The Case Against Shareholder Empowerment 158 U. Penn. L. Rev. 653 ( 2010) William W. Bratton

-

Upload

quincy-collins -

Category

Documents

-

view

13 -

download

0

description

Transcript of The Case Against Shareholder Empowerment 158 U. Penn. L. Rev. 653 ( 2010) William W. Bratton

11

The Case Against Shareholder Empowerment158 U. Penn. L. Rev. 653 ( 2010)

William W. BrattonPeter P. Weidenbruch, Jr., Professor of Business LawGeorgetown University Law Center

Michael L. WachterWilliam B. Johnson Professor of Law and Economics Co-Director, Institute for Law and EconomicsUniversity of Pennsylvania Law School

SASE Annual MeetingJune 25, 2010

2

Corporate legal theory

• Dominant view– Management power is the problem– The legal model empowers managers– Shareholder power is the answer– Defenders of the system bear the

theoretical burden of proof

3

This paper’s objective

• Reverse the theoretical burden of proof to fall on the law reform proponent

• Means to the end– (1) Clear the field of the conceptual inheritance of Berle

and Means– (2) Make transparent the theoretical assumptions that

motivate the shareholder case – (3) Show that management agency costs are not as salient

as claimed– (4) Show that shareholder empowerment would implicate

significant agency costs– (5) Decouple the financial crisis from the shareholder case

and recouple it with the case against

4

(1) Clear the field of the conceptual inheritance of Berle and Means

• Fama and Jensen (1983)– “Separation of ownership and control” is a

rational allocation of management functions• “Ultimate control” in board• Shareholders don’t know anything

– “Property” is split among decision initiators, monitors, and residual claimants

5

(2) Make transparent the theoretical assumptions that motivate the shareholder case

• “Ultimate control” in shareholders • Incentives

– Managers are conflicted and self-serving– Shareholders have a pure incentive to maximize

value• But shareholders don’t know anything

– Market price = objective and accurate measure of pure shareholder maximand

• Manage to maximize the market price

6

(3) Show that management agency costs are not as salient as claimed

• Shareholder win-win – Static agency cost picture dating from the 1980s

• Jensen and Meckling– Dynamic process of agency cost reduction

• Post 1980s developments– Managers become sensitive to shareholder value– Boards become better monitors– Discipline: Private equity buyouts– Hostility: Activist hedge funds

7

(3) Show that management agency costs are not as salient as claimed

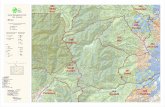

Payouts, 1987-2008

0

200

400

600

800

1000

1200

1400

1600

1800

2000

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Year End S&P 500 Average Dividends Repurchases

8

(4) Show that shareholder empowerment would implicate significant agency costs

• What does the market price teach?– (1) If markets were strong form efficient, the shareholders

would have a great case• Markets are not strong form efficient

– (2) The strength of the shareholder case varies depending on the content of public information and the governance issue

– (3) Information asymmetries are real and persistent– (4) Market prices are subject to speculative distortion

9

(5) Decouple the financial crisis from the shareholder case and recouple it with the case

against

• They say– Management caused the financial crisis– Shareholder empowerment will restore trust

• We say– Shareholder empowerment is about market

control and the financial crisis follows from market failure

– Managers and shareholders made the same mistakes

10

Figure II: S&P 500/S&P 500 Banks, 2000-2009

0

20

40

60

80

100

120

140

160

180

Jan

uary

31, 200

0 =

10

0

S&P 500

S&P 500 Banks

(5) Decouple the financial crisis from the shareholder case and recouple it with the case

against

11

(5) Decouple the financial crisis from the shareholder case and recouple it with the case

againstFigure III: Sectoral Variations

0

100

200

300

400

500

600

700

800

S&P 500 Banks

Countrywide Financial

JP Morgan Chase

Bank of America