The Flight of Capital From Canada · The Flight of Capital From Canada Share of GDP 9% 12% 11% 10%...

Transcript of The Flight of Capital From Canada · The Flight of Capital From Canada Share of GDP 9% 12% 11% 10%...

The Flight of Capital From Canada

Shar

e of

GD

P

9%

12%

11%

10%

13%

14%

15%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q12014 2015 2016 2017 2018

Post Recession Canada vs. U.S.Non-Residential Business Investment,as a Share of GDP

Canada

U.S.

13.5%

13.7%

11.6%

13.6%

Canadian Investment Abroadvs. Foreign Investment in Canada

Canadian direct investment abroad

Foreign direct investment in Canada

2013 2015 2017

40

80

120Billions of Dollars

Residentialstructures

Grossdomesticproduct

Perc

enta

ge c

hang

e (in

dol

lars

)

Machineryand

equipment

12.4%11.3%

-4.7%

Non-residentialstructures Intellectual

propertyproducts

-11.4%

-14.8%

Canadian investment abroad

Foreign investment in Canada

Niels Veldhuis, Jason Clemens, Milagros Palacios & Steven Globerman

3

Shar

e of

GD

P

9%

12%

11%

10%

13%

14%

15%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q12014 2015 2016 2017 2018

Post Recession Canada vs. U.S.Non-Residential Business Investment,as a Share of GDP

Canada

U.S.

13.5%

13.7%

11.6%

13.6%

Canadian Investment Abroadvs. Foreign Investment in Canada

Canadian direct investment abroad

Foreign direct investment in Canada

2013 2015 2017

40

80

120Billions of Dollars

Residentialstructures

Grossdomesticproduct

Perc

enta

ge c

hang

e (in

dol

lars

)

Machineryand

equipment

12.4%11.3%

-4.7%

Non-residentialstructures Intellectual

propertyproducts

-11.4%

-14.8%

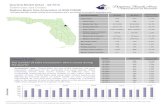

Over the last few years the federal and several provincial governments have materially worsened Canada’s economic and business competitiveness. Higher tax rates, deteriorating public finances, mounting debt, increased regulation, and heightened uncertainty have made Canada a markedly less attractive place to do business. The evidence is mounting that these ill-conceived policies are damaging our economy – in particular, business investment is collapsing and the economy is expected to remain on a path of slow economic growth for the foreseeable future.

This issue should be of great concern to all Canadians since business investment is critical for job creation,

increased productivity, higher wages, access to new technologies and ultimately, improved living standards.

This comes at a time when the United States has made itself significantly more attractive to investment, entrepreneurs and professionals through a series of policies, including sweeping tax reform and regulatory reductions, which exacerbate the policy missteps in Canada.

Given these challenges, this Bulletin visually summarizes recent Fraser Institute work documenting the decline in business investment.

Introduction

Business Investment in Canada(2012–2017)

12.4%11.3%

-4.7%

-11.4%

-14.8%

4

Canada vs. U.S. Business Investment*(as a share of GDP)

*Note: non-residential structures, machinery and equipment and intellectual property products.

Shar

e of

GD

P

9%

12%

11%

10%

13%

14%

15%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q12014 2015 2016 2017 2018

Post Recession Canada vs. U.S.Non-Residential Business Investment,as a Share of GDP

Canada

U.S.

13.5%

13.7%

11.6%

13.6%

Canadian Investment Abroadvs. Foreign Investment in Canada

Canadian direct investment abroad

Foreign direct investment in Canada

2013 2015 2017

40

80

120Billions of Dollars

Residentialstructures

Grossdomesticproduct

Perc

enta

ge c

hang

e (in

dol

lars

)

Machineryand

equipment

12.4%11.3%

-4.7%

Non-residentialstructures Intellectual

propertyproducts

-11.4%

-14.8%

5

Investment by Foreigners in Canada

Residentialstructures

Grossdomesticproduct

Perc

enta

ge c

hang

e

Machineryand

equipment

12.4%11.3%

-4.7%

Non-residentialstructures Intellectual

propertyproducts

-11.4%

-14.8%

Mill

ions

of d

olla

rs

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

125,476

65,679

25,94829,257

39,25443,076

71,459

65,186

58,330

49,434

32,110

Change in Business Investmentby Category, 2012–2017

Canadian Investment Abroadvs. Foreign Investment in Canada

Canadian direct investment abroad

Foreign direct investment in Canada

2009 2010 2011 2012 2013 2014 2015 2016 201720,000

40,000

60,000

80,000

100,000

120,000

Mill

ions

of d

olla

rs

Foreign investment

is down 74.4% since 2007

Canada’s investment

abroad up 73.7% since 2013

Investment by foreigners in

Canada down 55.1% since 2013

6

Canadian Investment Abroadvs. Foreign Investment in Canada

Residentialstructures

Grossdomesticproduct

Perc

enta

ge c

hang

e

Machineryand

equipment

12.4%11.3%

-4.7%

Non-residentialstructures Intellectual

propertyproducts

-11.4%

-14.8%M

illio

ns o

f dol

lars

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

125,476

65,679

25,94829,257

39,25443,076

71,459

65,186

58,330

49,434

32,110

Change in Business Investmentby Category, 2012–2017

Canadian Investment Abroadvs. Foreign Investment in Canada

Canadian direct investment abroad

Foreign direct investment in Canada

2009 2010 2011 2012 2013 2014 2015 2016 201720,000

40,000

60,000

80,000

100,000

120,000

Mill

ions

of d

olla

rs

Foreign investment

is down 74.4% since 2007

Canada’s investment

abroad up 73.7% since 2013

Investment by foreigners in

Canada down 55.1% since 2013

7

References & Notes

Business Investment in Canada (p.2)

NoteChange is in real terms.

SourcesStatistics Canada. Table 36-10-0104-01 Gross domestic product, expenditure-based, Canada, quarterly (x 1,000,000); calculations by authors.

Canada vs. U.S. Business Investment (p.3)

SourcesStatistics Canada. Table 36-10-0104-01 Gross domestic product, expenditure-based, Canada, quarterly (x 1,000,000); Bureau of Economic Analysis, Section 1—Domestic Product and Income, National Income and Product Accounts, National Data, US Department of Commerce, tables 1.1.5 and 1.1.6.; calculations by authors.

Investment by Foreigners in Canada (p.4)

NoteForeign direct investment shown on this graph is based on a directional principle basis (that is, net basis).

SourceStatistics Canada. Table 36-10-0025-01 Balance of international payments, flows of Canadian direct investment abroad and foreign direct investment in Canada, quarterly (x 1,000,000).

Canadian Investment Abroad (p.5)

Notes(1) Canadian direct investment abroad (CDIA) excludes deposits (claims net of liabilities) of Canadian banks with their foreign affiliates and branches abroad.

(2) Foreign direct investment in Canada (FDIC) excludes deposits (liabilities net of claims) of Canadian subsidiaries and branches of foreign banks with their head offices and related companies abroad.

SourceStatistics Canada. Table 36-10-0025-01 Balance of international payments, flows of Canadian direct investment abroad and foreign direct investment in Canada, quarterly (x 1,000,000).

Authors

Niels Veldhuis

President

The Fraser Institute

Milagros Palacios

Associate Director for the Addington Centre for

Measurement

The Fraser Institute

Steven Globerman

Resident Scholar and Addington Chair in

Measurement

The Fraser Institute

Jason Clemens

Executive Vice-President

The Fraser Institute

“The cumulative impact of regulation and higher taxation than other jurisdictions is making Canada a more difficult jurisdiction to allocate capital in.” Steve Williams, Suncor CEO

“64% of CEOs say Canada’s investment climate worsened in last five years.”Business Councilof Canada Survey

“Downshift in small business sentiment continues (2nd lowest in 10 years).”Canadian Federation of Independent Business

“Canada has a productivity issue and it has a competitiveness issue.”Brian Porter,Scotia Bank CEO

“Failure of the Trans Mountain Expansion … may alienate foreign investors who are already pulling back from Canada.”Economist Magazine

Canada’s rank on World Bank’s Ease of Doing Business index was 4th in 2007 and dropped to 18th in 2018.

“In real time, we’re seeing capital flow out of the country.”Dave McKay,RBC President and CEO

“Capital flight worst I’ve ever seen.”Jim Davidson, Vice-Chair GMP FirstEnergy