THE SECOND GREAT DEPRESSION

-

Upload

angela-romero -

Category

Business

-

view

571 -

download

0

Transcript of THE SECOND GREAT DEPRESSION

The Housing Bubble Bust: The Second

Great Depression

Presented to Allan P Nuttall

By Angela Romero

1

INTRODUCTION

The 2007 subprime mortgage crisis led America into what is now called The Great Recession-- a recession of epic proportions that has not been seen since The Great Depression. The subprime mortgage crisis turned into a financial debacle because it demolished several pillars of America’s economic infrastructure. The Great Recession was the result of loosely-knitted government regulations, interwoven with greedy lenders, and voracious financial markets. For a crisis of this magnitude to have happened, the cast of characters that created it must have had great power, private agendas, and ravening greed. This report is going to examine the driving forces of the housing bubble busts. This study was designed to analyze the mortgage meltdown. Specially, this study wants to answer the following questions:

Who were the key players in the mortgage meltdown? What were their motivations? Why they behaved as they did?

Figure 1: Housing Bubble Formation depicts the main forces and key players driving the housing bubble.

Figure 1: Housing Bubble Formation

Source: Primary, 2011

2

Causes of the Housing Bubble

Personal Borrowing DecisionsRisky ARM Loans

Home ownership Pressure

Bubble Psychology

High Household Debt

Institutional Lending DecisionsGSERiskyPractices

IrresponsibleLendingPractices

Low Interest Rates

WallStreet’sMBS

MBS Credit Ratings

THE GOVERNMENT

This section is going to cover the cultural pressures and the governmental influence on the housing bubble. Before the 1960s, only creditworthy individuals who fit the strict requirements of lenders would get approved for a mortgage loan. Since the underwriting standards were so strict, a big sector of the population did not qualify for loans. The Boston Fed made a study investigating lending practices because of the large quantity of loans denied. The results of the study suggested that Lenders were “redlining”, which is the practice of denying loans to minorities and economically distressed communities, regardless of their ability to pay. In other words, it is a deliberate discrimination on lending practices towards minorities and low-income citizens. The study caused an uproar among people who demanded to be protected from discriminatory lending practices. Further, the media sensationalized the story out of proportions, fuelling the heated issue even further. Together, communities and the media pressured the government to respond.

The Boston Fed study was the spark that ignited a government-driven engine towards the road of looser underwriting standards. The government realized that housing ownership was a powerful campaign that would increase votes and popularity. Swiftly, most politicians from left to right, took the “affordable housing” motto as an emblem for their campaigns. For example, in 1996 President Clinton started its “National Homeownership Strategy”. According to the Washington examiner, this campaign was the seed of the Great Recession “the roots of this crisis sprouted during the Clinton administration’s politically motivated effort in the 1990s, to use Fannie Mae and Freddie Mac to expand home ownership” (Washington Examiner 1)

Not all the pundits agreed with the redlining accusations made by the Fed. According to Liebowitz, the Boston Fed’s study was flawed and it was a smokescreen released in order to achieve relaxed underwriting standards. “My colleague, Ted Day, and I only decided to investigate the Boston Fed study because we knew that no single study, particularly the first study, should ever be considered definitive and that something smelled funny about the whole endeavor. Nevertheless, we were shocked at the poor quality of the data created by the Boston Fed… When we attempted to conduct statistical analysis removing the impact of these obvious data errors, we found that the evidence of discrimination vanished” (Lebowitz 1). Despite the accuracy of the study, the government enacted several laws to protect consumers against redlining.

The Community Reinvestment Act of 1977

The first legislation enacted to protect borrowers against discrimination and to increase rate of ownership among minorities was the Community Reinvestment Act of 1977. “The CRA is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods” (Bankers Academy 1). In a practical way, this Act requires banks to lower their lending standards to accommodate less-than-perfect or subprime borrowers. Further, under CRA legislation, it was made possible to pursue legal actions against banks that continued with discriminatory lending practices. “The regulators imposed quotas— and lenders had to resort to “innovative or flexible” standards and methods to meet those quotas” (Sowell 39).

3

Closing the Gap: A Guide to Equal Opportunity Lending

The Boston Fed published a manual for lending institutions called “Closing the Gap: A Guide to Equal Opportunity Lending” (Boston Fed 1) that addressed the new lax underwriting standards. This section is going to analyze excerpts from the manual and its consequences on lending practices. For example, the new obligation ratio stated that it is acceptable to lend to people who have an income-to-debt ratio lower than the golden standard of 28/36. “Obligation Ratios: it should be noted that the secondary market is willing to consider ratios above the standard 28/36” (Boston Fed 1). What this means is that the secondary mortgage market is willing to purchase riskier loans in order to boost home ownership. Second, not only is the manual lowering the debt-to-income ratios, which removes any type of cushioning in case of an emergency, but it is lending to people with no payment history “Credit History: Lack of credit history should not be seen as a negative factor… For lower–income applicants in particular, unforeseen expenses can have a disproportionate effect on an otherwise positive credit record” (Boston Fed 1). Lastly, “Sources of Income: In addition to primary employment income… the following are valid income sources: overtime and part–time work, second jobs (including seasonal work), retirement and Social Security income, alimony, child support, Veterans Administration (VA) benefits, welfare payments, and unemployment benefits” (Boston Fed 1). The problem with this statement is that part time jobs, secondary jobs, and child support are not valid sources of income because they are not stable.

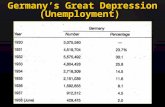

By lowering the underwriting standards, the government prompted lending institutions to make riskier and unsound investments. “Although the Community Reinvestment Act had no immediate impact, over the years its underlying assumptions and provisions provided the basis for ever more insistent pressure on lenders from a variety of government officials and agencies to lend to those whom politicians and bureaucrats wanted them to lend” (Sowell 37). Further, the CRA was a dynamic piece of legislation that was modified throughout different presidencies and used as banner of political propaganda. For example, George Bush, who was notorious for deregulating the mortgage market, in his 2002 Presidency speech said “it starts with setting a goal. And so by the year 2010, we must increase minority home owners by at least 5.5 million… We certainly don't want there to be a fine print preventing people from owning their home…We can change the print, and we've got to”( The white House President George W Bush 1). The last phrase “we can change the print, and we’ve got to” (The white House President George W Bush 1), portrays the essence of governmental deregulation on underwriting standard as a political strategy. Figure 2: Outstanding Mortgage Debt shows the residential mortgage debt and the property values from 1997 to 2009. As we can see from the graph, there is a spike in the 1980s following the CRA law enactment. This spike reflects the profound effect the CRA enactment had in lending practices.

4

Figure 2: Outstanding Mortgage Debt

Source: Seeking Alpha, 2009

Another example of how governmental deregulation fuelled the mortgage crisis was when Bill Clinton passed the Gramm-Leach-Bliley Act, commonly known in as the Financial Services Modernization Act, which repealed the Glass-Steagall Act. The Glass-Steagall Act prevented companies from consolidating because of possible conflict of interest that could adversely affect consumers. This new law makes it possible for investment banks, depository banks, and insurance companies to merge as one corporation. As a result, banks like Citicorp merged with insurance companies, such as Travelers. Corporate mergers of this magnitude have a deep effect on the economic fabric of America. However, the Great Recession can’t be explained only by governmental deregulations in lending practices, there are other characters that came into play.

5

THE EVIL TWINS: FANNIE MAE AND FREDDIE MAC

The Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation, colloquially known as Fannie and Freddie Mac, are Government-Sponsored Enterprises or GSEs. A GSE is a hybrid entity of governmental sponsorship with private ownership. Their main goal is to supply the mortgage industry with a constant stream of cash. The government created these GSEs to start a secondary mortgage market, which would smooth out wrinkles of the cashed-strapped lending industry. Before the secondary mortgage market creation, banks had to wait up to 30 years to recover their investment. As a result, the economy suffered periods of cash droughts and credit crunches. Further, the cash strapped banks couldn’t lend money, which meant they could not make money and some were forced into bankruptcy. As a solution, Fannie and Freddie Mac purchase these mortgages from banks, replenishing the bank’s cash reserves and starting the lending cycle again. The GSEs, then securitize these mortgages and sell them to investors in the form of bonds called mortgage-backed securities or MBS.

Furthermore, there were several pressures that caused the GSEs to lower the underwriting standards of the loans they will purchase. First, during the 1990s the Clinton and Bush Administrations loosened credit standards in order to increase affordable housing for economically distressed communities, as we saw in the previous section. Also, the Department of Housing and Urban Development HUD, imposed quotas on the amount of low-income mortgages the GSEs had to purchase. In turn, the GSEs lowered the underwriting standards in order to meet those quotas. The lowering of the underwriting standards opened the market for subprime loans. "Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980s” (The New York Times 1).

Furthermore, Fannie Mae and Freddie Mac were forced to compete with private label MBS issued by Wall Street’s investment banks. This external pressure imposed a further loosening of the credit requirements. As a result, Fannie and Freddie overextended themselves taking on too much debt without the appropriate cash reserves in case of an economic downturn. “The CEO of Fannie Mae Franklin Raines…pointed out that Fannie Mae had “amassed over $30 billion of private equity capital to finance $2 trillion of mortgages today”. He did not address the critic’s charge that it was precisely this high ratio of business done to the amount of capital available, to cover any problems that might arise, which posed a major risk to Fannie Mae and to the financial system” ( Sowell 53)

Fannie and Freddie eventually capsized under the weight of their own debt. The government intervened by giving the GSEs access to low-interest loans from the Fed’s reserves and authorized the Treasury to purchase the GSEs’ stock. Despite of the government’s efforts to boost the GSEs’ financial health, their stock price plummeted more than 90%. “On Oct 21, 2010 FHFA estimates revealed that the bailout of Freddie Mac and Fannie Mae will likely cost taxpayers $224–360 billion in total, with over $150 billion already provided” (Tucson Sentinel 1). The financial troubles of these giants weren’t enough to cause the mortgage meltdown, so we are going to analyze other sections of the economy that contributed to the crisis

6

THE FEDERAL RESERVE BANK

The Federal Reserve Bank, Fed, was another protagonist of the mortgage crisis. The Fed is an independent central bank that controls America’s monetary policies through three tools.

Open market operations-- it trades U.S Government securities in the open market. Discount rate— sets the interest rate charged to banks for overnight transactions. Reserve Requirements— sets the amount of money that banks must hold in their reserve.

Through these mechanisms the Fed controls the money supply and the overall direction of the economy. Furthermore, the discount rate or Federal Funds Rate has a direct effect on the amount of money supply that is in the economy. For example, a contractionary monetary policy sets interest rates high, which means that money becomes expensive. During this phase, the money supply becomes scarce, hindering lending. On the other hand, an expansionary monetary policy sets discount rate is low, which means that money becomes inexpensive. This increases the money supply and fosters lending. Figure 3: Federal Fund Rate Graph shows the interest rates from 1952 to 2012.

Figure 3: Federal Funds Rate Graph

Source: Serc Carletonu, 2011

Furthermore, the technology bubble in the mid 1990s and the mortgage bubble in the mid 2000s are perfect examples of expansionary monetary policies. The low interest rates during the mid-1990s and mid-2000s depicted in figure 3 stimulated the economy to the point of creating a bubble. For example, when the Federal Funds Rate is low, outstanding mortgage debt is high. As illustrated by comparing Figure 2: Outstanding Mortgage Debt to Figure 3: Federal Funds Rate Graph. For example, there is only 1.75 trillion Dollars on outstanding mortgage debt when the discount rate is 18%. On the contrary, during the 1990s there is significant growth in mortgage debt, up to 4 trillion Dollars, when the discount rate was 4%. Finally, there is an unprecedented boom in the mid-2000s of 15 trillion Dollars in mortgage debt when the discount rate was about 1%, a rate never seen since the 1950s.

7

During an economic downturn, the Fed lowers the discount rate in an effort to jumpstart the economy, by providing cheap capital for investments. The tech bust created a recession in the American economy, the Fed sought to alleviate it by stimulating the construction and the housing industry. “Fed officials conspicuously pinned their hopes for an economic recovery at least partly on the housing sector… With technology companies decimated by the collapse of their stock prices … housing, it appeared, it was the only game in town” (Andrews 72). The Fed pursued an expansionary policy that revived the American economy for half a decade.

The Fed’s biggest blunder was to raise the Federal Funds Rate from 1% to almost 5 % between mid-2004 and mid-2006, in intent to slow down inflation. This hike in interest rates increased foreclosures because most of the loans being made were adjustable rate mortgages. ARMs are pegged to an economic index that fluctuates with the Federal Funds Rate. Raising the discount rate made the ARMs payments unaffordable, forcing a major sector of homeowners into foreclosure.

Lastly, Alan Greenspan, then President of the Fed, didn’t act to prevent the meltdown from happening. “The Federal Reserve could have stopped this problem dead in its tracks…if the Fed had done its job, we would not have had the abusive lending and we would have a foreclosure crisis” (Andrews 78). The Fed oversees state chartered banks and under that jurisdiction, it could have stopped irregular lending practices. Also, there were several pundits that warned the Fed from an imminent housing bubble and its dreading consequences. However, the Fed kept low interest rates, which fueled the housing bubble.

Furthermore, Greenspan reported that derivatives such as, Mortgage-backed securities and credit default swaps were safe for the economy and should not be regulated. As a result, under the Commodity Futures Modernization Act of 2000, the government deregulated such derivatives making it impossible for oversight agencies to control those financial instruments. Despite the Fed’s actual intentions, its policies blew the housing bubble beyond proportions exacerbating the economic downturn

8

GREEDY LENDERS

As we saw in the past section, the government enacted laws that deregulated underwriting standards. Soon, the mortgage industry had a myriad of risky complex loans offered to the public, also known as “creative financing strategies”. In particular, the industry targeted borrowers with bad credit scores or uncertain income streams, the subprime market. Subprime mortgages are attractive to lenders and investors because they generate higher profits. Lenders did not limit their creativity to subprime loans. For example, loan officers offered No Income No Assets loans, called NINA, to unqualified individuals. These “liar loans” were originally designed for independent contractors whose income greatly differs from their IRS tax returns. Independent contractors can write-off many business expenses to lower their income, but in reality they have earned a substantial amount of money. However, lenders got creative and started to offer these loans to people who weren’t independent contractors and whose real income was stated in their tax returns. “Loans that require little or no documentation of income soared to $276 billion, or 46 percent, of all subprime mortgages last year from $30 billion in 2001, according to estimates from New York- based analysts at Credit Suisse Group. Homebuyers with those loans defaulted at a 12.6 percent rate in February, compared with 1.5 percent of fully documented prime mortgages” (Bloomberg 1)

Adjustable Rate Mortgages

Furthermore, lenders offered Adjustable Rate Mortgages to subprime borrowers because of their complex structure and seemingly low interest rates. Research has shown that many subprime borrowers did not understand these types of loans, which caused them to default at a higher rate.

An ARM loan has many components that interact with one another. For example, an ARM loan offers a low introductory rate of 1%. Also, the loan is tied to an underlying economic index, which fluctuates with the economy. In addition, the lender charges a profit, called margin. Lastly, ARM loans take an adjustment period to become fully indexed. The fully index rate, FIR, is equal to the rate of economic index plus the lender’s margin. As this wasn’t confusing enough, this loan gives different paying options. A borrower can choose to pay interest only, a minimum payment, or payment in full each month. When borrowers pay interest only, negative amortization happens. Neg-am means that if a borrower pays the minimum payment, the remainder of what the payment should have been will be added to the original principal owed. This process results in compounding interest, which means that the borrower will pay more than what was owed originally. “The flexible payment or "option" ARM, which grew rapidly in popularity during the housing bubble of 2003-2006, had an initial rate period of one month. It was a favorite instrument of hucksters because they could advertise rates as low as 1%. The FIR… was seldom volunteered” (The Mortgage Professor’s Website 1)

The majority of borrowers that used ARM loans to finance their homes were subprime; however, prime borrowers used them as well. For example, Figure 4: Average Credit Score of Borrowers shows that people with low credit scores used ARMs loans more than people with good credit scores.

9

Figure 4: Average Credits Score of Borrowers

S

oSource: LoanPerformance ABS Securities, 2011

Also, Figure 5: Loan Defaults Forecast shows that out of 55 billion Dollars in loans that were expected to default, 44 billon dollars were from subprime mortgages. Asides from the fact that non-sophisticated and low-income borrowers got lured in to a loan that they count afford by a teaser rate, during 2005 the Fed raised the discount rate. As a result, the interest rate charged on ARMs loans surged, causing a tsunami of defaults and foreclosures. “Option ARMs were exquisitely designed to exploit the worst excess of the housing bubble. Hey were perfect for fast-buck speculators, perfect for deceiving unsophisticated borrowers, and perfect for luring people with income into dream houses they could not possibly afford” ( Andrews 49). Lastly, the government could have stepped in and stopped these types of loans, but instead it said that ARM loans were fine as long and they were immediately sold to an investor.

10

Figure 5: Loan Defaults Forecast

Source: Bank of America Estimates Based on LoanPerformance data, 2011

11

WALL STREET GAMBLING: IN A SHADOW BANKING UNIVERSE

The primary mortgage market is composed of an institutional bank, which lends money to the consumer. After getting money from depositors, banks lend that money at a higher interest rate to make a profit. Banks encountered liquidity problems after making too many loans because they had to wait 30 years to be repaid or wait for more deposits from people. The government created the secondary mortgage market to smooth out the economic bumps that cashed-strapped banks caused.

The secondary mortgage participants— Federal National Mortgage Association or Fannie Mae, Federal Home Loan Mortgage Corporation or Freddie Mac , and the Government National Mortgage Association or Ginnie Mae—then sell those mortgages as securitized debt instruments called mortgage-backed securities. The mortgage-backed securities, MBS, are financial instruments created and issued first in 1968 by Ginnie Mae. Ginnie Mae’s MBS are based on FHA and VA mortgages and have explicit support from the U.S government. On the other hand, Fannie Mae and Freddie Mac sell MBS of private mortgages, which aren’t backed by the U.S government.

The MBS are debt instruments with an underlying pool of loans that were sliced, and repackaged to be sold as bonds. The investors who purchase the bonds receive mortgage payments from the original borrower. These investors were absorbing most of the risk because they would be receiving the payments from the original borrower and in case of default they would lose on their investment. On the contrary, institutional banks, which originated the loans, are secured because they will get their money back from the secondary mortgage market.

The mortgage business was booming and the private sector wanted to get their share. As a result, investment banks such as the Lehman Brothers and Solomon invented on its own kind of MBS, “private label MBS”. The invention of the private MBS was a milestone for Wall Street. Exotic financial instruments called derivatives arose from the creative and greedy minds of this part of town. The trading and speculating of these derivatives caused an unprecedented bubble in the financial sector, which busted when the underlying loans on those derivatives defaulted. “Investors purchased more than $60 billion of private-label (non-GSE) subprime mortgage-backed securities, six times more than 1991's volume of $10 billion” (U.S. Department of Housing and Urban Development 1).

Figure 6: Mortgage-Backed Securities by Entity shows the market share distribution of the MBS. From 1995 to 2000s, Fannie Mae and Freddie Mac were the main players, purchasing about 60% of all mortgages. After 2003, the private label MBS took over the market with a maximum market share of 60%. From 2003 to 2007, private label MBS dominated the market because they were not regulated by the government. Furthermore, the 2007-2010 stock market crash is represented in this graph by a sharp decline in MBS market share from the Wall Street’s firms.

12

Figure 6: Mortgage-Backed Securities by entity

Source: Congressional Budget Office Based from the Securities Industry, 2011

Securitization Patterns

To understand how the private label MBS work, we are going to analyze the process of loan securitization. Investment bankers securitize a pool of mortgages by dividing them into tranches, French for slices. Each tranche level represents different levels of risks. A bond rating of AAA means zero risk, while a rating of BBB means higher risk. In theory, the expected return goes up, as you go down the tranches. Financial analyst had to work with credit rating agencies to ensure that these MBS had good ratings, otherwise investors wouldn’t purchase them. To sell the bottom riskiest tranches, bankers invented— High Grade Collateralized Debt Obligations, mezzanine CDOs, and CDOs 2 to mask their risk. Figure 7: Securitization Pattern of Mortgage-Backed Securities depicts the securitization pattern of subprime mortgages mentioned above.

13

Figure 7: Securitization Pattern of Mortgage-Backed Securities

S

SSource: Bionic Turtle, 2011

Wall Street didn’t stop its creativity there, bankers created credit default swaps, synthetic CDOs, Bistros and many other complex derivatives that in the words of many pundits, not even a P.H.D in finance and mathematics would understand. In fact, Credit Defaults Swaps, CDS, which are insurance derivatives in case of default, caused the collapse of insurance giant AGI.

Furthermore, the big five investment banks-- Goldman Sachs, Bear Stearns, Merrill Lynch, Morgan Stanley, and Lehman Brothers – persuaded the Securities Exchange Commission to lax

14

its long standing regulation on the amount of debt they could take on. This legislation fuelled the financial boom because it suspended the net capital rule. The net capital rule legislation limits a bank’s ability to take on debt and establishes a minimum reserve requirement of capital to cover its assets during bad economic times. The loosening of the net capital rule freed up money, which was invested in risky MBS and related derivatives. Furthermore, “In loosening the capital rules, which are supposed to provide a buffer in turbulent times, the agency [S.E.C] also decided to rely on the firms’ own computer models for determining the riskiness of investments, essentially outsourcing the job of monitoring risk to the banks themselves” (New York Times 1).

There were warnings from wise people in the business to stop MBS trading in Wall Street. For example, Lewis Ranieri, the co-inventor of the MBS, warned the public about danger of these new mutant breed of MBS “Wall Street had gone gaga securitizing subprime mortgages without paying much attention to quality” (Muolo 216). Also, Bill Ackman, founder of Pershing Square Capital, predicted that when the investors realized they had been deceived, there would be an economic debacle. “[Bill] Ackman accused Wall Street of fueling the binge by turning risky …The danger was that the whole process would abruptly reverse” ( Andrews 122)

Credit Rating Agencies

Standard & Poor’s and Moody’s, rated most of these MBS as investments grade bonds from AAA to BBB. As a comparison, Treasury Bills have a rating of AAA, which basically means zero risk of default. The credit rating agencies were criticized for giving these new breed of securities such a high rating without proper knowledge of their true risk.

As a result of the increase in defaults, the credit rating agencies had to lower the rating of many MBS. For example, on July 10th 2007, Standards and Poor’s downgraded 612 MBS from investment bonds to junk bonds. Also, Moody’s downgraded 399 securities during that same period of time. This event was the first domino to tumble creating a chain reaction leading to the mortgage meltdown. The downgrades caused widespread panic in the stock markets. The increase in defaults and the unstable economic environment caused by the change in bond ratings opened the door to the stock market crash of 2007- 2010. Figure 8: Market Crash of 2007-2010, depicts the sad reality of the Great Recession.

Figure 8: Market Crash of 2007-2010

15

Source: Markit: Financial Information Services, 2010

As mentioned before, the Fed raised the Federal Funds Rate on 2005 causing the ARM interest to soar, which in turn created a Tsunami of foreclosures. As a result, home prices dropped causing borrowers to become upside down or owe more than they had in equity, increasing foreclosure rates even more. After borrowers started defaulting at increasing rates, the price of the MBS plummeted, causing a stock market crash. After the stock market crash of 2007, the big five investment banks failed. Bear Sterns and Merrill were sold at a bargain to other banks. The Lehman Brothers filed for bankruptcy. Goldman Sachs and Morgan Stanley converted into heavily regulated depository banks. The stock market crash and the tsunami of defaults was catastrophic economy because two of its strongest pillars were blown one after another.

CONCLUSION

The Great Recession was caused by a systematic fail of all components of society. Conflicting private agendas generated a free for all business environment in which the powerful abused the week and swindled the rest. The government failed to protect the consumer and regulate the business environment. The mortgage industry failed to be ethical in its lending practices, ending with major bankruptcies and corruption scandals. The financial banking industry created a time-bomb that wiped out five of its biggest investment banks and crashed its precious stock market. When the economy went awry, banking institutions received a big hand from the government, while ex-homeowners were left with nothing.

16

References

Andrews, Edmund. “Busted: Left Inside the Great Mortgage Meltdown”. London: Norton & Company, 2009.

Bankers Academy (2011). Community Reinvestment Act:. Retrieved July 2011 from http://www.bankersacademy.com/regulations/lending-acts.php

Britner, Richard. “Confessions of a Subprime Lender: An insider’s Tale of Greed, Fraud, and Ignorance”. New Jersey: Wiley Books, 2008.

Dewitt, Anthony. (2011, July 25). Close to half of all Az mortgages are 'underwater'. The Tucson Sentinel. Retrieved July 2011 from http://www.tucsonsentinel.com/local/report/072511_underwater_mortgages/

Federal Reserve Bank of Boston (1993). Closing the Gap: A Guide to Equal Opportunity Lending. Retrieved July 2011 from http://www.bos.frb.org/commdev/closing-the-gap/closingt.pdf

Holmes ,Steven. (1999, September 30). Fannie Mae Eases Credit To Aid Mortgage Lending. The New York Times. Retrieved July 2011 from http://www.nytimes.com/1999/09/30/business/fannie-mae-eases-credit-to-aid-mortgage-lending.html

Ivry, Bob.( 2007, April 25). Subprime `Liar Loans' Fuel Bust With $1 Billion Fraud . Bloomberg. Retrieved July 2011 from http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aN2DPRuRs93M

Liebowitz, Stan (2009). Anatomy of a Train Wreck: Causes of the Mortgage Meltdown. Retrieved July 2011 from ttp://johnrlott.tripod.com/Liebowitz_Housing.pdf

Michaelson, Adam. “The Foreclosure of America”. New York: Berkeley Books, 2009.

Muolo, Paul. “Chain of Blame: The Truth Behind America’s Housing and Mortgage Crisis”. New Jersey: Wiley Books, 2008.

Sowell, Thomas. “The Housing Boom and Bust”. New York: Basic Books, 2009.

The New York Times (2008).The Reckoning; Agency's '04 Rule Let Banks Pile Up New Debt, And Risk. Retrieved July 2011 from http://query.nytimes.com/gst/fullpage.html?res=9D05E2DA143EF930A35753C1A96E9C8B63&pagewant

17

The Mortgage Professor’s Website(2011). The Fully Indexed Rate: Better Know What It Is. Retrieved July 2011 from http://www.mtgprofessor.com/A%20-%20ARMs/the_fully indexed_rate_what_you_ don%27t_ know_can_hurt_ you.htm

The White House President George W Bush (2002). President Calls for Expanding Opportunities to Home Ownership Retrieved July 2011 from http://georgewbush-whitehouse.archives.gov/

Washington Examiner (2008). Roots of financial crisis in Clinton housing policy. Retrieved July 2011 from http://washingtonexaminer.com/opinion/roots-financial-crisis-clinton-housing-policy#ixzz1Tue61P9v

18