The Dividend Controversy

description

Transcript of The Dividend Controversy

The Dividend Controversy

Should firms pay high dividends?

Trap question one:

An investor buys a share. It never pays a dividend. Is it valueless?

No.

The investor resells it before any dividends are paid.

The buyer gets dividends.

Trap question two:

A firm never pays dividends to any investor and is never expected to do so.

Is it valueless?

No. Think of any small start-up.

The typical start-up firm is bought by another.

Its investors get cash or shares in the acquiring firm.

Dividend policy alternatives:

Either high dividends now, low later, or Low now, high later.

Dividend policy is irrelevant!

The firm has done all projects with NPV > 0.

It has some cash. What are the alternatives?

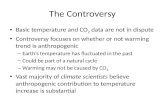

Separation theorem interpreted for dividends (Figure 18.4)

C1

C0

s lo p e = - (1 + r)

L o w -d iv id e n d fir m

H ig h -d iv id e n dfirm

w

F u tu rere tu rno r

d iv id e n d n o

Homemade dividends

Investors who want higher dividends sell some shares to get cash.

Those who want lower dividends use high dividends to buy more shares.

Example of partial tax sheltering by capital gains

Alternative one: dividend of $10,000. Pay taxes on all of it. Compare to capital gains of the same

amount.

Tax shield continued, homemade dividend

Alternative two: capital gains of $10,000.

Sell stock worth $10,000. The stock was bought when the price

was half the current price. Realized capital gains = $5,000 Pay taxes on $5,000.

Some tax-class clienteles prefer dividend income

because they have tax exemptions, e.g.,

non-profit institutions, pension funds, corporations etc.

Some tax-class clienteles prefer capital gains

because they can't shelter dividends from taxes,

but they can shelter capital gains. High income investors, for instance.

Implications of clienteles

Some cash flows in the high-dividend channel.

Some in the low-dividend channel. Like the Miller channels model.

Dividend equilibrium

$ of operatingcash flows

HiDivvalueper $1

LoDivvalueper $1

mq ili riuo iv

EL

mEquilibriuHiD iv

u bD

V*=1/Rh V*=1/RL

...

Value is invariant to dividend policy.

In equilibrium i.e., almost all the time

Out of equilibrium

i.e., after tax law changes, firms can increase value by

appropriately changing their dividend policy.

Example of disequilibrium

Suppose that the capital gains tax rate is lowered.

LoDiv cash flows are more valuable. Demand for LoDiv cash flows

increases.

Cut in capital gains tax rates

$ of operatingcash flows inthe economy

HiDivvalue

LoDivvalue

Increased valueof old equity

More LoDivfirms

Real-world evidence

for not changing dividend policy and for existence of tax-class clienteles.

Evidence

Actual dividends are highly smoothed Earnings fluctuate much more. Smooth means constant or increasing

at a constant rate. Smooth means pleasing to the tax-

class clientele that holds the shares.

A problem for the low-dividend firm

The firm has a quantity of spare cash after all NPV>0 projects are done.

Dilemma

Pay dividends: Shareholders pay extra taxes.

Invest in financial markets: Firm becomes a mutual fund.

Solution: use the cash to buy stock

Investors who sell are those who want cash.

Stock price is unaffected ... because the value of the firm falls by the value of the repurchased shares.

The IRS understands this game.

Stock buyback for tax avoidance is illegal.

Therefore...

Excuses, excuses

always another reason for a stock buyback,

usually ... our shares are a good investment

or...we disburse cash to prevent takeover.

Summary

Dividend policy is like capital structure. It probably doesn’t matter. If it does, it matters because of taxes,

and even that is temporary. In equilibrium, firms cannot increase

value by changing capital structure or dividend policy