Part 2 The Beginning of The Great Depression The Great Depression.

The Great Depression

description

Transcript of The Great Depression

The Great Depression

The Great DepressionEconomic Collapse

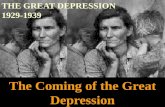

What do you see here?What message does the billboard send?How would you describe the surrounding area?Why do you think the area is so run down?Who do you think designed the billboard?What do you think those who live in the area think of it?What is the irony in the photograph?Here we see a billboard depicting American prosperity in a run-down, barren area.The Postwar Economic BoomYears following WWI are known as the Roaring TwentiesHoover said we had come nearer to the abolition of povertythan ever beforeEffects on societyAmericans earning more than ever 43% increaseMore money for luxuries Americans owned of all the cars in the worldIncrease in production prices lowerStock market at all-time high by 1929 experts advised people to invest as much as they couldThe Depression ForeshadowedBy late 1929, there were cracks in the US economyUnemployment on the riseFarmers losing landStock prices droppingNumber of Americans in poverty increasedThe Stock Market CrashTHE STOCK MARKET CRASH DID NOT CAUSE THE 10-YEAR-LONG GREAT DEPRESSION!There are six factors historians generally agree on:Domestic and international economic policyUnchecked stock speculationWeak and unregulated banking institutionsOverproduction of goodsDecline of farming industryUnequal distribution of wealthWhat do you see here?

How are the men dressed?Describe their facial expressions.What is the mood of the photograph?Do you think the men are wealthy or poor?Do you think the men are wealthy or poor?Why?These men are conservative Republicans.Based on what you know about conservatism, how do you think they dealt with business interests in the 1920s?Here we see Republicans President Coolidge, Sec. of the Treasury Andrew Mellon, and Herbert Hoover, Sec. Of Commerce and Future PresidentRepublican Economic PolicyCoolidges Economic policyThe business of America is businessPolicies that benefit wealthy would eventually benefit all Americans prosperity would trickle down from upper to middle to lower classesAndrew Mellons Economic policiesSlashed taxes for big business US Steel received a $15 million refundCut taxes for those who made over $60,000 a yearCut government expendituresRaised taxes for those in the middle and lower classesRepublican Economic PolicyTrickle-down effect did not workBusinesses used income to expand work facilities, increase production, and line their pocketsSome new jobs created, but used new machines primarily instead of peopleOwners kept workers wages lowWidened the gap between rich and poorInternational Business PolicyDuring WWI, the US lent $11 billion to European alliesAfter war, countries in economic ruin appealed to the US not to have to repay loans or reduce amountCoolidges administration refusedRescheduled loan paymentsBegan lending nations more moneyNations fell deeper into debtHigh tariffs so that people would buy AmericanEurope had no market for goods, and couldnt buy American goods or invest in the economyWhat do you see here?What building do you see?Who are the people on the ground?Who are the people on top of the building?What are they doing?What does this cartoon reflect about stockbrokers during this period?Here we see a political cartoon called The Anglers showing Wall Street stockbrokers hooking Americans to invest through speculation.

Real Estate SpeculationSpeculation a person or organization makes a risky investment in the hope of making a quick, large, profit widespread in the 1920sMany speculated on real estateOver 1 million moved to southern California after WWIPrompted investors to buy up huge tracts of land to sell to housing developers for a large profitBoom went bust when the amount of land for sale exceeded the demand for new homesReal Estate SpeculationTurned to FloridaReputation for vacation and retirementSpeculators used same tactics as in CaliforniaHowever, sometimes sold to other speculators, who sold it at still higher pricesMany buyers were northerners who bought land before they saw itDishonest scams land would be alligator infested swampland or be underwater at high tidesStock SpeculationInvestors felt stock market would go up indefinitely and that profits would continue to increaseThe value of many companies stock became artificially inflated and bore little connection to the companies actual worthSome investors used unethical practices to inflate pricesSome economic analysts predicted the market was headed for a fallWhat do you see here?

What is the building you see?What do you think the people are doing?Why might they be crowded around the bank?This bank is failing.How do you think the people trying to get their money are feeling?What might they be saying?How do you think bank failures affected the nation?Here we see a group outside of the Union Bank in New York in April 1933.The Stock Market CrashWarnings from analysts made some investors nervousMany began selling while they could still get a good priceAs investors began to withdraw, prices began to fallCompanies began to lower production, which led to price dropsOctober 24, 1929 investors flooded the NYSE with sell orders to get rid of their stocksGroup of bankers tried to stabilize market by purchasing investors stocks at a higher price than the market was offeringStill continued its descentThe Stock Market CrashOctober 28 investors sold stocks at loss of over $4 billionOctober 29 called Black Tuesday orders to sell at any price flooded marketFirst National Bank executive George Baker claimed he lost $15 millionOne distraught president threw himself from hotel after companys stock fell from $113 to $4At the end of the day, investors had lost $16 billionUnregulated Banking InstitutionsStock market crash triggered collapse of US banking industry instability in the 1920s was due to two main reasons:Laissez faire (Leave alone)Federal Reserve did nothing to stop banks from speculating depositors money on high-risk venturesDidnt make banks keep certain amount of money on reserve and availableDepositors money was uninsured no way for them to get money back after banks failedUnregulated Banking InstitutionsOver-extension of credit to stock investors and brokersAllowed investors to buy stocks on large margins of creditAllowed investors with little money to purchase large amounts of stockPut down 10-20% of total; allowed to borrow the rest and use the stock itself as collateralThe Banking Industry CollapseFamilies that had played the stock market lost all their savingsInvestors who bought stocks on margin couldnt sell stock at all, or had to sell at low pricesLittle or no money to repay banks loanBanks could not replace depositors money, so people who hadnt even invested lost all their moneyIncreasing number of people began defaulting on mortgages and other loansBy 1932, of nations banks had closed 6,000 banksWhat do you see here?

What are the men on the top doing?Why might they be spilling milk on the ground?How do you think they are feeling?What are the men on the bottom doing?These men are Henry Ford and his son Edsel. Why are they celebrating?What kinds of economic problems might dampen the mood at the Ford plant?How might the economic collapse be explained by what you see in these two images?At the top, we see striking dairy farmers emptying milk from a non-strikers truck during a blockade near Harvard, Illinois. They organized the blockade to raise prices and heighten awareness of oversupply.At the bottom, we see Henry Ford with his son Edsel standing next to the 20 millionth automobile to leave Fords production line on April 15, 1931.Overproduction of Industrial GoodsConsumer demand for goods was very high after WWINewly invented machines allowed US factories to produce more goods in less timeAmerican industrialists believed in unrestricted capitalism and unrestricted growthBy 1929, many companies had more plants than they needed, and the market was saturated with goods that few Americans could afford to buy.Overproduction of Agricultural GoodsDuring WWI, American farmers supplied both US and Europe with foodstuffsMechanized much of their workFarmers became more efficientProduced more than everAfter the war, European farmers resumed their own production, and the demand for US goods dropped significantlyFarmers often stuck with surplus of crops they couldnt sell or could only sell for a low priceWhat do you see here?

In what condition are the wheels in the foreground?Why do you think there are no people in the picture?Why do you think they left?Where might they have gone?What impact do you think the Dust Bowl had on farmers during the Depression?Here we see an abandoned farmhouse surrounded by several feet of dust after a major dust storm.The Toll on the Farming IndustryFarming had historically been the backbone of the American economy, but by 1929, the industry was in declineFarmers borrowed heavily to pay for new, advanced equipmentFarmers failed to sell surplus crops and became unable to pay back loansMany farmers defaulted on their loansSome lost farms to foreclosuresBank would attempt to resell land and equipment, but other farmers were barely able to hold onto their own farmsFarming trouble caused many banks to collapseFarming During the DepressionBetween 1929 and 1933, farmers income dropped by 50 percentHit with drought so severe that soil swept across the plains in choking black cloudsThe region became known as the Dust Bowl, and farmers left the region in drovesOver one million families lost their farms between 1930 and 1934

The Dust BowlFarmers fleeing Dust Bowl headed to California in search of employment and landKnown as Okies, since many of them came from OklahomaMany lived in makeshift shacks and shanties outside city limitsOne outside of Salinas, California, contained nearly 10,000 residentsWhat do you see here?How are the people in the center dressed?Where do you think the wealthy people are going?What might their home look like?How might their life be different from that of the doorman?How might extraordinary wealth on one hand and low wages on the other have contributed to the economic collapse of the late 1920s and 1930s?Here we see a wealthy couple arriving at the opera in New York City in 1929.

The Gap Between Rich and PoorWhile Americans were more prosperous than ever, most wealth remained in the hands of a few at the top of the economic pyramid1% of the population possessed 59 % of the countrys wealth60% lived on or below the poverty level of $2,000Average American saw a wage increase of 9%; the rich saw an increase of 75%In short, the rich were getting richer