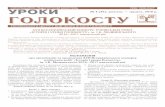

THE OFFICIAL MAGAZINE OF THE NAPAnet NATIONAL ......CD/ACD COPYWRITER AD User Printer Output Date...

Transcript of THE OFFICIAL MAGAZINE OF THE NAPAnet NATIONAL ......CD/ACD COPYWRITER AD User Printer Output Date...

NAPAnetthe magazine

THE OFFICIAL MAGAZINE OF THENATIONAL ASSOCIATION OF PLAN ADVISORS

Powered by ASPPAsummer 2014 • NAPA-NET.ORG

YoungGUNSTop 50 Plan Advisors Under 40

Scale 1” = 1” LastSavedBy: Aaron Swavey

Job#:1808-51631 TrimSize: 10” x 12” 10” x 12” StudioArtist: David Butterfield

Size:1 Version:1 BleedSize: 10.25” x 12.25” 10.25” x 12.25” ArtDirector: Ryan Glendening

LiveArea: 9” x 11” 9” x 11” PrintProduction:Francine Garcia

Built@100% Output@None Color:4C

PantoneColors:

NAPA Net Magazinedue 4/25proof due 4/23

Publications:

Links:mosaic_background2_fix_alt.tif(CMYK; 249ppi; 120.45%)

A registered investment advisor, member FINRA/SIPC

“I’D LIKE TO OFFER PLAN SPONSORS SOMETHING

REVOLUTIONARY.#AdvisorVoices That’s why we introduced Worksite

Financial Solutions. A revolutionary new platform that offers retirement plan participants access to professional advice from a financial advisor. So they have the potential to grow their financial assets. And you have the potential to grow your financial practice.

To learn more, download our white paper at Smart227.LPLNow.com, call 1-866-598-7123, or join the conversation on Twitter using #AdvisorVoices.

”

S:9”S:1

1”

T:10”T:1

2”

B:10.25”B

:12.2

5”

1808-51631_WFS-3_V1_R02g.indd 1 5/5/14 2:36 PM

n a p a n e t t h e m a g a z i n e2

36 Does suitability equal FiDuciary? by Steven Sullivan FINRA’s guidance on rollovers looks a lot like fiduciary prudence.

40 View From the summit by John Ortman and John IekelA look at some high points of the 2014 NAPA 401(k) Summit.

44 rumble in the Jungle by Fred BarsteinA power struggle is emerging between record keepers and advisors.

49 naPa Partner cornerOur directory of leading record keepers and DCIOs.

Young guns by John Iekel

40

401k

44Featuring the top 50 plan advisors under age 40.

Cover Illustration by Tyler Charlton

NAPAnetthe magazineSUmmer 2014

24

coVer

36

Features

Last Modified

Art Director

Copy Writer

Proj Mgr

Acct Svc

Prod Mgr

Art Buyer

Copy Edit

Mac

100

83.44%

None

Trim

Live

Folded Size

Finishing

Colors Spec’d

RS Congrats-Lipper

10.25” x 12.25”

None

Job Description

Bleed

Special Instr.

Publications None

Job # Document Name MAS1-14-02481-4681_10x12.inddMAS1-14-02481 Version #4681

N/A

N/A

j rodis

m. sabones

mgardner

None

None

sforza/tnavarra

Colors In-UseLinked GraphicsMM_NoRule100C43Y_K_R_Tag_2009.eps LIPPER_FA_AWARD_HOR_US.JPG RGB 86 ppi

Cyan Magenta Yellow Black

CONT

ENT

10” x 12”

9” x 11”

None

None

4C

BY SIGNING YOUR INITIALS ABOVE, YOU ARE STATING THAT YOU HAVE READ AND APPROVED THIS WORK.

4-4-

2014

3:4

8 PM

ACCT SERVICE PROD COPY EDIT

COPYWRITER ADCD/ACD

User Printer Output Date

4-4-2014 3:48 PM

ma-nminieri 10C-EXP550 4-4-2014 3:48 PMMech Scale

Print Scale

Stock

Mechd By: None RTVd By: nminieri

2

RELE

ASED

TO

VEND

OR

Vend

or: W

illiam

s

Relea

se Da

te: 4/

4/14

For the second year in a row, MassMutual is proud to win the Lipper Fund Award for Best Mixed Assets Small

Fund Group. This year we are also honored to win Best Overall Small Fund Group and Best International

Large-Cap Core Fund (MassMutual Select Overseas Fund).

We take great pride working alongside outstanding financial professionals and retirement plan sponsors,

and look forward to another year of helping participants retire on their own terms.

To learn how MassMutual Funds can help you and your clients, or to obtain a prospectus, call MassMutual

at 1-866-444-2601 or visit MassMutual.com/Retire

CELEBRATING.A REPEAT PERFORMANCE WORTH

TOTAL RETIREMENT SERVICES + TPA + DEFINED CONTRIBUTION + DEFINED BENEFIT + NONQUALIFIED + NONPROFIT + GOVERNMENT + TAFT-HARTLEY + STABLE VALUE + PEO + IRA

To qualify for the Lipper Mixed Assets Small Fund Group award, fund groups must have at least three mixed-asset funds. MassMutual Funds ranked #1 out of 37 eligible companies. To qualify for the Overall Small Fund Group award, fund groups must have at least three mixed-asset funds, three equity funds and three fixed-income funds. MassMutual Funds ranked #1 out of 26 eligible companies. Small Fund Groups are defined as having less than $50.7 billion in assets under management as of November 30, 2013. The lowest average decile rank of the three years’ Consistent Return measure of the eligible funds per asset class and group will determine the asset class group award winner over the three-year period. In cases of identical results the lower average percentile rank will determine the winner. Consistent Return measure does not reflect sales charges.

MassMutual Select Overseas Fund ranked #1 out of 42 qualified funds, which comprised 135 share classes in Lipper’s International Large-Cap Core Funds category.

All rankings are for the three-year period ended November 30, 2013.

Lipper, a wholly owned subsidiary of Reuters, is a leading global provider of mutual fund information and analysis to fund companies, financial intermediaries and media organizations.

Past performance is no guarantee of future results. Principal value and investment return will fluctuate, so an investor’s shares/units when redeemed may be worth more or less than the original investment. Investment portfolio statistics change over time. The investment is not FDIC-insured, may lose value and is not guaranteed by a bank or other financial institution.

Investors should consider a Fund’s investment objective, risks and charges and expenses carefully before investing. This and other information about a Fund is available in its prospectus (or summary prospectus). Read it carefully before investing. ©2014 Massachusetts Mutual Life Insurance Company. All rights reserved. MassMutual Financial Group refers to Massachusetts Mutual Life Insurance Company (MassMutual) and its affiliated companies and sales representatives. Principal Underwriter: MML Distributors, LLC, 1295 State Street, Springfield, MA 01111. RS: 33501-00

T:10”T:12”

MU19700_MAS1-14-02481-4681_10x12.indd 1 4/4/14 4:35 PM

n a p a n e t t h e m a g a z i n e4

ediTor-iN-ChiefFred barstein

PUbliShererik Vander [email protected]

ediTorJohn [email protected]

SeNior wriTerJohn [email protected]

ASSoCiATe ediTortroy [email protected]

ArT direCTortony Julien

AdverTiSiNG CoordiNATorrenato macedo [email protected]

NAPA offiCerS

PreSideNTsteven Dimitriou, aiF, PrP

PreSideNT eleCTJoseph F. Denoyior

viCe PreSideNTsamuel brandwein, qPa, cFP, cima, crPs

exeCUTive direCTor/Ceobrian h. graff, esq., aPm

NAPA Net the Magazine is published quarterly by the national association of Plan advisors, 4245 north Fairfax Dr., suite 750, arlington, Va 22203. For subscription information, advertising and customer service, please contact naPa at the above address or call 800-308-6714, or [email protected]. copyright 2014, national association of Plan advisors. all rights reserved. this magazine may not be reproduced in whole or in part without written permission of the publisher. opinions expressed in bylined articles are those of the authors and do not necessarily reflect the official policy of naPa.

Postmaster: Please send change-of-address notices for NAPA Net the Magazine to naPa, 4245 north Fairfax Dr., suite 750, arlington, Va 22203.

stock images: shutterstock

06 letter From the eDitorby Fred BarsteinMake your voice heard!

08 insiDe naPaby Steve DimitriouNAPA intensifies its efforts to engage members and Firm Partners.

10 insiDe the beltwayby Brian H. GraffRetirement: The new health care.

12 insiDe the lawby David N. LevineSignificant potential liability exists in three key areas of client services.

14 insiDe inVestmentsby Jerry BramlettTarget date funds: Is it time for professional intervention?

16 insiDe the Plan ParticiPant’s minD

by Warren CormierExplaining participant behavior via prospect theory.

18 insiDe the Plan sPonsor’s minD

by Steff C. ChalkA look at the unabashed needs of today’s plan trustee.

20 insiDe the stewarDshiP moVementby Donald B. TroneWhat is the “merely fiduciary” standard of care?

70 insiDe the marKetPlaceby Fred BarsteinPowerful forces are affecting all five pillars of the industry.

72 insiDe the numbersby Nevin E. AdamsA look inside EBRI’s 2014 Retirement Confidence Survey.

columns

70

n a p a n e t t h e m a g a z i n e6

those who make the extra effort — effort that may not result in immediate financial returns. But they are also the first ones to be hired and the last ones to be fired. n

ith this fourth issue of NAPA Net the Magazine, we have completed our first annual cycle. So far, the response has been positive. The magazine, the NAPA Net web portal the NAPA Net

Daily provide an integrated way for busy DC professionals to keep up with what’s happening on a daily basis, know what the industry’s thought leaders are saying and access a wealth of business intel and other resources.

I would say that NAPA Net is being heard loud and clear, with more than 30,000 reading at least one of our publi-cations. Many important decision makers in Washington and on Capitol Hill read the Daily. That helps fulfill one of NAPA’s main goals: to let Washington know that there are many accomplished and expe-rienced plan advisors out there who care and who are making a difference.

In this issue we highlight the emerging younger plan advisors, with NAPA’s list of “Top 50 Plan Advisors Under 40” — the first of its kind for our industry. There are a lot of great DC advisors, but it seems that the ones who get mentioned most often are older. This raises the question of where the new blood — the “Young Guns” — are coming from. In a market focused on retirement planning, we need to think

about the day when the current group of plan advisors rides off into the sunset. Who will be replacing them? Senior writer John Iekel tackles that question in our cover story.

The next market which will come under scrutiny by Washington is IRA rollovers. In a feature story on page 36, Steven Sullivan explains the new rules and requirements that are emerging. Look for increased activity by regulators and legisla-tors in the IRA arena.

Finally, as the DC market matures, a subtle power shift from record keepers to advisors, teams and broker dealers is taking place that can be, at times, uncom-fortable and contentious. Isn’t that usually the case with change? Read more about this power shift on page 44.

The DC market is constantly chang-ing. Retirement is becoming a top issue for politicians, employers, workers and the financial services industry. For NAPA and NAPA Net to stay relevant, we need your participation. We need to hear from you.

We are always looking for ways to in-clude new voices, especially plan advisors. So contact me if you want to contribute a post on NAPA Net or suggest an idea for a magazine article. And if you are concerned about what’s happening in Washington and want to make a difference, make sure you register for the NAPA DC Fly-In Forum at the end of September. Thought leaders are

l E T T E R f R O m T h E E d i T O R

FreD barstein » editor-in-chief

Make Your Voice Heard

W let washington know that there are many accomplished and experienced plan advisors out there who care and who are making a difference.”

l E T T E R f R O m T h E E d i T O R

Rainy Cloudy Partly Sunny Sunny

clear view of retirement,improving outcomes

We keep participants on course toward a funded retirement.What makes our approach to retirement readiness so effective is that it’s so

personalized. At any time, participants can check their own retirement forecast

to get an idea of whether they’re on course toward a funded retirement and,

if not, what steps they can take to improve it. Think how much more engaged your

clients’ participants would be with this kind of actionable guidance. To learn more,

call 888-401-5826 or visit trsretire.com.

Securities offered through Transamerica Investors Securities Corporation (TISC),440 Mamaroneck Avenue, Harrison, NY 10528. Transamerica and TISC are af� liated companies.14599-FA_AD (01/14)© 2014 Transamerica Retirement Solutions Corporation

n a p a n e t t h e m a g a z i n e8

i N s i d E N A P A

Get Engaged!throughout 2014, we’re intensifying our efforts to engage with naPa members and Firm Partners at a deeper level,

by demonstrating the value naPa provides them — and the industry

NAPA can be aggressively proactive re-garding what advisors want to see from a regulatory point of view. But doing so starts with you. Look for and participate in a higher-profile and more active Govern-ment Affairs Committee this year under the leadership of Jeff Atcheson, QPFC, AIF. Also, join the quarterly member-only “Washington Update” webcast series that began in April. After all, you can’t change the discussion if you don’t know the issues!

Also, please consider donating to NAPA’s political action committee, the NAPA PAC. A healthy, funded PAC assures that our voice is heard where it needs to be. Thanks to the hard work of NAPA Political Director Jim Dornan and his staff, the NAPA PAC is fighting the good fight — making our views known and exerting our influence in the legislative arena. But compared with oth-ers fighting for the same brief attention spans of our legislators, they are doing it mostly by force of personality and effort. Think of what they could do if we can give them a level playing field from a budgetary point of view! A mere $50 or $100 per member would put our PAC in a position commen-surate with our standing and importance in America’s financial landscape.

In short, expect to hear more from me and NAPA. Telling you about what we are doing is all about demonstrating the value and the need for NAPA — for both indi-vidual members like you and for our Firm Partners. We want your attention, and we want your active support. After all, we are your voice. n

» steven Dimitriou, aiF, PrP, is naPa’s 2014-2015 President. he served as President-elect in 2012 and 2013. Dimitriou is a managing Partner at mayflower advisors, llc, in boston.

gaging NAPA’s Firm Partners more. Doing so begins with demonstrating the value of their relationship with NAPA. We began that process this year with the launch of NAPA’s 401(k) Practice Builder. We developed the Practice Builder to help educate our Firm Partners’ newer advisors and staffers about the marketplace and to help them build their businesses. But we will not end there — in conjunction with our Firm Partners, we are developing other potential education oppor-tunities as well, including in the credentialing arena.

This year will certainly see a continued push in our advocacy efforts. We are off to a fantastic start with the PAC’s success at the NAPA 401(k) Summit in March, but we must keep that momentum going. There are several issues looming over the course of this summer legislatively and from a regulatory point of view that we must stay ahead of: the fiduciary redefinition, IRA rollovers, congressional and budget proposals, and state-proposed plans.

With a little more support, I believe

would like to start my first column as NAPA President by thanking Marcy Supovitz, who served so well as our first President. The effort Marcy put into NAPA during the organization’s first two years was amazing and self-less. She essentially worked two jobs, and on behalf of the organization and

its members I want to express our deep grat-itude. Of course, I now have the enormous task of following in her footsteps!

What can the average NAPA member look for during my term? In one word, engagement. Our advocacy efforts in Wash-ington and our education efforts among our membership mean nothing if our members are not engaged and active.

To begin with, I want those of you who don’t even know you are members to become aware of that fact! Chances are that if you are reading this, you are a member. Whether you knew it or not, your employer (a NAPA Firm Partner) paid for your mem-bership.

For those of you who are aware, I want to convey the importance of what we are do-ing on your behalf in Washington and state capitals, and to encourage you to participate in those efforts. For example, the NAPA DC Fly-In Forum this fall will be bigger and better than last year’s inaugural event — and it is already the most unique event in our industry. Also, the NAPA 401(k) Summit is fast becoming our industry’s national convention, not just another conference. The work has already begun on next year’s Summit — keep an eye on NAPA Net for a unique voting tool (the same one we used last summer) that allows you to directly shape the Summit agenda.

One key to achieving my goals is en-

by steVen Dimitriou

I our advocacy efforts in washington and our education efforts among our membership mean nothing if our members are not engaged and active.”

9S U M M E R 2 0 1 4 • n a p a - n E t . o R g

KEEP YOUR RETIREMENTPLANSON TRACK

Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. To obtain a Franklin Templeton fund summary prospectus and/or prospectus that contains this and other information, call 1-800-342-5236. Investors should read the prospectus carefully before investing.All investments involve risks, including possible loss of principal. Principal invested is not guaranteed at any time, including at or after the fund’s retirement target date; nor is there any guarantee that the fund will provide sufficient income at or through the investor’s retirement.Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, CA 94403 © 2013 Franklin Templeton Investments. All rights reserved.

FRANKLIN LIFESMART™ RETIREMENT TARGET FUNDSTo help plan participants reach their retirement goals, Franklin LifeSmart Retirement Target Funds are designed to seek the highest level of long-term total return, while continuously managing investment risk.

• Our “to-retirement” glide path seeks greater growth opportunities for a longer period and becomes increasingly conservative as investors approach their approximate target year for retirement.

• We take a comprehensive, disciplined approach to risk management, looking at both risk and return from every angle—and at every phase of the investment life cycle.

• Each portfolio is backed by the breadth and depth of our global resources, and our 65+ years of experience investing across market cycles, asset classes and the world.

To see why Franklin LifeSmart is a smart choice for your clients’ retirement plans, visit franklintempleton.com/lifesmart.

USEN_DC_LIFESMART_ONTRACK_TRADE_10x12_NAPA_060114.indd 1 4/24/14 1:02 PM

n a p a n e t t h e m a g a z i n e10

i N s i d E T h E b E l T w A y

Dozens of states are now considering the issue of retirement coverage. why are states getting involved in erisa plans?

Retirement: The New Health Care

by brian h. graFF

that, why don’t they just do a 401(k)? For one thing, employees can save more because of the higher limits in a 401(k) plan. There is opportunity here — a rising tide lifts all boats.

The view of ASPPA and NAPA is that strategically we must participate in the legislative debate over these proposals. Our goal: to ensure that there will be a role for the private sector. If we don’t participate, it’s likely that state legislators will create a state-mandated program that only allows for a state product.

We’ve been 100% successful so far in those states we’ve been involved in. Assum-ing we can continue at that level, our expec-tation is that we can get legislators to allow the private sector to fulfill the requirement for coverage.

The reality is that state legislators are intent on doing something because not enough people are saving enough for retire-ment. We do face a challenge — there are too many people in this country who still lack access to a retirement plan at work. There are people here in Washington who want to blow the whole thing up and not have any private sector role anywhere. Our view is that we can expand coverage, in-cluding through an employer mandate, and show that the private sector is now playing a prominent role in solving that problem, and that it must continue to do so if we are to achieve the goal of expanding coverage.

The key is that as those of us who represent NAPA in Washington and in state capitals where these issues are being discussed get engaged, you do too. Get en-gaged with your local politicians; let them know your take on these issues as a success-ful member of the plan advisor community. We’re here to help you. n

» brian h. graff, esq., aPm, is the executive Director/ceo of asPPa and naPa.

their health insurance and health care deliv-ery systems, focusing huge amounts of time and energy on that issue.

But enactment of the Affordable Care Act essentially took the health care issue away from those state legislators. And that’s where retirement comes in. In an import-ant sense, retirement is becoming the new health care.

Typically, the retirement security bills introduced in state legislatures take a two-part approach. The first part is a mandate — a requirement that employers must offer some kind of plan, the minimum level of which would be a payroll deduction IRA, or an “auto-IRA.”

The second part is the state default option. The view among AARP and others is that the industry is ripping people off and only the state can provide a reasonably priced and reliably packaged payroll de-duction IRA. Our view is that since private sector products can pass the requirement, we’re pretty confident that with their focus on micro plans, payroll providers and others will be very successful in distributing their products and competing with the state product.

By way of analogy, we have found in the 403(b) world that when there is com-petition it is almost invariably the products that are sold that win the day, because someone is out there convincing someone to save for retirement. The reality is that products which are distributed through payroll companies are likely to be the more popular choice.

We believe that state mandates create an opportunity to upsell. Small business-es, which have always been reluctant to provide a 401(k) plan for their employees for many good reasons, would now be required to do something. So the question that naturally follows is: If they have to do

ith the nation’s retirement system “broken” — at least according to its crit-ics and a growing number of reports in the media, that is — but only modest interest on Capitol Hill in

tackling the access and coverage problem on a nationwide scale, a kind of retirement policy vacuum has come to exist.

But politics, like nature, abhors a vac-uum. And so the cause of retirement access is being taken up by state legislators around the country. Over the course of the last year, dozens of states have considered the issue of retirement coverage — most notably in Connecticut, California and Maryland.

Why are states getting involved in ERISA plans? Because state legislators want to do something. Recent polls have shown that retirement security has become the number one economic concern among Americans. So we know that members of state legislatures are hearing about the issue from their constituents.

But there’s more to this issue. In recent years, the attention of many state legislators has been focused on budgetary issues and health care. Some states — like Massachu-setts, for example — explored regulating

W

the reality is that state legislators are intent on doing something because not enough people are saving enough for retirement.”

Products and services o� ered through the Voya family of companies. © 2014 ING North America Insurance Corporation. All rights reserved. CN0313-16174-0416

Inspired by ING

A new kindof company.

U.S. is becoming Voya Financial™, a new kind of company that’s dedicated to redefi ning what it means to prepare for retirement.

We believe everyone is entitled to a secure fi nancial future and we’re committed to making that possible — one person, one family and one institution at a time.

We’re here, each and every day, to help you and your clients envision the future, get organized and take the steps necessary to pursue fi nancial success together.

Rest assured that how you work with us won’t change. You’ll partner with the people you know and trust, and will have access to all the innovative products, services and thought leadership you’ve come to expect from us.

Our Investment Management and Employee Benefi ts businesses will be the fi rst to operate as Voya, beginning on May 1. The rest of ING U.S., including Retirement Solutions and Insurance Solutions, will follow on September 1.

We’ll be sure to keep you, our valued partners, informed through it all.

Have questions now? Call 844-226-8692or visit us at voya.com to learn more.

Introducing

Voya_Page_O_041414

April 14, 2014 4:35 PM

1

Bleed 10.25 x 12.25Trim 10 x 12.0Live 9.5 x 11.5

Folded Size N/AGutter N/APanel Sizes N/A

Job info

FontsArial Bold.ttfArial.ttfMinionPro-Regular.otfProxima Nova Cond Reg.otfProxima Nova-Light.otfProxima Nova-SBold.otf

ImagesING_Orange20.aiING.epsvoy_t_4cp_grd_pos.epsvoy_vb_hz5_bleed_4cp.eps

Fonts & Images Publication information

Saved at

Napa Net MagazineInsertion: SummerMaterials Due: 4/21

n a p a n e t t h e m a g a z i n e12

i N s i d E T h E l A w

Step Carefully: The Evolving Role of the Advisor

that is “fiduciary” advice. When an advisor is sitting in a one-on-one meeting with a participant and the participant asks, “What should I do?”, it may be hard for some advisors to say they can’t give actual advice. There are steps an advisor can take to limit his/her risks in providing participating education, but without stepping carefully, when a participant loses money because of education that became advice, the advisor could easily face liability as a fiduciary.

Plan Operational and Correction Advice In the course of their client relation-

ships, many advisors will hear this question: “We found a mistake in how we ran the plan; what should we do?” In addition, some advisors affirmatively take on a role of assisting their clients with questions about how to manage day-to-day oper-ations, such as implementing participant contributions through their payroll systems or fixing the failure to properly implement loan repayments or a post-termination distribution election. When an advisor steps into this role, the advisor can easily become a fiduciary for plan administrative — not just investment — activities, with the related fiduciary liability. Similarly, if the advisor’s advice is relied upon and turns out to be wrong, insurance coverage may not be available. As such, an advisor who elects to provide this advice should focus carefully on what is contractually agreed to, as well as which services are actually provided once the contract goes into effect.

Individual Wealth Management and IRA Rollover Advice

Some advisors include individual wealth management as a core part of their business model; others specifically elect not

to provide these services. In recent years, however, more and more advisors have been focusing on providing advice to participants on whether to roll over 401(k) accounts to IRAs. Although no one can know for sure until the “new” proposed fiduciary defini-tion (now called the “conflict of interest rule”) is issued, it is very likely that, not-withstanding the contours of DOL Advisory Opinion 2005-23A, IRA rollover advice is likely to be considered a fiduciary act when the definition of fiduciary is updated. If an advisor gets paid in any way for a rollover — from fees on the incoming rollover to ongoing fees that might be higher than the fees in the participant’s 401(k) plan — there probably will be significant prohibited transaction risks (and penalties) that an advisor could face.

There are many services beyond tradi-tional investment consulting that an advisor can provide to clients; we’ve only briefly touched on a few of them here. In the mod-ern retirement plan landscape, almost every activity an advisor undertakes involves risk. Avoiding all risk isn’t a practical solution. However, with some careful planning, ad-vice and counseling, an advisor can branch out into additional retirement-related activ-ities, provide quality services to clients and proactively manage its legal risk. The key is just to step carefully. n

» David n. levine is a principal with the groom law group, chartered, in washington, Dc.

or years on end, the advisor com-munity has been bouncing from one legal compliance requirement to another. Several years ago, fee disclosure was at the center of many advisors’ ERISA compliance uni-verse. In 2015, whether or not an

advisor is a fiduciary — and the extent to which they are involved with IRAs and IRA rollovers — is likely to take center stage.

However, the evolving legal require-ments which apply broadly to the retire-ment industry as a whole are only one part of the puzzle. As study after study shows, the fees paid in the industry for traditional “investment consultant” services are under significant pressure. As a result, many advisors have focused on additional services that they can provide to their clients. The decision to provide — or not to provide — services beyond traditional investment consulting is an individual one. However, should an advisor, whether consciously or inadvertently, provide a broader range of services, it is important to keep in mind that the key is stepping carefully because many of these services can open up new areas of potential ERISA liability. Let’s walk through three key areas: participant education, plan operational and correction advice and individual wealth management activities, including IRA rollover advice.

Participant Education An advisor can provide participant “ed-

ucation” in many forms, including services such as in-person group meetings, webinars, online programs and one-on-one counsel-ing. From a legal perspective (and under DOL Interpretive Bulletin 96-1), there can often be a fine line between education that is “non-fiduciary” in nature and advice

be careful: significant potential erisa liability exists in three key areas of client services.

by DaViD n. leVine

Fin the modern retirement plan landscape, almost every activity an advisor undertakes involves risk.”

Why view target date performance the same way when every client is different?

Call 1.800.638.7780 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. The principal value of the T. Rowe Price target date funds is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire (assumed to be age 65) and likely stop making new investments in the fund. If an investor plans to retire signi� cantly earlier or later than age 65, the funds may not be an appropriate investment even if the investor is retiring on or near the target date. The target date funds’ allocations among a broad range of underlying T. Rowe Price stock and bond funds will change over time, with a higher equity allocation initially. The target date funds are not designed for a lump-sum redemption at the target date and do not guarantee a particular level of income. T. Rowe Price Investment Services, Inc., Distributor.

When choosing a target date solution for your clients, performance is only one consideration. T. Rowe Price offers two target date solutions designed for different plan objectives, risk priorities, and participant needs.

To learn more about evaluating target date solutions, go to troweprice.com/tdf

T. R

ow

e Pr

ice

Advertisin

g

Initials:

Date: Time:

DTP Code:

Req Code:

Initials:

Date: Time:

Initials:

Date: Time:

Legal Ref #:

Line #:

Initials: Date:

Initials: Date:

Publication: Size/Color: Cover Date: On Sale Date:

Submitted On Date: Time: Due By Date: Time:

NAPAnet P(4CB) (10.25 x 12.25) 5/1/14SUMMER 14

bhq

4/15/14

10.25x12.25-(4CB)TDF_NN_S2014

ADDITION4/16

4/16

10

4

Desktop Publishing EP Proofreading Manager’s Approval Corp. Proofreading

10.25x12.25-(4CB)TDF_NN_S2014.indd 1 4/23/14 10:00 AM

Step Carefully: The Evolving Role of the Advisor

i N s i d E i N v E s T m E N T s

arget-date funds have helped to advance diversification and risk-appropriate allocations more than any other asset allocation vehicle to date. They are easy to explain (match your target retire-ment date with the appropriate

fund) and adopt (check the box). They tend to achieve high adoption rates, especially when used as a default option.

One of the criticisms of TDFs is that generally they do not adjust their glidepath in a dynamic fashion based on market conditions. In most TDFs, participants are continually invested based on mostly static glide paths, regardless of changing asset class valuations. Given the bullet that many near-target investors dodged in the Great Recession if they remained fully invested, this issue of risk management within TDFs ought to be of growing concern.

High Equity Exposure in TDFs: Sounding the Alarm

A recently published book, Fiduciary Handbook for Understanding and Selecting Target Date Funds, by pension consultant Ron Surz, attorney John Lohr and ethicist Mark Mensak, sounds the alarm as to what the future of TDFs might hold. According to the authors, “Sometime in the future there will be a market correction of the magnitude of a 2008 or even a 1929. Un-less risk controls are tightened, especially near the target date, fiduciaries will be sued as a result of losses.”

The authors focus on the “Big 3” TDF providers — T. Rowe Price, Fidelity and Vanguard — which, they contend, “main-

The authors state that, “it is the height of folly to assume that a market trading at 45 times normalized earnings (Shiller/PE), as the S&P 500 was in 2000, can achieve similar returns to one trading at 7 times, as it was in 1982, let alone the expected returns of any reasonable glide path.”

They bolster their argument by demon-strating that, while valuations cannot tell us much about returns in the short term, over a longer period of time, “the correlation between valuation and subsequent stock market returns [increases] as the time hori-zon lengthens from 1 to 20 years.” The au-thors back this statement with an analysis illustrating that the correlation of valuation and future return is 20% over a 1-year period, and then rises steadily to more than 70% as the investment period lengthens to 20 years. Even 10-year returns have a 60% correlation between current valuation and future returns.

The connection between low valua-tions and outperformance is not new. The famed investor Benjamin Graham, in his 1949 book, The Intelligent Investor (which many consider the stock market bible) made a strong case for allocating invest-ments to securities with a low valuation relative to their intrinsic value. Robert Shiller, who has said that Graham inspired his valuation approach, states in Irrational Exuberance (based on a historical analysis of the relation between price-earning ratios and subsequent returns) that, “long-term investors — investors who commit their money to an investment for 10 full years — did do well when prices were low relative to earnings at the beginning of the 10 years

tain the same exposure today as they had in the 2008 fiasco. Setting the stage for a repeat calamity, this time much more devastating.”

A few weeks before that book was published, Grantham, Mayo and Otterloo & Co. (GMO) released a white paper, “In-vesting for Retirement: The Defined Con-tribution Challenge” that sounded a similar alarm. However, rather than simply take the position that TDFs’ equity exposure is risky, the authors focus on the need for TDFs to be managed as “valuation-aware” portfolios.

T

by Jerry bramlett

TDFs: Is it Time for Professional Intervention?many 3(38) investment advisors are in a position to look further around the corner and take the position that tDFs should be dynamically managed over time based on market conditions.

Just as there has been a slow awakening to the reality that Dc investors prefer a do-it-for-me approach to investing, over the last 5 years or so, we are seeing plan sponsors espousing the same view through the adoption of the 3(38) advisor service structure.”

n a p a n e t t h e m a g a z i n e14

15S U M M E R 2 0 1 4 • n a p a - n E t . o R g

and did do poorly when prices were high at the beginning.”

The S&P 500 average real return over different 20-year periods has varied a great deal over time. The worst 20 years since 1920 was 1961-1981, a period in which the annual real return averaged -2%. The best 20-year period was 1979-1999, when the annual real return averaged +8.2%. (Source: New York Times, Creston Research.) One major difference between these two differ-ent 20-year periods of performance was the normalized S&P 500 PE ratio (Shiller P/E) at the beginning of the 20-year period. At the beginning of the best-performing 20-year period (1979), the P/E ratio was 9.26, while it was 18.47 in 1961, the beginning of the worst 20-year period. A more recent comparison is 2009, when the P/E was at 15.17, and April 29, 2014, when it was at 25.1 (52.1% higher than the historical mean of 16.5%).

It is perhaps telling that the difference in earnings between the beginning of the best-performing and the worst-performing 20-year periods of the S&P 500 since 1920 is 9.7 while the variance between 2009 and 2014 is 10.13. There are many variables that can impact what is considered a market top (e.g., interest rates, inflation). However, could the market (based on current valu-ations) be set up for an extended period of underperformance? Just as investment returns can enhance investor outcomes, prolonged periods of underperformance can greatly diminish investor outcomes, espe-cially for those DC investors who are close to retirement and have less opportunity to recover.

The next evolutionary step beyond providing participants with an asset allo-cation recommendation is to dynamically manage the asset allocation process based on “valuation-aware” portfolios (to use GMO’s term). This strategy, however, requires a long view given that the impact of valuations on returns is mostly experienced over the longer term. As the GMO white paper states, “Cheap valuations don’t guarantee that returns will follow particularly quickly: val-uations mean revert slowly, typically revert-ing one-seventh of the way back to normal every year, meaning that stocks can remain cheap or expensive for very long periods of time.” To adjust a TDF glidepath based in

asset class valuations requires a disciplined approach that is difficult for many money managers, much less plan sponsors, to prac-tice. However, this could change as more and more plan sponsors continue to outsource the investment selection process.

To the Rescue: Investment Outsourcing Just as there has been a slow awakening

to the reality that DC investors prefer a do-it-for-me approach to investing, over the last 5 years or so, we are seeing plan sponsors espousing the same view through the adop-tion of the 3(38) advisor service structure. Much is made of the fact that plan sponsors can share more of the liability with a 3(38) investment advisor; however, that may be missing the point. It may be somewhat of a moot fact from a liability standpoint given the plan sponsor is responsible for hiring and firing the 3(38) advisor. Plan sponsors can reduce their work and perhaps improve investor outcomes, but they cannot get rid of their responsibility for oversight.

What is important, however, is that the plan sponsor (the non-investment profession-al) is stepping aside and allowing the plan advisor (the investment professional) to do their work, which, ultimately should result in better investor outcomes.

In balancing returns against prudent practices, plan advisors are in a better po-sition to understand the importance of the latter over the former. Plan advisors are also:• not inclined to have an emotional at-

tachment to brand; • better able to separate luck from skill as

contributors to performance; and • better able to take a long view toward

investment outcomes, such as pulling back equity exposure when market valuations begin to become unattractive from a future return standpoint.

ConclusionBy 2018, target date strategies are pro-

jected to attract 63.4% of 401(k) contribu-tions and have 35% of total assets (Cerulli Associates, March 2014). As of year-end 2013, three firms — Fidelity, T Rowe Price and Vanguard — held 73% of the TDF mar-ket (Morningstar). On average, the retire-ment-date equity exposure is approximately 55%. The risk that these firms expose them-selves to if they pull back equity exposure is

that the markets could continue to climb for longer than expected. In that event, reducing equity exposure would negatively affect 1-year and even 3-year returns. That is why it may be preferable to take the hit to return downstream, and thus end up looking no better but no worse than the other main competitors. This is bit of a Catch-22 problem for all TDF providers.

The way forward — if these funds continue their high equity exposure in spite of what many consider to be a high market valuation — will not be for the plan sponsor to step in and make a change. Generally speaking, they are too attached to brand and hesitant to second-guess these highly regarded money management firms. Though many 3(38) investment ad-visors find themselves in the same boat as the fund firms and plan sponsors, they are at least in a better position to look further around the corner and take the position that TDFs should be dynamically managed over time based on market conditions. This, after all, would seem to be the more prudent approach. n

» Jerry bramlett was the founder, president and ceo of the 401(k) company, the ceo of benefit-street and the founder/ceo of nextstep. currently he is engaged in industry consulting.

given the bullet that many near-target investors dodged in the great recession if they remained fully invested, this issue of risk management within tDFs ought to be of growing concern.”

TDFs: Is it Time for Professional Intervention?

n a p a n e t t h e m a g a z i n e16

Explaining Participant Behavior via Prospect Theory

i N s i d E T h E P l A N P A R T i c i P A N T ’ s m i N d

a loss relative to their reference point of take-home pay.

“But wait,” we say, “the participant keeps the money and also receives a gain in the form of the match.” From the employ-ee’s point of view, this exchange may be considered a loss. Why? Because for the typical human, the pain of a loss is twice as powerful as the joy of a gain. (If you are wondering, yes, this has been measured by scholars.) So right off the bat, if the match is less than 100% of the contributed amount, the employee will see this, accord-ing to prospect theory, potentially as a loss and avoid it due to loss aversion. But there is another powerful force that is reinforcing this sense of loss. It is called “hyperbolic discounting.” What is this, exactly?

Hyperbolic discounting is a phenome-non where people typically intend to forfeit small immediate gains for larger rewards in the future, but often fail to make the op-timal choice at decision time. The decision maker values the small immediate reward more than the larger future reward. “Would you prefer a dollar today or three dollars next year?”

When combined with loss aversion, hyperbolic discounting can easily offset the incentive of a match. In effect, we are asking employees to receive less take-home pay and defer immediate gratification so they can fund the expenditures of a retired person (themselves) whom they may not be able to relate to today. In that the employee dis-counts deeply the future rewards (retirement income) relative to the immediate “loss,” the employee either declines the invitation to participate at all or minimizes the deferral

receiving nothing.In actual experimentation, the vast

majority select Option 1, a sure profit of $5,000. However, the rational (defined by economists as “reasonable”) choice would be an 80% chance to gain $7,000, which has an expected value of $5,600.

This simple thought experiment can tell us a great deal about the mind of the partic-ipant. When we look at participant behav-ior we often scratch our heads and conclude they are behaving irrationally. Why would they pass up guaranteed free money in the form of a match? But this is our view from the supply side of the DC industry. From the participant’s view, it runs counter to their psychology.

First, we need to consider whether making a contribution to their retirement account is seen as a gain or a loss. To assess if something is a gain or a loss, there needs to be a reference point or neutral point against which all outcomes will be assessed. In the employee’s mind, that reference point is their take-home pay before factoring in participation in a DC plan. Upon learning about the DC plan, the participant may see

hile preparing to teach a 2-day course in behavioral finance, I found myself more closely studying and reflecting on Daniel Kahneman’s Prospect Theory. As you may know, he was awarded a Nobel Prize for

this theory. What essentially is Prospect Theory and why would I be writing about it in column dedicated to the “Mind of the Participant”? Because I believe it provides great insight into participation and deferral rate decisions.

The essential ideas in Kahneman’s Pros-pect Theory are that:• People do not always behave rationally. • There are persistent biases motivated

by psychological factors that influence people’s choices under conditions of uncertainty.

• Prospect theory considers preferences as a function of “decision weights.”

• It assumes that these weights do not always match with probabilities.

• These decision weights tend to over-weigh small probabilities and under-weigh moderate and high probabilities.

• Investors tend to evaluate prospects or possible outcomes in terms of gains and losses relative to some reference point rather than the final states of wealth. A simple example serves to clarify

what this all means. Consider the following choice. Which of the two options would you choose?• Option 1: a sure profit (gain) of

$5,000; or• Option 2: an 80% possibility of

gaining $7,000, with a 20% chance of

exploring the true meaning of rationality and irrationality, and their application to participants’ decisions.

warren cormier

W For the typical human, the pain of a loss is twice as powerful as the joy of a gain.”

i N s i d E T h E P l A N P A R T i c i P A N T ’ s m i N d

trustworthy and knowledgeable source. However, most participants don’t trust themselves to pick the right advisor and inflate the probability (in their minds) of picking a bad one. They obviously need your help and need to feel that they made the right choice.

When trustworthy and knowledgeable advice is offered through the plan sponsor, why do so few participants take advantage of it? Prospect theory is at work.

Finally, keep in mind that participants are not acting irrationally. Economists typ-ically equate “rational” with “reasonable.” In his book, Thinking, Fast and Slow, Kahneman points out that, “The only test of rationality is not whether a person’s beliefs and preferences are reasonable, but whether they are internally consistent … rationality is logical coherence — reason-able or not.” n

» warren cormier is president and ceo of bos-ton research group, author of the DcP suite of satisfaction and loyalty studies, and director of the naPa research institute. he also is cofounder of the rand behavioral Finance Forum, along with Dr. shlomo bernartzi.

rate in an attempt to minimize the pain of a loss.

Furthermore, in that people tend to evaluate prospects or possible outcomes in terms of gains and losses relative to some reference point (their take-home pay) rather than the final states of wealth (the value of the DC account many years in the future), the DC plan doesn’t look as good as we believe it to be — especially if we compare it to a DB plan in which there is certainty of a gain and no probability of a loss.

Now let’s assume the employee enrolls anyway. Let’s also bring in the fact that investment decisions must now be made and that those decisions are made against a back-drop of warnings that the employee could lose all of his or her account balance. Loss aversion kicks in to do double duty. As the example above shows and the theory states, people tend to overweight the lower proba-bilities and underweight the larger probabil-ities. Although the risk of losing $7,000 in the example is only 20%, in order to make the two choices equal in value (i.e., for the person to be indifferent), the probability of winning was weighted down, emotionally, from 80% to 71% (or $7,000 X .71).

Throw in on top of that a healthy dose of regret aversion and ambiguity aversion (fear of unknown risks) on a lack of invest-ing experience/confidence and you have a dysfunctional investor. As a result, herding behavior appears, in which participants begin asking co-workers what they did or asking HR staffers what they should do. This often results in bad advice for the partici-pant.

Enter the advisor. A high percentage of participants say they want advice from a

investors tend to evaluate prospects or possible outcomes in terms of gains and losses relative to some reference point rather than the final states of wealth.”

NAPA Net – The Magazine is one bene�t of being a NAPA member… here are some others.

Whether you join as an individual member or through a NAPA Firm Partner (like your broker dealer or company), NAPA helps you manage your practice, grow your AUM and identify business opportunities and vital plan management services.

If you’re not already a member, what are you waiting for?Contact: Lisa Allen at 703-516-9300 x127 · [email protected]

Practice Management

and Networking

• NAPA – 7,000+ members and 100+ Firm Partners

• NAPA 401(k) SUMMIT • NAPA DC Fly-In Forum• Committee Leadership

Business Intelligence

• NAPA Net Daily • NAPA Net Online Portal• NAPA Net–The Magazine • NAPA quarterly webcasts

Advocacy

Your Voice on Capitol Hill and in the DOL, Treasury and IRS

NAPAnetthe magazine

THE OFFICIAL MAGAZINE OF THENATIONAL ASSOCIATION OF PLAN ADVISORS

Powered by ASPPA

DC POWER HITTERSFALL 2013 // NAPANET.ORG

i N s i d E T h E P l A N s P O N s O R ’ s m i N d

The Unabashed Needs of Today’s Plan Trustee required reading for all plan trustees who take seriously the role of overseeing the company retirement plan.

he majority of plan sponsor trustees realize they have an unfulfilled need for an unbiased source of reliable and practical information upon which they can depend. The astute plan trustee has awakened to the fact that the stakes are significantly

higher than plan asset values alone. The all-in stakes of today’s plan sponsor trustee include the troika of real asset values: the sum of plan participants’ accounts, what has been referred to as the “future dignity” of the workforce, and the financial viability of the plan sponsor.

The Thirst for KnowledgeOutside of corporate counsel and

boutique ERISA law firms, there are only a handful of sources that one might consider unbiased and reliable. While the aforemen-tioned counsel options are clearly the most reliable sources of unbiased advice, those options may be inaccessible to many plan trustees due to expense alone. In some situ-ations counsel has little interest in educating plan trustees since the rewards (attorney fees) for litigation or VCR submissions far exceed the legal fees associated with a few hours of preventive education. Sheer eco-nomics provide the legal community with an inducement to litigate over the preference for counsel to educate.

Plan trustees do not possess the expe-rience and awareness of an industry pro-

fessional. Part-time plan trustees are at the mercy of their professional contacts, which are normally limited or, for the recently appointed plan trustee, virtually non-ex-istent. A dearth of industry contacts may lead the newly appointed plan trustee to an Internet search and a range of choices when seeking knowledge.

The Hunger for Talented ResourcesA retirement plan committee is a dy-

namic group; annual turnover rates among committee members generally range between 15% and 30%. The size of a retirement plan committee is normally directly proportional to the size of the plan asset base; higher asset bases equate to a larger number of plan com-

by steFF c. chalK

T

Great-West Financial® refers to products and services provided by Great-West Life & Annuity Insurance Company (“GWLA”), Corporate Headquarters: Greenwood Village, CO; Great-West Life & Annuity Insurance Company of New York (“GWLANY”), Home Office: White Plains, NY; their subsidiaries and affiliates. The trademarks, logos, service marks, and

design elements used are owned by Great-West Life & Annuity Insurance Company. ©2014 Great-West Life & Annuity Insurance Company. All rights reserved. PT189627 (01/2014)

The sTrengTh of 100 years for a brighTer Tomorrow.

Just like the lasting strength of the Rocky Mountains, Great-West Financial® has endured peaks and valleys

in the market to become one of the nation’s top-ranked retirement solutions providers. Guided by our

core values of Partnership, Commitment and Integrity, we provide a superior experience to help prepare

our clients for a brighter tomorrow. Find out why we are a trusted

financial partner to and through retirement at www.greatwest.com.

PROOFING: Lasers: # ______ Contone: # ______ Dot Proof: # ______

Lo-Res PDF Lo-Res JPG

DISPATCH: Hard Drive Group Disk (e.g. A, B, C): _____ Individual Disk

FTP To: ______________________________________

Slingshot To: __________________________________

FILE TYPE: Layered with Fonts Hi-Res PDF OFG JPG

Layered w/ Outline Type

DUE DATE / TIME: _________________________________

NOTES: Build Size: 20" x 6" • Built @ 100% • 300dpi • Proofed @ 100% Bleed: .25” • Safety: .25”Pub: NAPA Net

GWFR05715313_Great_West_2014 Campaign_Underwriters_No_Tag

05/07/14

CMYK 100k

GWFR05715313_AD_NAPANet

Marquis 3226

Gardner 3017

Moyle 3362

Great_West_APS_Work

Zumbro 3428

Whitney 3036

Awwad 3437

Blake -3087

Hultberg 3049

Great-West Financial® refers to products and services provided by Great-West Life & Annuity Insurance Company (“GWLA”), Corporate Headquarters: Greenwood Village, CO; Great-West Life & Annuity Insurance Company of New York (“GWLANY”), Home Office: White Plains, NY; their subsidiaries and affiliates. The trademarks, logos, service marks, and

design elements used are owned by Great-West Life & Annuity Insurance Company. ©2014 Great-West Life & Annuity Insurance Company. All rights reserved. PT189627 (01/2014)

The sTrengTh of 100 years for a brighTer Tomorrow.

Just like the lasting strength of the Rocky Mountains, Great-West Financial® has endured peaks and valleys

in the market to become one of the nation’s top-ranked retirement solutions providers. Guided by our

core values of Partnership, Commitment and Integrity, we provide a superior experience to help prepare

our clients for a brighter tomorrow. Find out why we are a trusted

financial partner to and through retirement at www.greatwest.com.

PROOFING: Lasers: # ______ Contone: # ______ Dot Proof: # ______

Lo-Res PDF Lo-Res JPG

DISPATCH: Hard Drive Group Disk (e.g. A, B, C): _____ Individual Disk

FTP To: ______________________________________

Slingshot To: __________________________________

FILE TYPE: Layered with Fonts Hi-Res PDF OFG JPG

Layered w/ Outline Type

DUE DATE / TIME: _________________________________

NOTES: Build Size: 20" x 6" • Built @ 100% • 300dpi • Proofed @ 100% Bleed: .25” • Safety: .25”Pub: NAPA Net

GWFR05715313_Great_West_2014 Campaign_Underwriters_No_Tag

05/07/14

CMYK 100k

GWFR05715313_AD_NAPANet

Marquis 3226

Gardner 3017

Moyle 3362

Great_West_APS_Work

Zumbro 3428

Whitney 3036

Awwad 3437

Blake -3087

Hultberg 3049

And so plan trustees are accepting of the status quo when it comes to preserving their co-workers’ retirement plan assets. First and foremost, the role of a plan trust-ee is to preserve the asset base with which he or she has been entrusted. Reasonable growth and appreciation are expected, but they should never come at the expense of imprudent practices or unnecessary invest-ment risk.

Each and every plan trustee is well advised to become familiar with the con-cepts of a book first published in 1975, Investment Policy, How to Win at a Loser’s Game, by Charles D. Ellis. It addresses the confluence of knowledge and talent as it relates to investing and the resulting out-comes that are attributable to both actions and inactions. Penned well in advance of the current wave of interest in behavioral finance, it should be required reading for all plan trustees who take seriously the role of overseeing the company retirement plan. n

» steff c. chalk is the executive director of the retirement advisor university and the Plan sponsor university.

mittee members. Larger committees normally experience turnover rates that are indirectly proportional to the size of the plan assets. Conversely, smaller plan committees (that is, two to four members) usually struggle with the higher turnover rate, while larger com-mittees will experience a lower turnover rate among the committee members.

Large plan committees can comfortably absorb losing a single committee member each year, even if the departing committee member is the strongest of a team of eight or nine, while a small plan committee of three can ill afford to sustain the loss of a single committee member.

The Desire to Be a Better TrusteeVery few individuals head for work each

day intending to do an average job. The vast majority of the U.S. workforce arrives at work each day intending to perform at a lev-el that exceeds the average performance level of their peers and co-workers. Regardless of the circumstances or measures, most workers feel that they do perform at a level that is above average.

One exception to that pervasive self- assessment is in the area of overseeing the

company retirement plan and its assets, both financial and intangible. Retirement plan trustees, with few exceptions, become satisfied with surviving another quarter without a major self-inflicted mistake. When entrusted with the oversight of the compa-ny’s retirement plan assets and the favorable outcome associated with a coworker’s ability to retire with dignity, avoiding such a foible is perceived to be a success. Retirement plan committees should and do consider such an outcome to be a resounding success.

retirement plan trustees, with few exceptions, become satisfied with surviving another quarter without a major self-inflicted mistake.”

n a p a n e t t h e m a g a z i n e20

i N s i d E T h E s T E w A R d s h i P m O v E m E N T

’d like to propose that we start with an exercise: Consider the following five words that we often associate with a fiduciary standard of care: stewardship, loyalty, leadership, gov-ernance and trust.

Like the steps of a building, how would you arrange these words in ascend-ing order? Which word would you put at the base, the top, and in between? What is the hierarchy of these five terms?

Not an easy task, is it? And keep in mind these are terms we use every day with staff, clients and prospects.

Before I give you my answer to the hierarchy, a little background: I credit the origins of this article to John Taft, the head of RBC Wealth Management in the U.S. and author of the book, Stewardship. (A must-read, by the way.) John and I have had a number of intellectual discussions about leadership and stewardship, specifi-cally how the terms affect our understand-ing of a fiduciary standard of care.

It was during one of these discussions that he talked about the “merely fiduciary” standard of care. The first time I heard him make the reference I remember chuckling. It was like someone saying that Peyton Manning is merely a quarterback. Howev-er, after some consideration, I began to see his point.

It is not the place of regulators to be defining the gold standard for our profes-sion. To the contrary, the role of regulators is to define the minimum standard of care one must meet in order to conduct busi-ness. With regard to the current debates about subjecting more advisors and service providers to a fiduciary standard, it is

hierarchy will further illustrate this point.To begin, let me offer a definition for

each of the five terms.Stewardship is the passion and disci-

pline to protect the long-term interests of others — it is what you are willing to go to the mat for. My favorite quote to illustrate this point is from Ken Melrose: What does the organization, my stakeholders, need me to be today: a coach, a teacher, a decision-maker, a supporter, a listener, a pilgrim, a servant, someone who makes waves?

Loyalty is to be faithful and steadfast to principles and commitments. David Greene, of Greene Consulting, shared with me this quote from Horst Schulze, the founding president of Ritz Carlton: You don’t want a satisfied client — you want a loyal client.

The first time I heard that quote I did a double-take, as I did when John Taft first talked about “merely fiduciary.” What do you mean, you don’t want a satisfied customer? The explanation is exquisite: A client who is merely satisfied can be easily swayed to work with another advisor who is offering the same service for less or promising to deliver more for the same price.

Leadership to me means the ability to inspire and the capacity to serve. I credit one of my coaches, Lance Secretan, with introducing me to the concept that leader-ship is the ability to inspire others. Lance talks about the importance of understand-ing the difference between inspiration and motivation. Motivation is almost always negative — it’s trying to convince someone to do something that actually benefits you

becoming abundantly clear that if such regulations are promulgated, they will like-ly be de minimis standards — bronze, not gold. They will merely be fiduciary stan-dards: Are you a fiduciary? Yep. Check. The

The ‘Merely Fiduciary’ Standard of Carethese attributes can be used to substantiate the duality of the roles we typically have with our clients, where we are both leader and decision-maker.

by DonalD b. trone

I it is through both words and observable actions that we inspire others to follow.”

what is the hierarchy of the following steps? • Stewardship• loyalty• leadership• Governance• Trust

21S U M M E R 2 0 1 4 • n a p a - n E t . o R g

The news you need.The people you need.Delivered daily to your inbox.

BenefitsLink is now in its 20th year.

Since 1995, the BenefitsLink daily e-newsletters have provided employee benefits professionals with the latest developments and analysis in plan compliance, administration, policy and design.

We scour the web to deliver the very best articles to keep you on top of this ever-changing field. Our website includes active message boards, industry news and an extensive calendar of conferences and webcasts.

27,000 Employee Benefits Professionals rely on us to keep them up to date. Do you?

Together with our sister site, EmployeeBenefitsJobs.com, we offer the best-informed benefits professionals exciting and relevant opportunities for career development in this niche field.

Visit our site today and find out how we can help you.

BenefitsLink.com, Inc. • 1298 Minnesota Ave., Suite H • Winter Park, FL 32789 407.644.4146 • [email protected]

Download the new BenefitsLink App! Stay up to date with the same great information from our newletters, now available for iPad, iPhone, iPod touch.

n a p a n e t t h e m a g a z i n e22

ably be out of sequence for many of you. You might actually have put trust at the top of the hierarchy. After all, isn’t our primary objective to be the trusted advisor with our clients? That’s true, but what you’ll discov-er is that the remaining terms all build on trust. If there is no trust, there can be no sense of stewardship, loyalty or leadership. Think of trust as the cornerstone — remove the stone and the rest of the structure will fail.

Stewardship is next. To be a good stew-ard, you must be a trusted advisor. No one is going to believe that you are passionate about protecting their long-term interests if they don’t trust you.

Loyalty follows stewardship — it’s demonstrating that you are being faithful and steadfast to your stewardship princi-ples. Again, if people don’t trust you, they will not be loyal. And finally, at the top, is leadership.

So where does a fiduciary standard fall within this hierarchy? Fiduciary is the alignment of governance with trust. A fidu-ciary’s procedural prudence is defined by governance, and the principle of the “best interests of the client” forms the basis for trust.

Note that if we define fiduciary as the alignment of governance with trust, then stewardship, loyalty and leadership can ac-tually define a higher professional standard of care. Remember one of my opening com-ments: It is not the function of regulators to define the professional gold standard; their function is to define the minimum stan-dard one has to meet in order to conduct business.

We should all want to broaden and deepen the relationships we have with key clients. Through the eyes of our clients, we should not want to be viewed merely as fiduciaries; we should want to be viewed as leaders. n

» Donald b. trone, gFs® is the president of the leadership center for investment stewards and the ceo/chief ethos officer of the 3ethos. Don was the first director of the newly established institute for leadership at the u.s. coast guard academy; founder and past president of the Foundation for Fiduciary studies; and, principal founder and former ceo of fi360.

more than it benefits the other party. This is certainly true on Wall Street, where our industry is driven largely by fear, greed and ego.

In the words of Winston Churchill: You have enemies? Good. That means you’ve stood up for something, sometime in your life.

Governance is communicating and exercising your policies and procedures — what one must do to be in compliance. I define governance this way:

Doing the right thing, with the right people; At the right time, at the right place; With the right resources, with the right processes; For the right intentions, and for the right reasons. Trust is defined as the alignment of

principles with policies and procedures that, in turn, nurtures reliability and builds confidence. Stephen M.R. Covey, the author of The Speed of Trust (and the son of Stephen R. Covey, who is credited with writing 7 Habits of Highly Effective People), defines trust as the new currency of Wall Street: The ability to establish, grow, extend, and restore trust with all stakeholders — customers, business part-ners, investors, and coworkers — is the key leadership competency of the new global economy.

With each term now defined, how would you complete the hierarchy? This is my answer:

It starts with good governance; with your ability to clearly communicate your policies and procedures. This is also the point of compliance, which elicits the lowest form of personal behavior. For a number of firms in the financial services industry, there is no observable hierarchy above governance. Firms can demonstrate that they are in compliance with rules and regulations, but they struggle with building trust with staff and clients. Again, quoting from Covey: Compliance regulations have become a prosthesis for the lack of trust.

Trust is the next step, which will prob-

it is not the place of regulators to be defining the gold standard for our profession. to the contrary, the role of regulators is to define the minimum standard of care one must meet in order to conduct business.”

leadership

Trust

Stewardship

Governance

loyalty

A fiduciary standard is the alignment of Governance with Trust}

23S U M M E R 2 0 1 4 • n a p a - n E t . o R g

Scale 1” = 1” LastSavedBy: Aaron Swavey

Job#:1808-51632 TrimSize: 10” x 12” 10” x 12” StudioArtist: David Butterfield

Size:1 Version:1 BleedSize: 10.25” x 12.25” 10.25” x 12.25” ArtDirector: Bart Ashford

LiveArea: 9” x 11” 9” x 11” PrintProduction:Francine Garcia

Built@100% Output@None Color:4C

PantoneColors:

NAPA Net Magazinedue 4/25proof due 4/23

Publications:

Links:mosaic_background3_fix.psd(CMYK; 263ppi; 113.89%)

A registered investment advisor, member FINRA/SIPC

“I’M NOT AN ADMINISTRATOR. I’M AN ADVISOR.”

#AdvisorVoices We get it. You want to spend more time in front of your clients and less time behind your desk. So lighten your administrative workload with the Retirement Partners Tool Suite. An integrated set of tools to help you streamline the RFP process, recommend and monitor investment lineups, benchmark plan fees, and much more. That way you can focus on growing your business, while we focus on supporting it.

To learn more, download our white paper at Smart226.LPLNow.com, call 1-866-598-7121, or join the conversation on Twitter using #AdvisorVoices.

S:9”S:1

1”

T:10”T:1

2”

B:10.25”B

:12.2

5”

1808-51632_RP_Tools-2_V1_R02e.indd 1 5/5/14 2:37 PM

n a p a n e t t h e m a g a z i n e24

cO

vE

R

sT

OR

y

S U M M E R 2 0 1 4 • n a p a - n E t . o R g 25

pon learning that the New York Journal had published his obituary while he was still very much alive, Mark Twain famously remarked, “The reports of my death are greatly exaggerated.” In similar fashion, some have pronounced the aging and eventual demise of the plan advisor community. But like Twain’s ill-timed obituary, those laments are greatly exaggerated.

The face of the future of the financial advisor world is there to see. Or more accurate-ly, faces. It’s not the face of an aging avocation. It includes the freshness and vigor of new members and a new generation. It’s ready to take the profession into the future. In fact, it already is.

Here we provide a look at NAPA’s “Top 50 Plan Advisors Under 40” — the vanguard that is taking the profession into a new day. But first let’s take a look at why fresh faces are good news for this industry, and what is being done to bring them in and nurture them.

Falling Numbers, Graying Demographics Cerulli Associates, a Boston-based research and consulting firm that specializes in the

financial services industry, has reported that there were 334,919 financial advisors in 2004, and 320,378 in 2010. Says Deena Katz, Associate Professor at the Texas Tech University Department of Personal Financial Planning, “Realistically all [U.S. college and university] programs graduated only about 1,000 students a year. Considering the need for financial advisors, the lack of people entering the field is really astounding.”

Scott Smith, then a senior analyst at Cerulli and now its director, told Forbes in an in-terview that several factors are to blame for the lower number of young financial advisors. He cited a lack of awareness about the financial advice field and what advisors do; the hit the financial professions’ reputation took during and in the wake of the Great Recession; reluctance to do the heavy lifting of a sales-oriented job; and fewer training programs.

And as if the shrinking of the financial advisors’ ranks wasn’t problem enough, it’s also aging. Cerulli reported that in 2011, financial advisors’ average age was 49.6. Mark Elzweig, who heads the executive recruitment firm Mark Elzweig Company, also has ob-served that the financial advisor community is aging.

Fresh OpportunitySobering demographics may suggest that the financial advisor community is in decline,

but other research contains the seeds of hope and potential growth. Says Katz, “There is a huge demand now. In fact, a Pershing study released in January estimates that we are 235,000 planners short for the demand.”

Even better, younger adults need financial advisors. Those 18-39 years old evince a long-term view toward finances that is receptive to

saving. Northwestern Mutual in its Planning and Progress 2014 Study found that 59% of adults in that age group consider themselves disciplined financial planners. Even more interesting, that age group has the largest percentage of any who hold that opinion.

That includes the youngest segment of that group, those age 18-29. Northwestern Mu-tual found that 62% consider themselves to be at least disciplined, if not highly disciplined, about financial planning.

That’s good news for savings and suggests that the prospects are good that those under age 40 will actively prepare financially for retirement and already have established that as a habit. And that bodes well for an industry that fairly recent reports have argued is in decline and perhaps even doomed. If younger adults are interested in saving and financial planning, they’re going to need advisors.

There’s even better news for financial advisors. According to Northwestern Mutual, 68% of Millennials say they could do a better job managing their money. Not only that — 28% are not sure where to find help with financial planning, and only 13% have a financial advisor.

n a p a n e t t h e m a g a z i n e26

sponsor is contacted by an advisor asking for their business. The Practice Builder provides foundational knowledge, and importantly, in the same way advisors will have conversations out in the field,” she added.

Craig Garner of Eldridge Investment Advisors, who chairs NAPA’s Retirement Plan Academy Advisory Group and was one of the people who created Practice Builder, agrees with Allen. Says Garner, “Advisors can no longer be salespeople. Selling plans is no longer a commodity. Advisors must be experts in their field, and leaders in the retirement industry. They must know more than the general-ities of investments and investing. They are expected to have the knowledge to provide guidance and advice that will al-low plan sponsors to offer more effective retirement plans, and to help employees make better decisions that will translate into a more secure retirement.”

But is just training after hiring enough? Katz doesn’t think so. “Most of these career changers are older, and not so much younger than the average age of cur-rent advisors. The industry is not investing in human capital. The future advisors need mentoring, training and experience. Big broker dealers will ‘steal’ reps from each other, paying large dollar bonuses to get them to move assets over.”

Katz doesn’t think much of this prac-tice, commenting, “This is like rearranging the deck chairs on the Titanic. If the in-dustry took half that money and invested it in educating the next gen, we’d be

All this spells fresh opportunity to the financial advisor community.

Building the Ranks To increase the number of financial

advisors to meet the need for their services, firms are training and recruiting new ones. But they aren’t limiting themselves to only doing that in the traditional way of seeking newly minted college grads.

One way is to recruit professionals who are already in the workforce and in the jobs they held built and used the skills a financial advisor needs. “New advisors tend to be people who have demonstrated success in a previous career,” Elzweig notes.

Why would a financial advice firm want established professionals? For one thing, says Elzweig, they “have contacts whom they can approach for business.” He adds, “Some simply have the maturity and life experience to credibly approach investors many of whom are in their 40s and up.” Katz agrees, noting, “They want to hire guys with graying hair and a big rolodex.”

Cerulli’s Smith agrees, and identifies two more reasons. “Basically, firms see it as cheaper to recruit,” Smith says, adding that firms see “better results with career changers than recent college grads.”

Steff Chalk, Executive Director of The Retirement Advisor University (TRAU™) at the UCLA Anderson School of Management Executive Education (and NAPA Net the Magazine columnist), prefers to look beyond age, and sees experience as more important. “Experience is a phenomenal feature,” he says. Chalk argues that learning can — and should — occur independent of age. “If someone ceases to learn and ceases to seek out knowledge, that’s a problem.”

To Chalk, “client demand, legislation and the rapid speed of change” are “the real issues.” He added, “If an older advisor is still able to stay current on legislation, regulation and client needs, I don’t see age as a factor.”