The Bedford Lending Multifamily Bridge Loan

-

Upload

bob-burns -

Category

Real Estate

-

view

1.067 -

download

0

description

Transcript of The Bedford Lending Multifamily Bridge Loan

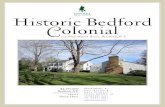

THE BEDFORD LENDING MULTIFAMILY BRIDGE LOAN

Purpose and Application:

Bedford Lending designed this loan product to meet the special needs of borrowers purchasing or holding multifamily properties with a clear strategy to stabilize the property. The stabilization effort can involve repositioning, re-tenanting, basic physical improvements or major redevelopment. Once the subject property is stabilized, our bridge loan can be rolled into a permanent, low interest, mortgage loan.

Comparative Advantages: This exceptional, multi-family property financing program offers the lowest interest rates and the highest LTV of any available bridge loan program. This is the 24 karat gold bridge loan program for multifamily properties.

Terms and Conditions:

LOAN AMOUNT: $2MM or more. LTV : 75% to 80% and in certain market up to 90% Boston, NY, San Francisco, DC, and San Jose.

RATES: 6.5% to 7.5%

POINTS: 2 to 4

TERM: 1 to 2 years.

PROPERTY TYPE: Multifamily.

TARGET MARKETS: All major US markets.

DEAL TYPES: Loans for acquisition, refinance, renovation, repositioning, and to purchase bank owned low occupancy properties.

Contact Information:

For more information or to apply contact:

Robert J. Harmon Richard PickettRegional Director Regional Director BEDFORD LENDING BEDFORD LENDING301. 830-8336 [email protected] [email protected]