor

FYE

Mkt C

apPr

iceEP

S (s

en)

EPS

(sen

)GD

PS (s

en)

BVPS

(RM)

RO

E PE

R (X

)PE

R (X

)PB

V (X

)GD

ivYld

(%)

12-M

(RMm

)^ (R

M)^

FY08

FY09

FY10

fCY

08CY

09CY

10f

FY09

FY10

fFY

09FY

10f

FY09

FY10

fFY

09FY

10f

CY09

CY10

fFY

09FY

10f

FY09

FY10

fTa

rget

(RM)

Alam

Mar

itim R

esou

rces

Oil &

Gas

Dec

976.0

1.9

2 15

.5 19

.4 24

.9 15

.5 19

.4 24

.9 1.5

2.0

0.99

1.34

19.6%

18.6%

9.9

7.7

9.9

7.7

1.9

1.4

0.81.0

2.99

C.I. H

olding

sCo

nsum

erJu

n28

6.8

2.02

10.2

14.8

19.7

12.5

17.3

21.8

7.0 6.

3 0.9

3 0.9

8 15

.8%20

.2%13

.6 10

.3 12

.0 9.3

2.2

2.1

3.53.1

2.40

Fabe

rCo

nglom

erate

Dec

914.8

2.5

2 16

.8 22

.9 26

.6 16

.8 22

.9 26

.6 6.0

7.0

1.07

1.34

21.3%

19.8%

11.0

9.5

11.0

9.5

2.4

1.9

2.42.8

2.75

Freig

ht Ma

nage

ment

Holdi

ngs

Logis

tics

Jun

98.0

0.81

10.0

11.1

13.1

10.9

12.6

13.9

4.5 5.

5 0.7

0 0.7

8 16

.2%16

.8%7.3

6.1

6.7

5.9

1.2

1.0

5.6

6.8 0.

95

Glom

ac

Prop

erty

Apr

430.9

1.4

5 11

.8 10

.8 14

.1 11

.8 10

.8 14

.1 7.0

7.0

1.74

1.89

6.2%

7.5%

13.4

10.3

11.9

10.1

0.8

0.8

4.84.8

1.66

Hai-O

Ente

rpris

eCo

nsum

erAp

r89

5.9

4.42

58.4

61.6

35.8

60.5

40.3

39.9

42.0

24.0

1.96

1.06

31.5%

33.7%

7.2

12.3

13.9

11.1

2.3

4.2

9.55.4

5.04

KPJ H

ealth

care

Healt

hcar

eDe

c1,5

55.0

2.94

14.8

19.3

21.3

14.8

19.3

21.3

8.8 9.

5 1.1

6 1.2

6 16

.6%16

.8%15

.2 13

.8 15

.2 13

.8 2.5

2.3

3.0

3.2 3.

92

Lead

er U

niver

sal

Holdi

ngs

Indus

trial

Prod

ucts

Dec

436.5

1.0

0 14

.9 12

.2 15

.7 14

.9 12

.2 15

.7 3.0

3.7

1.24

1.37

9.9%

11.5%

8.2

6.4

8.2

6.4

0.8

0.7

3.03.7

1.13

Lion I

ndus

tries

Corp

orati

onSt

eel

Jun

1,370

.7 1.9

2 12

0.9

-36.0

42.4

42.3

3.2

46.8

0.0 1.

0 3.8

6 4.2

3 -9

.3%10

.0%n.a

.4.5

n.a

. 4.1

0.5

0.5

0.0

0.5 2.

51

Naim

Hold

ings

Cons

tructi

onDe

c86

0.0

3.44

28.0

31.5

37.4

28.0

31.5

37.4

6.2 7.

5 2.6

7 2.8

8 11

.8%13

.0%10

.9 9.2

10

.9 9.2

1.3

1.2

1.8

2.2 4.

21

^ clos

ing sh

are

price

as a

t Apr

il 7 2

010

10

Top

Sect

or P

icks

(201

0 Ed

ition

)

Sect

orCo

mpa

nies

FY

EMk

t Cap

Price

EPS

(sen

)EP

S (s

en)

GDPS

(sen

) BV

PS (R

M)

ROE

(%)

PER

(X)

PER

(X)

PBV

(X)

GDivY

ld (%

) 12

-M (R

Mm)^

(RM)

^FY

08FY

09FY

10f

CY08

CY09

CY10

fFY

09FY

10f

FY09

FY10

fFY

09FY

10f

FY09

FY10

fCY

09CY

10f

FY09

FY10

fFY

09FY

10f

Targ

et (R

M)

Autom

otive

EP M

anufa

cturin

gDe

c84

.6 0.5

1 4.6

4.3

7.3

4.6

4.3

7.3

0.0

0.0

1.3

4 1.4

1 3.2

5.211

.97.0

11.9

7.0

0.4

0.4

0.00.0

0.59

Cons

umer

C.I. H

olding

sJu

n28

6.8

2.02

10.2

14.8

19.7

12.5

17.3

21.8

7.0

6.3

0.93

0.98

15.8

20.2

13.6

10.3

12.0

9.3

2.2

2.1

3.53.1

2.40

Cons

tructi

onNa

im H

olding

sDe

c86

0.0

3.44

28.0

31.5

37.4

28.0

31.5

37.4

6.2

7.5

2.67

2.88

11.7

13.0

10.9

9.210

.9 9.2

1.3

1.2

1.8

2.24.2

1

Healt

hcar

eKP

J De

c1,5

55.0

2.94

14.8

19.3

21.3

14.8

19.3

21.3

8.8

9.5

1.16

1.26

16.6

16.8

15.2

13.8

15.2

13.8

2.5

2.3

3.03.2

3.92

Logis

tics

Freig

ht Ma

nage

ment

Jun

98.0

0.81

10.0

11.1

13.1

10.9

12.6

13.9

4.5

5.5

0.70

0.78

16.2

16.8

7.36.1

6.7

5.91.2

1.0

5.6

6.80.9

5

Oil &

Gas

Alam

Mar

itimDe

c97

6.0

1.92

15.5

19.4

24.9

15.5

19.4

24.9

1.5

2.0

0.99

1.34

19.6

18.6

9.97.7

9.9

7.7

1.9

1.4

0.81.0

2.99

Prop

erty

Glom

acAp

r43

0.9

1.45

11.8

10.8

14.1

11.8

10.8

14.1

7.0

7.0

1.74

1.89

6.27.5

13.4

10.3

11.9

10.1

0.8

0.8

4.84.8

1.66

REIT

Hekta

r REI

TDe

c39

0.4

1.22

18.9

11.6

11.5

18.9

11.6

11.5

10.3

10.8

1.27

1.28

9.19.0

10.5

10.6

10.5

10.6

1.0

1.0

8.48.9

1.29

Rubb

er G

loves

Koss

an R

ubbe

r Ind

ustrie

sDe

c1,3

18.9

8.25

37.1

41.8

74.5

37.1

41.8

74.5

12.0

13.0

2.24

2.87

18.7

26.0

19.7

11.1

19.7

11.1

3.7

2.9

1.51.6

11.30

Stee

lLio

n Ind

ustrie

sJu

n1,3

70.7

1.92

120.9

-3

6.042

.4 42

.3 3.2

46

.8 0.0

1.0

3.8

6 4.2

3 -9

.310

.0n.a

.4.5

n.a.

4.1

0.5

0.5

0.00.5

2.51

Tech

nolog

yCB

S Te

chno

logy

Dec

87.5

0.37

3.8

6.9

8.0

3.8

6.9

8.0

0.0

0.0

0.27

0.35

25.4

23.3

5.44.6

5.4

4.6

1.4

1.1

0.00.0

0.48

Build

ing M

ateria

lsEv

ergr

een

Fibre

boar

dDe

c88

2.4

1.72

15.0

17.0

23.1

15.0

17.0

23.1

5.3

7.5

1.38

1.55

13.3

15.8

10.1

7.410

.1 7.4

1.2

1.1

3.1

4.42.0

8

^ clos

ing sh

are

price

as a

t Apr

il 7 2

010

11

INVESTMENT MERITS

Strong outstanding orderbook of RM1.2bn to last for the next 3 years Profound reputation, strong management team and balance sheet.

ABC stands out as one of the most competitive contenders for more infrastructure works to be rolled out from the 9MP

Strong balance sheet. Sitting on a huge cash pile of RM146.2m (net cash of RM78.5m or RM1.18/share)

Upcoming oil palm plantation (20,500ha) by 2010 will contribute significantly to ABC’s earnings post 9MP

COMPANY PROFILE

KEY HIGHLIGHTS

ABC Berhad“A” Class Contractor

Share Profile/Statistics Bloomberg Ticker ABC MKIssued Share Capital (m) 66.76Market Capitalisation (RMm) 169.5652 week H | L Price (RM) 2.85 | 1.803m Average Volume (’000) 77.23YTD Returns (%) 0.32Net gearing (x) 1.74Altman Z-Score 1.75ROCE/WACC 1.64Beta (x) 0.87Book Value/share (RM) 1.76

Major Shareholders (%)Zaki Holdings (M) SB 60.35Employees Provident Fund 2.97HSBC Nominees (T) SB 2.01

Share Performance (%)Month Absolute Relative1m 2.01 -1.14 3m 14.41 0.59 6m 20.95 -6.82 12m 46.27 2.03

CONSUMER

Target : RM1.28Price : RM0.955

Share Price Performance

2.00

2.20

2.40

2.60

2.80

3.00

3.20

3.40

Oct-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09

ABCABC Berhad

ABC Berhad, with its history dating back to 1982, was listed on the Second Board in 1999 and subsequently transferred to the Main Board in 2003. The Group is involved in civil and structural construction works, property develop-ment, supply of marine fuels and lubricants at Kemaman Port. Recently the Group also ventured into oil palm plantations in Indonesia as part of its diversification strategy. The actual field planting for the oil palm commenced in October 2006 and expected to be completed by year 2009/10. The construction division makes up about 87.4% of revenue in 2006, followed by 12.1% in the oil & gas division. The oil palm division measuring about 20,500ha, however, is expected to generate revenue for the Group in year 2010 and onwards.

Strong outstanding orderbook. Comfortably sitting on a strong outstand-ing orderbook of RM1.2bn on the back of RM1.7bn orderbook, ABC is poised to register double-digit growth for at least the next 2 years. Such strong outstanding orderbook will keep the Group busy over the next 3 years.

9MP will continue to underpin ABC’s earnings. It is no secret that ABC will be one of the prime beneficiaries of the 9MP. Having already secured two prime projects worth RM499m in the East Coast in mid-2006, the next immediate target is that of the East Coast Expressway Phase 2 (ECE2). Currently with a balance of about RM2.0bn to be awarded.

Guide To Report Format - Page 1Target Price

Intrinsic valuation of the stock based on various methodologies

Share Price Market price as at cut-off date

of April 07, 2010

Investment Merits Key attractions and selling

points of the stock including but not limited to growth prospects, earnings drivers and valuation fundamentals

Company Profile Principal activities Brief history of the company’s development Revenue contributors Location of operations

Key Highlights Existing and potential contracts/

orders New ventures Strategic alliance Expansion plan

Share Profile / Statistics Key stock data including

cash f low and e f f i c iency measures such as Altman Z-score* and ROC/WACC*

Major Shareholders Top shareholders o f the

company based on latest available data

Share Performance Shows the absolute and relative

performance vs. underlying benchmark index of the stock over a period of time

12

Income Statement (RMm)

FYE 31 Dec FY07 FY08 FY09 FY10fTurnover 257.9 243.7 432.2 669.7 Growth (%) -15.7 -5.5 77.3 55.0 EBITDA 24.5 30.1 41.3 50.4 Pretax -4.1 27.5 36.3 46.5 Net Earnings -11.7 18.2 23.7 30.0 EPS (sen) -17.6 27.3 35.6 45.0 Growth (%) -190.5 n.m. 30.5 26.4 NTA/Share (RM) 1.53 1.75 2.01 2.35 Gross Div (sen) 7.0 15.0 15.0 15.0 Div Yield (%) 2.8 5.9 5.9 5.9 PER (x) -14.4 9.3 7.1 5.6 P/NTA (x) 1.7 1.5 1.3 1.1 Net Cash/Share 1.46 1.52 1.18 1.94 Balance Sheet (RMm) FYE 31 Dec Fixed Assets 21.7 25.2 35.4 47.4 Current Assets 229.8 241.8 327.9 414.9 Current Liabilities -149.7 -152.7 -193.4 -283.3Others 28.9 28.0 34.4 18.4 Total 130.7 142.3 204.3 197.4 Share capital 66.3 66.7 66.7 66.7 Reserves 55.8 38.7 53.6 71.1 Shareholder Funds 122.1 105.4 120.3 137.8 LT Liabilities 7.1 35.2 82.5 56.9 Others 1.5 1.6 1.5 2.7 Total 130.7 142.1 204.2 197.3 Gross Debt 5.5 11.8 52.7 67.7 Net Cash/ (Debt) 95.2 97.7 101.4 78.5 Cash Flow Statement (RMm) FYE 31 Dec FY07 FY08 FY09Cash Flow from Ops 8.0 21.2 16.5 Cash Flow from Investing 1.0 -12.0 -21.8Cash Flow from Financing -6.2 37.6 -1.2Net Increase in Cash 2.9 46.9 -6.5Cash at Beginning of Year 99.0 101.9 148.7 Other Changes -0.0 -0.0 0.2 Cash at End of Year 101.9 148.7 142.5

COMPANY REPORT CARD

ROE. Registering a 16.7% and 18.9% ROE in FY05 and FY06 respectively, we expect the Group to post a strong ROE of 20.6% and 21.0% in FY07 and FY08 respectively.

Management. Strong fundamentals are not the only selling points of the Group. Its determined and experienced management team has been the key driving force.

Dividend. The Group has been declaring a gross dividend of 15sen for the past few years. Going forward, management has indicated that it would at least maintain the dividend payout level.

RECOMMENDATION

The illiquidity of the stock has been one of the prime reasons why its price is still a laggard compared to its peers. Given its current strong fundamentals and capacity, ABC may switch its attention soon to address the issue of its stock liquidity via a capital management exercise. Trading at a forward PER of only 5.6x and 4.7x in FY07 and FY08, ABC offers investors a great bargain for enhanced exposure to the 9MP boom.

speed diesel to marine and offshore vessels, ABC has the mandate to be the only sole supplier of that product in Port Kemaman. With a total capacity of 400m litres and utilisation rate of 50% only, the division will poise to contribute to the Group’s top and bottom line going forward given the recent increased offshore activities in Port Kemaman. All the division’s assets have been fully depreciated. The division will continue to act as a cash cow for the Group to fund its plantation activities in Kalimantan (still at its infancy).

Oil palm plantation to be one of the prime catalysts post year 2010. Located in the town of Ngabang, West Kalimantan, ABC owns the rights to cultivate palm oil on 20,500ha land. Acquired at a cost of only RM7m, the plantable area has well exceeded 85%, above industry average. The Group has already commenced field planting operations. Earnings contribution from this division is expected to kick-in in year 2010 onwards.

ABC Company

FY06 FY0 7 FY08 FY09

*DefinitionofAltmanZ-score A predictive model created by Edward Altman in the 1960s. This model combines five different financial ratios to determine the likelihood of bankruptcy

amongst companies. The general rule of thumb is that the lower the score, the higher the odds of bankruptcy. Companies with Z-Scores above 3 are considered to be healthy and, therefore, unlikely to enter bankruptcy. Scores in between 1.8 and 3 lie in a grey area. This is a relatively accurate model -real world application of the Z-Score successfully predicted 72% of corporate bankruptcies two years prior to these companies filing for bankruptcies.

*DefinitionofROC/WACC A calculation used to assess a company’s potential to be a quality investment by determining how well (i.e. profitably) a company’s management is able to

allocate capital into its operations. Comparing a company’s ROC with its cost of capital (WACC) reveals whether invested capital was used effectively.

WACC is a calculation of a firm’s cost of capital in which each category of capital is proportionately weighted. All capital sources - common stock, preferred stock, bonds and any other long-term debt - are included in a WACC calculation. WACC is calculated by multiplying the cost of each capital component by its proportional weight and then summing it up. A firm’s WACC is the overall required return on the firm as a whole and, as such, it is often used internally by company directors to determine the economic feasibility of expansionary opportunities and mergers. It is the appropriate discount rate to use for cash flows with risk that is similar to that of the overall firm.

Guide To Report Format - Page 2

Company Report Card Fair value, historical and

forward PER and sector PER Historical and forward ROE

perspective Management profile and

experience

Dividend policy

Recommendation Fundamental valuation of the

stock based on various valua-tion methodologies

Includes target price, dividend yield and total holding period returns where necessary over a

12 month period

Key Statistics The financial statements –

income statement and balance sheet

Various financial ratios for horizontal statement analysis

13

Sector Sector Snapshot Featured Stocks

Automotive We see 2010 as a good year for the automotive sector, spurred by strong vehicle sales amid an improving economic landscape and a favourable ringgit. We see value in our small cap coverage as most are still trading at attractive valuations. We expect the higher TIV momentum, which will hit a new record high, as a boon for auto part players overall as they essentially command better margins than the auto manufacturers themselves. In the long run, auto parts suppliers will further benefit as the industry shapes up to cater to global OEMs by establishing manufacturing hubs given the sector's accomodating policy, which is packaged with favorable incentives such as tax holidays and export tax exemptions. We remain OVERWEIGHT on the automotive sector.

Delloyd VenturesEP ManufacturingMBM ResourcesNew Hoong Fatt Holdings

Building Materials 2010 will be a turnaround year for most companies in the building material sector as both domestic and offshore orders increase. Net earnings projections are expected to jump from 15%-35% across our coverage. We are proud to point out that both Ajiya and Yi-lai continue to be in our list of top small caps. Ajiya still sees positive prospects going forward, with new development projects auguring well for its niche energy saving building materials segment while Yi-lai continues to be the most efficient tile manufacturer that also happens to pay attractive dividend. We also introduce Malaysia's top medium-density fibreboard manufacturer, Evergreen Fibreboard, which is our latest inclusion among the ranks of the building materials. With the sector riding on the global stimulus packages, we reckon that the worse is over for the sector and that earnings should recover strongly this year. We remain OVERWEIGHT on the building materials sector.

AjiyaEvergreen FibreboardSignature InternationalYi Lai Holdings

Consumer While retail players generally fared better than expected during the economic crisis, mainly driven by heavy promotions and discounting activities, with only slight margin compression, the luxury retailers generally experienced a more severe bottom line contraction compared to the high street brand retailers that are involved in the sale of necessities, which outperformed the rest as expected. Although we expect sales growth to slow and margins to normalize given the fewer discounts and buying activities as consumers would have stocked up during the previous sales season, companies would still report decent sales growth driven by a recovering economy, improving consumer sentiments and higher tourist arrivals. Apart from the more favourable macro outlook, most retail companies also offer decent dividend yields, which is a boon given expectations of a less sanguine 2H outlook. We are OVERWEIGHT on consumer retail. The food sector, on the other hand, is expected to peform better this year, particularly from impulse buying of products such as snacks, soft drinks and confectionary as the economy gains pace. Aggressive new product launches and marketing campaigns were evident in a bid to capture market share, which should prop up earnings going forward. Food companies involved in basic agrifood will continue to be profitable and we expect stronger demand coming from exports. Nonetheless, we are still concerned over rising raw material prices although most of the raw materials prices have remained flattish over the last few months. We like C.I. Holdings for exposure to the F&B segment and Hai-O for exposure to the consumer retail space.

C.I. HoldingsHai-O EnterpriseKawan FoodKian Joo Can FactoryMamee-Double Decker Multi Sports Holdings LtdNTPM HoldingsPadini HoldingsPelikan InternationalQL ResourcesZhulian

Construction One of our sector themes for 2010 is that most domestic contracts are likely to be mid and small sized in nature. As for the larger projects, small cap contractors will also have a participating chance as (i) these jobs are likely to be broken into smaller packages, and (ii) there will be subcontracting roles available. Small cap contractors are the key beneficiaries of such jobs given the stronger incremental earnings impact vs larger contractors. The Sarawak construction play is another theme we are bullish on, fuelled by the upcoming state election slated for early-mid 2011. Based on forward CY10 earnings, small cap contractors on average are trading at a 30%-40% discount to their larger cap peers. We have an OVERWEIGHT rating on the sector but favour the mid-small cap names.

Hock Seng LeeNaim HoldingsProtascoSunway Holdings

Sector Snapshots

14

Sector SnapshotsSector Sector Snapshot Featured Stocks

Healthcare The growing demand for private healthcare services will continue to sustain the growth momentum for private healthcare providers. The sector will remain as an excellent long term and portfolio balancing investment due to its steady dividend payout as well as growth potential in a defensive sector. Our top pick remains KPJ.

KPJ

Logistics The positive economic landscape will prove favorable for the logistic players on better volumes churned in tandem with the improvement in the manufacturing sector. This also jives in with the heightening economic activities across the globe as trade volume gains momentum. We see this benefiting logistics players that are exposed to both domestic and export markets. Also, an uptick in margins across our sector coverage will be evident as the cost-cutting initiatives implemented in the last few years bear fruit on the back of the higher turnover. We expect a strong rebound in profits across our logistics coverage. Our top pick is Freight Management.

Century LogisticsFreight ManagementTrans-Asia Shipping Corp

Oil & Gas The local O&G sector has been quite quiet since the crash in oil prices and global economic recession. Nevertheless, we expect Petronas and its PSC contractors to start awarding new contracts starting from 2H10 as job replenishment would be needed to sustain the existing oil fields as well as to discover new oil fields so that our reserve replacement ratio continues to be strong. Maintain OVERWEIGHT rating on the sector. We continue to like Alam Maritim for exposure to the sector.

Alam Maritim ResourcesCoastal ContractsHandal Resources

Property As we have predicted based on our Property Cycle Model, the downcycle since late 2008 may likely bottom only in mid-2010. The Malaysian real estate sector will warm up in 2H10 before ushering in a brief upcycle in 2011. During this period, especially in 2011, demand will return more convincingly and most developers will be able to make brisk sales on generally rising property prices even without the generous discounts and easy financing schemes. The upcycle in 2011, albeit brief, would again be led by high-end properties, supported by a favourable demographic landscape, recovering economy and the lack of incoming supply in 2010. As we believe that most mid-to-large cap stocks have already (at least almost) fully priced in such rebound, we think that values can now only be found in smaller cap property stocks, which are now merely trading at 0.6x CY10 P/NTA versus the mid-cap average of 0.85x CY10 P/NTA. If the rebound in the real estate sector becomes more evident and given the abundance of liquidity in the system, interest in certain quality smaller cap property stocks will likely return soon, with their current valuations potentially catching up with the mid-cap property stocks. Having said that, we are only upgrading our small cap property stocks to Trading Buys (instead of an outright buy) because we believe that there is risk that the impending rebound in the real property sector may not last beyond year 2011. As property stocks tend to react 9-12 months ahead of a change in the property cycle, this means that the valuation of the Malaysian property stocks will likely to also peak sometime in mid-to-late 2010.

GlomacPlenitude

REIT M-REITs certainly survived the global financial crisis very well in 2009, given the healthy domestic economy, resilient banking system, healthy balance sheet of the M-REITs as well as the defensive nature of their respective business models. Surviving the crisis means that M-REITs have now proven to be very resilient and investment-worthy, especially in an adverse environment. In addition, given the fact that most are still offering an attractive yield exceeding 8.0% amid an improvement in the economy, value can therefore still be found in M-REITs.

Axis REITHektar REIT

Sector Sector Snapshot Featured Stocks

Rubber Gloves The global demand for rubber gloves continue to be strong in tandem with the global economic recovery and grwoing healthcare awareness, especially after the H1N1 pandemic. Going forward, we only expect additional capacity to flood the market starting 2011 because even though new capacity will progressively come onstream in 2H10, there is ample demand to catch up with given the limited capacity expanson available in 2009. Also, we believe new demand for gloves from the more developed countries will start to come in as the standard of living of the global population rises. We maintain OVERWEIGHT on the sector. We like Kossan for small cap glove exposure.

AdventaKossan Rubber Industries

Steel We believe the on-going local projects will help sustain 70% of Malaysia’s regular annual long steel consumption, with the balance compensated for if most public projects are executed in a timely manner. There is also consistent demand for the exports of semi-finished products to South-East Asia (SEA) since China’s 25% export tax on billets has created a vacuum for 5m tonnes of billets. An improvement in the economies of the Middle East, Australia, Pakistan, and Bangladesh will also be a boon to Malaysia’s billet exports. Fundamentals aside, the recently concluded iron ore and coking coal benchmark at 90% and 55% increase were way above our in house estimates of a rise of 25%, although this would be good only for a single quarter as opposed to the typical yearly contract. This is in line with our expectations of further scope for steel prices to rise by 5%-10% in the immediate term. As there is a strong correlation of >0.85x between steel prices and share price performance, the possible hike in steel price will spur rotational play on steel counters. With that, we reiterate our OVERWEIGHT rating on the steel sector.

Lion IndustriesMalaysian Steel Works KLPantech Group HoldingsSouthern Steel

Technology The tech companies have been pricing in a business recovery and are trading at mid-cycle valuations or higher. Generally, their current valuations are neither expensive nor cheap relative to their historical valuations. Nevertheless, we still have some SELECTIVE Buy calls in the list, hoping that the optimism in the equity market will remain high in 2010, which would then allow the technology companies to continue to expand their PERs.

CBS TechnologyEfficient E-SolutionsEng Teknologi HoldingsNotion VTec

15

17

INVESTMENT MERITS

Market leader for young 5,000bhp vessels Has a high number of LT contracts with Petronas and its PSC

contractors Earns attractive GP margins of 30%-50% despite lower charter

rates Moving into provision of 1-stop offshore marine support

services Buy with TP of RM2.99 based on PER of 12x FY10 earnings

COMPANY PROFILE

Alam Maritim (Alam) is one of the largest and established offshore marine support vessel providers in Malaysia. The company was listed on the Bursa Malaysia Main Board in July 2006. It commenced operation in 1998 as a third party vessel operator. Today, besides providing vessel services, Alam is also involved in offshore facilities construction and installation as well as underwater services. It holds a licence that qualifies it to directly bid for contracts from Petronas and its PSC contractors.

KEY HIGHLIGHTS

Largest fleet of young 5,000bhp vessels. These vessels are suitable for both shallow and deepwater use, which gives Alam wider market diversity compared to companies with vessels of higher horsepower which are mainly for the deepwater market. Also, demand for this category of vessels continues to be robust since they are easier and cheaper to operate and their specifications are adequate for most South-East Asia waters. Currently, of its fleet of 34 vessels, some 70% is of 5,000bhp ones.

Possibly holds one of the highest number of LT contracts from Petronas and its PSC contractors. Alam has employed the right strategy by locking in long-term contracts with its customers. Although charter rates are not as attractive as that for spot charter, its long-term contracts provide Alam with stable and recurring income. Of course, its success in securing these contracts also depends on its performance and track record in consistently meeting customer expectations. In addition, not only does Alam hold a vessel licence from Petronas, but all of its vessels are also Malaysian flagged, which qualifies the company to bid for new jobs on technical specifications

Attractive GP margin of 30%-50%. Although charter rates for 5,000bhp vessels have come down to a low of USD1.70-USD2.00/bhp, Alam has managed to carve out attractive GP margins of 30%-50%. However, the lower rate is only applicable to its vessels that are due for renewal and not those that are not yet due, some of which were locked in earlier at a higher rate of USD2.20-USD2.50/bhp.

Alam MaritimMoving Into 1-Stop Marine Solutions

Target : RM2.99Price : RM1.92

OIL & GAS

Stock Profile/StatisticsBloomberg Ticker AMRB MKIssued Share Capital (m) 508.3Market Capitalisation (RMm) 976.052 week H | L Price (RM) 2.02 | 0.83 Average Volume (3m) ‘000 270.6YTD Returns (%) 2.1Net gearing (x) 0.9Altman Z-Score 1.62ROCE/WACC 0.8Beta (x) 1.2Book Value/share (RM) 0.94

Major Shareholders (%)Sar Venture Holdings 50.1LTH 9.5

Share Performance (%)Month Absolute Relative1m 8.8 2.5 3m 1.5 -5.0 6m 3.7 -9.9 12m 138.0 51.8

6-month Share Price Performance

2.1

2.0

1.9

1.8

1.7Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10

18

Becoming a one-stop marine solution provider. Although vessel chartering is Alam’s core business, the company has taken the initiative to diversify its income stream to enhance shareholder value by venturing into the provision of underwater services, vessels repair and pipe-laying. Of these 3 services, only pipe-laying is new to Alam. Although still “green” in this area, Alam has partnered with Swiber to own a 300-man accommodation pipelay work barge, which is expected to be delivered in 2QFY10.

COMPANY REPORT CARD

ROE. Alam has been consistently delivering an average ROE of 20% since 2005. This was mainly contributed by its LT contracts with Petronas and its PSC contractors, which have provided stable charter rates for its vessel fleet.

Management. Alam is managed by an experienced management team comprising Dato’ Captain Ahmad Sufian (Chairman), and En. Azmi (MD). Dato’ Capt Ahmad Suffian has over 36 years’ experience in the international maritime industry, having worked with a British shipping company and MISC. En Azmi, the co-founder, has shipping experience from Nepline Bhd.

Dividend. In general, the dividend yield of most O&G companies (including Alam) is less than attractive because these are high growth companies. Hence, we believe Alam would rather retain the cash generated from its business to expand its fleet, which would bring in higher future earnings, than to make a big payout to shareholders.

RECOMMENDATION

Maintain Buy. Our target price for Alam is RM2.99 based on a PER of 12x FY10 earnings. We like the company’s sound strategy in penetrating new businesses (such as its pipelay barge) and new geographical markets such as Middle East and India, and solid financial strategy (as in using the JV option to finance its new vessels), to not only safeguard its gearing but also to instill investor confidence in the company.

Income Statement (RMm)

FYE 31 Dec FY07 FY08 FY09 FY10fTurnover 249.9 356.7 347.4 410.4Growth (%) 65.3 42.7 -2.6 18.1EBIT 86.2 136.6 116.9 158.3Pretax 68.8 107.1 117.7 158.8Net Earnings 51.0 76.4 95.8 122.7FD EPS (sen) 10.3 15.5 19.4 24.9Growth (%) 62.2 49.8 25.4 28.1NTA/Share (RM) 0.59 0.76 0.97 1.33Div (Gross) (sen) 0.5 1.0 1.0 1.0Div (Yield) (%) 0.3 0.5 0.5 0.5PER (x) 18.6 12.4 9.9 7.7P/NTA (x) 3.3 2.5 2.0 1.4

Balance Sheet (RMm)

FYE 31 Dec FY07 FY08 FY09Fixed Assets 735.4 866.9 860.1Current Assets 251.5 390.4 518.9Current Liabilities -240.1 -302.7 -328.1Others - - -Total 746.9 954.6 1050.8Share capital 121.3 123.2 126.7Reserves 167.9 251.7 353.8Shareholders’ Fund 289.2 374.9 480.6LT Liabilities 444.0 574.4 562.7Others 13.6 5.3 7.6Total 746.9 954.6 1050.8Gross Debt 574.9 635.1 641.8Net Cash/ (Debt) -456.8 -513.5 -438.7

Cash Flow Statement (RMm)

FYE 31 Dec FY07 FY08 FY09Cash Flow from Ops 63.9 2.5 71.9Cash Flow from Investing -311.8 -33.9 -8.5Cash Flow from Financing 348.3 36.1 19.8Net Increase in Cash 100.4 4.6 83.1Cash at Beginning of Year 3.4 103.8 105.7Other Changes 0.0 0.0 0.0Cash at End of Year 103.8 108.4 188.9

Alam Maritim

19

INVESTMENT MERITS

Has a long-term relationship with Pepsico Strong presence in Malaysia and overseas Sizeable and expanding product lines Extensive distribution channel

COMPANY PROFILE

The company was incorporated on 28 Feb 1978 as a private limited company under the name C.I. Holdings SB. It converted into a public company and assumed its present name C.I. Holdings Bhd on 10 Dec 1982. The company, listed on the Main Board of Bursa Malaysia on 18 Feb 1983, started as a tap ware and sanitary ware manufacturer of brand names such as Doe and Potex. In 2004, it acquired Permanis Group and evolved into a manufacturer and distributor of beverages, tap ware and ceramic sanitary ware. Under Permanis, it has an exclusive bottling appointment with Pepsico to bottle, market, sell and distribute the soft drinks under this brand. Apart from manufacturing and distributing Pepsico beverage brands, C.I. Holdings has also sells peripheral brands such as Excel, Frost and others.

KEY HIGHLIGHTS

Bottler for global soft drink brand, PepsiCo. C.I. Holdings holds the exclusive rights from PepsiCo and Seven-Up International to bottle, market, sell and distribute soft drinks under PepsiCo such as Gatorade, Tropicana, Lipton and Kickapoo as well as brands like Boss coffee, Frost and others. With a long-standing 37-year relationship with PepsiCo, we believe C.I. Holdings would be able to keep ties warm because unlike the F&N and Coca-Cola agreements, its strategy is to focus on the PepsiCo product lines while its own brands complement PepsiCo’s.

Advertising for success. For soft drinks companies, advertising is an important element driving sales. However, under the PepsiCo agreement, C.I. Holdings pays a yearly “concentrate’’ which includes “above the line” advertising that allows it to leverage on PepsiCo’s impactful advertising campaigns. For instance, its 2007 launch of the Tropicana Twister orange juice was an astounding success, boosting its fruit juice market share from 0% to 30% in Malaysia.

C.I. HoldingsThe Momentum Builds Up

Target : RM2.40Price : RM2.02

CONSUMER

Stock Profile/StatisticsBloomberg Ticker CIH MKIssued Share Capital (m) 142.0Market Capitalisation (RMm) 286.852 week H | L Price (RM) 2.23 | 0.86Average Volume (3m) ‘000 47.1YTD Returns (%) 18.1Net gearing (x) 0.3Altman Z-Score 3.20ROCE/WACC 2.0Beta (x) 0.7Book Value/share (RM) 0.27

Major Shareholders (%)Johari bin Abdul Ghani 25.4Continental Theme SB 10.4Permodalan Nasional Berhad 8.2

Share Performance (%)Month Absolute Relative1m 11.1 7.8 3m 18.8 12.1 6m 44.6 26.2 12m 110.9 38.1

6-month Share Price Performance

2.5

2.3

2.1

1.9

1.7

1.5

1.3Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10

20

Sizeable and expanding product lines. Continuous improvements are being made to C.I. Holdings’ products across all brands, particularly those in its fruit juice segment. New flavours will be added to its Tropicana Twister line to further penetrate the chilled ready-to-drink juice market. Currently, it produces orange and apple juices under the brand. The company also does not restrict itself to certain types of beverages. It is instead open to exploring new opportunities and products that complement PepsiCo brands, to meet changing demand.

Extensive distribution network. Currently, C.I. Holdings distributes its beverages to about 40,000 licensed outlets out of a beverage distribution channel of 80,000 to 90,000 outlets throughout Malaysia. The company is the exclusive beverage supplier to fast food restaurants like KFC and Pizza Hut. It is targeting to distribute to at least 42,000 outlets by end-2010.

COMPANY REPORT CARD

ROE. C.I. Holdings’ ROE has consistently remained above 14% level over the last two years. Going forward, we expect stronger ROE on the back of new product launches to capture a larger market share.

Management. C.I. Holdings is led by a strong management team. Recently, it recruited new talent from the industry, which we believe will lead C.I.Holdings to greater heights

Dividend. The company has a dividend payout policy of 30%-35%, which translates into a dividend yield of 2%-3% p.a. Management expects to maintain this going forward.

RECOMMENDATION

We are ascribing a higher target price of RM2.40 by using the composite of 12x PER over FY10 EPS. We see potential growth in its beverages segment.

Income Statement (RMm)

FYE 30 Jun FY08 FY09 FY10f FY11fTurnover 290.5 363.0 379.3 468.0Growth (%) 9.3 25.0 4.5 23.4EBIT 20.4 32.8 38.5 46.1Pretax 15.5 28.0 35.8 43.1Net Earnings 14.5 21.0 28.0 33.8FD EPS (sen) 10.2 14.8 19.7 23.8Growth (%) 84.9 44.2 33.6 20.6NTA/Share (RM) 0.71 0.92 0.95 0.87Div (Gross) (sen) 4.1 7.0 6.3 7.6Div (Yield) (%) 2.0 3.5 3.1 3.8PER (x) 19.7 13.7 10.2 8.5P/NTA (x) 2.8 2.2 2.1 2.3

Balance Sheet (RMm)

FYE 30 Jun FY07 FY08 FY09Fixed Assets 125.4 146.5 139.3Current Assets 100.2 118.0 155.6Current Liabilities -113.5 -122.3 -120.9Others 0.0 0.0 0.0Total 112.1 142.2 174.0Share capital 129.6 129.6 142.0Reserves -39.9 -25.4 -9.2Shareholders’ Fund 89.7 104.2 132.8LT Liabilities 21.4 36.7 40.1Others 1.0 1.3 1.1Total 112.1 142.2 174.0Gross Debt 74.0 83.6 78.4Net Cash/ (Debt) -65.3 -66.5 -38.5

Cash Flow Statement (RMm)

FYE 30 Jun FY07 FY08 FY09Cash Flow from Ops 29.3 -8.6 2.3Cash Flow from Investing -8.8 -4.6 -9.4Cash Flow from Financing -17.3 -11.1 -3.2Net Increase in Cash 3.2 -2.1 -10.3Cash at Beginning of Year 3.6 12.4 37.6Other Changes 0.0 0.0 0.0Cash at End of Year 6.7 10.3 27.2

C.I. Holdings

21

INVESTMENT MERITS

A good balance of defensive and high growth businesses Potential M&A to boost earnings Sizeable growth potential overseas Potential upside on dividend Attractive and cheap valuation

COMPANY PROFILE

Faber holds a 15-year concession to provide healthcare facilities management services to 78 government hospitals in the northern (Perlis, Kedah, Penang and Perak) and East Malaysia (Sabah and Sarawak) regions. The concession expires in 2011. The services are facilities engineering maintenance, bio-medical facilities engineering maintenance, clinical waste management, linen & laundry services and cleansing services. Faber also provides facilities management services to non-healthcare operations locally and overseas, where it has secured several contracts totaling RM200m p.a. over the next few years. Faber is also an established property developer and has successfully developed Taman Desa and its surrounding areas. The Group is currently developing a 100-acre township in Kepong called Laman Rimbunan.

KEY HIGHLIGHTS

More growth in UAE and India. Its FY09 earnings were significantly boosted by the Integrated Facilities Management (IFM) business in UAE, particularly from low-cost housing and infrastructure facilities contracts which started contributing in 2H09. With about RM110m out of the RM220m in indicative annual contract value billed and recognized, work on the remaining contracts should be completed in FY10, with a further RM30m already billed in January this year alone. As expected, we gather that the “low cost housing” contract has been extended for another year, and anticipate the same for the infrastructure facilities contract in due course. Although Faber’s India IFM business contributed only RM20m in revenue in FY09, the earnings outlook is favorable given the substantial growth potential both in the country’s healthcare and non-healthcare segments.

Better year for property division. After a weak performance by its property division, mainly attributed to the economic slowdown and anaemic property market, Faber’s property division is expected to perform better from FY10 onwards attributed to its upcoming launches and a recovery in the property market. Faber currently has unbilled sales of RM30m in the property segment and is expected to launch three projects this year with an estimated GDV of RM495m, with the first expected to be launched by 2QFY10. Currently Faber has 43 acres of landbank in the Klang Valley and Sabah, and is in talks to acquire several parcels of land. The company is also likely to participate in the tender for Government land, either on its own or through joint ventures.

Faber GroupStriking a Good Balance

Target : RM2.75Price : RM2.52

CONGLOMERATE

Stock Profile/StatisticsBloomberg Ticker FAB MKIssued Share Capital (m) 363.0Market Capitalisation (RMm) 914.852 week H | L Price (RM) 2.57 | 0.75Average Volume (3m) ‘000 1652.4YTD Returns (%) 56.5Net gearing (x) Net CashAltman Z-Score 2.81ROCE/WACC 1.2Beta (x) 1.7Book Value/share (RM) 0.97

Major Shareholders (%)Khazanah Nasional 34.3Universal Trustee 23.42