The W-2 Form (Wage and Tax Statement). During the prior lesson, we learned about the W-4 Form. W-4...

-

Upload

rosamund-knight -

Category

Documents

-

view

214 -

download

0

Transcript of The W-2 Form (Wage and Tax Statement). During the prior lesson, we learned about the W-4 Form. W-4...

The W-2 FormThe W-2 Form(Wage and Tax Statement)(Wage and Tax Statement)

During the prior lesson, we learned about During the prior lesson, we learned about the W-4 Form.the W-4 Form.

W-4 Form:W-4 Form: The form YOU fill out for your employer.The form YOU fill out for your employer. You state the number of allowances you take.You state the number of allowances you take.

Less Allowances:Less Allowances: The government withholds money each paycheck.The government withholds money each paycheck. The government usually OWEs you a refund.The government usually OWEs you a refund.

More AllowancesMore Allowances The government doesn’t withhold that muchThe government doesn’t withhold that much You OWE taxes at the end of the year.You OWE taxes at the end of the year.

Do you have to pay tax on: Do you have to pay tax on:

•Weekly Wages?

•Yes!

Do you have to pay tax on: Do you have to pay tax on:

•Tips you make?•Yes!

Do you have to pay tax on: Do you have to pay tax on:

•Work Bonuses?•Yes!

How does the government know how many tips you got?

•You are supposed to report your tips to your employer.

April 15April 15thth::

The deadline for you to figure out how much The deadline for you to figure out how much tax you owe.tax you owe.

But how? How do you figure out how much But how? How do you figure out how much tax you owe?tax you owe?

W-2 Form:W-2 Form:

Your employer will send you a form called the W-2 Your employer will send you a form called the W-2 Form.Form.

It is also known as the Wage and Tax Statement.It is also known as the Wage and Tax Statement.

Using the information on this, you will complete a form Using the information on this, you will complete a form called the 1040. (But we’ll talk about that tomorrow)called the 1040. (But we’ll talk about that tomorrow)

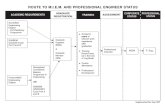

What is on the W-2?What is on the W-2?

Let’s look at an empty one:Let’s look at an empty one:

Here is one that an employer has filled out:Here is one that an employer has filled out:

So what are the numbers in the boxes for?So what are the numbers in the boxes for?

Box 1:Box 1:

This is your TOTAL taxable wages for This is your TOTAL taxable wages for FEDERAL (not state) income. It includes FEDERAL (not state) income. It includes wages, salary, tips you reported, bonuses, wages, salary, tips you reported, bonuses, etc… etc…

Box 2:Box 2:

This is the amount of tax that has already This is the amount of tax that has already been withheld from the government (based been withheld from the government (based on the allowances from your W-4). on the allowances from your W-4).

Box 3:Box 3:

This box reports the amount of your wages This box reports the amount of your wages that are subject to Social Security Tax. Only that are subject to Social Security Tax. Only $90,000 can be subject to SS tax. Since $90,000 can be subject to SS tax. Since most of us make UNDER $90,000 this will most of us make UNDER $90,000 this will always be the same as Box 1. always be the same as Box 1.

Box 4:Box 4:

This box reports the amount of Social This box reports the amount of Social Security Tax that was withheld from your Security Tax that was withheld from your paycheck. The SS tax is a flat rate of 6.2%paycheck. The SS tax is a flat rate of 6.2%

30,275 * .062 = 1,877.05 30,275 * .062 = 1,877.05

Box 5:Box 5:

The amount of wages subject to Medicare taxes. The amount of wages subject to Medicare taxes. There is a cap on the amount you get taxed for Social There is a cap on the amount you get taxed for Social Security($90 K), but none for Medicare! Security($90 K), but none for Medicare!

(Also, the wages applicable to Medicare taxes don't (Also, the wages applicable to Medicare taxes don't recognize any 401K or 403B contributions. This is recognize any 401K or 403B contributions. This is why the amount in Box 5 can be bigger than Box 1.)why the amount in Box 5 can be bigger than Box 1.)

Box 6:Box 6:

This box reports the amount of Medicare Tax This box reports the amount of Medicare Tax that was withheld from your paycheck. The that was withheld from your paycheck. The Medicare tax is a flat rate of 1.45%Medicare tax is a flat rate of 1.45%

30,275 * .0145 = 438.99 30,275 * .0145 = 438.99

Here is Mister Here is Mister Crow’s W-2:Crow’s W-2:

The 1090-INT FormThe 1090-INT Form(Income Interest Form)(Income Interest Form)

Let’s talk about…..Let’s talk about…..

InterestInterest

You want to buy a car that costs $10,000.You want to buy a car that costs $10,000.

You don’t have $10,000.You don’t have $10,000.

What do you do?What do you do?

Go to a bank and take out a LOAN!!Go to a bank and take out a LOAN!!

So, the bank let’s you borrow money. Do So, the bank let’s you borrow money. Do they let you borrow that money for free?they let you borrow that money for free?

NO! They charge interest.NO! They charge interest.

The bank charges interest to let you The bank charges interest to let you borrow their money.borrow their money.

Likewise, the bank will GIVE you money if Likewise, the bank will GIVE you money if you let them borrow money.you let them borrow money.

If you have a Savings Account with a bank If you have a Savings Account with a bank you are letting them borrow your money.you are letting them borrow your money.

What? I thought the bank put my money What? I thought the bank put my money in an account!in an account!

NO! The bank does not have a little box NO! The bank does not have a little box with your money in it. They just record with your money in it. They just record how much you gave them.how much you gave them.

The bank takes your money, and the The bank takes your money, and the money of everybody else, and they create money of everybody else, and they create a big pool of it!a big pool of it!

Your money.

Then, they let people borrow that money. Then, they let people borrow that money.

They charge interest, or course. That’s They charge interest, or course. That’s how banks work.how banks work.

But that’s no fair! They’re borrowing my But that’s no fair! They’re borrowing my money, letting other people use it, money, letting other people use it, charging interest, and making money? charging interest, and making money? What’s in this for me?What’s in this for me?

Well, the bank will pay you interest on the Well, the bank will pay you interest on the money you put in your account.money you put in your account.

For example, John puts $500 in a Savings For example, John puts $500 in a Savings account. The Savings account has an account. The Savings account has an interest rate of 3% per year.interest rate of 3% per year.

$500 * .03 = $15 $500 * .03 = $15 The bank gives him $15 The bank gives him $15 (the interest) at the end of the year.(the interest) at the end of the year.

What? Only $15? That stinks!!What? Only $15? That stinks!!

Well… not really. What is the interest for Well… not really. What is the interest for $2,000,000?$2,000,000?

$2,000,000 * .03 = $60,000$2,000,000 * .03 = $60,000

$60,000 isn’t bad. That’s more than Mister Crow makes. $60,000 isn’t bad. That’s more than Mister Crow makes. All you have to do is let the bank borrow your money for All you have to do is let the bank borrow your money for a year. You don’t have to do anything!! a year. You don’t have to do anything!! You could stay home all day long and watch Power You could stay home all day long and watch Power Rangers – and still make more than Mister Crow!Rangers – and still make more than Mister Crow!

The Question is…..The Question is…..

Do you have to pay tax on Interest?Do you have to pay tax on Interest?

YES!! You do! The government wants a YES!! You do! The government wants a cut of ANY money you make!cut of ANY money you make!

If you make money (income) from a bank, If you make money (income) from a bank, you get taxed on it!you get taxed on it!

The only time you don’t get taxed is if you The only time you don’t get taxed is if you get interest from letting a state or city get interest from letting a state or city borrow your money. (Bonds) borrow your money. (Bonds)

Taxable Interest Income:Taxable Interest Income: Bank Accounts.Bank Accounts.

Tax-exempt Interest Income:Tax-exempt Interest Income: State and City bonds.State and City bonds. ““Exempt” means it doesn’t apply to you.Exempt” means it doesn’t apply to you.

April 15April 15thth::

The deadline for you to figure out how much The deadline for you to figure out how much tax you owe.tax you owe.

But how? How do you figure out how much But how? How do you figure out how much tax you owe on any interest?tax you owe on any interest?

1099-INT Form:1099-INT Form:

Your bank will send you a form called the 1099-INT Your bank will send you a form called the 1099-INT Form.Form.

It is also known as the Interest Income Form.It is also known as the Interest Income Form.

Using the information on this, you will complete a form Using the information on this, you will complete a form called the 1040. (But we’ll talk about that tomorrow)called the 1040. (But we’ll talk about that tomorrow)

This is what a Form 1099-INT looks like:This is what a Form 1099-INT looks like:

How much interest did Mister Crow make?How much interest did Mister Crow make?