The Time Value of Money, An Overview Prof. Alley Butler Chapter 4 Part 1.

-

Upload

brent-nash -

Category

Documents

-

view

217 -

download

1

Transcript of The Time Value of Money, An Overview Prof. Alley Butler Chapter 4 Part 1.

The Time Value of Money,An Overview

Prof. Alley Butler

Chapter 4

Part 1

© 2010 Prof. A. C. Butler 2

Reference

Material for this lecture is taken from:

Van Horne, James C., Financial Management and Policy, Fifth Edition, Prentice-Hall, Englewood Cliffs, NJ, 1980.

Thusen, H. G., W. J. Fabrycky, and G. J. Thusen, Engineering Economics, 4th Edition, Prentice Hall, Englewood Cliffs, NJ, 1971.

© 2010 Prof. A. C. Butler 3

Outline

• Simple Interest and Compounding

• Future Worth

• Present Worth

• Annuity

• Sinking Fund

• Compounding Periods

• Interest Tables

• Complex Problems

© 2010 Prof. A. C. Butler 4

Simple Interest

Interest is the cost of using someone’s money for a period of time.

If $ 100 is left on deposit for one period at 6% then $ 6 in interest cost is owed. Using a formula:

$ 100 * 0.06 = $ 6

© 2010 Prof. A. C. Butler 5

Simple Interest

If the original funds are returned with the interest, the amount owed to the owner of the funds is:

$ 100 + $ 6 = $ 100 * (1.06) = Present Amount * (1 + Interest Rate) = Future Amount

© 2010 Prof. A. C. Butler 6

Simple Interest

For brevity, we will abbreviate the Present Amount as P and the Future Amount as F. The interest rate expressed as a decimal fraction is represented by i. So, the formula for a single period becomes:

P * (1 + i) = F

© 2010 Prof. A. C. Butler 7

Compound InterestIf funds are left on deposit for a second period of time then the interest is applied again. In the earlier example, the $ 100 left on deposit at 6% for one period became $ 106. If the $ 106 was left on deposit at 6% for a second period then the resulting amount would be:

$ 106 * (1 + 0.06) = $ 112.36

© 2010 Prof. A. C. Butler 8

Compound InterestNote that the $ 100 earned $ 6 in interest during the first period and it earned $ 6 in interest during the second period. So, the interest on the amount deposited should be $ 12 or 2 * $ 6. Where did the extra $ 0.36 come from?

Answer: The $ 0.36 is interest earned in the second period on the interest from the first period.

Compounding occurs because interest is earned on interest from prior periods.

© 2010 Prof. A. C. Butler 9

Extended Interest Formula

Amount in account at the end of the first period is:

P * (1 + i)If this amount is left on deposit for a second period, then the amount in the account at the end of the second period is:

P * (1 + i) * (1 + i)

© 2010 Prof. A. C. Butler 10

Extended Interest Formula

Extending this concept for n periods, we have:

P * (1 + i) * (1 + i) * (1 + i) ….* (1 + i)

where the multiplication by (1 + i) occurs n times, or:

F = P * (1 + i)n

© 2010 Prof. A. C. Butler 11

Example ProblemYou have borrowed $ 1,000 from a lender with 8% interest per year over four years. How much do you owe the lender at the end of the four years?

Solution:

F = P * (1 + i)n

= $ 1,000 * (1 + 0.08)4

= $ 1,360.49

© 2010 Prof. A. C. Butler 12

Present WorthWhat is you need to find the present amount (or present worth) given some future sum?

For example, you may want to know how much money to deposit today to have $ 10,000 in seven years at an interest rate of 5% per annum.

What do we do?

Simply invert the formula:

P = F / (1 + i)n

© 2010 Prof. A. C. Butler 13

An ExampleWhat is the present worth of $ 10,000 at 5% for 7 years?

Solution:

P = F/(1+i)n

= $ 10,000 / (1 + 0.05)7

= $ 7,106.81

© 2010 Prof. A. C. Butler 14

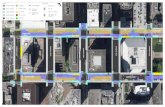

Graphical RepresentationFor the interest problems we have so far, the cash flows are relatively simple. However, some problems have much more complex cash flows, and a graphical representation is useful for understanding the time value of money problem.

We can use a graphical representation to better understand the problem. Arrows represent cash flow. Up arrows represent cash coming in and down arrows represent cash going out.

The length of the arrow represents how much money is going in or out.

© 2010 Prof. A. C. Butler 15

Graphical Representation

Example 1: You have borrowed $ 1,000 from a lender with 8% interest per year over four years.

1 2 3

4

© 2010 Prof. A. C. Butler 16

Graphical Representation

Example 2: You have deposited $ 7,106 at 5% for 7 years.

1 2 3 4 65 7

© 2010 Prof. A. C. Butler 17

An AnnuityA single premium annuity is a product sold by an insurance in which you pay a certain lump sum, and the insurance company pays you back each period over a long time (or until death – hopefully a long time).

In the world of capital budgeting and the time value of money, the term annuity stuck. It means an initial investment with periodic repayments. Graphically we have:

© 2010 Prof. A. C. Butler 18

AnnuityIf we designate the variable A to be the constant amount of the payment, then the formula for an annuity is:

n

n

i) (1 i

1i) (1A P

© 2010 Prof. A. C. Butler 19

Annuity

10

10

09.0109.0

10.091 500 P

Example: If you want $ 500 in funds each year for 10 years, how much would you expect to invest when interest is 9% per year?

i = 0.09A = 500n = 10

n

n

i) (1 i

1i) (1A P

P = $ 3,208.83

© 2010 Prof. A. C. Butler 20

AnnuityIf we designate the variable A to be the constant amount of the payment, then the formula for an annuity is:

n

n

i) (1 i

1i) (1A P

© 2010 Prof. A. C. Butler 21

Annuity

If we are given the value of P and want to determine A, then we simply invert the formula.

1i 1

i 1 i P A

n

n

© 2010 Prof. A. C. Butler 22

AnnuityFor example, we want to get a 15 year mortgage on a piece of real estate at 10% annual interest for $ 120,000. How much would an annual mortgage payment be?

1i 1

i 1 i P A

n

n P = $ 120,000i = 0.10n = 15

110.01

0.10 1 0.10 $120,000 A

15

15A = $ 15,776.85

© 2010 Prof. A. C. Butler 23

Sinking FundWhen a corporation is planning to retire a set of bonds, they can set aside a portion of the bond issue’s value each year, and when it comes time to retire the bonds there will be enough cash in the bank to pay off the bond holders. This is called a sinking fund. As a generalization of this situation, any time a constant amount of investment is made in each year with a future amount being available, the term sinking fund is used. Graphically it looks like:

© 2010 Prof. A. C. Butler 24

Sinking FundAs with the annuity, the constant value periodic payments are represented by variable A. Note that the sinking fund is very similar to the annuity, but we are interested in F as a Future Amount rather than P as a Present Amount.

The formula for a sinking fund is:

i

1i 1A F

n

© 2010 Prof. A. C. Butler 25

Sinking FundOf course, if you know the value of F which is the Future Amount and want to find the value of A which is the Constant Periodic Payment Amount, then the formula can be inverted.

1i) (1

i F A

n

© 2010 Prof. A. C. Butler 26

Sinking Fund

1i) (1

i F A

n

Example: You are saving for your child’s college education. She will attend college in 14 years, and you are able to get 7% interest per annum on your funds. How much will you have to save each year to have a college fund of $ 100,000?

F = $ 100,000i = 0.07n = 14

10.07) (1

0.07 100,000 A

14A = $ 4,434.39

© 2010 Prof. A. C. Butler 27

Sinking Fund

i

1i 1A F

n

Example: Your company has a long term lease on the facilities that your firm uses for manufacturing; however, this lease expires in 20 years. At that time, it is expected to cost you to relocate to another location. If your company puts away $ 5,000 per year at 9%, how much money will be available for relocation?

A = $ 5,000i = 0.09n = 20

0.09

10.09)(1A F

20F = $ 255,800.60

© 2010 Prof. A. C. Butler 28

Compounding PeriodsTo this point, we have worked with annual interest over annual periods; however, interest can be compounded on a more frequent basis. It can be compounded on a semiannual, quarterly, monthly, weekly, daily, or continuous basis. We will not cover continuous compounding, but the following calculations illustrate the effects of more frequent compounding. Each is a nominal equivalent of 12% per year for $ 1000.

Annual 1 period/yr at 12%/period F = $ 1,000 (1.12) = $ 1,120.00Semiannual 2 periods/yr at 6%/period F = $ 1,000 (1.06)2 = $ 1,123.60Monthly 12 periods/yr at 1%/period F = $ 1,000 (1.01)12 = $ 1,126.83Daily 365 periods/yr at 0.0329%/period F = $ 1,000 (1.000329)365 = $ 1,127.47

© 2010 Prof. A. C. Butler 29

Compounding PeriodsNotice from the previous calculation that as the number of periods for compounding increase, the amount of interest earned is increased. Again, we are earning interest on interest by increasing the frequency of compounding.

Since compounding could be annual, semiannual, quarterly, monthly, daily, or on another basis, a means of conversion is provided, where r is nominal interest in c periods per year.

1c

r 1 i Annual Equivalent

c

© 2010 Prof. A. C. Butler 30

Compounding Periods

1236.012

0.12 1 i Annual Equivalent

2

1c

r 1 i Annual Equivalent

c

1255.014

0.12 1 i Annual Equivalent

4

For the semiannual, quarterly, monthly, and daily compounding periods, the following annual equivalent interest rates apply.

1275.01365

0.12 1 i Annual Equivalent

365

1268.0112

0.12 1 i Annual Equivalent

12

Compounding Periods

• If the compounding is not annual we have c periods per year, and an APR which is variable r in the equation

• Use the same formulas, but there are c periods per year with n = c (years)

• Interest per period becomes i = r/c

© 2010 Prof. A. C. Butler 31

Compounding Periods

• If you have a $10,000 car loan with an APR of 6% over 4 years, what should your monthly payments be?

© 2010 Prof. A. C. Butler 32

1i 1

i 1 i P A n

n

1005.01

0.005 1 0.005 $10,000 A 48

48

i = APR/c = 0.06/12 = 0.005P = 10,000n = c (years) = 12 * 4 = 48

A = $ 234.85

© 2010 Prof. A. C. Butler 33

Interest TablesFor many of the interest formulas we have had P, F, or A multiplied by a quantity found in parenthesis or brackets. The quantity found in parenthesis or brackets can be calculated using the formulas provided to you, or the value in parenthesis or brackets can be found in a table.

The tables used in this lecture come from the appendix of Thussen, Fabrycky, Thussen, Engineering Economy, 4th Edition, Prentice Hall, Englewood Cliffs, NJ, 1971.

The table notation is based on X/Y (where X and Y are F, P, or A), with i = interest, and n = periods. The X/Y is notation for to find X given Y. So, P/A is to find P given A. This is often written as (X/Y, i, n) in the problem sets.

© 2010 Prof. A. C. Butler 34

Interest Tables

Table D.11 on page 453 of Thussen, Fabracky, and Thussen, Engineering Economy, 4th Ed, 1971.

© 2010 Prof. A. C. Butler 35

Interest TablesTo find F, given P at 8% interest over 4 years, look in the 8% table on the line for n = 4. The factor needed for this calculation listed under the column with F/P i, n at the top.

© 2010 Prof. A. C. Butler 36

Interest Tables

The F/P i, n factor from the table is 1.360. The calculations are as follows:

F = P * 1.360 = $ 1,360

This answer agrees with the answer obtained earlier in this lecture, except for 0.49 in roundoff error caused by using the interest tables.

Calculations for Present Value, Annuities, Sinking Funds are carried out in an analogous manner. The only difference is that the column in the table changes depending on which variable you know and which variable you need to find.

Complex Problems

• There are five variables for a simple problem: P, A, F, i, and n

• For the simple problems you will be given three variables, one is not of interest, and you are solving for the fourth variable

• Complex problems are really several simple problems that are related to each other

• The smartest thing you can do is to draw the cash flow diagram

© 2010 Prof. A. C. Butler 37

Complex Problems

© 2010 Prof. A. C. Butler 38

To solve a complex problem break the problem into parts and relate the parts. Remember to use the cash flow diagram and five variables.

F

P’ = F

© 2010 Prof. A. C. Butler 39

Outline

• Simple Interest and Compounding

• Future Worth

• Present Worth

• Annuity

• Sinking Fund

• Compounding Periods

• Interest Tables

• Complex Problems

© 2010 Prof. A. C. Butler 40

Conclusion

Using the methods covered in this lecture, you should be able to find equivalent sums of money considering the time value of money.