The FATCA Hurricane Hits Ground

-

Upload

michael-deblis-iii-esq-llm -

Category

Law

-

view

81 -

download

0

Transcript of The FATCA Hurricane Hits Ground

The FATCA Hurricane Hits Ground

The FATCA Hurricane Hits GroundMichael DeBlis III Esq., LLMPartnerDeBlis Law

Michael DeBlis III, Esq.

Trial LawyerActorAuthorNCDC GraduateMarathon runner

Foreign Account Tax Compliance Act (FATCA)

Recognizing that there is a substantial amount of money stored overseas that has gone unreported and that will continue to go unreported if left up to the taxpayer to voluntarily disclose Congress passed FATCA. FATCA requires foreign financial institutions (FFIs) to report specific information regarding their U.S. accountholders to the IRS.

It was passed in 2010 to clamp down on the use of foreign bank accounts by U.S. taxpayers to hide money that is otherwise subject to taxation in the United States.

FATCA is the U.S. governments newest enforcement tool in the fight against international tax evasion.

Foreign Account Tax Compliance Act (FATCA)Clearing up a major misconception: It is not illegal for a U.S. taxpayer to have an overseas bank account. Overseas financial accounts are maintained by U.S. taxpayers for a variety of legitimate reasons.History: If the average American that owns a foreign bank account isnt a tax cheat, what are his reasons for having one?

Reason # I: In the not too distant past, wealthy Americans and wannabe wealthy Americans found it convenient and/or fashionable to put much of their wealth in offshore financial institutions. Although it was not the only player in this game, Switzerland attracted much of the American wealth which was banked offshore.There are many countries in the Caribbean as well as Israel who were more than willing to provide this service, but Switzerland was the biggest name in the industry.

Foreign Account Tax Compliance Act (FATCA)Reason # 2: Convenience and access. In this global marketplace, many U.S. citizens have relocated abroad. Thus, maintaining an account with a local bank in order to conduct day-to-day affairs is an absolute necessity (i.e., to pay rent, phone, insurance, wifi, and electric bills, buy groceries, and so forth).Reason # 3: They may have inherited a foreign bank account from a relative back in the old country.

Foreign Account Tax Compliance Act (FATCA)The ProblemThe U.S. taxes its citizens on their worldwide income, regardless of where it is earned. Own a business in Sri Lanka? You must report the profits on a U.S. tax return. Work for a Belgium company in Costa Rica? You must report the earnings on your U.S. tax return. Very simply, U.S. taxpayers must report all of their income, even income earned outside of the United States.However, prior to 2010, many individuals with overseas accounts failed to mention this fact when they filed their 1040s.They also failed to file a Foreign Bank Account Report (FBAR) to disclose the existence of their foreign account.

Foreign Account Tax Compliance Act (FATCA)The FBAR is a tool used by the U.S. government to identify persons who may be using foreign financial accounts to break U.S. law. Information contained in FBARs can be used to identify or trace funds used for illegal purposes or to identify unreported income maintained or generated abroad.An FBAR is a creature of the Bank Secrecy Act (BSA) and not the Internal Revenue Code. It has been on the books since time and memorial. The BSA gives the Department of Treasury the authority to collect information from U.S. persons who have financial interests in or signature authority over financial accounts maintained at foreign financial institutions.

Foreign Account Tax Compliance Act (FATCA)Who must file an FBAR?A U.S. person must file an FBAR if that person has a financial interest in or signature authority over any financial account(s) outside of the U.S. and the aggregate maximum value of the account(s) exceeds $ 10,000 (USD) at any time during the calendar year.The government did not begin enforcing FBARs with the gusto that it does today until after 9/11.

Foreign Account Tax Compliance Act (FATCA)What are some of the reasons why the average American living abroad did not report their foreign bank accounts to the IRS?Some taxpayers did not know what an FBAR was, let alone that it applied to them. These folks did not know that they had an obligation to report their foreign income on a U.S. tax return. For example, many thought that they had satisfied their tax obligations by virtue of having reported their foreign-source income on a foreign tax return and paying taxes to the foreign government.Others knew exactly what their U.S. tax obligations were but thought that It was unlikely that the IRS would ever know the difference.

Foreign Account Tax Compliance Act (FATCA)What is it about this pestilent law that engenders such strong emotions?From the perspective of foreign banks:It turns foreign banks and financial institutions into enforcement arms of the Internal Revenue Service (IRS). This allows the IRS to make sure they are collecting every possible dollar from U.S. taxpayers who have offshore assets.Although they seemingly have two options disclose account information on clients who are U.S. persons or pay a whopping 30% of all payments they receive from America to the IRS most foreign financial institutions would argue that they have only one real choice if they want to be around long enough to report next years quarterly earnings. And that is to succumb to Uncle Sams heavy-handed demands and turn over U.S. accountholder information.

Foreign Account Tax Compliance Act (FATCA)From the perspective of U.S. taxpayers with unreported foreign accounts:It treats every taxpayer with a foreign bank account as though they are Al Capone. How so? The IRS punishes such taxpayers with penalties that are so exorbitant that it could leave them with nothing more than the shirt on their backs. For example, willful FBAR penalties are the greater of $ 100,000 or 50% of the closing balance in the account as of the last day of filing the FBAR. Considering the fact that FBAR penalties are assessed per account, and not per year, this could drive a taxpayers FBAR penalties into the stratosphere!

Foreign Account Tax Compliance Act (FATCA)Critics weigh inThose that denounce the law criticize its complexity, its expansive reach, and the high cost of compliance. Argument: With FATCA, the U.S. government has found a very effective way to bully foreign governments and financial institutions into giving it previously unobtainable information on U.S. taxpayers.Those that like it (and there are a few) argue that it will blow the lid off of the old way of exchanging tax information between countries on request, which they view as too lenient on tax cheats. FATCA, they predict, will revolutionize the exchange of information, by making it automatic, thereby removing any safe harbors for those who have, shall we say, less-than-pure motives.

Foreign Account Tax Compliance Act (FATCA)The Carrot and the Stick

FATCA gets its teeth from two provisions:

Non-compliant foreign financial institutions face a mandatory 30% withholding on payments from U.S. based financial institutions. (Ouch!)

The FATCA also beefed-up the ability of the Department of Justice to prosecute financial institutions criminally who were assisting U.S. taxpayers with tax evasion.

Foreign Account Tax Compliance Act (FATCA)The first cut is the deepest!

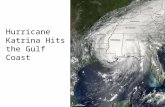

Landlocked Switzerland doesnt get to experience the effects of hurricanes often.

Switzerlands financial industry was landfall for Hurricane FATCA which was a category 5+ storm.

Under FATCA, Swiss banking powerhouse UBS was forced to turn over the names and information of 4,000 U.S. taxpayers. In order to settle a corporate criminal action for failure to comply, UBS paid a $780 million dollar fine. Many Swiss institutions got the point and came into compliance.

To prove its power to bankers who didnt comply after UBS, the DOJs next target was Switzerlands oldest bank, Wegelin & Co. The shot proved fatal. Wegelin paid $74 million in fines, restitution and forfeitures, and ceased to do business to avoid criminal liability.

Foreign Account Tax Compliance Act (FATCA)

The end of Swiss bank secrecy as the world once knew it

In August of 2013, Switzerland raised the white flag.

To avoid further prosecutions, Switzerland signed a non-prosecution agreement with the U.S. government (NPAs) for banks that have facilitated American tax evasion.In theory, such agreements guarantee banks immunity from prosecution. But the devil is in the details.

In December, 100 Swiss banks joined in the proposed amnesty deal with the DOJ. There is still ongoing debate over the fairness of the Justice Departments NPA proposal. However, it appears Switzerland and many other countries got the message clearly. The United States will no longer tolerate the non-disclosure of U.S. taxpayer information.

Foreign Account Tax Compliance Act (FATCA)It appears that the DOJ may have attempted to slide a couple of extra provisions into the non-prosecution agreement, including:Cooperate fully with the DOJ, the IRS, and any other domestic or foreign law enforcement agency designated by the DOJ regarding all matters related to the NPA.Assist the DOJ or any designated domestic or foreign law enforcement agency in any investigation, prosecution, or civil proceeding arising from or related to the NPA.Provide testimony as needed to enable the U.S. to use the information and evidence provided by the bank under the NPA.Provide the DOJ all requested information, documents, records, or other tangible evidence, not protected by legal privilege, regarding the covered conduct.To retain all records relating to its U.S. cross-border business for a period of 10 years from the NPAs termination date.The agreement also describes the circumstances under which the DOJ may determine that a bank has violated the NPA and may be prosecuted.

Foreign Account Tax Compliance Act (FATCA)The Swiss Grow a Backbone

Seventy-three Swiss banks responded in a joint letter saying they would not sign the NPA as proposed.

The Banks objections are fairly simple:

Since when does the United States Department of Justice have the authority to make a foreign institution cooperate in investigations by other foreign governments?

The fact that the NPA contains language basically saying the DOJ reserves the right to change its mind and prosecute anyway. So, is that really a non-prosecution agreement or a license for a fishing expedition that may lead to prosecution anyway?

Foreign Account Tax Compliance Act (FATCA)As more countries are pushed to the brink to share tax information, the focus will shift to Americas willingness (or unwillingness) to reciprocate. Who can forget the expression, Whats good for the goose is good for the gander? Hypocrisy? At present, the U.S. does not provide the same detailed information about foreign accountholders who bank with U.S. banks to foreign governments that it requires foreign financial institutions to provide.

Tel. [email protected]