The strategies and effects of low-cost airlines Simon Smith.

-

Upload

nickolas-simon -

Category

Documents

-

view

217 -

download

0

Transcript of The strategies and effects of low-cost airlines Simon Smith.

The strategies and effects of low-cost airlines

Simon Smith

Contents

Who and what are the low cost airlines?

What is the market for the low cost airlines?

How much ‘lower cost’ are they, and why?

What is the impact on long-distance rail?

What are the key strategies for success?

What is the future for the low cost sector?

Who and what are the low cost airlines?

Who are the low cost airlines?

The main low cost airlines operating to/from the UK are:

Globally, the largest and most successful low cost airline is Southwest in the US

What are the key characteristics of low cost airlines?

The low-cost model was pioneered by Southwest Airlines in the US, and European low-cost carriers have all followed this to an extent:

high seating density and load factors

uniform aircraft types (usually the 737-300)

direct booking (internet/call centre - no sales commissions)

no frills such as “free” food/drinks, lounges or ‘air miles’

simple systems of yield management (pricing)

use of secondary airports to cut charges and turnaround times

Successful low cost airlines are very profitable

The successful low cost airlines are more profitable than established carriers

Ryanair has a market capitalisation of about £3 billion

Operating margins by airline (1999)

British AirwaysAir FranceLufthansaKLMUnited AirlinesRyanairSouthwest

0.9%3.5%5.7%1.5%

11.9%22.7%21.8%

What is the market for the low cost airlines?

Entry spurs an increase in demand (often one-off)

Time of entry of lower cost carrier

Data is for passengers on routes to London. Source: CAA airline/airport statistics

80

100

120

140

160

180

200

220

240

260

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

Traffic (1991=100)

Belfast

Glasgow /Prestwick

Edinburgh

Dublin(Ryanair)

On some routes low-costs have become the majors

Growth averages 10.5% in the first two years after entry of a low cost carrier

At other times and on other routes, growth averages 4.4%

Evidence of saturation on some routes after 5-10 years

Low cost airlines are now the major operators on some routes:

For many destinations, easyJet now offers frequencies better than British Airways

Higher frequencies mean low cost airlines become more attractive to business passengers, and these are now a significant proportion of passengers for easyJet

Some traffic is new, but some comes from other airlines

Low cost market share 46% in 2003

If ‘natural’ growth 5% per year:

• 62% of low cost traffic is new or transferred from surface transport (38% from other airlines)

• Traffic on other airlines would be 32% higher now without the low cost operators.

Passengers between London and Glasgow (including Prestwick)

0

500

1000

1500

2000

2500

3000

3500

4000

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2002

Passengers (000s)

Other carriers Easyjet and Go Ryanair (Prestwick)

How much lower cost are the low costs?

The passengers fare varies in two ways

Different fare structures

Different overall costs

Low cost carriers are renowned for cheap fares...

Cheap fare offers are heavily publicised. Current available offers include:

Dublin to London €2.99 single (Ryanair)

London to Düsseldorf (almost) £0.99 single (Ryanair)

London to Edinburgh £9.99 single (easyJet)

London to Barcelona £12.99 single (easyJet)

... excluding government tax, plus on Ryanair, airport charges and a compulsory ‘wheelchair levy’, ‘insurance levy’ and charge for your credit or debit card

However, in reality most fares are higher than this: Ryanair’s average fare is around €40 per passenger and easyJet’s around €60 (excluding taxes and charges).

This results from different systems of yield management

Traditionally, airlines tried to design fares to charge each passenger as much as they were willing to pay, using:

Fare conditions: different degrees of flexibility, requirement to stay over a Saturday night, usually must buy a return ticket to get any discount (hence single fares often much more expensive than returns)

Different classes of service: business class may be 5-10 times the price of economy, but the service probably only costs 25% more

Distribution: cheaper fares were offered through discounters than through corporate travel agents

The availability of discount fares could be adjusted in response to variation in demand, but was generally on a flight-by-flight basis

Yield management still works (roughly) in this way for some long haul flights, especially on routes where bilateral air service agreements (ASAs) are relatively restrictive.

Low cost airlines use simpler, more flexible, pricing

Low cost airlines offered much simpler fares:

Seats sold first-come first-served, so passengers get cheaper fares by booking earlier; price thus automatically responds to variations in demand

The airline can also adjust the price bands if demand is greater or less than expected

All fares are one way and there is no difference in fare conditions

No attempt to buck the market by imposing ticket conditions (return trip required or Saturday night stay) to get the best fare

To an extent, British Airways and other full-service carriers have copied this, but their fares are still more inflexible than those the low-cost airlines offer. Rail operators have hardly responded at all.

Key issue: yield management through ticket restrictions only works if all competitors apply the same restrictions - so is unlikely to work in a very competitive market, where airlines have little or no market power and product differentiation is limited

Book in advance for cheap seats

The basic principle is that the cheapest seats are sold first - but the approaches to yield management do vary between the airlines:

easyJet - almost entirely first-come, first-served, with few special offers or sales

Ryanair - frequent “free”, “half price” or “99p” seat sales

Prices for peak, shoulder and off peak flights, by advance booking period

0

20

40

60

80

100

120

140

160

-150 -125 -100 -75 -50 -25 0

Days before flight

Price (£)

Peak

Shoulder

Off peak

Overall costs are significantly lower:

Higher seating density and no business class reduces per seat costs by 16% (easyJet relative to BMI)

Aircraft utilisation is also higher:

easyJet aircraft are in the air for 11 hours a day – BA’s equivalent aircraft fly for less than 8 hours

Costs per available seat kilometre for easyJet are 64% lower than for BMI

Costs per seat are 52% lower

The low cost airlines operate with higher load factors (fewer empty seats) so their costs per revenue passenger kilometre are even lower

Operational data for 1998 from CAA 1998 airline statistics; financial data is for FY1998 (CAA 1999 airline statistics)

Breakdown of cost saving

0 5 10 15 20 25

Other operating costs

Flight crew

Cabin crew

Aircraft fuel and oil

Airport and ANS charges

Sales and reservations costs

Advertising and promotions costs

Station costs

Commission

Aircraft related costs

Passenger services costs

Cost per 000 RPK (£)

Full cost short haul airline

Low cost airline

Ryanair has negotiated good (illegal?) deals with airports

Airport charges are typically in total £10-15 per passenger

Ryanair has reversed this and it is, in effect, paid to land at some airports. Airports may do this because:

Regional/local governments want Ryanair to come to their airports, perceiving that there are economic benefits to the region from this

Actual evidence is mixed - positive at Prestwick, negative at Blackpool

Airports can make money on associated services (catering, retail)

Airports may also make a profit from ground transport concessions (buses, car hire)

However, in some cases this is funded either through

direct subsidy from the regional government; or

cross-subsidy from other airlines

Newquay airport has been driven into losses as a result of the Ryanair deal it signed, and the local MP has called for the deal to be scrapped

The Charleroi ruling challenges this

At Charleroi, Ryanair was receiving:

Reduction in airport charges of €1-2 per passenger (illegal)

Reduction in ground handling charges from €8-13 to €1 per passenger (illegal)

“One-shot” flat rate incentives for starting up new routes, such as contribution to recruitment costs, hotels etc (illegal)

Route start-up aid - for example, shared marketing costs (legal, provided it is proportionate, does not exceed 50% of cost, is limited in duration and competitively available - none of which apply to Ryanair’s deal at Charleroi)

The Commission claims that Ryanair may be able to keep 70% of aid provided, but it is hard to see how (pay back €10 million?)

Impact could be about €15 per round-trip passenger

EC is now investigating other Ryanair deals (eg. Pau in France)

Probably only has a significant effect on Ryanair - easyJet claims not to receive equivalent subsidies and welcomes the ruling

Ryanair is appealing: this appears to be a delaying tactic only, but the delay could be quite long

What is the impact on long-distance rail?

Traffic will be taken from long-distance rail as well

0

40

80

120

160

200

0 200 400 600 800 1000 1200

Distance (km)

One-way airline cost / rail fare (€)

Traditional airlines Low cost airlines 2002 rail fares

Airline costs per passenger, and rail fares, from Barcelona

It’s not clear what rail operators can do about this

For short journeys (less than 3 hours) rail is likely to remain dominant: air journey times longer, particularly if (inconvenient) secondary airports used

For longer journeys, rail operators could try to cut costs - but this is difficult, in a heavily unionised environment

Internet sales could cut ticket costs significantly (currently 6-10% of total fare), improve load factors and help passengers find lowest fares:

SNCF is pioneering here - you can print your own ticket, which is scanned on board the train; some trains (idtgv) are internet booking only

Other rail operators are years behind airlines

A few niche services have successfully competed on quality (France-Spain Hotel Trains), but others are just withdrawing services: SNCB and NS have both withdrawn all the international long-distance trains they operated

However, so far, low-cost airlines are only competing with rail on the longest distance routes

Ferry operators (and Eurotunnel) also severely hit: have had to cut prices by up to 80%

Rail market share will fall

The market share curve may shift downwards, with the biggest impact being on long distance journeys (over 3-4 hours)

0%

20%

40%

60%

80%

100%

00:00 02:00 04:00 06:00 08:00 10:00

Rail journey time (hours)

Rai

l m

arke

t sh

are

Adapting the yield management system is key

Discounted tickets, if they exist at all, tend to be restrictive: Eurostar’s cheapest single to Paris is £149. easyJet costs from £17.99 (inc tax).

Rail fares vary less than air fares, and are therefore lower in peak periods (when airlines make most of their money) but higher for the rest of the year

In some countries, this is because rail fares are legally a tax which therefore cannot be varied, except by ministerial decree (!)

not the case in the UK, but regulation of Saver and season tickets limits potential for yield management

60-day booking limit (often much less in the UK, for various reasons) for most rail fares no longer appropriate

Airline yield management systems cannot be directly transferred to rail

Passengers board en-route - systems not designed to handle this

Rail is a network: some passengers may have to use specific trains to make connections - if they can’t use them at the right price, won’t travel by rail at all

What are the key strategies for success?

Despite the overall success of the sector, most fail

Almost all low cost airlines launched in the US (except Southwest) have failed

recent failures include Pro Air and ValuJet

Virgin Express reduced its network significantly in 2000, closing an Irish-based subsidiary

In the UK, AB Airlines, Debonair, Duo and Now have failed; ‘Now’ went bankrupt before the first flight had taken off

Go lost £47m in its first two years

Buzz was sold to Ryanair for a nominal sum (£15m)

To survive, airlines need to be genuinely low cost:

Virgin Express suffers from high Belgian labour costs, and from inheriting overheads from the predecessor charter airline

Debonair attempted to operate in the middle-ground, offering some frills

Buzz suffered from a mixed, unsuitable fleet and from inheriting overheads and higher costs from KLM UK

costs per 000 ASK for KLM UK were £84 in 1999-2000 (easyJet £49)

easyJet is lower cost – but only Ryanair is really cheap

Differences in strategy between easyJet and Ryanair are becoming clearer: easyJet primarily uses new aircraft; Ryanair usually has not (although has recently

placed a very large order for new 737s)

easyJet aims to build frequency, Ryanair generally just to expand its network

easyJet usually flies to major airports – Ryanair airports may be 100km from the cities they serve. But easyJet faces problems of congestion (Gatwick, CDG)

easyJet’s customer service is better (eg. limited compensation for delays)

These differences are apparent in the marketing strategy of the airlines. easyJet is overtly targeting business passengers: Business passengers help offset the fact that most leisure passengers want to

travel during weekends and peak holiday periods

As a result, easyJet’s costs per passenger are about €20 higher

easyJet’s ‘intermediate’ strategy makes it more of a threat to established airlines, but also carries more risks

Strategies may diverge further

Ryanair says US evidence shows that the “cheapest always wins” but this is not true:

JetBlue is overtly pursuing an ‘intermediate’ strategy which distinguishes it from airlines such as Southwest - new planes, leather seats, generous legroom, live satellite TV

Very successful and profitable

Demonstrates that cost efficient and cheap are not the same

There may be a gap for a low cost but mid-service carrier: easyJet could fill this role, but it is competing with BA and others

What is the future for the low cost sector?

Low cost airlines are planning growth but there are risks

Low cost travel in Europe is still less widespread than in the US

Ryanair and easyJet are planning rapid continuing growth

easyJet grew by 21% in the year to June 2004

Ryanair grew by 44% in the year to May 2004

This risks leading to:

greater competition, including between the low cost airlines - Ryanair issued a profit warning last year, due to lower yields and lower load factors

capacity constraints in Southeast England

management/operational problems as low-cost carriers grow into very big airlines

direct competition with major Continental airlines

General risks to the aviation sector could hit low-cost airlines harder

Aviation fuel tax / higher airport charges

Traditional airlines have responded

Low cost yield management systems are being copied:

BMI has adopted an economy-class ticket structure quite similar to easyJet’s

BA has also copied elements of easyJet’s pricing system although it is much more restrictive and absurdities remain

Eurostar has also copied it, but incompletely (arguably, inadequately)

They are also trying to cut costs:

Travel agent commissions have been cut, usually to zero

Most booking now online

Wider use of e-tickets (large surcharges for paper tickets)

BA has standardised on two aircraft types at Gatwick

In America, established carriers cut costs significantly in response to low cost airlines

Most growth will be outside the UK

Low cost services are limited in most big Continental European cities, although bases are being developed at:

Amsterdam, Geneva, Dortmund, Berlin and Paris (easyJet)

Rome Ciampino, “Barcelona” Girona, Brussels Charleroi, Frankfurt Hahn and Stockholm Skaavsta (Ryanair)

Low-cost services at Paris, Copenhagen, Milan and Madrid are still limited

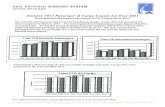

0% 5% 10% 15% 20% 25% 30%

Ireland

UK

Belgium

Spain

Italy

Germany

Netherlands

France

Low cost market share

Low cost market share by country, 2003

This is harder than expanding from the UK or Ireland

Continental European governments may do more to protect their ‘flag-carriers’ than the British or Irish government:

Ryanair has recently been prevented from advertising Dusseldorf “Weeze” airport

easyJet has found it difficult to obtain slots at Paris airports

Ryanair forced to withdraw from Strasbourg Airport after a French court ruling

Charleroi ruling may significantly impact on Ryanair (but not yet)

LCAs are also facing very strong competition, particularly in Germany - some incumbents are prioritising market share over profit

Ryanair still makes most of its profits on UK-Ireland routes

The air travel market is more limited

To compete for business traffic, LCCs need to build frequency, but this is difficult on routes other than from London, because there isn’t enough demand

London is a uniquely strong base market: large population and business centre, high incomes, low car ownership, on an island, bad/expensive rail services, congested roads, bad weather

More people in southern European countries take their holidays at home - so no need to fly

More dispersed origins and destinations mean more flights require interchange, but LCCs handle point-to-point traffic only; will low cost network carriers emerge?

Trains, buses and private cars in a better competitive position: the need to cross the Channel means surface travel is slower and more expensive from the UK.

Low cost airlines also compete with charter carriers

easyJet and Ryanair offer a number of routes to airports previously dominated by charter carriers (Malaga, Palma de Mallorca, Ibiza, Alicante)

However, charter carriers have several advantages:

operating costs equivalent to or below low-cost airlines, partly due to even higher aircraft utilisation

sales and distribution costs close to zero

load factors of 95% or higher

now selling seats to scheduled passengers

zero frills (food/drink) becomes less attractive on routes of 3+ hours

LCCs have taken significant market share from charter carriers, but as low fares were already available in these markets, less scope for growing total market size

The ability to offer low fares is under pressure

Ruling at Charleroi could significantly increase ticket prices, if upheld: many of Ryanair’s airport deals may be illegal, including perhaps some in the UK

Airlines now required to offer compensation, removing another of Ryanair’s cost advantages, although this is being challenged in court:

Free food, telephone calls and accommodation for cancellations/major delays - even if the airline isn’t responsible (eg. weather)

€250 cash compensation for most flight cancellations

Ryanair is now forced to pay for wheelchairs and has imposed a “wheelchair surcharge” on all passengers at Stansted and Gatwick

In the future, if airlines are required to contribute more to the environmental costs they impose, this will have a significant impact - although high speed rail travel also has significant environmental effects, over equivalent distances

Summary

Costs are genuinely lower - and need to be if a low cost carrier is to survive

Yield management has been transformed and the LCA approach has been copied by many other transport operators, but often inadequately

Market growth has been spurred but some passengers have transferred from established airlines and surface transport

Both full-service airlines and rail companies have to cut costs to compete; this is difficult - for railways, perhaps impossible

There are clear differences in strategy between easyJet and Ryanair. easyJet’s strategy is riskier, both for it and for the established carriers.

Charleroi ruling and other legal requirements a risk to Ryanair

Low cost airlines plan further expansion but this entails risks

Smaller low-cost carriers are likely to fail or be merged into the larger carries

![MORTIMER HISTORY SOCIETY - Simon de Montfort HISTORY SOCIETY SPRING MEETING Saturday 12 ... Katherine Ashe [US author] Tim Porter-Smith [Simon de Montfort Society] and John ... Prince](https://static.fdocuments.in/doc/165x107/5ab0330c7f8b9a5d0a8e7a4c/mortimer-history-society-simon-de-history-society-spring-meeting-saturday-12-.jpg)