Causes of the Great Depression Great Depression Unit – Part I.

The great depression 2

Transcript of The great depression 2

The Great Depression1929-1940What do we do now?

Unit 6 - Chapter 18

#3

The Great Depression Study Guide Packet – Test Day

Causes of the Great Depression– on(study guide)

• Depressed Farms & Industry• Unequal Wealth Distribution

- growing gap between rich and poor• Monetary Policy (tight money)

- credit dried upWould you borrow $ to someone if you didn’t think they would pay you back?

• Decline in Foreign Trade- high tariffs: Hawley-Smoot Tariff

- Trade Dropped by 1/3 from 1929-32

People lost all faith in the American

Banking System

Thousands of Banks closed

If the economy represented a train, then it came to a grinding halt on the tracks

Depression / Recession

• Recession:

2 consecutive quarters of economic decline

Recession “When you lose your job”

Depression “When I lose my job”

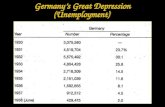

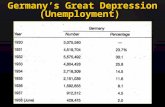

25% Unemployed

Economic Weaknesses

• Many Americans enjoyed good fortune in the 1920s, but

problems bubbled underneath the surface

• One problem in the American economy:

uneven distribution of wealth during the 1920s.

– The wealthiest 1% of the population’s income grew

75%, but the average worker saw under a 10% gain.

• Credit (Installment Buying) allowed Americans to buy

expensive goods, but by the end of the decade many

people reached their credit limits, and purchases slowed.

• Warehouses filled with goods no one could afford to buy

(How many Model T Fords could the ave person buy?)

In the 1920’s, people began to purchase items they couldn’t afford

through the use of INSTALLMENT BUYING/buying on credit

New Goods for Sale

Installment

buying

increased the

demand for

goods, while

consumer

Debt

increased

If paid in full within 12 months.*otherwise you pay 21.99%

ON ALL MAJOR APPLIANCE, FLOORING,

OUTDOOR POWER EQUIPMENT AND GRILL

PURCHASES of $299 or more made on your Lowe’s®

Consumer Credit Card.*Lowe's® Consumer Credit Card: Applies to single-receipt, in-store Major Appliances, Flooring, Outdoor Power Equipment and Grill purchases of $299 or more (and any other

items purchased on the same sales receipt) made March 6 through March 19, 2008 on a Lowe's Consumer Credit Card account.

No monthly payments will be required and no finance charges will be assessed on this promotional purchase if you pay the following in full within 12 months: (1) the promotional

purchase amount, and (2) any related optional credit insurance/debt cancellation charges.

If you do not, finance charges will be assessed on the promotional purchase amount from the date of purchase and monthly payments will be required. Standard account terms apply

to non-promotional purchases. APR is 21.99%. Minimum finance charge is $1.00. Offer must be requested at time of purchase. Offer is subject to credit approval.

Millions of Americans

invested in the BULL

MARKET, becoming

rich as stock prices rose

Stocks Surge

The Stock Market Crashes

September 3, 1929, the peak of the Market

• consumer purchasing was falling & rumors of a collapse began

October 24, 1929• nervous investors began selling, creating a huge sell-off with no buyers

• Stock prices plunged, triggering a panic to sell

• leading bankers bought stocks and prevented a further collapse,

stopping the panic through Friday

Black Tuesday, October 29- worst day, affecting stocks of even solid companies

• Damage was widespread and catastrophic. In a few days the market

had dropped in value - $16 billion, 1/2 its pre-crash value

(That’s about 1.3 Trillion Today)

Unquestioned

faith in the Bull

market helped

lead to the

GREAT

DEPRESSION!

Many were buying

stocks on margin,

which is similar to

installment buying

Suicide Rates Spiked

Many Men Abandoned Their Families - Hoboes

Hoovervilles /Shanty Towns

“Hoover Blankets”

Hoover became the most despised man in America

• Became more unpopular• Persuaded Congress to

establish: Reconstruction Finance Corp.

- power to make emergency loans to banks

but it was too little too late…• Hoover didn’t want programs

of direct govt. aid to individuals

• didn't want to erode Americans sense of:

RUGGED INDIVIDUALISM

Ironic image

The Depression finally ends in America when WWII starts

• NO NOTES AFTER THIS POINT–

• USE THE LAST FEW SLIDES to help REVIEW

How would your life/families lives be effected by the Great Depression?

• Unemployment – 25% (Chicago 50%)

• Bank closes and entire savings disappears (401K – gone)

- Between 1929-32: 9,000 Banks Closed

• There are no govt. programs to help

- No welfare Programs

What would your family do?

- make a list of about 10 items with your desk partner

Share with Class

Credit and the Stock Market

The Federal Reserve

• The board of the Federal Reserve,

the nation’s central bank, worried

about the nation’s interest in stock

and decided to make it harder for

brokers to offer margin loans to

investors.

• Their move was successful, until

money came from a new source:

American corporations who were

willing to give brokers money for

margin loans.

• Buying continued to rise.

Investors increasingly used credit to buy stocks as the market rose.

Buying on Margin• Investors were buying on margin,

or buying stocks with loans from stockbrokers, intending to pay brokers back when they sold the stock.

• As the market rose, brokers required less margin, or investors’ money, for stocks and gave bigger loans to investors.

• Buying on margin was risky, because fallen stocks left investors in debt with no money.

• If stocks fell, brokers could ask for their loans back, which was called a margin call.

The Human Impact of the Great Depression

Hoboes

• Hoboes were mostly men, but included teens and women.

• Boarding trains was hard and illegal, and railroads hired guards to chase hoboes away.

• Finding food was a constant challenge, because people had little to spare and rarely shared with hoboes.

• Hoboes developed a system of sign language to warn of possible dangers or opportunities.

The true measure of the Great Depression’s disaster lies in how it affected the American people.

Hoovervilles

• Thousand applied for a handful of jobs, and job loss resulted in poverty for most Americans.

• To survive, people begged door to door, relied on soup kitchens and bread lines. Some went hungry.

• Some who lost their homes lived in shantytowns, or Hoovervilles, named after President Hoover who many blamed for the Great Depression.

The Emotional Impact of the Depression

• The Great Depression’s worst blow might have been to the minds and spirits of the American people.

• Though many shared the same fate, the unemployed often felt that they failed as people.

• Accepting handouts deeply troubled many proud Americans. Their shame and despair was reflected in the high suicide rates of the time.

• Anger was another common emotion, because many felt the nation had failed the hardworking citizens who had helped build it.

The Act

• One of Hoover’s major efforts to address the economic crisis was the

1930 Smoot-Hawley Tariff Act.

• Tariffs are taxes on imported goods that raise their cost, making it more likely that American purchasers buy cheaper American goods.

• The Smoot-Hawley Tariff Act was a disaster.

• Originally designed to help farmers, it was expanded to include a large number of manufactured goods.

• The high tariff rates were unprecedented.

• When European nations responded with tariffs on American goods, international trade fell dramatically.

• By 1934 trade was down two thirds from its 1929 level.

The Smoot-Hawley Tariff Act

The Effects

Great Depression Paper

• MLA–1,000/7500® words/ (Film as guide)

• In your Essay – discuss 3 main points

1. Why did the crash of Wall St. and the Great Depression occur?

2. Discuss parallels with the current economic problems in America

3. What lessons should have been learned from the G.D.-Discuss at least 2

• Work’s Cited on Bibliography page

Partner - Stock Worksheet(stock quotes/old book)

• Two People in a group / One Sheet

• One Calculator

• All work is done in class-show your work

• Do not talk to other groups

• Answer all 7 questions / Follow the directions on the worksheet

-- Staple #7 onto the worksheet & turn in