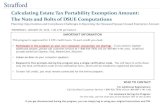

The Facts: National Real Estate Tax

-

Upload

charleston-trident-association-of-realtors -

Category

Real Estate

-

view

6 -

download

2

description

Transcript of The Facts: National Real Estate Tax

CharlestonRealtors.com

No real estate transfer tax in health care bill

ISSUE: There is no national real estate transfer tax in the Health Care bill passed by Congress.

WHAT THERE IS: There is a 3.8% Medicare tax on investment income as defined as interest, dividends, capital gains and net rents. The 3.8% Medicare tax is imposed ONLY on those individuals with more than $200,000 of Adjusted Gross Income (AGI) ($250,000 on a joint return).

CharlestonRealtors.com

CharlestonRealtors.com

Henrietta’s rental income is from a trade or business so it is NOT treated as investment income. Thus, she is NOT subject to the 3.8% investment income tax.

CharlestonRealtors.com

CharlestonRealtors.com

CharlestonRealtors.com

Questions?

Ryan CastleGovernment Affairs DirectorCharleston Trident Association of [email protected]

@ryanfcastle

www.ryanfcastle.com