the_union_budget_2011-2012[1]

-

Upload

kritika-verma -

Category

Documents

-

view

212 -

download

0

Transcript of the_union_budget_2011-2012[1]

-

8/7/2019 the_union_budget_2011-2012[1]

1/12

THE UNION BUDGET2011-2012

REPUBLIC OF INDIA

March 10, 2011

-

8/7/2019 the_union_budget_2011-2012[1]

2/12

EXECUTIVE SUMMARY

No Budget exercise can please the Indian intelligentsia, politicians, economic pundits and thecorporate world alike. The Union Budget 2011-2012 has been no exception.

This year, the focus on social infrastructure development a hallmark of the United ProgressiveAlliance government in its second term in power changes trajectory. Efforts are being made toensure that the pro-poor subsidies reach the beneficiaries in an efficient fashion. SocialSpending is also up 17 percent to USD 35 billion.

On the taxation front, there is good news. Both the unified Goods and Services Tax (GST) andthe Direct Tax Code (DTC) are back on the agenda. These tax reforms, which will take morethan 12 months to be implemented, will have a significant impact on how India does business.

Also there is good news for the private insurance sector as there are plans to raise the FDI capto 49 percent. This will help Indian promoters dilute their stake in these companies and fundnew projects.

On the other hand, there is genuine concern that fresh levies of indirect taxes may fuel inflationin the year to come. Disconcertingly, there seems to be no specific strategy to curb rampantinflation, particularly in light of the political situation in the Middle East, which has led to crude oilprices in excess of USD 110 per barrel.

There were no big- bang reforms proposals on the 20th anniversary of Indias economic reforms particularly a ringing endorsement of further FDI liberalisation in the multi-brand retail anddefence sectors. However, the stock markets, after a more tepid response on budget day,reacted far more buoyantly a day later with the two key stock market indices the BombayStock Exchanges Sensex and the National Stock Exchanges Nifty rising by 623 points and 189points respectively probably signaling that the Budget was a step in the right direction.

2011 APCO Worldwide Inc. All rights reserved.

-

8/7/2019 the_union_budget_2011-2012[1]

3/12

1

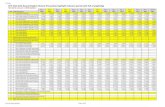

BUDGET 2011: AT A GLANCE

ECONOMIC INDICATORS

The Gross Domestic Product grew at 8.6 percent in 2010-2011 in real terms and isexpected to grow at 9 percent with an outside band of +/- 0.25 percent in 2011-2012

In 2010-2011, agriculture is estimated to have grown at 5.4 percent, industry at 8.1percent and services at 9.6 percent

Foreign Exchange reserves are estimated at USD 297.3 bn The savings rate has increased to 33.7 percent, while the investment rate is up at 36.5

percent of GDP

COMMERCE AND TRADE

Exports have grown at 29.4 percent to reach USD 184.6 billion Imports are at USD 273.6 billion, having recorded a growth of 17.6 percent during April-

January 2010-2011 The current account deficit is around the 2009-2010 levels and poses some concerns

because of the composition of its financing Proposal to introduce a scheme to refund taxes paid on services used for export of

goods Mega cluster scheme to be extended for leather products. Seven mega leather clusters

to be set up during 2011-2012

INFRASTRUCTURE

USD 47 billion allocated for infrastructure sector in 2011-12, up 23.3 percent over 2010-2011

Tax-free bonds of USD 6.6 billion proposed to be issued by government undertakingsduring 2011-2012 Government to evolve national public-private partnership (PPP) policy Additional deduction of USD 4.4 billion for investment in long-term infrastructure bonds

proposed to be extended for one more year Foreign Institutional Investors (FIIs) limit in corporate bonds in infrastructure sector

increased to USD 25 billion

TAXATION

Tax Reforms

Direct Taxes Code (DTC) to be finalised for enactment during 2011-2012. DTCproposed to be effective from April 1, 2012 Areas of divergence with States on proposed Goods and Services Tax (GST) have been

narrowed. As a step toward roll-out of the Goods and Services Tax (GST), ConstitutionAmendment Bill proposed to be introduced in this session of Parliament

Significant progress in establishing GST Network (GSTN), which will serve as the ITinfrastructure for introduction of GST

-

8/7/2019 the_union_budget_2011-2012[1]

4/12

2

Direct Taxes

Personal income tax exemption limit has been raised to approx. USD 4,000 Given the good growth in corporate tax collection during the year, base corporate tax

maintained at 30 percent Surcharge on domestic companies reduced to 5 percent from 7.5 percent Rate of Minimum Alternative Tax proposed to be increased from 18 percent to 18.5

percent of book profits Tax incentives extended to attract foreign funds for financing of infrastructure Individual investments in long-term infrastructure bonds to continue enjoying additional

deduction of USD 444 for one more year Benefit of investment linked deduction extended to businesses engaged in the

production of fertilisers and development of affordable housing Weighted deduction on payments made to national laboratories, universities and

institutes of technology to be enhanced to 200 percent System of collection of information from foreign tax jurisdictions to be strengthened

Indirect Taxes

To stay on course for transition to Goods and Services Tax (GST) Central Excise Duty to be maintained at standard rate of 10 percent 130 items out of 370 consumer goods items currently enjoying exemption from Central

Excise duty to be brought into tax net with nominal central excise duty of 1 percent Lower rate of Central Excise Duty to be enhanced from 4 percent to 5 percent Optional levy on branded garments or made up proposed to be converted into a

mandatory levy at unified rate of 10 percent Peak rate of Customs Duty held at its current level

Social Focus

Expansion of existing schemes:

Social-sector projects spending at USD 35 bn, an increase of 17 percent USD 12.8 bn allocation for rural infrastructure programme - Bharat Nirman (loosely

translates to India Building) - an increase of USD 2.2 bn from 2010-2011 levels.Enhanced wage rated under the National Rural Employment Guarantee Act

Remuneration of aanganwadi (community-based health centres) workers, who are thebackbone of Integrated Child welfare schemes, has been raised from USD 34 to USD 68per month. This will be effective from April 1, 2011, and more than 2.2 million workerswill benefit from this increase

Allocation of USD 11.5 bn for education sector, an increase of 24 percent Out of overall education outlay, USD 4.7 bn has been allocated for the Sarva Shiksha

Abhiyan ( universal education programme) a flagship government programme USD 1.1 bn to be provided to the National Skill Development Council Allocation for primitive Tribal groups increased from USD 40 m to USD 5 m Scope of Rashtriya Swasthya Bima Yojana (national health insurance scheme) to be

expanded to widen the coverage

-

8/7/2019 the_union_budget_2011-2012[1]

5/12

3

New schemes

Comprehensive national policy to control the trafficking of narcotics The Government is close to finalising the National Food Security Bill National Knowledge Network by March 2012. Connectivity to all 1,500 institutions of

higher learning and research through optical fibre backbone to be provided by March2012

THE NEWS-MAKERS

SUBSIDIES

Subsidy bill for fuel, food and fertilisers 13 percent lower for 2011-2012 at USD 29.6 bncompared to USD 33.8 bn in the current fiscal

Government to bring urea under the Nutrient Based Subsidy (NBS) net Government to move toward the direct transfer of cash subsidy to people living below

the poverty line in a phased manner for better delivery of kerosene, liquefied petroleumgas (LPG) and fertilisers. Task force to work out modalities for proposed system to beheaded by Mr Nandan Nilekani with interim report expected by June 2011. The systemwill be in place by March 2012

Investment in fertiliser sector is capital intensive and even considered high risk. Thegovernment proposes to include capital investment in fertiliser production as aninfrastructure sub-sector

ENVIRONMENT-RELATED INCENTIVES

Reduction in Excise Duty on kits used for the conversion of fossil fuel vehicles intohybrid vehicles

Full exemption from basic Customs Duty and a concessional rate of Central Excise Dutyextended to batteries imported by manufacturers of electrical vehicles Concessional Excise Duty of 10 percent to vehicles based on fuel cell technology Basic customs duty on solar lanterns reduced to 5 percent from 10 percent Full customs duty exemption for solar module cells

SECTORS

Hospitality and Aviation

Hotel accommodation that costs in excess of USD 22 and services provided by airconditioned restaurants that have license to serve liquor added in the Service Tax net

Service Tax on domestic and international air travel raised

Defence

Defence budget hiked by 11 percent, pegging the 2011-2012 allocation at USD 36billion, to fuel the rapid modernization of the Armed Forces

The percentage of the defence budget as a share of the GDP slumps to 1.8 percent, thefirst time it is under 2 percent in more than a decade

-

8/7/2019 the_union_budget_2011-2012[1]

6/12

4

APCO IN INDIA SPECIAL FOCUS AREAS

RETAIL, FOOD AND CONSUMER PRODUCTS

Food

Announcements:

Government to promote organic farming methods, combining modern technology withtraditional farming practices through the National Mission for Sustainable Agriculture

Approval being given to set up 15 more Mega Food Parks during 2011-2012 Removal of production and distribution bottlenecks for items like fruits and vegetables,

milk, meat, poultry and fish to be the focus of attention this year Special initiatives to improve post-harvest management of agricultural produce

Focus on augmentation of storage capacity and cold chain through privateentrepreneurs and warehousing corporations

Capital investment in creation of modern storage capacity will be eligible forviability gap funding of the Finance MinistryDuty exemptions

Full exemption from excise duty to air-conditioning equipment andrefrigeration panels for cold chain infrastructure

Including conveyor belts in the full exemption from excise duty toequipment used in cold storages, mandis (markets) andwarehouses

Efforts to persuade the state governments to review and enforce a reformed AgricultureProduce Marketing Act

Allocation of USD 66.3 m for implementation of vegetable cluster initiative to providequality vegetable at competitive prices

Allocation of USD 66.3 m to bring 60,000 hectares under oil palm plantations. Initiative toyield about 3 lakh metric tonnes of palm oil annually in five years

Impact:

In the longer run, the initiatives outlined to improve the production and distribution ofagricultural produce is expected to boost to the growth of organized retail sector. Thiswill also contribute to the objectives of meeting the food security obligations of thegovernment and to restrain rising food inflation.

In the meantime this opens up plethora of opportunities for private investment in thepost-harvest management infrastructure backed by viability gap funding from thegovernment

Retail & Consumer Goods

Announcements:

Optional levy on branded garments proposed to be converted into a mandatory levy atunified rate of 10 percent

130 out of 370 consumer goods items currently enjoying exemption from Central Exciseduty to be brought into tax net

Lower rate of Central Excise Duty to be enhanced from 4 percent to 5 percent

-

8/7/2019 the_union_budget_2011-2012[1]

7/12

5

Impact:

Henceforth, the branded apparel manufacturer will have to pay compulsorilythe exciseduty of 10 percent. The cost of branded garments and made-up textiles will go up by 10-15 percent

Some of the items to be included in the higher excise duty regime will be coffee or teapre-mixes; all kinds of food mixes (including instant food mixes); ready-to-eat packagedfood; silicon in all forms; articles of jewellery manufactured or sold under a brand name;mobile handsets; recorded CDs and DVDs; bicycles and cycles, etc. Prices of theseconsumer goods will dart up proportionately as producers, who are hemmed in by risinginput costs, will have little option but to pass it on partially or fully

The prices of consumer durables will also be maintained this year as there is no hike inexcise duties

Energy and Renewables

Announcements:

USD 44.2 m from the National Clean Energy Fund to be allocated to startimplementation of the Green India Mission in 2011 -2012

USD 44.2 m proposed to be allocated for launching Environmental Remediationprogrammes from the National Clean Energy Fund

USD 44.2 m allocated for cleaning of important lakes and rivers other than the Ganga ,from the National Clean Energy Fund

The budget allocation for the ministry of environment and forests increased only by 4percent from USD 487 m last year to USD 509 m this year

Provision of USD 36.5 m for schemes in the environment and forest sector in the north-

eastern states Plan outlay in funding for forestry and wildlife protection dropped from USD 175 m toUSD 173 m this year, while the conservation of ecology and environment saw anincrease from USD 270 m in 2010-2011 to USD 298 m this year

Impact:

Increased budgets indicate a clear intention of the government toward a cleanerenvironment by giving a boost to the implementation of the ambitious Green IndiaMission

The mission, which plans to restore around 10 million hectares of land between 2010and 2020, is a part of the National Action Plan on Climate Change (NAPCC). This willinvolve an investment of USD 10.1 bn over 10 years. India is also negotiating on theglobal climate change platform for funds to maintain forest cover as well as to increase it

Another mission under the NAPCC, the Jawaharlal Nehru National Solar Mission(JNNSM), did not get any increased budget allocation, indicating the governments wait -and-see approach during the first phase of the JNNSM, which has met with criticismlately for its slow progress

Banking and Insurance

Announcements:

Insurance Amendment Bill, LIC (Life Insurance Corporation) Bill and PensionDevelopment Authority Bill to be introduced in this session

-

8/7/2019 the_union_budget_2011-2012[1]

8/12

6

The insurance legislation, if successfully passed in parliament, would increase the FDIlimit to 49 percent from the current 26 percent

USD 6.6 bn to National Bank for Agriculture and Rural Development (NABARD) fromUnion Budget 2011 Home loan limit hiked to USD 55,000 for priority sector lending 1 percent interest subvention on home loans up to USD 33,000 Rural housing fund to get USD 664 m Indian micro-finance equity with Small Industries Development Bank of India (SIDBI) to

be formed with USD 22 m USD 1.2 bn for state-owned banks to maintain capital-to-risk assets ratio norms Banking Laws Amendment Bill, SBI (State Bank of India) Subsidiaries Bill and BIFR

(Board for Industrial and Financial Reconstruction) Bill will be introduced this year Capital infusion of USD 4.4 bn in state-owned banks in FY 2012 To create USD 22 m equity fund for micro-finance companies The LIC bill would increase the share capital of Life Insurance Corporation (LIC) to USD

22 m from its current USD 1.1 m Financial Inclusion - Target of providing banking facilities to all 73,000 habitations having

a population of more than 2,000 to be completed during 2011-2012

Impact:

The finance ministers announcement that the In surance Bill will be considered in thissession is a great boost to the insurance industry. It will empower the InsuranceRegulatory and Development Authority (IRDA) to introduce forward-looking regulation topromote sustainable growth of the industry. The bill gives a lot of flexibility to IRDA inframing such regulation

Guidelines on fresh banking licenses still unclear One may expect more new banks to enter the banking sector after a year or so. It willbe easier for new banks to enter the wholesale banking sector while entry into the retailbanking - for new banks will get tougher

Home loans to become cheaper Insurance products to become more expensive

Health and Pharmaceuticals

Healthcare budget hiked by 20 percent to USD 5.9 bn in FY 2012 Extension of Rashtriya Swasthya Bima Yojana (National Health Insurance Scheme) to

cover unorganized sector workers in hazardous mining and associated industries 1 percent hike in excise duty for vaccines and IV fluids and other medicaments Centralised air conditioned (AC) hospitals with more than 25 beds brought under 10

percent service tax

Diagnostic service providers levied 10 percent service tax The finance minister also proposed to provide outright concession to factory-built

ambulances in place of the existing refund-based concession from excise duty

-

8/7/2019 the_union_budget_2011-2012[1]

9/12

7

Impact

Pharmaceutical sector has expressed relief over continuation of concessions on exciseduty provided during the global economic meltdown. The budget does not have much forpharmaceutical industry as there is no major policy announcement

Private healthcare services will become more expensive with the direct and indirect taxproposals announced in the Union Budget 2011

Healthcare appears to be less investment friendly as it has not been allowed anybenefits from FDI or FII, which is not a good sign for the growth of the sector likehealthcare. Rather it has been burdened with increment in excise duty and service tax

Though the effective service tax would be 5 percent, as there is a 50 percent rebate,experts believe that bringing the hospitals sector under services tax is a detrimentalmove as the burden will be passed to the consumer

Earlier patients under insurance coverage were under the service tax bracket, but in thisbudget the government has expanded its scope of taxing by bringing even non-insurance patients under the tax bracket

Information and Communication Technologies (ICT)

Announcements:

Under the Bharat Nirman programme, rural broadband connectivity will be provided to all250,000 panchayats (local administrative bodies) in the country in three years

An optical fibre backbone through the National Knowledge Network, approved in March2010, will link 1,500 higher education institutions by March 2012

Since colour and unexposed jumbo rolls of cinematographic films are not manufactureddomestically and have to be imported jumbo rolls of 400 feet and 1000 feet will now be

fully exempted from CVD (additional customs duty) and excise duty The government has announced a levy of 1 percent excise duty on CDs and DVDs

Impact:

Since the government plans to take on much of the investment burden of the backbonenetwork without extending too far into the access network, many private-sectorcompanies are likely to be very pleased with it

The government hopes that through this method of co-option, operators would beencouraged in investing in end-user infrastructure, thus boosting the competitivebroadband market

The Budget did not waive service tax on copyright, which was one of the film industrysmain demands

The governments decision to exempt cinematographic rolls is expected to boost anti -piracy efforts. Piracy used to take place as distributors could not make more printsbecause of the high roll costs. Now, with the exemption, distributors will come out withmore prints that will help in fighting piracy

While the exemption on the rolls may not benefit high-budget movies, since printsconstitute only 10 percent of total costs, it is a relief for low-budget filmmakers

-

8/7/2019 the_union_budget_2011-2012[1]

10/12

8

POLITICAL GRAPEVINE

The finance minister did not take any cheap populist step,and the exercise was a reflection of an India aspiring to

become a super- powerconcrete steps have been taken tostrengthen the economic fundamentals in the budget."

Abhishek Manu Singhvi, Spokesperson,Indian National Congress

(Largest party in the ruling coalition government/Centrist)

"The Union Budget, presented by the Union finance

minister in the Lok Sabha today, is a document without a vision. There is no big idea which has guided and motivated the Budget presentation exercise. It is an

unimaginative budget, which has little nexus to the issues confronting the Indian economy."

Press statement, Bharatiya Janata Party (BJP)(Principal national opposition party/Rightist)

"The Budget reflects the abandoning of the aam admi (populist) agenda by the government and its pursuit of an

aggressive neoliberal agenda. The Polit Bureau of the CPI (M) calls upon the people to strengthen resistance

against these neoliberal policies ."Press statement, Communist Party of India (Marxist)

(Largest of the Communist parties/Leftist )

"It is a restrained budget. It is good to see allocation in agricultural, education and health sectors." Partha Chatterjee, Trinamool Congress

(Key government ally and principal opposition party in WestBengal, which goes to the polls this year/Centre-Left)

"The Union budget is a damp squib, and the status-quo-ist excercise will benefit only a small segment of people at the

cost of the vast majority." J.Jayalalitha, President, AIADMK

(Principal opposition party in the state of Tamil Nadu -heading forpolls this year/Centrist)

-

8/7/2019 the_union_budget_2011-2012[1]

11/12

9

INDUSTRY SPEAK

The support for green and energy initiatives, especially in the areas of automotive and solar, is worth noting in this years budget.Reduction in duty on LEDs will help boost growth of this technology and energy efficiency, since cost is one of the chief inhibitors for adoption of new energy efficient products.

Ashok Chandak, Senior Director,Global Sales and Marketing, NXPSemiconductors India

The finance minister has made anhonest effort to reconcile two seemingly conflicting objectives of maintaining growth momentum and containing the inflationary pressure in the economy. On the whole, the budget is intended to keep the growth momentum going in a

difficult environment.

Sunil Bharti Mittal, CEO, BhartiEnterprises

I think the most important thing isthat he (finance minister) has clearly given a signal of Goods and Services Tax coming through soon...that is a major development which is very welcome as it will help

us solve a lot of macro-economic issues, including inflation, fiscal deficit and help GDP growth.

Adi Godrej, Chairman, GodrejIndustries

The budget 2011 -2012 is a pragmatic budget given the present political and economic realities. It balances the demands of India's growth agenda with the need of

keeping fiscal and budgetary deficits within control.

AK Das, Executive Director, HindujaGroup

-

8/7/2019 the_union_budget_2011-2012[1]

12/12

10

TRACKING THE MARKETS ON BUDGET DAY

CONTACT APCO IN INDIA

Sukanti Ghosh, managing director: +91 98330 38520Samiran Gupta, executive director: +91 99990 19631Asitava Sen, director corporate advisory & PA: +91 98106 05233Tushar Panchal, director strategic communications & PA: +91 98336 87427Steven King, associate director strategic communications & PA: +91 95822 30497

BSE (SENSEX)

1,7823 (+122)

NYSE (NIFTY)

5,333 (+29)

![download the_union_budget_2011-2012[1]](https://fdocuments.in/public/t1/desktop/images/details/download-thumbnail.png)

![Pomalidomide Activity Blood 2012 Dispenzieri Blood 2012-02-413161[1][1]](https://static.fdocuments.in/doc/165x107/577d1d8f1a28ab4e1e8c86af/pomalidomide-activity-blood-2012-dispenzieri-blood-2012-02-41316111.jpg)

![Predictions February 2012[1][1]](https://static.fdocuments.in/doc/165x107/540c1dabdab5ca4e788b458d/predictions-february-201211.jpg)