The Theoretical and Empirical Failures of Fiscal Austerity Policies

-

Upload

callum-thain-black -

Category

Documents

-

view

217 -

download

0

Transcript of The Theoretical and Empirical Failures of Fiscal Austerity Policies

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

1/11

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

2/11

Pact of 1997 (adherence to which was a condition of European currency union membership)

(BBC News - Business, 2012). From this it is already clear that the label of universal fiscal

profligacy is unwarranted and that the rapid escalation of debt levels was symptomatic to the

financial crisis (Tyson, 2012)

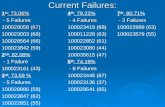

Figure 1 (Lane, 2012)

Structural defects and imbalances between the central European core and the southern

European periphery account for the rapid increase in debt post-financial crisis. Theintroduction of the European Monetary Union in 1999 saw a convergence of bond yields

(determined by their perceived risk) across member states. The potential benefits of the

currency union (and the elimination of exchange and inflation risks) fed investor confidence

and led to a reduction of sovereign bond yields from the periphery to align with those of the

core (European Central Bank, 2012).

The periphery capitalized on the now plentiful cheap credit, a fact which caused housing

bubbles in both Spain and Ireland (attributable for the most part to private sector borrowing)

and decidedly loose fiscal policy in Portugal and Greece. This fragile system, pushed over

the edge by the financial crisis, led to a major reassessment among investors of the

sustainability of rapid credit growth and large ... deficits. Concerns then turned to European

sovereign debt, when, in 2009, many countries reported unexpectedly high deficits as a result

of recession-induced dwindling tax revenues (Lane, 2012, pp. 56-58). What followed were a

rapid deterioration of bond yields and the spiralling of sovereign debt.

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

3/11

Figure 2 analyses the initial effects of, and the Euro zone reaction to, the recession with the

IS-LM framework1. For the purposes of this analysis the price level and inflation are fixed.

The initial equilibrium is at output (y1) and (i(1)), the recession caused a dramatic decrease in

consumption and autonomous investment and hence demand (Z). This decrease in output

(spurred on by the multiplier effect) then induced a leftward shift in the IS-curve causing

equilibrium to shift to [i(2), (y2)] . The effect of the recession was mildly offset by some

expansionary fiscal policy, though the initial scope for which (given the cash starved nature

of EMU member economies and their mounting debt) is minimal. To give an idea of the

extent of the immediate effects of the recession, during the second quarter of 2008 alone,

Eurozone GDP fell by 0.1%. The effect over the entire duration of the recession is of course

more pronounced (Finfacts , 2008).

Figure 2

1 The Is-curve herein contained is an aggregate Is, the horizontal summation of individual member countries.

Although the EMU represents a monetary union (and hence can only have one LM curve), it is comprised of

different member states that follow independent fiscal policies). Nonetheless, the scope of this analysis is suchthat it considers LM and Is curves for the EMU as a whole, that is to say it studies the aggregate effect(irrespective of whether some Is curves shift leftwards/ rightwards in the process).

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

4/11

From mid 2008, the European central bank reacted to the financial crisis with expansionary

monetary policy. The effects of such a policy, whereby the European central bank drastically

reduced short term interest rates, through the provision of extensive Euro-denominated

liquidity, are given by shifts in the LM curve (Lane, 2012, p. 55). The shift from LM (1) to

LM (2) results in the equilibrium given by (y4). However, due to the already low interest rate

level, a shift of the LM further than LM3 will induce neither changes in the interest rates nor

an increase in output. This point is given by X, the ineffective point, after which

expansionary monetary policy becomes futile (a Keynesian liquidity trap) (Krugman, 2011).

Figure 3 shows the steady decline in interest rates as a result of the continued monetary

expansion. The table shows the most recent results from mid 2011, note that at present, the

interest rates sit at around 0.25%, very close to 0.

Figure 3 (European Central Bank, 2012)

Given the prevailing situation in Europe a demand-deficiency-induced recession (low

output and consequently high unemployment) and spiralling debt (and debt-to-GDP ratios)

compounded by lower tax revenues (as a result of the recession) the role of austerity fiscal

policy seem dubious. The theoretical justification for such policy is based on the empirical

work by Alberto Alesina (2010) who, after a historical analysis of the effects of deficit

reduction/ austerity (that is to say, situations where government reduces spending or increases

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

5/11

taxation) on GDP, concluded that not all fiscal adjustments cause recessions (Alesina,

2010). The basic theory is summarised by Figure 4. When analysed from a traditional

Keynesian perspective, within the framework of the IS-LM model, we see that austerity (or

deficit reduction) results in the short-run in a decrease in output and interest rates via a

leftward shift of the IS curve (the decrease in government spending/ increase in taxation

results in a decrease in demand and through the multiplier effect, a decrease in output) 2.

Alesina posited that consumers and investors would perceive the governments return to

fiscal prudence and their move to bring debt under control, as a sign of future economic

stability. This would then cause an increase in consumer and investor confidence and a

rightward shift of the IS curve (movement I). Having revived demand, the economy would

then be better placed to make movement J, towards the initial equilibrium and then further to

such an extent such that full employment is restored. Given this evidence, it would seem that

the only course of action for the cash-strapped and heavily indebted Eurozone would indeed

be fiscal austerity. Not only would it restore demand but it would greatly improve budget

balances and aid in the reduction of the debt to GDP ratio. Van der Veen (2012) notes thatincreased levels of confidence would not be the only possible expansionary effect

(theoretically). Given that EMU countries cannot individually devalue their countries

(because they are part of a monetary union), austerity policies may contribute to internal

devaluation. The deficit reduction and ensuing lower output and higher unemployment could

put downward pressure on real wages, making exports more competitive and inducing

recovery (Veen, 2012, pp. 20-21).

2 Though interest rates decrease and as a result, investment increases, the increase in investment does not offset

the negative effect of the initial decrease in government spending.

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

6/11

Figure 4

Shiller (2012) argues that Alesinas historical analysis is flawed statistically because it

doesnt take into account the possibility of reverse causality and because it fails to distinguish

between the economic intent of governments appearing to go through austerity. A

government who, in expectation of an increase in domestic demand, takes on a more frugal

fiscal policy but whose cutbacks are insufficient to slow down the expected increase in

domestic demand, may appear to have increased performance under austerity. These

anomalies result from our inability to control for all variables in complex macroeconomic

situations.

Empirically, austerity seems not to have cured but exacerbated the European sovereign debt

crisis. Analysis of the reductions in government spending, controlling for intent, that is to say

cuts in government spending not due to the decrease in tax revenue (as a result of the

recession) show that austerity has lead to reductions in GDP growth rate (from 1, 06% in the

first quarter of 2008 to 0.97% in the last quarter of 2011) and has been accompanied by mild

increases in the debt to GDP ratio (controlling for decreases in tax revenue as a result of the

recession) (Shambaugh, 2012, pp. 29, 54). This resonates with the historical analysis of

Guardo et al. who (controlling for intent) found that austerity programs weaken both

consumption and investment (Shiller, 2012). The contractionary effects of austerity in the

EMU culminated in the downgrading of the credit rating of several member states in January

2012 (Veen, 2012, p. 21).

The fundamental premise of austerity is not a cruel or misguided one, sovereign debt needs to

be serviced as quickly as possible lest it spiral farther out of control- economies that too are

highly leveraged sit evermore precariously on the brink of financial crisis. But as Stiglitz

(2012) points out, growth and confidence (all essential to the long and short term

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

7/11

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

8/11

Figure 5 (BBC News - Business, 2012)

These structural imbalances do, ironically, have the capacity to improve the situation in the

Eurozone. Debt to GDP ratios can be reduced if there is sustained economic growth. Growth

would revive demand, increase tax revenues and reduce deficits and debt (Veen, 2012, p. 22).

Moreover broad-based structural reforms within Europe are crucial to ensure that conditions

encourage growth. Germany, given its relative economic stability and unparalleled cheap

borrowing costs has the ability to finance the investment and development required for the

GDP growth to take place in the rest of Europe. One particular target for such investment is

education, ensuring that human capital, typically negatively affected by sustained periods of

unemployment, does not atrophy (Stiglitz, 2012). The mainstream implementation of

instruments such as Eurobonds or group Project bonds which would act as credit rating

pooling devices, in tandem with the European Stability Mechanism could also help provided

finance to the cash strapped governments of the core. All these elements could contribute to

the recovery of European economy and the give Europe the means to rise above the debt

crisis.

Thus it is clear that, empirically, austerity failed as means of reducing the debt-to-GDP ratio

of indebted countries. It was flawed conceptually and had limited empirical justification.

Moreover, the low interest rates and the current liquidity trap means that the expansionary

monetary policy cannot be used to great effect. The only course of action is a German

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

9/11

financed, investment-based, period of growth. Only once a relative degree economic stability

has been achieved can governments rigorously deleverage.

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

10/11

Reference list

Alesina, A., 2010.Fiscal adjustments: lessons from recent history. Madrid , s.n., pp. 1 - 54.

BBC News - Business, 2012.Eurozone crisis explained. [Online]

Available at: http://www.bbc.co.uk/news/business-16290598[Accessed 16 September 2012].

BBC News - Business, 2012. Government Borrowing cost (diagram). InEurozone crisis

explained. [Online]

Available at: http://www.bbc.co.uk/news/business-16290598

[Accessed 16 September 2012].

European Central Bank, 2012. The euro area sovereign debt market: lessons from the crisis.

[Online]

Available at: http://www.ecb.int/press/key/date/2012/html/sp120628_1.en.html[Accessed 18 September 2012].

European Central Bank, 2012. Interest rates (diagram). In The euro area sovereign debt

market: lessons from the crisis. [Online]

Available at: http://www.ecb.int/press/key/date/2012/html/sp120628_1.en.html

[Accessed 18 September 2012].

Finfacts , 2008.News: EU Economy. [Online]

Available at: http://www.finfacts.ie/irishfinancenews/article_1014454.shtml

[Accessed 18 September 2012].

Krugman, P., 2000. How complicated does the model have to be?. Oxford Review of

Economic Policy, 16(4), pp. 33-42.

Krugman, P., 2011.IS-LMentary. New York Times: Conscience of a Liberal [blog]. [Online]

Available at: http://krugman.blogs.nytimes.com/2011/10/09/is-lmentary/

[Accessed 11 September 2012].

Lane, P. R., 2012. The European Sovereign debt crisis.Journal of Economic Perspectives,

July, 26(3), pp. 49-68.

Lane, P. R., 20120. The Evolution of Public Debt, 1982-2011 (diagram). InJournal of

Economic Perspectives,July, 26(3), pp. 49-68.

Matheron, J., Mojon, B. & Sahuc, J.-G., 2012. The sovereign debt crisis and monetary policy.

Banque de France - Financial Stability Review, April, pp. 155 - 168.

Shambaugh, J. C., 2012. The Euros Three Crises.Brookings Papers on Economic Activity,

April, 23(1), pp. 1-55.

Shiller, R., 2012.Does austerity promote economic growth? - Project Syndicate. [Online]

Available at: http://www.project-syndicate.org/commentary/does-austerity-promote-

-

7/28/2019 The Theoretical and Empirical Failures of Fiscal Austerity Policies

11/11