The Phillips Curve. Intro to Phillips Curve There is a short-run trade-off between unemployment and...

-

Upload

phyllis-jones -

Category

Documents

-

view

232 -

download

3

Transcript of The Phillips Curve. Intro to Phillips Curve There is a short-run trade-off between unemployment and...

The Phillips Curve

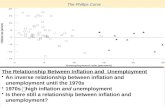

Intro to Phillips Curve There is a short-run trade-off between

unemployment and inflation Lower unemployment leads to higher

inflation Higher unemployment leads to lower

inflation

This is inverse relationship is represented by the Phillips Curve!

Short Run Phillips Curve

Short-Run Phillips Curve Demand shocks result in movement along SRPC

When AD increases along SRAS, unemployment rate ↓ and inflation rate ↑

When AD decreases along SRAS, unemployment rate ↑ and inflation rate ↓

Supply shocks result in shift of SRPC When SRAS increases along AD, both unemployment

and inflation rates ↓ (downward shift) When SRAS decreases along AD, both unemployment

and inflation rates ↑(upward shift) SRPC can extend below the horizontal axis (in

times of deflation)

Inflation Expectations Expected rate of inflation: rate of inflation

employers and workers expect in the near future Affect short-run trade-off between unemployment and

inflation Matters because no one wants to lose purchasing

power due to future inflation An increase in expected inflation shifts SRPC upward Relationship between changes in expected inflation

and actual is one-to-one (will rise by the same amount)

Long-Run Phillips Curve Most macroeconomists believe there is

no long-run trade-off between lower unemployment rates and higher inflation rates.

It is not possible to achieve lower unemployment in the long run by accepting higher inflation.

Let’s see why!

Natural Rate of Unemployment Revisited Non-accelerating inflation rate of

unemployment: represents the unemployment rate at which inflation does not change over time (NAIRU) Keeping unemployment below NAIRU leads

to ever-accelerating inflation—cannot be maintained

NAIRU is another name for natural rate Level of unemployment needed in order to

avoid accelerating inflation

Long Run Phillips Curve Vertical curve set at NAIRU The relationship between

unemployment and inflation in the long run, after expectations of inflation have had time to adjust to experience. Proves there are limits to expansionary

policies when already at full employment

Costs of Disinflation Recall: disinflation is the process of

bringing down inflation that has become embedded in expectations

To bring down inflation, contractionary policies raise unemployment above the natural rate for an extended period

As a result, the economy loses potential output

Deflation Value of money rising over time (fall in price

level) Debt deflation results from borrowers cutting

back their spending because of the additional burden of repaying money that is worth more, reducing aggregate demand – which leads to more deflation, which can spiral out of control

Effects of Expected Inflation Fisher Effect shows that interest rates are

impacted by expected inflation one-to-one In case of deflation, interest rates will fall –

but they are zero bound – which creates a limit for monetary policy

Interest rate too low leaves no incentive to save and a credit freeze

Liquidity trap results from sharp reduction in demand for loanable funds, causing interest rates to fall so low that monetary policy is ineffective