Toolkit Entry of Foreign Investors in India Aug26 v5 of Foreign... · Types of Foreign...

Transcript of Toolkit Entry of Foreign Investors in India Aug26 v5 of Foreign... · Types of Foreign...

FOREIGN PARTICIPATION IN INDIA

Contents

1. Setting up Business in India

1.1. Overview

2. Types of Foreign Participation

2.1. Overview

2.2. Understanding investors/ instruments

2.2.1 Foreign portfolio investors

2.2.2 Foreign venture capital investors

2.2.3 Depository receipts

2.2.4 NRI/PIO investors

2.2.5 Investment vehicles

2.2.5.1. Infrastructure Investment Trusts (InvITs)

2.2.5.2. Real Estate Investment Trusts (REITs)

2.2.5.3. Alternate Investment Funds

3. Foreign Direct Investment in India

3.1. Understanding FDI

3.2. Prohibited Sectors

3.3. Institutional Set-up

3.4. Eligible Investors

3.5. Eligible Investee Entities

3.6. Types of Instruments for FDI

3.7. Sectoral Caps (%) and Entry Routes

3.8. Reporting requirements

3.9. Issue and Transfer of Shares

3.10. Conversion of ECB/Lump sum fee/Royalty etc. into Equity

3.11. Repatriation of dividends and interest

3.12. Remittance of proceeds from sale and winding up

4. Frequently Asked Questions (FAQs)

FOREIGN PARTICIPATION IN INDIA

Abbreviations (1/3)

Act or the Act Companies Act, 2013

AD Authorised Dealer

AF Angel Fund

ADR American Depository Receipts

AIF Alternative Investment Fund

BO Branch Office

CA Chartered Accountant

CCEA Cabinet Committee on Economic Affairs

CCFI Cabinet Committee on Foreign Investment

CCS Cabinet Committee on Security

CoI Certificate of Incorporation

DDT Dividend Distribution Tax

DEA Department of Economic Affairs

DP Depository Participant

DR Depository Receipt

DSIM Department of Statistics and Information Management

ECB External Commercial Borrowing

EXIM Export-Import

FCCB Foreign Currency Convertible Bond

FCNR (B) Foreign Currency Non-Resident Account

FDI Foreign Direct Investment

FEMA Foreign Exchange Management Act

FII Foreign Institutional Investor

FIPB Foreign Investment Promotion Board

FPI Foreign Portfolio Investor

FVCI Foreign Venture Capital Investor

FOREIGN PARTICIPATION IN INDIA

Abbreviations (2/3)

GDR Global Depository Receipts

GoI Government of India

InvITs Infrastructure Investment Trusts

JV Joint Venture

KYC Know Your Customer

LLP Limited Liability Partnership

LO Liaison Office

MoA Memorandum of Association

MoU Memorandum of Understanding

NBFC Non-Banking Financial Corporation

NGO Non-Government Organization

NOC No Objection Certificate

NPO Non-Profit Organization

NRE Non-Resident Entity

NRE Account Non-Resident (External) Rupee Account

NRI Non-Resident Indian

NRO Account Non-Resident Ordinary Rupee Account

PAN Permanent Account Number

PIB Press Information Bureau

PIO Person of Indian Origin

PO Project Office

PSU Public Sector Undertaking

RBI Reserve Bank of India

REIT Real Estate Investment Trust

RoC Registrar of Companies

FOREIGN PARTICIPATION IN INDIA

Abbreviations (3/3)

SEBI Securities and Exchange Board of India

SEZ Special Economic Zone

SIA Secretariat for Industrial Assistance

SME Small and Medium-sized Enterprise

SMS Short Message Service

TDR Transferable Development Rights

TDS Tax Deducted at Source

VAT Value-Added Tax

VC Venture Capital

WOS Wholly-owned Subsidiary

FOREIGN PARTICIPATION IN INDIA

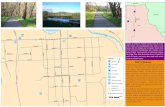

Setting up Business in India

EntryofForeign InvestorsinIndia

AnIndianCompany

JointVenture

WhollyOwned

Subsidiary

AForeignCompany*

LiaisonOffice

BranchOffice

ProjectOffice

LimitedLiabilityPartnership

LLP

Foreign Investor can commence business in India as:

OR

*Incorporate company in Indias.t. sectoral caps andrequisiteapprovals

JV as (i) PrivateLimited or (ii) PublicLimited Company,s.t. Companies Act,2013

Permissible in sectorswhere 100% FDI ispermitted

To representparent companyin India

Activities suchas Export Importof goods;research,consultancy etc.

Activities as percontract toexecute project

OR

Subject toprovisions ofLLP Act, 2008

FDI permittedunderautomaticroute in LLPsoperating insectors/activities where 100%FDI is allowed,through theautomaticroute andthere are noFDI-linkedperformanceconditions

RBI guidelines regarding establishment of LO/BO/PO: https://rbi.org.in/Scripts/NotificationUser.aspx?Id=10398&Mode=0

FOREIGN PARTICIPATION IN INDIA

Foreign participation in India

Investment in unlisted/ listed companies (except

through Stock Exchange)

Investment in listed companies

through stock exchange

ADRs and GDRs*

Investment Vehicle (REITs, INVITS, AIF)

Foreign Direct Investment

(FDI)

Foreign Venture Capital Investor

Foreign Portfolio

Investors (FPI)

Investment by NRIs/

PIOs

Repatriable Non- repatriable

Note: An investor can participate in Indian economy by either commencing business in India (forms explainedearlier in slide 7) via, say the FDI route as outlined above or can invest in the financial markets via a host ofavailable financial instruments. A few of these have been enumerated in the subsequent slides. In particular, FDIhas been explained in detail in Section 3 of this document.

Overview of Foreign Participation

FOREIGN PARTICIPATION IN INDIA

Types of Foreign ParticipationUnderstanding Investors/ Instruments

Foreign Portfolio Investors

(FPI)

• Under the SEBI FPI Regulations,2014, Foreign Institutional Investors(FIIs) or sub accounts and QualifiedForeign Investors (QFIs) weremerged into a single category,referred to as FPIs

• Category I FPI- Government andGovernment related investors;Category II FPI – broad based funds,banks, asset managementcompanies , university and pensionfunds etc; Category III FPI- otherssuch as charitable societies, trusts,foundations etc.

• Purchase of equity shares of eachcompany by a single FPI or aninvestor group shall be below 10% oftotal issued capital of the company

• No person can buy, sell or deal in securities as FPIunless obtained a Certificate of Registrat ion from aDesignated Depository Participant (on behalf ofSEBI)- Application in Form A along with prescribedfees

• Eligib ility- Conditions such as person non resident inIndia, not a NRI; applicant resident of country whosesecurities market regulator signatory to InternationalOrganization of Securities Commission's MultilateralMoU or a signatory to bilateral MoU; applicant legallypermitted to invest in securities outside the countryof its incorporation ; track record of applicant etc.

• Bank Account: Appoint a branch of a bank authorizedby RBI for opening a foreign currency denominatedaccount and special Non Resident Rupee accountbeforemaking any investments in India

• Compliancewith acts, rules and regulations issued byDesignated Depository Participant or SEBI

Comments

FOREIGN PARTICIPATION IN INDIA

Types of Foreign ParticipationUnderstanding Investors/ Instruments

ForeignPortfolioInvestors(FPI)

A FPI is permitted to invest only in the following securities:

a) Securities in the primary and secondary markets including shares, debentures and warrants of companies, listed or to be listed on a recognized stock exchange in India;

b) Units of schemes floated by domestic mutual funds, whether or not listed on recognized stock exchange

c) Units of schemes floated by a collective investment scheme;d) Derivatives traded on a recognized stock exchange;e) Treasury bills and dated government securities;f) Commercial papers issued by an Indian company;g) Rupee denominated credit enhanced bonds;h) Security receipts issued by asset reconstruction companiesi) Perpetual debt instruments and debt capital instruments, as specified by

the RBIj) Listed and unlisted non-convertible debentures/bonds issued by an

Indian company in the infrastructure sector k) Non-convertible debentures or bonds issued by NBFC categorized as

‘Infrastructure Finance Companies’(IFCs) by RBIl) Rupee denominated bonds or units issued by infrastructure debt funds;m) Indian depository receipts; andn) Such other instruments specified by the Board from time to time.

Permissiblesecurities

FOREIGN PARTICIPATION IN INDIA

Types of Foreign ParticipationUnderstanding Investors/ Instruments

Foreign Venture Capital Investor

• Venture capital fund means aFund established in the form ofa Trust, a company including abody corporate and registeredunder SEBI (Venture CapitalFund) Regulations, 1996, which(i) has a dedicated pool ofcapital; (ii) raised in the mannerspecified under the Regulations;and (iii) invests in accordancewith the Regulations

• Regulated under the SEBI (Foreign VentureCapital Investor) Regulations, 2000

• Considerations for Eligibility: applicant’s trackrecord financial soundness and competency;approval by RBI; whether investment company/trust/ pension fund/ mutual fund etc.

• Conditions and criteria : Disclose strategy toSEBI, at least 66.67% investable funds inunlisted equity shares/ equity linkedinstruments

• Registration Cert ificate: Applicat ion to SEBI inForm A along with the application fee

• Appoint a domestic custodian and bank

• Compliance requirement- Maintain books ofaccounts, records, records and documents for 8years

Comments

FOREIGN PARTICIPATION IN INDIA

Types of Foreign ParticipationUnderstanding Investors/ Instruments

Depository Receipts

• Negotiable securities representing INRdenominated equity shares (held as adeposit by custodian bank) of acompany

• Issued outside of India by a Depositorybank on behalf of the company

• Traded on stock exchanges in U.S.,Singapore, Luxembourg etc. - DRs listedand traded in US markets- AmericanDepository Receipts (ADRs), elsewhereGlobal Depository receipts (GDRs)

• Governed by FEMA notification 330/2014-RB, issued by RBI

• A person can issue DRs, if it is eligible toissue eligible instruments to person residentoutside India under Schedules 1, 2, 2A, 3, 5and 8 of Notification No. FEMA 20/2000-RBdated May 3, 2000, as amended from timeto time.

• The eligible securities shall not be issued ortransferred to a foreign depository for thepurpose of issuing DRs at a price less thanthe price applicable to a correspondingmode of issue or transfer of such securitiesto domestic investors under FEMA, 1999 asamended from time to time.

• DRs issued shall be reported to RBI inprescribed formats

Comments

FOREIGN PARTICIPATION IN INDIA

Types of Foreign ParticipationUnderstanding Investors/ Instruments

InvestmentbyNRIs/PIOs

• Major accounts permitted for Non-Resident include: NRE, NROand FCNR (B) accounts- Prior approval of RBI for accounts byindividuals/ entities of Pakistan and Bangladesh

• NRI can invest in capital of Indian companies on non-repatriation basis provided: (i) Amount is invested by inwardremittance or out of NRE/FCNR(B)/NRO account maintainedwith Authorized Dealers/Authorized banks (ii) entity is notengaged in agricultural/plantation or real estate business orprint media sector (iii) amount invested not eligible forrepatriation outside India

• For investments on repatriable basis, provisions of FDI policyapply

• Individual holding is restricted to 5 per cent of the total paid-up capital both on repatriation and non-repatriat ion basis andaggregate limit cannot exceed 10 per cent of the total paid-upcapital both on repatriation and non-repatriation basis.However, NRI holding can be allowed up to 24 per cent of thetotal paid-up capital both on repatriation and non-repatriationbasis provided the company passes a special resolution

• NRIs residents in Nepal and Bhutan permitted to invest in thecapital of Indian companies on repatriation bas is, s.t. conditionthat the amount of consideration for such investment shall bepaid only by way of inward remittance in free foreign exchangethrough normal banking channels.

• A ‘Non-resident Indian’ (NRI) is aperson resident outside India who is acitizen of India.

• A ‘Person of Indian Origin (PIO)’ is aperson resident outside India who is acitizen of any country other thanBangladesh or Pakistan or such othercountry as may be specified by theCentral Government, satisfying thefollowing conditions: (i) Who was acitizen of India by virtue of theConstitution of India or the CitizenshipAct, 1955 (57 of 1955); or (ii) Whobelonged to a territory that becamepart of India after the 15th day ofAugust, 1947; or (iii) Who is a child ora grandchild or a great grandchild of acitizen of India or of a person referredto in clause (a) or (b); or (iv) Who is aspouse of foreign origin of a citizen ofIndia or spouse of foreign origin of aperson referred to in clause (a) or (b)or (c). PIO included Overseas Citizenof India (OCI)

FOREIGN PARTICIPATION IN INDIA

Types of Foreign ParticipationUnderstanding Investors/ Instruments

Investment Vehicles

Infrastructure Investment Trusts (InvITs)• Governed by the SEBI (InvIT) Regulations, 2014

• Structure: Sponsor; trustee, Investment manager and projectmanager

• Cumulative project size ≥ INR 500 cr;

• Issue size ≥ INR 250 cr

• Sponsors to set up InvTS (max 3); 3 years min lock in periodfor sponsors

• Minimum distribution- 90% of distributable cash flow ofInvITs/ SPVs

• Permitted for any project in infrastructure sector- (as definedby vide Ministry of Finance Notification dated Oct. 2013 andany amendments/additions made thereof)

• Foreign investmentspermitted underAUTOMATIC ROUTE

• An entity registered/ incorporated inand a citizen ofPakistan/Bangladesh notpermitted

FOREIGN PARTICIPATION IN INDIA

Types of Foreign ParticipationUnderstanding Investors/ Instruments

Investment Vehicles Real Estate Investment Trusts (REITs)

• Governed by the SEBI (REITs) Regulations, 2014

• Set up as a trust under Indian Trusts Act, 1882 and registeredwith SEBI

• Parties: Sponsor, Manager and Trustee (registered with SEBI)

• Investments directly or indirectly through SPVs (must haveholding interest)- cannot invest in vacant or agriculture land ormortgages other than mortgage backed securities

• Mandatory distribution of at least 90% of net distributable cashflows to investors on a half yearly bas is and at least 90% of thesale proceeds from sale of assets to unit holders, unlessreinvested in another property.

• Foreigninvestmentspermitted underAUTOMATICROUTE

• An entityregistered /incorporated inand a citizen ofPakistan/Bangladesh notpermitted

FOREIGN PARTICIPATION IN INDIA

Types of Foreign Participation Understanding Investors/ Instruments

Investment Vehicles

Alternative Investment Funds (AIFs)• Governed by the SEBI (AIFs) Regulations, 2012

• Certificate of registration from SEBI

• Pooling or raising of private capital from institutional or high net worthindividuals (HNI) and include private equity fund, venture capital fund, angelinvestors, etc.

• Key conditions- Min size of AIF - INR 200 mn; Minimum investment amount byan investor should be 0.1% of the fund size, subject to a minimum of INR 10million; min 5% investment from sponsor (locked-in)

• 3 categories• Category I- invest in start-up or early stage ventures or social ventures or

SMEs or infrastructure. Includes venture capital funds, SME funds, socialventure funds, infrastructure funds, angel funds, etc.;

• Category II- private equity funds or debt funds for which no specificincentives or concessions are given by the government or any otherregulator;

• Category III- hedge funds, open ended funds etc. which employ diverse orcomplex trading strategies and may employ leverage including throughinvestment in listed or unlisted derivatives

• ‘Control’ of the AIF should be in the hands of ‘sponsors’ and ‘managers/investment managers’, with the general exclusion of others

• ForeigninvestmentspermittedunderAUTOMATICROUTE

• An entityregistered /incorporatedin and acitizen ofPakistan/Bangladeshnot permitted

FOREIGN PARTICIPATION IN INDIA

Foreign Direct Investment (FDI) in IndiaUnderstanding FDI

• Foreign Direct Investment (FDI) means investment by non-resident entity/person resident outside

India in the capital of an Indian company

• FDI entails acquiring a “lasting interest” outside of the economy of the investor and includes

capital investments from abroad in the productive capacity of a Nation in the form of:

– (i) incorporating a wholly owned subsidiary or company anywhere

– (ii) acquiring shares in an associated enterprise

– (iii) merger or an acquisition of an unrelated enterprise

– (iv) equity joint venture with another investor or enterprise

• Government of India has permitted foreign investment in almost all sectors with a few

exceptions, for instance in sectors such as atomic energy, lottery business, and chit funds etc.

where FDI is completely prohibited.

• For other sectors, FDI is either 100% permitted or partially permitted.

• In the permitted sectors, subject to sectoral caps, FDI may be via 2 routes:

– (i) Automatic route or

– (ii) Government route i.e. where prior approval of GoI is required.

FOREIGN PARTICIPATION IN INDIA

Foreign Direct Investment (FDI)Prohibited Sectors

Lottery Business including Government/private

lottery, online lotteries , etc.*

Gambling and Betting including casinos* Chit funds Nidhi company

Trading in Transferable Development Rights (TDR)

Real Estate Business or Construction of farm

houses*

Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

Sectors not open to private sector investment-

atomic energy, railway operations (other than

permitted activities mentioned in para 5.2, Consolidated FDI policy,

June 07, 2016)

• Notes

• *Foreign technology collaboration in any form including licensing for franchise, trademark, brand name,management contract is also prohibited for Lottery Business and Gambling and Betting activities

• **Real estate business shall not include development of townshops, construction of resident ial/ commercialpremises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI(REITs) Regulations, 2014

FOREIGN PARTICIPATION IN INDIA

Foreign Direct Investment (FDI) in IndiaInstitutional and Regulatory Set-up

• FDI in India is regulated under Schedule 1 of Foreign Exchange Management (Transfer or Issue

of Security by a Person Resident Outside India) Regulations,2000 (Original notification is

available at https://rbi.org.in/Scripts/BS_FemaNotifications.aspx?Id=174; Subsequent

amendment notifications are available at https://rbi.org.in/Scripts/BS_FemaNotifications.aspx)

• Besides Foreign Exchange Management Act, 1999, FDI is subject to other regulations as per

Reserve Bank of India (RBI), Foreign Investment Promotion Board (FIPB) (DEA, Ministry of

Finance) and Department of Industrial Policy and Promotion (Ministry of Commerce and

Industry)

• FIPB comprises of (i) Secretary to Government, Department of Economic Affairs, Ministry of

Finance- Chairperson; Secretary to Government, Department of Industrial Policy and

Promotion, Ministry of Commerce and Industry; Secretary to the Government, Department of

Commerce, Ministry of Commerce and Industry; Secretary to Government, Economic Relations,

Ministry of External Affairs

• The procedural instructions are issued by the Reserve Bank of India vide A.P. (DIR Series)

Circulars. The regulatory framework, over a period of time, thus, consists of Acts, Regulations,

Press Notes, Press Releases, Clarifications, etc.

• The level of approvals for cases under the Government route are summarized below:

Equity inflow of and below INR 5000 crore

Equity inflow of more than INR 5000 crore

Minister of Finance (in-charge of FIPB)

Cabinet Committee on Economic Affairs (CCEA)

Government Approval Route

+ Cases referred to CCEA by FIPB

FOREIGN PARTICIPATION IN INDIA

• Plain paper applications carrying all relevant details are also accepted. Application can be made in Form FC-IL, whichcan be downloaded from http://www.dipp.gov.in - No fee is payable• Link to Forms

Intimation to RBI by AD-Category I bank on receipt of FDI

Foreign Direct Investment (FDI) in IndiaApplication for FIPB Approval

1•Online registration at: http://fipb.gov.in/Public/ApplicantRegister.aspx

2

•Submission of duly signed printout of the application with following prescribed documents to Facilitation Counter, North Block within 10 days of electronic submission•Illustrative list of documents required :

•Summary of proposal on company (applicant) letterhead, Certificate of Incorporation (COI), Memorandum of Association(MoA), Board Resolution, Audited Financial Statement and Income Tax Return of Last Financial Year, Article of Association, LLP Draft; LLP Agreement, Passport Copy/ Identification Proof etc. (list at http://fipb.gov.in/FIPB_FAQ.aspx)

3

•As soon as the physical copy of proposal and documents are received, user will receive email/sms alerts and proposal will be forwarded to FIPB for further processing. During the processing stage user will get email/sms alert at specific stages .

4•Application discussed and decision taken in FIPB meeting

5•Decision communicated to applicant via Press Release or Approval/ rejection Letters

FOREIGN PARTICIPATION IN INDIA

Any Non resident Entity can invest subject to FDI policy (except in prohibited sectors)

NRI resident in and Citizens of Nepal & Bhutan permitted to invest on repatriation basis (amount of consideration for such investment shall be paid only by way of inward remittances through normal banking channels)

Erstwhile OCBs incorporated outside India can make fresh FDI investments as incorporated non-resident entities (prior approval of GoI if through Government route; RBI if through Automatic route)

Company, trust or partnership firm incorporated outside India and owned and controlled by NRIs

Foreign Institutional Investors (FII) and Foreign Portfolio Investors (FPI)

Registered FIIs/ FPIs/ NRIs as per Schedules 2, 2A and 3respectively of Foreign Exchange Management (Transfer orIssue of Security by a Person Resident Outside India)Regulations, 2000 can invest /trade through a registeredbroker of Indian Companies on recognized stock exchanges

SEBI registered Foreign Venture Capital Investor (FVCI)

• Citizen of Bangladeshor an entityincorporated inBangladesh can investonly under Governmentroute

• Citizen of Pakistan orentity incorporated inPakistan can invest onlyunder Governmentroute in sector/activities other thendefense, space &atomic energy andprohibited sector/activities

• FII and FPIs may investin capital of Indiancompanies under thePortfolio InvestmentScheme which limitsindividual holding tobelow 10% andaggregate limit ofFII/FPI investment to24% (this may beincreased to thesectoral cap throughresolution of Board ofDirectors followed by aSpecial Resolution)

Foreign Direct Investment (FDI) in IndiaEligible Investors

FOREIGN PARTICIPATION IN INDIA

Indian Companies can issue capital against FDI

NRI/PIO resident outside India can invest in Partnership Firm/

Proprietary Concern

Non Repatriation Basis

• Amount investedauthorized dealer/authorized banks

• Firm/ proprietaryconcern not engaged inagricultural/plantation/real estate business/ printmedia sector

• Amount invested noteligible for repatriationoutside India

• Investment byNRI/PIO/OCI on nonrepatriable bas is to betreated as domesticinvestment

Repatriation Basis

• Prior permission of RBI –application to bedecided in consultationwith the GoI

Non Residents (other than NRI/PIO) can invest in

Partnership Firm/ Proprietary Concern

• Make an application andseek prior approval ofRBI for makinginvestment in capital of afirm or proprietorshipconcern or anyassociation of persons inIndia

• NRI/PIO not allowed toinvest in f irm/proprietorship concernnot engaged inagricultural /plantationor real estate business orprint media sector

Foreign Direct Investment (FDI) in India Eligible Investee Entities

FOREIGN PARTICIPATION IN INDIA

Trusts

• FDI not permitted intrusts other than VCFregistered and regulatedby SEBI and ‘InvestmentVehicle’

Limited Liability Partnerships (LLPs)

• FDI permitted underautomatic route in LLPsin sectors where 100%FDI allowed throughautomatic route andthere are no FDI linkedperformance conditions

• FDI in LLP s.t.compliance of conditionsof the LLP act

Investment Vehicle

• Investment vehicleregistered and regulatedunder relevantregulations framed bySEBI or any otherauthority designated forthe purpose (incl. REITs,Invites, AIFs etc.)permitted to receiveforeign investment fromperson resident outsideIndia

Foreign Direct Investment (FDI) in IndiaEligible Investee Entities

FOREIGN PARTICIPATION IN INDIA

• FCCBs/DRs may be issued in accordance with Schemefor issue of Foreign Currency Convertible Bonds,Ordinary Shares (Through Depository ReceiptMechanism) Scheme, 1993 and DR Scheme 2014respectively, as per the guidelines issued by the GoI• A person can issue DRs, if it is eligible under Schedules

1, 2, 2A, 3, 5 and 8 of Notification No. FEMA 20/2000-RB dated May 3, 2000• Under FEMA 1999, price of eligible securities for purpose

of issuing DR should not be less than the price of acorresponding mode of issue or transfer of suchsecurities to domestic investors

Equity

DRs and FCCBs

Others

• Indian companies can issueEquity Shares; FullyCompulsorily andMandatorily ConvertibleDebentures and Fully,Compulsorily andMandatorily ConvertiblePreference Shares

• Price at the time of conversion should not be less thanthe fair value worked out at the time of issuance• Optionality clauses allowed s.t. conditions :

• Minimum lock-in period: 1 year• Exit (s.t. FDI policy provis ions) without any assured

return

Comments

• Issue of Depository Receiptsand Foreign CurrencyConvertible Bonds countedtowards FDI

Other types of Preference shares/Debentures i.e. non-convertible, opt ionally convertible or part ially convertible forissue of which funds have been received on or after May 1, 2007 are cons idered as debt- Hence, norms related toECB apply

• Warrants and Partly PaidShares

• s.t. T&C as stipulated by RBI in this behalf from time totime

Foreign Direct Investment (FDI) in India Types of Instruments for FDI

FOREIGN PARTICIPATION IN INDIA

Sector/Activity

AutomaticApproval

GovernmentApproval Notes

Agriculture&AnimalHusbandry

100

• Floriculture, Horticulture, Apiculture and Cultivation of Vegetables &Mushrooms under controlled conditions

• Development and Production of seeds and planting material• Animal Husbandry (including breeding of dogs), Pisciculture,

Aquaculture• Services related to agro and allied sectorsBesides the above, FDI not allowed in any other agricultural sector/activity**PIB print release dated 20 June, 2016: FDI in Animal Husbandry(including breeding of dogs), Pisciculture, Aquaculture and Apiculture-requirement of 'Controlled Conditions' removed

Plantation 100

• Tea sector including tea plantations• Coffee plantations• Rubber plantations• Cardamom plantations• Palm oil tree plantations• Olive oil tree plantationsBesides the above, FDI not allowed in any other plantation sector/activity

Mining 100 *Miningandmineralseparationoftitaniumbearingmineralsandores,itsvalueadditionandintegratedactivities– 100%,GovernmentRoute

For detailed clarifications/ exceptions, please refer to Consolidated FDI Policy, effective from June 07, 2016

Foreign Direct Investment (FDI) in India Sectoral Caps (%) and Entry Routes

FOREIGN PARTICIPATION IN INDIA

Sector/ ActivityAutomatic Approval

Government Approval

Notes

Petroleum and Natural Gas

100*Petroleum refining by the PSU without any disinvestment or dilution of domestic equity in existing PSUs – 49%, Automatic

Trading of Indian produced/manufactured food products.

100100% FDI under the government route is allowed for trading, including through e-commerce, in respect of food products manufactured and/or produced in India.

Broadcasting Content Services

0 49*Up-linking of Non-‘News & Current Affairs’ TV Channels/ Down-linking of TV Channels- 100%, Automatic

Defence 49 100

*Above 49% under the Government approval route on case to case basis (Wherever it is likely to result in access to modern technology or for other reasons to be recorded)

**PIB print release dated 20 June, 2016: Condition of state-of-art technology removed; FDI limit also made applicable to Manufacturing of Small Arms and Ammunitions covered under Arms Act 1959

For detailed clarifications/ exceptions, please refer to Consolidated FDI Policy, effective from June 07, 2016

Foreign Direct Investment (FDI) in India Sectoral Caps (%) and Entry Routes

FOREIGN PARTICIPATION IN INDIA

Sector/ ActivityAutomatic Approval

Government Approval

Notes

Print Media- Newspapers, Periodicals, Indian Editions of Foreign Magazines

26

Print Media- Scientific/ Technical Magazines, Specialty Journals; Facsimile editions of foreign newspapers

100

Civil Aviation - Greenfields/ Brownfields

100

Air Transport Services- Scheduled Air Transport Service/ Domestic Scheduled Passenger Airline; Regional Air Transport Service

49 100

Foreign Airlines allowed to invest in capital of Indian companies, operating scheduled and non-scheduled air transport services, up to the limit of 49% of their paid-up capital

Air Transport Services- Non Scheduled Air Transport Service/ Helicopters services/ seaplane services requiring DGCA approval

100

Other Services under Civil Aviation Sector

100

Foreign Direct Investment (FDI) in India Sectoral Caps (%) and Entry Routes

FOREIGN PARTICIPATION IN INDIA

Sector/ ActivityAutomatic Approval

Government Approval

Notes

Construction Development: Townships, Housing, Built-up Infrastructure

100FDI not permitted in entity engaged or proposes to engage in real estate business, construction of farm houses and trading in transferable development rights (TDRs)

Satellites – Establishment and Operations

100

Private Security Agencies 49 74

Telecom Services 49 100

Trading 100

E-Commerce Activities 100

• 100% FDI under automatic route is permitted in marketplace model of e-commerce

• FDI is not permitted in inventory based model of e-commerce

Single Brand Product Retail Trading

49 100

PIB print release dated 20 June, 2016: Local sourcing norms and sourcing regime for entities in this sector, and having “state-of-art and cutting edge technology” conditions have been relaxed for 3 years and 5 years respectively

Multi Brand Retail Trading

51In specified states

Foreign Direct Investment (FDI) in India Sectoral Caps (%) and Entry Routes

FOREIGN PARTICIPATION IN INDIA

Sector/ ActivityAutomatic Approval

Government Approval

Notes

Duty Free Shops 100• Duty Free Shop entity shall not engage into any retail

trading activity in the Domestic Tariff Area of thecountry

Railway Infrastructure 100

• Proposals involving FDI beyond 49% in sensit ive areasfrom security point of view, will be brought by theMinistry of Railways before the Cabinet Committee onSecurity (CCS) for consideration on a case to case basis

Credit Information Companies

100

Infrastructure Companies in Securities Market

49• No non-resident investor/ entity, including persons

acting in concert, will hold more than 5% of the equityin commodity exchanges

Insurance 49

Pension Sector 49

Power Exchanges 49• No non-resident investor/ entity, including persons

acting in concert, will hold more than 5% of equity inthese companies

Foreign Direct Investment (FDI) in India Sectoral Caps (%) and Entry Routes

FOREIGN PARTICIPATION IN INDIA

Sector/ ActivityAutomatic Approval

Government Approval

Notes

White Label ATM Operations

100

Non Banking Financial Institutions

100

Pharmaceuticals -Greenfields

100

Pharmaceuticals -Brownfields

74 100

Asset Reconstruction Companies

100

Banking - Private Sector 49 74• Except in regard to a wholly-owned subsidiary / branch

office of a foreign bank

Banking - Public Sector 20

Foreign Direct Investment (FDI) in India Sectoral Caps (%) and Entry Routes

FOREIGN PARTICIPATION IN INDIA

Foreign Direct Investment in India

33

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

TradingofFoodproductsmanufacturedorproducedin…

PrintMedia- Newspapers,Periodicalsetc.

Satellites– EstablishmentandOperations

Banking- PublicSector

AirTransportServices- ScheduledAirTransportService/…

TelecomServices

Banking- PrivateSector

Insurance

PowerExchanges

Agriculture&AnimalHusbandry

Mining

BroadcastingCarriage Services

AirTransportServices- NonScheduledAirTransport…

ConstructionDevelopment:Townships,Housing,Built-…

Trading

DutyFree Shops

AssetReconstructionCompanies

WhiteLabelATMOperations

Pharmaceuticals- Greenfields

Automatic

GovernmentApproval

NoFDI

Sectoral Caps and Entry Routes*

*Pl. refer to latest FDI policy for exceptions/ clarifications

FOREIGN PARTICIPATION IN INDIA

• Report the details of amount of cons iderat ion to the Regional RBI office within 30 days of receipt inthe Form ARF through an AD Category I bank with the following documents

• Foreign Inward Remittance Certificate (FIRC) evidencing receipt and KYC report of the non residentinvestor from overseas bank remitting the amount

• Report acknowledged by the regional Office which will allot lot a UIN for amount reported

Inflow

• File Form FC-GPR not later than 30 days from date of issue of shares• Signed by MD, Director, Secretary of the company (CS) and submitted to AD of the bank along

with following documents:• Certificate from CS; Certificate from SEBI registered Merchant Banker or Chartered Accounts

Issue of Shares

• Submit Form FC-TRS to AD Category I bank within 60 days from date of receipt of amount ofconsideration

• Onus of submission on transferor/ transferee resident in India; and on investee company in caseNon Resident investor (including NRI) acquires stock on stock exchange

Transfer of Shares

Issue of shares against conversion of ECB• Full conversion of ECB into equity- Form FC-GPR to RBI regional office and Form ECB-2 to

Department of Statistics and Information Management (DSIM), RBI within 7 working days fromclose of corresponding month

• Partial convers ion of ECB- Form FC-GPR to RBI regional office and Form ECB-2 with “ECB partiallyconverted to equity” indicated on top of form. In subsequent months, the outstanding balance ofECB shall be reported in Form ECB-2 to DSIM

Non-Cash

• Domestic custodian shall report issue/ transfer of sponsored/ unsponsored DR as per DR Scheme2014 in Form DRR within 30 days of close of issue/ program

FCCB/ DR

issues

Foreign Direct Investment (FDI) in India Reporting Requirements

FOREIGN PARTICIPATION IN INDIA

Foreign Direct Investment (FDI) in India Reporting Requirements

35

Entry of Foreign Investor in India

Funds Received from Foreign Entity

Advance Remittance Form

(ARF)

Allocation of Shares

Form FC-GPR

30 Days 180 Days

30 Days

Illustration: Documents for FormFC-GPR• Unique Identification Number fromRBI• KYC report for the beneficiary• CS certificate• Certificate from SEBI registeredMerchantBanker / CharteredAccountant• Disclaimer Certificate• Statutory AuditorCertificate• Board resolution• LRN (Loan Registration Number)• Copy of FIPB approval (if required)• Details of Transferof shares if any• No objection certificate from the remitter

etc.

Illustration: Documents for ARF • Certificate from the bank

evidencing the receipt of theremittance.

• KYC report on the non-residentinvestor from the overseas bankremittingthe amount

FOREIGN PARTICIPATION IN INDIA

Foreign Exchange Management (Transfer or Issue of Security by Persons Resident Outside India) Regulations, 2000 (notification No. FEMA20/2000-RB dated May 3, 2000)

Issue of Shares • Capital instruments should be issued within 180 days from day of receipt of

inward remittance; else refunded immediately to the non-resident investor byoutward remittance through normal banking channels or by credit toNRE/FCNR (B) account

• Issue priceof shares

• Listed on recognized stock exchange in India- not less than price workedout in accordance with SEBI guidelines

• Not listed on any stock exchange in India- not less than fair valuationdone by SEBI registered Merchant Banker or a Chartered Accountant asper any internationally accepted pricing methodology on an arm’s lengthbasis

• Preferential allotment- as per the pricingguidelines laiddown by RBI

Issue and Transfer of Shares

FOREIGN PARTICIPATION IN INDIA

Transfer of

Shares • General permission granted to non-residents/ NRIs for acquisition of shares byway of transfer s.t. conditions:1) Government approval not required for transfer of shares in the investee

company from one non-resident to another non-resident in sectors whichare under automatic route. Government approval required for transfer ofstake from one non-resident to another non-resident in sectors which areunder Government approval route

2) NRIs may transfer by way of sale or gift the shares or convertible debenturesheld by them to anotherNRI

3) A person resident outside India can transfer any security to a personresident in Indiaby wayof gift

4) A person resident outside India can sell shares and convertible debenturesof an Indian company on a recognized Stock Exchange in India through aregisteredstock broker or a registeredmerchant banker

5) A person resident in India can transfer by way of sale, shares/ convertibledebentures (including transfer of subscriber’s shares), of an Indian companyunder private arrangement to a person resident outside India, subject to theguidelines given in para 5.2 and Section 1 of Annexure 3 of ConsolidatedFDI Policy, effective fromJune07 2016

Foreign Exchange Management (Transfer or Issue of Security by Persons Resident Outside India) Regulations, 2000 (notification No. FEMA20/2000-RB dated May 3, 2000)

Issue and Transfer of Shares

FOREIGN PARTICIPATION IN INDIA

Transfer of

Shares • General permission granted to non-residents/ NRIs for acquisition of sharesby way of transfer s.t. conditions (Cont.):

6. General permission is also available for transfer of shares/convertibledebentures, by way of sale under private arrangement by a personresident outside India to a person resident in India, subject to theguidelines given in para 5.2 and Section 1 of Annexure 3 of ConsolidatedFDI Policy, effective fromJune07 2016

7. The above General Permission also covers transfer by a resident to a non-resident of shares/convertible debentures of an Indian company, engagedin an activity earlier covered under the Government Route but now fallingunder Automatic Route, as well as transfer of shares by a non-resident toan Indian company under buyback and/or capital reduction scheme of thecompany

Foreign Exchange Management (Transfer or Issue of Security by Persons Resident Outside India) Regulations, 2000 (notification No. FEMA20/2000-RB dated May 3, 2000)

Issue and Transfer of Shares

FOREIGN PARTICIPATION IN INDIA

Foreign Exchange Management (Transfer or Issue of Security by Persons Resident Outside India) Regulations, 2000 (notification No. FEMA20/2000-RB dated May 3, 2000)

Transfer of Capital

Instruments Prior approvalof RBI required in the following cases

1. Transfer of capital instruments from resident to non-residents by way of salewhere:

•Transfer is at a price which falls outside the pricing guidelines specified bythe Reserve Bank from time to time and the transaction does not fall underthe exception given in para 5.2. of Annexure 3 of Consolidated FDI Policy,effective fromJune07 2016

•Transfer of capital instruments by the non-resident acquirer involvingdeferment of payment of the amount of consideration. Further, in caseapproval is granted for a transaction, the same should be reported in FormFC-TRS, to an AD Category-I bank for necessary due diligence, within 60days from the dateof receipt of the full and final amount of consideration

2. Transfer of any capital instrument, by way of gift by a person resident inIndia to a person resident outside India. While forwarding applications toReserve Bank for approval for transfer of capital instruments by way of gift, thedocuments mentioned in Section 2 of Annexure 3 of Consolidated FDI Policy,effective fromJune07 2016 shouldbe enclosed.

Issue and Transfer of Shares

FOREIGN PARTICIPATION IN INDIA

Foreign Exchange Management (Transfer or Issue of Security by Persons Resident Outside India) Regulations, 2000 (notification No. FEMA20/2000-RB dated May 3, 2000)

Transfer of Capital

Instruments Prior approvalof RBI not required in the following cases: -

1. Transfer of Shares from a Non-Resident to Resident under the FDI schemewhere pricingguidelines under FEMAarenot met,providedthat•Original and resultant FDI is in compliance with the FDI policy and FEMAregulations•Pricing for transaction is compliant with SEBI regulations andguidelines•Chartered Accountants Certificate that compliance with the relevant SEBIregulations/guidelines as indicated above is attached to the Form FC-TRS to befiled with theAD bank

2. Transfer of shares fromResident to Non-Resident:•Transfer of shares requires the prior approval of the Government conveyedthrough FIPB as per the Consolidated FDI Policy, effective from June 07 2016and the approval has been obtained and transfer of shares adhered with thepricing guidelines anddocument requirements specifiedby RBI•Transfer of shares attract SEBI (Substantial Acquisition of Shares and Takeovers)Regulations subject to the adherence with the pricing guidelines anddocumentationrequirements as specified byRBI•Transfer of shares does not meet the pricing guidelines under the FEMA, 1999provided the resultant FDI is in compliance with the FDI policy and FEMAregulations; pricing for transaction is compliant with SEBI regulations andguidelines (Chartered Accountants Certificate that compliance with therelevant SEBI regulations/guidelines as indicated above is attached to theForm FC-TRS to be filed withthe AD bank)

Issue and Transfer of Shares

FOREIGN PARTICIPATION IN INDIA

ConversionofECB/Lumpsumfee/Royaltyetc.intoEquity

Conversion to Equity • Indian companies have been granted general permission for conversion of

External Commercial Borrowings (ECB) (excluding those deemed as ECB) inconvertible foreign currency into equity shares/fully compulsorily andmandatorily convertible preference shares, subject to the followingconditions and reporting requirements:• The activity of the company is covered under the Automatic Route for

FDI or the company has obtained Government approval for foreignequity in the company;

• The foreign equity after conversion of ECB into equity is within thesectoral cap, if any

• Pricing of shares is as per the provision of para 2 Annexure 3 ofConsolidatedFDI Policy

• Compliance with the requirements prescribed under any other statuteand regulation in force; and

• The conversion facility is available for ECBs availed under theAutomatic or Government Route and is applicable to ECBs, due forpayment or not, as well as secured/unsecured loans availed fromnon-resident collaborators.

• General permission is also available for issue of shares/preference sharesagainst lump sum technical know-how fee, royalty due for payment, subjectto entry route, sectoral cap and pricing guidelines (as per the provision ofpara 2 above)andcompliancewith applicable tax laws

Foreign Exchange Management Act

FOREIGN PARTICIPATION IN INDIA

• Freely repatriablewithoutany restrictions• Net after tax deduction at source (TDS) or dividend distribution tax (DDT) asapplicable• Governed by Foreign Exchange Management (Current Account Transactions) Rules,2000

Dividend

Interest

• Interest on fully, mandatorily & compulsorily convertible debentures freelyrepatriablewithout anyrestrictions• Net of applicable taxes• Governed by Foreign Exchange Management (Current Account Transactions) Rules,2000

Exceptions: Sectors such as Defense which are subject to a minimum lock in period; or where investments in specific non-repatriable schemes

Repatriation

FOREIGN PARTICIPATION IN INDIA

• Remittance of asset (i.e. sale proceeds of share and securities and their remittance) isgoverned by the Foreign Exchange Management (Remittance of Assets) Regulations,2000 under FEMA• AD Category-1 can allow remittance of sale proceeds (net of applicable taxes) of a

security to the seller of shares outside India provided• Security has been held on repatriation basis• Sale if security has been made in accordance with the prescribed guidelines•NOC/ Tax clearance cert ificate from the Income Tax department has beenproduced

• AD Category 1 banks allowed to remit winding up proceeds of companies in Indiawhich are under liquidation s.t. payment of applicable taxes an any order issued bythe court winding up the company or official liquidator• Applicant needs to submit the following to the AD Category1 bank:

•NOC/ Tax clearancecertificate fromthe Income Taxdepartment•Auditor’s certificate confirming that

• All liabilities in India have been either fully paid or adequately providedfor•Winding up is in accordance with the provisions of the Companies Act asapplicable• In case of winding up otherwise than by a court- No legal proceedingpending in any court in India against the applicant or the company underliquidationand there is no legal impedimentin permitting the remittance

Winding up/ liquidation of companies

Sale proceeds of shares & securities

Remittance

FOREIGN PARTICIPATION IN INDIA

FAQs

Who all are the eligibleentities that arepermitted to invest inIndia?

A number of entities are permitted to invest in India. The investing entity can be an individual,company, foreign institutional investor, foreign venture capital investor, foreign trust, privateequity fund, pension/provident fund, sovereign wealth fund, partnership/proprietorship firm,financial institution, non-resident Indian/person of Indian origin, others, etc. The investmentscan be via the automatic approval or the Government approval route as per the specifiedpolicies. However, there are certain restrictions for Bangladesh and Pakistan.

ArethereanyrestrictionsoninvestinginIndiafromcertaincountries?

Yes. A citizen of Bangladesh or an entity incorporated in Bangladesh can invest only under theGovernment approval route. Further, a citizen of Pakistan or an entity incorporated in Pakistancan invest, only under the Government route, in sectors/activities other than defence, spaceand atomic energy and sectors/activities prohibited for foreign investment.

AredomesticandforeigninvestorstreateddifferentlyinIndia?

No. Foreign investors are treated at par with domestic investors and they enjoy similar rights.However, foreign investors need to additionally follow Foreign Exchange Management Act(FEMA) guidelines. Investment by NRIs under FEMA (Transfer or Issue of Security by PersonsResident Outside India) Regulations will be deemed to be domestic investment at par with theinvestmentmade by residents.

AreforeignersallowedtoinvestinIndia?

A non-resident entity can invest in India, subject to the prevailing FDI Policy except in thosesectors which are prohibited. However, a citizen or entity incorporated in Bangladesh can investonly under the Government route. Further, a citizen of Pakistan or an entity incorporated inPakistan can invest, only under the Government route, in sectors/activities other than defence,space and atomic energy and sectors/activities prohibited for foreign investment.

FOREIGN PARTICIPATION IN INDIA

FAQs

Howcana foreigninvestorsetupbusinessinIndia?

A foreign company can set up business in India via FDI either by incorporating an Indiancompany, under the Companies Act, 1956 (as a Joint Venture or a Wholly Owned Subsidiary) oras a Foreign Company (by setting up a Liaison Office / Representative Office or a Project Officeor a Branch Office of the foreign company) which can undertake activities permitted under theForeign Exchange Management (Establishment in India of Branch Office or Other Place ofBusiness) Regulations, 2000. An Indian company may receive FDI under the two routes (i)Automatic Route without prior approval either of the Government or the Reserve Bank of Indiain all activities/sectors as specified in the consolidated FDI Policy, issued by the Government ofIndia from time to time or (ii) Government Route for FDI in activities that require prior approvalof the Government which are considered by the Foreign Investment Promotion Board (FIPB),Department of Economic Affairs,Ministry of Finance.

CanNRI/PIOinvestinsoleproprietorship/partnershipfirminIndia?

NRI/PIO can invest in sole proprietorship (repatriable) / partnership firm (non-repatriable),except those in agricultural or plantation or real estate business, or in the printmedia sector, s.t.approval of RBI

CanforeigninvestorinvestinunlistedsharesissuedbyacompanyinIndia?

Yes. As per the regulations/guidelines issued by the Reserve Bank of India/Government of India,investment can be made in unlisted sharesof Indian companies.

FOREIGN PARTICIPATION IN INDIA

FAQs

Who is a ForeignPortfolio Investor (FPI)?

FPIs refers to a class of investors who invest in financial securities of a country without directownership of the underlying company. These are considered liquid investments.Under the recent SEBI FPI Regulations, 2014, Foreign Institutional Investors (FIIs) or sub accountsand Qualified Foreign Investors (QFIs) have been merged into a single category, referred to asFPIs.

Can anyonebuyorsellsecuritiesasaFPIinIndia?

No person can buy, sell or deal in securities as FPI unless he/she has obtained a certificate ofregistration from a Designated Depository Participant (on behalf of SEBI) post submission of anapplication in Form A along with the prescribed fees

WhoisaForeignVentureCapitalInvestor (FVCI)?

FVCI refers to an investor incorporated and established outside India, which is registered underthe Securities and Exchange Board of India (Foreign Venture Capital Investor) Regulations, 2000{SEBI(FVCI) Regulations} and proposes tomake investment in accordance with these Regulations.

WhatareDepositoryReceipts(DRs)?

DRs refer to negotiable securities representing INR denominated equity shares (held as a depositby custodian bank) of a company and issued outside of India by a Depository bank on behalf ofthe company

WhatareAmericanDepositoryReceipts(ADRs)?

The DRs listed and traded in US markets are known asAmerican Depository Receipts (ADRs)

What areGlobalDepositoryReceipts(GDRs)?

The DRs listed and traded except in the US markets are known as the Global Depository receipts(GDRs)

FOREIGN PARTICIPATION IN INDIA

FAQs

Are investments in Indiarepatriable?

ForeigncapitalinvestedinIndiaisgenerallyallowedtoberepatriatedalongwithcapitalappreciation,ifany,afterpaymentoftaxesdue,providedtheinvestmentwasmadeonarepatriationbasis.

RepatriationofDividendDividends are freely repatriable without any restrictions (net after Tax deduction at source orDividend Distribution Tax, if any, as the case may be). The repatriation is governed by theprovisions of the Foreign ExchangeManagement (Current Account Transactions) Rules, 2000, asamended from time to time.

Repatriation of InterestInterest on fully, mandatorily & compulsorily convertible debentures is also freely repatriablewithout any restrictions (net of applicable taxes). The repatriation is governed by the provisions ofthe Foreign Exchange Management (Current Account Transactions) Rules, 2000, as amendedfrom time to time.

WhoisaNonResidentIndian (NRI)? A ‘Non-resident Indian’ (NRI) is a person resident outside India who is a citizen of India.

WhoisapersonofIndianorigin (PIO)?

A ‘Person of IndianOrigin (PIO)’ is a person resident outsideIndia who is a citizen ofany countryother than Bangladesh or Pakistan or such other country as may be specified by the CentralGovernment, satisfying the following conditions: (i) Who was a citizen of India by virtue of theConstitution of India or the Citizenship Act, 1955 (57 of 1955); or (ii) Who belonged to aterritory that became part of India after the 15th day of August, 1947; or (iii) Who is a child or agrandchild or a great grandchild of a citizen of India or of a person referred to in clause (a) or(b); or (iv) Who is a spouse of foreign origin of a citizen of India or spouse of foreign origin of aperson referred to in clause (a) or (b) or (c). PIO includedOverseas Citizen of India (OCI)

FOREIGN PARTICIPATION IN INDIA

FAQs

Can NRIs invest in India? An NRI can invest in capital of Indian companies on non- repatriation basis provided: (i) Amountis invested by inward remittance or out of NRE/FCNR(B)/NRO account maintained withAuthorized Dealers/Authorized banks (ii) entity is not engaged in agricultural/plantation or realestate business or print media sector (iii) amount invested not eligible for repatriation outsideIndia. For investments on repatriable basis, provisions of FDI policy apply .NRIs residents in Nepal and Bhutan are permitted to invest in the capital of Indian companies onrepatriation basis, s.t. condition that the amount of consideration for such investment shall bepaid only by way of inward remittancein free foreign exchange through normal banking channels.

What areinvestmentvehicles?

Investment Vehicles refer to entity registered and regulated under relevant regulations framedby SEBI or any other authority designated for the purpose and include Real Estate InvestmentTrusts (REITs) governed by the SEBI (REITs) Regulations, 2014, Infrastructure Investment Trusts(InvIts) governed by the SEBI (InvIts) Regulations, 2014 and Alternative Investment Funds (AIFs)governed by the SEBI (AIFs)Regulations, 2012.

Areforeign investmentspermittedininvestmentvehicles?

Yes. Foreign investments are permitted in investment vehicles under the automatic route.However, an entity registered / incorporated in and a citizen of Pakistan/ Bangladesh is notpermitted

FOREIGN PARTICIPATION IN INDIA

FAQs

WhatistheinstitutionalframeworkgoverningFDIin India?

FDI in India is regulated under Schedule 1 of Foreign ExchangeManagement (Transfer or Issue ofSecurity by a Person Resident Outside India) Regulations,2000 (Original notification is available athttps://rbi.org.in/Scripts/BS_FemaNotifications.aspx?Id=174 ; Subsequent amendmentnotifications are available at https://rbi.org.in/Scripts/BS_FemaNotifications.aspx )Besides Foreign Exchange Management Act, 1999, FDI is subject to other regulations as perReserve Bank of India (RBI), Foreign Investment Promotion Board (FIPB) (DEA,Ministry of Finance)and Department of Industrial Policy and Promotion (Ministry of Commerce and Industry).

WhatisFIPB? The Foreign Investment Promotion Board (FIPB), housed in the Department of Economic Affairs,Ministry of Finance, is an inter-ministerial body, responsible for processing of FDI proposals andmaking recommendations for Government approval. The extant FDI Policy, Press Notes and otherrelated notified guidelines formulated by Department of Industrial Policy and Promotion (DIPP) inthe Ministry of Commerce and Industry are the bases of the FIPB decisions. In the process ofmaking recommendations, the FIPB providessignificant inputs for FDI policy-making.

FIPB comprises of (i) Secretary to Government, Department of Economic Affairs, Ministry ofFinance- Chairperson; Secretary to Government, Department of Industrial Policy and Promotion,Ministry of Commerce and Industry; Secretary to the Government, Department of Commerce,Ministry of Commerce and Industry; Secretary to Government, Economic Relations, Ministry ofExternal Affairs

WhatisForeignDirectInvestment(FDI)?

Foreign Direct Investment (FDI) means investment by non-resident entity/person residentoutside India in the capital of an Indian company and entails acquiring a “lasting interest”outside of the economy of the investor with an element of “control” (i.e. ownership of at least10% shares) and includes capital investments from abroad in the productive capacity of a Nation?

FOREIGN PARTICIPATION IN INDIA

FAQs

Can aninvestorinvestinanysectorasFDI?

There are different criteria, application procedures, remittance rules and reporting requirementfor each form of investment. For details regarding the eligibility, permitted activities, sectoralcaps, investment routes and regulatory requirements etc., one can access the latest“Consolidated FDI Policy Circular” dated June 07, 2016 which is available in the public domainand can be downloaded from the website of Ministry of Commerceand Industry, Department ofIndustrial Policy and Promotion – http://dipp.nic.in/English/policies/FDI_Circular_2016.pdf. Asubsequent amendment to this circular dated 20 June, 2016 is available at:http://pib.nic.in/newsite/PrintRelease.aspx?relid=146338

Which are theprohibited sectors inwhich FDI is notallowed?

FDI is prohibited in:a) Lottery Business including Government/private lottery, online lotteries, etc. b) Gambling andBetting including casinos etc. c) Chit funds d) Nidhi company e) Trading in TransferableDevelopment Rights (TDRs) f) Real Estate Business or Construction of Farm Houses ‘Real estatebusiness’ shall not include development of townships, construction of residential /commercialpremises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulatedunder the SEBI (REITs) Regulations 2014. g) Manufacturing of cigars, cheroots, cigarillos andcigarettes, of tobacco or of tobacco substitutes h) Activities/sectors not open to private sectorinvestment e.g.(I) Atomic Energy and (II) Railway operations(other than permitted activitiesmentioned in para 5.2 of the Consolidated FDI Policy 2016).

What are the levels ofapproval of FDI inIndia?

Ministry of Finance approves cases for equity inflow of and below INR 5000 crore. For equityinflow of more than INR 5000 crore, the cases are considered by the Cabinet Committee onEconomic Affairs (CCEA) .

FOREIGN PARTICIPATION IN INDIA

FAQs

Who all can invest inFDI in India?

• Any Non resident Entity can invest subject to FDI policy (except in prohibited sectors)• NRI resident in and Citizens of Nepal & Bhutan permitted to invest on repatriation basis

(amount of consideration for such investment shall be paid only by way of inward remittancesthrough normal banking channels)

• Erstwhile OCBs incorporated outside India can make fresh FDI investments as incorporatednon-resident entities (prior approval of GoI if through Government route; RBI if throughAutomatic route)

• Company, trust or partnership firm incorporated outside India and owned and controlled byNRIs

• Foreign Institutional Investors (FII) and Foreign Portfolio Investors (FPI)• Registered FIIs/ FPIs/ NRIs as per Schedules 2, 2A and 3 respectively of Foreign Exchange

Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations,2000 can invest /trade through a registered broker of Indian Companies on recognized stockexchanges

• SEBI registered Foreign Venture Capital Investor (FVCI)Can citizens ofBangladesh invest viaFDI in India?

Citizen of Bangladesh or an entity incorporated in Bangladesh can invest only underGovernmentroute

Can citizens of Pakistaninvest via FDI in India?

Citizen of Pakistan or entity incorporated in Pakistan can invest only underGovernment route insector/ activities other then defense, space & atomic energy and prohibited sector/ activities

Who are the eligibleinvestment entitieswhich can attract FDIin India?

The eligible instruments for FDI include:• Indian Companies can issue capital against FDI• NRI/PIO resident outside India can invest in Partnership Firm/ Proprietary Concern• Non Residents (other than NRI/PIO) can invest in Partnership Firm/Proprietary Concern• Trusts• Limited Liability Partnerships (LLP)• Investment Vehicles

FOREIGN PARTICIPATION IN INDIA

FAQs

What are the eligibleinstruments for FDI inIndia?

Investments can be made by non-residents in the equity shares/fully, compulsorily andmandatorily convertible debentures/fully, compulsorily and mandatorily convertible preferenceshares of an Indian company, through the Automatic Route or the Government Route. Thecompany is also permitted to issue Foreign Currency Convertible Bonds (FCCBs) ; DepositoryReceipts(DRs); warrants and partly paid shares to a person resident outside India subject toterms and conditions as stipulated by the RBI.

Are thereanyrestrictionsonthesectorsforFDIinIndia?

Yes. Investments by non-residents can be permitted in the capital of a resident entity in certainsectors/activity with entry conditions. Such conditions may include norms for minimumcapitalization, lock-in period, etc. as per the latest FDI policy.

WhataretheroutesforFDIinvestmentinIndia?

There are 2 routes for FDI in India. Under the Automatic Route, the non-resident investor or theIndian company does not require any approval from Government of India for the investment.Under the Government Route, prior approval of the Government of India is required. Proposalsfor foreign investment underGovernment route, are considered by FIPB.

Whichsectorsis FDIpermittedviatheautomaticrouteinIndia?

FDI via automatic route is permitted in almost all sectors in India, for instance, in mining,plantation, railways infrastructure, pharmaceuticals, NDFCs, petroleum and natural gas, civilaviation etc. subject to certain conditions as specified in the FDI policy. However, these aresubject to certain conditions, such as sectoral caps.

In whichsectorsinIndiaisFDIpermitted100%viaautomaticroute?

The sectors which are 100% automatic include Agriculture & Animal Husbandry , Plantation ,Mining, Petroleum and Natural Gas, Broadcasting Carriage Services, Civil Aviation - Greenfields/Brownfields, Air Transport Services (Non Scheduled Air Transport Service/ Helicopters services/seaplane services requiring DGCA approval); Other Services under Civil Aviation Sector;Construction Development: Townships, Housing, Built-up Infrastructure; Industrial Parks;Trading; E-Commerce Activities; Duty Free Shops; Railway Infrastructure; Asset ReconstructionCompanies; Credit Information Companies; White Label ATM Operations; Non-Banking Financialcompanies; Pharmaceuticals – Greenfields. These are further s.t. conditions as stipulated in thelatest FDI policy circular.

FOREIGN PARTICIPATION IN INDIA

FAQs

Whatarethereportingrequirementsfor FDIinIndia?

The amount so received must be reported in Advance Remittance Form (ARF) within 30 days ofsuch receipt. The capital instruments should be issuedwithin 180 days from the date of receiptof the inward remittance received through normal banking channels including escrow accountopened and maintained for the purpose or by debit to the NRE/FCNR (B) account of the non-resident investor. The details of issue of capital instruments must be reportedwithin 30 days ofsuch issue in Form FC-GPR.

Whatifthethere isadelayinissueofcapitalinstruments?

In case the capital instruments are not issued within 180 days from the date of receipt of theinward remittance or date of debit to the NRE/FCNR (B) account, the amount of consideration soreceived should be refunded immediately to the non-resident investor by outward remittancethrough normal banking channels or by credit to the NRE/FCNR (B) account, as the case maybe.

FOREIGN PARTICIPATION IN INDIA

FAQs

InwhichsectorsisFDIpermittedundertheGovernmentroute?

FDI partly or fully underGovernment route is permitted under various sectors including Tradingof Food products manufactured or produced in India; Broadcasting Content Services; PrintMedia- Newspapers, Periodicals etc.; PrintMedia- ScientificMagazines, Specialty Journals etc.;Satellites – Establishment andOperations; Multi Brand Retail Trading; Banking - Public Sector;Defence; Air Transport Services- Scheduled Air Transport Service/ Domestic ScheduledPassenger Airline; Regional Air Transport Service; Private Security Agencies; Telecom Services;Single Brand Product Retail Trading and Banking - Private Sector. These are further s.t.conditions as stipulated in the latest FDI policy circular.

Which are the sectorswhere 100% FDI ispermitted via theGovernment approvalroute?

100% FDI via Government approval route only is permitted in Trading of Food productsmanufactured or produced in India; Print Media- including Scientific Magazines, SpecialtyJournals etc.; Satellites – Establishment andOperations s.t. conditions as stipulated in the latestFDI policy circular.

What are the modes ofpayment allowed forreceivingForeign DirectInvestment in an Indiancompany?

Indiancompanyissuingshares/convertibledebenturesunderFDISchemetoapersonresidentoutsideIndiashallreceivetheamountofconsiderationrequiredtobepaidforsuchshares/convertibledebenturesby:(i)inwardremittancethroughnormalbankingchannels.(ii)debittoNRE/FCNRaccountofapersonconcernedmaintainedwithanADcategoryIbank.(iii)conversionofroyalty/lumpsum/technicalknowhowfeedueforpaymentorconversionofECB,shallbetreatedasconsiderationforissueofshares.(iv)conversionofimportpayables/preincorporationexpenses/shareswapcanbetreatedasconsiderationforissueofshareswiththeapprovalofFIPB.(v)debittonon-interestbearingEscrowaccountinIndianRupeesinIndiawhichisopenedwiththeapprovalfromADCategory– IbankandismaintainedwiththeADCategoryIbankonbehalfofresidentsandnon-residentstowardspaymentofsharepurchaseconsideration.

FOREIGN PARTICIPATION IN INDIA

FAQs

Whataretheguidelines fortheissuepriceofsharesagainstFDIreceivedforacompanylistedinIndia?

In case the company is listed on recognized stock exchange in India, the issue price must not benot less than price worked out in accordance with SEBI guidelines.

What are theguidelines for the issueprice of shares againstFDI received for anunlisted company inIndia?

In case the company is not listed on any stock exchange in India, the price of the share must not beless than fair valuation done by a SEBI registeredMerchant Banker or a Chartered Accountant asper any internationally accepted pricing methodologyon an arm’s length basis

Is transferofsharestonon-residents/NRIspermittedaspertheFDIpolicy?

General permission is granted to non-residents/ NRIs for acquisition of shares by way of transfers.t. conditions such as following:1) Government approval is not required for transfer of shares in the investee company from

one non-resident to another non-resident in sectors which are under automatic route.Government approval is required for transfer of stake from one non-resident to anothernon-resident in sectors which are underGovernment approval route

2) NRIs may transfer by way of sale or gift shares or convertible debenturesto anotherNRI3) Person resident outside India can transfer any security to a person resident in India by way

of gift4) A person resident outside India can sell shares and convertible debentures of an Indian

company on a recognized Stock Exchange in India through a registered stock broker or aregisteredmerchant banker

5) A person resident in India can transfer by way of sale, shares/ convertible debentures(including transfer of subscriber’s shares), of an Indian company under privatearrangement to a person resident outside India, subject to the FDI Policy guidelines

6. General permission is also available for transfer of shares/convertible debentures, by wayof sale under private arrangement by a person resident outside India to a person residentin India, subject to the FDI guidelines

7. The above General Permission also covers transfer by a resident to a non-resident ofshares/convertible debentures of an Indian company, engaged in an activity earliercovered under the Government Route but now falling under Automatic Route, as well astransfer of shares by a non-resident to an Indian company under buyback and/or capitalreduction scheme of the company

FOREIGN PARTICIPATION IN INDIA

FAQs

Istransfer ofcapitalinstrumentsfromresidenttonon-residentspermitted?

Yes. Transfer of capital instruments from resident to non-residents is permitted. However, thereare certain cases that require prior RBI approval.

Which casesoftransferofcapitalinstrumentsfromresidenttonon-residentsrequireRBIapproval

1. Transfer is at a price which falls outside the pricing guidelines specified by the Reserve Bankfrom time to time and the transaction does not fall under the exception given in para 5.2. ofAnnexure 3 of Consolidated FDI Policy, effectivefrom June 07 2016Transfer of capital instruments by the non-resident acquirer involving deferment of payment ofthe amount of consideration. Further, in case approval is granted for a transaction, the sameshould be reported in Form FC-TRS, to an AD Category-I bank for necessary due diligence,within60 days from the date of receipt of the full and final amount of consideration2. Transfer of any capital instrument, by way of gift by a person resident in India to a personresident outside India. While forwarding applications to Reserve Bank for approval for transferof capital instruments by way of gift, the documents mentioned in Section 2 of Annexure 3 ofConsolidated FDI Policy, effective from June 07 2016 should be enclosed.require prior RBI approval.

Can ECBs be convertedinto Equity?

Yes. Indian companies have been granted general permission for conversion of ExternalCommercial Borrowings (ECB) (excluding those deemed as ECB) in convertible foreign currencyinto equity shares/fully compulsorily andmandatorily convertible preference shares, subject toconditions and reporting requirements as per the latest FDI policy.