Together tackling the next natural disaster and extreme weather …8bbb9737-6422-445… · 6.1 %...

Transcript of Together tackling the next natural disaster and extreme weather …8bbb9737-6422-445… · 6.1 %...

Together tackling the next natural disaster and extreme weather event

ANZ Webinar8th May 2019

Stephen Higginson - Head Sales & Distribution, Swiss Re Corporate Solutions

Clarence Wong - Chief Economist Asia, Swiss Re Institute

Jane Sexton - Director - Hazard & Risk Infrastructure and Applications Section, Geoscience Australia

Alex Pui - Nat Cat Specialist APAC, Swiss Re Corporate Solutions

Andre Martin Head Innovative Risk Solutions APAC,Swiss Re Corporate Solutions

Exposure: Tropical Cyclone causing wide area damage and loss of attraction to island resort

Protection for the pure economic impact unrelated to physical damage

Your Panel of Speakers

Welcome & Introductions

Clarence WongChief Economist Asia, Swiss Re Institute

ANZ Webinar8th May 2019

68%

of economic losses caused by natural catastrophes over the past decade were

uninsured

Number of events: 304

Total economic losses: USD 165 billion

Insured losses: USD 85 billion

Number of victims: 13 500+

Insured losses above 10-year average of USD71 billion

Economic losses increased >7 times since 1970

Catastrophe losses in 2018 – number of disasters same while total losses declined compared to 2017

68%

of economic losses caused by natural catastrophes over the past decade were

uninsured

Insured vs uninsured losses, globally1970-2018, in USD billion at 2018 prices

5.5%Growth in ECONOMIC losses

6.1% Growth in INSURED losses

0

50

100

150

200

250

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

ECONOMIC loss (10-year moving average)

INSURED loss (10-year moving average)

Source: Swiss Re Institute

Only one third of the economic loss is covered

70%Source: Swiss Re Institute and Swiss Re Non-Life Risk Transformation.

Protection gap by regions (2009-2018)

• Economic losses: USD 15.5 billion (Jebi: USD 12 billion; Trami: USD 3.5 billion)

• Insured losses: USD 12.5 billion (Jebi: USD 9.8 billion ; Trami: USD 2.7 billion)

• More than 52 000 buildings damaged (more than 50 000 from Jebi and around 2000 from Trami)

Typhoon Jebi and Trami (Japan) in Sep and Oct 2018

• Worst event in 100 years:

– Heavy rainfall resulted in massive flooding across the state

– Affected key sectors like tourism, plantation and general trade

• Economic losses: USD 3.5 billion

• Insured losses: USD 359 million

• Victims: More than 500

Kerala Floods (India) in Aug 2018

Jane SextonDirector – Hazard & Risk Infrastructure and Applications Section, Geoscience Australia

ANZ Webinar8th May 2019

© Commonwealth of Australia (Geoscience Australia) 2019

Disaster Risk Resilience in Australia

Overview and contributions from Geoscience Australia

© Commonwealth of Australia (Geoscience Australia) 2019

Just released

Priority 1: Understand disaster risk

Priority 2: Accountable decisions

Priority 3: Governance, ownership and responsibility

Priority 4: Enhanced investment

© Commonwealth of Australia 2019

© Commonwealth of Australia (Geoscience Australia) 2019

Key messages• Shared responsibility

– i.e. mainstream disaster risk in government policy

• Increasing availability of data and information for decision making

• Consumers being aware of their risks to make decisions

• Risk informed infrastructure development

Collaborating to build a resilient future

© Commonwealth of Australia (Geoscience Australia) 2019

GA capability

Hazard and risk assessments,

Scenarios

Event support

Post-disaster surveys

National datasets

Open source software

© Commonwealth of Australia (Geoscience Australia) 2019

Probabilistic Hazard

www.ga.gov.au/nsha

www.ga.gov.au/ptha

www.ga.gov.au/tcha

Alex PuiNat Cat Specialist, Swiss Re Corporate Solutions

ANZ Webinar8th May 2019

Framework to Assess Climate Risks

Central Banks and financial regulators to Firms : “Adapt or you will NOT exist in the new world”*

Physical Risk

• Impacts today on insurance liabilities and the value of financial assets due to weather and climate related events

• E.g: Property damage & disruption of trade from weather related events such as flood, storms, sea level rises and hurricanes

Transition Risk

• The financial risks that could result from the process of adjustment towards a low carbon economy

• Risks that arise from changes in policy, technology and physical risks

Liability Risk

• The future impacts if parties who suffered loss from climate change seek compensation

*Source: Network for Greening Financial System (NGFS – which consists of 34 central banks) official statement, April, 2019 (https://www.bbc.com/news/world-47965284)

An integrated approach to Disaster Risk Management adds economic value

Leveraging tools such as climate change projections and catastrophe modelling expertise to improve resilience

Exposure Resilience

Risk Mitigation

Hazard Models

Climate Projections

Economic Loss

Driven by climate policy, technological change, latest scientific findings

Catastrophe Modelling of physical assets, insurers traditionally have expertise in this domain

Take pro-active decisions to manage climate physical risk

Risk Transfer

Andre MartinHead Innovative Risk Solutions APAC, Swiss Re Corporate Solutions

ANZ Webinar8th May 2019

Traditional insurance is indemnity based

Repair / replacement of damaged asset and indemnification for consequential loss incurred

Parametric insurance insures the probability of a

pre-agreed event occurring

Rely on measurement of a triggering event or indexeg. EQ magnitude, Temperature, Wind Speed, Precipitation

“Too Much or Too Little”

Independent from underlying asset

Quick formulaic Payout if pre-defined parameters are met or exceeded

Choice of Trigger / Index

Objectivity: independent, verifiable data

Reliability: data source to provide consistent and timely measurement

Availability: historical statistical records to allow modelling

Correlation: proxy for economic loss sustained Basis Risk (Difference between pay-out and actual loss sustained)

Parametric insuranceFundamental principles

When and Why?

• “Uninsurable” perils or asset classes (eg. inclement weather, T&D lines)

• Pure economics loss without physical damage (Non-damage BI, Supply chain disruption

• Scarce NatCat capacity: EQ Japan, (access to capital markets)

• Liquidity enhancement when fast payoutis crucial (Emergency relief actions, Share price impact)

Example : Cat-in-a-circle Philippines

Wind intensity category

Payout per event (subject to overall AAL of USD 30m)

Cat 3 USD 5m

Cat 4 USD 15m

Cat 5 USD 30m

Case 1: Cat 4 Hurricane track misses circle. No payout

Case 2: Cat 4 Hurricane track hits circle. $15M payout

Case 3: Cat 1 Hurricane track hits circle. No payout

Complementing traditional insurance for pure economic losses and protection gaps

Parametric insuranceValue proposition

HazardProbability

Asset Distribution

VulnerabilityRisk Quality

Insurance Structure

wind speed

loss

(%)

loss

(%)

wind speed Proceeds can beused at the full discretion of theinsured

Payment of the pre-agreed amount is made within 30

business days

The trigger event exceeds the pre-agreed threshold

Event is reported by Independent

Agency i.e. Bureau of Meteorology

Trigger event occursi.e. Typhoon of certain category

Parametric insuranceTransparency and simplicity

Parametric NatCat

Weather

Non-Weather

Market Indices

Typhoon• Storm category• Wind Speed

Earthquake• Magnitude• Shaking

Intensity

Flood / Drought• Precipitation• River Levels

Inclement Weather• Precipitation• Temperature• Wind / Wave Action• Haze

Resource Risk• Wind / Solar Hedge• Crop Yield Index

• RevPAR / Occupancy Rates• Insolvency of key supplier• Bushfire• Volcanic Eruption• Pandemics

Double Trigger:Combination with economic index:• CPI• Power Price• Commodity Prices

• Airport Closure• Regulatory Shutdown• Loss of License

Index based insurance in practiceApplications predominantly for weather and NatCat events

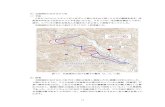

Triggering event: Typhoon passing through a defined Indemnification Zone (“Cirlce”)

Indemnification Zone defined by economic impact assessment

Formulaic Payout as function of reported storm category

Payout Structure derived from modelled scenarios validated by historical events

Motivation: protection for “non-damage” economic losses and access additional NatCat capacity

Exposure: Tropical Cyclone causing wide area damage and loss of attraction to island resort

Protection for the pure economic impact unrelated to physical damage

Cat-in-a-circle trigger

Parametric structure

Tropical Cyclone in North QueenslandLoss of attraction and “non-damage” economic losses

Questions & Answers

24

Legal notice

©2019 Swiss Re. All rights reserved. You are not permitted to create any modifications or derivative works of this presentation or to use it for commercial or other public purposes without the prior written permission of Swiss Re.

The information and opinions contained in the presentation are provided as at the date of the presentation and are subject to change without notice. Although the information used was taken from reliable sources, Swiss Re does not accept any responsibility for the accuracy or comprehensiveness of the details given. All liability for the accuracy and completeness thereof or for any damage or loss resulting from the use of the information contained in this presentation is expressly excluded. Under no circumstances shall Swiss Re or its Group companies be liable for any financial or consequential loss relating to this presentation.