The Ability To Pay Principle

-

Upload

guest17f274d -

Category

Economy & Finance

-

view

665 -

download

5

description

Transcript of The Ability To Pay Principle

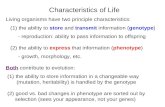

The Ability to Pay Principle

The ability to pay principle believes that taxes should be imposed on a person depending on the person’s capability to bear and deal with such burden.

The ability to pay principle believes that taxes should be imposed on a person depending on the person’s capability to bear and deal with such burden.

This principle leads to vertical equity and horizontal equity.

This principle leads to vertical equity and horizontal equity.

Vertical equity is the idea that people who are able to pay more should pay more tax.

Horizontal equity on the other hand states that if the people have almost the same ability to pay taxes should pay the same amount.

Vertical Equity brings up 3 different tax systems: Proportional tax, Regressive tax, and Regressive tax.

Proportional Tax is a system which both high income and low income payers pay the same fraction of income.

Regressive Tax is a system which high income payers pay smaller fraction of their income than low income payers. This does not mean that they pay less. They still pay a larger amount.

Regressive Tax is a system which high income payers pay smaller fraction of their income than low income payers. This does not mean that they pay less. They still pay a larger amount.

Progressive Tax is a system which high income payers pay a larger fraction of their income than low income payers.

Horizontal Equity also brings up an important question. What defines “similar”? How do we know who is similar to who?