THE RUSSIAN BANKING SYSTEM: PROSPECTS FOR REMAINING INDEPENDENT Michel Perhirin, CEO, MDM Bank...

-

date post

15-Jan-2016 -

Category

Documents

-

view

216 -

download

0

Transcript of THE RUSSIAN BANKING SYSTEM: PROSPECTS FOR REMAINING INDEPENDENT Michel Perhirin, CEO, MDM Bank...

THE RUSSIAN BANKING SYSTEM: PROSPECTS FOR REMAINING

INDEPENDENT

Michel Perhirin, CEO, MDM Bank

RUSSIAN ECONOMIC AND FINANCIAL FORUMIN SWITZERLAND

Sixth Session, Zurich18 – 19 March 2007

2

CONTENTS

MACROECONOMIC OVERVIEW: POSITIVE TRENDS

FINANCIAL SECTOR: DYNAMIC GROWTH

FOREIGN BANKS: COMPETITIVE ANALYSIS M&A TRENDS

CONCLUSIONS

3

MACROECONOMIC OVERVIEW

▄ ▄ ▄2006 was another good year for Russia’s economy, with preliminary GDP growth estimated at 6.8% – the eighth consecutive year of growth. This compares to global growth of about 5% and growth of developed economies of 2.7%. Russia’s growth rate also exceeded the estimated 5.3% seen in Central and Eastern Europe (excluding the CIS).

▄ ▄ ▄

In 2006 Russia achieved single-digit consumer price inflation for the first time in post-Soviet history (9%).

▄ ▄ ▄

Growth is expected to be sustained over the coming years, with real GDP growth averaging at around 6%, inflation slowly declining, budget surpluses, forex reserves rising and external debt falling.

GDP growth forecast

Inflation forecast

4

MACROECONOMIC OVERVIEW

+ - ▄ ▄ ▄The government’s prudent fiscal policy is without doubt the most fundamental factor behind Russia’s sustained growth. The federal surplus reached an impressive 7.6% of GDP in 2006.

▄ ▄ ▄Exports are forecast to total about USD300-280 bn annually until 2010, while imports will gradually expand. The trade balance is expected to be brought to negative by 2010.

5

MACROECONOMIC OVERVIEW: FOREIGN INVESTMENT INFLOW

▄ ▄ ▄Russia managed to attract more than

USD30 bn in foreign direct investment in 2006, more than double the amount seen in 2005. Oil and gas accounted for about half of FDI inflows, while manufacturing accounted for 20%.

▄ ▄ ▄Most notably there was a significant

increase in FDI into Russia’s financial sector. In 1H06, FDI in the sector amounted to USD661 mn, outstripping the USD589 mn seen in the whole of 2005 and clearly reflecting increased foreign interest in Russia’s banking system.

▄ ▄ ▄Russian non-sovereign issuers placed almost USD28 bn in eurobonds in 2006, and over two-thirds of issues involved the banking sector.

▄ ▄ ▄In 2006, Russian eurobonds traded within a relatively narrow band over benchmark assets. Given favorable market sentiment towards emerging market assets, the EMBI+Russia spread tightened to below 100 bp.

6

MACROECONOMIC OVERVIEW: SOVEREIGN RATINGS

Thanks to the improved macroeconomic environment, both Standard and Poor’s and Fitch upgraded Russia’s credit rating

in 2006 from BBB to BBB+; Moody’s maintained its rating at Baa2. From 2000 to 2006, the country moved up six rungs: from

one of lowest in the wake of the financial crisis, up to investment grade. The financial authorities estimate that Russia could

climb the remaining seven rungs to the highest rating within 10 years.

7

FINANCIAL SECTOR: DYNAMIC GROWTH

8

FINANCIAL SECTOR: DYNAMIC GROWTH

▄ ▄ ▄ The Russian banking system will likely continue reaping the benefit of reforms and ongoing macroeconomic stability. Assets, loans and deposits are forecast to grow by 35%, 31% and 30% per year respectively in 2006-2010.

▄ ▄ ▄ This strong growth outlook makes the market attractive for foreign entrants. To gain exposure, foreign banks have been looking to buy equity stakes in Russian banks or expand their footprint organically. These trends will continue and are likely to intensify going forward.

▄ ▄ ▄ Competitive advantages in the sector include a strong branch network, exposure to retail and SMEs, a regional presence, a well-developed product line, quality of services and strong management.

9

Top Russian Banks as of YE 2006*

* Based on Russian Accounting Standards

** MDM Bank only, excluding subsidiaries

USD'000 Assets Loans Deposits Capital

1 Sberbank 132 004 742 99 656 486 107 871 208 13 543 515

2 Vneshtorgbank 29 318 761 14 613 901 11 920 364 5 108 053

3 Gasprombank 27 300 068 11 752 635 14 104 537 3 249 693

4 Bank of Moscow 13 707 587 9 045 560 10 621 393 1 161 989

5 Alfa Bank 13 220 386 10 047 918 8 109 193 1 553 217

6 Uralsib 10 959 618 5 946 602 6 834 757 1 578 583

7 Rosbank 10 645 292 6 095 147 8 020 554 999 983

8 International Moscow Bank 9 103 022 5 651 146 5 710 911 799 697

9 Rosselkhozbank 8 964 288 5 939 872 2 831 970 896 807

10 Raiffeisenbank 8 592 335 5 536 015 4 418 963 681 011

11 MDM Bank** 7 752 976 5 178 458 4 298 249 860 622

12 Promsviazbank 6 658 064 4 370 777 4 317 624 564 591

13 VTB 24 6 291 270 4 600 344 3 937 181 684 553

14 Promstroybank SPb 5 486 434 3 699 715 4 174 760 619 591

15 Petrocommerce 4 909 879 3 514 419 3 258 683 555 243

16 Citibank 4 856 219 1 825 304 3 255 303 447 756

17 Impexbank 2 429 179 1 589 412 1 561 504 275 236

MDM Bank as a % of the top 17 2.57% 2.60% 2.09% 2.56%

10

FINANCIAL SECTOR: IMPACT OF ACCESSION TO WTO

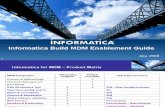

Top 50 banks: Equity capital breakdown and growth dynamic in 2006-2007

Equity capital Growth dynamic

▄ ▄ ▄ Russia has set out a 50% limit for foreign capital participation in the domestic banking system.

▄ ▄ ▄ WTO accession is unlikely to negatively impact the domestic banking sector as a large proportion of capital belongs to the state-owned banks and the state does not intend to withdraw from the sector.

11

FOREIGN-OWNED BANKS: A COMPETITIVE ANALYSIS

12

FOREIGN-OWNED BANKS: CONCENTRATION

▄ ▄ ▄ Due to the high concentration of banks in Moscow and St. Petersburg, profit margins have been depressed, and the banks are starting to look to the regions to expand their business. With 75% of Russia’s GDP coming from the regions and 85% of financing coming from Moscow, it is natural that foreign banks are contemplating regional expansion.

▄ ▄ ▄ Foreign-owned banks are increasing their presence in Russia in terms of assets and numbers, thereby establishing a new standard of competition

13

CREDIT RATING COMPARISON

Banks with foreign participation have solid credit ratings, comparable to those of the largest state-owned banks and leading private Russian banks.

14

FOREIGN-OWNED BANKS: ASSETS&PROFIT

▄ ▄ ▄

Assets of banks with foreign participation amount to about 15% of the top 50 banks’ total assets. Their assets are growing at a faster pace than private and state-owned Russian banks.

▄ ▄ ▄

Russian banks’ profits are growing faster than any other countries’, at some 40% per year. In contrast, Brazilian banks’ profit is growing 19% per year, Chinese 15 percent and Indian 10 percent. Foreign-owned banks have the highest profit growth rates.

▄ ▄ ▄

Local banks’ profits are forecast to increase six-fold to USD90 bn by 2015 from USD14 bn at present.

15

FOREIGN-OWNED BANKS: RETAIL BANKING

▄ ▄ ▄

Foreign-owned banks do not consider operations in Russia to be radically different from those in other, more mature markets: banks lend on the same criteria as everywhere else and offer similar product ranges.

▄ ▄ ▄

Banks with foreign participation hold about 17% of credits to individuals among the top 50 banks. However, private Russian banks lead in terms of growth rates in this segment.

▄ ▄ ▄

As recently as three or four years ago, having retail operations in Russia was not a consideration for foreign banks, but today these banks are developing strategies to strengthen their retail practices either via organic growth or by acquisitions.

16

FOREIGN-OWNED BANKS: CORPORATE BANKING

▄ ▄ ▄

Foreign-owned banks account for about 12% of credits to enterprises and have the highest growth rates in this segment.

▄ ▄ ▄

5-6 years ago, foreign banks were concentrating on serving their global customers, and perhaps the largest local corporate customers. But today a great of deal of interest and demand exist for foreign banks to expand their businesses.

▄ ▄ ▄

Foreign banks have increased their presence via offshore financial services. For example, in 2006 the non-financial sector attracted about USD28 bn in syndicated loans and a further USD8.8 bn via eurobond issues.

17

M&A TRENDS

18

M&A TRENDS

Russia's banking sector offers good opportunities for foreign investors as more and more domestic banks meet international criteria of transparency, quality of service, accounting standards and business ethics. To gain Russian exposure, many foreign banks have been looking to buy equity stakes in Russian banks. There may be more M&A deals in the industry as some Russian banks are considering ADR and GDR programs and initial public offerings.

P/BV ratios of deals between foreign and Russian banks in 2006

Target - Buyer

Source: Banks, media

19

M&A TRENDS

P/BV ratios of deals involving Russian banks in 2006

Source: Banks, media

There were about 20 M&A deals in 2006 involving local players. The average P/BV ratio was 2.1, but this figure was higher in deals involving foreign banks (3.0). The capital size of the purchased banks amounts to maximum USD60 mn.

20

CONCLUSIONS

Russia’s economic picture is now more predictable thanks to excellent external factors, so the economy should continue to develop smoothly. Both Russian and foreign banks stand to benefit from this if they adapt to the changing competition in time and place more emphasis on the quality of service.

The Russian banking sector is becoming more and more “international,” and foreign banks are playing and ever more important role. Foreign banks offer some products that local banks do not, and this benefits the Russian people at large. Meanwhile, local banks are employing foreign specialists, installing better systems and hiring experienced managers.

The current expansion of foreign banks in Russia is unlikely to result in the latter’s overexposure to the local market due to the huge credit and long-term capital outlays coming from offshore. Foreign banks now have the choice of putting money earmarked for Russia into different baskets. What is more important for them is to catch up with the market growth.

Now the time has come for Russian banks to react. Local bankers are becoming more pragmatic and more aggressive, so local banks are likely to become more competitive in the future and rule the roost in the country’s banking sector.

21

2004, 2003 – Euromoney Best Bank in Russia in 2004Best Bank in Russia in 2003

In 2003 and 2004 MDM Bank was named Best Bank in Russia by the Euromoney agency. Euromoney’s nomination cited MDM’s high-quality management, strategy, profitability and innovative approach.

2004 – Emerging Markets Best Bank Best Investment Bank

In April 2004, Emerging Markets magazine named MDM Bank Best Bank and Best Investment Bank on the Russian and CIS markets. Emerging Markets decided on these awards after consulting leading investment banking analysts and international ratings agencies.

2005 – Global Finance Best Bank in RussiaNominated for transparent corporate structure award

At the beginning of 2005, Global Finance magazine named MDM Bank the Best Domestic Bank of 2005 and awarded it the Editor’s Special Award for Transparency. The magazine cited MDM’s market leadership, innovative approach, commitment to the market and long-term strategy.

2005 – NAUFOR Best IPO Project in the 2004 Stock Market Elite competition

In May 2005, the National Association of Stock Market Participants (NAUFOR) named MDM Bank the winner of its Best IPO Project award as part of its Equity Market Elite competition, for its work on the Irkut IPO.

2005 – NAUFOR Special prize “For the discovery of new names for the Russian stock market”

In May 2005, the National Association of Stock Market Participants (NAUFOR) awarded MDM Bank a special prize in its national Equity Market Elite competition for the discovery of new names for the stock market.

International Recognition

2006 – Global Finance Best Bank in Russia in 2006 in several categories

At the beginning of 2006, Global Finance magazine named MDM Bank Best Domestic Bank, Best Organizer of Eurobond Issues on the Russian Market, Best M&A Transaction Consultant on the Russian Market, and Best Bank on the Forex Market.

2007 – Global Finance Best Foreign Exchange Bank in Russia

In 2007, Global Finance magazine named MDM Bank Russia’s Best Foreign Exchange Bank.

“BB-” Stable “BВ-“ Positive, “А+rus”

“Ba2”/”NP”/”D” Stable